Governance

Rationalizing Subsidies in India

- 15 Jan 2025

- 26 min read

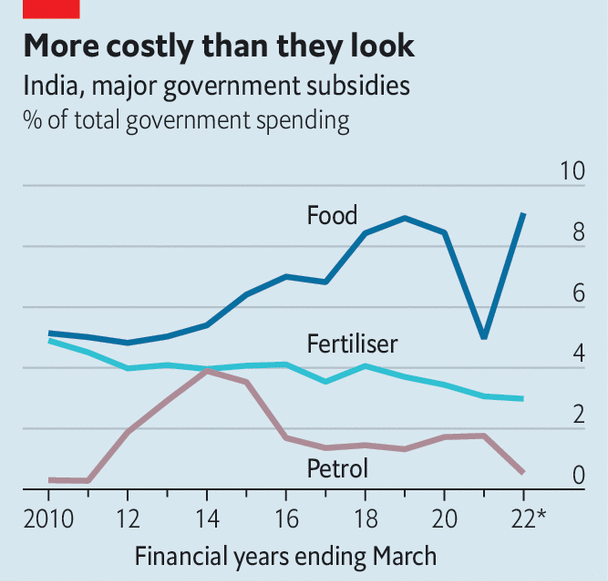

This editorial is based on “Subsidy reforms need a fresh push, open-ended sops are irrational” which was published in The Financial Express on 14/01/2025. The article brings into picture the evolving subsidy landscape in India, highlighting reforms like fuel price deregulation and targeted LPG subsidies, while addressing persistent inefficiencies in food and fertilizer subsidies. Explicit subsidies have fallen to 9.3% of the budget in FY24, with further rationalization needed to reduce them below 1% of GDP.

For Prelims: India's subsidy landscape,Pradhan Mantri Garib Kalyan Anna Yojana, PM-KISAN Samman Nidhi, Nutrient Based Subsidy, Production Linked Incentive (PLI) Scheme, PM-KUSUM, FAME-II Scheme, Vanbandhu Kalyan Yojana, Public Distribution System, Pradhan Mantri Krishi Sinchayee Yojana - Per Drop More Crop (PDMC) scheme, Ayushman Bharat - Pradhan Mantri Jan Arogya Yojana , Faster Adoption and Manufacturing of Hybrid and Electric Vehicles, Janani Suraksha Yojana , PM-WANI scheme.

For Mains: Key Benefits of Government Subsidies in Fostering Development and Equity, Major Challenges Associated with Government Subsidies.

India's subsidy landscape has undergone significant reforms, including fuel price deregulation, streamlined LPG subsidies, and technology-driven delivery systems. However, challenges persist, such as targeting inefficiencies in food subsidies under Pradhan Mantri Garib Kalyan Anna Yojana and static fertilizer MRPs despite rising costs. Explicit subsidies have decreased from 12.7% of the budget in FY23 to 9.3% in FY24. Achieving further rationalization below 1% of GDP requires targeted measures without undermining genuine beneficiaries' support.

What are Subsidies?

- About: Subsidies are financial assistance or benefits provided by the government to individuals, businesses, or sectors to promote public welfare, economic development, and social equity.

- Subsidies are aimed at reducing the cost of goods and services, supporting vulnerable populations, and incentivizing activities that align with national priorities, such as agricultural production, renewable energy adoption, and industrial development.

- These can be direct (cash payments) or indirect (tax breaks or price support).

- Types:

|

Key Types of Subsidy |

Description |

Examples |

|

Direct Subsidies |

Financial assistance directly transferred to beneficiaries. |

|

|

Indirect Subsidies |

Support provided indirectly via tax exemptions, reduced duties, etc. |

Section 80C tax exemptions for investments like housing and insurance. |

|

Input-Based Subsidies |

Reduce costs of inputs like fertilizers, seeds, electricity, and irrigation. |

|

|

Consumption-Based Subsidies |

Make essential goods and services affordable to the public. |

Subsidized grains under NFSA (₹2-3/kg), Subsidized rail tickets for senior citizens by Indian Railways. |

|

Production-Linked Subsidies |

Promote production in specific sectors to boost economic activity. |

|

|

Export Subsidies |

Encourage exports by making them competitive in global markets. |

Remission of Duties and Taxes on Exported Products (RoDTEP) scheme |

|

Cross-Subsidies |

Higher prices for one group subsidize lower prices for another. |

Railways cross subsidises passenger fare making freight expensive |

|

Climate and Environmental Subsidies |

Support for eco-friendly practices and renewable energy adoption. |

Subsidies for solar pumps under PM-KUSUM, FAME-II Scheme for electric vehicles. |

|

Food and Nutritional Subsidies |

Ensure food security and better nutrition for vulnerable populations. |

Midday Meal Scheme (PM Poshan), Anganwadi Nutrition Programs under ICDS. |

|

Regional Subsidies |

Incentives for backward regions to promote equitable growth. |

North East Industrial and Investment Promotion Policy), Tribal subsidies under Vanbandhu Kalyan Yojana |

What Are the Major Advantages of Government Subsidies in Promoting Development and Ensuring Equity?

- Ensuring Food Security and Alleviating Hunger: Government subsidies, particularly on food, play a critical role in ensuring that the most vulnerable sections of society have access to affordable nutrition.

- Subsidized grains distributed through the Public Distribution System (PDS) and schemes like Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) have significantly reduced hunger during crises like Covid-19.

- For example, 810 million beneficiaries receive free grains under PMGKAY. In FY25, food subsidy expenditure is projected at ₹2.25 lakh crore, highlighting the government’s focus on food security amidst global inflation and supply chain disruptions.

- Supporting Farmers and Enhancing Agricultural Productivity: Agricultural subsidies on fertilizers, irrigation, and power ensure affordable input costs for farmers, enabling them to maintain profitability and increase yields.

- In 2022, the Centre increased the fertilizer subsidy by more than double due to a surge in prices, ensuring farmers were shielded from inflationary pressures.

- Recently, Centre has extended the special subsidy of Rs 3,500 per tonne on di-ammonium phosphate (DAP) for an additional year, starting from 1st January, 2025

- Similarly, the Pradhan Mantri Krishi Sinchayee Yojana - Per Drop More Crop (PDMC) scheme government offers financial assistance of 55% for small and marginal farmers, and 45% for others, to install these systems.

- In 2022, the Centre increased the fertilizer subsidy by more than double due to a surge in prices, ensuring farmers were shielded from inflationary pressures.

- Promoting Clean Energy and Sustainability: Subsidies in renewable energy sectors, such as solar and wind, accelerate the transition to green energy and reduce dependence on fossil fuels.

- For instance, The Pradhan Mantri Kisan Urja Suraksha evam Utthan Mahabhiyan (PM-KUSUM) subsidizes solar pumps for farmers, reducing diesel consumption and groundwater depletion.

- This reduces carbon emissions while ensuring energy equity.

- For instance, The Pradhan Mantri Kisan Urja Suraksha evam Utthan Mahabhiyan (PM-KUSUM) subsidizes solar pumps for farmers, reducing diesel consumption and groundwater depletion.

- Enabling Affordable Healthcare and Social Security: Subsidies in healthcare ensure access to quality medical services for economically weaker sections, reducing the burden of out-of-pocket expenditure.

- For instance, Ayushman Bharat - Pradhan Mantri Jan Arogya Yojana is the world's largest health assurance scheme, providing ₹5,00,000 per family annually for secondary and tertiary care hospitalization, covering more than 50 crore beneficiaries in India's bottom 40%.

- Reducing Inequality through Targeted Welfare: Subsidies reduce disparities by ensuring basic services and goods for marginalized groups, thus fostering social equity.

- LPG subsidies under the Pradhan Mantri Ujjwala Yojana (PMUY) provided clean cooking fuel access to over 9.6 crore households, significantly reducing health risks from indoor pollution.

- Recent stabilizations in LPG prices since March 2024 have improved refill rates for Ujjwala beneficiaries to 4 refills per year, ensuring long-term adoption.

- This empowers women and promotes gender equity in rural India.

- Spurring Industrial Growth and Employment: Subsidies in industrial sectors like manufacturing and MSMEs stimulate production, create jobs, and enhance India’s global competitiveness.

- For example, the Production-Linked Incentive (PLI) Scheme allocated ₹1.97 lakh crore across 14 key sectors (e.g., electronics, automobiles, pharma) and is expected to generate over 60 lakh jobs and contribute significantly to GDP growth.

- India's smartphone exports have set a new benchmark, surging past the $2 billion mark in October 2024, which can be credited to the PLI Scheme.

- Mitigating Climate Change and Environmental Degradation: Environmental subsidies reduce reliance on harmful practices and encourage sustainable alternatives.

- Subsidies for electric vehicles (EVs) under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME-II) scheme have led to the sale of 1.67 million units of EVs in FY24, reducing CO₂ emissions.

- Similarly, subsidies for afforestation and clean water initiatives under Namami Gange have improved river health and groundwater recharge, fostering long-term environmental equity.

- Strengthening Human Capital through Education and Skill Development: Education subsidies reduce barriers for underprivileged students, enhancing access to quality learning and boosting long-term economic prospects.

- For example, scholarships for SC/ST students and subsidies under schemes like PM Poshan (Midday Meal) have increased enrollment and retention rates, especially among girls.

- Recent data shows that the gross enrollment ratio in higher education reached 28.3%.

- Empowering Women and Marginalized Communities: Subsidy schemes targeted at women and marginalized groups promote inclusivity and empowerment.

- For instance, stand-up India subsidies have supported over 1.8 lakh women entrepreneurs, enabling access to affordable credit and capacity building.

- Similarly, maternal healthcare under schemes like Janani Suraksha Yojana have led to a reduction in maternal mortality rates from 130 per lakh live births in 2014 to 97 in 2018-20, fostering gender equality.

- Facilitating Inclusive Digital Transformation: Subsidies in the digital sector ensure access to technology and connectivity for underserved areas, bridging the digital divide.

- For example, the PM-WANI scheme subsidizes Wi-Fi hotspots, ensuring internet access in rural and semi-urban regions.

- India’s digital payments ecosystem, with UPI transactions reaching Rs 23.25 lakh crore in December 2024, has been bolstered by subsidies and incentives for small merchants, fostering financial inclusion and digital empowerment.

What Are the Key Challenges Linked to Government Subsidies?

- Fiscal Strain and Resource Misallocation: Government subsidies place a heavy burden on public finances, often diverting resources from critical sectors like health, education, and infrastructure.

- The government will spend around Rs 4.1-4.2 lakh crore on major subsidies in FY25, with food subsidies taking the lead.

- While public health spending remains stagnant at just 1.84%% of GDP, far below the global average of 6%.

- Poor Targeting and Ghost Beneficiaries: Subsidies often fail to reach intended beneficiaries due to inefficiencies, resulting in inclusion errors and leakages.

- The National Food Security Act, 2013 (NFSA) targets coverage for up to 75% of the rural and 50% of the urban population; however, concerns persist regarding the inclusion of undeserving beneficiaries.

- More than 40% of the total subsidized rice and wheat meant for distribution to households through fair-price shops (FPS) gets diverted to open markets and similar challenges exist in LPG subsidies under Ujjwala Yojana due to poor last-mile delivery.

- Former PM Rajiv Gandhi once remarked that out of every rupee spent by the government on welfare and poverty alleviation, only 15 paise effectively reaches the intended beneficiaries.

- Encouraging Overuse and Resource Depletion: Subsidized electricity and fertilizers promote overuse, depleting natural resources and causing environmental harm.

- The provision of free electricity for irrigation has contributed to the over-extraction of groundwater.

- According to the Central Ground Water Board (CGWB), approximately 230 billion cubic meters of groundwater are drawn annually for agricultural irrigation, leading to rapid depletion in many regions of India.

- Similarly, excessive fertilizer use, supported by subsidies, has led to imbalanced soil nutrients and environmental damage, with India’s agricultural sector contributing 18% of greenhouse gas emissions.

- The provision of free electricity for irrigation has contributed to the over-extraction of groundwater.

- Market Distortions and Private Sector Disincentives: Subsidies distort markets by artificially lowering costs, discouraging competition, innovation, and private investment.

- For instance, the fertilizer subsidy of ₹1.75 lakh crore(Budget 2024-25) has disincentivized the usage of organic and biofertilizers.

- Similarly, heavy subsidization of LPG under Ujjwala reduces the economic viability of alternatives like biogas, hindering market diversification.

- Lack of Transparency and Delayed Payments: Subsidies often lack transparency and proper accounting, leading to delays in fund transfers and accumulation of fiscal liabilities.

- For instance, the Food Corporation of India (FCI) accrued ₹1.18 lakh crore in debt with the National Small Savings Fund (NSSF) for food subsidy payments (though cleared in 2021).

- Such practices undermine fiscal discipline and increase the government’s interest burden.

- Global Trade Challenges and WTO Criticism: Subsidies attract criticism in global trade forums, leading to disputes and reputational risks.

- India’s $48 billion farm input subsidies in 2022-23 drew criticism from WTO members like the US, EU, and Canada for allegedly distorting trade.

- These countries argue that India’s subsidies breach WTO’s Aggregate Measurement of Support (AMS) norms, giving Indian farmers an unfair competitive advantage in global markets.

- Populism and Electoral Motivations: Subsidies are frequently used as populist tools for electoral gains, leading to unsustainable policies and delays in necessary reforms.

- The rising trend of freebie culture, such as promises of free electricity and other resources, undermines long-term fiscal sustainability and governance credibility.

- For instance, the annual electricity bill for providing free power to the agricultural sector has surpassed ₹6,500 crore, yet persists due to political compulsions.

- Also, Subsidies often foster dependence rather than enabling beneficiaries to achieve self-sufficiency or productivity improvements.

- Weak Incentive for Innovation: Subsidies often fail to incentivize innovation and the adoption of modern technologies, entrenching inefficiencies.

- While nano urea has been introduced as a sustainable alternative, traditional urea remains heavily subsidized, reducing farmers' incentive to adopt newer options.

- Similarly, delays in fertilizer DBT rollout and lack of awareness about advanced irrigation techniques hinder technology-led improvements in agriculture.

How Can India Rationalize its Subsidy System for Greater Efficiency?

- Comprehensive Implementation of DBT for Enhanced Targeting: Complete transitioning to DBT ensures subsidies are directed to the intended beneficiaries, reducing leakages and inefficiencies.

- The successful DBT implementation in LPG under PAHAL demonstrates the potential.

- Extending DBT to fertilizer subsidies can curtail misuse and ensure that subsidies reach genuine farmers.

- To enhance transparency, linking DBT with Aadhaar and real-time digital monitoring is essential.

- The Shanta Kumar Committee also emphasized the importance of shifting towards cash transfers rather than grain-based distribution, improving efficiency and reducing leakages.

- Dynamic Targeting Based on Poverty and Consumption Data: Periodic revision of beneficiary lists using dynamic poverty data, such as the Socio-Economic and Caste Census (SECC) and household consumption surveys, ensures more accurate targeting.

- The integration of advanced analytics and AI-based data verification can refine the subsidy pool, ensuring that only the most deserving populations benefit from support.

- These refinements align with the Expenditure Management Commission (2014)'s call for rationalizing subsidies based on targeted needs.

- Promote Sustainable Alternatives to Reduce Overdependence: Encouraging the adoption of technologies like nano urea and organic fertilizers can significantly reduce the demand for traditional subsidies.

- Nano urea can save the government ₹10,000–₹15,000 crore annually while mitigating environmental harm.

- Additionally, the NITI Aayog recommends targeted subsidies for liquid fertilizers to promote fertigation in micro-irrigation systems, ensuring more efficient resource use.

- Linking solar-powered irrigation systems under PM-KUSUM with fertilizer DBT schemes can also help reduce electricity subsidies and promote cleaner, more efficient energy use in agriculture.

- The Kelkar Committee (2012) suggested reducing subsidies on fuel, food, and fertilizers to curb unnecessary public expenditure.

- Integrate Technology for Better Monitoring and Accountability: Technologies such as GIS and blockchain can be deployed to improve the efficiency and transparency of subsidy distribution.

- GIS mapping ensures that subsidies like fertilizers are granted only to actual cultivators, avoiding diversion.

- Blockchain can enhance transparency in the Public Distribution System (PDS), ensuring that subsidies reach the correct beneficiaries.

- Align Subsidies with Environmental Sustainability: Subsidies should be aligned with sustainable agricultural practices and environmental goals.

- Replacing free electricity for irrigation with time-bound, metered electricity can help reduce groundwater depletion, which is exacerbated by unsustainable irrigation practices.

- Additionally, redirecting fossil fuel subsidies to renewable energy initiatives, can contribute to India’s transition to a cleaner energy future.

- Link Subsidies with Behavioral Change Campaigns: Combine subsidies with behavioral change programs to ensure long-term adoption of sustainable practices.

- Linking Ujjwala with programs like PM Poshan (Midday Meal Scheme) can encourage households to prioritize clean cooking for better health outcomes.

- Similarly, integrating subsidies for fertilizers with Soil Health Card Scheme can promote scientific nutrient usage and reduce environmental degradation.

- Foster Public-Private Partnerships (PPP) for Efficiency: Encourage Public-Private Partnerships (PPP) to leverage private sector expertise and funding in delivering subsidies.

- For example, fertilizer companies can collaborate with the government to promote nano fertilizers and improve distribution networks.

- PPPs can also enhance infrastructure for e-PoS systems in rural areas, ensuring better delivery of food and LPG subsidies.

- Reform Agricultural Subsidies with Crop Diversification: Encourage crop diversification by linking agricultural subsidies to sustainable farming practices.

- For example, incentivizing farmers to grow pulses and oilseeds through MSP subsidies rather than water-intensive rice and wheat can conserve resources and reduce buffer stock surpluses.

- Recent procurement data shows that rice stocks are 4 times above required buffer norms, leading to wastage and fiscal strain.

- Integrating diversification incentives with subsidies under Mission for Integrated Development of Horticulture (MIDH) can promote horticulture, improve farmer incomes, and reduce environmental stress.

- Subsidy "Credit Points" Linked to Beneficiary Performance: Introduce a subsidy credit system where beneficiaries earn subsidies based on responsible usage and performance in sustainable practices.

- For example, farmers who adopt micro-irrigation or reduce fertilizer overuse (verified by soil health data) earn additional fertilizer subsidies.

- LPG subsidy eligibility can depend on consistent Ujjwala refill usage. This would create incentives for sustainable behavior while reducing waste.

- Linking these points to a Unified Subsidy Wallet (Aadhaar-linked) would make the process seamless.

- Introduce "Graduated Exit Plans" for Beneficiaries: Create a graduated exit strategy where subsidies are phased out as beneficiaries achieve self-sufficiency.

- For example, farmers receiving free electricity for irrigation could gradually shift to metered power tariffs as their incomes increase.

- Ujjwala LPG beneficiaries could transition from full to partial subsidy over 3-5 years based on household income growth, verified by Aadhaar-linked income data.

- This ensures subsidies are temporary support rather than long-term dependence.

- Encourage Agri-Startups to Replace Subsidies with Innovation: Shift from direct subsidies to funding agri-startups that provide sustainable farming solutions at affordable costs.

- Subsidies for fertilizers and pesticides could be reduced by promoting startups offering drone-based precision agriculture or biological pest control.

- Under the Agriculture Infrastructure Fund (AIF), startups providing AI-based soil testing or irrigation solutions can receive financial incentives instead of blanket subsidies.

- This fosters entrepreneurship while reducing dependence on direct subsidies.

Conclusion

India's subsidy system plays a crucial role in providing social security, but inefficiencies and fiscal burdens pose significant challenges. To improve its effectiveness, a more targeted approach, integrating Direct Benefit Transfers (DBT), can ensure that benefits reach the right beneficiaries. Additionally, promoting sustainable alternatives to subsidies, such as renewable energy and agricultural reforms, is necessary to reduce long-term dependency. Leveraging technology can further streamline the delivery of benefits.

|

Drishti Mains Question: The rationalization of subsidies is essential to balance fiscal discipline with social welfare. Analyze the effectiveness of recent subsidy reforms in India and suggest measures to ensure equitable and efficient subsidy delivery. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. With reference to chemical fertilizers in India, consider the following statements: (2020)

- At present, the retail price of chemical fertilizers is market-driven and not administered by the Government.

- Ammonia, which is an input of urea, is produced from natural gas.

- Sulphur, which is a raw material for phosphoric acid fertilizer, is a by-product of oil refineries.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3

Ans: (b)

Mains

Q1. How do subsidies affect the cropping pattern, crop diversity and the economy of farmers? What is the significance of crop insurance, minimum support price and food processing for small and marginal farmers? (2017)

Q2. In what way could replacement of price subsidy with direct benefit Transfer (DBT) change the scenario of subsidies in India? Discuss. (2015)

Q3. What are the different types of agriculture subsidies given to farmers at the national and at state levels? Critically, analyse the agricultural subsidy regime with reference to the distortions created by it. (2013)