Indian Economy

Challenges and Reforms in India’s Taxation System

For Prelims: Goods and Services Tax (GST), Taxes, Investments, Minimum Alternative Tax (MAT), Capital Gains Tax, Securities Transaction Tax, Corporate Tax, Dividends, 101st Amendment Act, 2016, GST Council, Vodafone International Holding Case, 2012, Input Tax Credit, Tax Evasion.

For Mains: GST, Challenges and reforms needed in India’s taxation system.

Why in News?

The current tax system, particularly under the Goods and Services Tax (GST) framework, retards growth that hinder business development, suppress consumption, and damage India’s investment reputation.

How is the Tax System in India?

- About taxes: Taxes are mandatory financial charges or levies imposed by a government on individuals, businesses, or property to fund public services and government operations.

- There is no quid pro quo between the tax payer and the public authority.

- The Tax System in India consists of a mix of Direct Taxes, Indirect Taxes and Other Taxes.

- Types of Taxes:

- Direct Taxes: They are paid by individuals or entities to the government and cannot be transferred to others.

- Indirect Taxes: They are levied on goods and services, collected by intermediaries from consumers at the point of sale, and remitted to the government.

- Other Taxes: These taxes are levied for specific purposes, often funding infrastructure or welfare programs.

- Direct Taxes:

- Income Tax: It is imposed on income that is progressive in nature, with different slabs for various taxpayer categories.

- Capital Gains Tax: Tax on gains from investments, with different rates for short-term and long-term holdings.

- Securities Transaction Tax: Tax on transactions involving securities in the stock market.

- Perquisite Tax: Tax on benefits provided by an employer to employees (e.g., housing, cars).

- Corporate Tax: Tax paid by companies on their earnings, with different slabs for various income levels.

- Minimum Alternative Tax (MAT): MAT ensures companies pay a minimum tax, set at 18.5%.

- Fringe Benefit Tax (FBT): Tax on non-cash benefits provided by employers (abolished in 2009).

- Dividend Distribution Tax (DDT): Tax on dividends paid by companies.

- Banking Cash Transaction Tax: Tax on banking transactions (abolished in 2009).

- Indirect Taxes:

- GST: A consumption-based tax on value-added goods and services (ad valorem tax), levied at each stage of the supply chain.

- It is regressive in nature as it is imposed at the same rate on all individuals irrespective of income.

- Value Added Tax (VAT): Tax on goods sold, applied at each stage of the supply chain. It is imposed on goods that are excluded from the GST regime like alcoholic beverages, petroleum products etc.

- Custom Duty & Octroi: Taxes on imported goods (Custom Duty) and on goods crossing state borders (Octroi).

- Excise Duty: Tax on goods manufactured within India.

- GST: A consumption-based tax on value-added goods and services (ad valorem tax), levied at each stage of the supply chain.

- Other Levies (Cess):

- Education Cess: A 2% tax to fund educational initiatives like developing classrooms, libraries, providing scholarships etc.

- Swachh Bharat Cess: Tax introduced in 2015 to fund cleanliness initiatives like Swachh Bharat Mission.

- Krishi Kalyan Cess: Tax introduced in 2016 to support agricultural welfare like irrigation projects, subsidized seeds etc.

What is the Goods and Services Tax (GST)?

- About: GST is a value-added tax applied to goods and services for domestic consumption.

- It is an indirect tax i.e., while consumers pay the GST, it is collected and remitted to the government by the businesses selling the goods and services.

- Legislative Basis: The 101st Amendment Act, 2016 established the GST system by introducing a single indirect tax regime for the entire country by subsuming various taxes.

- Central taxes subsumed under GST are Central Excise Duty, Additional Excise Duties, Service Tax, etc.

- State taxes subsumed under GST are State VAT (Value Added Tax), Central Sales Tax, Luxury Tax, etc.

- Main Features:

- Supply Side: GST applies to the supply of goods and services, unlike the old tax on manufacturing, sale, or provision.

- Destination-Based Taxation: GST follows destination-based consumption taxation, unlike the origin-based system.

- Dual GST: Both the Centre (CGST) and States (SGST) levy tax on a common base.

- Imports of goods or services are treated as inter-state supplies and are subject to Integrated Goods & Services Tax (IGST) along with applicable customs duties.

- GST Council: CGST, SGST, and IGST rates are mutually decided by the Centre and States, based on the GST Council's recommendations.

- Multiple Rates: GST is levied at five rates i.e., 0% (nil-rated), 5%, 12%, 18%, and 28%, with item classifications determined by the GST Council.

- GST Council: Article 279A establishes the GST Council, headed by the Union Finance Minister and comprising state-nominated ministers.

- The Centre holds 1/3rd voting power, while states have 2/3rd, with decisions made by a 3/4th majority.

What are the Challenges in the Current Taxation System?

- Retrospective Taxation: The 55th GST Council’s recommendation for a retrospective tax amendment is a regressive move that disregards Supreme Court (SC) rulings.

- The ill-advised retrospective amendment to nullify the Vodafone verdict resulted in an international penalty of Rs 8000 crore, which India had to pay.

- In 2014, the former Finance Minister Arun Jaitley termed retrospective taxation “tax terrorism”.

- This erodes investor confidence and discourages long-term investments, as companies cannot rely on consistent rules.

- The ill-advised retrospective amendment to nullify the Vodafone verdict resulted in an international penalty of Rs 8000 crore, which India had to pay.

- Revenue Maximisation: The GST Council’s single-minded focus on maximizing revenue results in arbitrary and exaggerated tax demands, leading to business frustration and inefficiencies.

- Input Tax Credit Denial: Denying businesses input tax credit, particularly in sectors like real estate, is economically detrimental.

- This increases the final price for consumers, distorts market competition, and dampens sectors that could stimulate growth.

- In the Chief Commissioner of Central Goods and Service Tax & Ors. Vs Safari Retreats Case, 2024, the SC ruled that the real estate sector can claim Input Tax Credit (ITC) on construction costs for commercial buildings used for renting or leasing purposes that was earlier not allowed.

- Complicated Tax Structure: The multiple tax rates in both indirect and direct taxes, complex tax notifications, complicated system of exemption and concessions, and circulars create an environment that benefits tax professionals rather than businesses.

- Low Direct Tax Collection: Corporations, particularly multinationals, use transfer pricing to shift profits from high-tax to low-tax jurisdictions, reducing their tax liabilities.

- Some corporations underreport their income or overstate their expenses to reduce their tax liability.

- Such low direct tax collection forces the government to generate revenues from other sources like high indirect tax rate, surcharge, and cess.

What are the Consequences of Complex Tax Structure?

- Imports Dependency: A burdensome tax system makes domestic manufacturing less competitive compared to imported goods, leading to over-reliance on foreign products.

- E.g., imports from China increased from USD 70 billion in 2018-19 to USD 100 billion in 2023-24.

- It also leads to inverted duty structure where the rate of tax on inputs used is higher than the rate of tax on the finished goods.

- The share of manufacturing in India’s GDP has fallen below 15%.

- Currency Depreciation: As businesses face higher costs, reduced competitiveness, and suppressed growth, it leads to weakening of the Indian rupee and escalating the trade deficit.

- It can lead to twin account deficits when a country has both a fiscal deficit and a current account deficit.

- Investment Discouragement: A complicated tax system, with unclear structures and retrospective amendments, creates uncertainty for investors and negatively impacts ease of doing business.

- Lower Revenue Collection: Businesses struggle to navigate the complex tax system, resulting in either underreporting or tax evasion.

- Lower revenue collection forces the government to resort to higher taxes to meet fiscal targets, which leads to a cycle of stagnation.

- Downward Economic Spiral: Lower growth, reduced investment, and rising imports create a vicious cycle that undermines long-term economic stability and perpetuates inefficiencies.

Way Forward

- Streamline GST: A more simplified and uniform tax rate structure should be introduced to ensure ease of doing business, especially in sectors like real estate and infrastructure.

- India must focus on simplifying the tax framework by rationalizing rates. E.g., three GST rates on popcorn i.e., Unlabelled (5%), Labelled ready-to-eat (12%) and Caramelized (18%).

- Tax Certainty: Avoid frequent amendments or arbitrary tax demands that are essential to establish clear and consistent tax rules.

- End retrospective taxation that has been detrimental to investor confidence.

- Optimize Revenue Collection: Leverage digital platforms and artificial intelligence to improve tax collection efficiency and prevent evasion.

- Technology can help in identifying tax anomalies, ensuring businesses report accurately, and preventing underreporting.

- Focus on Economic Growth: The tax system should prioritize long-term growth over revenue maximization, as a growth-oriented policy expands the tax base in the future.

- Improving Corporate Tax Collection: Conduct regular and thorough audits of corporate tax filings to identify potential underreporting, evasion, or fraud.

- Offer incentives like early payment discounts or lower penalties for early voluntary disclosures of tax errors or omissions to encourage companies to pay taxes on time.

|

Drishti Mains Question: Q. Analyze the impact of a complex taxation system on functioning of India's economy and suggest reforms to enhance its competitiveness. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q.Consider the following items: (2018)

- Cereal grains hulled

- Chicken eggs cooked

- Fish processed and canned

- Newspapers containing advertising material

Which of the above items is/are exempted under GST (Good and Services Tax)?

(a) 1 only

(b) 2 and 3 only

(c) 1, 2 and 4 only

(d) 1, 2, 3 and 4

Ans: (c)

Q. What is/are the most likely advantages of implementing ‘Goods and Services Tax (GST)’?(2017)

- It will replace multiple taxes collected by multiple authorities and will thus create a single market in India.

- It will drastically reduce the ‘Current Account Deficit’ of India and will enable it to increase its foreign exchange reserves.

- It will enormously increase the growth and size of the economy of India and will enable it to overtake China in the near future.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (a)

Mains

Q. Explain the rationale behind the Goods and Services Tax (Compensation to States) Act of 2017. How has COVID-19 impacted the GST compensation fund and created new federal tensions? (2020)

Q. Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (2019)

International Relations

Strengthening India-Indonesia Ties

For Prelims: Indonesia, Republic Day 2025, Comprehensive Strategic Partnership, Ex Garuda Shakti (Army), Ex Samudra Shakti (Naval), AITIGA, Local Currency Settlement Systems, Biofuels, Traditional Medicine, Digital Public Infrastructure, Quantum Communication, High-Performance Computing, Kashi Cultural Pathway, ASEAN Outlook on Indo-Pacific, NAM, 1955 Bandung Conference, ‘Look East’ Policy 1991, ‘Act East’ 2014 Policy, South China Sea, UNCLOS, BrahMos, Strait of Malacca, Panchashila.

For Mains: Evolution of India-Indonesia ties, Importance of Indonesia for India.

Why in News?

The President of Indonesia was the Chief Guest at India’s 76th Republic Day celebrations, marking the 75th anniversary of India-Indonesia diplomatic relations.

- Both countries signed several MoUs covering areas such as health cooperation, digital infrastructure, and defence collaboration.

What are the Key Highlights of the India-Indonesia Ties?

- Comprehensive Strategic Partnership: Both leaders reaffirmed their commitment to elevating the bilateral relationship, which was upgraded to a Comprehensive Strategic Partnership in 2018.

- Defence Cooperation: The leaders committed to strengthening defence ties through initiatives like Coordinated Patrol, Ex Garuda Shakti (Army), and Ex Samudra Shakti (Naval).

- Both agreed to establish Bilateral Maritime Dialogue and Cyber Security Dialogue.

- Trade Cooperation: Both nations aim to boost bilateral trade, which reached USD 38.8 billion in 2022-2023, and agreed to resolve trade barriers and expedite the AITIGA review.

- The MoU on Local Currency Settlement Systems aims to boost trade by enabling transactions in local currencies.

- Energy, and Health Security: Both nations are focusing on biofuels and joint exploration of critical minerals like nickel and bauxite.

- MoUs on Health Cooperation and traditional medicine Quality Assurance were signed, focusing on digital health and healthcare professional capacity-building.

- Technological Cooperation: India offered to share its expertise in Digital Public Infrastructure, Quantum Communication, and High-Performance Computing with Indonesia.

- Cultural Cooperation: India aims to assist in restoring the Prambanan Temple in Indonesia and reaffirmed the "Kashi Cultural Pathway" principles from the G20 Culture Ministers' Meeting.

- The Kashi Cultural Pathway aims to restore heritage structures and return cultural artifacts to their countries of origin.

- Multilateral Cooperation: Both countries emphasized the importance of ASEAN centrality and cooperation on regional issues like the ASEAN Outlook on Indo-Pacific, India-Indonesia-Australia Trilateral and Indo-Pacific Oceans Initiative (IPOI), BRICS and Indian Ocean Rim Association (IORA).

How India-Indonesia Ties Evolved Overtime?

- Early Post-Independence Period (1940s-1950s): India, under Prime Minister Jawaharlal Nehru, strongly supported Indonesia’s fight for independence from Dutch colonial rule.

- The two countries signed a Treaty of Friendship in 1951, and cooperation in trade, culture, and military matters flourished.

- Both nations aligned on non-alignment, anti-colonialism, and peaceful coexistence, leading to their active participation in the 1955 Bandung Conference and NAM's formation in 1961.

- Deterioration in Ties (1960s): Relations strained in the 1950s-60s as India’s ties with China worsened post-1959 uprising and Sino-Indian 1962 war, while Indonesia stayed cordial with China.

- In the 1960s, Indonesia sided with Pakistan during the 1965 India-Pakistan conflict, showing solidarity and providing military aid.

- Cold War Era (1966-1980s): Under President Suharto, Indonesia moved away from its previous alignment with China and sought to rebuild ties with India.

- Indonesia and India improved ties with key agreements like the 1977 maritime boundary pact and Suharto's 1980 visit to India.

- 'Look East' Policy 1991 (1990s): Under India’s ‘Look East’ policy 1991, trade grew and both nations evolved a comprehensive partnership covering economic, security, and cultural cooperation.

- India's 2014 ‘Act East’ 2014 policy strengthened ties with Southeast Asia, making Indonesia a key regional partner.

- Recent Developments (Since 2000s): Indonesia is now India’s 2nd largest trading partner in the ASEAN region (1st-Singapore), and trade has grown significantly from USD 4.3 billion in 2005-06 to USD 38.84 billion in 2022-23. Indian investments in Indonesia amount to USD 1.56 billion.

- India and Indonesia jointly called for resolving maritime disputes and finalizing the South China Sea Code of Conduct as per international law, including UNCLOS.

- Indonesia is negotiating with India to acquire the BrahMos missile system, with a broad agreement on pricing, estimated at USD 450 million.

Why is Indonesia Significant to India?

- Strategic Importance: Indonesia occupies a pivotal position in the Indo-Pacific region, with control over key sea lanes such as the Strait of Malacca, Sunda, and Lombok, making it a critical partner in ensuring maritime security and the free flow of trade in the region.

- Natural Resources: Indonesia, rich in resources like palm oil, tin, rubber, cocoa, coffee, nickel, copper, timber, gold, and coal, is a key supplier for global markets and offers opportunities for India in energy, agriculture, and infrastructure.

- Defense Cooperation: The potential USD 450 million BrahMos missile deal and growing defense ties highlight economic cooperation between Indonesia and India.

- Their defense partnership can address emerging challenges like cyber threats, maritime security, and counter-terrorism.

- Politics and Governance: Indonesia, with the world’s largest Muslim population, practices secularism through its unique Panchashila Constitution.

- Indonesia has effectively tackled terrorism through consistent police efforts, avoiding military force. India can learn from this approach, given the shared challenges both countries face.

- Global Influence: Indonesia's leadership in ASEAN strengthens its cooperation with India, crucial for regional stability and mutual interests.

- Indonesia, a regional pivot and emerging power in the Indo-Pacific, is a valuable partner for India.

Conclusion

Indonesia plays a vital role in India’s regional strategy, with strong ties in trade, defense, and maritime security. Both countries aim to deepen collaboration through technological, cultural, and multilateral efforts, bolstering their Comprehensive Strategic Partnership and reinforcing stability in the Indo-Pacific.

|

Drishti Mains Question: How has India-Indonesia cooperation evolved over time, and what is Indonesia's strategic importance in India's foreign policy today? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. In which one of the following groups are all the four countries members of G20? (2020)

(a) Argentina, Mexico, South Africa and Turkey

(b) Australia, Canada, Malaysia and New Zealand

(c) Brazil, Iran, Saudi Arabia and Vietnam

(d) Indonesia, Japan, Singapore and South Korea

Ans: (a)

Q. Consider the following countries: (2009)

- Brunei Darussalam

- East Timor

- Laos

Which of the above is/are member/members of ASEAN?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Mains

Q. Indian Diaspora has an important role to play in South East Asian countries’ economy and society. Appraise the role of Indian Diaspora in South-East Asia in this context. (2017)

Q. Explain the formation of thousands of islands in Indonesian and Philippines archipelagos. (2014)

Indian History

Iron Age and and Urbanization

For Prelims: Iron Age, Indus Valley Civilisation, Bronze Age, Arthashastra, NBPW Culture, Vindhyas, Megalithic Culture, Urbanization, Ganga Valley.

For Mains: Iron age in India, Role of iron technology in states formation and urbanisation

Why in News?

A report titled ‘Antiquity of Iron: Recent Radiometric Dates from Tamil Nadu’, claims that use of iron in Tamil Nadu dates back to the first quarter of the 4th millennium BCE.

- The Iron Age in India is believed to have emerged between 1500 and 2000 BCE, closely following the Indus Valley Civilisation (Bronze Age).

What is the Iron Age?

- About: The Iron Age is a prehistoric period that followed the Bronze Age, characterized by the widespread use of iron for tools, weapons, and other implements.

- Iron metallurgy involves multiple stages, including ore procurement and manufacturing tools.

- Antiquity of Iron in India:

- Rigvedic Period: No knowledge of iron was recorded.

- Early Historic Period: References to iron smithing are found in early Buddhist literature and Kautilya’s Arthashastra.

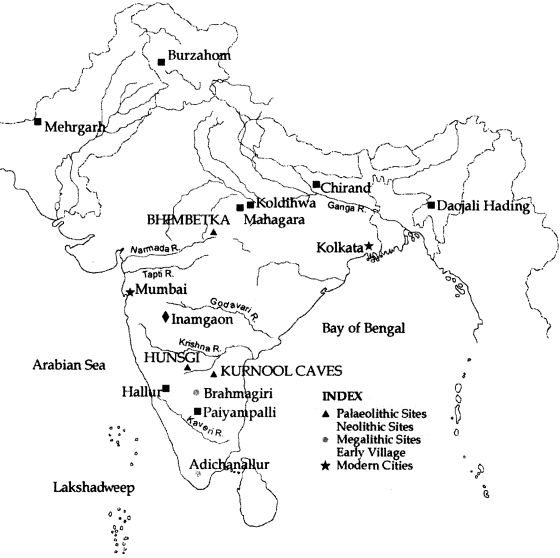

- Significant Excavation Sites:

- Raja Nal Ka Tila (North-Central India): Iron tools and slag found in pre-NBP (Northern Black Polished) deposits (1400–800 BCE).

- Malhar (Chandauli, Uttar Pradesh): Evidence of iron tools, furnaces, and slag indicates it was an important iron metallurgy center.

- Cultural Associations:

- Black-and-Red Ware (BRW): Characterized by distinctive pottery with black interiors and red exteriors due to inverted firing techniques.

- It is found in Harappan context (Gujarat), Pre-PGW context (northern India), and Megalithic context (southern India).

- Painted Grey Ware (PGW) Culture: Characterized by grey pottery with black geometric patterns.

- Iron reported at multiple sites in the Ganga valley and South Indian Megaliths (1st millennium BCE).

- Northern Black Polished Ware (NBPW) Culture: Wheel-made pottery which is fine, black, and highly polished. Significant in north India.

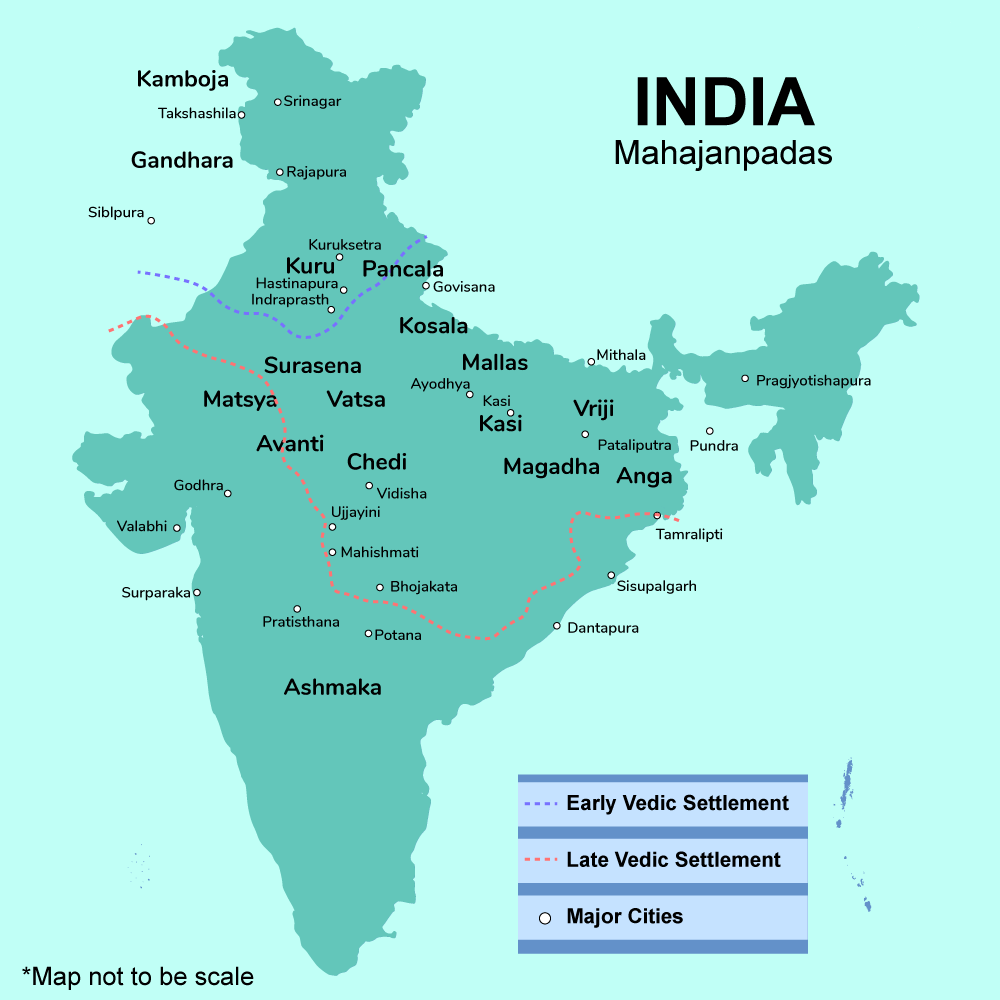

- During 700 BCE-100 BCE (NBPW Culture period), the formation of states and emergence of urbanism in the Ganga valley crystallized.

- NBPW Culture was associated with 2nd Urbanization in the Ganga Valley (6th century BCE) during which Buddhism flourished.

- Ahar Chalcolithic Culture:

- Middle phase (2500–2000 BCE): Evidence of iron artifacts.

- Late phase (2000–1700 BCE): Iron usage became more prominent.

- Megalithic Culture: Megaliths (large stones used to construct a prehistoric structure), linked to iron, are found in the Vindhyas (southern Uttar Pradesh), Vidisha region, and much of South India.

- Black-and-Red Ware (BRW): Characterized by distinctive pottery with black interiors and red exteriors due to inverted firing techniques.

Megalithic Culture Relationship with Iron

- Megalithic Culture: It is a prehistoric phase marked by large stone structures used for burials, sacred spaces, and rituals.

- The Megalithic culture in south India is closely associated with the beginning of iron usage.

- Iron Uses: Around 33 types of iron tools have been identified from Megalithic burials. These served various purposes:

- Agriculture: Hoes, sickles, and axes.

- Domestic use: Dishes and tripod stands.

- Artisanal activities: Chisels and nails.

- War and hunting: Swords, daggers, spears, and arrowheads.

- Notable Evidence of Iron Use:

- Naikund (Vidarbha): Discovery of an iron smelting furnace.

- Mahurjhari (Nagpur): Head ornaments for horses made of copper sheets with iron knobs.

- Paiyampalli (Tamil Nadu): Large quantities of iron slag, indicating local iron smelting.

- Advancements in Iron Technology: People learned to control fire and extract iron from ore, marking a key technological advance.

How Iron Technology Helped in Urbanization in the Ganga Valley?

- About Urbanization: According to historian, and archaeologist Gordon V. Childe, urbanization relies on surplus production, leading to ruling classes, social stratification, and monumental architecture.

- It refers to the shift from agriculture-based economies to industries, services, and trade as the primary sources of income.

- Role of Iron Technology: The 2nd Urbanization in the Ganga Valley (6th century BCE) was marked by the proliferation of settlements and Iron technology played a pivotal role by:

- Clearing Forests: Iron tools enabled deforestation, creating arable land.

- Boosting Agricultural Productivity: Iron plows enhanced efficiency and yields.

- Agricultural Surplus: Increased productivity supported large populations and complex societies.

- The first urbanization (2500 and 1900 BCE) in India was during the Indus Valley Civilization.

- Impact on Urbanization: It led to development of 16 Mahajanapadas in the Indian subcontinent.

- Population Growth: The agricultural surplus facilitated population growth, essential for the development of urban centers.

- Development of Settlements: Settlements grew in number and complexity, showing a clear hierarchy.

- Social Stratification and State Formation: Surplus production enabled the emergence of ruling classes, social hierarchy (e.g., varna system), and centralized power structures.

- Trade and Craft Specialization: Surplus allowed people to engage in non-agricultural activities like trade and crafts, leading to economic diversification and urban growth.

Conclusion

Iron technology played a crucial role in the development of urban centers in ancient India, especially in the Ganga Valley. It boosted agricultural productivity, supported population growth, and enabled the rise of social hierarchies and state formation, marking a significant shift towards urbanization during the second urbanization phase.

|

Drishti Mains Question: Q. Discuss the role of iron technology in the urbanization of the Ganga Valley. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q.With reference to the difference between the culture of Rigvedic Aryans and Indus Valley people, which of the following statements is/are correct? (2017)

- Rigvedic Aryans used the coat of mail and helmet in warfare whereas the people of Indus Valley Civilization did not leave any evidence of using them.

- Rigvedic Aryans knew gold, silver and copper whereas Indus Valley people knew only copper and iron.

- Rigvedic Aryans had domesticated the horse whereas there is no evidence of Indus Valley people having been aware of this animal.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Q. Which of the following Kingdoms were associated with the life of the Buddha? (2014)

- Avanti

- Gandhara

- Kosala

- Magadha

Select the correct answer using the code given below:

(a) 1, 2 and 3

(b) 2 and 4

(c) 3 and 4 only

(d) 1, 3 and 4

Ans: (c)

Mains

Q. The ancient civilization in the Indian sub-continent differed from those of Egypt, Mesopotamia and Greece in that its culture and traditions have been preserved without a breakdown to the present day. Comment. (2015)

Biodiversity & Environment

Rat-Hole Mining

For Prelims: Rat-Hole Mining, National Green Tribunal (NGT), Article 371A, Rat-Hole Mining, Coal

For Mains: Article 371A limitations and challenges, Sustainable mining practices, Rat-Hole Mining, Environmental pollution and degradation

Why in News?

The rat-hole mining tragedy in Assam's Dima Hasao district, where nine miners were trapped after a flood in an illegal coal mine, highlights the persistent dangers of unregulated mining despite existing bans.

- Also, biomining is being conducted at the Koottupatha trenching ground in Palakkad, Kerala.

What is Rat-hole Mining?

- About:

- Rat-hole mining is a primitive, crude, labor-intensive and hazardous method of coal mining.

- It involves digging of very small tunnels, usually only 3-4 feet deep and 2 to 3 feet wide into the ground, in which workers, more often children, enter and extract coal.

- It is typically practiced in northeastern India, particularly in Meghalaya and Assam.

- Methods of Extraction:

- Side-Cutting Procedure: This involves digging narrow tunnels into hill slopes to access thin coal seams, usually less than 2 meters in height, found in the region's hilly terrain.

- Box-Cutting: In this method, a rectangular opening is first created, followed by digging a vertical pit.

- Horizontal tunnels, resembling rat holes, are then dug for coal extraction.

- Reasons for Rat-Hole Mining:

- Poverty: Due to limited livelihood options, local tribal communities often turn to rat-hole mining as a means of survival.

- The immediate financial gain from selling extracted coal, despite the high risks, is a significant pull for those struggling economically.

- Land Ownership Issues: Ambiguities in land titles and lack of proper regulation create opportunities for illegal mining operations to exploit gaps in governance and persist without accountability.

- Coal Demand: Continuous demand for coal, both legal and illegal, sustains the practice.

- Middlemen and illegal traders further perpetuate this cycle by creating a market for unlawfully mined coal.

- Poverty: Due to limited livelihood options, local tribal communities often turn to rat-hole mining as a means of survival.

What are the Challenges Associated with Rat-hole Mining?

- Safety Hazards: The narrow tunnels are prone to collapses, often trapping miners, while poor ventilation leads to suffocation. The lack of safety measures results in frequent accidents, injuries, and life-threatening diseases.

- Eg: The 2024 Wokha mine explosion in Nagaland claimed 6 lives, while the 2018 Ksan mine flooding in Meghalaya resulted in the deaths of 17 miners.

- Environmental Impact: Rat-hole mining contributes to deforestation, soil erosion, and water contamination.

- Improper waste disposal from mining operations leads to acidic runoff (Acid Mine Drainage, or AMD), which degrades water quality and harms biodiversity in surrounding ecosystems.

- Eg: In Meghalaya, AMD turned rivers like Lukha acidic, while in Nagaland, mining degraded fertile lands and polluted water in Wokha and Mon districts.

- Social Issues: It causes exploitation of child labor and poorly paid workers. Also, leads to displacement of local communities.

- Reports by NGO Impulse revealed that 70,000 child labor, primarily from Bangladesh and Nepal, were employed in mines due to their small size for navigating narrow tunnels.

How is Rat Hole Mining Regulated?

- Regulation in India:

- Status in India:

- Rat hole mining is illegal and falls under the jurisdiction of the State/District administration to address as a law and order issue.

- Ban by the National Green Tribunal (NGT):

- In 2014, the National Green Tribunal (NGT) banned rat-hole mining due to numerous incidents of fatalities, particularly during the monsoon season.

- The Supreme Court of India, in July 2019, upheld the ban on rat hole mining in Meghalaya, originally imposed by the NGT in 2014.

- SC ruled that such mining is illegal under the Mines and Minerals (Development and Regulation) Act, 1957.

- Regulation of Rat-Hole Mining in Nagaland: The Nagaland Coal Policy, 2006 regulates rat-hole mining by granting Small Pocket Deposit Licences (SPDLs) to individual landowners under strict conditions.

- Article 371A also provides Nagaland with autonomy to protect land, resources, and customary laws, creating legal hurdles in regulating mining practices.

- Sixth Schedule: The Sixth Schedule grants autonomy to tribal areas in Meghalaya, Mizoram, Tripura, and Assam through Autonomous District Councils (ADCs), complicating mining regulation.

- Local tribal communities own both land and minerals, limiting central oversight and enforcement of national mining and environmental laws.

- ADCs' authority to legislate on land and resources often conflicts with central regulations under the MMDR Act, 1957, creating regulatory ambiguities.

- Status in India:

- International Context: There's no specific international law directly addressing rat-hole mining.

- However, international regulations promote sustainable mining methods and prioritise worker safety, indirectly influencing member states to adopt similar practices.

What is Biomining?

- About:

- Biomining refers to the extraction of metals from ores and other solid materials using microorganisms such as bacteria, archaea, fungi, or plants.

- It is an eco-friendly technique that can also be applied to remediate sites polluted by metal contaminants.

- It extracts metals by oxidising them, making them more soluble and easier to recover. The two main processes are:

- Bioleaching: Microorganisms directly dissolve the target metal from its ore for easier extraction.

- Biooxidation: Microbes break down surrounding minerals, enriching the target metal and facilitating its extraction.

- Metals Extracted via Biomining

- Biomining primarily extracts metals like copper, uranium, nickel, and gold, typically found in sulfidic minerals.

- Advantages of Biomining:

- Environmental Sustainability: Minimal hazardous waste and reduced carbon footprint compared to traditional mining.

- Energy Efficiency: Requires less energy, lowering greenhouse gas emissions.

- Reduced Water Usage: Uses water more efficiently, beneficial in water-scarce areas.

- Challenges of Biomining:

- Slower Extraction Rates: Biomining tends to be a slower process compared to conventional mining, making it less suitable for large-scale operations.

- Limited Scope: Not all ores are suitable for biomining, particularly those that do not contain metals that are easily oxidized by microorganisms.

- Technical Challenges: The process requires specialized knowledge of microbiology and may involve complex operational conditions, making it more difficult to scale up.

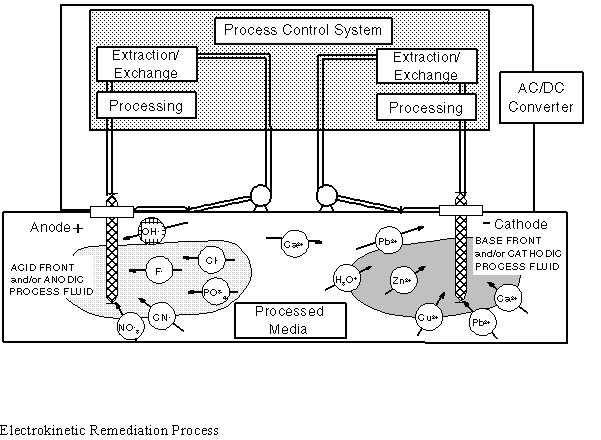

Electrokinetic Technology

- About:

- Electrokinetic Mining (EKM) is an innovative, eco-friendly technique for extracting rare earth elements.

- It uses an electric field to mobilize ions from in-adsorption rare earth deposits (IADs) and extract them efficiently.

- Significance:

- It reduces leaching agent usage by 80% and energy consumption by 60%, achieving a recovery rate of over 95%, marking a significant breakthrough in sustainable mining.

- This innovation simultaneously minimizes environmental impacts and enhances the recovery of rare earth elements (REEs).

|

Drishti Mains Question: Examine the environmental and safety challenges posed by rat-hole mining in India. Propose measures to mitigate these issues and promote sustainable mining practices. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. “In spite of adverse environmental impact, coal mining is still inevitable for development”. Discuss.(2017)

Important Facts For Prelims

Indore and Udaipur Joined Wetland Accredited Cities

Why in News?

Indore and Udaipur have become the first Indian cities to gain international recognition as accredited wetland cities under the Ramsar Convention.

- Currently, 85 Indian wetlands are protected under the Ramsar Convention, which includes 172 member countries globally.

What are Wetland Accredited Cities?

- About: It is an international recognition for cities committed to conserving and sustainably managing their wetlands.

- It recognises urban areas that protect wetlands, ensuring they provide essential services to the environment and communities.

- Accreditation Criteria: It is granted to cities that meet six international criteria, primarily focusing on the conservation of wetland ecosystems and their services.

- Accredited cities are recognised for their efforts to balance urban development with ecological preservation.

- 6 International Criteria are:

- Global Recognition: The highest number of accredited cities come from China (22 cities), followed by France (9 cities) reflecting the city's effort to integrate wetland conservation into urban planning.

- Global Ramsar Sites: There are currently over 2,400 Ramsar Sites around the world covering over 2.5 million square kilometres.

Note: Bhopal, another city nominated from India, did not receive accreditation due to concerns raised about potential ecological damage from a proposed road project affecting the Bhoj Wetland.

- Udaipur, Rajasthan is known as the City of Lakes because of its scenic lakes that are spread throughout the city. Key lakes in Udaipur include Lake Pichola, Fatehsagar Lake, Swaroop Sagar Lake etc.

- Famous lakes in Indore include Lotus lake, Choral dam, Pipliyapala lake, Sirpur lake etc.

What are Key Facts About Bhoj Wetland?

- About: It is a Ramsar site designated in 2002 that comprises two interconnected man-made reservoirs i.e., the Upper Lake (created by Raja Bhoj in the 11th century on Kolans River) and the Lower Lake.

- Upper Lake borders Van Vihar National Park.

- Biodiversity:

- Avifauna (Birdlife): Notable species include Coot (Fulica atra), Red-Crested Pochard, Sarus Crane, Black-necked Stork and Pallas’s Fish Eagle.

- Other Fauna: Van Vihar National Park provides a sanctuary for large mammals like Chital, Wild Boar, Nilgai, and Sambar.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. If a wetland of international importance is brought under the ‘Montreux Record’, what does it imply?(2014)

(a) Changes in ecological character have occurred, are occurring or are likely to occur in the wetland as a result of human interference

(b) The country in which the wetland is located should enact a law to prohibit any human activity within five kilometres from the edge of the wetland

(c) The survival of the wetland depends on the cultural practices and traditions of certain communities living in its vicinity and therefore the cultural diversity therein should not be destroyed

(d) It is given the status of ‘World Heritage Site’

Ans: (a)

Important Facts For Prelims

NGO Regulation Under FCRA

Why in News?

The Ministry of Home Affairs (MHA) warns NGOs using foreign funds without a valid FCRA license will face penalties under the FCRA, 2010 amended in 2020.

What is Foreign Contribution Regulation Act?

- About: The FCRA, enacted in 1976 during the Emergency, governs the acceptance and utilization of foreign contributions by individuals, associations, and organizations in India.

- It ensures that such contributions are used only for legitimate purposes and do not compromise national interest.

- Amendments: It was amended in 2010 and 2020 to ensure transparency and prevent misuse of foreign contributions in India.

- Validity and Renewal: FCRA registration is valid for five years, with NGOs needing to apply for renewal six months before expiry.

- Amendments Made in 2020:

- Suspension: MHA is empowered to suspend an NGO's FCRA registration for up to 360 days if it is found in violation of the FCRA, 2010.

- Aadhaar identification was made mandatory for all office-bearers, directors, or key functionaries of NGOs.

- Bar on Public Servants: The amendment prohibits public servants from receiving foreign contributions.

- Administrative Expenses: NGOs are now restricted to using a maximum of 20% of foreign funds for administrative purposes.

- Earlier, they could use up to 50% for administrative expenses.

- Prohibition on Sub-Granting: NGOs receiving foreign funds are prohibited from transferring these funds to other NGOs or entities.

- Designated Bank Account: NGOs are required to open a designated FCRA account exclusively at a branch of the State Bank of India (SBI) in New Delhi.

- Suspension: MHA is empowered to suspend an NGO's FCRA registration for up to 360 days if it is found in violation of the FCRA, 2010.

- Prohibited Activities: The applicant must not represent fictitious entities or engage in religious conversions.

- They should have no history of communal tension, disharmony, or seditious activities.

- The FCRA bars foreign funds for candidates, journalists, media, judges, government servants, politicians, and political organizations.

Rapid Fire

Supreme Court of India Foundation Day

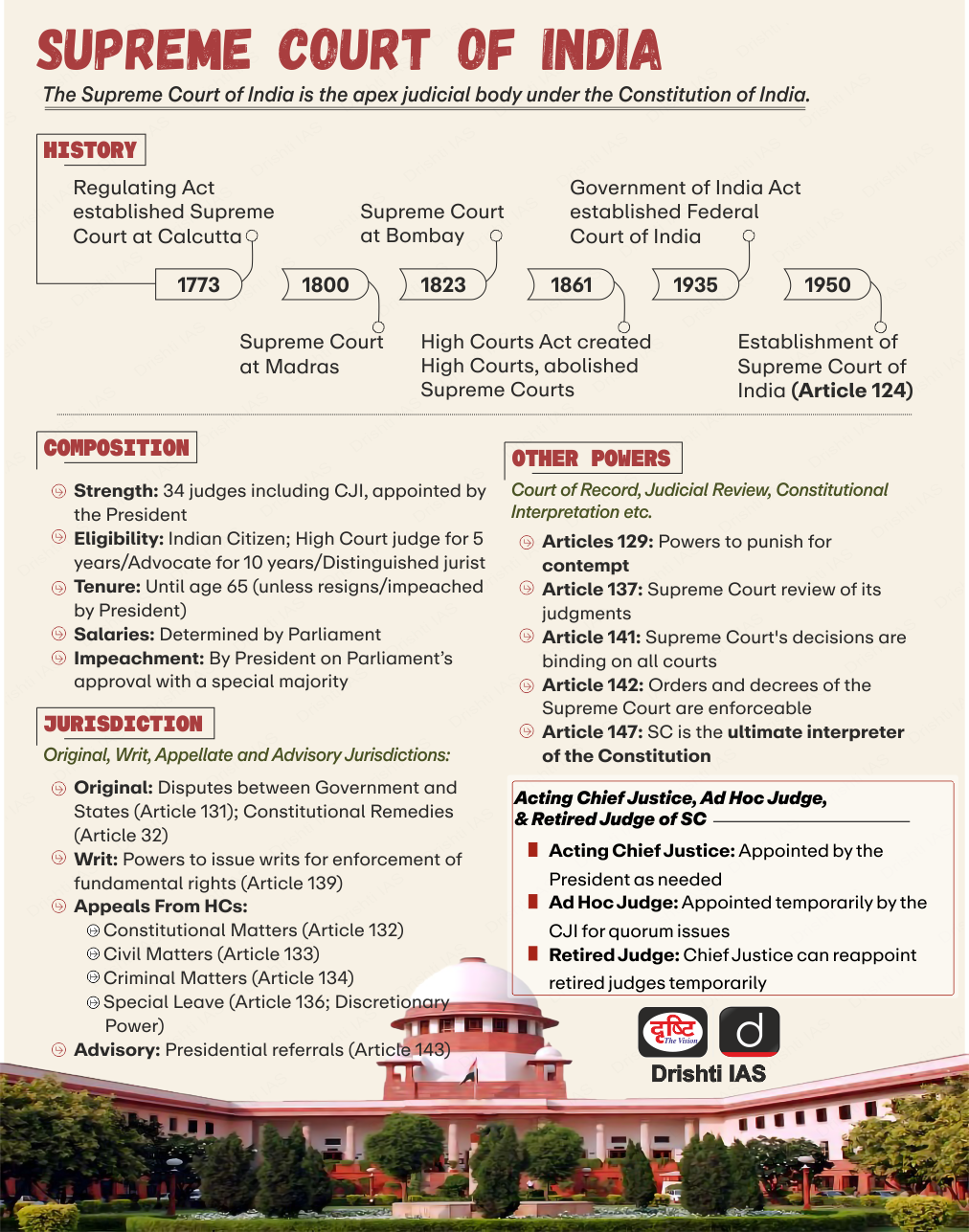

The Supreme Court (SC) of India, established on 26th January 1950 under Article 124, was inaugurated on 28th January 1950 and began operations from the old Parliament House. It moved to its current building in 1958, inaugurated by President Dr. Rajendra Prasad.

- SC initially envisioned with a Chief Justice of India (CJI) and 7 puisne judges, its strength has since expanded to a CJI and 33 judges as of 2024, appointed by the President and retiring at 65.

- Eligibility includes being an Indian citizen with 5 years as a High Court judge, 10 years as an advocate, or is in the opinion of the President a distinguished jurist.

- In 2024, a new "Lady Justice" statue was unveiled at the SC, replacing the original. Dressed in a saree and without a blindfold, it holds scales and the Indian Constitution.

- Unlike the original, based on Justitia (Roman goddess) with a blindfold, scales, and a sword, the new statue's open eyes signify that the law is not blind and sees everyone equally.

- The Indian Constitution replaces the sword, emphasizing its supremacy in justice.

- In 2024, the new flag and insignia of the SC are unveiled to mark its 75th year. The flag features the Ashok Chakra, the SC building, and the Book of Constitution, with the insignia inscribed with “Yato Dharmastato Jayah,” meaning "Where there is Dharma, there is victory."

Read more: 75 Years of Supreme Court

Rapid Fire

PM YASASVI Scheme

The Ministry of Social Justice and Empowerment addressed student beneficiaries of the PM Young Achievers Scholarship Award Scheme for Vibrant India (PM-YASASVI) scheme on Republic Day 2025.

- PM-YASASVI Scheme:

- About: Launched by the Ministry of Social Justice and Empowerment, it provides financial aid for quality education to marginalized students.

- Eligibility: It is open to OBC, Economically Backward Classes (EBC), and DNT students with family income up to Rs 2.5 lakh per annum.

- Sub-Schemes: It is an umbrella scheme consisting of sub-schemes like:

- Pre-Matric Scholarship: Rs. 4,000 annual academic allowance to families with income below Rs. 2.5 lakh.

- Post-Matric Scholarship: Rs. 5,000 to Rs. 20,000 depending on the course category.

- College Education: Top college students get full financial support, including tuition, living expenses, and education materials.

- Hostels: Accommodation facility near government schools and institutions.

- Other Similar Schemes: National Scholarships for Disabled Students, INSPIRE Scholarship, Maulana Azad National Fellowship.

Read More: Scholarship Schemes in India

Rapid Fire

Essential Religious Practice

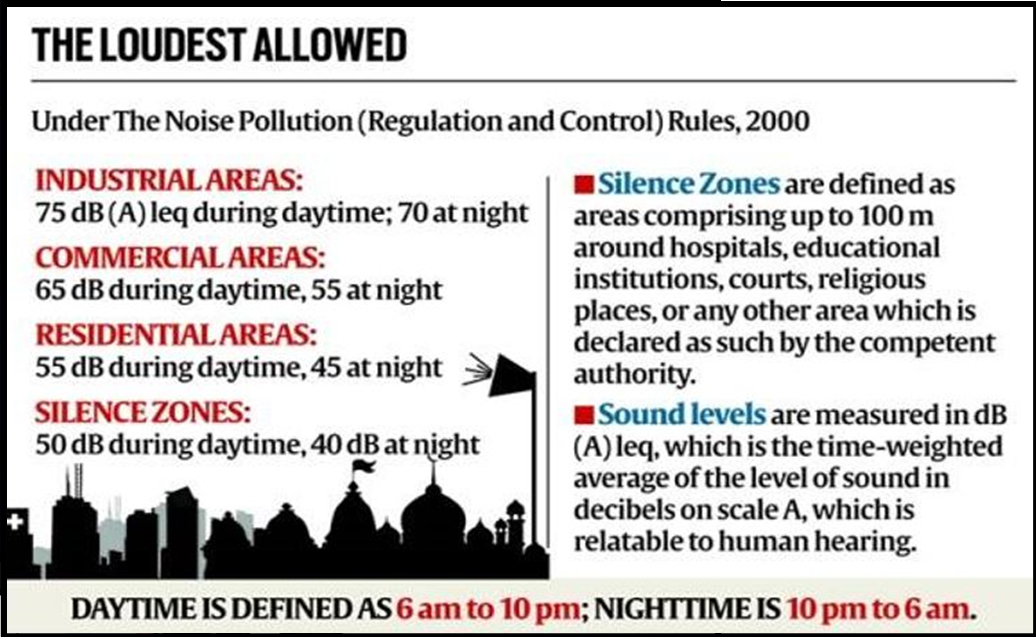

- The Bombay High Court ruled that using loudspeakers is not an essential religious practice protected under Article 25 or Article 19(1)(a) of the Constitution.

- Essential Religious Practice (ERP): ERP refers to practices integral to a religion's doctrine, protected under Article 25. The judiciary determines ERP based on religious tenets.

- Santhara (Sallekhana): In 2015, the Rajasthan High Court ruled Santhara as non-essential to religion, but the Supreme Court stayed the order, allowing the practice to continue.

- Triple Talaq Case: The SC invalidated instant triple talaq, ruling it was not an essential Islamic practice and violated women's rights.

- HC Ruling Related to Loudspeaker: Bombay HC in Dr Mahesh Vijay Bedekar v Maharashtra case, 2016, ruled for strict enforcement of noise pollution rules.

- It clarified that loudspeakers are not essential to religion and banned their use from 10 pm to 6 am and in silence zones, with exceptions for specific cultural or religious events (15 days/year).

- Noise is considered as an "air pollutant” and regulated under the Air (Prevention and Control of Pollution) Act, 1981.

- It mandates a maximum noise level of 55 decibels in residential areas during the day and 45 decibels at night.

Read More: Supreme Court on Religious Practices

Rapid Fire

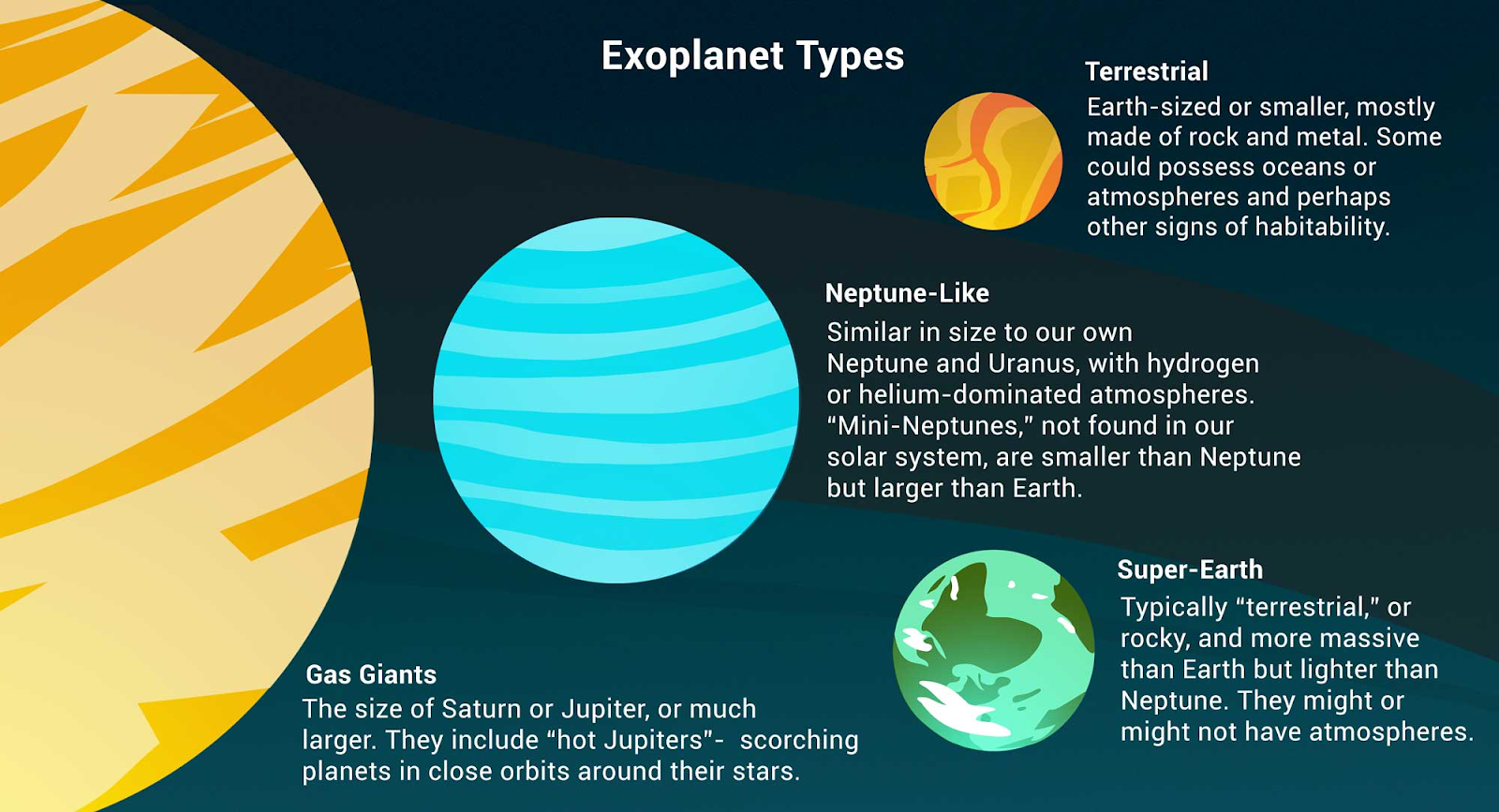

Exoplanet WASP-127b

Astronomers have discovered extreme wind speeds of up to 33,000 km/h on the exoplanet WASP-127b, a gas giant located about 520 light years from Earth.

- These winds move at around 6 times the speed of the planet's rotation, which is the fastest observed on any planet.

WASP-127b

- About:

- Orbit:

- The planet orbits its star closely, completing an orbit every 4 days, resulting in extreme temperature differences between its day side (constantly exposed to stellar radiation) and its night side (perpetually in darkness).

- Atmosphere:

- The atmosphere consists of hydrogen, helium, and traces of carbon monoxide and water. The day side temperature reaches 1,127°C, with the night side also heated by stellar radiation (Electromagnetic Radiation emitted by stars).

Read More: Exoplanet