Indian Economy

51st meeting of RBI Monetary Policy Committee

- 10 Oct 2024

- 12 min read

For Prelims: Monetary Policy Committee, Reserve Bank of India, Repo Rate, Consumer Price Index, UPI123PAY, Non-Banking Financial Companies (NBFCs), Microfinance Institutions (MFIs), Housing Finance Companies (HFCs), Deposit Insurance and Credit Guarantee Corporation, Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority.

For Mains: Monetary Policy Committee Decisions, Issues related to NBFCs

Why in News?

Recently, the 51st Monetary Policy Committee (MPC) meeting of the Reserve Bank of India (RBI) was chaired by the RBI Governor.

What are the Key Decisions Taken at the 51st MPC Meeting?

- Unchanged Repo Rate: Monetary Policy Committee (MPC) decided to keep the repo rate unchanged at 6.5% for the 10th consecutive time.

- Change in Monetary Policy Stance: The MPC changed the policy stance to ‘Neutral’ from ‘withdrawal of accommodation’.

- Neutral stance allows the MPC greater flexibility to adjust monetary policy as needed while “withdrawal of accommodation” means restrictive monetary policy stance where the RBI aims to reduce the money supply in the economy (curb inflationary pressures).

- When the RBI withdraws accommodation, it signals that it is less inclined to support economic growth through lower rates, focusing instead on stabilising prices.

- Inflation Targets: The RBI has retained its Consumer Price Index (CPI) inflation forecast for FY2025 at 4.5%.

- Flexible Inflation Targeting (FIT) was introduced in 2015 to control inflation with a target of 4% (±2%) while allowing temporary deviations to support economic growth.

- Real GDP Growth Projections: The RBI kept its real GDP growth projection for FY25 at 7.2%. India’s growth story remains strong, driven by private consumption and investment demand.

- Hike in UPI123PAY Transaction Limit: The RBI has hiked the UPI 123PAY per transaction limit to Rs 10,000 from Rs 5,000.

- RBI announced a hike in the UPI lite per transaction limit to Rs 1,000 from Rs 500. RBI also hiked the UPI lite wallet limit to Rs 5,000 from currently Rs 2,000.

- UPI 123PAY is a payment system mainly for non-smart phone/feature phone users by which they can make payment using UPI without internet connectivity.

- Reserve Bank-Climate Risk Information System (RB-CRIS): RBI has proposed to create a data repository namely RB-CRIS to bridge the gap in climate-related data that is currently available in a fragmented manner.

- It will undertake climate risk assessments for ensuring stability of balance sheets of financial entities and that of the financial system. It will be in two parts.

- The first part will be a web-based directory listing various publicly accessible meteorological and geospatial data sources on the RBI's website.

- The second part will be a data portal with standardised datasets, accessible only to regulated entities in a phased manner.

- It will undertake climate risk assessments for ensuring stability of balance sheets of financial entities and that of the financial system. It will be in two parts.

- Direction of NBFCs: RBI issued a strong advisory to non-banking financial companies (NBFCs), microfinance institutions (MFIs) and housing finance companies (HFCs), to follow a 'compliance first' culture and take a sincere approach to customer grievances.

- Compliance first culture prioritises adherence to laws, regulations, and internal policies above other business considerations.

Note:

The MPC determines the policy repo rate required to achieve the inflation target while other decisions are taken by the RBI.

- UPI Lite is a new payment solution that leverages the trusted NPCI Common Library (CL) application to process low value transactions.

- UPI lite wallet is a digital wallet where you load money from your bank account to make online transactions.

What is RBI's Stance on NBFCs in the 51st meeting of RBI MPC?

- Growth at Any Cost Approach: RBI Governor expressed concerns regarding the "growth at any cost" mentality prevalent among some NBFCs while ignoring sustainable business practices and robust risk management frameworks.

- Review of Compensation Practices: RBI has directed NBFCs to reassess how they structure their employee compensation, especially regarding bonuses and incentives linked to short-term performance goals.

- The RBI is concerned that such practices may encourage risky or unsustainable behaviours focused solely on immediate results.

- Usurious Practices: Concerns were raised about NBFCs charging high-interest rates and imposing unreasonably high processing fees and penalties.

- Push Effect of Growth Targets: RBI Governor highlighted that aggressive growth targets could lead to retail credit growth that does not align with actual demand.

- It could potentially lead to high indebtedness posing financial stability risks.

- Investor Pressure: Some NBFCs, including MFIs and HFCs are driven by investor pressure to achieve excessive returns on equity (RoE).

- RBI urged NBFCs to adopt sustainable business goals and asked not to compromise long-term sustainability for short-term gains.

What are Non-Banking Financial Companies (NBFCs)?

- About NBFCs: A Non-Banking Financial Company (NBFC) is defined as a company that operates under the Companies Act, 1956 and is primarily involved in providing loans and advances, acquiring financial securities such as shares, bonds, and debentures, as well as engaging in leasing and hire-purchase transactions.

- However, NBFCs do not encompass institutions whose principal business involves agriculture, industrial activities, the purchase or sale of goods (except securities), providing services, or dealing with immovable property.

- Criteria for Classification: NBFC must conduct financial activities as its principal business. This means that more than 50% of its total assets should be in financial assets, and similarly, income from financial assets must exceed 50% of its gross income.

- This classification criteria is often referred to as the 50-50 test.

- Differences Between Banks and NBFCs: Although NBFCs perform functions similar to banks, several key differences exist.

- NBFC cannot accept demand deposits.

- NBFCs do not form part of the payment and settlement system and cannot issue cheques drawn on itself.

- Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of banks.

- Registration Requirements for NBFCs: Under the RBI Act, 1934, it is mandatory for every NBFC to obtain a certificate of registration from the RBI before commencing its operations.

- Additionally, an NBFC must maintain a minimum Net Owned Funds (NOF) of Rs 25 lakhs (or Rs 2 crore since April 1999) to qualify for registration.

- Exemptions from Registration: Certain categories of NBFCs are exempt from registration with the RBI because they are regulated by other authorities. E.g.,

- Venture Capital Funds: Regulated by the Securities and Exchange Board of India (SEBI).

- Insurance Companies: Regulated by the Insurance Regulatory and Development Authority (IRDA).

- Housing Finance Companies: Regulated by the National Housing Bank (NHB).

- Recent Trends in NBFCs: In FY24, NBFCs' assets under management (AUM) grew 18% to Rs 47 trillion while NPA ratio stood at 2.6% as of June 2024.

- It is growing at a healthy rate of 18% annually.

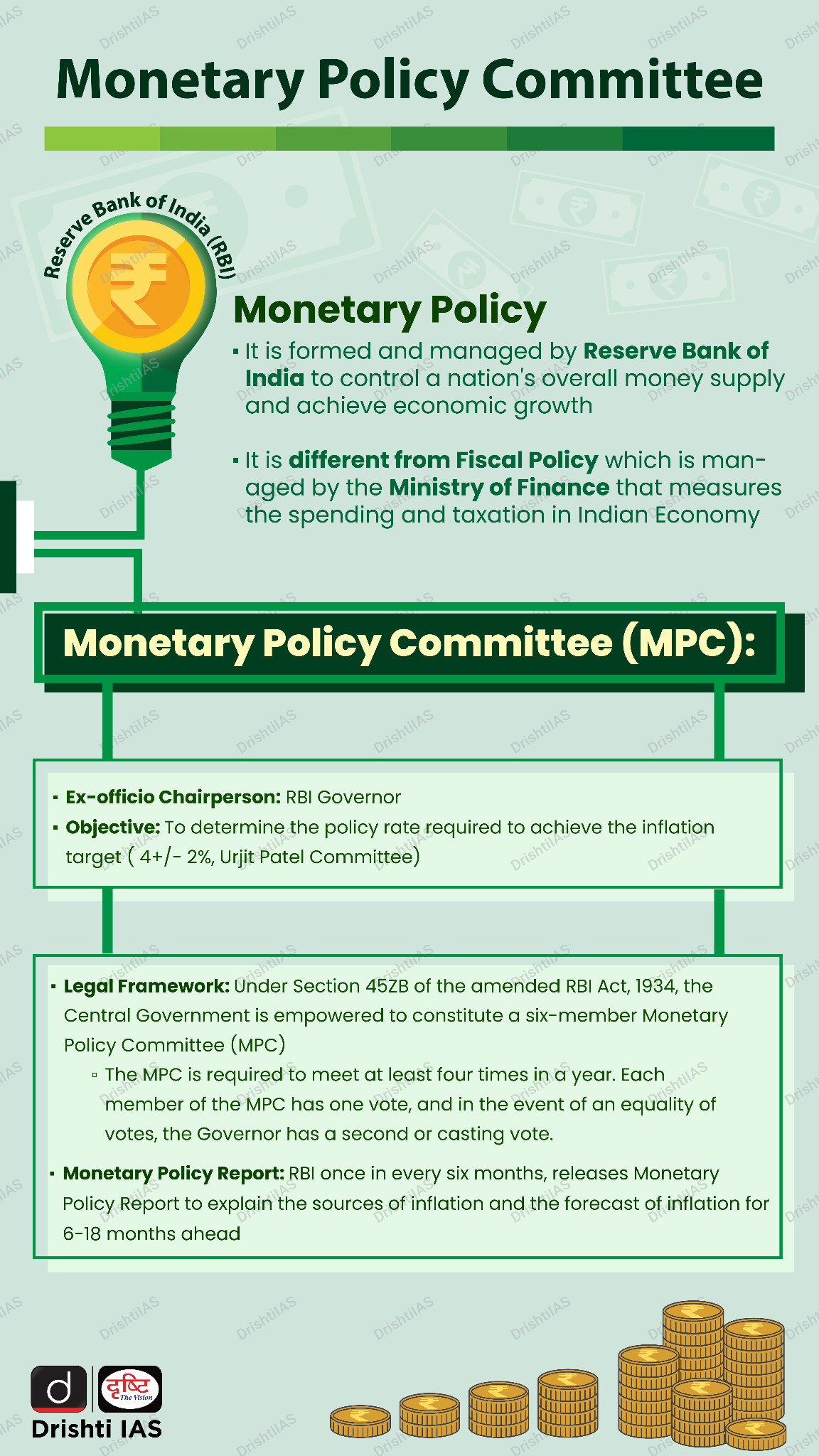

What is the Monetary Policy Committee?

Conclusion

The 51st MPC meeting of the RBI emphasised a neutral monetary policy stance while maintaining the repo rate. It highlighted the need for NBFCs to adopt sustainable practices over aggressive growth strategies, underscoring the importance of compliance, responsible lending, and risk management to ensure long-term financial stability. Additionally, it announced increased transaction limits for UPI and stressed compliance among NBFCs to ensure sustainable growth.

|

Drishti Mains Question: What are Non-Banking Financial Companies (NBFCs)? Explain the role of the RBI in regulating NBFCs. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Which of the following statements is/are correct regarding the Monetary Policy Committee (MPC)? (2017)

- It decides the RBI’s benchmark interest rates.

- It is a 12-member body including the Governor of RBI and is reconstituted every year.

- It functions under the chairmanship of the Union Finance Minister.

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 2 and 3 only

Ans: (a)

Q.Which one of the following is not the most likely measure the Government/RBI takes to stop the slide of Indian rupee? (2019)

(a) Curbing imports of non-essential goods and promoting exports

(b) Encouraging Indian borrowers to issue rupee denominated Masala Bonds

(c) Easing conditions relating to external commercial borrowing

(d) Following an expansionary monetary policy

Ans: (d)

Mains

Q. Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. (2019)