Indian Economy

Inflation in India: Demand vs. Supply

- 03 Jan 2024

- 7 min read

For Prelims: Inflation, Consumer Price Index (CPI), Headline Inflation, COVID-19, Russia-Ukraine Conflict, Pandemic, Lockdowns, Consumer Price Index (CPI), International Monetary Fund, Demand Pull Inflation, Cost-push Inflation

For Mains: Impact of Demand and Supply over Inflation.

Why in News?

Recently, Inflation in India is a perennial concern, but recent observations by the Reserve Bank of India (RBI) suggest changing dynamics influenced by both supply and demand factors.

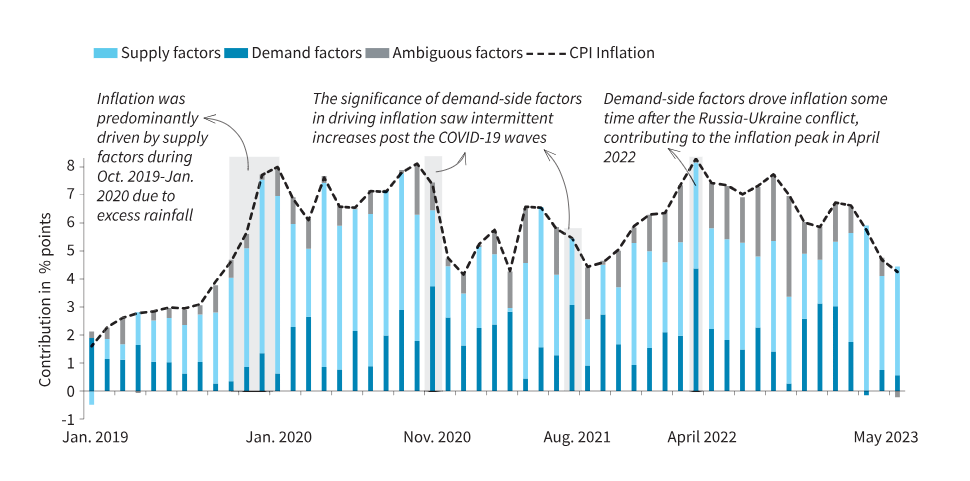

- Over the entire period from January 2019 to May 2023, approximately 55% of the Consumer Price Index (CPI) headline inflation is attributed to supply-side factors and the contribution of demand drivers to inflation stood at 31%.

What has Caused Inflation in India in Recent Years?

- During the two waves of Covid-19, supply disruptions were the main cause of inflation.

- The start of the pandemic, lockdowns caused a major decline in production and demand, leading to a steep drop in economic growth.

- This phase also saw a decrease in commodity prices due to weakened demand.

- As the economy began to reopen with distribution of vaccines and release of pent-up demand, demand recovered more rapidly than supply. This imbalance resulted in rising pressures on commodity prices.

- The onset of the Russia-Ukraine conflict in 2022 further intensified supply chain challenges and added to commodity price pressures.

What is the Methodology for Assessing Inflation Causes?

- Unforeseen shifts in prices and quantities within a month determine whether inflation is demand-driven (prices and quantities move in the same direction) or supply-driven (prices and quantities move in opposite directions).

- An increase in demand leads to a rise in both prices and quantities, while a decrease in demand results in a reduction in both.

- Inflation is considered to be supply-driven if there is an unexpected change in prices and quantities that move in opposite directions. In this case, a decrease in supply is linked with a lower volume but an increase in price, and vice versa.

- Demand and supply factors at the sub-group level were combined using the CPI weights to assess overall headline inflation.

- Headline inflation is a measure of the total inflation within an economy, including commodities such as food and energy prices, which tend to be much more volatile and prone to inflationary spikes.

- The headline inflation figure is reported through the Consumer Price Index (CPI), which calculates the cost to purchase a fixed basket of goods to determine how much inflation is occurring in the broad economy.

What is Inflation?

- About:

- Inflation, as defined by the International Monetary Fund, is the rate of increase in prices over a given period, encompassing a broad measure of overall price increases or for specific goods and services.

- It reflects the rising cost of living and indicates how much more expensive a set of goods and/or services has become over a specified period, usually a year.

- In India, inflation's impact is particularly significant due to economic disparities and a large population.

- Different Causes of Inflation:

- Demand-Pull Inflation:

- Demand Pull inflation occurs when the demand for goods and services exceeds their supply. When the overall demand in the economy is high, consumers are willing to pay more for the available goods and services, leading to a general rise in prices.

- A booming economy with high consumer spending can create excess demand, putting upward pressure on prices.

- Demand Pull inflation occurs when the demand for goods and services exceeds their supply. When the overall demand in the economy is high, consumers are willing to pay more for the available goods and services, leading to a general rise in prices.

- Cost-Push Inflation:

- Cost-push inflation is driven by an increase in the production costs for goods and services. This can be caused by factors such as increased incomes, increased costs of raw materials, or disruptions in the supply chain.

- Built-In or Wage-Price Inflation:

- This type of inflation is often described as a feedback loop between wages and prices. When workers demand higher wages, businesses may raise prices to cover the increased labor costs. This, in turn, prompts workers to seek higher wages, and the cycle continues.

- Collective bargaining by labor unions can result in higher wages, leading to increased production costs and subsequently higher prices for goods and services.

- This type of inflation is often described as a feedback loop between wages and prices. When workers demand higher wages, businesses may raise prices to cover the increased labor costs. This, in turn, prompts workers to seek higher wages, and the cycle continues.

- Demand-Pull Inflation:

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q.1 With reference to Indian economy, demand-pull inflation can be caused/increased by which of the following? (2021)

- Expansionary policies

- Fiscal stimulus

- Inflation-indexing of wages

- Higher purchasing power

- Rising interest rates

Select the correct answer using the code given below:

(a) 1, 2 and 4 only

(b) 3, 4 and 5 only

(c) 1, 2, 3 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (a)

Q.2 Consider the following statements: (2020)

- The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI).

- The WPI does not capture changes in the prices of services, which CPI does.

- The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (a)

Q 3. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do? (2020)

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(A) 1 and 2 only

(B) 2 only

(C) 1 and 3 only

(D) 1, 2 and 3

Ans: B