Rapid Fire

72% of Taxpayers Opted for New Tax Regime

- 08 Aug 2024

- 2 min read

The Central Board of Direct Taxes (CBDT) reported that 72% of Income Tax (IT) assessees chose the new tax regime in 2023-24.

- Out of the 7.28 crore IT returns filed for the assessment year 2024-25, 5.27 crore were under the new regime.

- Increase in I-T Return Filings: Assessment Year 2024-25 saw a 7.5% rise in filings, with nearly 58.6 lakh returns from first-time filers, indicating an expanding tax base.

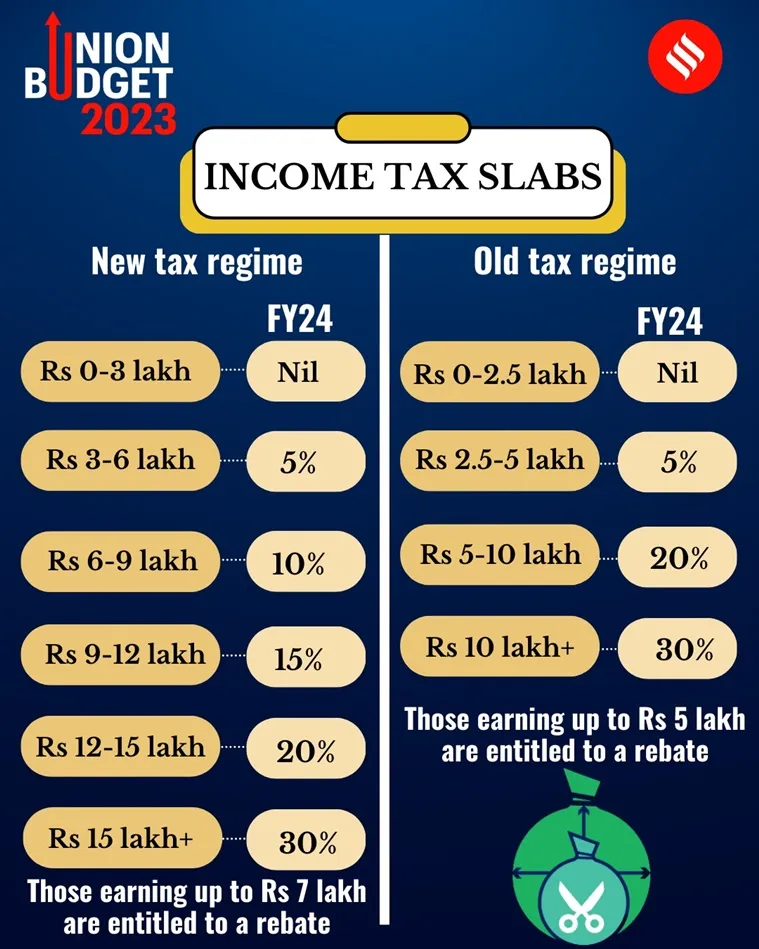

- Changes in Tax Structure:

- The new tax regime was made the default option, with tax slabs reduced from 6 to 5.

- The tax-free income limit increased from Rs 2.5 lakh to Rs 3 lakh.

- The tax rebate limit under the new regime was raised from Rs 5 lakh to Rs 7 lakh.

- The standard deduction was increased from Rs 50,000 to Rs 75,000.

- India's net direct tax collections increased by 17.7% in 2023-24, reaching Rs. 19.58 lakh crores, largely due to a rise in personal income taxes, which now comprise 53.3% of total tax revenue, up from 50.06% in 2022-23.

- Direct taxes are the taxes an individual pays directly to the government, such as income tax, poll tax, land tax, and personal property tax.