Important Institution

International Monetary Fund (IMF)

- 16 Jun 2022

- 23 min read

Last Updated: July 2022

The International Monetary Fund (IMF) is an organization of 190 member countries, each of which has representation on the IMF's executive board in proportion to its financial importance, so that the most powerful countries in the global economy have the most voting power.

What are the Objectives of IMF?

- Foster global monetary cooperation

- Secure financial stability

- Facilitate international trade

- Promote high employment and sustainable economic growth

- And reduce poverty around the world

- Macro-economic growth

- Policy advise & financing for developing countries,

- Promotion of exchange rate stability, and an international payment system

What Does the IMF Do?

- It has three critical missions:

- Furthering international monetary cooperation, encouraging the expansion of trade and economic growth,

- Discouraging policies that would harm prosperity.

- To fulfill these missions, IMF member countries work collaboratively with each other and with other international bodies.

What is the History of IMF?

- The IMF, also known as the Fund, was conceived at a UN conference in Bretton Woods, New Hampshire, United States, in July 1944.

- The 44 countries at that conference sought to build a framework for economic cooperation to avoid a repetition of the competitive devaluations that had contributed to the Great Depression of the 1930s.

- Countries were not eligible for membership in the International Bank for Reconstruction and Development (IBRD) unless they were members of the IMF.

- IMF, as per Bretton Woods agreement to encourage international financial cooperation, introduced a system of convertible currencies at fixed exchange rates, and replaced gold with the U.S. dollar (gold at $35 per ounce) for official reserve.

- After the Bretton Woods system (system of fixed exchange rates) collapsed in the 1971, the IMF has promoted the system of floating exchange rates. Countries are free to choose their exchange arrangement, meaning that market forces determine the value of currencies relative to one another. This system continues to be in place today.

- During 1973 oil crisis, IMF estimated that the foreign debts of 100 oil-importing developing countries increased by 150% between 1973 and 1977, complicated further by a worldwide shift to floating exchange rates. IMF administered a new lending program during 1974–1976 called the Oil Facility. Funded by oil-exporting nations and other lenders, it was available to nations suffering from acute problems with their balance of trade due to the rise in oil prices.

- IMF was one of the key organisations of the international economic system; its design allowed the system to balance the rebuilding of international capitalism with the maximisation of national economic sovereignty and human welfare, also known as embedded liberalism.

- The IMF played a central role in helping the countries of the former Soviet bloc transition from central planning to market-driven economies.

- In 1997, a wave of financial crises swept over East Asia, from Thailand to Indonesia to Korea and beyond.

- The International Monetary Fund created a series of bailouts (rescue packages) for the most-affected economies to enable them to avoid default, tying the packages to currency, banking and financial system reforms.

- Global Economic Crisis (2008): IMF undertook major initiatives to strengthen surveillance to respond to a more globalized and interconnected world.

- These initiatives included revamping the legal framework for surveillance to cover spill-overs (when economic policies in one country can affect others), deepening analysis of risks and financial systems, stepping up assessments of members’ external positions, and responding more promptly to concerns of the members.

What are the Functions of IMF?

- Provides Financial Assistance: To provide financial assistance to member countries with balance of payments problems, the IMF lends money to replenish international reserves, stabilize currencies and strengthen conditions for economic growth. Countries must embark on structural adjustment policies monitored by the IMF.

- IMF Surveillance: It oversees the international monetary system and monitors the economic and financial policies of its 190 member countries.

- As part of this process, which takes place both at the global level and in individual countries, the IMF highlights possible risks to stability and advises on needed policy adjustments.

- Capacity Development: It provides technical assistance and training to central banks, finance ministries, tax authorities, and other economic institutions.

- This helps countries raise public revenues, modernize banking systems, develop strong legal frameworks, improve governance, and enhance the reporting of macroeconomic and financial data. It also helps countries to make progress towards the Sustainable Development Goals (SDGs).

What is the Governance Setup of IMF?

- Board of Governors: It consists of one governor and one alternate governor for each member country. Each member country appoints its two governors.

- It is responsible for electing or appointing executive directors to the Executive Board.

- Approving quota increases, Special Drawing Right allocations,

- Admittance of new members, compulsory withdrawal of member,

- Amendments to the Articles of Agreement and By-Laws.

- Board of Governors is advised by two ministerial committees, the International Monetary and Financial Committee (IMFC) and the Development Committee.

- Boards of Governors of the IMF and the World Bank Group normally meet once a year, during the IMF–World Bank Annual Meetings, to discuss the work of their respective institutions.

- Ministerial Committees: The Board of Governors is advised by two ministerial committees,

- International Monetary and Financial Committee (IMFC): IMFC has 24 members, drawn from the pool of 190 governors, and represents all member countries.

- It discusses the management of the international monetary and financial system.

- It also discusses proposals by the Executive Board to amend the Articles of Agreement.

- And any other matters of common concern affecting the global economy.

- Development Committee: is a joint committee (25 members from Board of Governors of IMF & World Bank), tasked with advising the Boards of Governors of the IMF and the World Bank on issues related to economic development in emerging market and developing countries.

- It serves as a forum for building intergovernmental consensus on critical development issues.

- International Monetary and Financial Committee (IMFC): IMFC has 24 members, drawn from the pool of 190 governors, and represents all member countries.

- Executive Board: It is 24-member Executive Board elected by the Board of Governors.

- It conducts the daily business of the IMF and exercises the powers delegated to it by the Board of Governors & powers conferred on it by the Articles of Agreement.

- It discusses all aspects of the Fund’s work, from the IMF staff's annual health checks of member countries' economies to policy issues relevant to the global economy.

- The Board normally makes decisions based on consensus, but sometimes formal votes are taken.

- Votes of each member equal the sum of its basic votes (equally distributed among all members) and quota-based votes. A member’s quota determines its voting power.

- IMF Management: IMF’s Managing Director is both chairman of the IMF’s Executive Board and head of IMF staff. The Managing Director is appointed by the Executive Board by voting or consensus.

- IMF Members: Any other state, whether or not a member of the UN, may become a member of the IMF in accordance with IMF Articles of Agreement and terms prescribed by the Board of Governors.

- Membership in the IMF is a prerequisite to membership in the IBRD.

- Pay a quota subscription: On joining the IMF, each member country contributes a certain sum of money, called a quota subscription, which is based on the country’s wealth and economic performance (Quota Formula).

- It is a weighted average of GDP (weight of 50 %)

- Openness (30 %),

- Economic variability (15 %),

- International reserves (5 %).

- GDP of member country is measured through a blend of GDP—based on market exchange rates (weight of 60 %) and on PPP exchange rates (40 %).

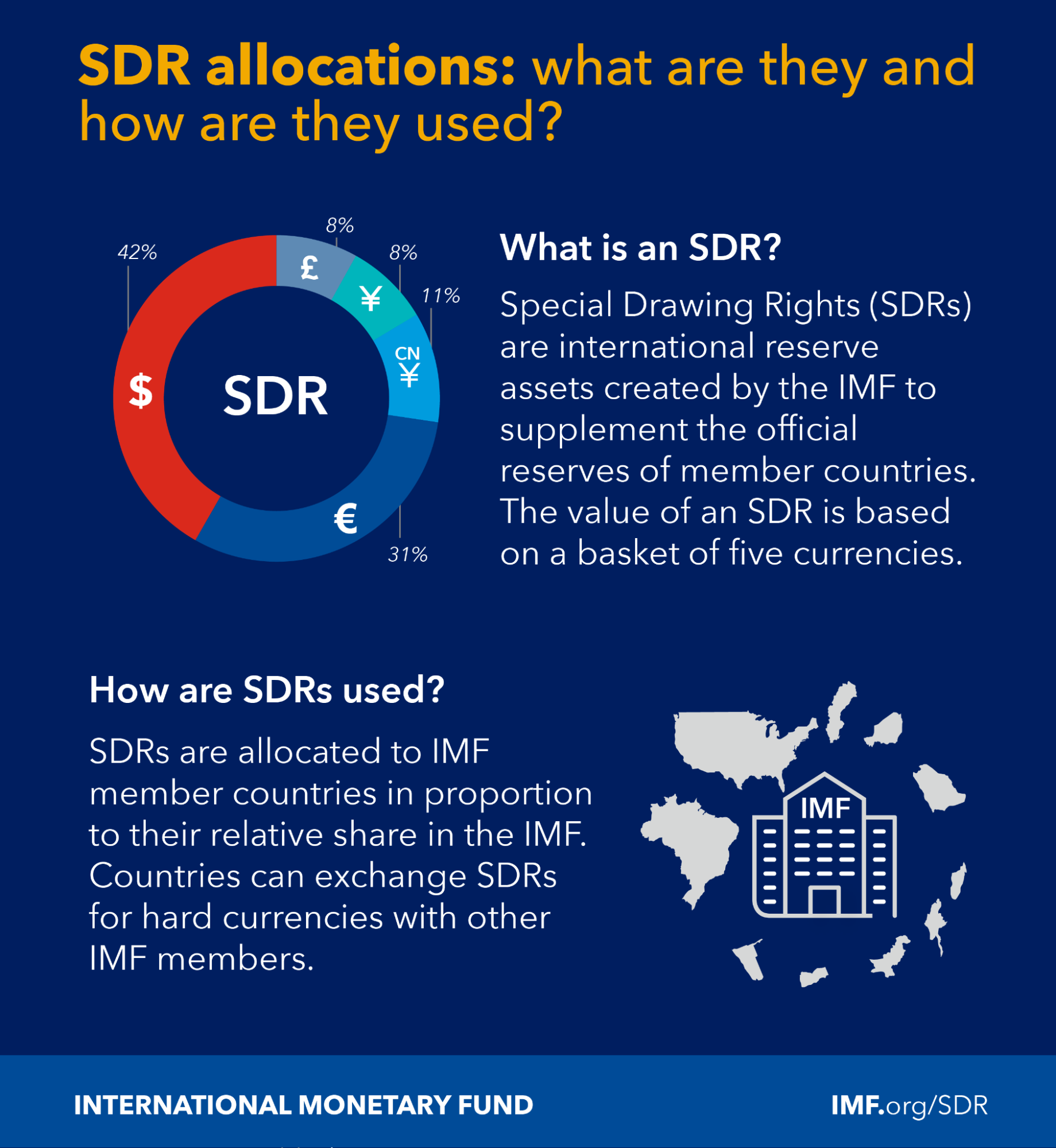

- Special Drawing Rights (SDRs) is the IMF’s unit of account and not a currency.

- The currency value of the SDR is determined by summing the values in U.S. dollars, based on market exchange rates, of a SDR basket of currencies

- SDR basket of currencies includes the U.S. dollar, Euro, Japanese yen, pound sterling and the Chinese renminbi (included in 2016).

- The SDR currency value is calculated daily (except on IMF holidays or whenever the IMF is closed for business) and the valuation basket is reviewed and adjusted every five years.

- Quotas are denominated (expressed) in SDRs.

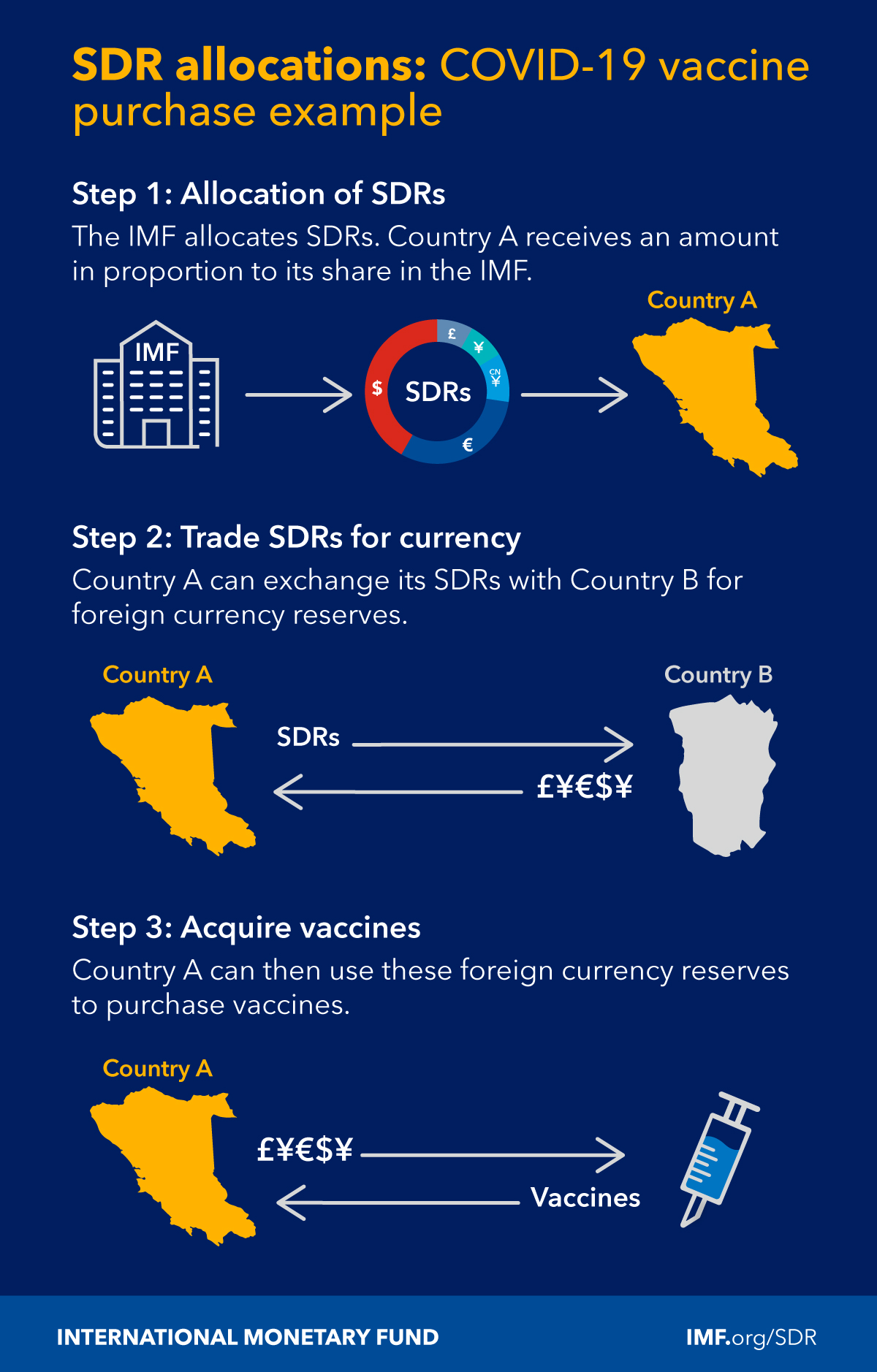

- SDRs represent a claim to currency held by IMF member countries for which they may be exchanged.

- Members’ voting power is related directly to their quotas (the amount of money they contribute to the institution).

- IMF allows each member country to choose its own method of determining the exchange value of its money. The only requirements are that the member no longer base the value of its currency on gold (which has proved to be too inflexible) and inform other members about precisely how it is determining the currency’s value.

What are Special Drawing Rights (SDR)?

- The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries' official reserves.

- To date, a total of SDR 660.7 billion (equivalent to about US$943 billion) have been allocated.

- This includes the largest-ever allocation of about SDR 456 billion approved on August 2, 2021 (effective on August 23, 2021).

- This was to address the long-term global need for reserves, and help countries cope with the impact of the Covid-19 pandemic.

- The value of the SDR is based on a basket of five currencies—the U.S. dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling.

- The SDR basket is reviewed every five years.

- During the last review concluded in November 2015, the Board decided that the Chinese renminbi (RMB) met the criteria for SDR basket inclusion.

IMF and India: What is the Scenario?

- India is a founder member of the IMF.

- International regulation by IMF in the field of money has certainly contributed towards expansion of international trade. India has, to that extent, benefitted from these fruitful results.

- Post-partition period, India had serious balance of payments deficits, particularly with the dollar and other hard currency countries. It was the IMF that came to her rescue.

- The Fund granted India loans to meet the financial difficulties arising out of the Indo–Pak conflict of 1965 and 1971.

- From the inception of IMF up to March 31, 1971, India purchased foreign currencies of the value of Rs. 817.5 crores from the IMF, and the same have been fully repaid.

- Since 1970, the assistance that India, as other member countries of the IMF, can obtain from it has been increased through the setting up of the Special Drawing Rights (SDRs created in 1969).

- India had to borrow from the Fund in the wake of the steep rise in the prices of its imports, food, fuel and fertilizers.

- In 1981, India was given a massive loan of about Rs. 5,000 crores to overcome foreign exchange crisis resulting from persistent deficit in balance of payments on current account.

- India wanted large foreign capital for her various river projects, land reclamation schemes and for the development of communications. Since private foreign capital was not forthcoming, the only practicable method of obtaining the necessary capital was to borrow from the International Bank for Reconstruction and Development (i.e. World Bank).

- India has availed of the services of specialists of the IMF for the purpose of assessing the state of the Indian economy. In this way India has had the benefit of independent scrutiny and advice.

- The balance of payments position of India having gone utterly out of gear on account of the oil price escalation since October 1973, the IMF has started making available oil facility by setting up a special fund for the purpose.

- Early 1990s when foreign exchange reserves – for two weeks’ imports as against the generally accepted 'safe minimum reserves' of three month equivalent — position were terribly unsatisfactory.

- Government of India's immediate response was to secure an emergency loan of $2.2 billion from the International Monetary Fund by pledging 67 tons of India's gold reserves as collateral security.

- India promised IMF to launch several structural reforms (like devaluation of Indian currency, reduction in budgetary and fiscal deficit, cut in government expenditure and subsidy, import liberalisation, industrial policy reforms, trade policy reforms, banking reforms, financial sector reforms, privatization of public sector enterprises, etc.) in the coming years.

- The foreign reserves started picking up with the onset of the liberalisation policies.

- India has occupied a special place in the Board of Directors of the Fund. Thus, India had played a creditable role in determining the policies of the Fund. This has increased the India’s prestige in the international circles.

- India has not taken any financial assistance from the IMF since 1993.

- Repayments of all the loans taken from the International Monetary Fund were completed on 31 May 2000.

- The Finance Minister of India is the ex-officio Governor on the Board of Governors of the IMF.

- RBI Governor is the Alternate Governor at the IMF.

- India’s current quota in the IMF is SDR (Special Drawing Rights) 5,821.5 million, making it the 13th largest quota holding country at IMF and giving it shareholdings of 2.44%.

- However, based on voting share, India (together with its constituency countries Viz. Bangladesh, Bhutan, and Sri Lanka) is ranked 17th in the list of 24 constituencies at the Executive Board.

What is India’s Contribution to Lending Resources to IMF?

- In the London Summit of the Group of Twenty (G-20), a decision was taken to triple the IMF’s lending capacity up to US$ 500 billion.

- In pursuance of this decision, India decided to invest its reserves, initially up to US$ 10 billion through the Notes Purchase Agreement (NPA), and subsequently up to US$ 14 billion through New Arrangement to Borrow (NAB).

- As of 7 April 2011, India has invested SDR 750 million (approx. 5,340.36 crores) through nine note purchase agreements with the IMF.

What is Criticism of IMF?

- IMF’s governance is an area of contention. For decades, Europe and the United States have guaranteed the helm of the IMF to a European and that of the World Bank to an American.

- The situation leaves little hope for ascendant emerging economies that, despite modest changes in 2015, do not have as large an IMF voting share as the United States and Europe.

- Conditions placed on loans are too intrusive and compromise the economic and political sovereignty of the receiving countries. 'Conditionality' refers to more forceful conditions, ones that often turn the loan into a policy tool.

- These include fiscal and monetary policies, including such issues as banking regulations, government deficits, and pension policy.

- Many of these changes are simply politically impossible to achieve because they would cause too much domestic opposition.

- These include fiscal and monetary policies, including such issues as banking regulations, government deficits, and pension policy.

- IMF imposed the policies on countries without understanding the distinct characteristics of the countries that made those policies difficult to carry out, unnecessary, or even counter-productive.

- Policies were imposed all at once, rather than in an appropriate sequence. IMF demands that countries it lends to privatize government services rapidly. It results in a blind faith in the free market that ignores the fact that the ground must be prepared for privatization.

What is the Status of IMF Reforms?

- Quota Reforms: As part of the Fourteenth General Review of Quotas (2010, India’s total quota has been increased to SDR 13,114.4 million from SDR 5821.5 million.

- With this increase, India’s share would increase to 2.75 % (from 2.44%), making it the 8th largest quota-holding country in the IMF.

- Significantly, the reforms will lead to a realignment of quota shares of member countries, with the shifts to dynamic Emerging Market and Dynamic Countries (EMDCs) and from over- to under-represented countries both exceeding 6%, while protecting the voting share of the poorest member.

- Due to discontent with IMF, BRICS countries established a new organization called BRICS bank to reduce the dominance of IMF or World Bank and to consolidate their position in the world as BRICS countries accounts for 1/5th of WORLD GDP and 2/5th of world population.

- It is almost impossible to make any reform in the current quota system as more than 85% of total votes are required to make it happen. The 85% votes does not cover 85% countries but countries which have 85% of voting power and only USA has voting share of around 17% which makes it impossible to reform quota without consent of developed countries.

- 2010 Quota Reforms approved by Board of Governors were implemented in 2016 with delay because of reluctance from US Congress as it was affecting its share.

- Combined quotas (or the capital that the countries contribute) of the IMF increased to a combined SDR 477 billion (about $659 billion) from about SDR 238.5 billion (about $329 billion). It increased 6% quota share for developing countries and reduced same share of developed or over represented countries.

- More representative Executive Board: 2010 reforms also included an amendment to the Articles of Agreement established an all-elected Executive Board, which facilitates a move to a more representative Executive Board.

- The 15th General Quota Review (in process) provides an opportunity to assess the appropriate size and composition of the Fund’s resources and to continue the process of governance reforms.