Indian Economy

Inflation

- 30 Nov 2023

- 17 min read

For Prelims: Retail Inflation, Reserve Bank of India, Monetary Policy, Gross Domestic Product (GDP), International Monetary Fund, Monetary Policy Committee, Wholesale Price Index (WPI), Consumer Price Index, Core Inflation, Headline Inflation, Disinflation, National Statistical Office (NSO), Periodic Labour Force Survey (PLFS), Fiscal Policy

For Mains: Impact of Inflation on the growth and development of Economy and its potential relationship with creation of employment opportunities.

What is Inflation?

- About:

- Inflation, as defined by the International Monetary Fund, is the rate of increase in prices over a given period, encompassing a broad measure of overall price increases or for specific goods and services.

- It reflects the rising cost of living and indicates how much more expensive a set of goods and/or services has become over a specified period, usually a year.

- In India, inflation's impact is particularly significant due to economic disparities and a large population.

- Relevance:

- Price Stability:

- Maintaining a moderate level of inflation is often seen as desirable for economic stability as it encourages spending and investment, as consumers and businesses expect the value of money to decline slightly over time.

- Central Bank Policy Tool:

- Central banks, such as the Federal Reserve in the US or the European Central Bank, and the Reserve Bank of India use inflation targeting as a key monetary policy tool. They set target inflation rates and adjust interest rates to achieve these targets.

- Real Interest Rates:

- Inflation influences real interest rates, which are nominal interest rates adjusted for inflation. When inflation is factored into interest rates, it provides a more accurate measure of the true cost of borrowing and the return on savings.

- Income Redistribution:

- Inflation can affect the distribution of income and wealth. Debtors may benefit from inflation because they repay loans with money that has a lower real value.

- Conversely, creditors may lose purchasing power as the real value of money decreases. This dynamic can lead to shifts in wealth and income distribution.

- Encouraging Investment:

- Moderate inflation can encourage investment and economic activity. When prices are expected to rise, individuals and businesses are more likely to spend and invest rather than hoard money due to the expectation of high returns.

- Nominal Wage Adjustments:

- Inflation allows for nominal wage adjustments. Even if real wages (adjusted for inflation) remain constant or decrease slightly, the nominal wages (actual dollar amount) can increase.

- This can help prevent sticky wages and facilitate adjustments in the labor market.

- Impact on Global Competitiveness:

- Inflation can impact a country's global competitiveness. If a country experiences higher inflation than its trading partners, it may face challenges in international trade as its goods and services become relatively more expensive.

- Taxation Effects:

- Inflation can affect the real value of taxes. When prices rise, individuals may move into higher tax brackets, leading to increased tax revenue for the government.

- However, if tax brackets are not adjusted for inflation, individuals may experience "bracket creep," paying higher taxes without a real increase in income.

- Price Stability:

What are the Different Causes of Inflation?

- Demand-Pull Inflation:

- Demand Pull inflation occurs when the demand for goods and services exceeds their supply. When the overall demand in the economy is high, consumers are willing to pay more for the available goods and services, leading to a general rise in prices.

- A booming economy with high consumer spending can create excess demand, putting upward pressure on prices.

- Demand Pull inflation occurs when the demand for goods and services exceeds their supply. When the overall demand in the economy is high, consumers are willing to pay more for the available goods and services, leading to a general rise in prices.

- Cost-Push Inflation:

- Cost-push inflation is driven by an increase in the production costs for goods and services. This can be caused by factors such as increased incomes, increased costs of raw materials, or disruptions in the supply chain.

- For instance, (as per CPI data) inflation in 'oils and fats' in March, 2022 soared to 18.79% as the geopolitical crisis due to the Russia-Ukraine war pushed edible oil prices higher.

- Cost-push inflation is driven by an increase in the production costs for goods and services. This can be caused by factors such as increased incomes, increased costs of raw materials, or disruptions in the supply chain.

- Built-In or Wage-Price Inflation:

- This type of inflation is often described as a feedback loop between wages and prices. When workers demand higher wages, businesses may raise prices to cover the increased labor costs. This, in turn, prompts workers to seek higher wages, and the cycle continues.

- Collective bargaining by labor unions can result in higher wages, leading to increased production costs and subsequently higher prices for goods and services.

- This type of inflation is often described as a feedback loop between wages and prices. When workers demand higher wages, businesses may raise prices to cover the increased labor costs. This, in turn, prompts workers to seek higher wages, and the cycle continues.

- Monetary Inflation:

- Monetary inflation is often linked to an increase in the money supply in an economy. When there is more money in circulation, consumers have more purchasing power, which can drive up demand and prices.

- Central banks printing more money or implementing policies that increase the money supply can contribute to monetary inflation.

- Monetary inflation is often linked to an increase in the money supply in an economy. When there is more money in circulation, consumers have more purchasing power, which can drive up demand and prices.

- Supply Shocks:

- Supply shocks occur when there is a sudden and unexpected disruption to the supply of goods and services. Natural disasters, geopolitical events, or other unforeseen circumstances can lead to a reduction in supply, causing prices to rise.

- A drought affecting agricultural output can lead to a decrease in the supply of crops, causing food prices to spike.

- Supply shocks occur when there is a sudden and unexpected disruption to the supply of goods and services. Natural disasters, geopolitical events, or other unforeseen circumstances can lead to a reduction in supply, causing prices to rise.

- Built-In Expectations:

- If people expect prices to rise in the future, they may adjust their behavior accordingly. This can create a self-fulfilling prophecy where businesses raise prices in anticipation of higher costs, and consumers, expecting further increases, may buy more now, contributing to inflation.

- If individuals believe that inflation will increase in the future, they may demand higher wages and businesses may raise prices in anticipation of increased costs.

- If people expect prices to rise in the future, they may adjust their behavior accordingly. This can create a self-fulfilling prophecy where businesses raise prices in anticipation of higher costs, and consumers, expecting further increases, may buy more now, contributing to inflation.

What are the Different Ways to Measure Inflation In India?

The two primary indices used to measure inflation in India are the Consumer Price Index (CPI) and Wholesale Price Index (WPI).

| Consumer Price Index (CPI) | Wholesale Price Index (WPI): | Producer Price Index for Manufacturing (PPIM): |

|

|

|

What are the Impacts of Rising Inflation?

- Decreased Purchasing Power:

- Inflation erodes the purchasing power of money, meaning that with the same amount of money, individuals can buy fewer goods and services.

- For example, if inflation is 5%, a product that cost Rs 100 last year would cost Rs 105 this year.

- This decrease in purchasing power can impact the standard of living for individuals and reduce the real value of savings.

- Interest Rates and Investment:

- Central banks often respond to inflation by raising interest rates. Higher interest rates can increase the cost of borrowing for businesses and individuals, potentially slowing down investment and economic growth.

- For example, if interest rates rise, the cost of mortgage loans increases, affecting the housing market and construction industry. This leads to the Twin Balance Sheet Problem.

- Uncertainty and Planning Challenges:

- High or unpredictable inflation can create uncertainty in the economy. Businesses may find it challenging to plan for the future when prices are constantly changing.

- Long-term planning becomes difficult, and uncertainty can lead to hesitancy in making investment decisions. This forces the government to spur the investments and leads to crowding-out effects.

- Speculative Behavior and Asset Prices:

- Inflation can sometimes lead to speculative behavior in financial markets as investors seek assets that can provide returns exceeding the inflation rate. This can contribute to asset price bubbles.

- For example, during periods of high inflation, real estate prices may surge as investors view real assets as a hedge against inflation as witnessed during the 2008 financial crisis in the US in SubPrime Lending.

- Social and Political Consequences:

- Persistent and high inflation can have social and political consequences. It may lead to public dissatisfaction, protests, and demands for wage increases.

- Governments facing high inflation may implement policies to address these concerns, but the effectiveness of such measures can vary and may have broader economic implications.

- For example, in countries like Sri Lanka, Venezuela, Zimbabwe etc.

What are the Different Ways to Contain Inflation?

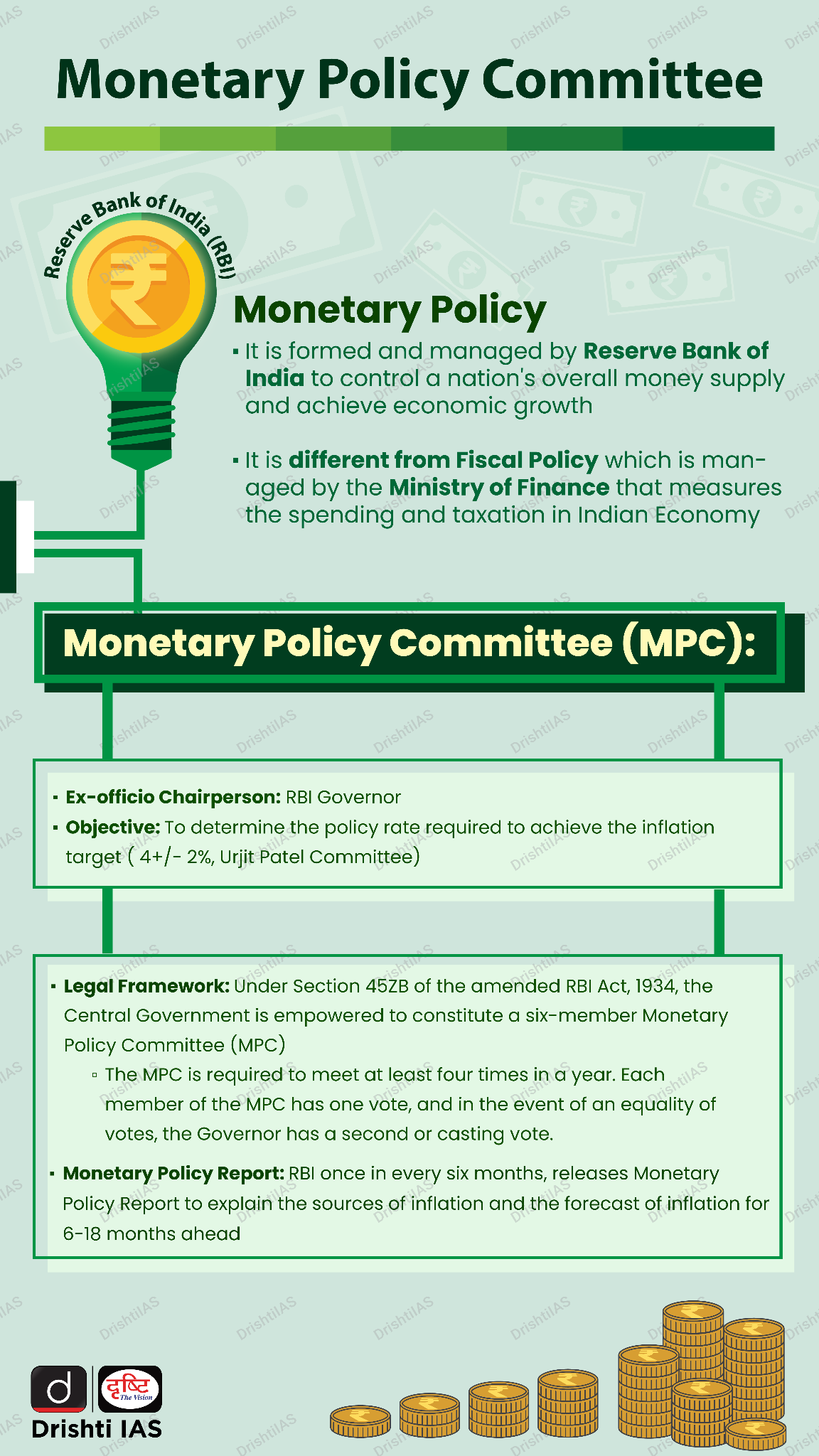

- Monetary Policy: The Reserve Bank of India (RBI), India's central bank, plays a crucial role in controlling inflation through monetary policy. The RBI adjusts key interest rates, such as the repo rate, to influence money supply and credit in the economy.

- The RBI can conduct Open Market Operation (OMO) by buying or selling government securities in the open market. These operations impact the money supply, which, in turn, affects inflation.

- Fiscal Policy Measures: The government uses fiscal policies like taxation and public spending to manage inflation.

- Appropriate fiscal measures can help in curbing demand and controlling inflationary pressures. Higher taxes can reduce disposable income, curbing spending and inflation.

- Food Price Management: Given that food prices often contribute significantly to inflation in India, the government implements various schemes to manage food supplies and prices.

- The Minimum Support Price (MSP) and the Public Distribution System (PDS) are examples of such initiatives.

- Buffer Stock Operations: The government maintains buffer stocks of essential commodities to stabilize prices in times of shortage. The creation and release of these stocks can help mitigate inflationary pressures.

- Price Support Scheme (PSS) needs to be rolled out effectively for all the important cereals and pulses. Under the PSS, Central nodal agencies procure pulses, oilseeds and copra with proactive role of state governments where the steps taken are not encouraging.

- Trade Policies: The government manages trade policies, including import and export regulations, to influence the supply of goods and control price levels.

- Restrictions on certain imports or exports may be imposed to stabilize domestic markets. Foreign Trade Policy should precisely address these concerns along with Import and Export targets.

- Anti-Hoarding Measures: To prevent artificial scarcity and price manipulation, the government conducts regular checks and takes action against hoarding and black market activities.

- This helps in maintaining a fair market and controlling inflation. Essential Commodities Act, 1955 has been largely ineffective in preventing hoarding by the wholesalers.

- Exchange Rate Management: The government monitors and manages the exchange rate to ensure competitiveness in international trade. A stable exchange rate can contribute to price stability by controlling the cost of imports.

- The Public Debt and Exchange Rate Management Agency should be set up by the government to regulate exchange rates.

- Financial Inclusion Initiatives: Improving financial inclusion through schemes like the Pradhan Mantri Jan Dhan Yojana (PMJDY) can help channelize savings into the formal banking system. This can reduce inflationary pressures by providing a stable source of funds for investment.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q 1. The lowering of Bank Rate by the Reserve Bank of India leads to (2011)

(A) More liquidity in the market

(B) Less liquidity in the market

(C) No change in the liquidity in the market

(D) Mobilization of more deposits by commercial banks

Ans: A

Q.2 Consider the following statements: (2020)

- The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI).

- The WPI does not capture changes in the prices of services, which CPI does.

- Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (a)

Q 3. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do? (2020)

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(A) 1 and 2 only

(B) 2 only

(C) 1 and 3 only

(D) 1, 2 and 3

Ans: B