Indian Economy

Privatisation of Public Sector Banks

- 25 Aug 2022

- 10 min read

For Prelims: Public Sector Banks, Private Sector Banks, Non-Performing assets, Re-capitalisation, Financial Inclusion, Pradhan Mantri Jan Dhan Yojana (PMJDY).

For Mains: Significance of Privatising Public Sector Banks.

Why in News?

In the Union Budget 2021-22, the government announced its decision to privatise two Public Sector Banks.

What is Privatisation?

- The transfer of ownership, property or business from the government to the private sector is termed privatisation. The government ceases to be the owner of the entity or business.

- Privatisation is considered to bring more efficiency and objectivity to the company, something that a government company is not concerned about.

- India went for privatisation in the historic reforms budget of 1991, also known as 'New Economic Policy or LPG policy'.

What are Public Sector and Private Sector Banks?

- Public Sector:

- Public Sector Banks (PSBs) are those banks where the government holds more than 50% ownership.

- Further, the government regulates the financial guidelines, because of government ownership, most depositors believe that their money is more secured in public sector banks.

- As a result, most public sector banks have a large customer base.

- For example, The State bank of India (SBI) is the largest public sector bank in India.

- In this bank, the Indian government holds more than 63% share.

- Private Sector Banks:

- Private sector banks are those banks where private individuals or private companies own a major part of the bank’s equity.

- Even though these banks follow the nation’s central bank’s guidelines, they can formulate their independent financial strategy for the customers.

- Private sector banks are those banks where private individuals or private companies own a major part of the bank’s equity.

Why is there a Need to Privatise Public Sector Banks?

- Issues with Public Sector Banks:

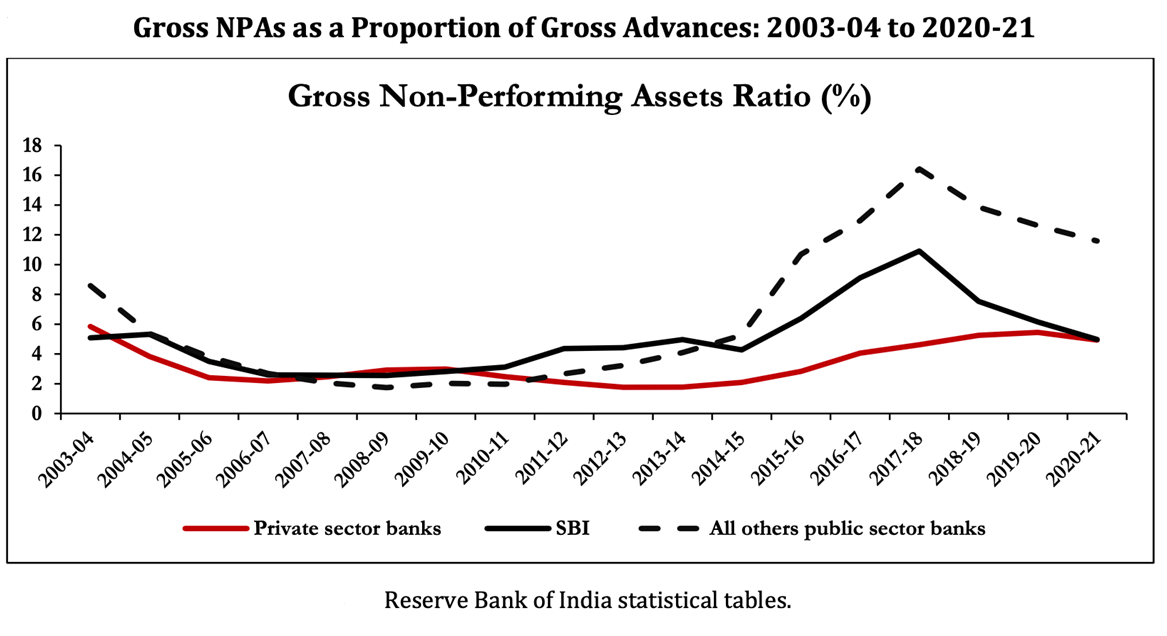

- NPA’s:

- Non-Performing Assets (NPA) are loans that the borrower fails to pay back to the bank, further high levels of NPAs erode a bank’s profitability.

- Most of PSBs are also unable to maintain a capital adequacy ratio.

- In the case of many a PSBs, the RBI had to restrict the normal functioning of the banks — this is referred to as the banks being put under Prompt Corrective Action (or PCA) — and forced them to improve their financial performance metrics before being allowed to resume normal banking activities.

- Losses in Rural Branches:

- Most of the rural branches are running at a loss because of high overheads and the prevalence of the barter system in most parts of rural India.

- Bureaucratisation:

- The smooth functioning of banks has been hampered by red-tapism, long delays, lack of initiative, and failure to take quick decisions.

- Financial Burden to Government:

- Rather than wasting taxpayers’ money to recapitalise PSBs, the government should simply sell them off to the private sector.

- This would reduce the financial burden on the government while also ensuring that PSBs become more efficient and profit-making entities under private ownership.

- According to the Union Budget 2021-22, the government had announced its decision to start by privatising two PSBs.

- NPA’s:

- Efficient Performance of Private Sector Banks:

- Efficient:

- The Private sector Banks (PVBs) are far more efficient, far more productive, and far less corrupt than the PSBs.

- Less Amount of NPA:

- Private sector banks have lower gross NPAs.

- Enhanced Banking Facilities:

- They provide a more significant contribution towards extending loans and a higher percentage of contribution to getting deposits from savers.

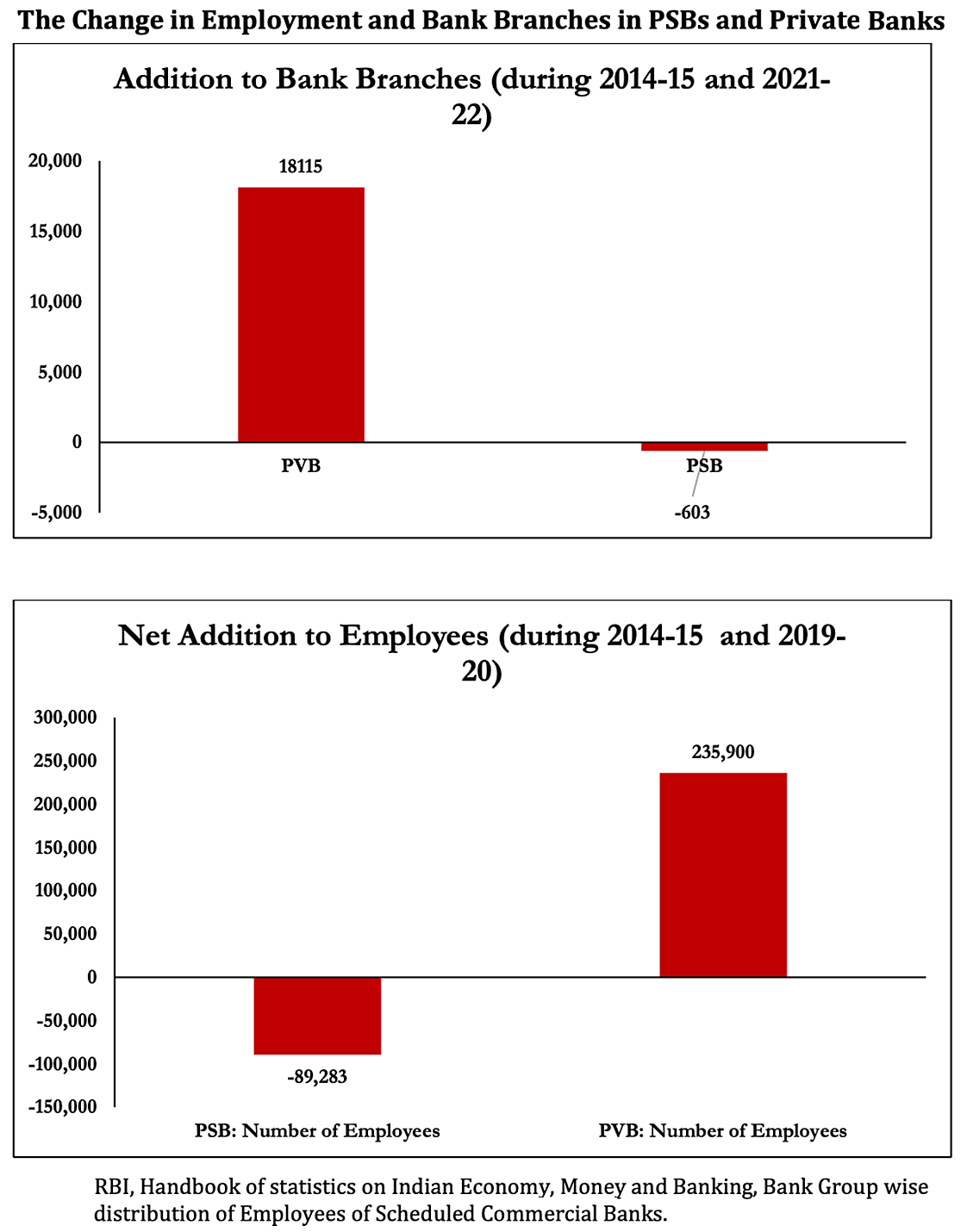

- More Branches and More Jobs:

- They created more branches and new jobs while the public sector banks saw declines on both counts.

- Fetches More Market Value:

- When the Economic Survey reviewed bank nationalisation in 2020, it is found that every rupee of taxpayer money invested in PSBs fetches a market value of just 71 paise. This is called the market to book ratio.

- In stark contrast, every rupee invested in new private sector banks fetches a market value of Rs 3.70. In other words, private banks give more than five times more value than PSBs.

- Efficient:

Who is More Efficient?

- Financial Inclusion:

- Pradhan Mantri Jan Dhan Yojana (PMJDY), envisages universal access to banking facilities with at least one basic banking account for every household.

- Public Sector Banks provide 36.2 crore beneficiaries while Private sector banks accounted for just Rs 1.3 crores of the total of almost Rs 46 crore beneficiaries.

- While the private banks dominate the metropolitan areas, it is the public sector banks that operate branches in rural India.

- PSBs provide more ATMs in rural India.

- Efficiency:

- PSBs are more efficient than PVB in Financial Inclusion, while when profit maximisation is the sole motive, efficiency of the PVBs has always surpassed that of their public sector counterparts.

- However, when the objective function is changed to include financial inclusion—like total branches, agricultural advances and PSL advances— PSBs prove to be more efficient than PVBs (middle and bottom panel).

- PSBs are more efficient than PVB in Financial Inclusion, while when profit maximisation is the sole motive, efficiency of the PVBs has always surpassed that of their public sector counterparts.

- Relevance in Economy:

- The relevance of banking lies in knowing whether banks lend when borrowers need the money the most.

- Thus, PSBs have a lion’s share in infrastructure finance lendings and their role has been especially crucial against the backdrop of the withering away of erstwhile development financial institutions.

Way Forward

- There is a need for a nuanced approach and further, members of RBI’s Banking Research Division have warned against the conventional perspective of viewing privatisation as a panacea for all ills.

- The big bang approach of privatization of the public sector banks may do more harm than good as the repercussions could lead to the vulnerable population losing their financial inclusion and further making it difficult for them to access banking and related facilities.

- That’s why It is best to steer clear of an ideologically-driven stance and instead focus on achieving a mix of public and private banks that best serves the needs of a diverse economy such as India.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. With reference to the governance of public sector banking in India, consider the following statements: (2018)

- Capital infusion into public sector banks by the Government of India has steadily increased in the last decade.

- To put the public sector banks in order, the merger of associate banks with the parent State Bank of India has been affected.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

- The government has done capital infusion in state-owned banks to support credit expansion and to help them tide over losses resulting from the provisions that are to be made for non-performing assets (NPAs). But the capital infusion trend in state-owned banks has not been specific in a direction, like increasing or decreasing trend. While it has increased in some years, it has also decreased in a few years. Hence, statement 1 is not correct.

- Union Government in February 2017 had approved the merger of five associate banks along with the Bharatiya Mahila Bank with SBI. The purposes of the merger were rationalisation of public bank resources, reduction of costs, better profitability, and lower cost of funds leading to a better rate of interest to the public at large and improve productivity and customer service of the public sector banks. Parliament passed the State Banks (Repeal and Amendment) Bill, 2017 to merge six subsidiary banks with State Bank of India to affect rationalisation of public bank. Hence, statement 2 is correct.

- Therefore, option (b) is the correct answer.

Mains

Q. Pradhan Mantri Jan Dhan Yojana (PMJDY) is necessary for bringing the unbanked to the institutional finance fold.Do you agree with this for financial inclusion of the poorer section of the Indian society? Give arguments to justify your opinion (2016)