Indian Economy

India Surpasses USD 1 Trillion in FDI

- 19 Dec 2024

- 15 min read

For Prelims: Foreign Direct Investment, World Competitive Index, Global Innovation Index, Angel tax, Make in India initiative, Production Linked Incentive Scheme, Department for Promotion of Industry and Internal Trade

For Mains: India’s Foreign Direct Investment (FDI), FDI’s role in the development

Why in News?

India has surpassed USD 1 trillion in Foreign Direct Investment (FDI) inflows since 2000, highlighting its growing appeal as a global investment hub.

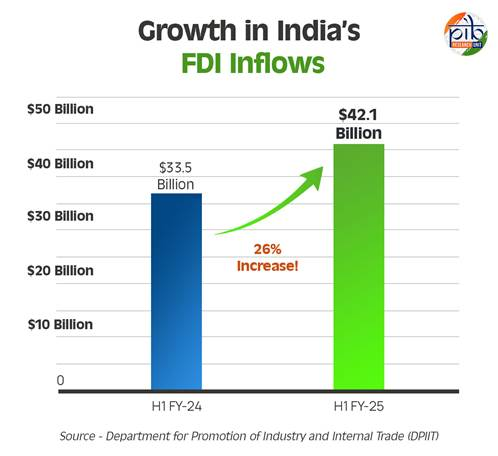

- This milestone is further supported by a 26% rise in FDI to USD 42.1 billion in the first half of the current financial year 2024-25, reflecting the impact of strategic initiatives, policy reforms, and enhanced global competitiveness.

What Factors are Driving India’s FDI Growth?

- Competitiveness and Innovation: India's World Competitive Index 2024 ranking improved to 40th from 43rd in 2021.

- In the Global Innovation Index 2023, India secured 40th place out of 132 economies, a significant rise from 81st in 2015.

- Progress in innovation and competitiveness has positioned India as a global hub for innovation-driven investment.

- Global Investment Standing: India ranked 3rd globally for greenfield projects with 1,008 announcements (World Investment Report 2023).

- International project finance deals in India also increased by 64% making it the recipient of the second-largest number of international finance deals.

- These figures highlight India's growing global investment prominence.

- Improved Business Environment: India improved its business environment significantly, rising from 142nd in 2014 to 63rd in the 2020 World Bank Doing Business Report.

- This reflects efforts to simplify regulations, and reduced bureaucratic hurdles have boosted investor confidence.

- Policy Reforms: The 2024 amendment to the Income Tax Act, 1961 abolished angel tax and reduced the income tax rate for foreign companies to simplify compliance for startups and investors.

- Initiatives to Boost FDI:

- Bilateral Investment Treaty (BIT) with UAE: The signing of a BIT with the UAE aims to increase investor confidence and stimulate investments aligned with the 'Atmanirbhar Bharat' vision.

- Production Linked Incentive (PLI) Scheme: The PLI scheme supports manufacturing sectors, driving FDI in the white goods sector.

- Make in India Initiative: Between 2014-2022, the Make in India initiative boosted FDI in the manufacturing sector by 57%.

- Foreign Investment Facilitation Portal (FIFP): The FIFP streamlines the FDI approval process by offering a single interface for investors, speeding up approvals and facilitating smoother foreign investment inflows.

- PM Gati Shakti: Measures like PM Gati Shakti aim to further boost FDI by improving infrastructure, and connectivity.

- Key Sectors with FDI Liberalization: India has made significant strides in liberalizing FDI across multiple sectors to attract global investments.

- The space sector allows 100% FDI, the Defence sector has raised its FDI cap to 74% through the automatic route and 100% via government approval.

- The pharmaceutical sector permits 74% FDI in Brownfield projects, and civil aviation allows 100% FDI in brownfield airport projects.

- Retail, insurance, and telecom sectors have also seen increased FDI limits, with significant reforms aimed at enhancing infrastructure and boosting exports.

- The textile sector benefits from the National Technical Textiles scheme and PLI initiatives, further promoting FDI.

What is Foreign Direct Investment?

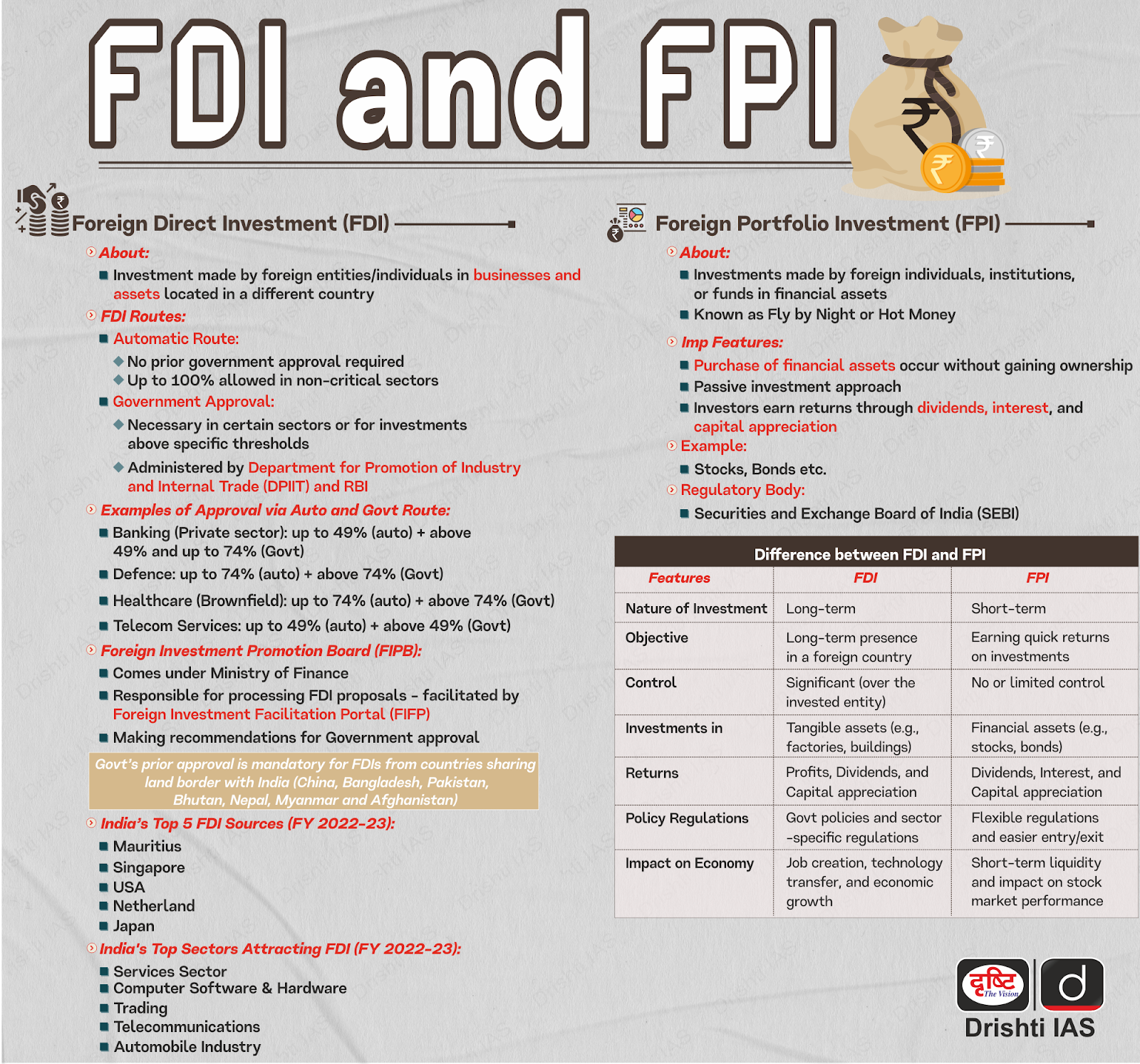

- About: FDI refers to an investment where a company or individual from one country makes an investment in a business or establishes a controlling interest in a business in another country.

- This involves more than just capital, it also brings in expertise, technology, and skills, which can contribute to the economic development of the host country.

- Types of FDI:

- Greenfield Investment: Creating new business operations from the ground up, offering high control and customization.

- Brownfield Investment: Expanding through mergers, acquisitions, or joint ventures by utilizing existing facilities.

- The control may not be as high as in Greenfield investments, as the organisation is leveraging existing structures, but still allows significant influence over the operation.

- FDI in India:

- Governance: FDI in India is governed by the Foreign Exchange Management Act (FEMA), 1999, and is administered by the Department for Promotion of Industry and Internal Trade (DPIIT), under the Ministry of Commerce and Industry.

- FDI Entry Routes: FDI under sectors is permitted either through the Automatic route or Government route.

- Under the Automatic Route, the non-resident or Indian company does not require any approval from the Government of India.

- Whereas, under the Government route, approval from the Government of India is required prior to investment.

- Proposals for foreign investment under the Government route are considered by the respective Administrative Ministry/Department.

- Sectors Under the Automatic Route: Agriculture & Animal Husbandry, Air-Transport Services, Auto-components, Automobiles, Biotechnology (Greenfield), E-commerce Activities, Renewable Energy, and various other sectors

- Sectors Under the Government Route: Banking & Public Sector, Broadcasting Content Services, Food Products Retail Trading, Satellite Establishment and Operations.

- FDI Prohibition in India: FDI is strictly prohibited in sectors like atomic energy generation, gambling and betting, lotteries, chit funds, real estate, and the tobacco industry.

- India’s Top FDI Sources: India received the highest FDI from Singapore in 2023-24, followed by Mauritius, United States, Netherlands and Japan.

Note: In order to curb opportunistic takeovers/acquisitions of Indian companies due to the Covid-19 pandemic, Government amended the FDI policy 2017 vide Press Note 3 (2020).

- It required entities from countries sharing a land border with India, or whose beneficial owner is from such countries, can only invest in India through the Government route.

- For the purpose of Press Note 3, India recognises Pakistan, Afghanistan, Nepal, Bhutan, China (including Hong Kong), Bangladesh and Myanmar as countries sharing land border with India (Bordering Countries).

What is the Significance of FDI?

- Employment and Economic Growth: FDI stimulates job creation, reduces unemployment, and enhances income levels, contributing to overall economic growth.

- FDI infuses capital, increasing tax revenue, and improving infrastructure.

- For instance, the entry of global companies like Amazon and Walmart (through Flipkart) has created numerous jobs in the retail and logistics sectors.

- Human Resource Development: Exposure to global skills and technologies improves workforce quality, benefiting the wider economy.

- For example, the establishment companies like IBM and Microsoft in India have enhanced the skill set of the local workforce.

- Development of Backward Areas: FDI helps transform underdeveloped regions into industrial hubs, driving regional economic progress.

- The automobile hub in TamilNadu, with investments from companies like Hyundai and Ford, has significantly boosted the local economy.

- Increase in Exports: FDI may lead to the establishment of export-oriented units, enhancing a country's export potential.

- For example, India's IT sector, which receives significant FDI from companies like Accenture, has become a major industry, exporting software services to clients worldwide.

- Exchange Rate Stability: Continuous FDI inflows provide foreign exchange, supporting currency stability.

- The steady inflow of FDI in key sectors like telecommunications and pharmaceuticals helps maintain a stable exchange rate.

- Creation of a Competitive Market: FDI fosters competition, drives innovation, and offers consumers a broader range of products at competitive prices.

- The entry of global brands like IKEA has increased competition in the retail sector, benefiting consumers.

What are the Concerns Regarding the FDI?

- National Security: FDI in strategic sectors, such as defence or telecommunications, can pose national security risks.

- For example, concerns have been raised about Chinese investments in critical infrastructure in various countries.

- Economic Dependence: Heavy reliance on FDI can make a country vulnerable to economic fluctuations in the investing country.

- This can lead to instability if the foreign investor decides to withdraw or reduce their investment.

- This is a concern in sectors like banking, where foreign entities might prioritize their interests over national ones.

- Profit Repatriation: Foreign companies often repatriate profits back to their home countries, which can limit the economic benefits for the host country. This can result in a net outflow of capital.

- Impact on Local Businesses: Large foreign companies can outcompete local businesses, leading to closures and job losses.

- This is particularly concerning in developing economies where local businesses may not have the resources to compete.

- Environmental Concerns: Foreign investments, especially in extractive industries, can lead to environmental degradation.

- There have been instances where foreign companies like PepsiCo have been accused of not adhering to local environmental regulations.

- Labor Exploitation: There are concerns that foreign companies might exploit local labor by paying lower wages or not adhering to labor laws. This can lead to poor working conditions and social unrest.

Way Forward

- Enhance Ease of Doing Business: Continue simplifying FDI regulations, reducing bureaucratic hurdles, and streamlining approval processes to attract more foreign investors.

- Sustainability Focus: Encouraging FDI in green and sustainable technologies to align with global environmental goals.

- Ensuring stable and transparent policies will build investor confidence and encourage sustained FDI inflows.

- Skilling and Employment: Ensure that the FDI contributes to local employment and skill development, particularly in manufacturing and technology sectors.

- Investment in R&D and Innovation: Promote FDI in research and development to foster innovation and enhance India’s global competitiveness.

- Infrastructure Development: Investing in infrastructure, including digital and physical assets, can enhance India's attractiveness as an investment destination.

- Sector-Specific Reforms: Implement targeted reforms in high-potential sectors like defence, space, and renewable energy to encourage innovation and investment.

Conclusion

India’s FDI inflows, surpassing USD 1 trillion since 2000, reflect its growing global competitiveness and successful reforms. Initiatives like "Make in India" and sectoral liberalization position India for continued sustainable growth and development on the global stage.

|

Drishti Mains Question: Analyze the role of Foreign Direct Investment (FDI) in India’s competitiveness and innovation ecosystem. How do improvements in global competitiveness affect FDI? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. With reference to Foreign Direct Investment in India, which one of the following is considered its major characteristic? (2020)

(a) It is the investment through capital instruments essentially in a listed company.

(b) It is a largely non-debt creating capital flow.

(c) It is the investment which involves debt-servicing.

(d) It is the investment made by foreign institutional investors in Government securities.

Ans: (b)

Q. Consider the following: (2021)

- Foreign currency convertible bonds

- Foreign institutional investment with certain conditions

- Global depository receipts

- Non-resident external deposits

Which of the above can be included in Foreign Direct Investments?

(a) 1, 2 and 3

(b) 3 only

(c) 2 and 4

(d) 1 and 4

Ans: (a)

Mains

Q. Justify the need for FDI for the development of the Indian economy. Why is there a gap between MOUs signed and actual FDIs? Suggest remedial steps to be taken for increasing actual FDIs in India. (2016)