Indian Polity

SC to Hear Challenge on Designation of Bills as Money Bills

- 18 Oct 2023

- 7 min read

For Prelims: Supreme Court of India, Money Bills, Consolidated Fund of India, Types of Bills

For Mains: Indian Constitution, Features, Amendments, Significant Provisions, Judicial Review

Why in News?

A seven-judge Bench of the Supreme Court of India, led by the Chief Justice of India, addresses a request for priority to a reference concerning the manner in which the Centre got crucial amendments passed in the Parliament as Money Bills.

What are the Challenged Amendments Passed as Money Bills?

- Prevention of Money Laundering Act (PMLA) Amendments:

- Amendments made from 2015 onwards to the Prevention of Money Laundering Act (PMLA) granted the Enforcement Directorate extensive powers, including the authority to make arrests and conduct raids.

- The primary concern is the passage of these amendments as Money Bills, raising questions about their legality and constitutionality.

- Legal experts and petitioners question whether these significant changes should have followed the standard legislative process involving both houses of Parliament.

- Amendments made from 2015 onwards to the Prevention of Money Laundering Act (PMLA) granted the Enforcement Directorate extensive powers, including the authority to make arrests and conduct raids.

- Finance Act of 2017:

- The Finance Act of 2017 was categorized and passed as a Money Bill, raising concerns about the proper use of this legislative procedure.

- Allegations that the Act aimed to alter appointments to 19 key judicial tribunals, including the National Green Tribunal and Central Administrative Tribunal.

- Accusations that categorizing the 2017 Act as a Money Bill was a deliberate attempt to extend executive control over these tribunals.

- The Act's passage was accompanied by changes that substantially downgraded the qualifications and experience required to staff these key judicial bodies.

- Aadhaar Act, 2016:

- The Supreme Court in 2018, had ruled in favor of the government and had cleared the Aadhaar Act as a valid money bill under Article 110 of the Constitution.

- The government had argued that since the subsidies distributed through Aadhaar flows from the Consolidated Fund of India, the law is validly categorized as a Money Bill. which raised legal and procedural questions.

- Money Bills are exclusive to the Lok Sabha and limit the Rajya Sabha's influence.

- The government had argued that since the subsidies distributed through Aadhaar flows from the Consolidated Fund of India, the law is validly categorized as a Money Bill. which raised legal and procedural questions.

- Recently, the CJI, asked for a more comprehensive review.

- The Supreme Court in 2018, had ruled in favor of the government and had cleared the Aadhaar Act as a valid money bill under Article 110 of the Constitution.

What will be the Implications of the Larger Bench?

- Clarity on the constitutionality of the PMLA, Aadhaar Act, and Tribunal reforms.

- Determination of whether these laws were rightly categorized as money bills or used to circumvent Rajya Sabha scrutiny.

- Resolution of whether these classifications were legally sound or strategic manoeuvres to avoid oversight.

- The discussions within the larger bench might offer additional insights into the level of scrutiny that the judiciary can exercise over the Speaker's determinations in classifying bills as money bills.

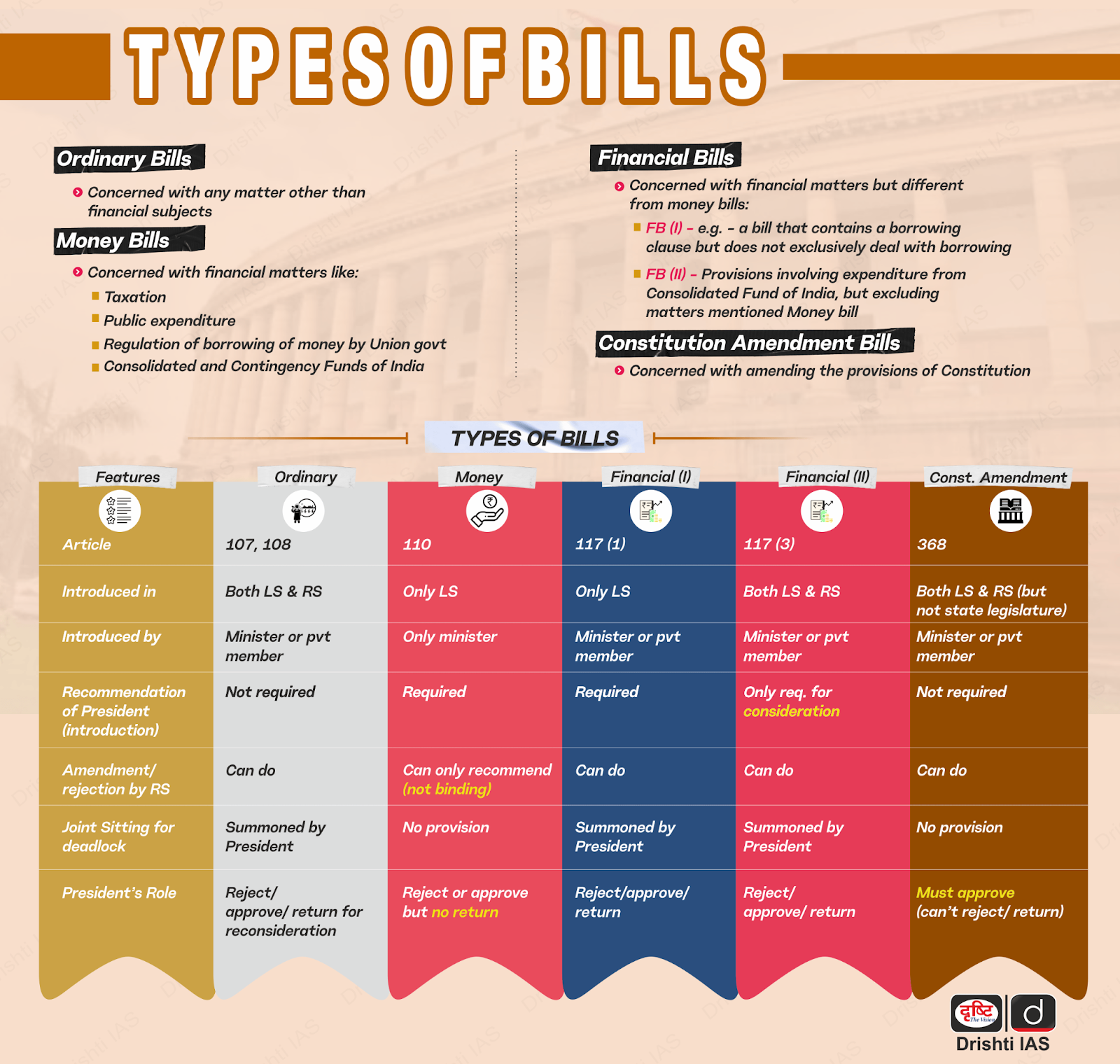

What is a Money Bill?

- Definition:

- A Money Bill is a financial legislation that contains provisions exclusively related to revenue, taxation, government expenditures, and borrowing.

- Constitutional Basis:

- Article 110(1), a Bill is deemed to be a money Bill if it deals only with matters specified in Article 110 (1) (a) to (g) — taxation, borrowing by the government, and appropriation of money from the Consolidated Fund of India, among others.

- Article 110(1)(g) adds that “any matter incidental to any of the matters specified in Articles 110(1)(a)-(f)” can also be a Money Bill.

- Article 110 (3) of the Constitution, “If any question arises whether a Bill is a Money Bill or not, the decision of the Speaker of the House of the People thereon shall be final.

- Article 110(1), a Bill is deemed to be a money Bill if it deals only with matters specified in Article 110 (1) (a) to (g) — taxation, borrowing by the government, and appropriation of money from the Consolidated Fund of India, among others.

- Procedure:

- Money Bills must be introduced in the Lok Sabha and cannot be introduced in the Rajya Sabha (the upper house).

- The Rajya Sabha can only make recommendations on a Money Bill but does not have the power to amend or reject it.

- President can either accept or reject a money bill but cannot return it for reconsideration.

- There is no provision for Joint sitting.

Legal Insights

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q1. Regarding the Money Bill, which of the following statements is not correct? (2018)

(a) A bill shall be deemed to be a Money Bill if it contains only provisions relating to the imposition, abolition, remission, alteration or regulation of any tax.

(b) A Money Bill has provisions for the custody of the Consolidated Fund of India or the Contingency Fund of India.

(c) A Money Bill is concerned with the appropriation of money out of the Contingency Fund of India.

(d) A Money Bill deals with the regulation of borrowing of money or giving of any guarantee by the Government of India.

Ans: (c)

Q2. What will follow if a Money Bill is substantially amended by the Rajya Sabha? (2013)

(a) The Lok Sabha may still proceed with the Bill, accepting or not accepting the recommendations of the Rajya Sabha.

(b) The Lok Sabha cannot consider the Bill further.

(c) The Lok Sabha may send the Bill to the Rajya Sabha for reconsideration.

(d) The President may call a joint sitting for passing the Bill.

Ans: (a)