Indian Economy

Transforming India's Logistics Landscape

- 01 Oct 2024

- 18 min read

This editorial is based on “How the logistics industry is positioned in India” which was published in The Hindu Business Line on 18/09/2024. The article brings into picture the rapid growth of India's logistics industry, with a projected market size of ₹35.3 trillion by FY 2029 and anticipated improvements in efficiency as logistics costs decrease.

For Prelims: India's logistics industry, National Logistics Policy, Gati Shakti, E-commerce, Dedicated Freight Corridor , Mega Food Parks, India-Middle East-Europe Economic Corridor, Mega Food Parks, Jawaharlal Nehru Port

For Mains: Key Drivers to the Growth of India's Logistic Sector, Key Issues Related to India's Logistics Sector.

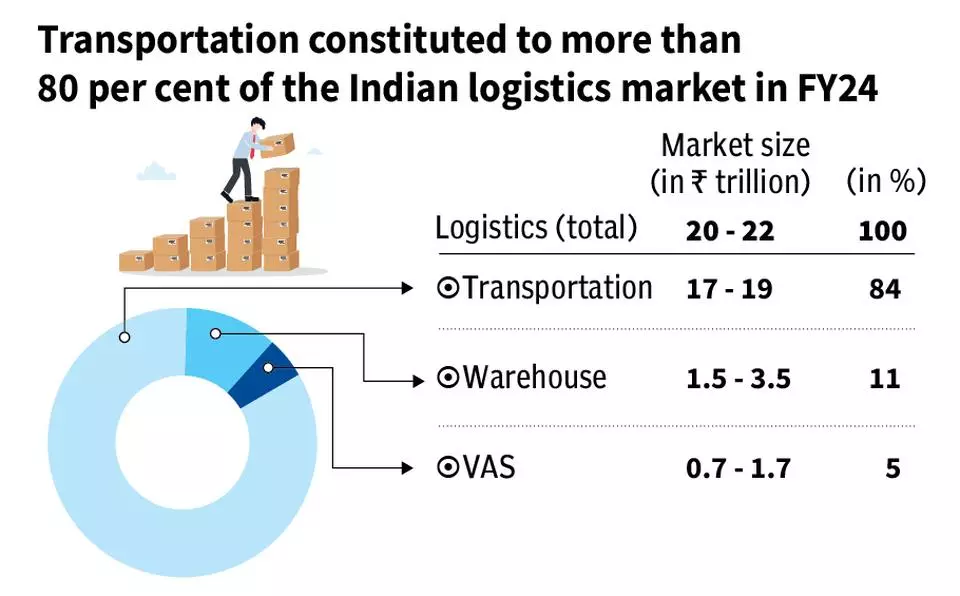

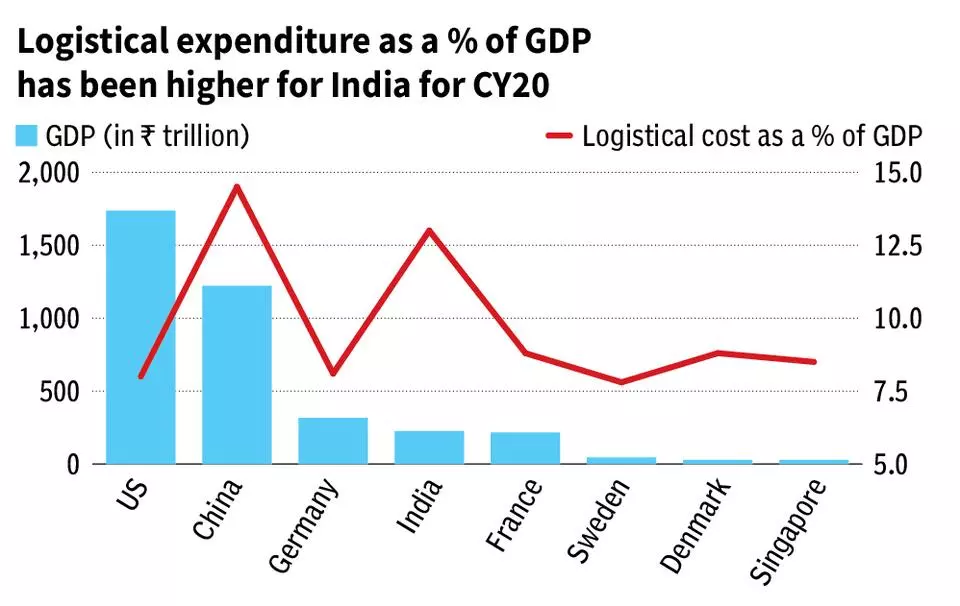

India's logistics industry has been experiencing robust growth, with its market size expanding at a compound annual growth rate (CAGR) of 11% from fiscal year 2019 to 2024. This momentum is expected to continue, with projections indicating the sector could reach a substantial market size of ₹35.3 trillion by fiscal year 2029. While the current logistics expenditure, at 13% of GDP, is relatively high, there's optimism for improvement. As the economy formalizes and connectivity enhances, this percentage is anticipated to decrease to high single digits, signaling increased efficiency in the sector.

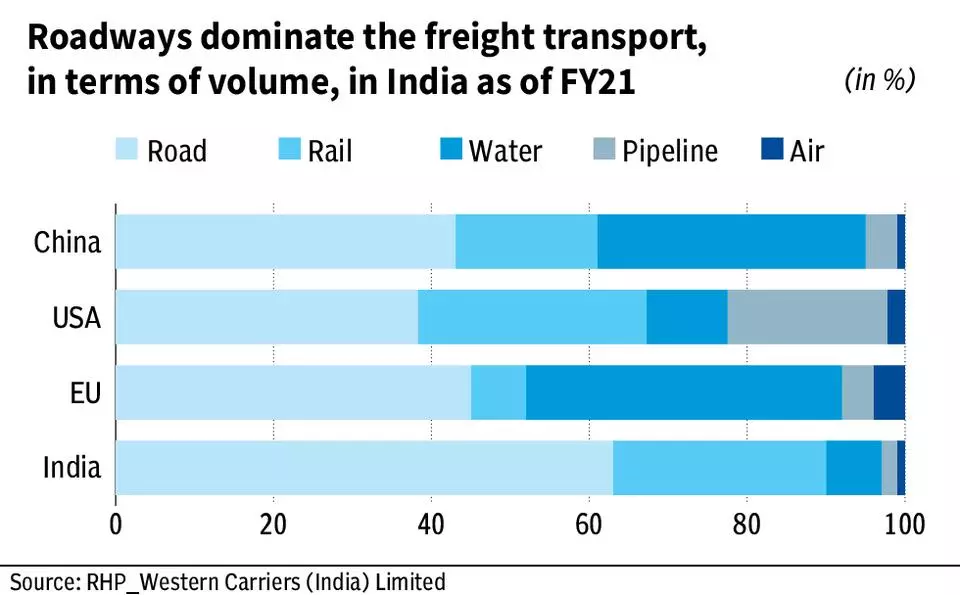

The transportation segment currently dominates India's logistics market, with roadways playing a pivotal role as of fiscal year 2021. However, the landscape is poised for change. With significant investments and improvements in rail infrastructure, the railways are expected to grow at an accelerated pace, potentially reshaping the modal mix of logistics in the country. Despite these positive trends, it is imperative for India to continue enhancing its logistics sector, focusing on innovation, technology adoption, and infrastructure development to make it more efficient, cost-effective, and globally competitive.

What are the Key Drivers to the Growth of India's Logistic Sector?

- Government Initiatives and Policy Support: The Indian government's focus on improving logistics through initiatives like the National Logistics Policy (NLP) and Gati Shakti has been a major growth driver.

- The NLP, launched in September 2022, aims to reduce logistics costs from 13-14% of GDP to single digits (8% which is the global average) by 2030.

- The PM Gati Shakti National Master Plan, introduced in October 2021, is designed to develop multimodal connectivity infrastructure to various economic zones.

- As of August 2023, over 1,400 layers of data have been integrated into the Gati Shakti portal, facilitating better planning and execution of infrastructure projects.

- These initiatives are expected to significantly boost efficiency and reduce costs in the logistics sector.

- E-commerce Boom and Last-Mile Delivery: The rapid growth of e-commerce in India has been a significant driver for the logistics sector.

- Indian e-commerce is expected to grow at a compound annual growth rate (CAGR) of 27% to reach USD 163 billion by 2026, due to this the demand for efficient last-mile delivery services has surged.

- This has led to the rise of specialized logistics companies and increased investments in technology-driven solutions.

- For instance, the rise of major logistics players Delhivery highlighting the sector's growth driven by e-commerce.

- The Covid-19 pandemic has further accelerated this trend, with more consumers shifting to online shopping, thereby increasing the need for robust logistics networks.

- Indian e-commerce is expected to grow at a compound annual growth rate (CAGR) of 27% to reach USD 163 billion by 2026, due to this the demand for efficient last-mile delivery services has surged.

- Infrastructure Development: Massive investments in transportation infrastructure have been crucial in driving logistics sector growth.

- The government's focus on developing highways, railways, ports, and airports has improved connectivity and reduced transit times.

- For example, the Dedicated Freight Corridor (DFC) project, with the Eastern and Western corridors, is set to revolutionize freight movement.

- Additionally, the National Infrastructure Pipeline (NIP) for FY 2020-25 has allocated ₹111 lakh crore for infrastructure projects, with a significant portion dedicated to transport.

- These developments are expected to enhance logistics efficiency and reduce transportation costs significantly.

- Technology Adoption and Digitalization: The integration of advanced technologies like AI, IoT, blockchain, and data analytics is transforming the logistics landscape in India.

- These technologies are enhancing operational efficiency, improving transparency, and enabling real-time tracking.

- For instance, Rivigo, an Indian logistics startup, uses AI and big data to optimize routes and reduce delivery times.

- The implementation of e-way bills and FASTag has digitized and streamlined goods movement and toll collection.

- This digital transformation is attracting investments and driving innovation in the sector.

- Rise of Third-Party Logistics (3PL) and Fourth-Party Logistics (4PL): The increasing complexity of supply chains and the need for specialized logistics services have led to the growth of 3PL and 4PL providers in India.

- These companies offer end-to-end supply chain solutions, allowing businesses to focus on their core competencies.

- The India third-party logistics market size is forecast to increase by USD 16.77 billion, at a CAGR of 9.45% between 2023 and 2028.

- The trend towards outsourcing logistics operations is likely to continue, driving further growth in this segment.

- Warehousing and Cold Chain Development: The demand for modern warehousing facilities and cold chain infrastructure has been a significant driver of growth in the logistics sector.

- The implementation of GST has led to the consolidation of warehouses and the development of large-scale logistics parks.

- According to Knight Frank India, the warehousing sector attracted investments worth $743 million in FY2022.

- The government's focus on reducing post-harvest losses has also boosted investments in cold chain infrastructure.

- As of 30th June 2024, the Ministry of Food Processing Industries (MoFPI) has approved 41 Mega Food Parks, 399 Cold Chain projects, 76 Agro-processing Clusters, and 588 Food Processing Units under the Pradhan Mantri Kisan Sampada Yojana (PMKSY).

- These developments are crucial for improving storage capabilities and reducing spoilage, particularly in the agriculture and pharmaceutical sectors.

- Growing Export-Import Trade: India's increasing participation in global trade is driving demand for logistics services.

- Despite global economic challenges, merchandise imports surged by 16.51% to USD 714.24 billion in 2022-23, while merchandise exports grew by 6.03% to USD 447.46 billion.

- For example, the recent India-Middle East-Europe Economic Corridor (IMEC) agreement, signed in September 2023, aims to enhance trade connectivity, potentially increasing demand for maritime and multimodal logistics services.

What are the Key Issues Related to India's Logistics Sector?

- Infrastructure Bottlenecks: Despite significant investments, infrastructure bottlenecks continue to plague the logistics sector.

- Poor road conditions, congested ports, and inadequate rail connectivity lead to delays and increased costs.

- For example, though the average turnaround time at major ports has fallen from 127 hours in 2010-11 to 53 hours as of 2021-22.

- The World Bank's Logistics Performance Index 2023 ranked India 38th out of 139 countries, with infrastructure quality being a key area of concern.

- Poor road conditions, congested ports, and inadequate rail connectivity lead to delays and increased costs.

- Fragmented and Unorganized Market: The Indian logistics sector remains highly fragmented, with the unorganized sector amounting to over 90% of the logistics industry.

- This fragmentation leads to inefficiencies, lack of standardization, and difficulties in implementing technology and best practices.

- This fragmentation also makes it challenging to implement uniform regulations and quality standards across the sector.

- Skill Gap and Workforce Challenges: The logistics sector faces a significant skill gap, with a shortage of trained professionals across various levels.

- The logistics sector, growing at a compound annual growth rate of 12%, is expected to add 10 million jobs by 2027, but there's a severe shortage of skilled workers.

- This skill gap is particularly acute in areas like supply chain management, warehouse operations, and technology adoption.

- Between FY17 and FY23 (up to 5th January 2023), around 1.1 crore individuals were trained under Pradhan Mantri Kaushal Vikas Yojana 2.0, with 83% certified but only 21.4 lakh placed.

- Last-Mile Delivery Challenges: The rapid growth of e-commerce has intensified last-mile delivery challenges, particularly in urban areas.

- Lack of proper addressing systems, and limited parking spaces for delivery vehicles contribute to inefficiencies.

- According to the Capgemini Research Institute, last-mile delivery costs account for 41% of total logistics supply chain costs.

- Despite innovations like drone deliveries being piloted, regulatory hurdles and infrastructure limitations continue to pose significant challenges to efficient last-mile logistics.

- Environmental Concerns and Sustainability: The logistics sector faces increasing pressure to reduce its environmental impact, particularly in terms of carbon emissions.

- In India, the transport sector accounts for approximately 13.5% of the nation's carbon emissions.

- While the government has set ambitious targets, including reducing carbon intensity by 45% by 2030, the logistics sector lags in adoption of sustainable practices.

- For example, as of September 2023, electric vehicles constitute a very minor share of the commercial vehicle fleet used in logistics.

- The lack of charging infrastructure ( just 6,000 EV charging stations) and high initial costs of EVs remain significant barriers to widespread adoption of green logistics practices.

- Multimodal Integration Challenges: Despite efforts to promote multimodal transportation, integration between different modes remains a challenge.

- Road transport still accounts for about 60% of freight movement in India, leading to higher costs and environmental impact.

- The shift to more efficient modes like railways and inland waterways has been slow.

- Indian Railways has experienced a significant decline in its share of freight transport, from 85% in 1951 to less than 30% in 2022.

- The Dedicated Freight Corridor (DFC) project has faced delays.

- This lack of effective multimodal integration continues to impact overall logistics efficiency and costs.

- Road transport still accounts for about 60% of freight movement in India, leading to higher costs and environmental impact.

- Cybersecurity and Data Protection: As the logistics sector becomes increasingly digitized, cybersecurity and data protection have emerged as critical concerns.

- Many logistics companies, especially small and medium enterprises, lack robust cybersecurity measures.

- With the increasing integration of IoT devices and cloud-based systems in logistics operations, the vulnerability to cyber threats has grown, posing a significant risk to the sector's digital transformation efforts.

What Steps can be Taken to Strengthen India's Logistics Sector?

- Accelerate Infrastructure Development: Prioritize and fast-track the completion of key infrastructure projects, particularly those aimed at improving multimodal connectivity.

- Increased Focus on last-mile connectivity to major economic hubs and ports. For instance, expedite the completion of the Dedicated Freight Corridors (DFCs).

- Implement a project monitoring system similar to the PM Gati Shakti National Master Plan for all major logistics infrastructure projects like Canal Development.

- A recent example is the Mumbai Trans Harbour Link, completed in January 2024, which has significantly reduced travel time and improved connectivity to the Jawaharlal Nehru Port .

- Such focused infrastructure development can dramatically improve logistics efficiency.

- Streamline Regulatory Processes: Implement a single-window clearance system for logistics-related approvals across all states.

- Harmonize state-level regulations to create a unified national market. Accelerate the implementation of faceless assessment in customs to reduce physical interfaces and expedite clearances.

- For example, build upon the success of the e-SANCHIT (e-Storage and Computerized Handling of Indirect Tax Documents) system, which has digitized customs documentation.

- Extend this digitization to all regulatory processes in the logistics sector to significantly reduce compliance burdens and improve ease of doing business.

- Promote Technology Adoption: Incentivize the adoption of advanced technologies like AI, IoT, and blockchain in all major logistics operations through tax benefits and subsidies.

- Expanding the scope and adoption of the Unified Logistics Interface Platform (ULIP) to cover all major logistics players. Encourage startups to develop India-specific logistics solutions by providing them with access to government data and testbeds for pilot projects.

- Enhance Skill Development: Revamp logistics education and training programs to align with industry needs.

- Establish more specialized logistics training institutes in partnership with industry leaders.

- Collaborate with e-commerce giants like Amazon and Flipkart to develop training modules for last-mile delivery personnel.

- Implement a national certification program for logistics professionals to standardize skill levels across the industry.

- Improve Warehousing and Cold Chain Infrastructure: Develop a national warehousing grid with strategically located modern warehouses.

- Offer fiscal incentives for the construction of Grade A warehouses and cold storage facilities in underserved regions.

- Implement mandatory quality standards for warehouses to improve overall storage conditions, incentivizing upgrades and modernization.

- Promote Multimodal Transportation: Develop integrated multimodal logistics parks (IMLPs) at key locations to facilitate seamless transfer between different modes of transport.

- Offer incentives for shifting cargo from road to more efficient modes like rail and inland waterways.

- For example, expedite the development of the 35 multimodal logistics parks planned under the Bharatmala Pariyojana.

- Encourage private sector participation in developing multimodal infrastructure through public-private partnerships (PPPs).

- Enhance Cybersecurity Measures: Develop sector-specific cybersecurity guidelines for logistics companies. Mandate regular cybersecurity audits for logistics service providers handling sensitive data.

- Establish a Logistics Sector Computer Emergency Response Team (L-CERT) to address cyber threats specific to the industry.

- Create a dedicated program for logistics cybersecurity, offering subsidized security assessments and tools for small and medium logistics enterprises.

- Promote Green Logistics: Introduce a carbon credit trading system specific to the logistics sector to incentivize emission reductions.

- Offer tax breaks for companies investing in green logistics technologies.

- Develop green multimodal corridors for freight movement under the Green Highway Policy with dedicated infrastructure for low-emission vehicles.

- Implement a national green logistics certification program, recognizing and rewarding companies that achieve significant reductions in their carbon footprint.

Conclusion

India’s logistics sector is on a strong growth trajectory, driven by government initiatives, infrastructure development, and increasing technology adoption. By focusing on multimodal transport, digitalization, and green logistics, India can improve efficiency, reduce costs, and make its logistics industry globally competitive.

|

Drishti Mains Question: Discuss the key challenges and opportunities in India's logistics sector, highlighting the role of infrastructure development and technology in improving efficiency and reducing costs. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. The Gati-Shakti Yojana needs meticulous coordination between the government and the private sector to achieve the goal of connectivity. Discuss. (2022)