Indian Economy

Union Budget 2024-2025

- 23 Jul 2024

- 12 min read

For Prelims: Union Budget, Parliament, Pradhan Mantri Gram SadakYojana (PMGSY), Mudra loan, Interim Budget, Digital Public Infrastructure (DPI), India Post Payment Bank, Mudra loan, Vivad se Vishwas Scheme

For Mains: Significance of Parliament and Government Policies & Interventions for Indian Economy.

Why in News?

Recently, Union Budget 2024-25 was presented in the Parliament. It was the first general budget of the 18th Lok Sabha.

What are the Major Highlights of the Union Budget 2024-25?

- Focus Area:

- As outlined in the Interim Budget, the focus of the budget remains on four major groups: 'Garib' (Poor), 'Mahilayen' (Women), 'Yuva' (Youth), and 'Annadata' (Farmers) .

- Budget Theme:

- The Union Budget 2024-25 emphasises employment, skilling, support for MSMEs, and the middle class. A significant allocation of Rs 1.48 lakh crore is earmarked for education, employment, and skilling.

- Budget Priorities:

- The budget prioritizes nine areas including agriculture, employment, human resource development, manufacturing, services, urban development, energy security, infrastructure, innovation, research & development, and next-generation reforms.

- Priority 1: Productivity and Resilience in Agriculture:

- Measures include releasing new 109 high-yielding crop varieties, promoting natural farming among 1 crore farmers, establishing 10,000 need-based bio-input bio-input centres, and enhancing production, storage, and marketing of pulses and oilseeds (achieve‘atmanirbharta’ for oil seeds).

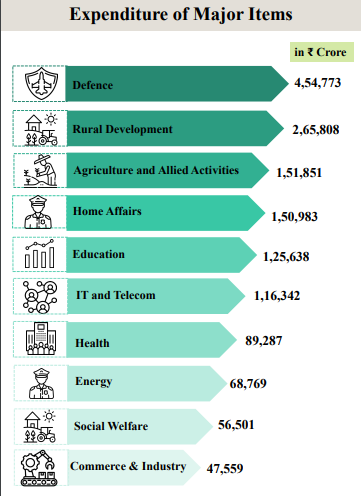

- A provision of Rs 1.52 lakh crore has been announced for agriculture and allied sectors this year.

- Government along with the states, will facilitate the implementation of the Digital Public Infrastructure (DPI) in agriculture for coverage of farmers and their lands in 3 years.

- Priority 2: Employment & Skilling:

- The budget introduces schemes like Employment Linked Incentive and initiatives to boost skilling with a focus on skilling 20 lakh youth over a 5-year period and upgrading 1,000 Industrial Training Institutes.

- Financial support for higher education and loans for skilling are also announced.

- The Model Skill Loan Scheme will be revised to facilitate loans up to Rs 7.5 lakh with a guarantee from a government promoted fund, which is expected to help 25,000 students every year.

- The budget introduces schemes like Employment Linked Incentive and initiatives to boost skilling with a focus on skilling 20 lakh youth over a 5-year period and upgrading 1,000 Industrial Training Institutes.

- Priority 3: Inclusive Human Resource Development and Social Justice:

- Enhanced support for economic activities among marginalised groups, including tribal communities and women entrepreneurs, is emphasized.

- The government's Purvodaya initiative aims to comprehensively develop the eastern region of India- including Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh, focusing on human resource development, infrastructure enhancement, and economic growth to advance towards a developed nation.

- The Finance Minister announced the launch of the Pradhan Mantri Janjatiya Unnat Gram Abhiyan to enhance the socio-economic conditions of tribal communities, covering 63,000 villages in tribal-majority areas and aspirational districts, benefiting approximately 5 crore tribal people.

- Over 100 branches of India Post Payment Bank will be established in the North East region to enhance banking services, alongside a provision of Rs 2.66 lakh crore allocated for rural development and infrastructure this year.

- Priority 4: Manufacturing & Services:

- The budget emphasises support for MSMEs, focusing on labour-intensive manufacturing, with a new self-financing guarantee fund offering up to Rs 100 crore per applicant.

- Public sector banks will enhance their internal assessment capabilities for MSME credit. Additionally, Mudra loan limits will increase to Rs 20 lakh for previous 'Tarun' category borrowers.

- The budget also includes initiatives like setting up 50 food irradiation units, establishing 100 food quality labs, and creating E-Commerce Export Hubs.

- Furthermore, a scheme for internships in 500 top companies aims to benefit 1 crore youth over 5 years.

- Priority 5: Urban Development:

- PM Awas Yojana Urban 2.0, has been allocated Rs 10 lakh crore to address housing needs of 1 crore urban poor and middle-class families, with Rs 2.2 lakh crore in central assistance over 5 years.

- The government will also collaborate with State Governments and Multilateral Development Banks to promote water supply, sewage treatment, and solid waste management in 100 large cities through bankable projects.

- Additionally, building on the success of PM SVANidhi, the government plans to establish 100 weekly street food hubs (haats) annually over the next five years.

- Priority 6: Energy Security:

- PM Surya Ghar Muft Bijli Yojana aims to install rooftop solar plants for free electricity to 1 crore households (up to 300 units every month).

- Nuclear energy is highlighted as a significant part of India's energy mix.

- Priority 7: Infrastructure:

- Government will try to maintain strong fiscal support for infrastructure over the next 5 years on this line Rs 11,11,111 crore for capital expenditure has been allocated this year, which is 3.4% of our GDP.

- Phase IV of Pradhan Mantri Gram Sadak Yojana (PMGSY) to connect 25,000 rural habitations with all-weather roads due to population growth has been announced.

- For Bihar, under the Accelerated Irrigation Benefit Programme and other sources, the government will allocate Rs 11,500 crore for projects like the Kosi-Mechi intra-state link and 20 other schemes including barrages, river pollution abatement, and irrigation.

- Additionally, financial assistance will be provided to Assam, Himachal Pradesh, Uttarakhand, and Sikkim for flood management, landslides, and related projects.

- Priority 8: Innovation, Research & Development:

- The government will establish the Anusandhan National Research Fund to support basic research and prototype development, allocating Rs 1 lakh crore to spur private sector-driven research and innovation at a commercial scale.

- To expand the space economy fivefold in the next decade, a venture capital fund of Rs 1,000 crore will be established.

- Priority 9: Next Generation Reforms:

- Plans for an Economic Policy Framework, labour reforms, and simplification of FDI regulations are outlined to spur economic growth.

- Jan Vishwas Bill 2.0 to improve Ease of Doing Business will be introduced by the government.

- Other Highlights:

- Economic Policy Framework:

- The government will formulate an Economic Policy Framework to guide economic development and reforms for enhancing employment.

- Labour related reforms:

- Implementing comprehensive labour reforms through integrated portals like e-shram portal, Shram Suvidha and Samadhan portals will be revamped to enhance ease of compliance for industry and trade.

- Government will come up with a taxonomy for climate finance for enhancing the availability of capital for climate adaptation and mitigation.

- Foreign Direct Investment and Overseas Investment:

- The rules and regulations for Foreign Direct Investment and Overseas Investments will be simplified to facilitate foreign direct investments, nudge prioritisation, and promote opportunities for using Indian Rupee as a currency for overseas investments.

- NPS Vatsalya

- A plan for contribution by parents and guardians for minors and on attaining the age of majority, the plan can be converted seamlessly into a normal NPS account.

- New Pension Scheme (NPS)

- A Committee to review the NPS has been constituted to addresses the relevant issues while maintaining fiscal prudence to protect the common citizens.

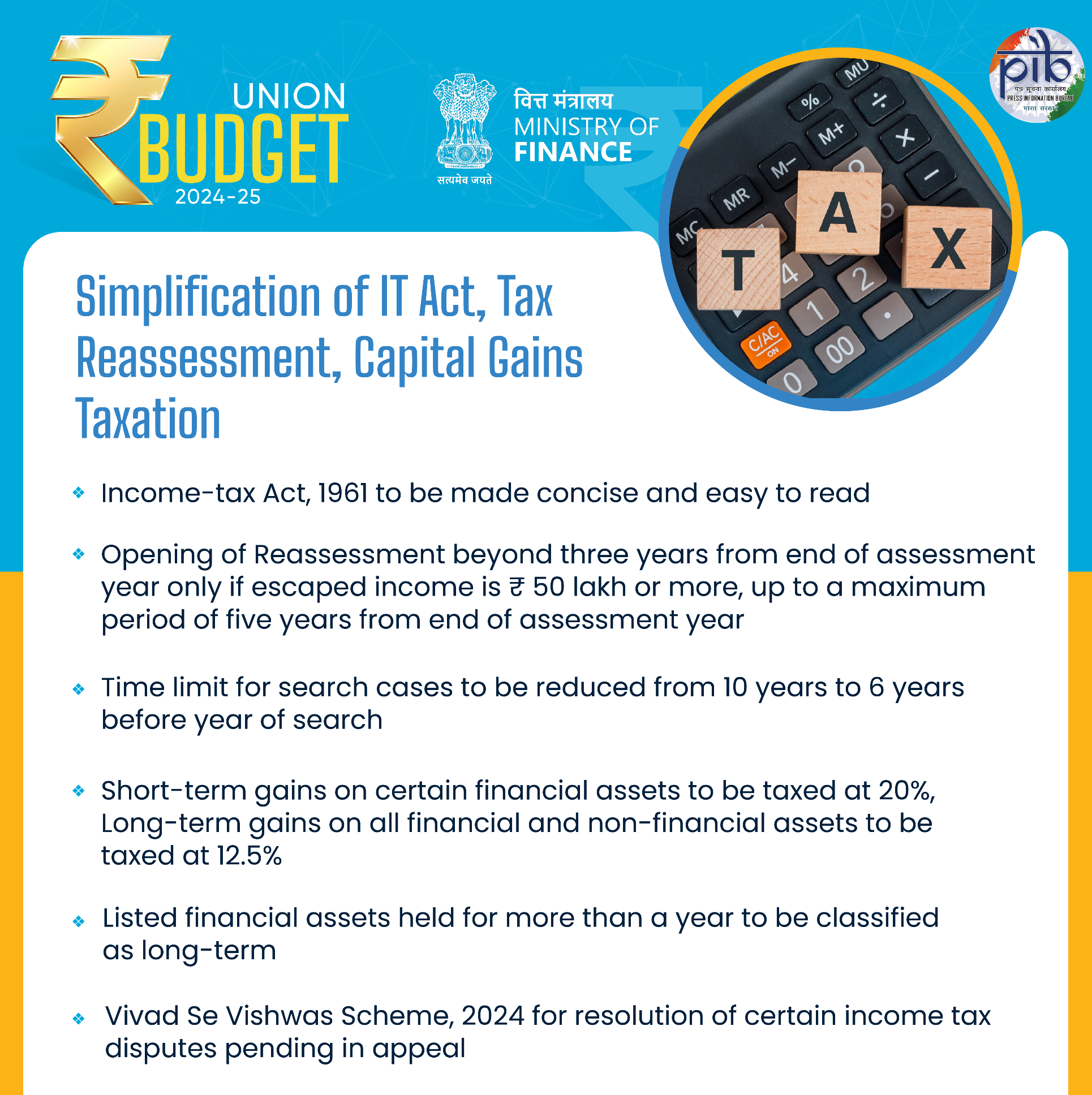

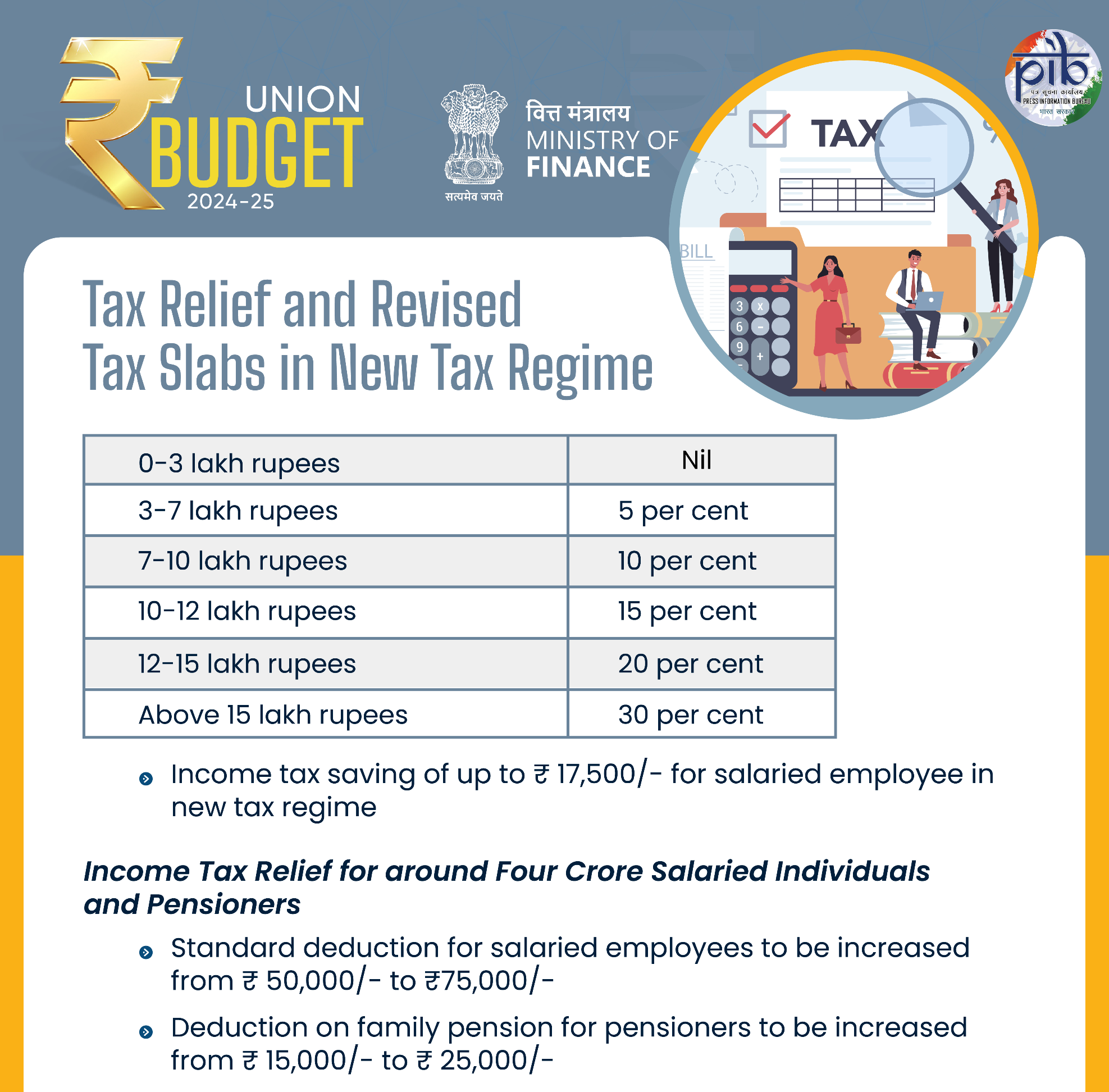

- Direct Tax Reforms: Comprehensive review and simplification of direct and indirect tax regimes are proposed.

- Changes include revised income tax slabs and deductions, simplification of tax compliance, and reforms in capital gains taxation.

- Custom Duty Reforms: Rationalization of GST and custom duty rates, exemptions for essential medicines and critical minerals, and measures to promote domestic manufacturing are highlighted.

- Dispute Resolution: Initiatives like Vivad se Vishwas Scheme, increased monetary limits for appeals, and measures to streamline transfer pricing assessments are aimed at reducing litigation and providing tax certainty.

- Economic Policy Framework:

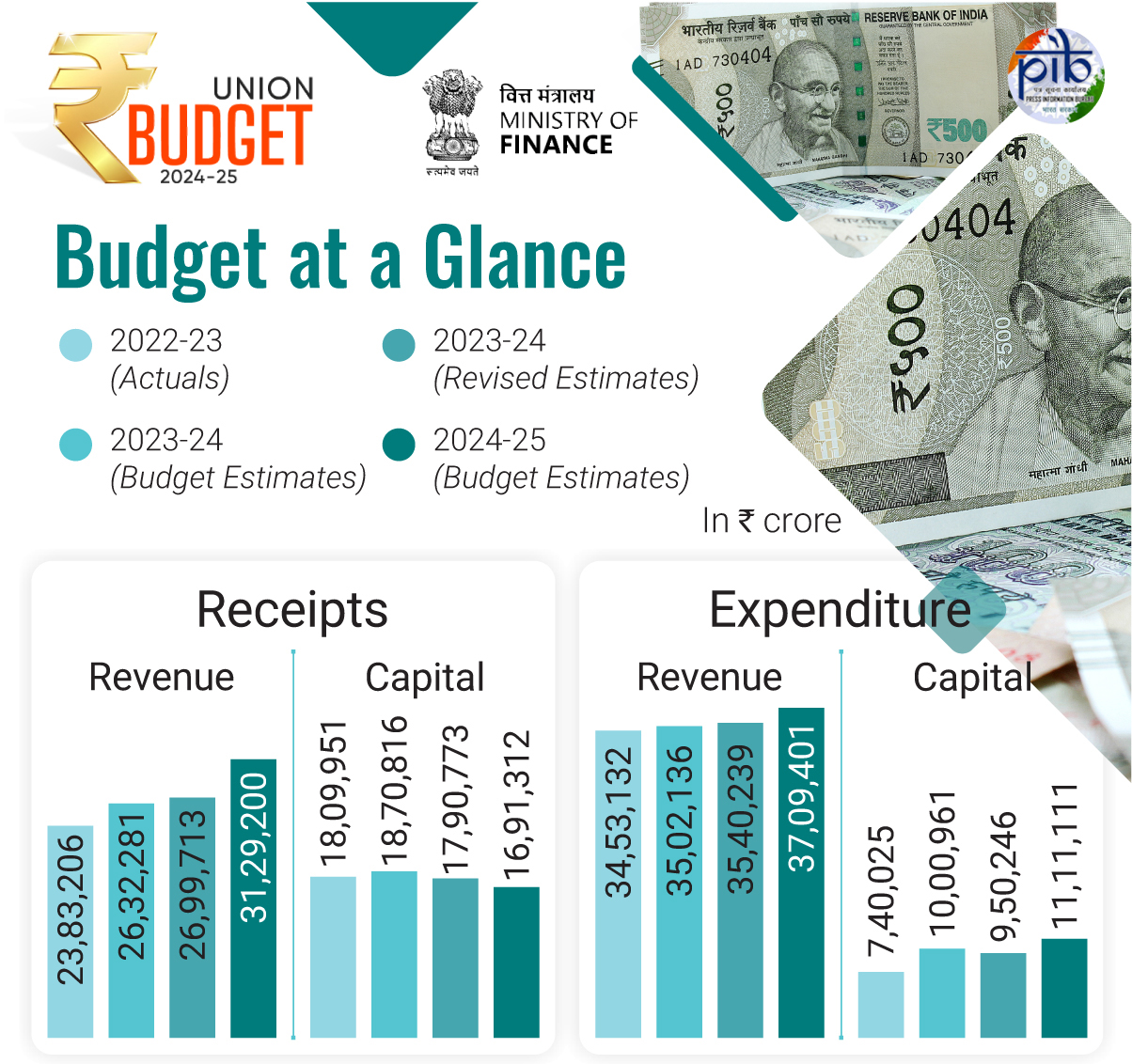

Budget Estimates 2024-25

- For the year 2024-25, the total receipts other than borrowings and the total expenditure are estimated at Rs 32.07 lakh crore and Rs 48.21 lakh crore respectively.

- The net tax receipts are estimated at Rs 25.83 lakh crore and the fiscal deficit is estimated at 4.9% of GDP. Also, the government will aim to reach a deficit below 4.5% next year.

- The gross and net market borrowings through dated securities during 2024-25 are estimated at Rs 14.01 lakh crore and Rs 11.63 lakh crore respectively.

- Budget speech highlighted India's low and stable inflation moving towards the 4% target, with specific measures to ensure adequate supply of perishable goods.

|

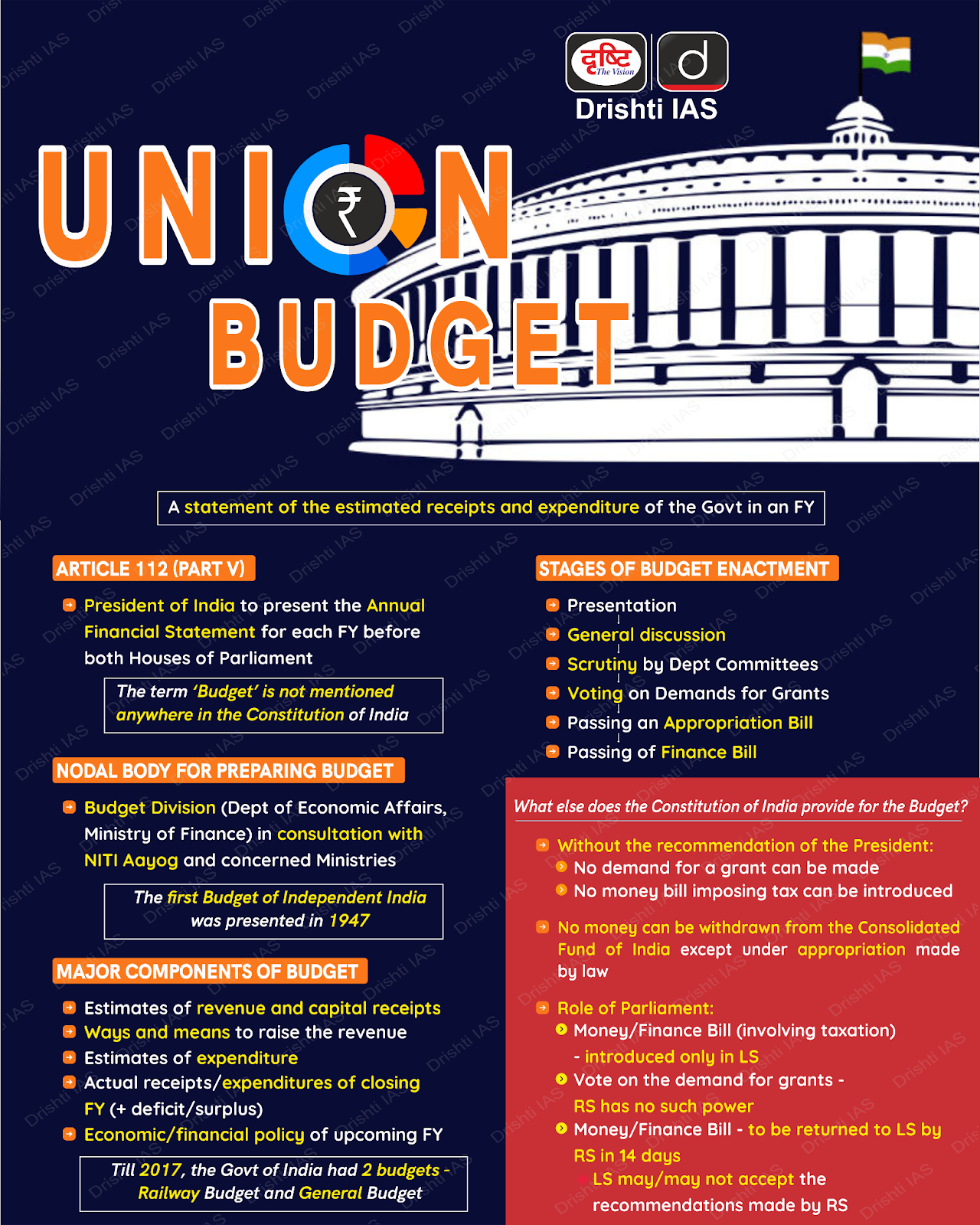

Drishti Mains Question Discuss the constitutional provisions related to Budget in India. How does the constitutional framework ensure parliamentary control over financial matters and expenditure? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Along with the Budget, the Finance Minister also places other documents before the Parliament which include ‘The Macro Economic Framework Statement’. The aforesaid document is presented because this is mandated by (2020)

(a) Long standing parliamentary convention

(b) Article 112 and Article 110(1) of the Constitution of India

(c) Article 113 of the Constitution of India

(d) Provisions of the Fiscal Responsibility and Budget Management Act, 2003

Ans: (d)

Mains:

Q. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. (2021)