Indian Economy

Container Port Performance Index (CPPI) 2023

- 21 Jun 2024

- 11 min read

For Prelims: Sagarmala Programme, Major & Minor Ports, Shipbuilding Financial Assistance Policy (SBFAP), Foreign Direct Investment (FDI), Container Port Performance Index (CPPI)

For Mains: Scenario of India’s Port Ecosystem, Challenges Faced by Port Sector in India, Way Forward

Why in News?

India's port development program received a major boost as 9 ports from India were included in the Global Top 100 for the first time in the Container Port Performance Index (CPPI), 2023.

- The credit for this achievement has been given to the Sagarmala programme which has focused on the modernisation of the ports and improving their efficiency.

What are the Key Highlights of the CPPI 2023?

- About the Index:

- It is a global index developed by the World Bank and S&P Global Market Intelligence. It measures and compares the performance of container ports around the world.

- The index ranks 405 global container ports by efficiency, focusing on the duration of port stay for container vessels.

- Its primary aim is to identify areas for enhancement for the benefit of multiple stakeholders in the global trading system and supply chains, from ports to shipping lines, national governments, and consumers.

- It is a global index developed by the World Bank and S&P Global Market Intelligence. It measures and compares the performance of container ports around the world.

- Global Ranking:

- In the CPPI 2023 rankings, Yangshan Port in China is first, followed by the Port of Salalah in Oman. The Port of Cartagena is third, and Tangier-Mediterranean is fourth.

- India’s Position:

- Visakhapatnam Port jumped from 115 in 2022 to 19 in the 2023 rankings, becoming the first Indian port to reach the Global Top 20.

- Mundra Port also improved its position, rising from 48 last year to 27 in the current ranking.

- Seven other Indian ports, which secured ranks in the top 100, are Pipavav (41), Kamarajar (47), Cochin (63), Hazira (68), Krishnapatnam (71), Chennai (80) and Jawaharlal Nehru (96).

Sagarmala Programme

- The Sagarmala programme launched in 2015, a flagship initiative of the Ministry of Ports, Shipping and Waterways, represents a visionary approach by the Government to transform the country's maritime sector.

- With India's extensive coastline, navigable waterways, and strategic maritime trade routes, Sagarmala aims to unlock the untapped potential of these resources for port-led development and coastal community upliftment.

- It seeks to enhance the performance of the logistics sector by reducing logistics costs for both domestic and international trade.

- By leveraging coastal and waterway transportation, the program aims to minimise the need for extensive infrastructure investments, thus making logistics more efficient and improving the competitiveness of Indian exports.

What is the Scenario of India’s Port Ecosystem?

- About:

- According to the Ministry of Shipping, around 95% of India's trading by volume and 70% by value is done through maritime transport.

- In November 2020, the Prime Minister renamed the Ministry of Shipping as the Ministry of Ports, Shipping and Waterways.

- According to the Ministry of Shipping, around 95% of India's trading by volume and 70% by value is done through maritime transport.

- The Indian Government plays an important role in supporting the ports sector. It has allowed Foreign Direct Investment (FDI) of up to 100% under the automatic route for port and harbour construction and maintenance projects.

- Major Ports vs Minor Ports:

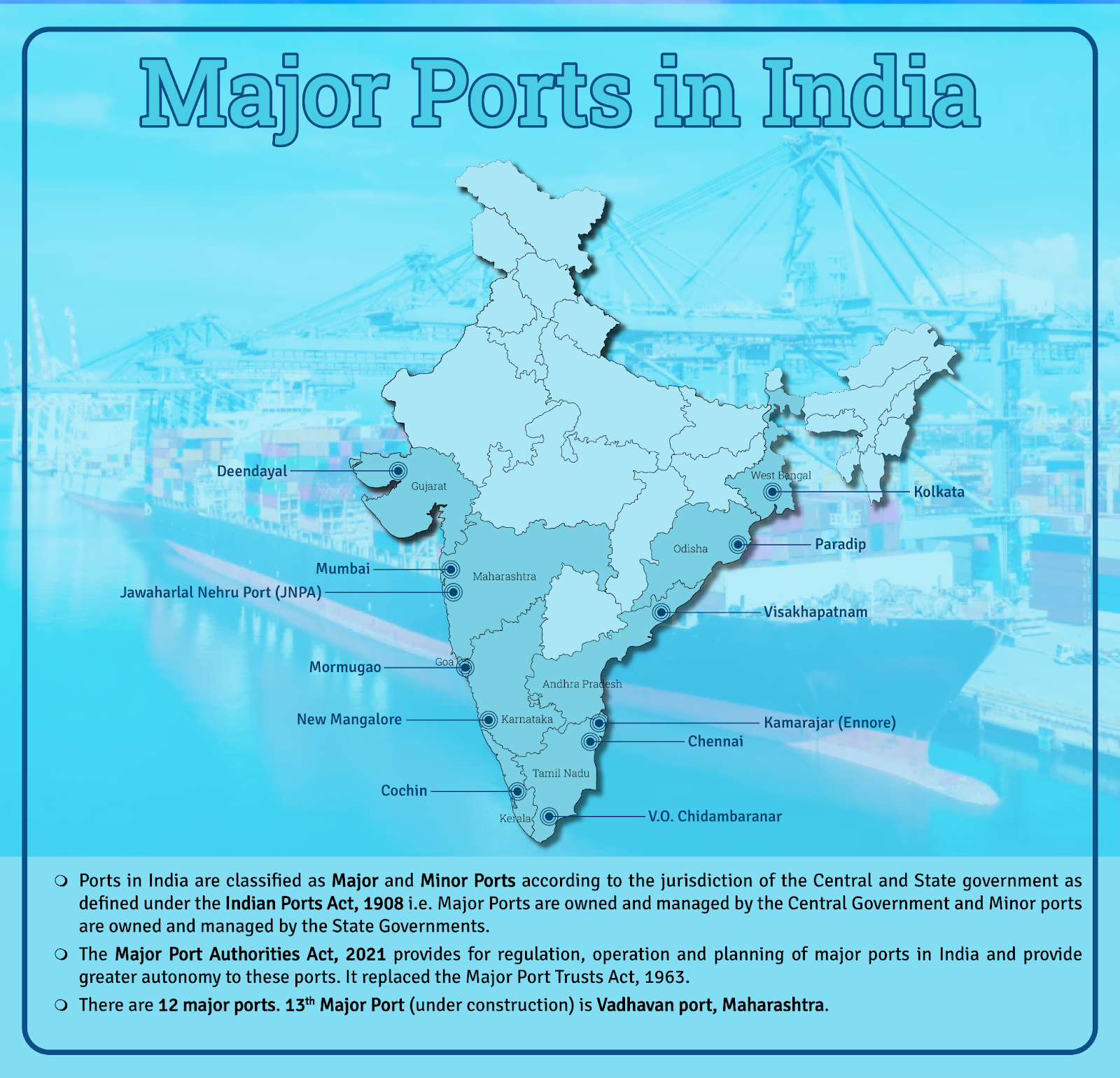

- Ports in India are classified as Major and Minor Ports according to the jurisdiction of the Central and State government as defined under the Indian Ports Act, 1908.

- All the 13 Major Ports are governed under the Major Port Trusts Act, 1963 and are owned and managed by the Central Government.

- All the Minor Ports are governed under the Indian Port Act, 1908 and are owned and managed by the State Governments.

- Ports in India are classified as Major and Minor Ports according to the jurisdiction of the Central and State government as defined under the Indian Ports Act, 1908.

- Under the National Perspective Plan for Sagarmala, six new mega ports will be developed in the country.

- Related Statistics:

- India is the sixteenth-largest maritime country in the world with a coastline of 7,516.6 kms. The Indian ports and shipping industry play a vital role in sustaining growth in the country’s trade and commerce.

- The Ports sector in India is being driven by high growth in external trade.

- In FY23, major ports in India handled 783.50 million tonnes of cargo traffic, implying a Compound Annual Growth Rate (CAGR) of 3.26% in FY16-23.

- In FY24 (April-January) cargo traffic handled by major ports stood at 677.22 million tonnes.

- Domestic waterways have found to be a cost-effective and environmentally sustainable mode of freight transportation.

- The government aims to operationalise 23 inland waterways by 2030.

- India is the sixteenth-largest maritime country in the world with a coastline of 7,516.6 kms. The Indian ports and shipping industry play a vital role in sustaining growth in the country’s trade and commerce.

- Major Initiatives:

- In 2023, the Ministry of Ports, Shipping, and Waterways proposed the Indian Ports Bill with the aim of enhancing transparency in port tariffs and updating penalties.

- The bill empowers the Maritime States Development Council (MSDC) for integrated planning and introduces a three-tier dispute resolution mechanism for conflicts between state maritime boards.

- To bolster the shipbuilding industry under the Make in India initiative, the Ministry introduced the Shipbuilding Financial Assistance Policy (SBFAP).

- This scheme, operational until March 2026, offers financial aid to Indian shipyards, encouraging competitiveness and securing global orders.

- In 2023, the Ministry of Ports, Shipping, and Waterways proposed the Indian Ports Bill with the aim of enhancing transparency in port tariffs and updating penalties.

Note

- India is home to the largest ship breaking facilities in the world with over 150 yards along its coast. On an average, close to 6.2 Million GT (Gross Tonnage) is scrapped in India every year, which accounts for 33% of the total scrapped tonnage in the world.

- India is recycling around 70 lakh GT every year, followed closely by Bangladesh, Pakistan and China.

- Alang Ship Breaking Yard in Gujarat being the world's largest ship recycling facility.

What are the Challenges Faced by Port Sector in India?

- Low Share of Indian Fleet in Global Shipping: Despite India's vast coastline and strategic location, the Indian fleet's share in global shipping remains minimal. As of recent statistics ,Indian ships constitute less than 1% of the world's shipping fleet, far behind countries like China. This is far behind countries like China (around 19%).

- However, India ranks third among nations supplying sailors, providing almost 10% of global seafarers, only behind China and Philippines.

- High Turnaround Times at Indian Ports: Indian ports are plagued with high turnaround times, affecting efficiency and increasing costs for shipping companies.

- For instance, the average turnaround time at major Indian ports was around 2.48 days in 2022, compared to the global average of 0.97 days.

- Poor performance at one port can disrupt schedules, increase import/export costs, reduce competitiveness, and hinder economic growth, especially affecting Landlocked Developing Countries (LLDCs) and Small Island Developing States (SIDS).

- Infrastructure and Operational Inefficiencies: Existing ports suffer from inadequate road and rail connectivity within the port area, lack of cargo handling equipment and machinery, poor hinterland connectivity, insufficient dredging capacity, and a shortage of technical expertise.

- Limited Supporting Infrastructure such as insurance and financing companies, are predominantly based outside India. For instance, many marine insurance companies are headquartered in London, making it challenging for Indian shipping firms to access cost-effective and reliable services domestically.

Way Forward

- Digitalisation: Digital and physical connectivity go hand in hand. Just as trade benefits from the latest technologies such as Artificial Intelligence (AI), the Internet of Things (IoT) and blockchain, port and shipping operations would also benefit from tapping the opportunities arising from digitalization.

- Port Modernisation: Port clients, i.e. the shipping lines and the traders, require fast, reliable and cost-efficient services to ships and cargo. Ports need to continuously invest in their technological, institutional and human capacities. Public and private cooperation is key in this regard.

- Widen the Hinterland: Ports should aim at attracting cargo from neighbouring countries and domestic production centres.

- There is a common interest between many seaports and traders in neighbouring countries, especially landlocked countries. Investments in corridors, regional trucking markets, and cross-border trade and transit facilitation can help expand ports’ hinterlands.

- Promote Sustainability: Port stakeholders are varied and may include shipping lines and traders, as well as social partners and the port-city community. Stakeholders are increasingly demanding that ports deliver on their social, economic and environmental sustainability obligations.

|

Drishti Mains Question Q. Analyse the current scenario of the Indian port ecosystem. Also, highlight the major challenges faced by the port sector in India. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Q. Consider the following pairs: (2023)

| Port | Well known as |

| 1. Kamarajar Port | First major port in India registered as a company |

| 2. Mundra Port | Largest privately owned port in India |

| 3. Visakhapatnam Port | Largest container port in India |

How many of the above pairs are correctly matched?

(a) Only one pair

(b) Only two pairs

(c) All three pairs

(d) None of the pairs

Ans: (b)

Q. In India, the ports are categorized as major and nonmajor ports. Which one of the following is a nonmajor port? (2009)

(a) Kochi (Cochin)

(b) Dahej

(c) Paradip

(d) New Mangalore

Ans: (b)