Indian Economy

RBI’s Repatriation of Gold

- 04 Nov 2024

- 11 min read

For Prelims: Reserve Bank of India, Bank for International Settlements, Foreign Exchange Reserves, Sovereign Gold Bonds, Import Cover, External Debt, World Gold Council, Treasury Bills, Government Securities, Foreign Currency Assets, Gold reserves, Special Drawing Rights, Reserve Tranche position.

For Mains: Role gold and foreign exchange reserves in an economy.

Why in News?

Recently, the Reserve Bank of India (RBI) has repatriated 102 tonnes of gold from the Bank of England (BoE) and the Bank for International Settlements (BIS).

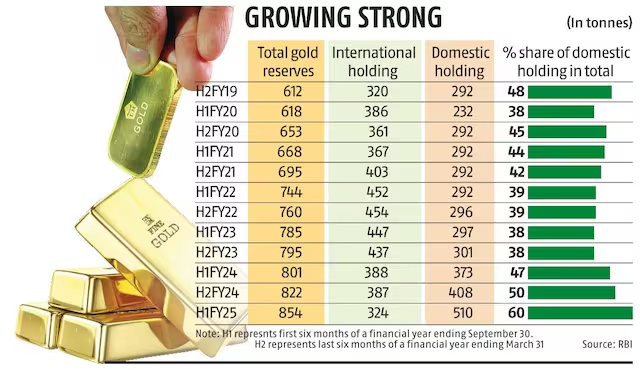

- According to the RBI’s “Half Yearly Report on Management of Foreign Exchange Reserves” gold held domestically stands at 510.46 metric tonnes in September 2024.

- India’s total gold reserves held by the RBI amount to 854.73 metric tonnes.

Note:

- According to the World Gold Council (June 2024), India ranks 8th in terms of sovereign gold holdings while the US tops the list.

- India’s gold holdings amount to 840.76 metric tonnes comprising 9.57% of its forex reserves.

- Other countries ahead of India in terms of gold holdings are Germany, Italy, France, Russia, China, and Japan.

Why is India Repatriating Gold?

- Reducing Geopolitical Risks: Countries prefer holding their gold reserves domestically to protect it from potential foreign sanctions or restrictions that could freeze or restrict access to assets held abroad.

- E.g., Due to sanctions by the US and allies amid the Ukraine war, Russia’s access to USD 300 billion in gold and foreign exchange reserves has been frozen.

- Increasing Market Confidence: Gold is seen as a “safe haven” asset, especially in emerging markets, and having it within national borders can boost public confidence in the financial system.

- Economic Sovereignty: India’s gold reserves now exceeds 101% of the India's external debt which enhances India’s debt repaying capacity.

- Supporting Domestic Financial Markets: With gold physically present in India, the RBI has more flexibility to support gold-backed financial products in domestic markets.

- India’s government has promoted initiatives like Sovereign Gold Bonds (SGBs) to reduce dependence on physical gold imports.

- Global Trend of Gold Repatriation: There has been a broader trend of central banks moving gold back to their home countries, especially over the past decade.

- E.g., Venezuela brought gold back from US and European vaults in 2011 and Austria in 2015.

- Cost Savings: RBI typically pays insurance, transportation fees, custodial fees and vault charges to institutions such as the Bank of England or the Federal Reserve for holding their gold.

- By repatriating some of this gold, the RBI can reduce these recurring costs.

- Increasing Import cover: Import cover is a crucial trade indicator, reflecting reserves adequacy, which strengthened alongside the increase in foreign-exchange reserves.

- Current foreign reserves are sufficient to cover 11.8 months of import.

India’s Foreign Exchange Reserves

- Foreign exchange reserves are assets held on reserve by a central bank in foreign currencies, which can include bonds, treasury bills and other government securities.

- India’s Forex Reserve includes Foreign Currency Assets, Gold reserves, Special Drawing Rights and Reserve Tranche position with the International Monetary Fund (IMF).

- India’s foreign exchange reserves position in October, 2024 was estimated at USD 688.27 billion.

- It includes:

- Foreign Currency Assets (FCA) of USD 598.24 billion

- Gold worth of USD 67.44 billion

- Special Drawing Rights (SDRs) of USD 18.27 billion

- Reserve Tranche Position (RTP) of USD 4.32 billion.

- It includes:

Background of Foreign Exchange Rate Management

- Gold Standard (1870-1914): Currencies were directly tied to the value of gold. Each country held gold reserves to back their currency. Stable exchange rates made international trade easier and predictable.

- Bretton Woods System (1944-1971): It was established after World War II and its key features were:

- Fixed exchange rates with the US dollar as the reserve currency.

- Other currencies were pegged to the dollar at a fixed rate.

- The US dollar was, in turn, convertible to gold at a fixed price of USD 35 per ounce.

- Current Scenario (Multiple Regimes - Post-1971): Market forces of supply and demand determine exchange rates with a variety of regimes.

- Floating Exchange Rate: A currency's value is determined by supply and demand in the foreign exchange market. Exchange rates fluctuate continuously and are not officially pegged or fixed to any other currency or commodity.

- Pegged Rates: A country ties its currency to a single strong currency (e.g., USD) or a basket of currencies.

- Dollarization: Some countries completely abandon their own currency and adopt the US dollar (e.g., Ecuador).

Why the RBI Stores Gold Reserves Abroad?

- Mitigating Geopolitical Risks: By holding gold in multiple international locations, the RBI minimises the risk of having its reserves concentrated within India.

- Storing reserves in key global financial hubs like London and NewYork ensures that assets are accessible and secure in the event of any domestic or regional disruptions.

- International Liquidity: Gold held in financial centres like London, New York, and Zurich offers the RBI immediate access to global markets.

- These cities are primary hubs for gold trading, making it easy to convert gold into cash quickly if needed.

- Economic Resilience: The availability of gold reserves in international markets allows India to use them as collateral for loans or other financial instruments, supporting economic resilience and bolstering India's ability to meet international financial obligations.

- Trusted Custodians: Bank of England is considered a trusted custodian known for safeguarding national assets.

- Bank for International Settlements (BIS) offers an established international framework for central banks to manage and store their gold reserves.

What are Security Measures in Major International Gold Vaults?

- Bank of England, UK: It offers advanced surveillance systems, reinforced vault doors, and stringent access controls.

- BIS, Switzerland: The vaults feature state-of-the-art security measures, including reinforced structures, biometric access controls, and continuous monitoring.

- Federal Reserve Bank of New York, USA: Located 80 feet below street level, the vault is encased in a 90-tonne steel cylinder that makes it exceptionally secure and resistant to potential security breaches.

Conclusion

India's decision to repatriate gold reflects a shift towards enhanced economic resilience and risk mitigation. By holding more gold domestically, India reduces geopolitical and custodial risks, increases market confidence, and supports financial products, while also aligning with a global trend of central banks strengthening national control over gold reserves.

|

Drishti Mains Question: How does India’s holding of gold reserves abroad contribute to its international liquidity and economic resilience? |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q.What is/are the purpose/purposes of Government’s ‘Sovereign Gold Bond Scheme’ and ‘Gold Monetization Scheme’? (2016)

- To bring the idle gold lying with Indian households into the economy.

- To promote FDI in the gold and jewellery sector.

- To reduce India’s dependence on gold imports.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Q.Which one of the following groups of items is included in India’s foreign-exchange reserves? (2013)

(a) Foreign-currency assets, Special Drawing Rights (SDRs) and loans from foreign countries

(b) Foreign-currency assets, gold holdings of the RBI and SDRs

(c) Foreign-currency assets, loans from the World Bank and SDRs

(d) Foreign-currency assets, gold holdings of the RBI and loans from the World Bank

Ans: (b)

Mains

Q. Craze for gold in Indians has led to surge in import of gold in recent years and put pressure on balance of payments and external value of rupee. In view of this, examine the merits of Gold Monetization scheme. (2015)