Neighbourhood First in MEA’s Aid Allocation

For Prelims: Union Budget, Development Assistance, Neighbourhood First Policy, Chabahar Port, Humanitarian Needs, Migration, Border Security, Line of Credit (LOC), Joint Military Exercises, Maritime, India-Myanmar-Thailand Trilateral Highway, SAARC, BIMSTEC, Trade Barriers, Indus, Teesta.

For Mains: Role of India’s Development Aid in Security and Stability in India’s Neighbourhood.

Why in News?

In the recently announced Union Budget 2024-25, the Ministry of External Affairs (MEA) has outlined its development assistance plans, focusing on strategic partners and neighbouring countries.

- It is geared towards promoting regional connectivity, cooperation and stability in line with India’s Neighbourhood First Policy.

How is the Development Aid Distributed Among Countries?

- A major chunk of the Ministry of External Affairs’ outlay, Rs 4,883 crore, has been earmarked for “aid to countries”. It has been allocated as follows:

- Bhutan: It received the highest aid at Rs 2,068.56 crore, though slightly less than last year’s Rs 2,400 crore.

- Nepal: It was allocated Rs 700 crore, up from Rs 550 crore last year.

- Maldives: It maintained a consistent allocation of Rs 400 crore, despite a higher revised amount of Rs 770.90 crore for the previous year.

- Sri Lanka: It received Rs 245 crore, an increase from Rs 150 crore last year.

- Afghanistan: Afghanistan receives Rs 200 crore, illustrating India's role in aiding the country's stability and development amidst ongoing challenges.

- Maldives: Maldives got Rs 400 crore despite the anti-India protests and remarks from its top leadership.

- Iran: Chabahar Port Project continues to receive Rs 100 crore, unchanged for the past three years.

- Africa: African countries collectively received Rs 200 crore, showcasing India's expanding influence and engagement with the continent.

- Seychelles: It receives Rs 40 crore, up from Rs 10 crore.

What are the Benefits of Development Aid Granted to Neighbouring Countries?

- Strengthening Diplomatic Relations: By providing aid to neighbouring countries, India enhances diplomatic ties, fostering stronger political and economic relationships.

- Promoting Regional Stability: Financial support helps stabilise neighbouring countries, which can lead to a more secure and stable region, benefiting India's strategic interests.

- Supporting Economic Development: Aid contributes to infrastructure projects, development programs, and other initiatives that can boost economic growth in recipient countries, creating a more prosperous region. Eg. Chabahar port in Iran.

- Encouraging Trade and Investment: Improved infrastructure and economic conditions in neighbouring countries can lead to increased trade and investment opportunities for India e.g., Agartala-Akhaura railway project between India and Bangladesh.

- Enhancing Strategic Influence: Providing aid allows India to exert influence and build alliances, ensuring that neighbouring countries have positive engagements with India and align more closely with its interests.

- Eg. Bhutan’’s favour to India on Doklam issue.

- Addressing Humanitarian Needs: Aid often addresses urgent humanitarian needs, such as health care, education, and disaster relief, improving the quality of life in recipient countries.

- Eg. India launched "Operation Karuna" to provide humanitarian assistance to Myanmar during Cyclone Mocha.

- Strengthening Soft Power: By investing in neighbouring countries' development, India bolsters its soft power and reputation as a responsible regional leader.

- Eg. It helps in alleviating the Big Brother syndrome among India's smaller neighbours.

India’s Neighbourhood First Policy

- The concept of the Neighbourhood First Policy came into being in 2008.

- India’s ‘Neighbourhood First Policy’ guides its approach towards the management of relations with countries in its immediate neighbourhood, that is Afghanistan, Bangladesh, Bhutan, Maldives, Myanmar, Nepal, Pakistan and Sri Lanka.

- The Neighbourhood First policy, inter alia, is aimed at enhancing physical, digital and people to people connectivity across the region, as well as augmenting trade and commerce.

- This policy has evolved into an institutional priority for all the relevant arms of the Government managing relations and policies with our neighbourhood.

- India's approach to engaging with its neighbouring countries is characterised by consultation, non-reciprocity and a focus on achieving tangible outcomes. This approach prioritises enhancing connectivity, infrastructure, development cooperation, security, and fostering greater people-to-people contacts.

Why is the Neighbourhood First Policy Important for India?

- Terrorism and Illegal Migration: India faces terrorism and illegal migration threats, including the smuggling of weapons and drugs, from its immediate neighbours.

- Better relations can Improve border security infrastructure and monitor demographic changes due to illegal migration.

- Relations with China and Pakistan: Relations with China and Pakistan are strained, particularly due to terrorism linked to Pakistan.

- Engaging in regional and multilateral organisations can highlight Pakistan’s role in terrorism and create a common platform for counter-terrorism under the Neighbourhood First Policy.

- Investment in Border Infrastructure: There is a deficiency in border infrastructure and the need to stabilise and develop border regions.

- Improved connectivity infrastructure like cross-border roads, railways, and ports, and explore a regional development fund for such infrastructure.

- Monitoring Line of Credit (LOC) Projects: India’s LOC to neighbours increased significantly, with 50% of global soft lending going to them.

- It enhances India’s influence in the region, expands Indian firms' presence and builds economic linkages with recipient countries.

- Defence and Maritime Security: Defense cooperation is crucial, with joint military exercises conducted with various neighbours.

- It helps in enhancing maritime domain awareness in the extended neighbourhood.

- Development in the North-Eastern Region: The North-Eastern region’s development is crucial for the Neighbourhood First and Act East Policies.

- Countries like Myanmar and Thailand can help improve connectivity, economic development, and security in the North-Eastern Region e.g., the India-Myanmar-Thailand Trilateral Highway.

- Tourism Promotion: India is a major source of tourists for Maldives and Bangladesh and a destination for Nepali religious tourism.

- Tourism fosters cultural exchange, which can lead to increased interest in Indian culture and businesses, potentially boosting exports of Indian cultural products and services.

- Multilateral Organisations: India’s engagement with neighbours is driven by regional mechanisms like SAARC and BIMSTEC.

- Both help India assert its leadership role in South Asia and counterbalance the influence of other major powers in the region.

What are the Challenges in India's Relationship with its Neighbouring Countries?

- Border Disputes: Disagreements over borders, especially with China and Pakistan, lead to tensions and conflicts.

- China’s growing influence in the South Asian region and its close ties with Pakistan pose strategic challenges.

- Terrorism: Pakistan has continuously provided support, safe havens and funding to various militant groups, such as Lashkar-e-Taiba (LeT) and Jaish-e-Mohammed (JeM), which have carried out attacks in India.

- Illegal Migration: The influx of illegal migrants from Bangladesh into India causes demographic and security concerns.

- Trade Imbalances: Economic issues and trade barriers with neighbours like Pakistan, Bangladesh, and Nepal affect relations.

- Issues related to trade restrictions and tariffs have often exacerbated diplomatic tensions.

- Water Disputes: Conflicts over sharing river waters, such as the Indus and Teesta rivers, strain ties with Pakistan and Bangladesh respectively.

- Internal Conflicts: Political instability or disputes in neighbouring countries, like Nepal and Bangladesh, impact bilateral relations.

- Diplomatic Relations: Issues such as the treatment of minorities in Sri Lanka and India's stance on Myanmar’s government create friction.

- Eg. Free Movement Regime (FMR) issue with Myanmar.

- Environmental Issues: Natural disasters and environmental problems, like flooding in Bangladesh, require joint efforts and can affect relations.

- E.g. Bhutan’s concerns over the environmental impact of BBIN and tourism on its fragile ecology.

- Regional Cooperation: Disagreements within regional organisations like SAARC and BIMSTEC can hinder effective cooperation.

Initiatives by India to Improve Relationships with Neighbours

Way Forward

- Strengthening Diplomatic Engagement: Establish and maintain regular diplomatic dialogues and high-level meetings to address and resolve issues.

- Develop and institutionalise mechanisms for resolving disputes, such as joint committees and arbitration panels.

- Enhancing Economic Cooperation: Negotiate and implement fair trade agreements that address imbalances and promote mutual benefits.

- Collaborate on roads, railways, and energy corridors, to improve connectivity and economic integration.

- Promoting Security and Stability: Coordinate on regional security initiatives to address common threats like terrorism and illegal migration.

- Establish joint task forces and intelligence-sharing mechanisms.

- Fostering People-to-People Connections: Increase educational and tourism initiatives to build mutual understanding and goodwill among populations.

- Addressing Environmental and Humanitarian Issues: Synergize on natural disasters and environmental problems using joint efforts and regional plans. Provide humanitarian assistance and support in times of crisis, fostering goodwill and cooperation.

- Strengthening Regional Organisations: Actively participate in regional organisations like SAARC and BIMSTEC to address regional issues and improve their mechanisms for decision-making and implementation.

- Addressing Internal and External Factors: Ensure that domestic policies do not adversely impact relations with neighbouring countries.

- Strive for balanced policies that consider both domestic and international implications aligning with the principles of the Gujral Doctrine.

Read more: MEA's Development Aid

|

Drishti Mains Question: Why does stability in India’s neighbourhood hold a significant position for India’s internal security in the changing geopolitical scenario? Discuss. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q.Critically examine the compulsions which prompted India to play a decisive role in the emergence of Bangladesh. (2013)

Q.Project ‘Mausam’ is considered a unique foreign policy initiative of the Indian government to improve relationships with its neighbors. Does the project have a strategic dimension? Discuss. (2015)

Q.What is meant by Gujral doctrine? Does it have any relevance today? Discuss. (2013)

Q.“The diverse nature of India as a multi-religious and multi-ethnic society is not immune to the impact of radicalism which is seen in her neighborhood.” Discuss along with strategies to be adopted to counter this environment. (2014)

UNAIDS Global AIDS Update

For Prelims: Acquired Immunodeficiency Syndrome (AIDS), Human Immunodeficiency Virus (HIV), Antiretroviral Therapy (ART), UNAIDS, Global AIDS Update

For Mains: Challenges Related to AIDS, Steps Needed to Eliminate AIDS

Why in News?

Recently, the 2024 UNAIDS Global AIDS Update, titled "The Urgency of Now: AIDS at a Crossroads", presented a critical overview of the current state of the HIV/AIDS epidemic and the global response to it.

What are the Key Highlights of the Reports?

- About:

- The report underscores the potential to end AIDS as a public health threat by 2030, emphasising the necessity of addressing inequalities, increasing access to prevention and treatment, and ensuring sustainable resources.

- Progress and Challenges:

- Reduction in New HIV Infections and AIDS-Related Deaths:

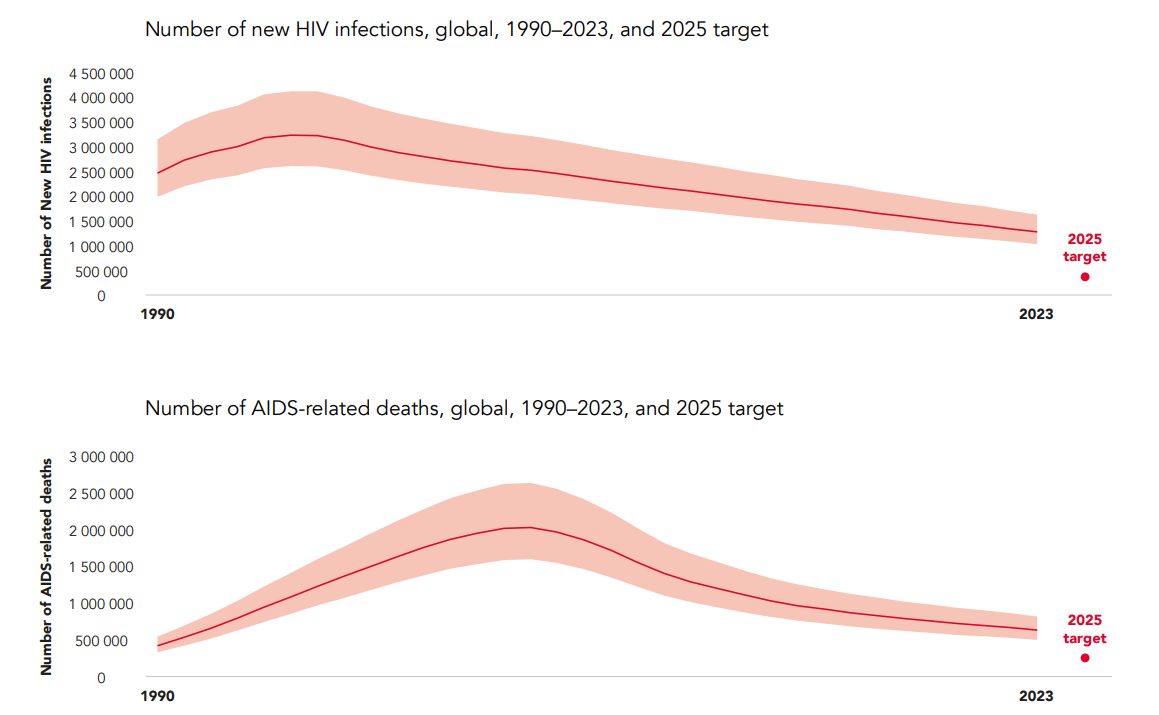

- There has been a 39% reduction in new HIV infections globally since 2010, with sub-Saharan Africa achieving the steepest decline (56%).

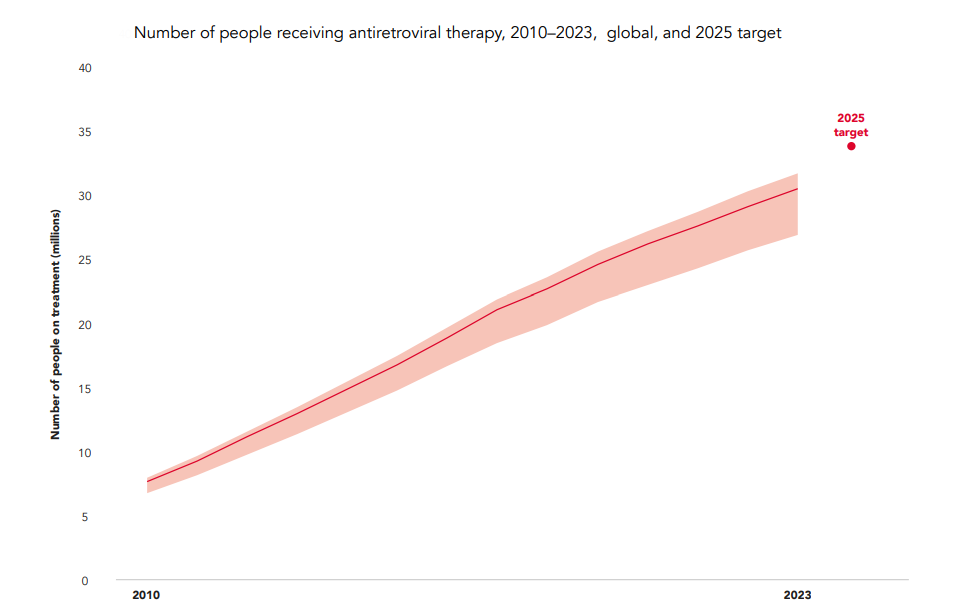

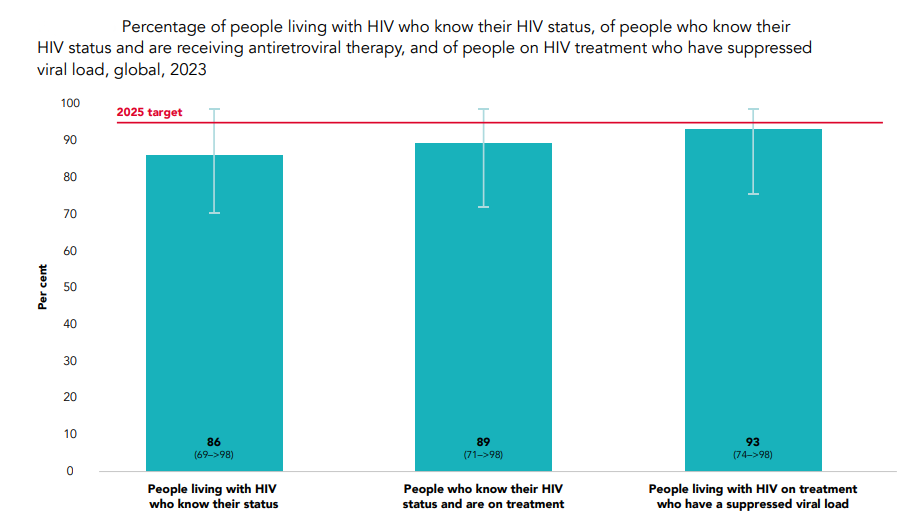

- In 2023, fewer people acquired HIV than at any point since the late 1980s, and almost 31 million people were receiving antiretroviral therapy (ART).

- AIDS-related deaths have decreased to their lowest level since the peak in 2004, largely due to increased access to ART.

- Regional Disparities:

- While sub-Saharan Africa has seen significant progress, regions such as Eastern Europe, Central Asia, Latin America, and the Middle East and North Africa have experienced rising numbers of new HIV infections.

- For the first time, more new HIV infections occurred outside sub-Saharan Africa than within it.

- Key Affected Groups:

- Key populations, including sex workers, men who have sex with men, people who inject drugs, transgender people, and people in prisons, continue to face high risks of HIV infection due to inadequate prevention programs and persistent stigma and discrimination.

- Community-led interventions are critical but often underfunded and unrecognized.

- Prevention and Treatment Gaps:

- HIV prevention efforts are falling short, with notable deficiencies in access to services like pre-exposure prophylaxis (PrEP) and harm reduction for people who inject drugs.

- About 9.3 million people living with HIV are not receiving ART, with children and adolescents particularly affected.

- Reduction in New HIV Infections and AIDS-Related Deaths:

UNAIDS

- UNAIDS is a model for United Nations reform and is the only cosponsored Joint Programme in the United Nations system.

- It draws on the experience and expertise of 11 United Nations system Cosponsors and is the only United Nations entity with civil society represented on its governing body.

- UNAIDS is leading the global effort to end AIDS as a public health threat by 2030 as part of the Sustainable Development Goals.

What is HIV/AIDS?

What is HIV/AIDS?

- About:

- HIV/AIDS is a viral infection that attacks the immune system, specifically the CD4 cells (T cells), which help the immune system fight off infections.

- Left untreated, HIV reduces the number of CD4 cells (T cells) in the body, making the person more likely to get infections or infection-related cancers.

- AIDS is the final stage of HIV infection when the immune system is severely damaged and can no longer fight off infections.

- Causes of HIV/AIDS:

- HIV infection is caused by the human immunodeficiency virus (HIV). The virus is transmitted through contact with infected bodily fluids, such as blood, semen, vaginal fluids, rectal fluids, and breast milk.

- It can be spread through sexual contact, sharing needles or syringes, from mother to child during childbirth or breastfeeding, and rarely, through blood transfusions or organ transplants.

- Symptoms of HIV/AIDS:

- Clinical Latent Infection:

- HIV is still active but reproduces at very low levels. People may not have any symptoms or only mild ones.

- Acute HIV Infection:

- Symptoms can resemble those of the flu, including fever, swollen lymph nodes, sore throat, rash, muscle and joint aches, and headache.

- AIDS:

- The symptoms of AIDS are severe and include rapid weight loss, recurring fever or profuse night sweats, extreme and unexplained tiredness etc.

- Clinical Latent Infection:

- Diagnosis of HIV/AIDS:

- HIV antibody/antigen tests: These tests detect antibodies or antigens produced by the virus and are usually done on blood or oral fluid.

- Nucleic acid tests (NATs): These tests look for the virus itself and can detect HIV infection earlier than antibody tests.

- Treatment and Management:

- Antiretroviral therapy (ART): ART involves taking a combination of HIV medicines every day. ART can't cure HIV, but it can control the virus, allowing people with HIV to live longer, healthier lives and reducing the risk of transmitting the virus to others.

- Pre-exposure prophylaxis (PrEP): PrEP is a daily pill for people who don't have HIV but are at risk of getting it. When taken consistently, PrEP can reduce the risk of HIV infection.

- A revolutionary HIV drug that reduces the need for a daily cocktail of drugs to half a dozen injections a year has recently been approved in the UK.

India's Efforts to Prevent HIV

- HIV and AIDS (Prevention and Control) Act, 2017

- Access to Antiretroviral Therapy (ART)

- Memorandum of Understanding (MoU): The Ministry of Health and Family Welfare signed a MoU with the Ministry of Social Justice and Empowerment in 2019 for enhanced HIV/AIDS outreach and to reduce the incidence of social stigma and discrimination against victims of drug abuse and Children and People Living with HIV/AIDS.

- Project Sunrise:

- Project Sunrise was launched by the Ministry of Health and Family Welfare in 2016, to tackle the rising HIV prevalence in north-eastern states in India, especially among people injecting drugs.

- Targets: India sought to leverage the targeted interventions to achieve UNAIDS's 90-90-90 targets (90% of HIV-infected individuals diagnosed, 90% of those diagnosed to be on anti-retroviral therapy (ART), and 90% of people on ART to achieve sustained virologic suppression), and end AIDS by 2030

International Initiatives

- Joint United Nations Programme on HIV/AIDS:

- It is leading the global effort to end AIDS as a public health threat by 2030 as part of the Sustainable Development Goals. It was started in 1996.

- UNAIDS has a vision of zero new HIV infections, zero discrimination and zero AIDS-related deaths, and a principle of leaving no one behind.

- The UN Political Declaration on Ending AIDS was adopted in 2016 which seeks to end AIDS as a public health threat by 2030.

- The World Health Organization's (WHO) “Treat All” guidance of September 2015, recommended that all individuals be treated as soon as possible after HIV infection and diagnosis.

- In addition, because the reduction in HIV viral load to undetectable levels eliminates the risk of onward transmission, the Treat All approach has the potential to provide the population health benefit of reducing HIV incidence.

- Global AIDS Strategy 2021-2026 - End Inequalities. End AIDS. is a bold new approach to using an inequalities lens to close the gaps that are preventing progress towards ending AIDS.

What are the Key Suggestions From the Report?

- Accelerating HIV Prevention:

- The report emphasises the need to expand access to HIV prevention services, particularly for key populations including sex workers, men who have sex with men, people who inject drugs, transgender people, and people in prisons.

- Reinstate and fund condom programs for safe sex, especially in regions where their use has declined.

- Scale up the availability and use of PrEP, aiming to reach the global target of 21.2 million people using PrEP by 2025.

- Enhancing Treatment and Care:

- Ensure that 95% of people living with HIV are on ART by 2025. Currently, only 77% of people living with HIV are receiving ART.

- Improve the diagnosis and treatment of children with HIV. Only 48% of children living with HIV are receiving ART, compared to 78% of adults.

- Integrate HIV services with broader health services to improve outcomes and address comorbidities such as tuberculosis, hepatitis, and non-communicable diseases.

- Addressing Inequalities and Stigma:

- Remove harmful laws that criminalise HIV transmission, exposure, and non-disclosure, as well as those targeting key populations. Currently, punitive laws are prevalent in most countries.

- Implement programs to reduce stigma and discrimination in health care and community settings. Ensure legal protection and support for people living with HIV and key populations.

- Community-Led Responses:

- Strengthen the role of community-led organisations in delivering HIV services.

- The goal is for these organizations to deliver 30% of testing and treatment services and 80% of HIV prevention services for high-risk populations.

- Strengthen the role of community-led organisations in delivering HIV services.

- Sustainable Financing:

- Address the significant shortfall in funding for HIV programs. An estimated additional USD 9.5 billion is needed by 2025 to meet the targets.

- Explore new funding sources and mechanisms to sustain the HIV response, especially in low- and middle-income countries.

|

Drishti Mains Question: Discuss the major challenges in eliminating AIDS in developing countries like India. Suggest measures to address these challenges. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Consider the following statements: (2021)

- Adenoviruses have single-stranded DNA genomes whereas retroviruses have double-stranded DNA genomes.

- Common cold is sometimes caused by an adenovirus whereas AIDS is caused by a retrovirus.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Q. Which of the following diseases can be transmitted from one person to another through tattooing? (2013)

- Chikungunya

- Hepatitis B

- HIV-AIDS

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Q. With regard to the transmission of the Human Immunodeficiency Virus, which one of the following statements is not correct? (2010)

(a) The chances of transmission from female to male are twice as likely as from male to female

(b) The chances of transmission are more if a person suffers from other sexually transmitted infections

(c) An infected mother can transmit the infection to her baby during pregnancy, at childbirth and by breast feeding

(d) The risk of contracting infection from transfusion of infected blood is much higher than an exposure to contaminated needle

Ans: (a)

Q. Consider the following statements: (2010)

- Hepatitis B is several times more infectious than HIV/AIDS

- Hepatitis B can cause liver cancer

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)

Mains:

Q. In order to enhance the prospects of social development,sound and adequate health care policies are needed particularly in the fields of geriatric and maternal health care. Discuss. (2020)

Key Economic Reforms in the Budget 2024-25

For Prelims: Angel tax, Start-ups, Prevention of Money Laundering Act, Indian Tech Startup Funding Report 2023, Equalisation levy, E-commerce, Non-resident digital companies, OECD/G20 Inclusive Framework, Union Budget 2024-25, Long-term capital gains, MSMEs, Mudra loans

For Mains: Capital Market, Government Budgeting, Effect of Fiscal policy

Why in News?

In the Union Budget 2024-25, there have been several changes related to the angel tax, equalisation levy on e-commerce, application of capital gains and Securities Transaction Tax (STT) and several new initiatives related MSMEs sector.

What are the Key Changes in the Budget Regarding Industry?

- Angel Tax: The government in the Union budget 2024-25 has announced the abolition of the angel tax.

- Angel tax is the tax that must be paid on the funds raised by unlisted companies through the issuance of shares in off-market transactions if they exceed the fair market value of the company.

- The angel tax was introduced in 2012 through the Income Tax Act 1961 with the intent to keep a check on money laundering practices through investments in startups.

- Equalisation Levy: The government has decided to withdraw the 2% equalisation levy on the e-commerce supply of goods and services.

- However, the 6% equalisation levy under the Finance Act 2016 for specified digital services, such as online advertising, will remain in effect.

- In April 2020, India imposed a 2% equalisation levy on the revenue generated by non-resident e-commerce operators from e-commerce supply or services.

- The equalization levy is aimed at taxing foreign companies that have a significant local client base in India but are billing them through their offshore units, effectively escaping the country’s tax system.

- The levy affected major US digital companies, leading Washington to propose retaliatory import tariffs of up to 25% on several Indian products to offset approximately USD 55 million in taxes.

- In November 2021, India and the US agreed under the OECD/G20 Inclusive Framework’s two-pillar solution to address the tax challenges arising from the digitalisation of the economy, leading to the suspension of retaliatory tariffs.

- Increased Taxation on Capital Gains and Securities Transaction Tax (STT):

- The Budget 2024 has revised the rules for determining long-term capital gains, changing the holding periods for various types of capital assets that qualify for short-term or long-term capital gains.

- There will now be only two holding periods: 12 months for the Short-term and 24 months for the long-term to determine whether capital gains from assets are short-term or long-term.

- However, the proposed holding period for all listed assets is 12 months to qualify for long-term capital gains.

- For all other assets, the holding period will be 24 months to qualify the gains as long-term capital gains.

- The exemption limit for capital gains on listed equity and equity-oriented mutual funds has been increased to Rs 1.25 lakh per annum from Rs 1 lakh.

- Short-term capital gains from all assets, except listed equity shares and equity mutual funds, will be taxed according to the investor's tax slab rates.

- The short-term capital gains tax rate for equity shares and equity mutual funds has been increased to 20%, regardless of the tax slab.

- The STT on the Future and Option (F&O) of securities has been doubled. For futures, the STT is increased to 0.02%, and for options, it is increased to 0.1%.

- Options and futures are two types of derivatives contracts that derive their value from market movements for the underlying index, security, or commodity.

- An option gives the buyer the right, but not the obligation, to buy (or sell) an asset at a specific price at any time during the life of the contract.

- A futures contract obligates the buyer to purchase a specific asset, and the seller to sell and deliver that asset, at a specific future date.

- New Assessment Model and Credit Schemes for MSMEs:

- New Credit Assessment Model for MSME:

- Public Sector Banks (PSBs) are required to assess MSME credit eligibility based on digital footprints rather than traditional criteria like assets or turnover.

- It will also cover MSMEs that do not have a formal accounting system.

- Increase in Mudra Loan Limit:

- The Mudra loan limit has been raised from Rs 10 lakh to Rs 20 lakh, and entrepreneurs who have successfully repaid previous 'Tarun' category loans are eligible for the increased limit.

- Mandatory Onboarding on the TReDS Platform:

- The turnover threshold for mandatory onboarding on the Trade Receivables Discounting System (TReDS) platform has been reduced from Rs 500 crore to Rs 250 crore.

- This move will bring 22 more Central Public Sector Enterprises (CPSEs) and 7,000 additional companies onto the platform, enhancing liquidity and working capital access for MSMEs.

- Expansion of SIDBI Branches:

- The Small Industries Development Bank of India (SIDBI) will open new branches in major MSME clusters, with 24 branches to be added this year and a target of covering 168 out of 242 clusters within three years.

- New Credit Assessment Model for MSME:

Pradhan Mantri Mudra Yojana

- The PMMY (launched in 2015) provides collateral-free institutional loans up to Rs. 10 lakhs for small business enterprises.

- Funding is provided by Member Lending Institutions (MLIs) i.e. Scheduled Commercial Banks (SCBs), Regional Rural Banks (RRBs), Non-Banking Financial Companies (NBFCs) and Micro Finance Institutions (MFIs).

- There are three loan products under PMMY:

- Shishu (loans up to Rs. 50,000)

- Kishore (loans between Rs. 50,000 and Rs. 5 lakh)

- Tarun (loans between Rs. 5 lakh and Rs. 10 lakh)

Trade Receivables Discounting System (TReDS)

- Trade Receivables Discounting System (TReDS) is the institutional mechanism for facilitating the financing of trade receivables of MSMEs from corporate and other buyers, including Government Departments and Public Sector Undertakings (PSUs), through multiple financiers.

What are the Implications of the Recent Changes?

- Angel tax:

- The scrapping of angel tax would help bolster the Indian start-up ecosystem, boost the entrepreneurial spirit, and support innovation.

- The abolition of the angel tax is expected to attract more foreign investors and provide essential capital for start-ups, especially amid the significant decline in start-up funding.

- According to the Indian Tech Startup Funding Report 2023 by Inc42, start-up funding fell by 60% in 2023 to USD 10 billion.

- Equalisation levy:

- The withdrawal of the 2% levy is expected to reduce compliance burdens and create a mutually conducive environment for non-resident digital companies operating in other jurisdiction.

- This move is likely to ease trade tensions between India and the US, fostering a more collaborative international trade environment.

- The decision underscores India’s commitment to aligning with global taxation norms and practices, facilitating a smoother transition to the OECD/G20’s Pillar 1 solution.

- Pillar One ensures a fairer distribution of profits and taxing rights among countries with respect to the largest multinational enterprises(MNEs), including digital companies.

- Increase in STT:

- It could lead to reduced speculative trading, thereby cooling down market activity.

- The increase in STT aims to curb the exponential rise in volumes in the F&O segment, which the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI) have flagged as a potential risk to macroeconomic stability.

- High volumes in derivatives can pose systemic risks and affect capital formation, investment, and economic growth.

- The new tax rates are likely to increase compliance costs for traders and investors while generating additional revenue for the government.

- It could lead to reduced speculative trading, thereby cooling down market activity.

- MSMEs:

- The shift to a digital footprint-based assessment model will facilitate easier credit access for MSMEs, especially those without formal accounting systems.

- The increased Mudra loan limit and the introduction of a collateral-free credit guarantee scheme will enhance financial support for MSMEs, enabling them to upgrade technology, invest in new machinery, and improve competitiveness.

- Lowering the threshold for mandatory onboarding on the TReDS platform will improve liquidity for smaller enterprises by allowing them to convert trade receivables into cash more efficiently.

- Expanding SIDBI branches will ensure that MSMEs in major clusters have better access to financial services, facilitating their growth and development.

Conclusion

- The recent economic reforms outlined in the Union Budget 2024-25 are poised to significantly enhance India's financial landscape. These measures demonstrate a commitment to fostering a more dynamic and inclusive economy by streamlining credit access for MSMEs, aligning tax policies with global standards, and mitigating risks in the financial markets.

- By addressing both domestic and international challenges, these reforms aim to create a more resilient economic environment conducive to sustainable growth and innovation.

Read More: Economic Survey, Union Budget 2024-25

|

Drishti Mains Question: Discuss the recent economic reforms introduced in the Union Budget 2024-25 and evaluate their potential impact on India's financial landscape. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. What is/are the recent policy initiative(s)of Government of India to promote the growth of manufacturing sector? (2012)

- Setting up of National Investment and Manufacturing Zones

- Providing the benefit of ‘single window clearance’

- Establishing the Technology Acquisition and Development Fund

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Q. Which of the following can aid in furthering the Government’s objective of inclusive growth? (2011)

- Promoting Self-Help Groups

- Promoting Micro, Small and Medium Enterprises

- Implementing the Right to Education Act

Select the correct answer using the codes given below:

(a) 1 only.

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (d)

Mains:

Q. Can the strategy of regional-resource-based manufacturing help in promoting employment in India? (2019)

Higher Food Inflation

For Prelims: Retail inflation, RBI, CFPI, Food Price gains, Consumer Price Index (CPI) CPI-Combined (CPI-C), WPI, Cost-push inflation, drip irrigation, minimum export price (MEP), headline inflation, Russia-Ukraine war

For Mains: Significance and Challenges of Food Inflation for Indian Economy.

Why in News?

Recently, the Reserve Bank of India (RBI) in its monthly bulletin titled “ State of Economy” reported that a sharp rise in vegetable prices in June 2024 has halted the disinflation process towards the 4% target.

- The report emphasised the need for monetary policy to remain focused on aligning inflation with the 4% target.

Recent Trends in Consumer Price Inflation in India

- Headline Inflation: Year-on-year (y-o-y) headline inflation rose to 5.1% in June 2024 from 4.8% in May 2024, driven by food prices.

- Food Inflation Increase: Food inflation increased to 8.4% in June 2024 from 7.9% in May 2024, with significant contributions from cereal, pulses, and edible oils.

- High-Frequency Data: Data for July shows increases in cereal prices (mainly wheat), pulses (gram and arhar/tur), and edible oils (mustard and groundnut).

What are the Causes of the Rise in Food Inflation?

- Temperature and Weather Challenges: Issues like adverse weather conditions, such as the prediction of a weak monsoon and heatwave for this year affecting crop yields, particularly for cereals, pulses, and sugar, contributed to supply shortages and higher prices domestically.

- For example, cereal and pulse inflation showed double-digit inflation in April 2024.

- Fuel Prices: The price of fuel, key input in agriculture, has witnessed a considerable increase in recent years.

- For example, an increase in fuel inflation by 1% leads to a 0.13% rise in food inflation, and the effect slowly declines through the next 12 months.

- Transportation Issues: Disruptions in the supply chain due to factors like transportation constraints, labour shortages, and logistical challenges can lead to a decrease in the availability of food products, causing prices to rise.

- Production Costs: Rising production costs for farmers can lead to higher food prices. This includes expenses such as fuel, fertiliser, and labour costs.

- Global Causes: The ongoing Russia-Ukraine war has a global impact, particularly affecting developing countries. Energy and commodity prices have risen, and global logistical supply chains have been disrupted.

- Ukraine and Russia account for up to 30% of global wheat exports, leading to an increase in food prices.

What Measures Government Has Taken to Curb Food Inflation?

- Subsidised Commodities: The government is increasing the distribution of subsidised vegetables like onions and tomatoes through its network and releasing stocks of wheat and sugar to stabilise prices.

- Buffer Stock Management: The Government maintains a buffer stock of essential food commodities like wheat, rice, and pulses to release into the market during periods of scarcity or price spikes.

- Procurement and PDS: The Public Distribution System (PDS) ensures food security for the poor by providing subsidised grains. Increasing procurement and expanding PDS coverage can help stabilise prices.

- Minimum Support Price (MSP): Guaranteeing remunerative prices to farmers for their produce incentivises production, leading to increased supply and potentially lower prices.

- Import-Export Policies: The government can regulate imports and exports of food items to manage domestic supply and prices. For instance, import duties can be reduced to augment supply, while export bans can be imposed to control domestic prices.

- Infrastructure Development: Investments in cold storage, warehousing, and transportation facilities reduce post-harvest losses and improve supply chain efficiency, leading to lower prices.

- Technology Adoption: Promoting the use of technology in agriculture, such as precision farming and weather forecasting, can enhance productivity and reduce production costs.

Remove Food items from Inflation Targeting (Economic Survey 2023-24)

- RBI Inflation Targeting Strategy: In March 2021, the government retained the Reserve Bank of India (RBI)'s flexible inflation target of 2-6% for five years, through March 2026.

- Under this framework, introduced in 2016, RBI targets headline inflation as measured by the Consumer Price Index (CPI).

- Suggestions of Economic Survey:

- The Economic Survey 2023-24 suggested excluding food inflation from India's inflation targeting framework.

- Food makes up 46% of CPI Headline Inflation in developing countries, thus controlling food prices is key to managing overall inflation.

- In June 2024, overall inflation was 5.1%, food inflation was 9.4%, and core inflation was 3.1%.

- Reasons for Excluding Food from Inflation Targeting:

- Supply-Induced Price Changes: Food price fluctuations are mainly due to supply shocks (For example: poor harvests, climate conditions) rather than demand.

- Traditional monetary policy tools, designed to address demand-side pressures, are ineffective for supply-induced changes.

- Direct Benefit Transfers (DBT): To help poor and low-income consumers cope with rising food prices, the Survey suggests using direct benefit transfers or coupons, offering targeted assistance without disrupting the inflation framework.

- Core Inflation Focus: Excluding food items allows the focus to shift to core inflation, which better reflects underlying inflation trends and the economy's health, as it is less influenced by temporary shocks.

- International Practices: Countries like the US, UK, and Canada also exclude food and energy prices in their inflation targeting to maintain a more stable and predictable monetary policy framework.

- Supply-Induced Price Changes: Food price fluctuations are mainly due to supply shocks (For example: poor harvests, climate conditions) rather than demand.

Note

- Consumer Price Index (CPI) vs. Wholesale Price Index (WPI):

- WPI tracks inflation at the producer level and CPI captures changes in prices levels at the consumer level.

- WPI does not capture changes in the prices of services, which CPI does.

- Headline inflation and Core Inflation:

- Headline Inflation is a measure of the total economic inflation that includes food and energy prices.

- Core Inflation is the change in the costs of goods and services but does not include those from the food and energy sectors.

- This measure of inflation excludes these items because their prices are much more volatile.

- Core inflation = Headline inflation – (Food and Fuel) inflation.

Way Forward

- Supply Chain Improvement: Investing in infrastructure, such as storage facilities, cold chains, and transportation, can reduce post-harvest losses and ensure food reaches consumers faster and in better condition, stabilizing prices.

- Direct procurement initiatives, like the Direct Benefit Transfer (DBT) and expanding schemes like Pradhan Mantri Kisan Samman Nidhi (PM-KISAN), can help farmers receive fair prices without intermediaries, reducing price volatility.

- Regulatory Measures: Price controls and monitoring can provide immediate relief during inflationary spikes by implementing temporary price controls on essential commodities.

- Strengthening the Essential Commodities Act can help regulate storage and movement, preventing hoarding and ensuring availability at reasonable prices.

- Investment in Technology: Encouraging the use of modern agricultural techniques and technologies (e.g., precision farming, and genetically modified crops) can increase yields.

- According to the Economic Survey 2022-23, adopting new technologies can potentially increase productivity by 20-30%.

- Encouraging Crop Rotation: Promoting crop diversification can help stabilise prices. For instance, shifting from traditional crops to pulses and oilseeds can reduce dependency on imports and stabilise local markets.

- Market Reforms: Strengthening Agricultural Produce Market Committees (APMCs) and establishing more regulated markets can ensure better price discovery and reduce middlemen's influence.

- Additionally, digital platforms like e-NAM (National Agriculture Market) can connect farmers directly with buyers, helping them secure better prices.

|

Drishti Mains Question: What are the primary factors behind India's Rising food inflation, and what strategies can be employed to mitigate this gap between Overall Inflation and Food Inflation? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q.1 Consider the following statements: (2020)

- The weightage of food in Consumer Price Index (CPI) is higher than that in Wholesale Price Index (WPI).

- The WPI does not capture changes in the prices of services, which CPI does.

- The Reserve Bank of India has now adopted WPI as its key measure of inflation and to decide on changing the key policy rates.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (a)

Q 2. If the RBI decides to adopt an expansionist monetary policy, which of the following would it not do? (2020)

- Cut and optimize the Statutory Liquidity Ratio

- Increase the Marginal Standing Facility Rate

- Cut the Bank Rate and Repo Rate

Select the correct answer using the code given below:

(A) 1 and 2 only

(B) 2 only

(C) 1 and 3 only

(D) 1, 2 and 3

Ans: B

Mains

Q. There is also a point of view that Agricultural Produce Market Committees (APMCs) set up under the State Acts have not only impeded the development of agriculture but also have been the cause of food inflation in India. Critically examine. (2014)

Concerns Regarding Opium Stockpiles in Afghanistan

For Prelims: UNSC report, Poppy ban, Narcotics trafficking, ISI, Drug money, Methamphetamine production, Indian security agencies, National Investigation Agency, PIB, UPSC CSE, PYQ.

For Mains: UNSC report, Afghanistan opium stockpiles, Taliban poppy ban, Implication for India

Why in News?

Recently, the latest report by the United Nations Security Council (UNSC) highlights significant concerns regarding Afghanistan's extensive opium stockpiles despite the Taliban's ban on poppy cultivation.

What are the Key Findings of the Report?

- Despite the Taliban's April 2022 ban on poppy cultivation, Afghanistan retains substantial stockpiles of opium.

- The report suggests it could take several years to assess the full impact of the ban due to these stockpiles.

- The trade-in narcotics remains significant, with no noticeable reduction in drug exports based on seizure data.

- Senior Taliban figures and well-connected traders, including the Haqqani Network, continue to profit from drug trafficking.

- Key Taliban figures control various narcotics trafficking routes.

- Methamphetamine production has surged, with significant quantities of fentanyl also being recorded.

- Major hubs for methamphetamine production include Farah, Herat, and Nimroz, with active labs in Bahramcha, Dishu district, and Helmand province.

What are the Implications of Opium Stock Piles and Drug Trafficking?

- Trafficking Networks: A majority of drugs trafficked to India originate from Afghanistan, with Pakistan's Inter-Services Intelligence (ISI) agency controlling these networks.

- Terrorism Funding: Drug money is increasingly being used to fund anti-India terror groups such as Lashkar-e-Taiba (LeT).

- Narcotics procured from Afghanistan are labelled in clandestine laboratories in Balochistan and then smuggled into India.

- Significant Seizures: Indian security agencies have uncovered direct links between Kandahar-based cartels and drug smuggling networks.

- Notable seizures include the National Investigation Agency (NIA) intercepting 3,000 kg of heroin at Mundra port in September 2021.

- Government Response: The Union Home Minister has urged security agencies to adopt a ruthless approach towards smuggling networks.

- The central government is working on installing container scanners at all ports and land border crossings to curb drug trafficking.

Initiatives to Tackle Drug Abuse

- Global Initiatives:

- Single Convention on Narcotic Drugs, 1961

- The Convention on Psychotropic Substances, 1971

- The UN Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances, 1988.

- India is a signatory to all three and has enacted the Narcotics Drugs and Psychotropic Substances (NDPS) Act, 1985

- Every year, the UN publishes a World Drug Report, the Global Drug Policy Index.

- United Nations Office on Drugs and Crime: It was established in 1997 and was named the United Nations Office on Drugs and Crime (UNODC) in 2002.

- It acts as the Office for Drug Control and Crime Prevention by combining the United Nations International Drug Control Program (UNDCP) and the Crime Prevention and Criminal Justice Division of the United Nations Office in Vienna.

- Indian Initiatives:

Famous Hotspot of Illicit Drugs

- The Golden Triangle refers to a region in Southeast Asia known for the production of illicit drugs, particularly Opium. It's an area where the borders of three countries meet: Myanmar (formerly Burma), Laos, and Thailand.

- Golden Crescent or “Death Crescent” region includes Afghanistan and Iran – making it a natural transit point for drugs being smuggled out of Pakistan.

Opium Regulation and Uses

- Narcotics Commissioner under the Narcotic Drugs & Psychotropic Substances Act 1985 and Narcotic Drugs & Psychotropic Substances Rules, 1985 performs all functions relating to superintendence of the cultivation of the opium poppy and production of opium.

- The opium poppy can be cultivated only in such tracts as are notified by the Government.

- At present these tracts are confined to three States, viz. Madhya Pradesh, Rajasthan and Uttar Pradesh.

- Mandsaur district of Madhya Pradesh and Chittorgarh and Jhalawar Districts of Rajasthan constitute about 80% of the total area cultivated.

- Uses of Opium:

- Opium is unique in its therapeutic value and is indispensable in the medical world.

- It also finds use in Homeopathy and Ayurveda or Unani systems of indigenous medicines.

- Opium which is used as an analgesic, Anti-Tussive, Anti spasmodic and as a source of edible seed oil, acts as a medicinal herb.

|

Drishti Mains Question: Discuss the implications of Afghanistan's opium trade on India's security and socio-economic stability. Highlight the measures that India can take to mitigate these challenges. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Consider the following statements:

- The United Nations Convention against Corruption (UNCAC) has a ‘Protocol against the Smuggling of Migrants by Land, Sea and Air’.

- The UNCAC is the ever-first legally binding global anti-corruption instrument.

- A highlight of the United Nations Convention against Transnational Organized Crime (UNTOC) is the inclusion of a specific chapter aimed at returning assets to their rightful owners from whom they had been taken illicitly.

- The United Nations Office on Drugs and Crime (UNODC) is mandated by its member States to assist in the implementation of both UNCAC and UNTOC.

Which of the statements given above are correct?

(a) 1 and 3 only

(b) 2, 3 and 4 only

(c) 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (c)

Mains

Q. In one of the districts of a frontier state, the narcotics menace has been rampant. This has resulted in money laundering, mushrooming of poppy farming, arms smuggling and near stalling of education. The system is on the verge of collapse. The situation has been further worsened by unconfirmed reports that local politicians as well assume senior police officers are providing surreptitious patronage to the drug mafia. At that point of time a woman police officer, known for her skills in handling such situations is appointed as Superintendent of Police to bring the situation to normalcy.

Q. If you are the same police officer, identify the various dimensions of the crisis. Based on your understanding, suggest measures to deal with the crisis. (2019)

Agriculture-Related Initiatives in Union Budget 2024-25

Why in News?

In the Union Budget 2024-25, the Finance Minister announced the allocation of Rs 500 crore for providing drones to women self-help groups (SHGs) under the Namo Drone Didi scheme, along with support for one crore farmers to adopt natural farming practices.

What are the Key Initiatives in the Field of Agriculture?

- Namo Drone Didi Scheme:

- The scheme was launched in March 2024 and aims to provide drones to 15,000 selected women SHGs for offering rental services to farmers.

- The implementation period spans from 2023-24 to 2025-26.

- Rs 500 crore has been earmarked for this initiative under the Union budget 2024-25.

- This scheme will empower women in rural areas by integrating them into the technological advancements in agriculture, thus fostering entrepreneurship.

- Drones will enhance farming efficiency through precision agriculture, leading to better crop management and yield optimisation.

- The scheme was launched in March 2024 and aims to provide drones to 15,000 selected women SHGs for offering rental services to farmers.

- Support for Natural Farming:

- One crore farmers will be encouraged to adopt natural farming practices, supported by certification and branding.

- Natural farming is an agricultural practice that emphasises minimal intervention and the use of natural resources to cultivate crops.

- This will be carried out through scientific institutions and willing gram panchayats.

- Under the National Mission on Natural Farming, Rs 365.64 crore has been allocated for 2024-25.

- 10,000 need-based bio-input resource centres will be established.

- One crore farmers will be encouraged to adopt natural farming practices, supported by certification and branding.

- Jan Samarth-based Kisan Credit:

- The issuance of Jan Samarth-based Kisan Credit will be enabled in states, streamlining access to 13 government schemes through a single-window online platform.

- Pulses, Oilseeds, and Vegetable Production:

- A strategy is being formulated to achieve self-sufficiency (‘atmanirbharta’) in pulses and oilseeds production, which is crucial as India currently relies heavily on imports for edible oil.

- Large-scale clusters for vegetable production will be developed near major consumption centres.

- This includes promoting farmer-producer organisations, cooperatives, and startups for efficient supply chains.

- National Cooperation Policy and Rural Economy:

- The government announced a National Cooperation Policy for systematic and orderly all-round development of the cooperative sector.

- Fast-tracking the growth of the rural economy and the generation of employment opportunities on a large scale will be the policy goal.

- Shrimp Production and Export:

- India is one of the world's largest shrimp exporters.

- In 2022-23, India's seafood exports stood at USD 8.09 billion and shrimps accounted for a bulk of these exports at USD 5.6 billion.

- Further financial support will be provided for setting up a network of nucleus breeding centres for shrimp broodstocks, enhancing shrimp production and export capabilities.

- India is one of the world's largest shrimp exporters.

Other Initiatives Related to Agriculture

- Mission Organic Value Chain Development for North Eastern Region (MOVCDNER)

- National Mission on Sustainable Agriculture

- Paramparagat Krishi Vikas Yojana (PKVY)

- Sub-mission on AgroForestry (SMAF)

- Rashtriya Krishi Vikas Yojana

- AgriStack

- Digital Agriculture Mission

- Unified Farmer Service Platform (UFSP)

- National e-Governance Plan in Agriculture (NeGP-A)

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q1. Under the Kisan Credit Card scheme, short-term credit support is given to farmers for which of the following purposes? (2020)

- Working capital for maintenance of farm assets

- Purchase of combine harvesters, tractors, and mini trucks

- Consumption requirements of farm households

- Post-harvest expenses

- Construction of family house and setting up of village cold storage facility

Select the correct answer using the code given below:

(a) 1, 2 and 5 only

(b) 1, 3 and 4 only

(c) 2, 3, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)

National Time Release Study Report 2024

Recently, the Central Board of Indirect Taxes and Customs (CBIC) released the National Time Release Study (NTRS) 2024 report, which measures the cargo release time at 9 ports in India.

- The NTRS 2024 report aims to assess the progress made towards the National Trade Facilitation Action Plan (NTFAP) targets, identify the impact of various trade facilitation initiatives, and identify the challenges to a more expeditious reduction in release time.

- The NTFAP aims to transform the cross-border clearance ecosystem through efficient, transparent, risk-based, coordinated, digital, seamless and technology-driven procedures that state-of-the-art sea ports, airports and land borders support.

- NTRS 2024 is the fourth annual national-level study utilising standardised methodology to analyse customs clearance times for imports and exports from 1st January to 7th February 2024.

- The study highlights the efficiency of the CBIC Pre-payment Customs Compliance Verification initiative, which speeds up final clearance upon duty payment, often within 3 minutes.

- In the CBIC Pre-payment Customs Compliance Verification (PCCV) initiative, all the Customs formalities are completed and final clearance is pending only for payment of duties by the importer.

Read more: CBIC Releases National Time Release Study (NTRS) 2023 Report

Lal Dora-Free Haryana

All villages of Haryana have been made Lal Dora-free. The state government launched a scheme to make villages "Lal Dora-free" on Good Governance Day on 25th December 2019.

- It is a reformative step towards the establishment of clear ownership of property in rural inhabited areas by mapping land parcels using drone technology and providing a 'Record of Rights' to village household owners with the issuance of legal ownership cards.

- Field verification of rural and residential areas was conducted in every village, and the mapping of every property falling under 'Lal Dora' was closely inspected.

- In some states, the inhabited areas of villages, known as "lal dora" land in Punjab and Haryana and "abadi" in some, were mostly excluded from such surveys.

- Many Indian village communities lacked documented land rights, relying instead on actual possession to claim ownership of land in residential areas.

- Rural property owners cannot use their properties as financial assets to obtain loans from banks without a legal document.

Read more: SVAMITVA Scheme

Nipah Virus

Recently, a 14-year-old boy from Kerala died after testing positive for the Nipah virus.

- Nipah virus (NiV) is a zoonotic virus (transmitted from animals to humans) and can also be transmitted through contaminated food or directly between people.

- Nature: The organism that causes Nipah Virus encephalitis is an RNA or Ribonucleic acid virus of the family Paramyxoviridae, genus Henipavirus, and is closely related to Hendra virus.

- Hosts and Transmission: NiV initially appeared in domestic pigs, dogs, cats, goats, horses, and sheep.

- It spreads through fruit bats (genus Pteropus). The virus is found in bat urine, faeces, saliva, and birthing fluids.

- Fatality: The case fatality rate ranges from 40% to 75%.

- Symptoms: Causes encephalitic syndrome in humans, presenting with fever, headache, drowsiness, disorientation, mental confusion, coma, and potentially death.

- Diagnosis: Diagnosis can be established through real-time polymerase chain reaction (RT-PCR) from bodily fluids and antibody detection via enzyme-linked immunosorbent assay (ELISA).

- Prevention: No vaccines available for humans or animals.

- WHO Response: It has identified Nipah as a priority disease

Read More: Nipah virus Infection (NiV)

National Mission on Cultural Mapping (NMCM)

Recently, the Ministry of Culture has launched the National Mission on Cultural Mapping (NMCM) to provide a comprehensive overview of the cultural heritage of villages across India.

- It aims to raise awareness of cultural heritage's role in development and identity while mapping the cultural aspects of 6.5 lakh villages and creating a National Register of Artists and Art Practices, along with a web portal and mobile app for the National Cultural Workplace (NCWP).

- It will encompass all inhabited villages in India according to the 2011 Census, with a specific focus on all villages in Bihar for the mapping process.

- The database will be available at the Mera Gaon Meri Dharohar Web Portal which can be utilised by other ministries and organisations to protect and promote local cultures, traditions, and art forms.

Mera Gaon Meri Dharohar (MGMD):

- It is a National Mission on Cultural Mapping (NMCM) conducted by the Ministry of Culture in coordination with the Indira Gandhi National Centre for the Arts (IGNCA).

- It compiles detailed information about Indian villages, covering aspects of life, history, and ethos.

- Information is categorised into 7 areas: Arts and Crafts, Ecology, Scholastic Traditions, Epics, Local and National History, Architectural Heritage, and other unique characteristics.

Read more: Mera Gaon, Meri Dharohar Programme