Indian Economy

Self-Reliant India Fund for MSMEs

- 01 Aug 2023

- 9 min read

For Prelims: Self Reliant India, MSME, SEBI, Venture Capital Fund, Credit Guarantee Fund Trust for Micro & Small Enterprises, Raising and Accelerating MSME Performance

For Mains: Challenges Related to MSME Sector in India, Related Government Policies.

Why in News?

Recently, the Minister of State for Micro Small and Medium Enterprises provided valuable insights into the Self Reliant India Fund during a written reply in the Lok Sabha.

What is Self-Reliant India (SRI) Fund?

- About:

- As part of the Atmanirbhar Bharat package, the Indian government announced the allocation of Rs. 50,000 crores for equity infusion in MSMEs through the Self-Reliant India (SRI) Fund.

- SRI fund operates through a mother-fund and daughter-fund structure for equity or quasi-equity investments.

- The National Small Industries Corporation (NSIC) Venture Capital Fund Limited (NVCFL) was designated as the Mother Fund for the implementation of the SRI Fund.

- It was registered as a Category-II Alternative Investment Fund (AIF) with SEBI.

- Objectives of the SRI Fund:

- To provide equity funding to viable and high-potential MSMEs, fostering their growth and transformation into larger enterprises.

- To bolster the MSME sector's contribution to the Indian economy by promoting innovation, entrepreneurship, and competitiveness.

- To create an environment conducive to technological upgradation, research and development, and increased market access for MSMEs.

- Composition of the SRI Fund:

- The Rs. 50,000 crore SRI Fund comprises:

- Rs. 10,000 Crore from the Government of India to initiate equity infusion in select MSMEs.

- Rs. 40,000 Crore sourced through Private Equity (PE) and Venture Capital (VC) funds, leveraging private sector expertise and investment.

- The Rs. 50,000 crore SRI Fund comprises:

Note:

- Equity Infusion: It refers to the process of injecting fresh capital or funds into a company by issuing additional shares to existing shareholders or new investors.

- Venture Capital Fund: It is a type of investment fund that provides capital to early-stage and startup companies with high growth potential.

- The primary objective of a venture capital fund is to identify promising startups and invest in them in exchange for equity (ownership) in the company.

- SEBI: It is a Statutory Body established on 12th April, 1992 in accordance with the provisions of the Securities and Exchange Board of India Act, 1992.

- The basic functions of SEBI is to protect the interests of investors in securities and to promote and regulate the securities market.

What is the Status of MSME Sector in India?

- About:

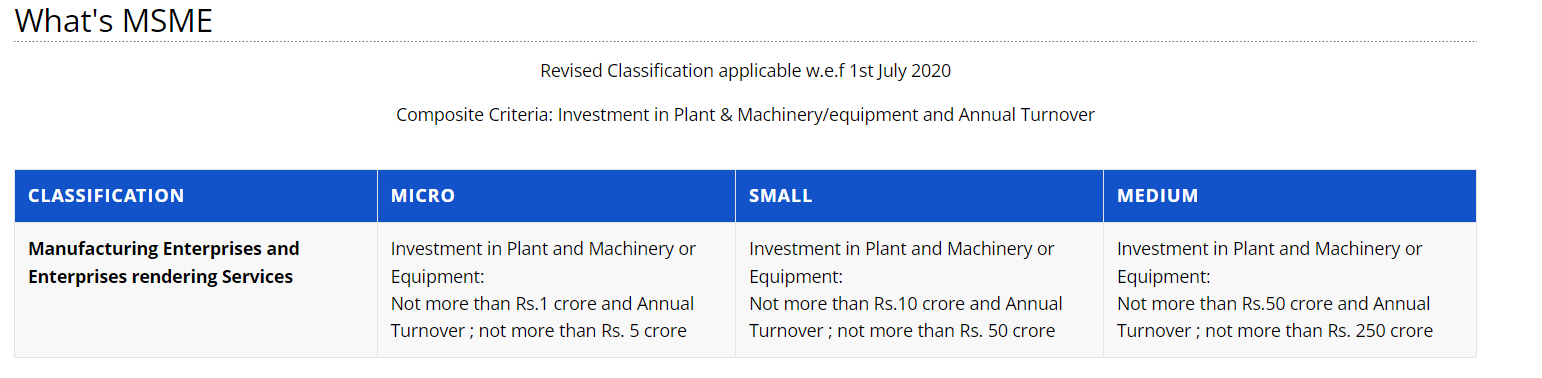

- MSME stands for Micro, Small, and Medium Enterprises. The MSME sector of India contributes around 33% of the country's total GDP and is predicted to contribute worth USD 1 trillion to India's total exports by 2028.

- Significance:

- Employment Generation: MSMEs provide about 110 million jobs which is 22-23% of the total employment in India.

- It contributes to reducing unemployment and underemployment, supporting inclusive growth and poverty reduction.

- Promotion of Entrepreneurship and Innovation: The MSME sector fosters a culture of entrepreneurship and innovation.

- It encourages individuals to start their own businesses, promotes indigenous technologies, and contributes to the development of new products and services.

- Boon for Rural Development: Compared with large-scale companies, MSMEs aided in the industrialisation of rural areas at minimal capital cost.

- Employment Generation: MSMEs provide about 110 million jobs which is 22-23% of the total employment in India.

- Challenges:

- Infrastructure and Technology: Outdated infrastructure and limited access to modern technology due to limited finance and expertise can hinder the growth and efficiency of MSMEs.

- The lack of proper transportation, power supply, and communication networks affects their ability to compete on a global scale.

- Complex Regulatory Environment: Cumbersome and complex regulations can be challenging for small businesses to navigate.

- Compliance with various laws related to taxation, labor, environmental norms, etc., requires time, effort, and expertise.

- Inadequate Working Capital Management: Many MSMEs struggle with managing their working capital effectively.

- Late payments from customers and long payment cycles with suppliers can create cash flow issues.

- Vulnerability to Economic Fluctuations: The MSME sector is particularly vulnerable to economic downturns, as they may not have the financial buffers or scale to withstand challenging economic conditions.

- Infrastructure and Technology: Outdated infrastructure and limited access to modern technology due to limited finance and expertise can hinder the growth and efficiency of MSMEs.

- Government Initiatives for the MSME Sector:

- MSME Champions Scheme: Comprising MSME-Sustainable (ZED), MSME-Competitive (Lean), and MSME-Innovative (for incubation, IPR, Design, and Digital MSME), this scheme provides financial assistance to MSMEs to enhance their competitiveness and innovation capabilities.

- Infusion in Credit Guarantee Fund: As part of the Budget 2023-24, the government announced an infusion of Rs. 9,000 crore in the corpus of Credit Guarantee Fund Trust for Micro & Small Enterprises.

- Raising and Accelerating MSME Performance (RAMP): This initiative focuses on strengthening institutions and governance of MSME programs at both the central and state levels.

- Amendment in Income Tax Act: The Finance Act 2023 brought about an amendment in Section 43B of the Income Tax Act, 1961, to offer more favorable tax provisions for MSMEs.

Way Forward

- Ease of Doing Business: There is a need to continuously work towards improving the ease of doing business for MSMEs, reducing bureaucratic red tape, and simplifying regulatory compliance

- Mobile Innovation Labs: There is a need to set up mobile innovation labs that travel to different regions, especially in rural areas, to provide MSMEs with access to cutting-edge technologies, training, and mentorship.

- This initiative would help bridge the technology gap and promote innovation in remote areas.

- Government-Private Sector Co-Innovation Funds: It's a time to create co-investment funds where the government partners with private sector companies to invest in promising MSME innovations.

- This collaboration would not only support the growth of innovative businesses but also enhance public-private partnerships.

- Innovation Impact Assessment: There is a need to develop a standardized impact assessment framework that measures the societal and environmental benefits of MSME innovations.

- Businesses that can demonstrate a positive impact through their innovations can receive additional recognition and support.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q.1 What is/are the recent policy initiative(s)of Government of India to promote the growth of the manufacturing sector? (2012)

- Setting up of National Investment and Manufacturing Zones

- Providing the benefit of ‘single window clearance’

- Establishing the Technology Acquisition and Development Fund

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Q.2. Which of the following can aid in furthering the Government’s objective of inclusive growth? (2011)

- Promoting Self-Help Groups

- Promoting Micro, Small and Medium Enterprises

- Implementing the Right to Education Act

Select the correct answer using the codes given below:

(a) 1 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (d)

Q.3 Consider the following statements with reference to India : (2023)

- According to the ‘Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, the ‘medium enterprises’ are those with investments in plant and machinery between `15 crore and `25 crore.

- All bank loans to the Micro, Small and Medium Enterprises qualify under the priority sector.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)