Union Budget 2025-26

|

For Prelims: Parliament, Makhana, Exclusive Economic Zone, Made in India, Small Modular Reactors (SMRs), Atomic Energy Act, Civil Liability for Nuclear Damage Act, UDAN scheme, Lithium-ion battery, UPI, e-Shram portal, PM Jan Arogya Yojana, NaBFID, Prime Minister Dhan-Dhaanya Krishi Yojana, Atma Nirbharta in Pulses, Revised MSME Classification, Urban Challenge Fund. For Mains: Significance of the Union Budget for resource allocation, Economic planning, Fiscal stability, Welfare schemes, and National development. |

Why in News?

The Union Budget 2025-26 was presented by the Union Finance Minister in the Parliament recognising 4 engines of development- agriculture, Micro, Small and Medium Enterprises (MSME),investment and exports.

- The Union Budget 2025-26, with the theme Sabka Vikas, aims to stimulate balanced growth across all regions.

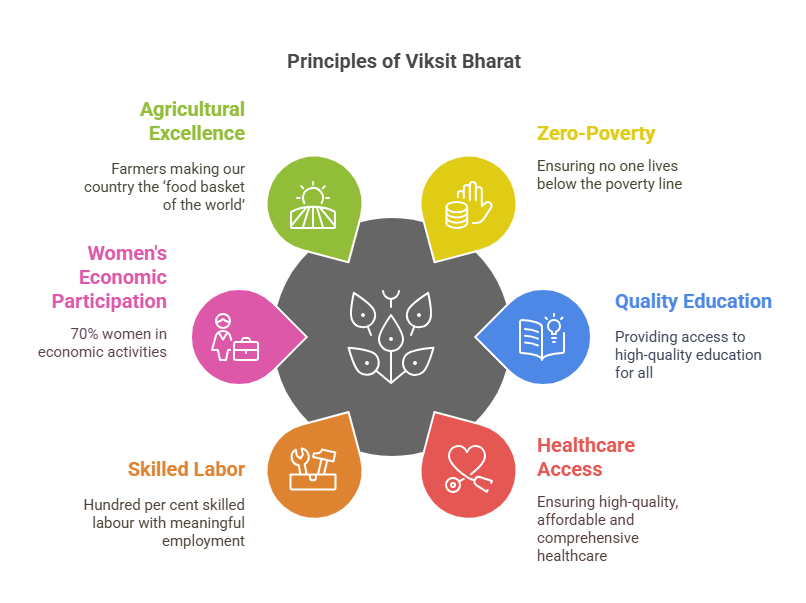

- In line with the Budget theme, the Finance Minister outlined the broad principles of Viksit Bharat.

- The Budget proposes development measures focusing on the poor (Garib), Youth, farmers (Annadata) and women (Nari).

What are the 4 Engines of Development in the Union Budget 2025-26?

- 1st Engine- Agriculture:

- Prime Minister Dhan-Dhaanya Krishi Yojana: Announced to cover 100 low agricultural productivity districts, benefiting 1.7 crore farmers, enhancing irrigation, and post-harvest storage facilities.

- A ‘Rural Prosperity and Resilience’ programme will be launched with states to address agricultural underemployment through skilling, investment, and technology.

- Atma Nirbharta in Pulses: A 6-year mission focusing on Tur, Urad, and Masoor announced launched, ensuring climate-resilient seeds and remunerative prices.

- Central agencies (NAFED and NCCF) will be prepared to procure these 3 pulses from farmers over the next 4 years.

- Enhanced Kisan Credit Card (KCC) Limit: Raised from ₹3 lakh to ₹5 lakh to facilitate credit flow for 7.7 crore farmers.

- National Mission on High Yielding Seeds: To strengthen research, ensuring availability of 100+ high-yielding and pest-resistant seed varieties.

- Mission for Cotton Productivity: A 5-year initiative promoting sustainable farming, increasing extra-long staple cotton production, and improving quality.

- Makhana Board in Bihar: To be established to enhance production, processing, and value addition of Makhana.

- Comprehensive Program for Fruits and Vegetables: To promote efficient supply chains and ensure better market prices for farmers.

- Fisheries Development: New framework for sustainable fishing in the Indian Exclusive Economic Zone and High Seas, focusing on Andaman & Nicobar and Lakshadweep.

- Urea Plant in Assam: A new urea plant in the premises of Brahmaputra Valley Fertilizer Corporation Ltd (BVFCL) with 12.7 lakh metric ton capacity to boost agricultural productivity.

- Prime Minister Dhan-Dhaanya Krishi Yojana: Announced to cover 100 low agricultural productivity districts, benefiting 1.7 crore farmers, enhancing irrigation, and post-harvest storage facilities.

- 2nd Engine- MSMEs:

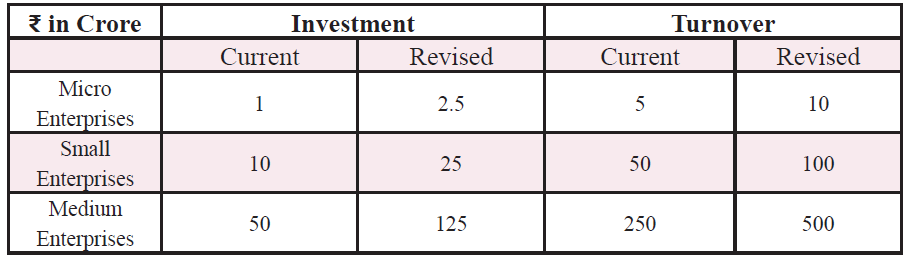

- Revised MSME Classification: Investment and turnover limits increased to 2.5 times, expanding credit opportunities for small businesses.

- Micro Enterprise Credit Cards: Rs 5 lakh credit facility for 10 lakh micro enterprises, promoting financial inclusion and economic participation.

- Credit Cover for MSMEs: Guarantee cover increased from ₹5 crore to ₹10 crore, enabling higher loan access.

- Focus Product Scheme for Leather and Footwear: Expected to generate 22 lakh jobs and ₹4 lakh crore turnover, and exports of over ₹ 1.1 lakh crore.

- Toy Sector Development: Clusters and innovation-based manufacturing fostering 'Made in India' brand in global markets.

- National Institute of Food Technology: A National Institute of Food Technology, Entrepreneurship and Management to be established in Bihar, promoting food processing, skilling, and entrepreneurship.

- Fund of Funds for Startups: To be established with an expanded scope and an additional contribution of ₹10,000 crore.

- 3rd Engine- Investment

- Urban Challenge Fund: ₹1 lakh crore allocated to support ‘Cities as Growth Hubs,’ ‘Creative Redevelopment of Cities,’ and ‘Water and Sanitation,’ with ₹10,000 crore allocated for 2025-26.

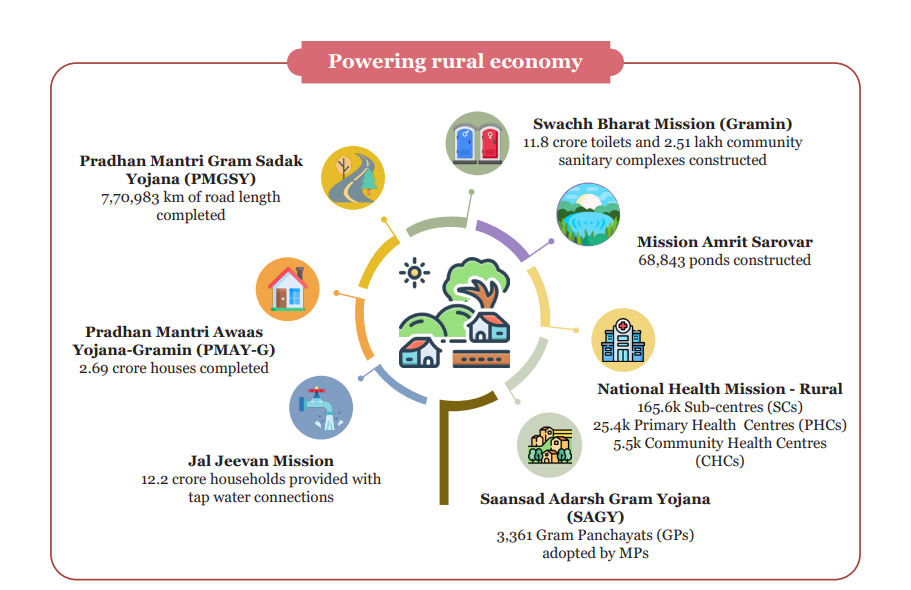

- Jal Jeevan Mission: With total budget outlay enhanced to Rs 67,000 Crore and extension till 2028, ensuring universal piped water coverage with enhanced funding for rural water projects.

- 15 crore households representing 80% of India’s rural population have benefitted by the mission.

- Maritime Development Fund: ₹25,000 crore fund (49% contribution by the Government), supporting long-term financing for shipbuilding, ports, and logistics infrastructure.

- Expansion of IITs: Additional infrastructure for 6,500 more students, boosting India’s technical education capacity.

- PM Research Fellowship: 10,000 fellowships for advanced research in IITs and IISc.

- Day Care Cancer Centers: To be set up in all district hospitals in the next 3 years, with 200 Centres in 2025-26, ensuring affordable cancer treatment accessibility.

- Bharatiya Bhasha Pustak Scheme: Digital Indian language books to enhance school and higher education accessibility.

- Nuclear Energy Mission for Viksit Bharat: To be set up with a ₹20,000 crore outlay for Small Modular Reactors (SMRs), with at least 5 indigenously developed SMRs operational by 2033.

- Amendments to the Atomic Energy Act and the Civil Liability for Nuclear Damage Act will be taken up for active partnership with the private sector.

- UDAN - Regional Connectivity Scheme: A revised UDAN scheme will enhance regional connectivity to 120 new destinations, aiming to carry 4 crore passengers over the next 10 years.

- It will also support helipads and smaller airports in hilly, aspirational, and North East regions.

- Greenfield Airport in Bihar: Greenfield airports will be developed in Bihar, alongside the expansion of Patna airport and a brownfield airport at Bihta (Patna).

- Western Koshi Canal ERM Project: Financial support for irrigation infrastructure in Mithilanchal, Bihar.

- Tourism for Employment-led Growth: The top 50 tourist destinations across the country will be developed in partnership with states through a challenge mode.

- 4th Engine- Export Promotion:

- Export Promotion Mission: It will be established, with sectoral and ministerial targets, led collaboratively by the Ministries of Commerce, MSME, and Finance.

- BharatTradeNet (BTN): A unified digital platform facilitating international trade documentation and financing solutions.

- National Framework for GCC: Policy incentives to promote outsourcing hubs (Global Capability Centres) in emerging Tier-2 cities.

- Warehousing Facility for Air Cargo: Development of storage infrastructure for high-value perishable exports.

What are Other Major Highlights of the Union Budget 2025-26?

- Taxation and Financial Reforms:

- Direct Taxes: No Income Tax for annual incomes up to ₹12 lakh, extended to ₹12.75 lakh for salaried taxpayers with deductions.

|

Income (in ₹) |

Tax Rate |

|---|---|

|

₹0 - ₹4 lakh |

Nil |

|

₹4 - ₹8 lakh |

5% |

|

₹8 - ₹12 lakh |

10% |

|

₹12 - ₹16 lakh |

15% |

|

₹16 - ₹20 lakh |

20% |

|

₹20 - ₹24 lakh |

25% |

|

Above ₹24 lakh |

30% |

- Tax Deducted at Source (TDS): TDS on Rent increased from ₹2.4 lakh to ₹6 lakh, reducing tax compliance burden.

- Tax Returns: Time limit for updated tax returns extended from 2 years to 4 years, facilitating voluntary tax compliance.

- Basic Customs Duty (BCD) Exemptions: 36 life-saving drugs for cancer, chronic, and rare diseases fully exempted from BCD.

- Lithium-ion battery manufacturing capital goods for EVs and mobile devices exempted to boost domestic production.

- Textile and electronics sector components exempted to encourage local manufacturing and reduce dependency on imports.

- Social Welfare and Inclusion:

- PM SVANidhi Scheme: UPI-linked credit cards with ₹30,000 limit for street vendors to enhance financial inclusion.

- Identity Cards for Gig Workers: Registration on e-Shram portal, ensuring social security and health benefits under PM Jan Arogya Yojana.

- 50,000 Atal Tinkering Labs: To be established in government schools in the next five years to promote innovation.

- Expansion of Medical Education: 10,000 new medical seats, targeting a total increase of 75,000 seats in five years.

- Financial Sector Reforms:

- Grameen Credit Score: A framework enabling SHG members and rural borrowers to access formal credit facilities more efficiently.

- Jan Vishwas Bill 2.0: Decriminalizing 100+ legal provisions, easing business operations and reducing regulatory compliance burdens.

- SWAMIH Fund 2.0: A ₹15,000 crore fund to complete 1 lakh more dwelling units, with contributions from the government, banks, and private investors.

- FDI in Insurance Sector: The FDI cap in the insurance sector will be increased from 74% to 100% for companies that invest the entire premium in India.

- Investment Friendliness Index of States: A new ranking framework for states to promote competitive cooperative federalism.

- Credit Enhancement Facility: NaBFID will establish a ‘Partial Credit Enhancement Facility’ to support corporate bonds for infrastructure.

- Pension Sector: A forum will be established for regulatory coordination and the development of pension products.

- High-Level Committee for Regulatory Reforms: A High-Level Committee will be formed to review all non-financial sector regulations, certifications, licenses, and permissions.

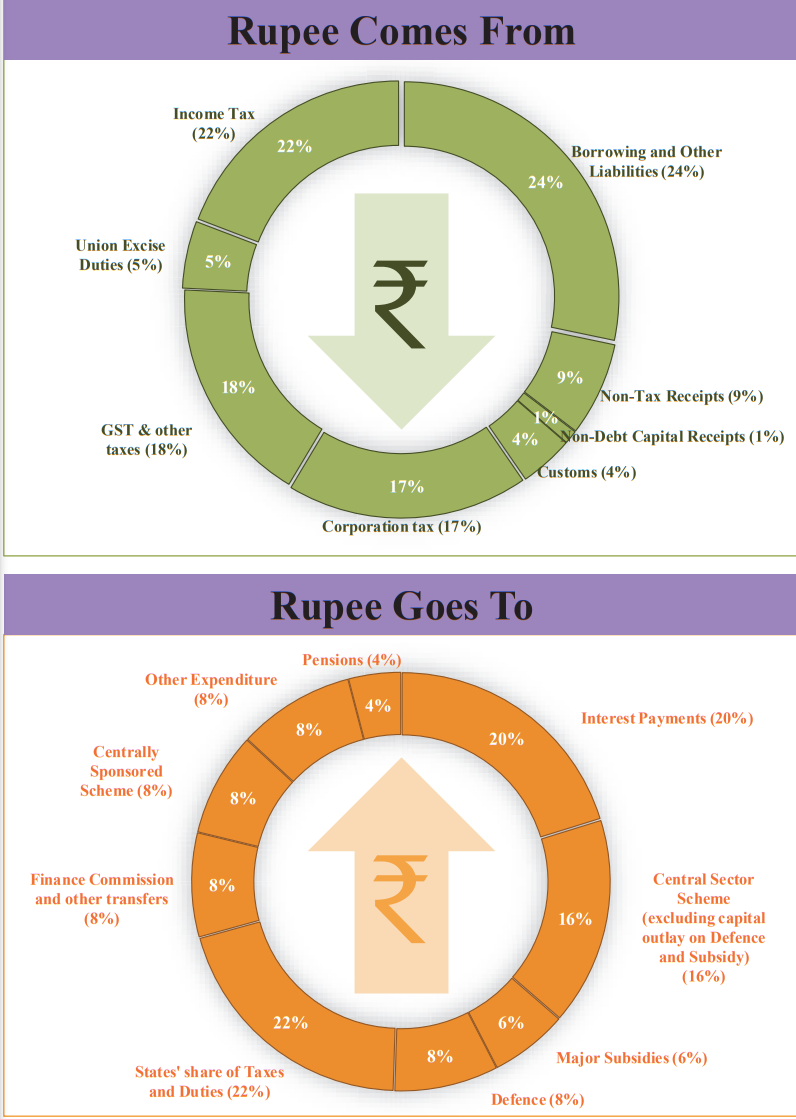

- Major Sources of Revenue and the Expenditure from the Budget:

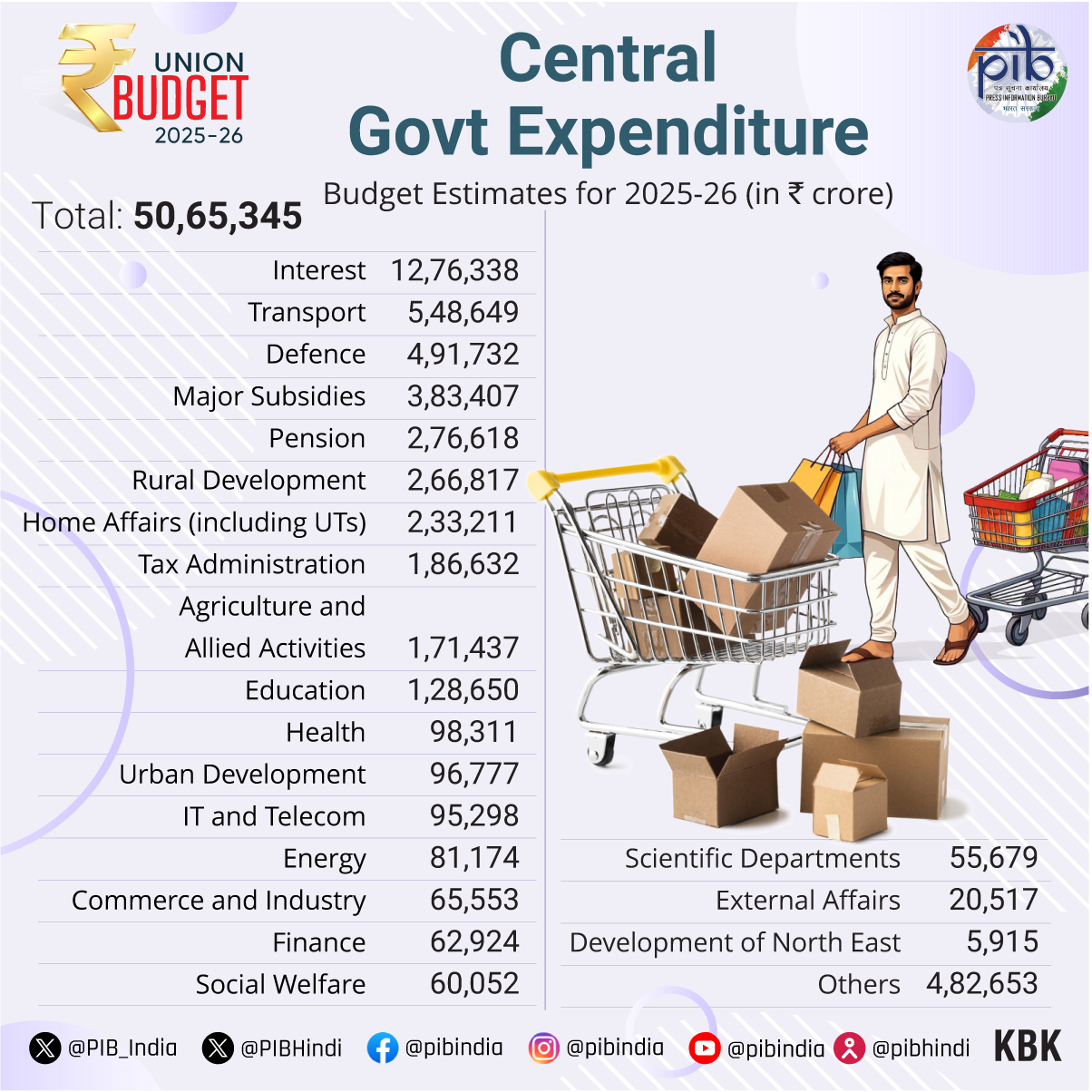

- Major Central Govt Expenditure (Budget Estimates):

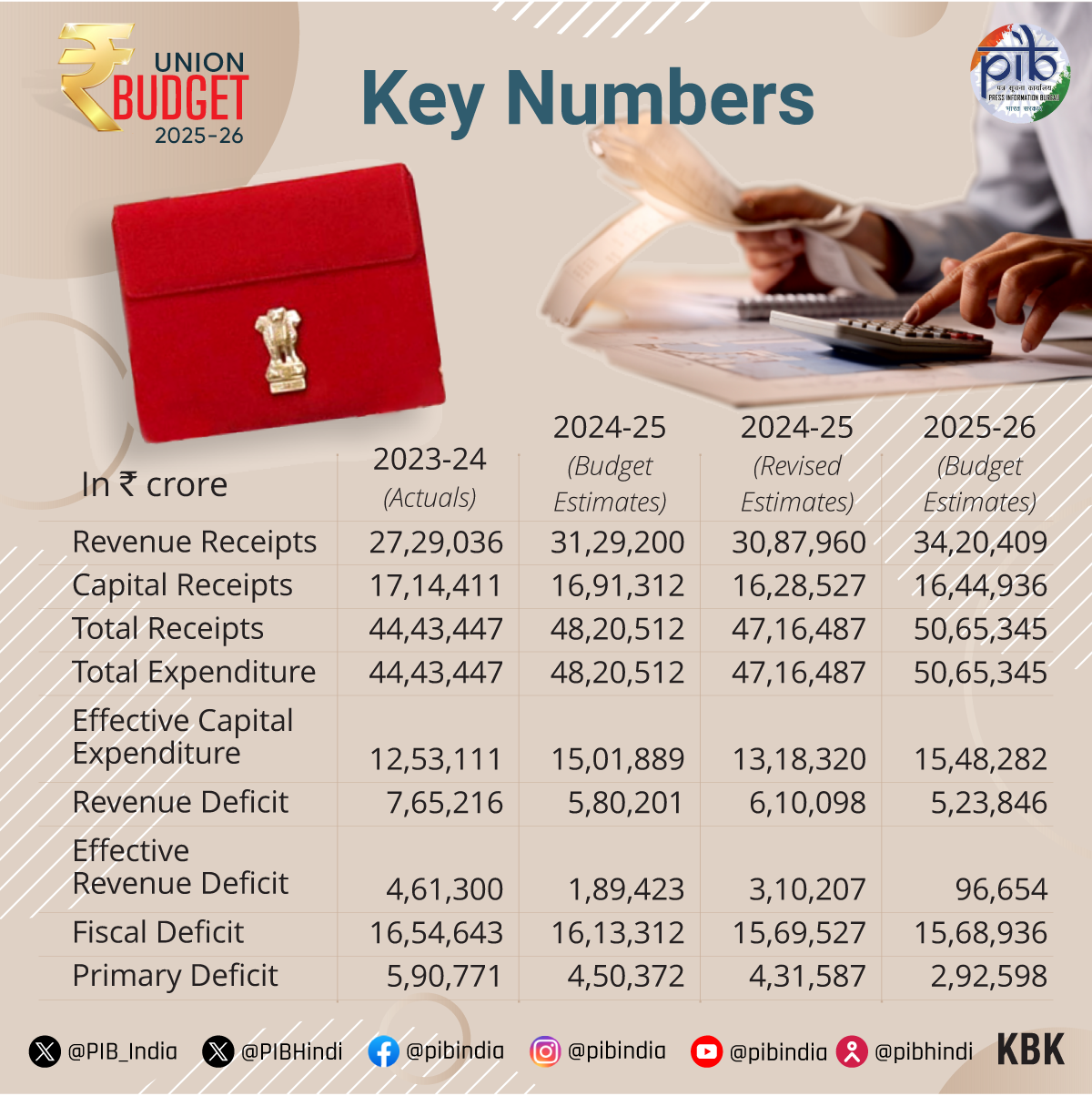

What are Financial Trends and Budgetary Estimates (2023-24 & 2024-25)?

- Receipts and Expenditure: In 2023-24, revenue receipts were ₹27.3 lakh crore, rising to ₹31.3 lakh crore (BE) for 2024-25.

- Effective capital expenditure fell from ₹17.1 lakh crore to ₹16.3 lakh crore (RE). Revenue expenditure increased from ₹34.9 lakh crore to ₹37.0 lakh crore (RE).

- Capital expenditure rose from ₹12.5 lakh crore to ₹15.0 lakh crore (BE) but was later revised to ₹13.2 lakh crore.

- Deficit Trends (as a percentage of GDP): The fiscal deficit was 3.3% in 2023-24, and the estimate for 2024-25 (RE) remains unchanged at 3.3%.

- The revenue deficit was 0.3% in 2023-24, which increased slightly to 0.8% in 2024-25 (RE).

- The effective revenue deficit in 2023-24 was 0.3%, and for 2024-25 (RE), it stood at 0.8%.

- Total Transfers to States & UTs: In 2023-24, the total transfers to States and Union Territories amounted to ₹20.65 lakh crore.

- This figure was revised to ₹22.76 lakh crore in 2024-25 (RE) and is projected to increase further to ₹25.60 lakh crore in 2025-26 (BE).

- Net Receipt of the Central Government: The net tax revenue collected by the Centre in 2024-25 (RE) was ₹28.4 lakh crore, while non-tax revenue stood at ₹5.8 lakh crore.

- Additionally, non-debt capital receipts, which include disinvestment proceeds and recoveries of loans, amounted to ₹0.8 lakh crore in 2024-25 (RE).

Conclusion

The Union Budget 2025-26, centered on the theme "Sabka Vikas," lays a strong foundation for Viksit Bharat by promoting inclusive growth, poverty eradication, quality education, and economic empowerment. By prioritizing youth, women, farmers, and the middle class, the Budget aims to stimulate sustainable development and private sector investment while ensuring social equity. If effectively implemented, these measures can accelerate India's transformation into a globally competitive and economically resilient nation.

Read more: Economic Survey 2024-25

|

Drishti Mains Question: Q. Assess how recent Union Budgets have managed the trade-off between fiscal discipline and economic stimulus through taxation, public spending, and deficit management. |

UPSC Civil Services Examination, Previous Year Question (PYQ)Prelims: Q1. What is the difference between “vote-on-account” and “Interim Budget”? (2011)

Which of the statements given above is/are correct? (a) 1 only Ans: (b) Q2. Along with the Budget, the Finance Minister also places other documents before the Parliament which include ‘The Macro Economic Framework Statement’. The aforesaid document is presented because this is mandated by (2020) (a) Long standing parliamentary convention Ans: (d) Mains:Q1. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. (2021) Q2. The public expenditure management is a challenge to the Government of India in the context of budget-making during the post-liberalization period. (2019) |

Economic Survey 2024-25

|

For Prelims: Economic Survey, Parliament, Union Budget, Chief Economic Adviser, International Monetary Fund, Inflation, Russia-Ukraine war, Gross Domestic Product, Current account deficit, Non-Performing Assets, Reserve Bank of India, Initial Public Offerings, Red Sea, Vadhavan Mega Port, National Infrastructure Pipeline, BharatNet, Swachh Bharat Mission, Gaganyaan, Carbon sink, Gini coefficient, Foreign Direct Investment For Mains: India’s Economic Growth, Economic Survey, Fiscal Policy and Financial Stability, Challenges to Economic Growth. |

Why in News?

The Finance Minister Nirmala Sitharaman tabled the Economic Survey 2024-25 in Parliament, It provides a roadmap for reforms and growth, setting the stage for the Union Budget 2025.

Economic Survey

- The Economic Survey is an annual report presented by the government before the Union Budget to assess India's economic condition.

- Prepared by the Economic Division of the Ministry of Finance under the Chief Economic Adviser's supervision, it is tabled in both houses of Parliament by the Union Finance Minister.

- The survey assesses economic performance, highlights sectoral developments, outlines challenges and provides an economic outlook for the coming year.

- The Economic Survey was first presented in 1950-51 as part of the budget and became a separate document from the Union Budget in 1964, tabled a day before the budget.

What are the Key Highlights of the Economic Survey 2024-25?

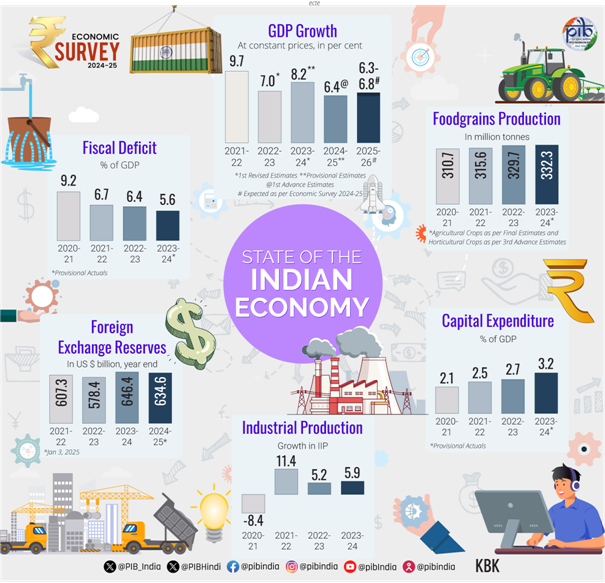

- State of the Economy:

- Global Economy: The International Monetary Fund (IMF) projected 3.2% global growth in 2024 (3.3% in 2025), with manufacturing slowing due to supply chain disruptions, while services remain strong.

- Inflation eased globally, yet services inflation remained persistent, leading to divergent monetary policies across central banks.

- Geopolitical Uncertainties: Russia-Ukraine war and Israel-Hamas conflict have impacted trade, energy security, and inflation.

- Suez Canal disruptions forced ships to reroute via the Cape of Good Hope, increasing freight costs and delivery times.

- India’s Economy: India's Gross Domestic Product (GDP) is projected to grow between 6.3-6.8% in FY26 (2025-26), with real Gross Value Added (GVA) estimated at 6.4% in FY25 (2024-25).

- Sector-Wise Performance:

- Agriculture: 3.8% growth in FY25, driven by record Kharif production and strong rural demand.

- Industry & Manufacturing: 6.2% growth in FY25, with manufacturing slowing due to weak global demand.

- Services: Fastest-growing sector at 7.2% in FY25, led by Information technology (IT), finance, and hospitality.

- External Sector: Overall exports (merchandise+services) grew by 6% (YOY) in the first nine months of FY25. Services sector by 11.6% during the same time.

- Merchandise exports grew 1.6%, while imports rose 5.2%, widening the trade deficit.

- India remained the top global recipient of remittances, helping contain the Current account deficit (CAD) at 1.2% of GDP.

- Sector-Wise Performance:

- Global Economy: The International Monetary Fund (IMF) projected 3.2% global growth in 2024 (3.3% in 2025), with manufacturing slowing due to supply chain disruptions, while services remain strong.

- Monetary and Financial Sector Developments: Gross Non-Performing Assets (GNPA) of Scheduled Commercial Banks (SCBs) dropped to a 12-year low of 2.6% in 2024, with net NPAs at 0.6%.

- Return on Assets (RoA) rose to 1.4%, and Return on Equity (RoE) improved to 14.1% (Sep 2024).

- Reserve Bank of India (RBI) Financial Inclusion Index increased from 53.9 (2021) to 64.2 (2024), supported by Regional Rural Banks (RRBs).

- RBI maintained the repo rate at 6.5%, while reducing the CRR to 4%, injecting Rs 1.16 lakh crore into the system.

- The money multiplier rose to 5.7, reflecting increased liquidity.

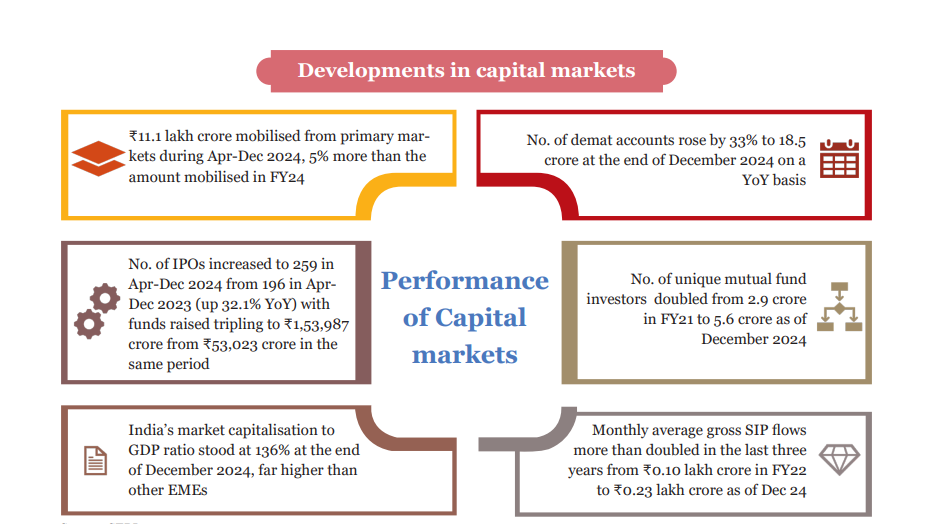

- Capital markets mobilized Rs 11.1 lakh crore in primary markets (Apr–Dec 2024), a 5% increase over FY24. Initial Public Offerings (IPO) tripled their fundraising to Rs 1.53 lakh crore.

- Development Financial Institutions (DFIs) like National Bank for Financing Infrastructure and Development (NaBFID) and India Infrastructure Finance Company Limited (IIFCL) financed infrastructure projects, with NaBFID sanctioning Rs 1.3 lakh crore in loans.

- External Sector: India's external sector remained resilient. Total exports (merchandise + services) grew by 6%, reaching USD 602.6 billion.

- Imports also increased by 6.9% to USD 682.2 billion, reflecting strong domestic demand.

- Global trade faced challenges due to rising trade policy uncertainty and disruptions in key shipping routes, such as the Red Sea and the Panama Canal drought, leading to higher costs and longer delivery times.

- A shift towards friend-shoring and near-shoring was observed, as countries prioritized trade within geopolitical alliances.

- Foreign Portfolio Investments (FPIs): The FPIs fluctuated due to global uncertainties, though India’s strong economic fundamentals kept overall inflows positive.

- Foreign Exchange Reserves: USD 640.3 billion (Dec 2024), covering 90% of external debt (USD 711.8 billion as of Sep 2024), ensuring macroeconomic stability and resilience against external shocks.

- Prices and Inflation:

- Global Inflation Trends: Inflation peaked at 8.7% in 2022, driven by supply chain disruptions, but fell to 5.7% in 2024 due to monetary tightening.

- Domestic Inflation Trends: Retail inflation eased from 5.4% in FY24 to 4.9% in FY25, but food inflation rose from 7.5% to 8.4%, driven by vegetables (tomatoes, onions) and pulses, despite price stabilization efforts.

- Supply chain issues and weather disruptions kept Consumer Price Index (CPI) volatility high.

- Core inflation hit a 10-year low, with declining service and fuel price inflation.

- The RBI revised FY25 inflation from 4.5% to 4.8%, expecting 4.2% in FY26, while the IMF forecasts 4.4% in FY25 and 4.1% in FY26, assuming stable conditions.

- Medium-Term Outlook: The IMF projects India to become a USD 5 trillion economy by FY28 and USD 6.3 trillion by FY30, with a nominal GDP growth rate of 10.2% (FY25-FY30).

- To reach its Viksit Bharat 2047 goal, India must grow at 8% annually for the next two decades.

- However, global challenges such as geo-economic fragmentation, trade restrictions, and China's dominance in manufacturing and energy transition pose risks to supply chains and investment flows.

- The IMF forecasts India's real GDP growth at 6.5% annually (FY26-FY30), with the CAD expected to rise to 2.2% of GDP by FY30.

- The rupee is projected to depreciate mildly at 0.5% per year, indicating improved economic stability compared to previous decades.

- Investment and Infrastructure: The capital expenditure (Capex) growing at 38.8% Compounded Annual Growth Rate (CAGR) (FY20-FY24).

- The government has launched multiple initiatives, including the National Infrastructure Pipeline, and the National Monetisation Pipeline.

- Key Developments:

- Railway connectivity: 2031 km of railway network commissioned (Apr-Nov 2024), 17 new Vande Bharat trains introduced.

- Infrastructure: National Highway construction reached 6,215 km (Bharatmala), 619 UDAN air routes (Regional Connectivity Scheme).

- Port capacity grew under Sagarmala, with the launch of projects like Vadhavan Mega Port.

- Energy: Total installed power capacity reached 456.7 GW (renewables at 209.4 GW (47% share)).

- Connectivity: 5G covers 779 districts, and BharatNet expanded fiber to 2.14 lakh Gram Panchayats.

- Rural and Urban Development: Pradhan Mantri Awas Yojana (PMAY) sanctioned 1.18 crore houses, and Jal Jeevan Mission reached 15.3 crore households (79.1%).

- 18,374 villages electrified and 2.9 crore households connected under Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and SAUBHAGYA.

- Under Swachh Bharat Mission (Phase II) in 2024, 1.92 lakh villages declared ODF Plus, making a total of 3.64 lakh ODF Plus villages by 2024.

- Space assets: India operates 56 active space assets, with Space Vision 2047 targeting missions like Gaganyaan and Chandrayaan-4.

- Industry & Manufacturing: The industrial sector expected to grow by 6.2% in FY-25 (first advance estimates), driven by robust growth in electricity and construction.

- The government has been actively promoting Smart Manufacturing and Industry 4.0, supporting the establishment of SAMARTH Udyog centres.

- Key sectors saw growth, with steel production up 3.3% (Apr–Nov FY25) and electronics output reaching Rs 9.52 lakh crore, with 99% of smartphones made domestically, drastically reducing India’s dependence on imports.

- As per the WIPO Report 2022, India ranks sixth among the top 10 patent filing offices globally, with resident filings accounting for over half of all submissions (55.2%)—a first for the country.

- The MSME sector employs 23.24 crore people, with 2.39 crore businesses formalized under Udyam Assist.

- To provide equity funding to MSMEs with the potential to scale up, the government launched the Self-Reliant India Fund.

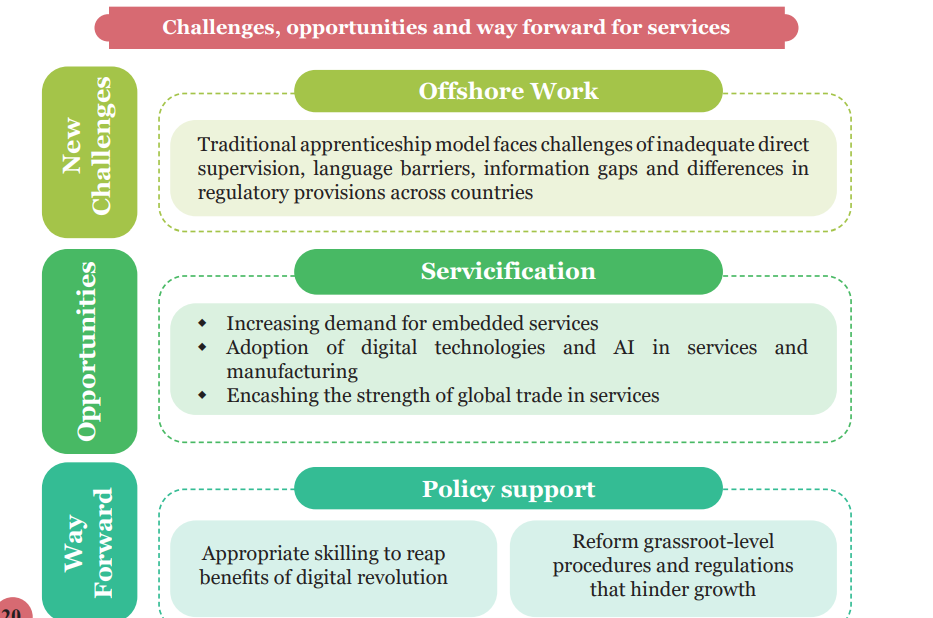

- Services: India’s services sector contributes 55% to GVA in FY25, up from 50.6% in FY14, employing 30% of the workforce and driving manufacturing growth through servicification.

- India ranks 7th in global services exports (4.3% share).

- Information and computer-related services grew at 12.8% CAGR (FY13–FY23), increasing their GVA share from 6.3% to 10.9%.

- Railway passenger traffic grew 8%, freight movement increased 5.2% (FY24).

- Tourism rebounded, contributing 5% to GDP (FY23), and real estate sales hit an 11-year high in H1 FY25.

- The telecom sector, with 1.18 billion subscribers, leads in global mobile data consumption.

- Agriculture and Food Management: India’s agriculture sector contributes 16% to GDP (FY24), employing 46.1% of the population, with 5% annual growth (FY17-FY23).

- Kharif foodgrain production hit 1,647 LMT (2024), up 89.37 LMT YoY, while fisheries (184 LMT) and livestock (CAGR 12.99%) outpaced traditional farming.

- Minimum Support Price for Arhar and Bajra increased by 59% and 77% (FY25) to ensure farmer profitability.

- 55% of India’s net sown area is irrigated, with severe drought risks in two-thirds of farmland.

- Kisan Credit Cards (KCC): 7.75 crore accounts.

- PM Fasal Bima Yojana (Crop Insurance): 4 crore farmers enrolled, covering 600 LMT hectares in FY24.

- e-NAM platform linked 1.78 crore farmers, 2.62 lakh traders (Oct 2024) for better price discovery.

- Food Security & Processing: Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) provides free food grains to 80 crore people.

- Food processing exports reached USD 46.44 billion (FY24), with 23.4% share in agri-food exports (11.7 % of India's total exports).

- Kharif foodgrain production hit 1,647 LMT (2024), up 89.37 LMT YoY, while fisheries (184 LMT) and livestock (CAGR 12.99%) outpaced traditional farming.

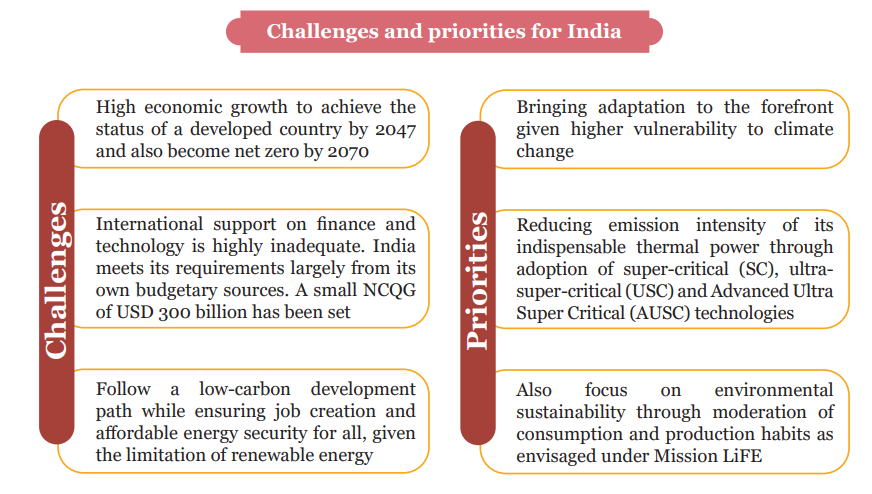

- Climate & Environment: Climate adaptation spending rose from 3.7% to 5.6% of GDP (FY16-FY22).

- The Lifestyle for the Environment (LiFE) initiative promotes sustainability, with potential global savings of USD 440 billion by 2030 through reduced consumption and lower prices.

- Renewable Energy & Emissions: 46.8% of India’s power capacity is non-fossil (target 50% by 2030).

- Forest carbon sink increased by 2.29 billion tonnes CO₂ (2005-2023).

- Climate Finance & International Cooperation: Conference of Parties 29 failed to secure adequate climate funds, with a USD 300B annual goal vs. USD 5.1 to 6.8T needed by 2030.

- India issued USD 20,000 crore in Sovereign Green Bonds in FY24 to fund green projects.

- Sustainable Development & Resilience: Mangrove Initiative for Shoreline Habitats & Tangible Incomes (MISHTI) initiative restoring 22,560 hectares of mangroves across 13 states and UTs.

- Water conservation via AMRUT 2.0 (3,078 water body rejuvenation projects approved).

- PM Surya Ghar (7 lakh rooftop solar systems installed; goal: 1 crore households).

- Energy Security & Transition: Coal remains India’s primary energy source, with 65,290 MW supercritical coal plants for efficiency.

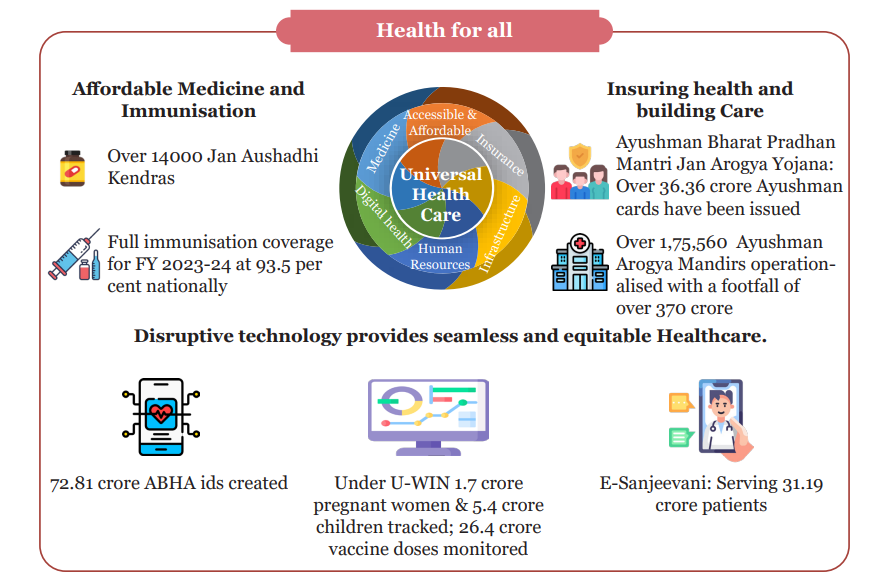

- Social Sector: India's social sector spending grew at 15% CAGR (FY21-FY25), reaching Rs 25.7 lakh crore in FY25.

- The Gini coefficient for rural areas declined to 0.237 in 2023-24 from 0.266 in 2022-23, and for urban areas, it fell to 0.284 in 2023-24 from 0.314 in 2022-23.

- Education & Skill Development: Education spending rose 12% CAGR to Rs 9.2 lakh crore, reducing dropout rates to 1.9% (primary) and 14.1% (secondary), while higher education enrolment increased 26.5% (2014-2022), pushing Gross Enrolment Ratio (GER) to 28.4%.

- Healthcare & Social Security: Healthcare spending surged 18% to Rs 6.1 lakh crore, with Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) saving Rs 1.25 lakh crore in medical expenses.

- Welfare: Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) provides free food grains to 80 crore people, covering 84% of households via ration cards.

- Fiscal policies helped reduce inequality, with bottom 5% rural and urban consumption rising by 22% and 19%.

- Employment and Skill Development: India’s unemployment rate declined from 6% (2017-18) to 3.2% (2023-24), with labour force participation (LFPR) rising to 60.1%.

- The working-age population (15-59 years) reached 923.9 million (2026 projection), offering a demographic dividend (26% of the population aged 10-24).

- The female LFPR grew from 23.3% (2017-18) to 41.7% (2023-24), driven by rural women’s participation.

- Self-employment rose to 58.4%, while regular wage jobs remained at 21.7%.

- Employment Trends: Formal sector jobs surged, with Employees' Provident Fund Organisation (EPFO) net payroll additions doubling from 61 lakh (FY19) to 131 lakh (FY24).

- Skill Development & Job Creation: 73,151 startups with women directors under Startup India.

- Skill India and Mudra Yojana supported entrepreneurship and vocational training.

- The growing digital economy and renewable energy sectors are driving job creation, vital for Viksit Bharat.

- The government is enhancing skills for global trends like AI and climate change. Initiatives like the PM-Internship Scheme are boosting employment and self-employment.

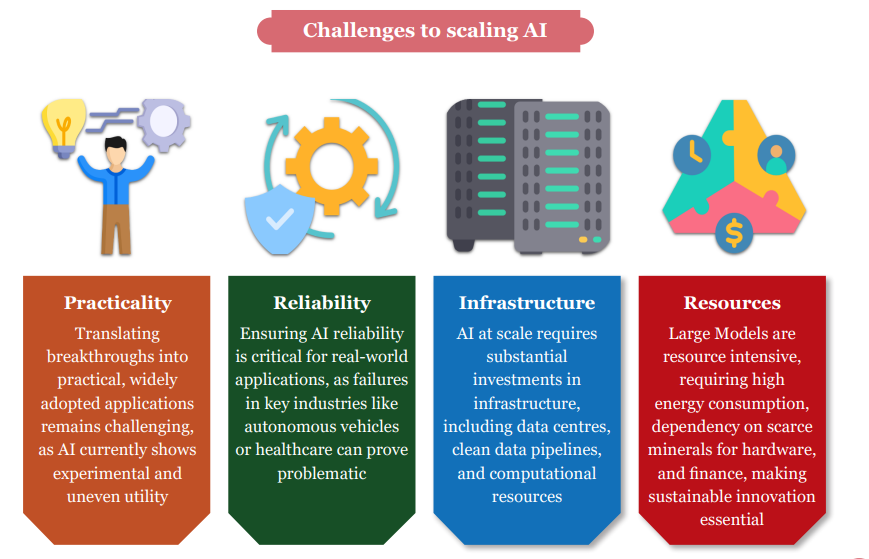

- Labour in the AI Era: Artificial Intelligence (AI) presents both opportunities and risks for labour markets, with 75 million global jobs at risk (ILO 2024) and 300 million full-time roles exposed (Goldman Sachs).

- India’s AI market is set to grow at 25-35% CAGR by 2027 (NASSCOM), making workforce upskilling, regulatory oversight, and human-AI collaboration crucial for a balanced transition.

What are India's Economic Challenges According to the Economic Survey 2024-25?

- Global:

- Geopolitical Risks: Conflicts like the Russia-Ukraine war and Red Sea disruptions impact trade, energy prices, and supply chains.

- Global Trade Slowdown: Protectionism, supply chain realignments affect India’s export competitiveness.

- Financial Market Volatility: Interest rate fluctuations in the US and European Union may cause capital outflows, impacting India's foreign exchange reserves and currency stability.

- Inflation:

- Persistent Food Inflation: Create inflationary pressures, despite stable core inflation.

- Climate Impact: Erratic monsoons, droughts, and extreme weather events affect food security and farm incomes.

- Investment & Infrastructure Bottlenecks: While public Capex grew at 38.8% CAGR (FY20-FY24), private investment remains cautious due to global uncertainties and regulatory concerns.

- Logistics costs remain high (13-14% of GDP), limiting industrial competitiveness despite National Logistics Policy efforts.

- Lack of planned urbanization results in traffic congestion, inadequate public transport, and rising housing costs in major cities.

- Smart City and urban transport projects face delays in execution due to regulatory hurdles and financing gaps.

- Employment & Skilling Gaps:

- Jobless Growth Concerns: India faces a critical challenge of jobless growth, with economic growth outpacing job creation, largely due to a focus on high-skill, low-employment sectors, premature deindustrialisation, and skill mismatches.

- Low LFPR: Female LFPR in India is 41.7% (FY25), still below the global average of over 50%.

- Fiscal & Financial Sector Risks: Several states face high debt burdens due to rising subsidies, limited revenue growth, and dependency on central transfers.

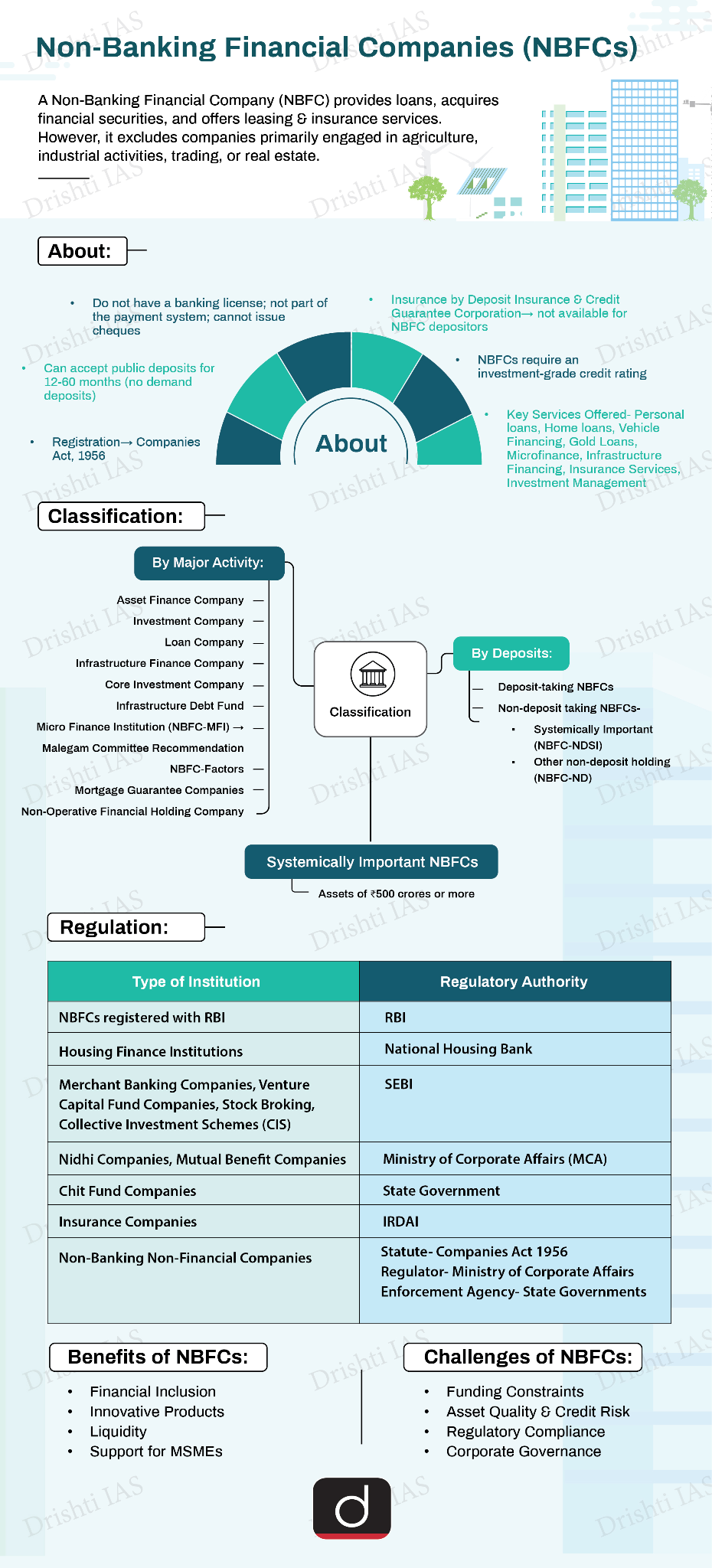

- Rising unsecured lending risks pose a challenge for NBFCs and fintech lenders, requiring better regulation and monitoring and cyber threats remain.

- Slow credit penetration to MSMEs, despite digital lending growth, hinders small business expansion.

- External Sector: While Foreign Direct Investment inflows grew 17.9% YoY, higher repatriation and disinvestment remain a concern.

- Export Dependency on IT & Services (70% of services exports rely on IT & business services), increasing vulnerability to global demand shocks.

- Climate Change & Energy Transition: India faces energy transition challenges due to grid stability issues, high storage costs, and slow renewable adoption.

- Dependency on Coal remains high, delaying the shift to clean energy.

- Climate risks, extreme weather, and inadequate global climate finance further hinder sustainable growth.

- EoDB reforms: Despite Ease of Doing Business Reforms(EoDB) reforms, labour laws, land acquisition, and tax complexity still hinder MSMEs and startups.

- India’s R&D spending remains low at 0.64% of GDP, affecting innovation and tech competitiveness.

- Effect of AI: AI’s reliability is still unproven, leading to biases in hiring, predictive policing, and automation failures.

- Energy demand for AI data centers may reach India's total electricity consumption (1,580 terawatt-hours) (Bloomberg, 2024).

- Indian IT, Business process outsourcing (BPO), and banking sectors face high AI disruption, particularly in low-value service jobs.

Way Forward

- Managing Geopolitical Uncertainties: Diversify trade partners and strengthen regional agreements (e.g., Indo-Pacific Economic Framework, India-Middle East-Europe Corridor) to reduce dependence on conflict-affected areas.

- Enhance domestic energy security by investing in strategic petroleum reserves and renewable alternatives.

- Expand domestic manufacturing & supply chain resilience through Production Linked Initiative' (PLI) schemes and allow 100% FDI in key sectors.

- Controlling Inflation: Strengthen food supply chains with better storage, logistics, and real-time price monitoring to control food inflation.

- Encourage private investment via tax incentives, land & labour reforms, and easing compliance for businesses.

- Strengthen Fiscal Stability: Enhance state tax collection efficiency by expanding GST coverage and digitizing tax administration.

- Rationalize subsidies to balance welfare with fiscal discipline. Encourage states to adopt fiscal responsibility frameworks and limit unsustainable borrowing.

- Address Unemployment: Deregulation is essential for MSME growth, fostering innovation and job creation by reducing compliance burdens.

- Integrate AI and digital skills in vocational training to prepare the workforce for future jobs.

- Energy Transition: Accelerate green hydrogen, solar, and wind projects to reduce coal dependence. Invest in energy storage solutions to improve grid stability for renewables.

- Enhance climate resilience by expanding crop insurance, water conservation, and sustainable agriculture practices.

Conclusion

While India’s economic fundamentals remain strong, challenges from global uncertainties, inflation, investment hesitancy, job creation, and climate change require policy interventions, fiscal discipline, and structural reforms to sustain high growth and global competitiveness.

Read more: Union Budget 2025-26

|

Drishti Mains Question: Q. Assess India's economic growth prospects, highlighting the key challenges, and suggest policy measures to promote sustainable growth. |

UPSC Civil Services Examination, Previous Year Question (PYQ)Prelims: Q. Along with the Budget, the Finance Minister also places other documents before the Parliament which include ‘The Macro Economic Framework Statement’. The aforesaid document is presented because this is mandated by (2020) (a) Long standing parliamentary convention Ans: (d) Mains:Q. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. (2021) Q. “Industrial growth rate has lagged behind in the overall growth of Gross-Domestic-Product(GDP) in the post-reform period” Give reasons. How far are the recent changes in Industrial Policy capable of increasing the industrial growth rate? (2017) Q. Do you agree that the Indian economy has recently experienced a V- shapes recovery? Give reasons in support of your answer. (2021) |

Writ Jurisdiction and the State

For Prelims: Supreme Court (SC), Scheduled Banks, NBFCs, Writ Jurisdiction, State, RBI, Statutory Bodies, Fundamental Rights, Parliament, Municipalities, Panchayats, Article 12, Articles 32 and 226.

For Mains: Application of writ jurisdiction on private bodies, Type of writs and scope.

Why in News?

In S. Shobha vs. Muthoot Finance Ltd Case, 2025, the Supreme Court (SC) ruled that private companies, including scheduled banks and NBFCs, are not subject to writ jurisdiction as they do not perform public functions or duties.

- The SC held that NBFCs are not a "State" under Article 12 and ‘function’ test should decide the maintainability of a writ application.

What are the Key Highlights of the Case?

- Case Background: The appellant argued that though NBFCs are not a "State" under Article 12, NBFCs violating RBI rules should be subject to writ jurisdiction.

- Supreme Court Verdict: Being subject to regulatory guidelines under a statute does not automatically make an entity subject to writ jurisdiction.

- Function Test: Writ jurisdiction applies only if an entity performs public duties such as governmental or essential public functions imposed by a statute or statutory rule.

- Writ jurisdiction applies to state authorities, statutory bodies, state-owned or funded private bodies, and private entities performing public duties.

- NBFCs duties are confined to account holders and borrowers, not the general public.

- Public Law Element Requirement: If a private body denies rights concerning a public duty imposed on it, a writ can be enforced.

What are Writs?

- About: A writ is a legal order issued by Constitutional courts under Articles 32 and 226 of the Indian Constitution to protect citizens' rights. It is adopted from English "prerogative writs."

- Authority to Issue Writs:

- Supreme Court (Article 32): Can issue writs only for the enforcement of Fundamental Rights (FRs).

- High Courts (Article 226): Can issue writs for the enforcement of FRs and other legal rights.

- Before 1950: Only the High Courts of Calcutta, Bombay, and Madras had the power to issue writs.

- Parliament (Under Article 32): Can empower any other court to issue writs, but no such provision has been made yet.

- Types of Writs and Their Scope:

| Writ | Purpose | Issued To | Court's Role | Not Issued If | Example |

| Habeas Corpus | "To Have the Body" - Protects individuals from illegal detention. | Any public authority or private individual responsible for unlawful detention. | Examines the legality of detention and orders release if unlawful. | Detention is lawful, detention due to contempt of court or legislature, detention ordered by a competent court, outside jurisdiction of the court. | If a person is detained without legal justification, a Habeas Corpus writ can secure their release. |

| Mandamus | "We Command" - Directs a public official, body, corporation, tribunal, or government to perform a duty they have failed to fulfill. | Government officials, public corporations, tribunals, and courts. | Directs the performance of a duty that has been neglected. | Private individuals / organizations, discretionary duties, duties with no statutory backing, against President/Governors, Chief Justice acting judicially. | If a government official refuses to issue a passport despite fulfilling all legal requirements, a Mandamus writ can be issued. |

| Prohibition | "To Forbid" - Prevents lower courts or tribunals from exceeding their jurisdiction or acting illegally. | Higher courts (Supreme Court or High Courts). | Prevents unlawful actions or excess jurisdiction. | Administrative authorities, legislative bodies, private individuals / organizations. | If a district court takes up a case beyond its legal authority, the High Court can issue a Prohibition writ. |

| Certiorari | "To Be Certified" - Transfers a case or quashes an illegal or unconstitutional order of a lower court/tribunal. | Judicial or quasi - judicial bodies, administrative authorities (after 1991 SC ruling). | Quashes illegal or unconstitutional orders, or transfers cases. | Legislative bodies, private individuals / organizations. | If a tribunal passes an unlawful order violating natural justice, the High Court can quash it using Certiorari. |

| Quo Warranto | "By What Authority" - Prevents illegal occupation of a public office by a person not entitled to hold it. | Any person wrongly occupying a substantive public office. | Challenges unlawful occupation of public offices. | Private offices, ministerial (non-substantive) offices. | If a person is appointed as a Minister without meeting the legal requirements, a Quo Warranto writ can be issued. |

Differences in Writ Jurisdiction of SC and HC:

|

Aspect |

Supreme Court |

High Court |

|

Scope of Enforcement |

Can issue writs only for FRs violations. |

Can issue writs for FRs and other legal rights (broader scope). |

|

Territorial Jurisdiction |

Can issue writs throughout India. |

Can issue writs only within its territorial jurisdiction, except when the cause of action arises within its jurisdiction. |

|

Nature of the Right |

Writ jurisdiction is a FRs itself (Article 32), so the court cannot refuse to exercise it. |

Writ jurisdiction is discretionary (Article 226), meaning the High Court may refuse to issue a writ. |

What is the Definition of a State under Article 12?

- About: Article 12 has defined the term “State” for the purposes of Part III (FRs) that has been used in different provisions concerning fundamental rights.

- Scope of ‘State’: According to Article 12, the State includes the following:

- Government and Parliament of India, and Government and legislature of states (i.e., executive and legislative organs of the government).

- All local authorities, that is, municipalities, panchayats, district boards, improvement trusts, etc.

- All other authorities, that is, statutory or non-statutory authorities like LIC, ONGC, SAIL, etc.

- Thus, the State has been defined in a wider sense so as to include all its agencies. It is the actions of these agencies that can be challenged in the courts as violating the Fundamental Rights.

- Judicial Stand: The SC in the Binny Ltd Case, 2005 held that even a private body or an agency working as an instrument of the State falls within the meaning of the ‘State’ under Article 12.

Conclusion

The Supreme Court and High Courts issue writs to address violations of fundamental and legal rights, focusing on entities performing public duties. Writ jurisdiction is determined based on whether the entity performs public duties. Only statutory bodies and entities performing governmental functions are subject to writs.

|

Drishti Mains Question: Discuss the scope of writ jurisdiction under Articles 32 and 226 of the Indian Constitution. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. In India, Judicial Review implies (2017)

(a) the power of the Judiciary to pronounce upon the constitutionality of laws and executive orders.

(b) the power of the Judiciary to question the wisdom of the laws enacted by the Legislatures.

(c) the power of the Judiciary to review all the legislative enactments before they are assented to by the President.

(d) the power of the Judiciary to review its own judgements given earlier in similar or different cases.

Ans: (a)

Q. Who/Which of the following is the custodian of the Constitution of India? (2015)

(a) The President of India

(b) The Prime Minister of India

(c) The Lok Sabha Secretariat

(d) The Supreme Court of India

Ans: (d)

Mains

Q. Judicial Legislation is antithetical to the doctrine of separation of powers as envisaged in the Indian Constitution. In this context justify the filing of a large number of public interest petitions praying for issuing guidelines to executive authorities. (2020)

Exploitation of Domestic Workers

For Prelims: Supreme Court of India, Care economy, International Labour Organization, Code on Social Security, 2020

For Mains: Domestic workers in India, Labour Laws and Reform, Welfare and Protection

Why in News?

The Supreme Court (SC) of India has raised concerns over the exploitation and abuse of domestic workers in India due to the absence of a protective legal framework.

- It has directed the Centre to form an inter-ministerial expert committee to assess the need for a protective law.

Who are Domestic Workers?

- About: According to the ILO, Domestic workers are those workers who perform work in or for a private household or households.

- They provide direct and indirect care services, and as such are key members of the care economy.

- Status of Domestic Workers in India: Women make up the majority of domestic workers in India, with 26 lakh of the 39 lakh workers being female, according to 2019 government estimates.

- 12.6 million minors are employed as domestic workers (86% are girls, and 25% are under 14 years old).

- Characteristics of Domestic Workers:

- Informal and Unregulated: Most domestic workers lack job contracts, social security, and legal protection.

- Live-in and Part-time Work: Some workers live with their employers (live-in workers), while others work in multiple households (part-time workers).

- Migration: Domestic workers often migrate from poverty-stricken states like Jharkhand, Bihar, and Odisha to cities such as Delhi, Bengaluru, and Mumbai, as well as to Arab States, due to extreme poverty and a lack of job opportunities.

- Marginalized Communities: The workforce is primarily composed of marginalized communities from Scheduled Castes (SCs), Other Backward Classes (OBCs), and Scheduled Tribes (STs).

What are the concerns of Domestic Workers India?

- Low Wages: Many earn below the minimum wage, with no formal contracts. They often work excessive hours without breaks or overtime pay.

- Abuse: Workers face physical and emotional abuse, including beatings, harsh conditions, sexual harassment, forced labour, and human trafficking, particularly minors from vulnerable communities.

- The ILO states domestic work as a "modern slavery" practice, where workers, including minors, are vulnerable to abuse, exploitation, forced labor, and trafficking.

- Sexual Harassment: Female workers are vulnerable to sexual abuse. Many cases of abuse go unreported due to fear of retaliation or the lack of legal recourse.

- Exploitation by Agencies: Placement agencies exploit domestic workers by charging high fees for employment, without guaranteeing fair wages or safe conditions.

- Workers are often not informed about the terms of their employment, including wages or job responsibilities.

- Pandemic: Covid-19 worsened conditions, a 2020 study found that 57% of domestic workers in Kochi, Delhi, and Mumbai faced discrimination, while 40% worked without safety measures.

What Laws Govern Domestic Work in India?

- No Dedicated Central Law: Domestic workers are excluded from mainstream labor laws as "workman" and "workplace" definitions do not cover household work, often seen as "unproductive" women's labor.

- Multiple attempts were made to pass a Central law to protect domestic workers, including the Domestic Workers (Conditions of Employment) Bill of 1959 and the Domestic Workers (Regulation of Work and Social Security) Bill of 2017.

- The 2019 National Domestic Worker Policy aimed to regulate agencies and ensure workers' rights, including wages, social security, and benefits. However, none of these proposed laws were enacted.

- Multiple attempts were made to pass a Central law to protect domestic workers, including the Domestic Workers (Conditions of Employment) Bill of 1959 and the Domestic Workers (Regulation of Work and Social Security) Bill of 2017.

- Weak Legal Protections:

- Unorganised Sector Social Security Act, 2008: Provided some benefits but was later replaced by the Code on Social Security, 2020, which has not been implemented.

- Minimum Wages Act, 1948: Recognizes domestic work, but only 10 states have set minimum wages for domestic workers.

- Sexual Harassment at Workplace Act, 2013: Recognizes domestic workers but lacks an enforcement mechanism.

- Child Labour (Prohibition and Regulation) Act, 1986: In 2006, India banned minors under 14 from domestic work, deeming it "hazardous child labor," but the Child Labour Act, 1986, allows children over 14 to work in homes, considering them a "safe" place.

- State Laws: Tamil Nadu, Maharashtra, and Kerala have implemented laws to protect domestic workers.

- These states have established specialized bodies to oversee social security benefits, maternity care, education assistance, medical reimbursements, and minimum wages.

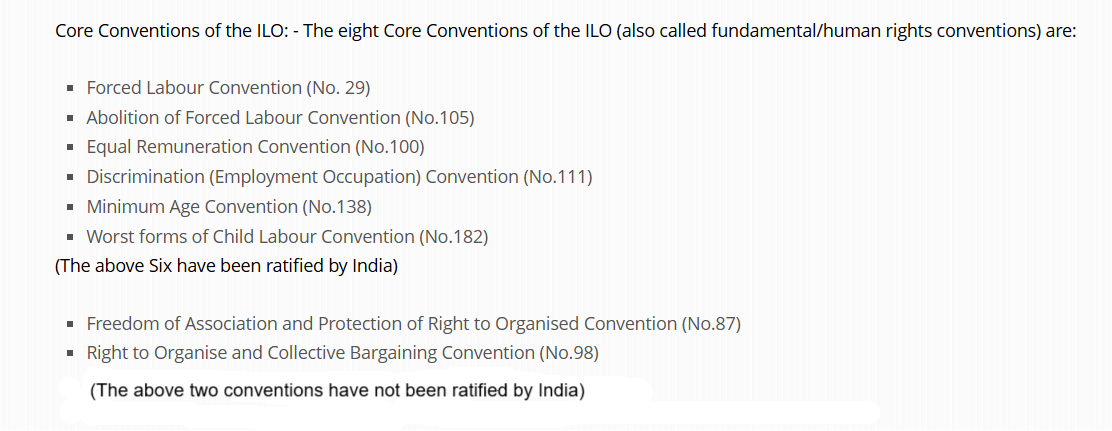

- Global Protections: In 2011, India voted in favor of ILO Convention 189, which aims to improve domestic workers' conditions by recognizing domestic work as legitimate work ensuring domestic workers enjoy the same rights as others. However, India has yet to ratify the convention.

Way Forward

- Policy Changes: Implement the Draft National Domestic Worker Policy, 2019 to regulate placement agencies, ensure mandatory contracts with fair wages and benefits, and include domestic workers in social security and pension schemes.

- Ratify the ILO Convention 189, create laws to protect domestic workers' rights, recognize their work as legitimate, and ensure legal protection and policy enforcement.

- Anti-Trafficking Measures: Mandatory registration of placement agencies to ensure transparency, additionally, ensure strict enforcement of anti-trafficking laws under the Bharatiya Nyaya Sanhita, 2023 which mandates punishment up to life imprisonment for trafficking offenses, including those involving domestic workers.

- Empower Workers: Raise awareness of domestic workers' rights, provide access to legal aid and social services, and establish a statutory body to address grievances.

|

Q. Critically examine the exploitation of domestic workers in India and suggest measures to improve their working conditions and social security. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains

Q. Distinguish between ‘care economy’ and ‘monetized economy’. How can the care economy be brought into a monetized economy through women empowerment? (2023)

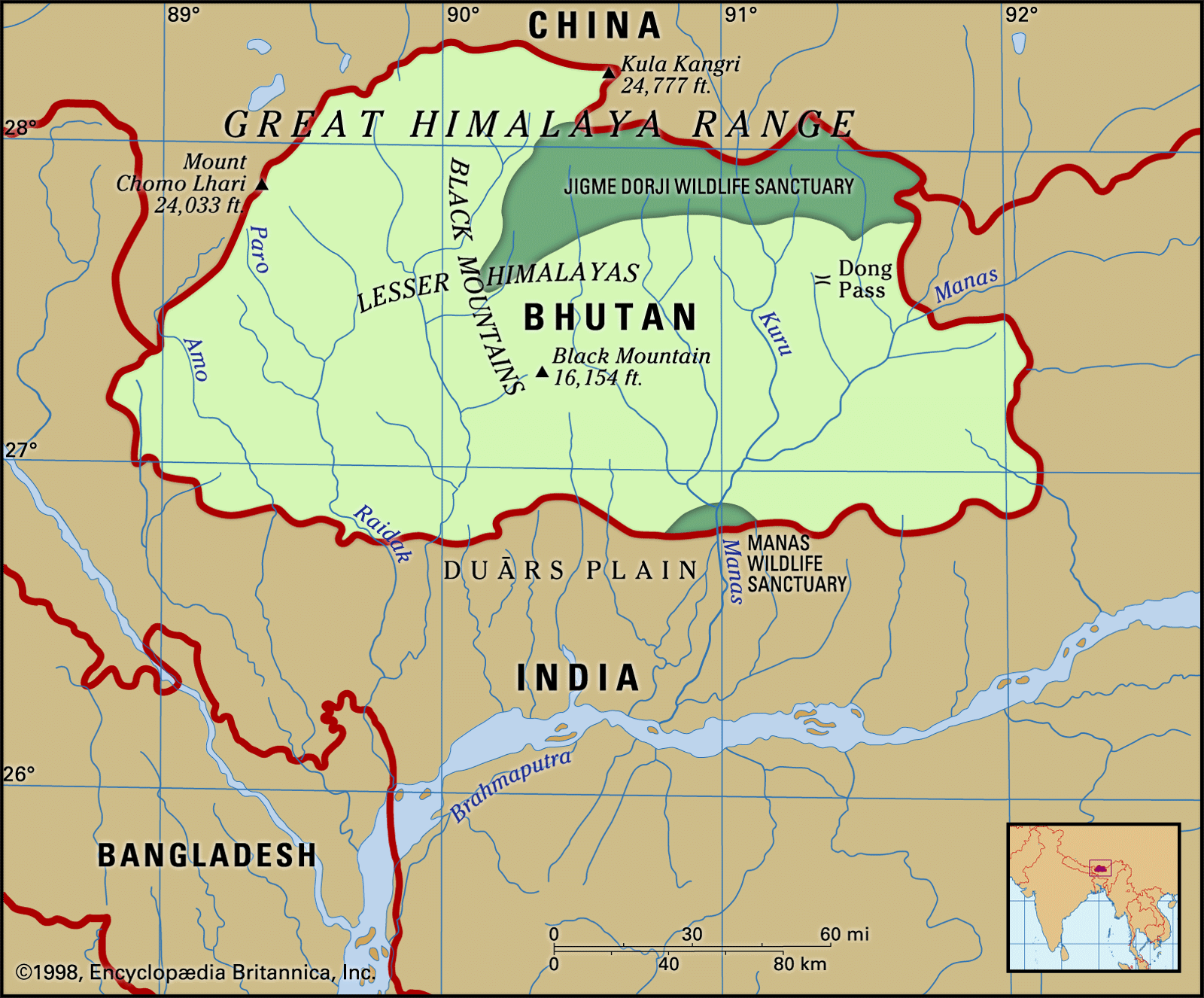

India-Bhutan Ties and Subnational Diplomacy

For Prelims: Five Year Plan, Gelephu Mindfulness City Project, Punatshangchhu-II hydro Project, Town Twinning, Farakka Water-Sharing Treaty 1996, Union List, GDP, Manas National Park, Royal Manas National Park.

For Mains: India-Bhutan ties, Potential of subnational diplomacy in advancing India’s national interests.

Why in News?

Following the King of Bhutan visit to India, both countries committed to strengthening India and Bhutan ties in which Subnational diplomacy by states like Assam can further strengthen economic and cultural relations.

What were the Key Outcomes of the Visit?

- Strengthened Cooperation: Bhutan expressed gratitude for India’s continued support for its 13th Five Year Plan (2024-29) and for India's contributions to Bhutan’s Economic Stimulus Programme.

- Economic Development: India has assured continued support for the Mindfulness City project, a sustainable economic hub.

- Hydropower Cooperation: Significant progress has been made in the 1020 MW Punatshangchhu-II hydro project and both countries agreed to expedite the completion of the Punatsangchhu-I project.

- Cross-Border Connectivity: The Integrated Check Post (ICP) at Darranga, Assam, was inaugurated to boost tourism and economic activities in Bhutan's eastern region and Assam's border areas.

What is Subnational Diplomacy?

- About: Subnational diplomacy (paradiplomacy) refers to subnational entities (like states or regions) engaging in international relations to promote their mutual interests.

- Globalization has fueled subnational diplomacy, with regional governments seeking to advance their goals in an interconnected world.

- Institutional Mechanisms in India:

- States Division: The 'States Division' under the MEA facilitates better Centre-state interaction, helping states develop foreign linkages in trade, tourism, investment, and more.

- Consular Offices and Federal Foreign Affairs Offices: Foster diplomacy with sub-national units.

- City Diplomacy: City Diplomacy, or town twinning, focuses on cultural and economic exchanges. E.g., Kobe-Ahmedabad Sister Cities.

- Global City Diplomacy Examples: Sao Paulo city in Brazil has its own policy for conducting international relations with support from Brazil’s Ministry of Foreign Affairs.

- Barcelona (Spain), Quebec (Canada), California (USA), London (UK), Vancouver (Canada) also conduct foreign relations.

- Subnational Diplomacy in India: Indian states enjoy some liberty in foreign policy implementation in areas like trade, commerce, and cultural exchange.

- In 2015, Andhra Pradesh's CM led a delegation to China before the Prime Minister's (PM) visit, and West Bengal's CM joined India’s PM in Bangladesh.

- Gujarat's "Vibrant Gujarat Global Investors Summit" promotes investment in Gujarat.

- Other states like Karnataka, Tamil Nadu, and Bihar attract FDI boosting trade opportunities

- In 1992, Maharashtra partnered with MNCs (Enron and General Electric) to finance the Dabhol Power Project.

- The 1996 Farakka water-sharing issue was resolved after West Bengal CM's visit to Bangladesh, resulting in the Farakka Water-Sharing Treaty 1996.

- Benefits:

- State-Level Influence: Indian states shape foreign policy by aligning federal and state policies in sectors like land, labor, and health.

- It can prevent issues like Kachchatheevu Island where the union's decision negatively affected the local population.

- Complementary Strengths: Indian states and their counterparts collaborate in sectors like IT and automotive, adopting tailor made approaches based on the mutual requirements.

- Global Challenges: State cooperation in climate change and pandemic recovery can offer effective solutions at local levels for the global world.

- Long-Term Alliances: Subnational diplomacy fosters grassroots partnerships, encourages P2P and B2B relations, ensuring lasting relations.

- State-Level Influence: Indian states shape foreign policy by aligning federal and state policies in sectors like land, labor, and health.

- Concerns:

- Constitutional Constraints: Foreign affairs are under the Union List in India's Constitution, limiting states' involvement and raising concerns over central authority encroachment.

- National Security Concerns: Subnational diplomacy could impact national security, particularly in sensitive areas like the Northeast or states bordering Pakistan and China.

- External Influence: Local governments may become targets of disinformation, affecting their ability to manage international relations independently.

- Smaller cities may be vulnerable to manipulation by foreign powers.

- Public Backlash: Independent foreign relations by states can lead to public opposition and diplomatic friction if they conflict with national interests.

How Subnational Diplomacy with Assam can Enhance India-Bhutan Ties?

- Trade and Connectivity: Establishing more ICPs like Darranga and developing railway links like Kokrajhar-Gelephu and Banarhat-Samtse, along with Assam's natural resources (tea, oil, Joha rice, Bhut Jolokia), will boost trade with Bhutan.

- Currently, more than 70% of trade between India and Bhutan passes through the Jaigaon Land Customs Station (LCS) in West Bengal.

- Energy Cooperation: Long-term power purchase agreement (PPA) with Bhutan’s hydroelectric companies can help meet Assam’s energy needs.

- The sale of hydro-power accounts for about 63% of Bhutan’s GDP.

- Maritime Connectivity: Bhutan can reduce transport costs to Bangladesh by using Dhubri River port and utilising Assam’s Asom Mala initiative (road infrastructure development program).

- Ecological Collaboration: Collaboration on Manas National Park (Assam) and Royal Manas National Park (Bhutan) will strengthen conservation and eco-tourism, attracting more tourists.

- Cultural Diplomacy: Assam’s cultural links with Bhutan can foster greater solidarity through cultural exchanges.

Conclusion

Subnational diplomacy, particularly through Assam, plays a vital role in strengthening India-Bhutan ties by enhancing trade, energy cooperation, and cultural exchanges. It offers innovative solutions to global challenges, while also fostering grassroots partnerships for long-term bilateral collaboration.

|

Drishti Mains Question: Discuss the potential benefits and concerns of subnational diplomacy in India’s foreign policy. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Mains

Q.Terrorist activities and mutual distrust have clouded India-Pakistan relations. To what extent the use of soft power like sports and cultural exchange could help generate goodwill between the two countries. Discuss with suitable examples. (2015)

Injecting Liquidity in Economy

Why in News?

The Reserve Bank of India (RBI) has announced measures to inject over Rs 1.5 lakh crore to increase money liquidity in the economy.

What are Key Points About RBI’s Liquidity Measures?

- Money Liquidity: It refers to the availability of cash and easily accessible funds in the economy, influencing spending and investment.

- Liquidity refers to how quickly and easily an asset can be converted into cash without impacting its price much.

- Reason for Liquidity Shortfall: The RBI's forex sale to stabilize the rupee amid foreign institutional investors (FIIs) outflows led to a liquidity deficit.

- RBI sells US dollars in exchange for rupees, reducing the supply of rupees in the banking system.

- It led to tighter short-term interest rates and increased borrowing costs.

- Measures Taken by RBI: RBI's liquidity infusion plan comprises three measures:

- Government Bond Buyback: It means the central bank or the government repurchases bonds from the market before maturity.

- It injects liquidity by paying bondholders (banks, financial institutions, or investors), increasing fund availability in the banking system.

- Repo Auction: Repo auction is a liquidity adjustment tool used by the RBI where banks bid for funds at desired borrowing rates, and the RBI accepts the lowest bids until the required amount is allotted.

- US Dollar-Rupee Swap Auction: A swap auction increases liquidity in the market by facilitating the temporary exchange of currencies or financial instruments.

- Borrowing dollars stabilizes the domestic currency and prevents a liquidity drain by avoiding rupee sales in the forex market.

- Government Bond Buyback: It means the central bank or the government repurchases bonds from the market before maturity.

- Potential Repo Rate Cut: Addressing the liquidity deficit may be a precursor to a possible repo rate cut in the upcoming monetary policy review.

- Sufficient liquidity will ensure that any future repo rate cuts are effectively transmitted to borrowers through lower interest rates.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do?(2020)

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Q. Which of the following statements is/are correct regarding the Monetary Policy Committee (MPC)?(2017)

- It decides the RBI’s benchmark interest rates.

- It is a 12-member body including the Governor of

- RBI and is reconstituted every year.

- It functions under the chairmanship of the Union Finance Minister.

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 2 and 3 only

Ans: (a)

First Indian to Pilot Axiom Mission

Indian Air Force Group Captain Shubhanshu Shukla is set to become the first Indian astronaut to travel to the International Space Station (ISS) on a private mission in 2025.

- It is led by NASA astronaut Peggy Whitson, and Shubhanshu Shukla will serve as the mission pilot.

- He is also the astronaut-designate for India’s human spaceflight program, Gaganyaan.

- He will board the SpaceX Dragon spacecraft from Kennedy Space Center in Florida as part of the Axiom Mission 4 (Ax-4), a joint venture between NASA and ISRO.

- The Axiom Mission 4 (Ax-4) will involve astronauts from India, Poland, and Hungary and is the first such collaboration in over 40 years.

- The astronauts will spend 14 days aboard the ISS conducting scientific experiments, educational outreach, and commercial activities with NASA and ISRO.

- Rakesh Sharma was the first Indian to travel to space in 1984 aboard the Soviet Soyuz T-11 mission under the Interkosmos program.

Read More: Gaganyaan Astronauts Selected for Axiom-4 Mission

Card Tokenization in India

Card tokenization has become a significant technological advancement in India, enhancing security and customer convenience in digital payments.

- Over 91 crore tokens were issued by December 2024 and has enabled nearly 98% of e-commerce transactions to be processed without actual card data, reducing the risk of data breaches.

- Tokenization: It substitutes actual card details with a unique code, or "token," which acts as a secure identifier during transactions.

- Types: Device tokenization (specific to each device) and Card-on-File tokenization (specific to each merchant).

- Security Benefits: Tokens prevent merchants from storing sensitive card details, safeguarding customers' information in case of a security breach.

- Future Expansion: Tokenization is expected to grow beyond e-commerce into contactless payments, recurring transactions, and potentially UPI-linked credit card payments.

- Cybersecurity Regulations: In October 2022, RBI mandated that merchants and payment processors no longer store customer card data, relying entirely on tokenization.

Read more: Tokenization of Cards in India

Inter-State Committees for Workers’ Social Security

Labour Ministers and Secretaries from Union and State governments concluded with major discussions on labour reforms and workers’ welfare.

- It focused on the implementation of the new Labour Codes and expanding social security coverage.

- Three committees comprising five states each will develop a sustainable model for social security for workers, with reports due in March 2025.

- A key labor reform proposed shifting from a labor inspector model to an inspector-cum-facilitator to reduce compliance burden and enhance ease of doing business.

- It emphasized the need for sustainable models to utilize the cess funds for pension schemes and education for children of construction workers.

- The welfare of construction workers was prioritized, with concerns over Rs 70,744.16 crore in unused cess funds.

- The government is also working on a dedicated Social Security Scheme for gig and platform workers, focusing on funding, data collection, and registration on the eShram portal.

Read More: India's Labour Reforms