Indian Economy

Gist of Economic Survey 2024-25

- 12 Feb 2025

- 42 min read

01: State of the Economy: Getting Back into the Fast Lane

- Global Economy: The global economy in 2024 experienced moderate but uneven growth, with the International Monetary Fund (IMF) projecting 3.2% growth for 2024 and 3.3% for 2025, with a slowdown in manufacturing due to supply chain disruptions while the services sector remained strong.

- Inflation eased globally, yet services inflation remained persistent, leading to divergent monetary policies across central banks.

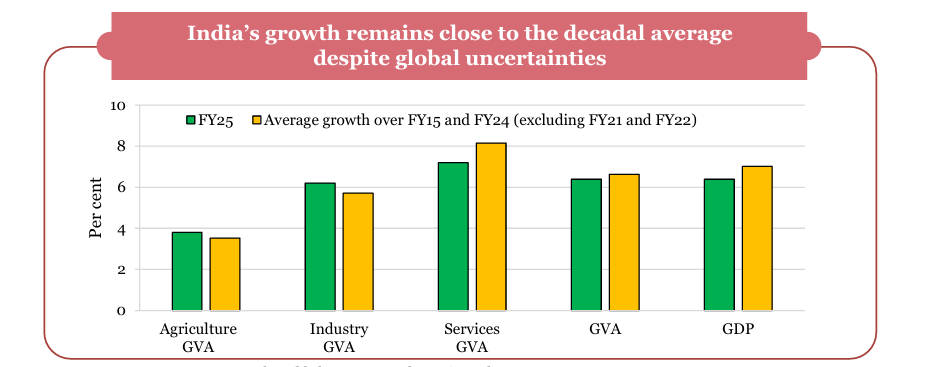

- India’s Economy: India's Gross domestic product (GDP) is projected to grow between 6.3-6.8% in FY26 (2025-26).

- India’s real GDP is estimated to grow by 6.4% in FY25 (2024-25), driven by agriculture and services, while manufacturing faces challenges.

- Retail Inflation averaged at 4.9% in 2024, down from 5.4% in FY24, but remained near the upper limit of the Reserve Bank of India’s (RBI) tolerance band (inflation target of 4%, with a tolerance band of +/- 2 percentage points).

- Food Inflation increased to 8.4%, primarily driven by vegetables and pulses, due to supply disruptions and erratic weather patterns.

- Core Inflation (excludes food and fuel prices) declined, reflecting easing cost pressures in goods and services.

- Sector-Wise Performance:

- Agriculture: 3.8% growth in FY25, driven by record Kharif production and strong rural demand.

- Industry & Manufacturing: The industrial sector is expected to grow 6.2% in FY25, driven by construction and utilities, while manufacturing slows due to weak global demand.

- Services: Fastest-growing sector at 7.2% in FY25, led by Information technology, finance, and hospitality.

- External Sector: Overall exports (merchandise+services) grew by 6% (YOY) in the first nine months of FY25. Services sector by 11.6% during the same time.

- Merchandise exports grew 1.6%, while imports rose 5.2%, widening the trade deficit.

- India remained the top global recipient of remittances, helping contain the current account deficit (CAD) at 1.2% of GDP, supported by strong job markets in Organisation for Economic Cooperation and Development (OECD) economies.

- Overall, India’s economic outlook remains positive, driven by domestic resilience and structural reforms, though risks from global uncertainties persist.

- Challenges Facing India’s Economy: Geopolitical tensions (Russia-Ukraine, Israel-Hamas) have disrupted trade, energy security, and inflation. Suez Canal issues increased freight costs and delivery times.

- Food prices remain volatile due to weather and supply disruptions.

- Financial risks include state fiscal stress from rising subsidies and lower tax revenues and increasing dependence on central transfers.

- India’s manufacturing sector remains under pressure from weak global demand .

- Way forward: Strategic fiscal and monetary policies are essential to navigate global uncertainties while fostering domestic growth.

- Deregulation through governance reforms, tax simplification, labor law rationalization, and decriminalizing business laws boosts industrialization and grassroots-level reforms will enhance India’s competitiveness and investment climate.

- Managing inflation through stable agricultural output and external sector stability remains crucial. Effective execution of Union Budget 2025-26 initiatives will drive sustainable economic expansion.

02. Monetary and Financial Sector Developments: The cart and the Horse

- Banking Sector Growth: Credit growth remains steady, aligning with deposit growth, while gross non-performing assets (GNPAs) fell to a 12-year low of 2.6%, with net NPAs at 0.6%.

- Financial Inclusion: The RBI Financial Inclusion Index increased from 53.9 (2021) to 64.2 (2024), reflecting significant progress in access to financial services.

- Monetary Policy: The RBI kept the repo rate at 6.5%, shifting its stance from "withdrawal of accommodation" to "neutral" in late 2024 to support growth.

- The cash reserve ratio (CRR) was reduced to 4%, injecting approximately Rs. 1,16,000 crore into the banking system.

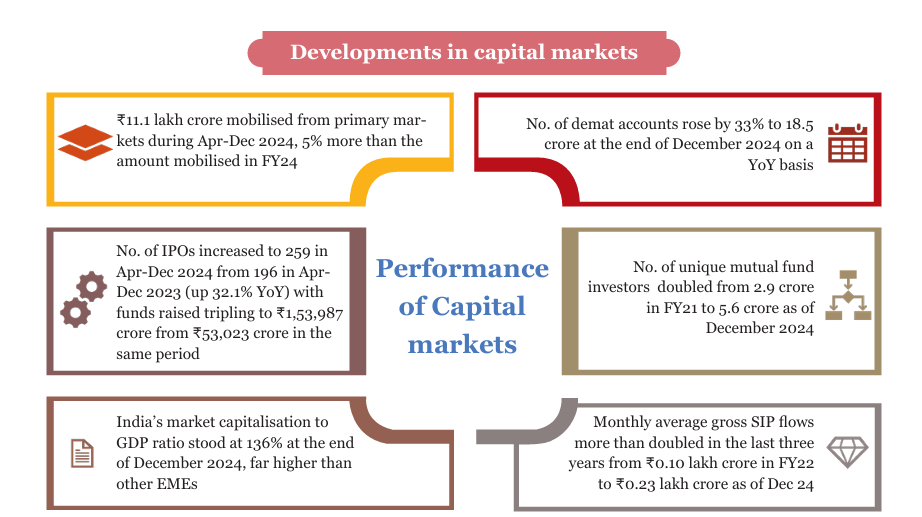

- Capital Markets: India's Initial Public Offerings (IPOs) surged sixfold between FY13 and FY24, ranking first globally in listings.

- India's stock market performed well despite global uncertainties and election-driven volatility. Young investors now make up 40% of the equity market.

- Development Financial Institutions (DFIs): India Infrastructure Finance Company Limited (IIFCL) co-financed Rs. 13.9 lakh crore in projects, supporting highways, energy, and ports.

- National Bank for Financing Infrastructure and Development (NaBFID) sanctioned Rs. 1.3 lakh crore in loans, targeting Rs. 3 lakh crore by FY26.

- Challenges:

- Consumer Debt Rise: Increased unsecured lending by digital lending, Non-Banking Finance Companies (NBFCs) and high retail participation in equity markets pose regulatory concerns .

- Global Headwinds: Geopolitical tensions (Russia-Ukraine, Middle East (Iran- Israel Conflict)) and financial market volatility may impact India’s financial stability.

- Banking Risks: Expanding NBFCs requires stricter oversight to prevent financial imbalances .

- Future Outlook:

- AI in Banking: Increased use of Artificial Intelligence (AI) and machine learning in risk assessment, fraud detection, and customer service can improve financial efficiency .

- Insurance Sector Growth: India projected to be the fastest-growing insurance market among G20 nations over the next five years (2024-2028).

- Pension Market Expansion: Expected to grow as India transitions from a lower-middle-income to an upper-middle-income economy.

03. External Sector: Getting FDI Right

- Trade Performance: Total exports (merchandise + services) grew 6% in FY25 to USD 602.6 billion, while imports rose 6.9% to USD 682.2 billion, widening the trade deficit to USD 79.5 billion.

- Foreign Exchange Reserves: India’s forex reserves reached USD 640.3 billion, covering 90% of external debt (USD 711.8 billion) as of December 2024 .

- Sectoral Highlights:

- Textiles & Apparel: India is the 6th largest exporter of Textiles and Apparel, contributing 2.3% to GDP, 13% to industrial production, 12% to exports and employs over 45 million people, with USD 34 billion in exports (2023).

- Services Exports: Grew 11.6%, with net receipts rising to USD 131.3 billion in FY25.

- FDI: The Foreign direct investment (FDI) rose by 17.9%, reaching USD 55.6 billion in FY25; cumulative gross FDI surpassed USD 1 trillion (2000– 2024), but, but net FDI declined due to increased repatriation .

- Current Account Deficit (CAD): Moderated to 1.2% of GDP in Q2 FY25, with private transfers (remittances) rising to USD 31.9 billion.

- Challenges:

- Rising Protectionism: Rising global protectionism and geopolitical tensions pose a significant challenge to India's trade growth. Increasing tariff and non-tariff barriers (NTMs) limit India's ability to expand its trade opportunities.

- Protectionism refers to government policies that restrict international trade to help domestic industries.

- Export Competitiveness: High trade costs, inefficient supply chains, and compliance challenges hinder India’s ability to integrate into global supply chains.

- Rising Protectionism: Rising global protectionism and geopolitical tensions pose a significant challenge to India's trade growth. Increasing tariff and non-tariff barriers (NTMs) limit India's ability to expand its trade opportunities.

- Future Outlook and Way Forward:

- E-commerce Export Growth: Business-to-consumer (B2C) market projected to expand from USD 83 billion (2022) to USD 150 billion (2026) and exports to rise to USD 200–300 billion by 2030, driven by digital trade policies .

- Strengthening FDI Climate: Policy reforms in investment facilitation, trade agreements, and ease of doing business will attract foreign capital .

- Sustainability Compliance: India can consider aligning exports with global carbon regulations (Carbon Border Adjustment Mechanism (CBAM), European Union Deforestation Regulation (EUDR)) to maintain competitiveness .

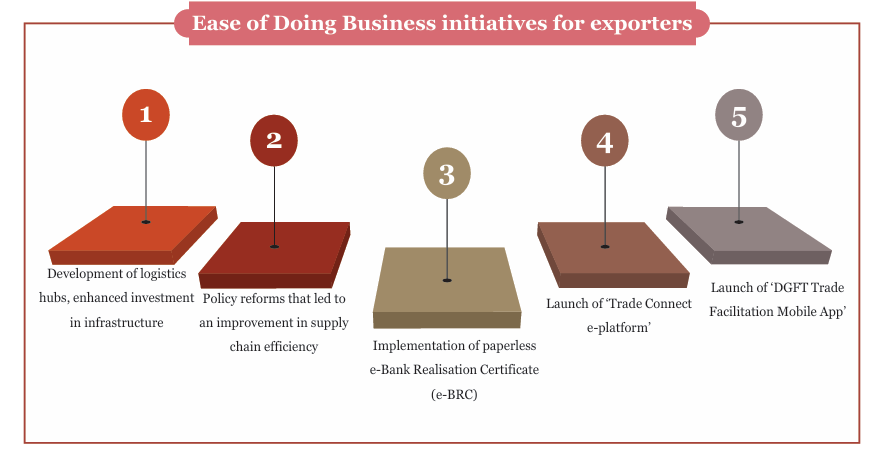

- Ease of Doing Business Reforms (EoDB):

04. Prices and Inflation – Understanding the Dynamics

- Global Inflation Trends: Declined to 5.7% in 2024, aided by monetary policy tightening by central banks .

- Food inflation globally eased but remained high in some economies, including India.

- India’s Inflation Trends: Retail inflation moderated from 5.4% (FY24) to 4.9% (FY25) .

- Core inflation dropped to its lowest level in a decade. Food inflation remains high, driven by extreme weather, supply chain issues, and reduced production of key items like onions, tomatoes, and pulses.

- Vegetables and pulses accounted for 32.3% of total food inflation, despite having only an 8.42% weight in the Consumer Price Index (CPI).

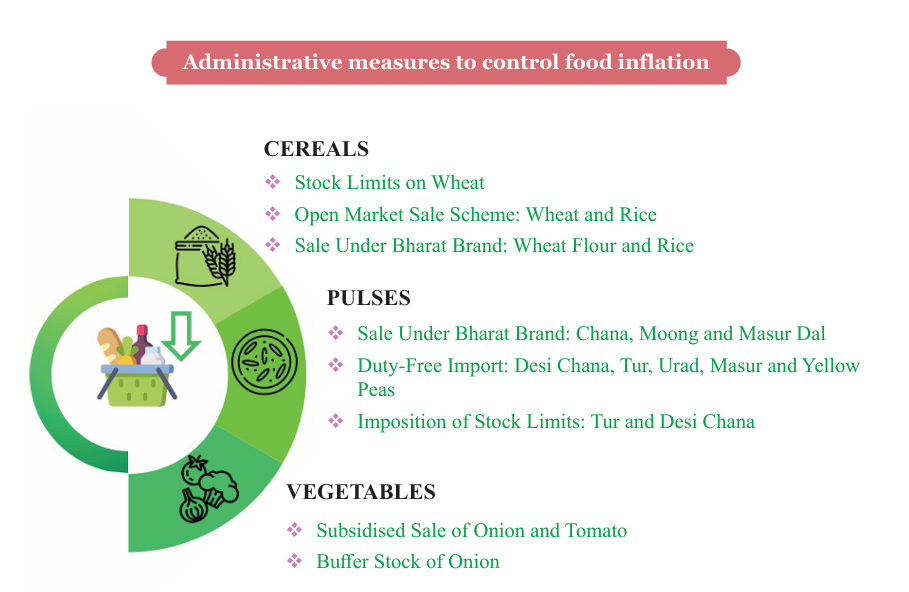

- Government Measures to Control Inflation: Maintained Buffer stocks of onions, price stabilization funds, and subsidized sales of vegetables.

- Ensured stock limits and import easing on pulses to balance supply, and led Open Market Sale Scheme (OMSS) to release wheat and rice into markets to control cereal prices .

- Challenges:

- Extreme Weather Events: Heatwaves and unseasonal rains damaged crops, leading to supply chain disruptions and price spikes in vegetables.

- Structural Issues in Food Supply: India remains a top producer of onions and tomatoes, limiting import options during shortages.

- Post-harvest losses, inefficient storage, and transportation bottlenecks exacerbate food inflation.

- Global Commodity Price Uncertainty: India’s dependence on pulses and edible oil imports remains a risk factor .

- Future Outlook and Way Forward:

- Projected Inflation Trends: RBI forecasts headline inflation at 4.2% in FY26, assuming normal monsoons and stable commodity prices.

- Commodity Prices Expected to Ease: Global prices expected to decline by 5.1% in 2025, with oil and metals seeing the largest drops. Lower import costs could help stabilize domestic inflation.

- Agriculture and Price Stability Measures: Expansion of vegetable clusters, farmer cooperatives, and digital market linkages can reduce price volatility.

- Develop climate-resilient crop varieties and post-harvest infrastructure to minimize losses .

- Control Food Inflation:

05. Medium-Term Outlook – Deregulation Drives Growth

- India’s Growth Aspirations: To become a USD 5 trillion economy by FY28 and USD 6.3 trillion by FY30, with a nominal GDP growth rate of 10.2% (FY25-FY30). India must maintain a sustained GDP growth rate of 8% annually .

- Investment & Employment: Achieving high growth requires raising investment from 31% to 35% of GDP and creating 7.85 million non-farm jobs annually .

- Structural Reforms: India has implemented Goods and Services Tax (GST), and increased recovery under the Insolvency and Bankruptcy Code (2016) , and led to digital inclusion under the digital public infrastructure (DPI), but regulatory burdens continue to hinder Micro, Small and Medium Enterprises (MSME) growth .

- Challenges:

- Rising Trade Barriers: Global trade restrictions rose to USD 887 billion in 2024, limiting India’s export potential .

- Dependence on China: India imports 75% of lithium-ion batteries and key solar panel components from China, creating vulnerabilities in the clean energy transition .

- Regulatory Bottlenecks: Complex compliance requirements discourage firm expansion, limit employment growth, and stifle innovation .

- Climate Change Risks: Extreme weather events and energy security concerns necessitate policy shifts in manufacturing and transportation .

- Way Forward:

- Deregulation for Growth: Systematic simplification of business laws, rationalization of compliance, and reducing licensing burdens will enhance economic freedom .

- Boosting Domestic Investment: Policies should focus on raising investment efficiency, improving ease of doing business, and incentivizing MSME expansion .

- Green Energy & Manufacturing: Strengthening domestic battery production, Electric Vehicles (EVs) supply chains, and renewable energy sectors will enhance self-reliance .

- State-Level Reforms: Competitive federalism should drive ease of doing business reforms at the state level, mirroring global best practices to boost GDP growth .

06. Investment and Infrastructure – Keeping It Going

- Investment Trends: Union government Capital Expenditure (Capex) on major infrastructure sectors grew at a rate of 38.8% (FY20-FY24).

- The National Infrastructure Pipeline (NIP) targets Rs 111 lakh crore investment from FY20-FY25, covering 9,766 projects across 37 sub-sectors .

- The National Monetisation Pipeline (NMP) identified core assets worth Rs 6 lakh crore (FY22-FY25) for private sector participation, with Rs 3.86 lakh crore transactions completed till FY24 .

- Sectoral Developments:

- Railways: Expansion continued with 17 new Vande Bharat trains, freight corridors, and railway station modernization under the Amrit Bharat Station Scheme.

- The Mumbai-Ahmedabad High-Speed Rail project achieved 47.17% physical progress .

- Key initiatives to enhance railway services include the Pradhan Mantri Bhartiya Janaushadhi Kendras (PMBJKs) and the One Station One Product Scheme.

- Roads & Highways: Bharatmala Pariyojana advanced, with 76% of the 34,800 km highway projects awarded (projects covering a total length of 26,425 km have been awarded and 18,714 km has been constructed).

- The Char Dham project completed 620 km of its planned 825 km .

- Civil Aviation: UDAN (Ude Desh ka Aam Nagrik) regional connectivity scheme operationalized 619 routes connecting 88 airports, increasing air connectivity and cargo handling capacity .

- Ports and Shipping: Vadhavan Mega Port was launched under the Sagarmala Programme.

- Dedicated Freight Corridors improved logistics efficiency, reducing container turnaround time .

- Power & Renewable Energy: India’s total installed power capacity reached 456.7 GW (FY25), with renewable energy forming 47% of total capacity .

- Digital Connectivity: 5G services expanded to 779 districts, while the Bharat Net project connected 2.14 lakh Gram Panchayats with broadband .

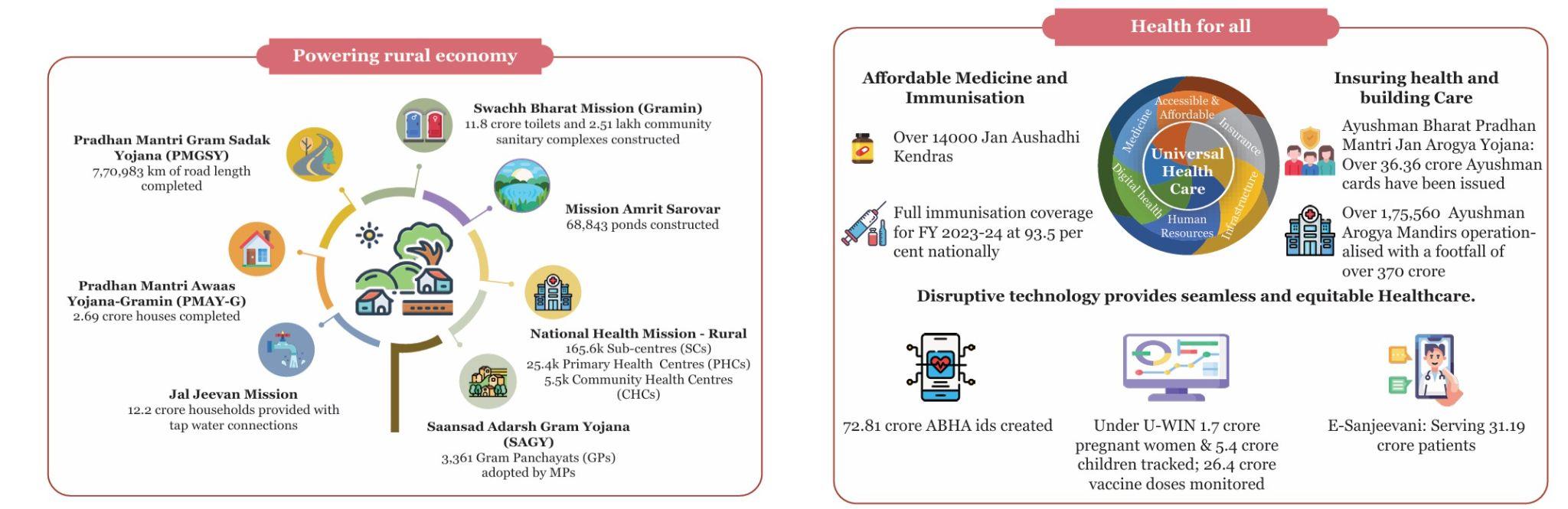

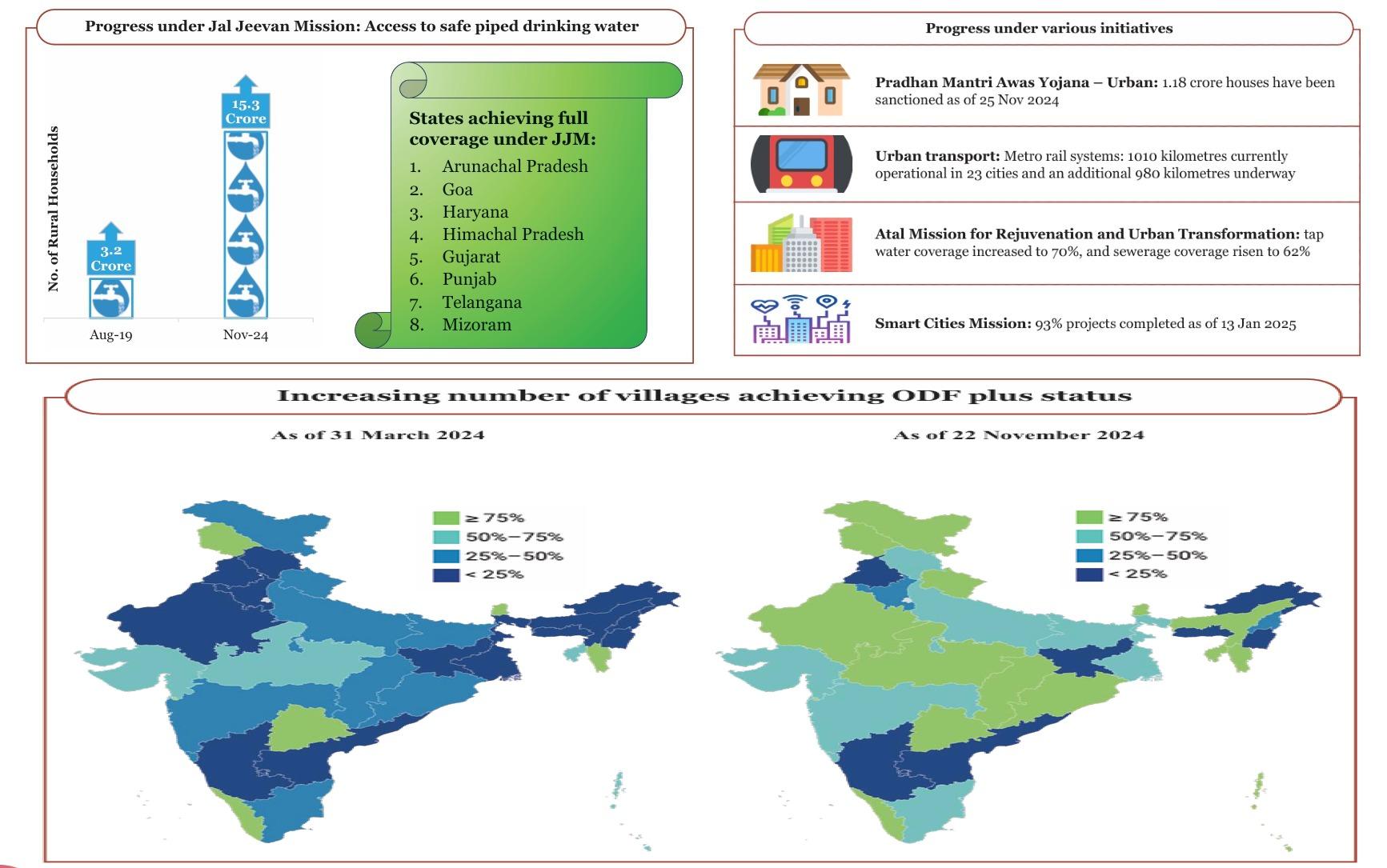

- Rural and Urban Development: Pradhan Mantri Awas Yojana (PMAY) sanctioned 1.18 crore houses, and Jal Jeevan Mission reached 15.3 crore households (79.1%).

- 18,374 villages electrified and 2.9 crore households connected under Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY) and SAUBHAGYA.

- Under Swachh Bharat Mission (Phase II) in 2024, 1.92 lakh villages declared Open Defecation Free (ODF) Plus, making a total of 3.64 lakh ODF Plus villages by 2024.

- Space assets: India operates 56 active space assets, with Space Vision 2047 targeting missions like Gaganyaan and Chandrayaan-4.

- Railways: Expansion continued with 17 new Vande Bharat trains, freight corridors, and railway station modernization under the Amrit Bharat Station Scheme.

- Challenges:

- Funding Gaps: While public spending on infrastructure has increased, private sector participation remains limited due to risk concerns and project delays .

- Regulatory & Policy Barriers: Complex approval processes, land acquisition challenges, and financing bottlenecks hinder infrastructure growth .

- Climate Change Risks: Extreme weather events impact rail, road, and power sector expansion, necessitating greater resilience in infrastructure planning .

- Election Disruptions: The Model Code of Conduct by Election Commission of India (ECI) slowed Capex in Q1 FY25, but spending picked up between July-November 2024 .

- Future Outlook and Way Forward:

- Public-Private Partnerships (PPPs): PPP models in highways, railways, and urban infrastructure need further expansion to bridge the investment gap .

- Increase Infrastructure Investment: A continued rise in infrastructure investment is needed for sustained growth, focusing on multi-modal transport, modernising assets, and improving efficiency.

- Sustainability Focus: Emphasize sustainable practices in infrastructure projects, especially in highways, waterways, power, and waste management.

07. Industry – Business Reforms and Manufacturing Growth

- India’s Rising Manufacturing Share: India's manufacturing sector holds a 2.8% global share, significantly behind China’s 28.8%, but presents a major opportunity for expansion .

- Growth in steel, cement, chemicals, automobiles, electronics, and pharmaceuticals has stabilized industrial output .

- Industrial growth in FY25 reached 6.2%, driven by electricity and construction, although it slowed to 3.6% in Q2 FY25 due to weak export demand and weather disruptions .

- MSME Sector employs 23.24 crore people, with 2.39 crore businesses formalized under Udyam Assist.

- Government Initiatives: National Logistics Policy and Production-Linked Incentive (PLI) schemes have improved industrial competitiveness .

- PLI in electronics manufacturing led to a 17.5% Compound Annual Growth Rate (CAGR) growth in domestic production, reducing mobile imports from 78% in FY15 to 4% in FY23 .

- State-wise business reforms have significantly influenced industrial performance, with Tamil Nadu emerging as a leader in footwear manufacturing .

- Challenges:

- Global Headwinds: Geopolitical tensions, trade restrictions, and supply chain disruptions have slowed India's manufacturing exports .

- Rising protectionist policies by major economies threaten India’s global market access .

- Structural Barriers: MSMEs face difficulties in scaling up due to regulatory burdens, limited financial access, and high logistical costs .

- Industrial Research and Development (R&D) spending is low (0.64% of GDP), compared to China, the US, and South Korea, limiting innovation-driven growth .

- Sector-Specific Challenges: Textile sector struggles due to reliance on cotton, while global markets favor man-made fibers (MMF) .

- Steel exports declined in FY25 due to lower international prices and high domestic production costs .

- Global Headwinds: Geopolitical tensions, trade restrictions, and supply chain disruptions have slowed India's manufacturing exports .

- Way Forward:

- Deregulation & Business Reforms: Simplifying regulatory compliance, labor laws, and taxation policies will encourage industrial expansion .

- Strengthening EoDB will promote competitive industrial growth .

- Investment & Infrastructure Growth: Expanding PLI schemes in high-tech manufacturing (quantum) to enhance self-reliance .

- Public-private partnerships (PPPs) in infrastructure and logistics to improve manufacturing competitiveness .

- Sustainable Manufacturing: Enhance Steel Scrap Recycling Policy to reduce carbon emissions and improve resource efficiency .

- Adoption of energy-efficient technologies in cement, steel, and chemicals to align with global sustainability standards .

- Deregulation & Business Reforms: Simplifying regulatory compliance, labor laws, and taxation policies will encourage industrial expansion .

08. Services Sector – New Challenges for the Growth Engine

- Global Services Growth: The Global Services Purchasing Manager's Index (PMI) reached 53.8 in December 2024, marking 23 months of expansion, but faces risks from geopolitical uncertainties and protectionism .

- Services as the Key Growth Driver: The services sector contributed 55% to India’s Gross Value Added (GVA) in FY25, up from 50.6% in FY14, and employs 30% of the workforce .

- India ranked 7th in global services exports (4.3% share), growing at 12.8% YoY in FY25, led by IT and business services .

- Sectoral Performance:

- IT & Business Services: India’s tech industry revenue reached $254 billion in FY24, with tech exports nearing USD 200 billion. The sector added 60,000 new jobs, despite global economic headwinds.

- Financial Services: Bank credit to the services sector reached RS 48.5 lakh crore (2024), growing 13% YoY, led by computer software (22.5%) and professional services (19.4%) .

- Logistics and Connectivity: Indian Railways’ passenger and freight traffic grew by 8% and 5.2%, respectively in (FY24), with digital ticketing adoption at 86% in reserved categories .

- Telecom sector: With 1.18 billion subscribers, leads in global mobile data consumption.

- Tourism: In FY23, the tourism sector created 7.6 crore jobs, earned USD 28 billion in foreign exchange, and contributed 5% to India's GDP. India secured 14th rank globally in tourism receipts in FY23.

- Key schemes like Pilgrimage Rejuvenation And Spiritual Augmentation Drive (PRASHAD) and Swadesh Darshan 2.0 focus on enhancing tourism infrastructure and promoting domestic tourism in India.

- Challenges:

- Service Inflation & Wage Pressures: High nominal wage growth globally has kept service inflation elevated, affecting cost competitiveness .

- Regulatory Barriers: Offshore audit and regulatory scrutiny in global markets pose risks to India’s IT and financial services exports .

- Uneven State-wise Growth: Maharashtra, Karnataka, Tamil Nadu, Gujarat, and UP contribute over 50% to India’s service sector GVA, while 19 other states collectively account for just 25% .

- Future Outlook and Way Forward:

- Digital & AI Integration: Banking, retail, telecom, and logistics are driving AI adoption, with automation improving service efficiency .

- Public-Private Investment in Logistics: Expansion of highways, railways, waterways, and airport infrastructure under PM Gati Shakti and National Logistics Policy will improve trade and services efficiency .

- Real Estate Growth: Rising demand in commercial real estate and REITs, along with regulatory reforms, is strengthening the sector .

- Expanding Financial & Insurance Services: FDI inflows in insurance grew by 62% in FY25, reflecting investor confidence in India’s financial sector .

09. Agriculture and Food Management – Sector of the Future

- Agriculture’s Role in the Economy: The sector contributes 16% to India’s GDP and employs 46.1% of the population.

- Growth has been steady, averaging 5% annually from FY17 to FY23 .

- Income Growth: Agricultural income grew at 5.23% annually over the past decade, compared to 6.24% for non-agriculture and 5.80% for the overall economy.

- Crop Production & Diversification: Kharif foodgrain production for 2024 projected at 1,647.05 LMT, an increase of 124.59 LMT over the 5-year average.

- India accounts for 11.6% of the world's cereal production, but productivity lags behind global averages .

- Floriculture: With a 100% export orientation, floriculture is emerging as a profitable alternative for small farmers, exporting Rs 717.83 crore worth of products in FY24 .

- High-Value Sectors: Horticulture, livestock, and fisheries drive agricultural growth. Fisheries led with a 13.67% CAGR (FY15-FY23), followed by livestock at 12.99%.

- Support to Farmers: 7.75 lakh crore operational Kisan Credit Cards (KCC) accounts with loans outstanding of Rs. 9.82 lakh crore as of March 2024.

- Over 110 million farmers benefited from the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme, and 2.36 million enrolled in the Pradhan Mantri Kisan Maandhan Yojana (PM-KMY) pension scheme.

- Pradhan Mantri Fasal Bima Yojana (PMFBY) insured 600 lakh hectares in FY24, reducing farmers’ risks .

- e-NAM platform linked 1.78 crore farmers, 2.62 lakh traders (Oct 2024) for better price discovery.

- Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) provides free food grains to 80 crore people.

- Food processing exports reached USD 46.44 billion (FY24), with 23.4% share in agri-food exports (11.7 % of India's total exports).

- Challenges:

- Climate Change: Erratic monsoon patterns and extreme weather events increase vulnerability.

- Only 55% of net sown area is irrigated, with drought risk affecting two-thirds of agricultural land .

- Soil degradation and declining organic carbon levels threaten long-term productivity.

- Structural Constraints: Small farm sizes (85% are below 2 hectares) limit economies of scale.

- Yield gaps compared to global averages highlight the need for better agricultural practices .

- Low oilseed productivity (1.9% CAGR) increases dependence on edible oil imports .

- Climate Change: Erratic monsoon patterns and extreme weather events increase vulnerability.

- Way Forward:

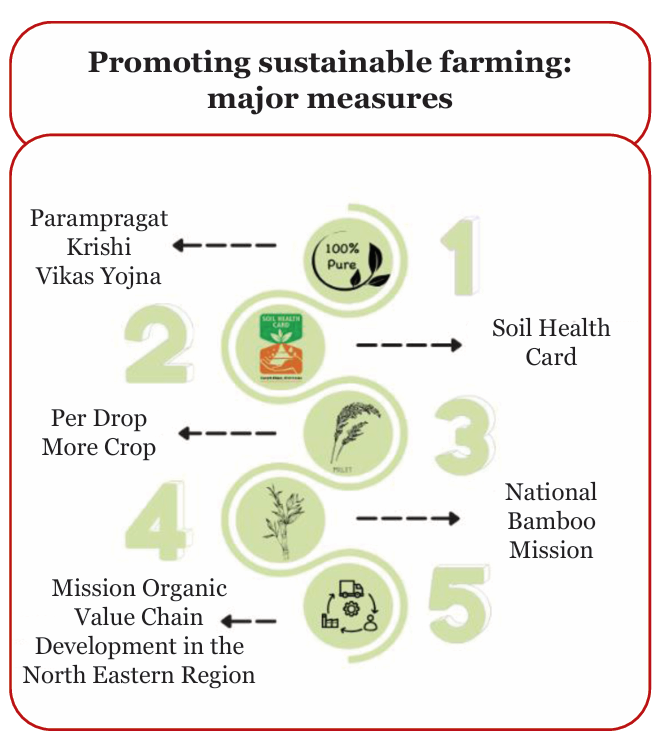

- Addressing Challenges: Promote climate-resilient farming practices, alongside investment in R&D for climate-resistant crops and micro-irrigation.

- Market Efficiency and Infrastructure: Strengthen market infrastructure, enhance e-NAM platform utilization, and support Farmers Producer Organisations and cooperatives for inclusive and efficient agricultural markets.

- Policy Reforms & Sustainability: Implement policies for balanced crop production, improve soil fertility, and adopt mechanisms for price risk hedging to ensure sustainable agriculture growth.

10. Climate and Environment - Adaptation Matters

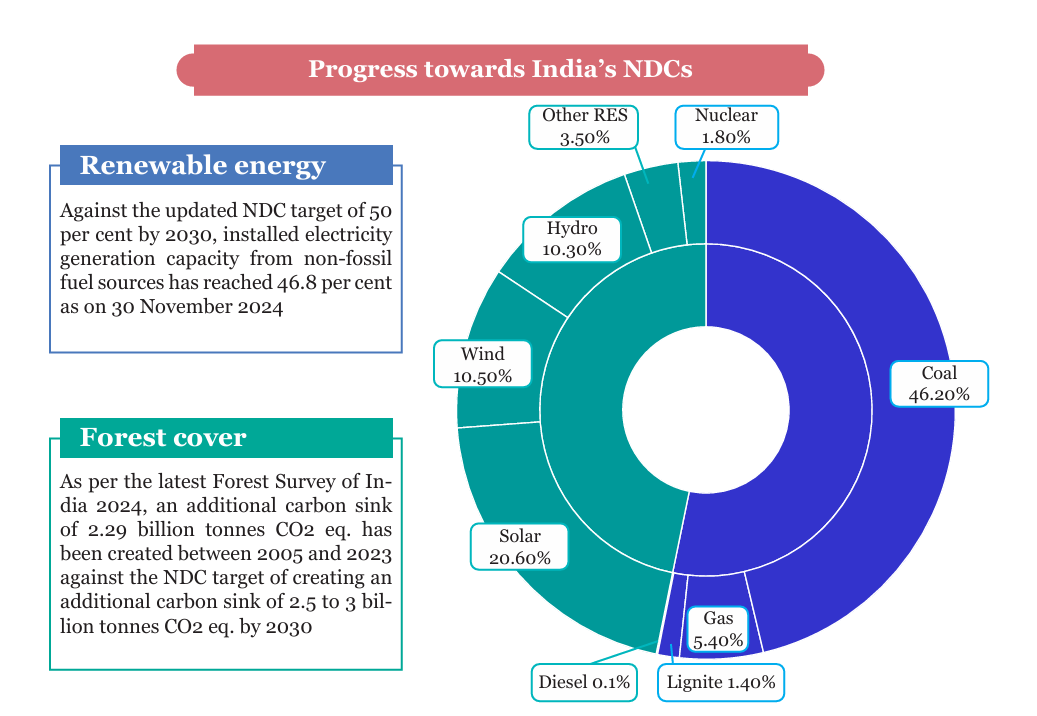

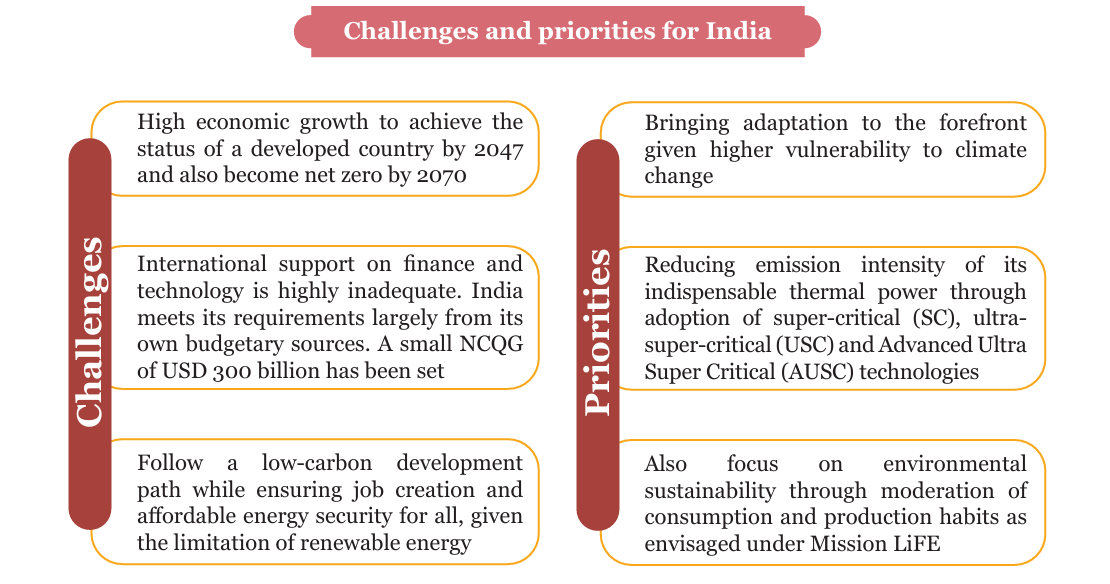

- Carbon Emissions: India’s per capita carbon emissions are one-third of the global average.

- Adaptation Expenditure: Increased from 3.7% of GDP in FY16 to 5.6% in FY22, highlighting growing investment in climate adaptation.

- Climate Action Financing is largely domestic, international finance remains insufficient.

- Climate Finance & International Cooperation: Conference of Parties 29 failed to secure adequate climate funds, with a USD 300B annual goal vs. USD 5.1 to 6.8T needed by 2030.

- Sustainable Development:

- MISHTI Program: The Mangrove Initiative for Shoreline Habitats & Tangible Incomes (MISHTI) a Mangrove restoration programme targeting 540 sq. km, generated 22.8 million man-days of employment, and a carbon sink of 4.5 million tons of carbon dioxide (CO2).

- Energy Mix (2024): Coal (46.2%), Solar (20.6%), Wind (10.5%), Hydro (10.3%), Nuclear (1.8%).

- Green Hydrogen Mission: The Green Hydrogen Mission aims to achieve 5 million metric tons of green hydrogen production by 2030, supported by 125 gigawatts (GW) of renewable energy capacity.

- It is expected to create over six lakh jobs, reduce fossil fuel imports by over Rs 1 lakh crore, and cut annual greenhouse gas emissions by nearly 50 MMT (50 million tons of CO₂).

- PM-Surya Ghar: Aims for 30 GW residential rooftop solar capacity by 2027.

- Sovereign Green Bonds: India issued Rs. 20,000 crore in FY24, with a FY25 target of Rs. 21,697 crore.

- RBI Green Deposits Framework: Promotes lending to renewable energy projects.

- LiFE initiative: The Lifestyle for Environment (LiFE) initiative, launched at COP26 in Glasgow (2021), aims to mobilize one billion Indians and global citizens to adopt pro-environmental lifestyles .

- A 13% shift in global lifestyles can reduce emissions by 20%. Changes like reducing food waste (90 kg per person annually) and carpooling could save substantial fuel.

- Green Credit Programme: Incentivizes environmental conservation efforts, including tree plantation.

- Jal Shakti Abhiyan (2019): Water conservation and rainwater harvesting; Smart Laboratory on Clean Rivers (SLCR) rejuvenates Varuna River.

- Swachh Bharat Mission: Focuses on Waste management and promoting sanitation for sustainability.

- Circular Economy: Aimed at reducing waste, recovering valuable materials, and promoting resource efficiency.

- National Clean Air Programme (NCAP): launched to address air quality issues in cities.

- Net-Zero Emissions by 2070: India’s long-term goal to balance low-carbon development with economic growth.

- Challenges:

- Climate Vulnerability: India ranks 7th most vulnerable to climate change, experiencing extreme weather events, biodiversity loss, and water insecurity .

- Renewable Energy Deployment: Key issues include lack of storage technology, access to critical minerals, and the high costs of green hydrogen .

- Insufficient Global Climate Finance: The estimated climate finance requirement is USD 5.1 - 6.8 trillion by 2030, but current mobilization targets remain far lower (with USD 300 Billion annual goal) .

- Energy Transition Challenges: Premature shutdown of thermal energy without viable alternatives may lead to energy instability.

- Expansion of nuclear energy faces challenges due to fuel supply monopolies and public safety concerns .

- Urban Sustainability: Rapid urbanization requires enhanced climate resilience to address heat stress, urban flooding, and groundwater depletion .

- Future Outlook and Way Forward:

- Renewable Energy Investments: India's efforts in solar power, wind energy, and green hydrogen can accelerate the energy transition. Investments in battery storage, carbon capture, and grid modernization are crucial .

- Green Finance and Market-Based Incentives: Policies like Green Credit Rules 2023, Perform Achieve and Trade (PAT) scheme, and electric vehicle subsidies can incentivize low-carbon choices .

- Energy Storage Solutions: Invest in the R&D of battery storage technologies to support renewable energy supply reliability.

- Carbon Capture Technologies: Develop and deploy carbon capture, utilization, and storage (CCUS) technologies to reduce emissions from existing thermal plants.

11. Social Sector – Extending Reach and Driving Empowerment

- Social sector spending has risen significantly, with government expenditure on social services increasing from Rs 14.8 lakh crore in FY21 to Rs 25.7 lakh crore in FY25 (CAGR of 15%) .

- Household Consumption Expenditure Survey (HCES) 2023-24 shows a narrowing urban-rural consumption gap, with rural MPCE (Rs 4,122) and urban MPCE (Rs 6,996) reflecting improved rural living standards .

- Inequality Reduction (Gini Coefficient):

- Rural (2023-24): 0.237 (down from 0.266 in 2022-23).

- Urban (2023-24): 0.284 (down from 0.314 in 2022-23).

- Education & Health Focus: Education expenditure grew by 12% annually, reaching Rs 9.2 lakh crore in FY25. Government school enrollment rose to 69%.

- Key Digital Education Initiatives: Digital Infrastructure for Knowledge Sharing (DIKSHA), Study Webs of Active Learning for Young Aspiring Minds (SWAYAM), Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA), and PM e-Vidya.

- Healthcare spending surged 18% to Rs 6.1 lakh crore in FY25, with Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PM-JAY) saving Rs 1.25 lakh crore in medical expenses.

- Welfare & Inclusion Initiatives: 84% of households have ration cards, ensuring food security through the Public Distribution System and Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY).

- Direct Benefit Transfers (DBTs) and self-help group (SHG) loans empower low-income households, with 77% of surveyed rural households receiving cash transfers .

- Deendayal Antyodaya Yojana (DAY-NRLM) expanded SHG financing, with 78% of SHG members receiving loans for income generation.

- Challenges:

- Education & Skill Gaps: Dropout rates remain high at 14.1% at the secondary level, and higher education Gross Enrolment Ratio (GER) needs to reach 50% by 2035 (currently at 28.4%).

- Digital divide persists, with lower internet access in rural areas (55%) compared to urban (69%) .

- Affordability: Despite progress, Gini coefficient remains higher in urban areas (0.284) than rural (0.237) .

- Health: Mental health issues are rising due to social media overuse and work stress, requiring targeted interventions .

- Gender & Social Inclusion: Women’s workforce participation remains low despite financial inclusion efforts.

- Education & Skill Gaps: Dropout rates remain high at 14.1% at the secondary level, and higher education Gross Enrolment Ratio (GER) needs to reach 50% by 2035 (currently at 28.4%).

- Way Forward:

- Education and Skilling: Expanding vocational education, AI-driven learning tools, and teacher training. Improving higher education affordability and bridging the rural-urban digital divide .

- Healthcare and Well-being: Strengthening affordable medical education and rural health infrastructure. Promoting mental health awareness and lifestyle-based interventions .

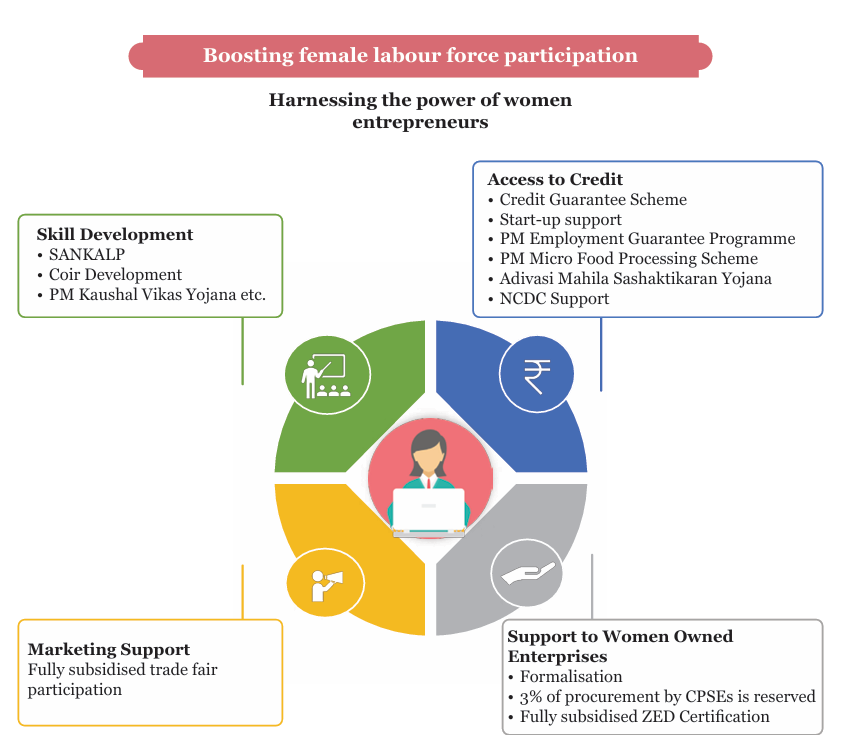

- Women and Rural Empowerment: Expanding SHG networks, rural entrepreneurship programs, and targeted subsidies . Enhancing gender-focused financial literacy and employment programs.

12. Employment and Skill Development: Existential Priorities

- Unemployment Trends: Overall Unemployment Rate decreased by 3.2% in 2023-24, showing improvement in the labor market.

- Urban Unemployment slightly dropped from 6.6% in Q2 FY24 to 6.4% in Q2 FY25, indicating steady recovery.

- The working-age population (15-59 years) reached 923.9 million (2026 projection), offering a demographic dividend (26% of the population aged 10-24).

- Female Labour Force Participation: Increased from 23.3% in 2017-18 to 41.7% in 2023-24, particularly in rural areas. Represents significant female engagement in the workforce.

- Platformization and remote work opportunities boost female workforce participation .

- Gig Economy Growth: Projected Gig Workers by 2029-30 expected to reach 23.5 million, comprising 6.7% of the non-agricultural workforce (up from 2.6% in 2020-21).

- Formal Employment Growth: 9.56 million net payroll additions under the Employees' Provident Fund Organisation (EPFO) in FY24, reflecting growth in formal employment.

- Wage and Rural Employment Trends: Rural wages have grown faster than urban wages, reflecting broader economic shifts.

- Skill Development & Education: Government initiatives focus on early vocationalization, upskilling and reskilling, and Industry 4.0 training in areas like AI and machine learning.

- Participation of women in the National Apprenticeship Promotion Scheme (NAPS) increased from 7.7% in 2016-17 to 22.8% in 2024-25 (up to October 31, 2024).

- Entrepreneurship Support: Skill India and Mudra Yojana aid in entrepreneurship and vocational training.

- Job Creation: Driven by the growing digital economy and renewable energy sectors, crucial for Viksit Bharat.

- Challenges:

- Skill Mismatch: 90.2% of the workforce has only secondary-level education or below, with 88.2% engaged in low-competency occupations .

- Gender Gap: While female labour force participation has increased, gender-based challenges in skill acquisition and employment remain significant.

- Technological Disruptions: Rapid automation and AI adoption threaten job displacement, requiring constant adaptation .

- Global Competition: India’s skilling initiatives must align with international labour market requirements to enhance global employability.

- Way Forward

- Strengthening Industry-Academia Collaboration: Bridging the skill gap through public-private partnerships, training infrastructure upgrades, and demand-driven curriculum .

- Vocational Training Expansion: Ensuring early vocational exposure at the school level, in alignment with National Education Policy (NEP) 2020 .

- AI and Digital Skilling: Implementing a tiered skill framework focusing on foundational, intermediate, and advanced AI training .

- Global Workforce Integration: Aligning skilling programs with international demand-supply trends, improving mobility for skilled Indian workers .

13. Labour in the AI Era: Crisis or Catalyst?

- AI in Decision-Making: Outperforming humans in healthcare, criminal justice, education, and finance.

- Job Risk: 300 million jobs at risk of AI-driven automation (Goldman Sachs).

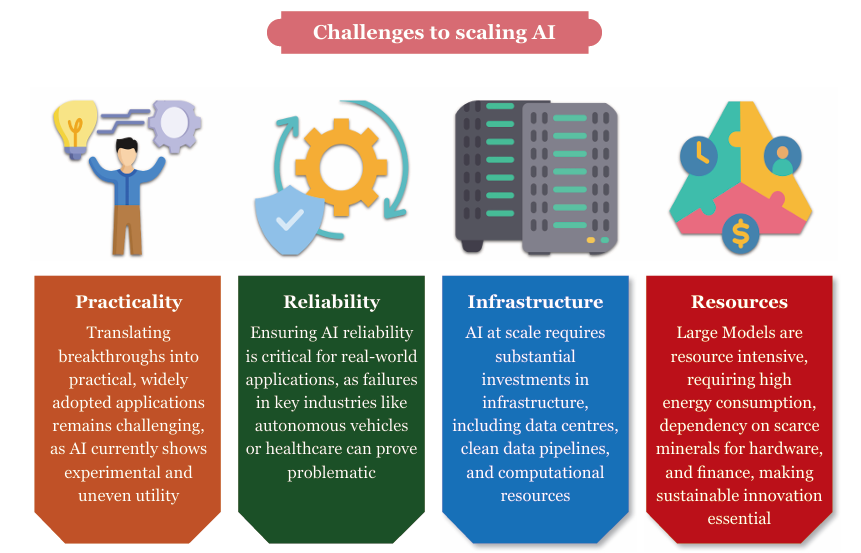

- AI Automation Impact: AI presents both opportunities and risks, with 75 million jobs at risk globally and 300 million roles exposed (Goldman Sachs).

- India’s AI market is set to grow at 25-35% CAGR by 2027 (National Association of Software and Services Companies (NASSCOM)), making workforce upskilling, regulatory oversight, and human-AI collaboration essential for a balanced transition.

- Environmental Impact: AI data centers require over 1 billion liters of water daily, straining resources.

- Challenges:

- Job Displacement & Inequality: AI adoption threatens entry-level jobs and could exacerbate social and economic divides.

- Indian IT, Business process outsourcing (BPO), and banking sectors face high AI disruption, particularly in low-value service jobs.

- Infrastructure Deficits: Widespread AI adoption requires significant investments in digital infrastructure, computing power, and high-quality data management .

- AI Reliability & Accountability: AI models can produce biased results, leading to ethical and governance concerns in areas like hiring, law enforcement, and healthcare .

- Job Displacement & Inequality: AI adoption threatens entry-level jobs and could exacerbate social and economic divides.

- Way forward:

- Building Social Infrastructure: Institutions must be developed to minimize AI-induced labor disruptions and provide necessary support systems .

- Regulatory & Ethical Frameworks: AI regulations must be updated to ensure fairness, transparency, and accountability in AI-driven decision-making .

- Balancing Automation & Human Workforce: AI should be seen as an augmentation tool rather than a substitute for human labor, ensuring a cooperative model for productivity growth .

Conclusion

India’s Economic Survey 2024-25 highlights resilient growth, fiscal prudence, and structural reforms driving the nation towards Viksit Bharat 2047. Despite global uncertainties, climate risks, and technological disruptions, India's strong domestic demand, infrastructure push, and digital advancements ensure stability. Sustained investment in human capital, regulatory simplification, and green growth strategies will be key to long-term progress with a balanced policy approach, innovation-driven economy, and inclusive development will help India maintain its high-growth trajectory in the coming decades.