Indian Economy

45th GST Council Meeting

- 22 Sep 2021

- 4 min read

Why in News

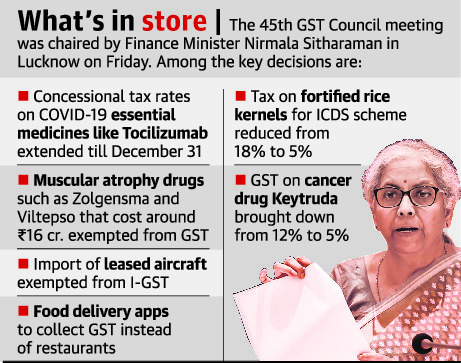

Recently, the 45th Goods and Services Tax (GST) Council meeting was held.

Key Points

- Extension of Concessional GST Rates:

- The Council decided to extend the GST relief on several drugs related to Covid-19 treatment till December 2021.

- Food Delivery Apps to Collect GST:

- Online food delivery aggregator firms such as Swiggy and Zomato will now be liable to pay GST and not the restaurant partners.

- Currently, online bills generated by food aggregators already have a tax component in it.

- The taxed amount is paid back to the restaurant partners who are then expected to pay this amount to the government.

- Online food delivery aggregator firms such as Swiggy and Zomato will now be liable to pay GST and not the restaurant partners.

- Petrol and Diesel will not come under GST Regime:

- The council has decided not to bring petrol and diesel under the GST regime. States vehemently opposed the inclusion of the fuels while raising concerns on revenue buoyancy during the meet.

- If petrol and diesel come under the GST regime, prices will become mostly uniform across all states as the different excise and VAT rates that the Centre and the states impose would then be done away with.

- This would help bring down diesel and petrol prices greatly, which has touched new highs in the recent past.

- The council has decided not to bring petrol and diesel under the GST regime. States vehemently opposed the inclusion of the fuels while raising concerns on revenue buoyancy during the meet.

- GST on Fortified Rice Reduced:

- The GST rate on fortified rice kernels for schemes like integrated child development schemes has been recommended to be reduced from 18% to 5%.

- GoM to Look After Rate Rationalisation:

- A Group of state ministers (GoM) will be established to look after the rate rationalisation related issues to correct the inverted duty structure and to take steps to augment revenues.

- An inverted duty structure arises when the taxes on output or final product is lower than the taxes on inputs, creating an inverse accumulation of input tax credit which in most cases has to be refunded.

- Inverted duty structure has implied a stream of revenue outflow for the government prompting the government to relook the duty structure.

- Other GoMs will be set up in order to look after issues of e-way bills, FASTAGs, compliances, technology, plugging of loopholes, composition schemes etc.

- A Group of state ministers (GoM) will be established to look after the rate rationalisation related issues to correct the inverted duty structure and to take steps to augment revenues.

GST Council

- It is a constitutional body (Article 279A) for making recommendations to the Union and State Government on issues related to Goods and Services Tax.

- The GST Council is chaired by the Union Finance Minister and other members are the Union State Minister of Revenue or Finance and Ministers in-charge of Finance or Taxation of all the States.

- It is considered as a federal body where both the centre and the states get due representation.