Indian Economy

Economic Survey 2022-23

- 01 Feb 2023

- 23 min read

For Prelims: Key points of Economic Survey 2022-23

For Mains: Key points of Economic Survey 2022-23

Why in News?

The Union Finance Minister tabled the Economic Survey for the Financial Year 2022-23, after the President’s address.

- The Economic Survey 2022-23 highlighted that India’s economic recovery from the pandemic is complete and the economy is expected to grow in the range of 6% to 6.8% in the coming financial year 2023-24.

What is the Economic Survey?

- The Economic Survey of India is an annual document released by the Ministry of Finance. It is usually presented in Parliament a day before the Union Budget.

- It is prepared by the Economics Division of the Department of Economic Affairs (DEA) under the guidance of the Chief Economic Advisor.

- It reviews the developments in the Indian economy over the previous 12 months and presents the economic outlook for the current fiscal year.

- It also presents the current state of the Indian economy, including data on gross domestic product (GDP), inflation, employment, and trade.

- The first Economic Survey in India was presented in the year 1950-51.

- Up to 1964, it was presented along with the Union Budget. From 1964 onwards, it has been delinked from the Budget.

How was the State of Indian Economy in 2022-23?

- Performance:

- India hosted the world's second-largest vaccination drive, involving over 2 billion doses.

- The improvement in the financial health of public sector banks has enabled them to increase credit supply, leading to rapid credit growth for the micro, small, and medium enterprises (MSME) sector.

- Current Challenges:

- Indian economy still faces persistent challenges, including the depreciating rupee and the possibility of further US Fed interest rate hikes.

- The current account deficit (CAD) may also continue to widen as global commodity prices remain elevated.

- Outlook 2023-24:

- India's economic growth in FY23 is being led by private consumption and capital formation, generating employment.

- The recovery of MSMEs is progressing, with the Emergency Credit Linked Guarantee Scheme (ECGS) easing their debt concerns.

- Global growth is projected to decline in 2023, but India's growth is expected to be swift in FY24 with a vigorous credit disbursal and capital investment cycle.

- The expansion of public digital platforms and measures such as PM GatiShakti, the National Logistics Policy, and the Production-Linked Incentive schemes will support economic growth and boost manufacturing output.

- India's economic growth in FY23 is being led by private consumption and capital formation, generating employment.

What is India's Medium-term Growth Outlook?

- Context:

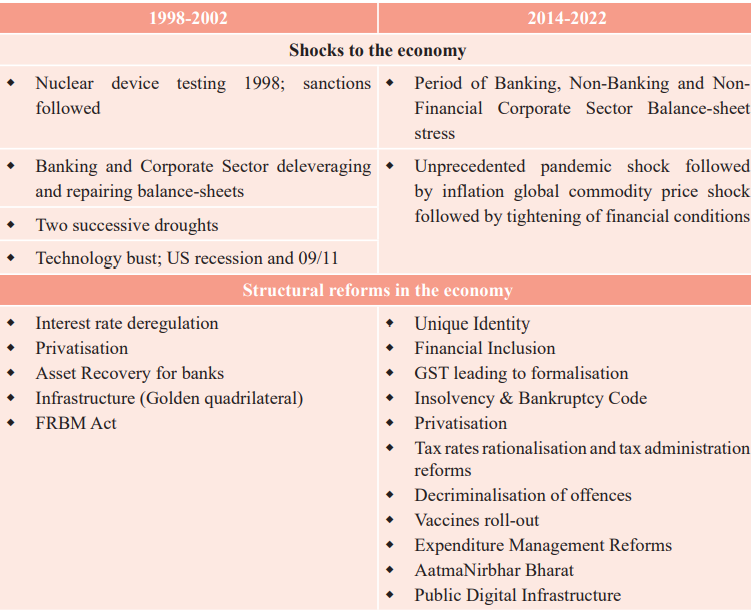

- The current decade is similar to 1998-2002, where transformative reforms had delayed growth returns due to temporary shocks, but structural reforms later paid growth dividends.

- 2014-2022 Period:

- 2014-2022 is an important period in India's economic history with reforms aimed at improving the ease of living and doing business.

- The reforms were based on creating public goods, trust-based governance, co-partnering with the private sector and increasing agricultural productivity.

- However, due to balance sheet stress and global shocks, key macroeconomic variables were negatively impacted during this period.

- 2014-2022 is an important period in India's economic history with reforms aimed at improving the ease of living and doing business.

- 2023-2030 Outlook:

- The growth outlook is better than pre-pandemic years and the Indian economy is prepared to grow at its potential in the medium term.

What were the Major Fiscal Developments Related to Revenue?

- Context:

- During the fiscal year 2023, the Union Government's finances showed resilience, which was a result of various factors like the increase in direct taxes and Goods and Services Tax (GST) revenues.

- Revenue Growth and Performance:

- From April to November 2022, the Gross Tax Revenue experienced a YoY growth of 15.5%, which was primarily driven by the strong growth of both direct taxes and GST.

- GST has established itself as a vital source of revenue for the central and state governments, as seen from the YoY growth of 24.8% from April to December 2022.

- Over the years, the Centre's Capex has steadily increased from 1.7% of GDP (FY09 to FY20) to 2.5% of GDP in FY22.

- To prioritise spending on Capex, the Centre incentivized the state governments through interest-free loans and increased borrowing limits.

- The increased Capex, particularly in infrastructure-intensive sectors such as roads and highways, railways, housing, and urban affairs, has substantial positive effects on medium-term growth.

- Towards Sustainable Debt-to-GDP ratio:

- The government's strategy of focusing on Capex-led growth will keep the growth-interest rate differential positive, resulting in a sustainable debt-to-GDP ratio in the medium run.

What was the Status of Monetary Management and Financial Intermediation?

- Context:

- The Reserve Bank of India (RBI) started its monetary tightening cycle in April 2022, and since then, they have raised the repo rate by 225 basis points.

- This has led to a decrease in surplus liquidity and improved the balance sheets of financial institutions, making it easier for them to lend money.

- It is expected that the growth in credit offtake will continue and be sustained by an increase in private capital expenditure, which will start a virtuous cycle of investment.

- The Reserve Bank of India (RBI) started its monetary tightening cycle in April 2022, and since then, they have raised the repo rate by 225 basis points.

- Performance and Growth:

- The Gross Non-Performing Assets (GNPA) ratio of SCBs (scheduled commercial banks) has dropped to a seven-year low of 5.0, and the Capital-to-Risk Weighted Assets Ratio (CRAR) remains healthy at 16.0.

- In FY22, the recovery rate through the Insolvency and Bankruptcy (IBC) channel was the highest compared to other channels, which shows a positive trend for the SCBs.

How Prices and Inflation was Regulated in 2022-23?

- Context:

- In 2022, India experienced three phases of consumer price inflation. During the first phase, from January to April, inflation peaked at 7.8% due to the war between Russia and Ukraine and crop shortages caused by heat waves in some parts of the country.

- However, prompt actions by the government and the Reserve Bank of India helped bring inflation under control, with a decline to 5.7% by December.

- In 2022, India experienced three phases of consumer price inflation. During the first phase, from January to April, inflation peaked at 7.8% due to the war between Russia and Ukraine and crop shortages caused by heat waves in some parts of the country.

- Bottlenecks:

- The gap between the wholesale price index and the consumer price index remained wide, with core inflation still showing resistance to change.

- Regulatory Measures:

- The government adopted a multi-pronged approach to control the increase in prices, which included: reducing the export duty of petrol and diesel, bringing the import duty on major inputs to zero, imposing export ban on wheat products and export duty on rice, and reducing the basic duty on crude and refined palm oil.

- The government's timely policy intervention in the housing sector, along with low home loan interest rates, boosted demand in the affordable housing segment and attracted more buyers in FY23.

- RBI’s Forecast:

- The RBI forecasts higher domestic prices for cereals, spices, and milk in the near future, mainly due to supply shortages and rising feed costs.

- The changing climate around the world is also increasing the risks of higher food prices.

- The RBI forecasts higher domestic prices for cereals, spices, and milk in the near future, mainly due to supply shortages and rising feed costs.

What is the Status of Social Infrastructure and Employment in India during 2022-23?

- Context:

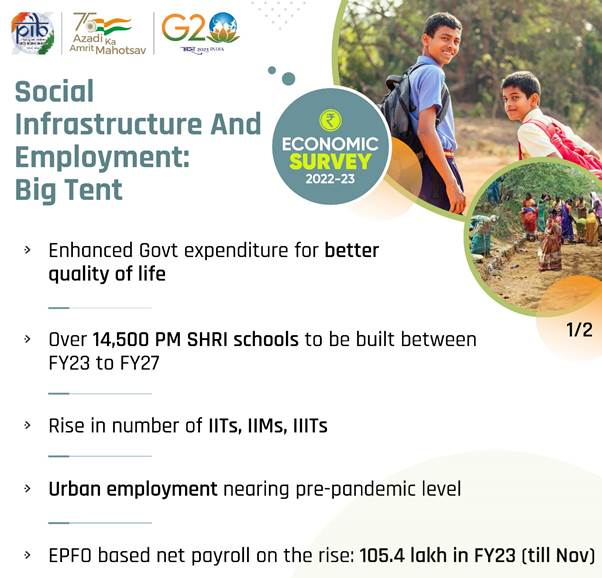

- The government increased its spending on the social sector. The twin pillars of education and health are being strengthened to form human capital.

- Overall, the government's social sector spending increased from Rs. 9.1 lakh crore in FY16 to Rs. 21.3 lakh crore in FY23.

- The government increased its spending on the social sector. The twin pillars of education and health are being strengthened to form human capital.

- Social Infrastructure:

- Education:

- The National Education Policy 2020 is expected to enrich the nation's growth and development prospects.

- The government's efforts have led to improvements in enrollment ratios and gender parity in schools.

- Healthcare:

- In FY23, the government's budgeted spending on the health sector was 2.1% of GDP, up from 1.6% in FY21.

- As of January 4, 2023, nearly 22 crore people have benefited from the Ayushman Bharat Scheme, and over 1.54 lakh health and wellness centres have been established across the country.

- Poverty Alleviation:

- The progress in attaining the Sustainable Development Goal of halving poverty by 2030 is demonstrated by the fact that more than 41 crore people have exited poverty between 2005-06 and 2019-21 according to the UN Multidimensional Poverty Index.

- Aadhaar and Co-Win:

- Aadhar played a critical role in developing the Co-WIN platform and administering over 2 billion vaccine doses.

- Aspirational Districts Programme:

- The Aspirational Districts Programme is seen as a model of good governance, especially in remote areas.

- Education:

- Employment:

- Labour Force Participation: Labour markets have recovered from the effects of Covid-19, with unemployment rates falling from 5.8% in 2018-19 to 4.2% in 2020-21.

- The Rural Female Labor Force Participation Rate has risen from 19.7% in 2018-19 to 27.7% in 2020-21, which is a positive development.

- eShram Portal: The eShram portal was created to create a national database of unorganised workers, and as of December 31, 2022, over 28.5 crore workers were registered.

- Jam Trinity and DBT: The JAM trinity, combined with Direct Benefit Transfer (DBT), has brought marginalised people into the formal financial system, empowering them.

- Labour Force Participation: Labour markets have recovered from the effects of Covid-19, with unemployment rates falling from 5.8% in 2018-19 to 4.2% in 2020-21.

How was India’s Economic Performance in Climate Change and Environment?

- Context:

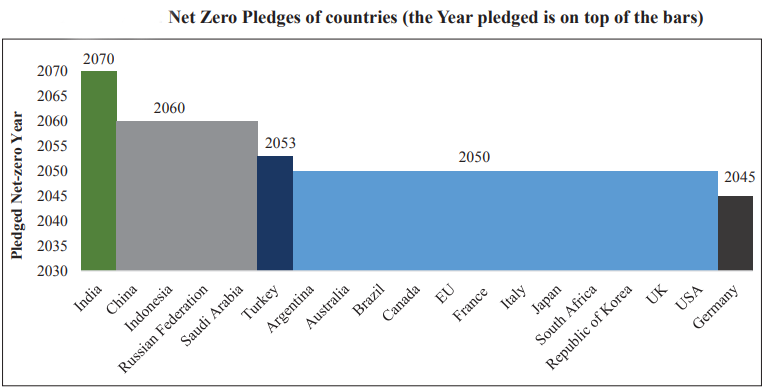

- The Economic Survey 2022-23 presented a chapter on 'Climate Change and Environment’ listing out India's nationally determined contributions (NDCs) that include the transition to renewable energy resources, commitment to achieve "Net Zero" emissions by 2070 and steps taken to become energy independent.

- Performance and Goals:

- India has also committed to reduce emissions intensity of its GDP by 45% by 2030 from 2005 levels.

- Another target has been set to achieve about 50% cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030.

- India has already achieved its target of 40% installed electric capacity from non-fossil fuels ahead of 2030 and the likely installed capacity from non-fossil fuels will be more than 500 GW by 2030.

- This would lead to a decline of average emission rate by around 29% by 2029-30 (compared to 2014-15).

- A mass movement LiFE– Lifestyle for Environment was launched at the Glasgow climate summit at UNFCCC COP26.

- In Nov 2022, India’s first Sovereign Green Bonds (SGrBs) Framework was issued. RBI auctioned two tranches of ₹4,000 crore SGrBs.

- The survey also highlighted India's plans to be energy independent by 2047, by relying on green hydrogen through the National Green Hydrogen Mission.

- The survey shows that India is becoming a favoured destination for renewables with investments standing at USD 78.1 billion in the past 7 years.

- Solar power capacity installed, a key metric under the National Solar Mission, stood at 61.6 GW as of October 2022.

How was India’s Economic Performance in Agriculture and Food Management?

- Context:

- India’s agriculture sector has witnessed a robust average annual growth rate of 4.6% over the last six years. This enabled agriculture to contribute significantly towards the country's overall growth, development and food security.

- Performance:

- In recent years, India has emerged as the net exporter of agricultural products, with exports in 2021-22 touching a record USD 50.2 billion.

- Agri sector saw buoyant growth due to the following measures taken by the govt:

- Augmentation of crop and livestock productivity

- MSP for all mandated crops fixed at 1.5 times of all India weighted average cost of production

- Promotion of crop diversification

- Mechanisation and boost to horticulture and organic farming.

- Private investment in agriculture increased to 9.3% in 2020-21. Institutional credit to the Agri sector continued to grow to Rs. 18.6 lakh crore in 2021-22.

- Foodgrains production in India saw sustained increase and stood at 315.7 million tonnes in 2021-22.

- As per the First Advance Estimates for 2022-23 (Kharif only), total foodgrains production in the country is estimated at 149.9 million tonnes which is higher than the average Kharif foodgrain production of the previous five years (2016-17 to 2020-21).

- Also, the GoI has recently decided to provide free foodgrains to beneficiaries under the NFSA 2013 for one year from 1 January 2023.

- The National Agriculture Market (e-NAM) Scheme has established an online, competitive, transparent bidding system to ensure farmers get remunerative prices for their produce (covering 1.74 crore farmers and 2.39 lakh traders).

- Under Paramparagat Krishi Vikas Yojana (PKVY), organic farming is being promoted through Farmer Producer Organisations (FPO).

- India stands at the forefront to promote millets after the UNGA, in its 75th session in 2021, declared 2023 the International Year of Millets (IYM).

How was India’s Economic Performance in the Industrial Sector?

- Context:

- The Economic Survey 2022-23 showed a rise of 3.7% of overall Gross Value Added (GVA) by the Industrial Sector (for the first half of FY 22-23) which is higher than the average growth of 2.8% achieved in the first half of the last decade.

- Performance:

- Robust growth in Private Final Consumption Expenditure, export stimulus during the first half of the year, increase in investment demand triggered by enhanced public capex and strengthened bank and corporate balance sheets have provided a demand stimulus to industrial growth.

- The supply response of the industry to the demand stimulus has been robust.

- Both the Purchasing Managers Index (PMI) and Index of Industrial Production (IIP) are in an upward growth trajectory since July 2021.

- Robust growth in Private Final Consumption Expenditure, export stimulus during the first half of the year, increase in investment demand triggered by enhanced public capex and strengthened bank and corporate balance sheets have provided a demand stimulus to industrial growth.

- Credit to both MSMEs and large industries have shown double digit growth (MSMEs by 30% since Jan 2022).

- India’s electronics exports have risen nearly threefold, from US $4.4 billion in FY19 to US $11.6 Billion in FY22 with India becoming the second-largest mobile phone manufacturer globally.

- Foreign Direct Investment (FDI) flows into the Pharma Industry have risen four times, from US $180 million in FY19 to US $699 million in FY22.

- Production Linked Incentive (PLI) schemes were also introduced across 14 categories, with an estimated capex of Rs. 4 lakh crore over the next five years, to plug India into global supply chains.

- Over 39,000 compliances have been reduced and more than 3500 provisions decriminalised as of January 2023 by amending the Companies Act 2013.

- To further enhance India’s integration in the global value chain, ‘Make in India 2.0’ is now focusing on 27 sectors, which include 15 manufacturing sectors and 12 service sectors.

How was India’s Economic Performance in the Services Sector?

- Context:

- The Services Sector in India is expected to grow at 9.1% in FY23, compared to 8.4% (YoY) in FY22.

- Performance:

- Robust expansion in PMI (Purchasing Managers' Index) services has been observed since July 2022.

- India was among the top ten services exporting countries in 2021, with a share of 4% in world commercial services exports.

- India’s services sector has been resilient even throughout the Covid-19 pandemic and amid geopolitical uncertainties due to higher demand for digital support, cloud services, and infrastructure modernization.

- In the real-estate sector, there was sustained growth, leading to pre-pandemic housing sales levels, with a 50% rise between 2021 and 2022.

- In the tourism sector, hotel occupancy rate improved from 30-32% in April 2021 to 68-70% in November 2022 showing signs of revival with increasing foreign tourist arrivals in FY23.

- Digital platforms are transforming India’s financial services; India’s e-commerce market is projected to grow at 18% annually through 2025.

How was India’s Economic Performance in the External Sector?

- Context:

- Owing to the recent geopolitical developments, India's external sector has been facing considerable global headwinds.

- However, India has diversified its markets and increased its exports to Brazil, South Africa and Saudi Arabia.

- Performance:

- India's current account balance (CAB) recorded a deficit of US$ 36.4 billion (4.4% of GDP) in the second quarter (Q2) of FY23 in contrast to a deficit of US$ 9.7 billion (1.3% of GDP) in Q2 of FY22.

- This was mainly due to a higher merchandise trade deficit of US$ 83.5 billion and an increase in net investment income outgo.

- To increase its market size and ensure better penetration, in 2022, India signed CEPA with UAE and ECTA with Australia.

- India is the largest recipient of remittances in the world receiving US$ 100 bn in 2022.

- Remittances are the second largest source of external financing after service export.

- As of December 2022, India’s Forex Reserves stood at US$ 563 bn covering 9.3 months of imports (this is a decline from 13 months of imports in FY 21-22).

- Despite this, India was the 6th largest foreign exchange reserves holder in the world.

- India's current account balance (CAB) recorded a deficit of US$ 36.4 billion (4.4% of GDP) in the second quarter (Q2) of FY23 in contrast to a deficit of US$ 9.7 billion (1.3% of GDP) in Q2 of FY22.

How was India’s Economic Performance in the Digital Public Infrastructure?

- Context:

- India's Digital Public Infrastructure (DPI) can add around 60-100 basis points (BPS) to India's potential GDP growth rate.

- In the immediate future, platforms such as Open Network for Digital Commerce (ONDC), Open Credit Enablement Network (OCEN) will open avenues for e-commerce market access and credit availability for smaller businesses and strengthen the expected economic growth.

- Performance:

- Unified Payment Interface (UPI):

- UPI-based transactions grew in both value (121%) and volume (115%), between 2019-22, paving the way for its international adoption.

- Telephone and Radio - For Digital Empowerment:

- Total telephone subscriber base in India stands at 117.8 crore (as of Sept,22), with 44.3% of subscribers in rural India.

- More than 98% of the total telephone subscribers are connected wirelessly.

- As of March 2022, India’s overall teledensity (number of telephone connections per 100 people) in India stood at 84.8%.

- Total telephone subscriber base in India stands at 117.8 crore (as of Sept,22), with 44.3% of subscribers in rural India.

- Unified Payment Interface (UPI):

- Economic Survey states that a landmark achievement in telecommunications in India was the launch of 5G services.

- The Indian Telegraph Right of Way (Amendment) Rules, 2022, will facilitate faster and easier deployment of telegraph infrastructure to enable speedy 5G rollout.

- Prasar Bharati, India’s autonomous public service broadcaster, broadcasts in 23 languages, 179 dialects from 479 stations and reaches 92% of India’s total area and 99.1% of the total population.

- Digital Public Goods:

- Schemes like MyScheme, TrEDS, GEM, e-NAM, UMANG have transformed India’s market place and has enabled citizens to access services across sectors.

- Open Credit Enablement Network aims towards democratising lending operations while allowing end-to-end digital loan applications.

- National AI portal has published 1520 articles, 262 videos, and 120 government initiatives and ‘Bhashini’ is being viewed as a tool for overcoming the language barrier.

- The bouquet of digital public infrastructure products like e-RUPI, e-Way Bill etc. have ensured real value for money to consumers while reducing the compliance burden for producers.