Indian Economy

Economic Survey 2024-25

- 01 Feb 2025

- 24 min read

|

For Prelims: Economic Survey, Parliament, Union Budget, Chief Economic Adviser, International Monetary Fund, Inflation, Russia-Ukraine war, Gross Domestic Product, Current account deficit, Non-Performing Assets, Reserve Bank of India, Initial Public Offerings, Red Sea, Vadhavan Mega Port, National Infrastructure Pipeline, BharatNet, Swachh Bharat Mission, Gaganyaan, Carbon sink, Gini coefficient, Foreign Direct Investment For Mains: India’s Economic Growth, Economic Survey, Fiscal Policy and Financial Stability, Challenges to Economic Growth. |

Why in News?

The Finance Minister Nirmala Sitharaman tabled the Economic Survey 2024-25 in Parliament, It provides a roadmap for reforms and growth, setting the stage for the Union Budget 2025.

Economic Survey

- The Economic Survey is an annual report presented by the government before the Union Budget to assess India's economic condition.

- Prepared by the Economic Division of the Ministry of Finance under the Chief Economic Adviser's supervision, it is tabled in both houses of Parliament by the Union Finance Minister.

- The survey assesses economic performance, highlights sectoral developments, outlines challenges and provides an economic outlook for the coming year.

- The Economic Survey was first presented in 1950-51 as part of the budget and became a separate document from the Union Budget in 1964, tabled a day before the budget.

What are the Key Highlights of the Economic Survey 2024-25?

- State of the Economy:

- Global Economy: The International Monetary Fund (IMF) projected 3.2% global growth in 2024 (3.3% in 2025), with manufacturing slowing due to supply chain disruptions, while services remain strong.

- Inflation eased globally, yet services inflation remained persistent, leading to divergent monetary policies across central banks.

- Geopolitical Uncertainties: Russia-Ukraine war and Israel-Hamas conflict have impacted trade, energy security, and inflation.

- Suez Canal disruptions forced ships to reroute via the Cape of Good Hope, increasing freight costs and delivery times.

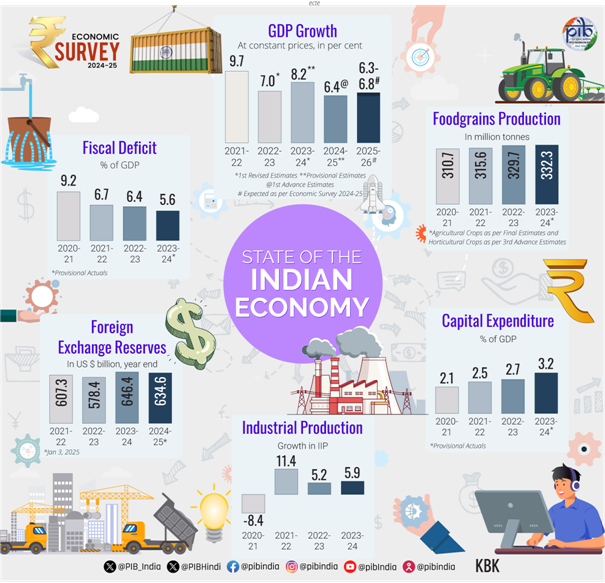

- India’s Economy: India's Gross Domestic Product (GDP) is projected to grow between 6.3-6.8% in FY26 (2025-26), with real Gross Value Added (GVA) estimated at 6.4% in FY25 (2024-25).

- Sector-Wise Performance:

- Agriculture: 3.8% growth in FY25, driven by record Kharif production and strong rural demand.

- Industry & Manufacturing: 6.2% growth in FY25, with manufacturing slowing due to weak global demand.

- Services: Fastest-growing sector at 7.2% in FY25, led by Information technology (IT), finance, and hospitality.

- External Sector: Overall exports (merchandise+services) grew by 6% (YOY) in the first nine months of FY25. Services sector by 11.6% during the same time.

- Merchandise exports grew 1.6%, while imports rose 5.2%, widening the trade deficit.

- India remained the top global recipient of remittances, helping contain the Current account deficit (CAD) at 1.2% of GDP.

- Sector-Wise Performance:

- Global Economy: The International Monetary Fund (IMF) projected 3.2% global growth in 2024 (3.3% in 2025), with manufacturing slowing due to supply chain disruptions, while services remain strong.

- Monetary and Financial Sector Developments: Gross Non-Performing Assets (GNPA) of Scheduled Commercial Banks (SCBs) dropped to a 12-year low of 2.6% in 2024, with net NPAs at 0.6%.

- Return on Assets (RoA) rose to 1.4%, and Return on Equity (RoE) improved to 14.1% (Sep 2024).

- Reserve Bank of India (RBI) Financial Inclusion Index increased from 53.9 (2021) to 64.2 (2024), supported by Regional Rural Banks (RRBs).

- RBI maintained the repo rate at 6.5%, while reducing the CRR to 4%, injecting Rs 1.16 lakh crore into the system.

- The money multiplier rose to 5.7, reflecting increased liquidity.

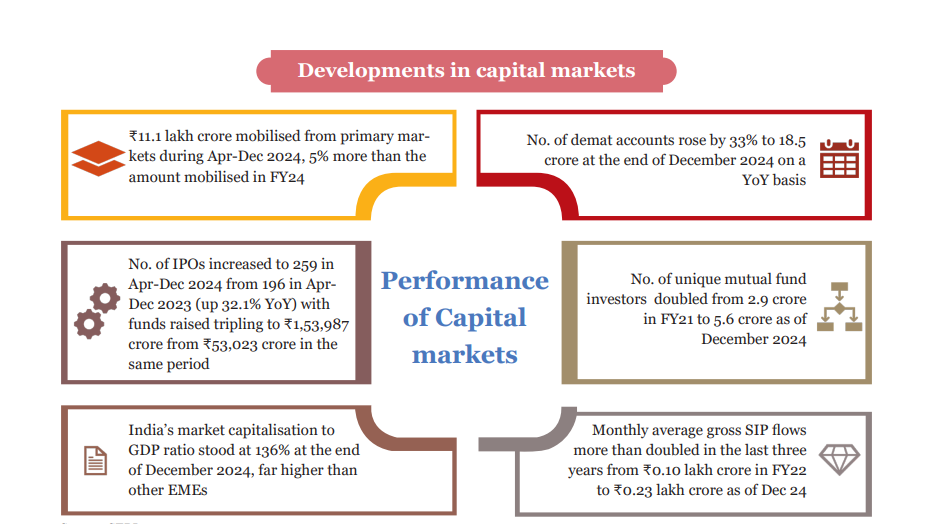

- Capital markets mobilized Rs 11.1 lakh crore in primary markets (Apr–Dec 2024), a 5% increase over FY24. Initial Public Offerings (IPO) tripled their fundraising to Rs 1.53 lakh crore.

- Development Financial Institutions (DFIs) like National Bank for Financing Infrastructure and Development (NaBFID) and India Infrastructure Finance Company Limited (IIFCL) financed infrastructure projects, with NaBFID sanctioning Rs 1.3 lakh crore in loans.

- External Sector: India's external sector remained resilient. Total exports (merchandise + services) grew by 6%, reaching USD 602.6 billion.

- Imports also increased by 6.9% to USD 682.2 billion, reflecting strong domestic demand.

- Global trade faced challenges due to rising trade policy uncertainty and disruptions in key shipping routes, such as the Red Sea and the Panama Canal drought, leading to higher costs and longer delivery times.

- A shift towards friend-shoring and near-shoring was observed, as countries prioritized trade within geopolitical alliances.

- Foreign Portfolio Investments (FPIs): The FPIs fluctuated due to global uncertainties, though India’s strong economic fundamentals kept overall inflows positive.

- Foreign Exchange Reserves: USD 640.3 billion (Dec 2024), covering 90% of external debt (USD 711.8 billion as of Sep 2024), ensuring macroeconomic stability and resilience against external shocks.

- Prices and Inflation:

- Global Inflation Trends: Inflation peaked at 8.7% in 2022, driven by supply chain disruptions, but fell to 5.7% in 2024 due to monetary tightening.

- Domestic Inflation Trends: Retail inflation eased from 5.4% in FY24 to 4.9% in FY25, but food inflation rose from 7.5% to 8.4%, driven by vegetables (tomatoes, onions) and pulses, despite price stabilization efforts.

- Supply chain issues and weather disruptions kept Consumer Price Index (CPI) volatility high.

- Core inflation hit a 10-year low, with declining service and fuel price inflation.

- The RBI revised FY25 inflation from 4.5% to 4.8%, expecting 4.2% in FY26, while the IMF forecasts 4.4% in FY25 and 4.1% in FY26, assuming stable conditions.

- Medium-Term Outlook: The IMF projects India to become a USD 5 trillion economy by FY28 and USD 6.3 trillion by FY30, with a nominal GDP growth rate of 10.2% (FY25-FY30).

- To reach its Viksit Bharat 2047 goal, India must grow at 8% annually for the next two decades.

- However, global challenges such as geo-economic fragmentation, trade restrictions, and China's dominance in manufacturing and energy transition pose risks to supply chains and investment flows.

- The IMF forecasts India's real GDP growth at 6.5% annually (FY26-FY30), with the CAD expected to rise to 2.2% of GDP by FY30.

- The rupee is projected to depreciate mildly at 0.5% per year, indicating improved economic stability compared to previous decades.

- Investment and Infrastructure: The capital expenditure (Capex) growing at 38.8% Compounded Annual Growth Rate (CAGR) (FY20-FY24).

- The government has launched multiple initiatives, including the National Infrastructure Pipeline, and the National Monetisation Pipeline.

- Key Developments:

- Railway connectivity: 2031 km of railway network commissioned (Apr-Nov 2024), 17 new Vande Bharat trains introduced.

- Infrastructure: National Highway construction reached 6,215 km (Bharatmala), 619 UDAN air routes (Regional Connectivity Scheme).

- Port capacity grew under Sagarmala, with the launch of projects like Vadhavan Mega Port.

- Energy: Total installed power capacity reached 456.7 GW (renewables at 209.4 GW (47% share)).

- Connectivity: 5G covers 779 districts, and BharatNet expanded fiber to 2.14 lakh Gram Panchayats.

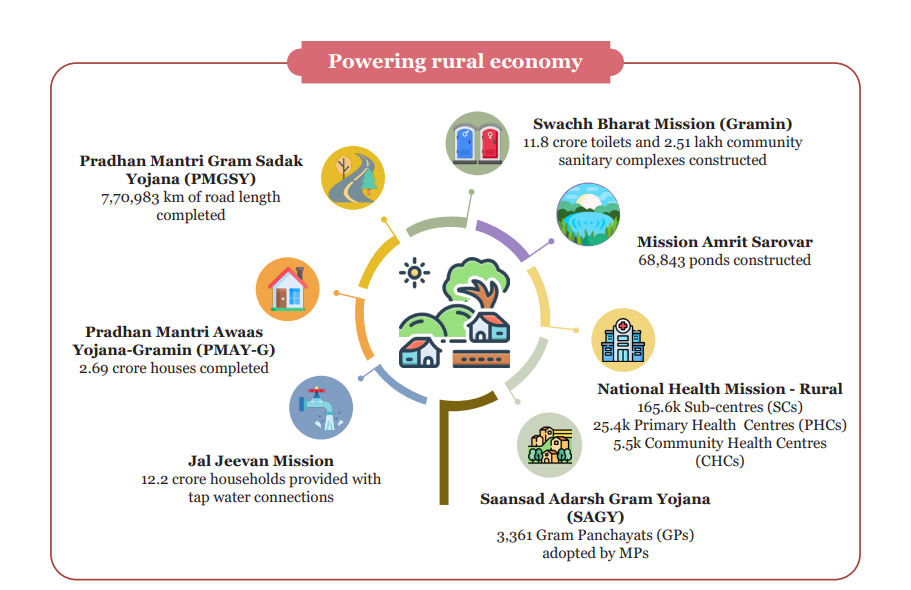

- Rural and Urban Development: Pradhan Mantri Awas Yojana (PMAY) sanctioned 1.18 crore houses, and Jal Jeevan Mission reached 15.3 crore households (79.1%).

- 18,374 villages electrified and 2.9 crore households connected under Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and SAUBHAGYA.

- Under Swachh Bharat Mission (Phase II) in 2024, 1.92 lakh villages declared ODF Plus, making a total of 3.64 lakh ODF Plus villages by 2024.

- Space assets: India operates 56 active space assets, with Space Vision 2047 targeting missions like Gaganyaan and Chandrayaan-4.

- Industry & Manufacturing: The industrial sector expected to grow by 6.2% in FY-25 (first advance estimates), driven by robust growth in electricity and construction.

- The government has been actively promoting Smart Manufacturing and Industry 4.0, supporting the establishment of SAMARTH Udyog centres.

- Key sectors saw growth, with steel production up 3.3% (Apr–Nov FY25) and electronics output reaching Rs 9.52 lakh crore, with 99% of smartphones made domestically, drastically reducing India’s dependence on imports.

- As per the WIPO Report 2022, India ranks sixth among the top 10 patent filing offices globally, with resident filings accounting for over half of all submissions (55.2%)—a first for the country.

- The MSME sector employs 23.24 crore people, with 2.39 crore businesses formalized under Udyam Assist.

- To provide equity funding to MSMEs with the potential to scale up, the government launched the Self-Reliant India Fund.

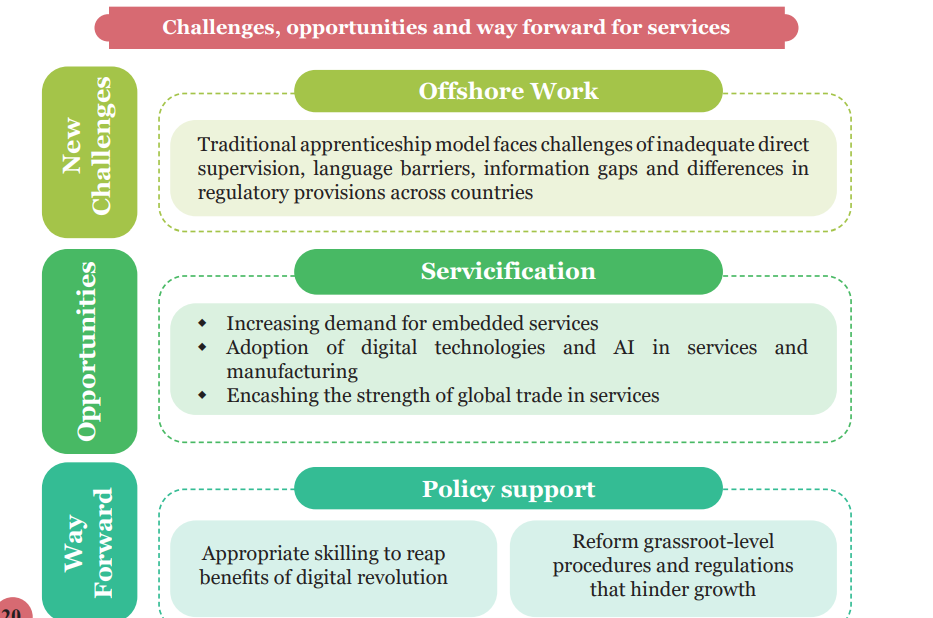

- Services: India’s services sector contributes 55% to GVA in FY25, up from 50.6% in FY14, employing 30% of the workforce and driving manufacturing growth through servicification.

- India ranks 7th in global services exports (4.3% share).

- Information and computer-related services grew at 12.8% CAGR (FY13–FY23), increasing their GVA share from 6.3% to 10.9%.

- Railway passenger traffic grew 8%, freight movement increased 5.2% (FY24).

- Tourism rebounded, contributing 5% to GDP (FY23), and real estate sales hit an 11-year high in H1 FY25.

- The telecom sector, with 1.18 billion subscribers, leads in global mobile data consumption.

- Agriculture and Food Management: India’s agriculture sector contributes 16% to GDP (FY24), employing 46.1% of the population, with 5% annual growth (FY17-FY23).

- Kharif foodgrain production hit 1,647 LMT (2024), up 89.37 LMT YoY, while fisheries (184 LMT) and livestock (CAGR 12.99%) outpaced traditional farming.

- Minimum Support Price for Arhar and Bajra increased by 59% and 77% (FY25) to ensure farmer profitability.

- 55% of India’s net sown area is irrigated, with severe drought risks in two-thirds of farmland.

- Kisan Credit Cards (KCC): 7.75 crore accounts.

- PM Fasal Bima Yojana (Crop Insurance): 4 crore farmers enrolled, covering 600 LMT hectares in FY24.

- e-NAM platform linked 1.78 crore farmers, 2.62 lakh traders (Oct 2024) for better price discovery.

- Food Security & Processing: Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) provides free food grains to 80 crore people.

- Food processing exports reached USD 46.44 billion (FY24), with 23.4% share in agri-food exports (11.7 % of India's total exports).

- Kharif foodgrain production hit 1,647 LMT (2024), up 89.37 LMT YoY, while fisheries (184 LMT) and livestock (CAGR 12.99%) outpaced traditional farming.

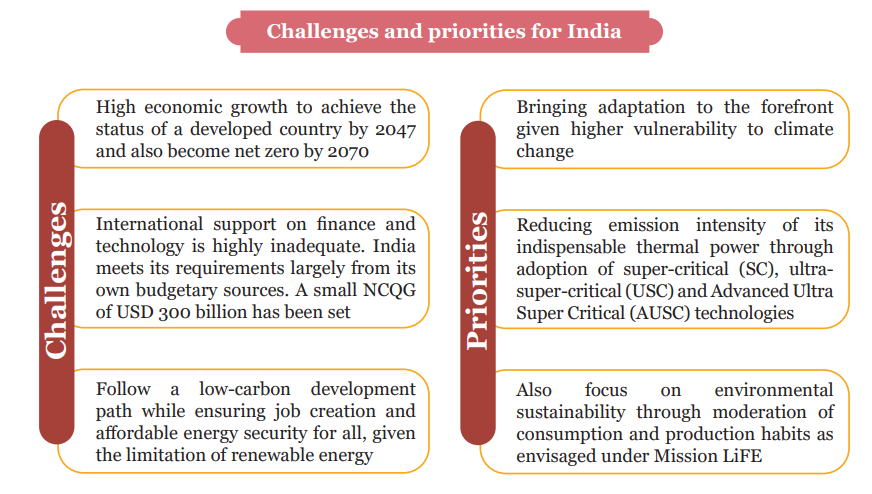

- Climate & Environment: Climate adaptation spending rose from 3.7% to 5.6% of GDP (FY16-FY22).

- The Lifestyle for the Environment (LiFE) initiative promotes sustainability, with potential global savings of USD 440 billion by 2030 through reduced consumption and lower prices.

- Renewable Energy & Emissions: 46.8% of India’s power capacity is non-fossil (target 50% by 2030).

- Forest carbon sink increased by 2.29 billion tonnes CO₂ (2005-2023).

- Climate Finance & International Cooperation: Conference of Parties 29 failed to secure adequate climate funds, with a USD 300B annual goal vs. USD 5.1 to 6.8T needed by 2030.

- India issued USD 20,000 crore in Sovereign Green Bonds in FY24 to fund green projects.

- Sustainable Development & Resilience: Mangrove Initiative for Shoreline Habitats & Tangible Incomes (MISHTI) initiative restoring 22,560 hectares of mangroves across 13 states and UTs.

- Water conservation via AMRUT 2.0 (3,078 water body rejuvenation projects approved).

- PM Surya Ghar (7 lakh rooftop solar systems installed; goal: 1 crore households).

- Energy Security & Transition: Coal remains India’s primary energy source, with 65,290 MW supercritical coal plants for efficiency.

- Social Sector: India's social sector spending grew at 15% CAGR (FY21-FY25), reaching Rs 25.7 lakh crore in FY25.

- The Gini coefficient for rural areas declined to 0.237 in 2023-24 from 0.266 in 2022-23, and for urban areas, it fell to 0.284 in 2023-24 from 0.314 in 2022-23.

- Education & Skill Development: Education spending rose 12% CAGR to Rs 9.2 lakh crore, reducing dropout rates to 1.9% (primary) and 14.1% (secondary), while higher education enrolment increased 26.5% (2014-2022), pushing Gross Enrolment Ratio (GER) to 28.4%.

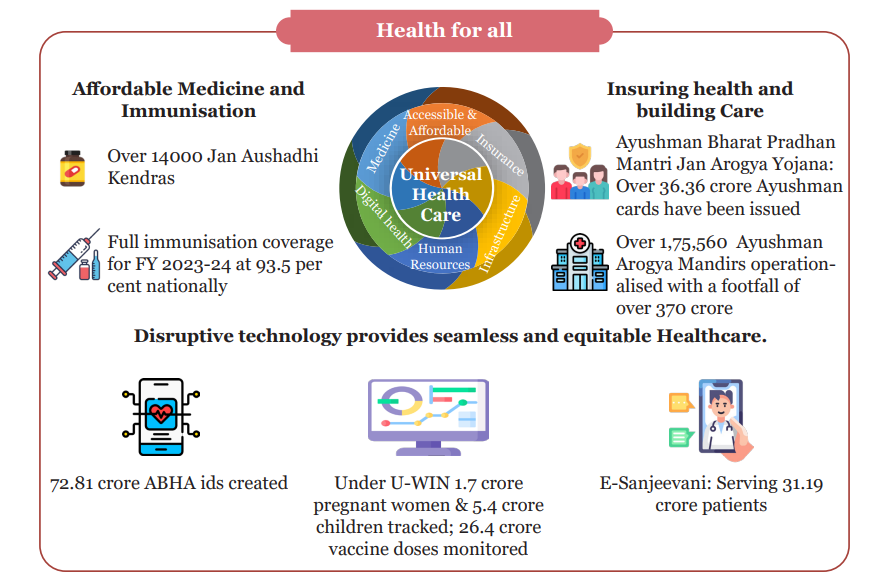

- Healthcare & Social Security: Healthcare spending surged 18% to Rs 6.1 lakh crore, with Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) saving Rs 1.25 lakh crore in medical expenses.

- Welfare: Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) provides free food grains to 80 crore people, covering 84% of households via ration cards.

- Fiscal policies helped reduce inequality, with bottom 5% rural and urban consumption rising by 22% and 19%.

- Employment and Skill Development: India’s unemployment rate declined from 6% (2017-18) to 3.2% (2023-24), with labour force participation (LFPR) rising to 60.1%.

- The working-age population (15-59 years) reached 923.9 million (2026 projection), offering a demographic dividend (26% of the population aged 10-24).

- The female LFPR grew from 23.3% (2017-18) to 41.7% (2023-24), driven by rural women’s participation.

- Self-employment rose to 58.4%, while regular wage jobs remained at 21.7%.

- Employment Trends: Formal sector jobs surged, with Employees' Provident Fund Organisation (EPFO) net payroll additions doubling from 61 lakh (FY19) to 131 lakh (FY24).

- Skill Development & Job Creation: 73,151 startups with women directors under Startup India.

- Skill India and Mudra Yojana supported entrepreneurship and vocational training.

- The growing digital economy and renewable energy sectors are driving job creation, vital for Viksit Bharat.

- The government is enhancing skills for global trends like AI and climate change. Initiatives like the PM-Internship Scheme are boosting employment and self-employment.

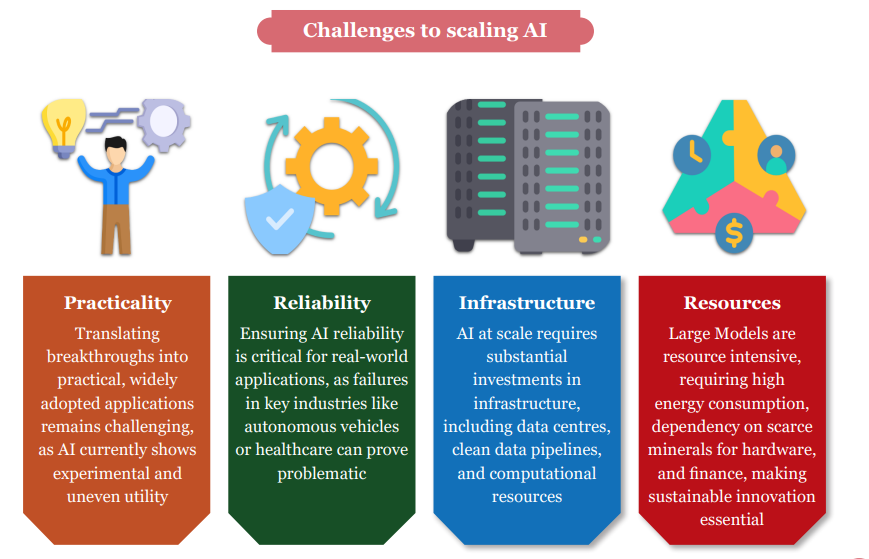

- Labour in the AI Era: Artificial Intelligence (AI) presents both opportunities and risks for labour markets, with 75 million global jobs at risk (ILO 2024) and 300 million full-time roles exposed (Goldman Sachs).

- India’s AI market is set to grow at 25-35% CAGR by 2027 (NASSCOM), making workforce upskilling, regulatory oversight, and human-AI collaboration crucial for a balanced transition.

What are India's Economic Challenges According to the Economic Survey 2024-25?

- Global:

- Geopolitical Risks: Conflicts like the Russia-Ukraine war and Red Sea disruptions impact trade, energy prices, and supply chains.

- Global Trade Slowdown: Protectionism, supply chain realignments affect India’s export competitiveness.

- Financial Market Volatility: Interest rate fluctuations in the US and European Union may cause capital outflows, impacting India's foreign exchange reserves and currency stability.

- Inflation:

- Persistent Food Inflation: Create inflationary pressures, despite stable core inflation.

- Climate Impact: Erratic monsoons, droughts, and extreme weather events affect food security and farm incomes.

- Investment & Infrastructure Bottlenecks: While public Capex grew at 38.8% CAGR (FY20-FY24), private investment remains cautious due to global uncertainties and regulatory concerns.

- Logistics costs remain high (13-14% of GDP), limiting industrial competitiveness despite National Logistics Policy efforts.

- Lack of planned urbanization results in traffic congestion, inadequate public transport, and rising housing costs in major cities.

- Smart City and urban transport projects face delays in execution due to regulatory hurdles and financing gaps.

- Employment & Skilling Gaps:

- Jobless Growth Concerns: India faces a critical challenge of jobless growth, with economic growth outpacing job creation, largely due to a focus on high-skill, low-employment sectors, premature deindustrialisation, and skill mismatches.

- Low LFPR: Female LFPR in India is 41.7% (FY25), still below the global average of over 50%.

- Fiscal & Financial Sector Risks: Several states face high debt burdens due to rising subsidies, limited revenue growth, and dependency on central transfers.

- Rising unsecured lending risks pose a challenge for NBFCs and fintech lenders, requiring better regulation and monitoring and cyber threats remain.

- Slow credit penetration to MSMEs, despite digital lending growth, hinders small business expansion.

- External Sector: While Foreign Direct Investment inflows grew 17.9% YoY, higher repatriation and disinvestment remain a concern.

- Export Dependency on IT & Services (70% of services exports rely on IT & business services), increasing vulnerability to global demand shocks.

- Climate Change & Energy Transition: India faces energy transition challenges due to grid stability issues, high storage costs, and slow renewable adoption.

- Dependency on Coal remains high, delaying the shift to clean energy.

- Climate risks, extreme weather, and inadequate global climate finance further hinder sustainable growth.

- EoDB reforms: Despite Ease of Doing Business Reforms(EoDB) reforms, labour laws, land acquisition, and tax complexity still hinder MSMEs and startups.

- India’s R&D spending remains low at 0.64% of GDP, affecting innovation and tech competitiveness.

- Effect of AI: AI’s reliability is still unproven, leading to biases in hiring, predictive policing, and automation failures.

- Energy demand for AI data centers may reach India's total electricity consumption (1,580 terawatt-hours) (Bloomberg, 2024).

- Indian IT, Business process outsourcing (BPO), and banking sectors face high AI disruption, particularly in low-value service jobs.

Way Forward

- Managing Geopolitical Uncertainties: Diversify trade partners and strengthen regional agreements (e.g., Indo-Pacific Economic Framework, India-Middle East-Europe Corridor) to reduce dependence on conflict-affected areas.

- Enhance domestic energy security by investing in strategic petroleum reserves and renewable alternatives.

- Expand domestic manufacturing & supply chain resilience through Production Linked Initiative' (PLI) schemes and allow 100% FDI in key sectors.

- Controlling Inflation: Strengthen food supply chains with better storage, logistics, and real-time price monitoring to control food inflation.

- Encourage private investment via tax incentives, land & labour reforms, and easing compliance for businesses.

- Strengthen Fiscal Stability: Enhance state tax collection efficiency by expanding GST coverage and digitizing tax administration.

- Rationalize subsidies to balance welfare with fiscal discipline. Encourage states to adopt fiscal responsibility frameworks and limit unsustainable borrowing.

- Address Unemployment: Deregulation is essential for MSME growth, fostering innovation and job creation by reducing compliance burdens.

- Integrate AI and digital skills in vocational training to prepare the workforce for future jobs.

- Energy Transition: Accelerate green hydrogen, solar, and wind projects to reduce coal dependence. Invest in energy storage solutions to improve grid stability for renewables.

- Enhance climate resilience by expanding crop insurance, water conservation, and sustainable agriculture practices.

Conclusion

While India’s economic fundamentals remain strong, challenges from global uncertainties, inflation, investment hesitancy, job creation, and climate change require policy interventions, fiscal discipline, and structural reforms to sustain high growth and global competitiveness.

Read more: Union Budget 2025-26

|

Drishti Mains Question: Q. Assess India's economic growth prospects, highlighting the key challenges, and suggest policy measures to promote sustainable growth. |

UPSC Civil Services Examination, Previous Year Question (PYQ)Prelims: Q. Along with the Budget, the Finance Minister also places other documents before the Parliament which include ‘The Macro Economic Framework Statement’. The aforesaid document is presented because this is mandated by (2020) (a) Long standing parliamentary convention Ans: (d) Mains:Q. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. (2021) Q. “Industrial growth rate has lagged behind in the overall growth of Gross-Domestic-Product(GDP) in the post-reform period” Give reasons. How far are the recent changes in Industrial Policy capable of increasing the industrial growth rate? (2017) Q. Do you agree that the Indian economy has recently experienced a V- shapes recovery? Give reasons in support of your answer. (2021) |

-min.jpg)