Indian Economy

Goods and Services Tax Council

- 30 Jun 2022

- 10 min read

For Prelims: GST Council, One Nation One Tax

For Mains: Significance and Challenges associated with GST

Why in News?

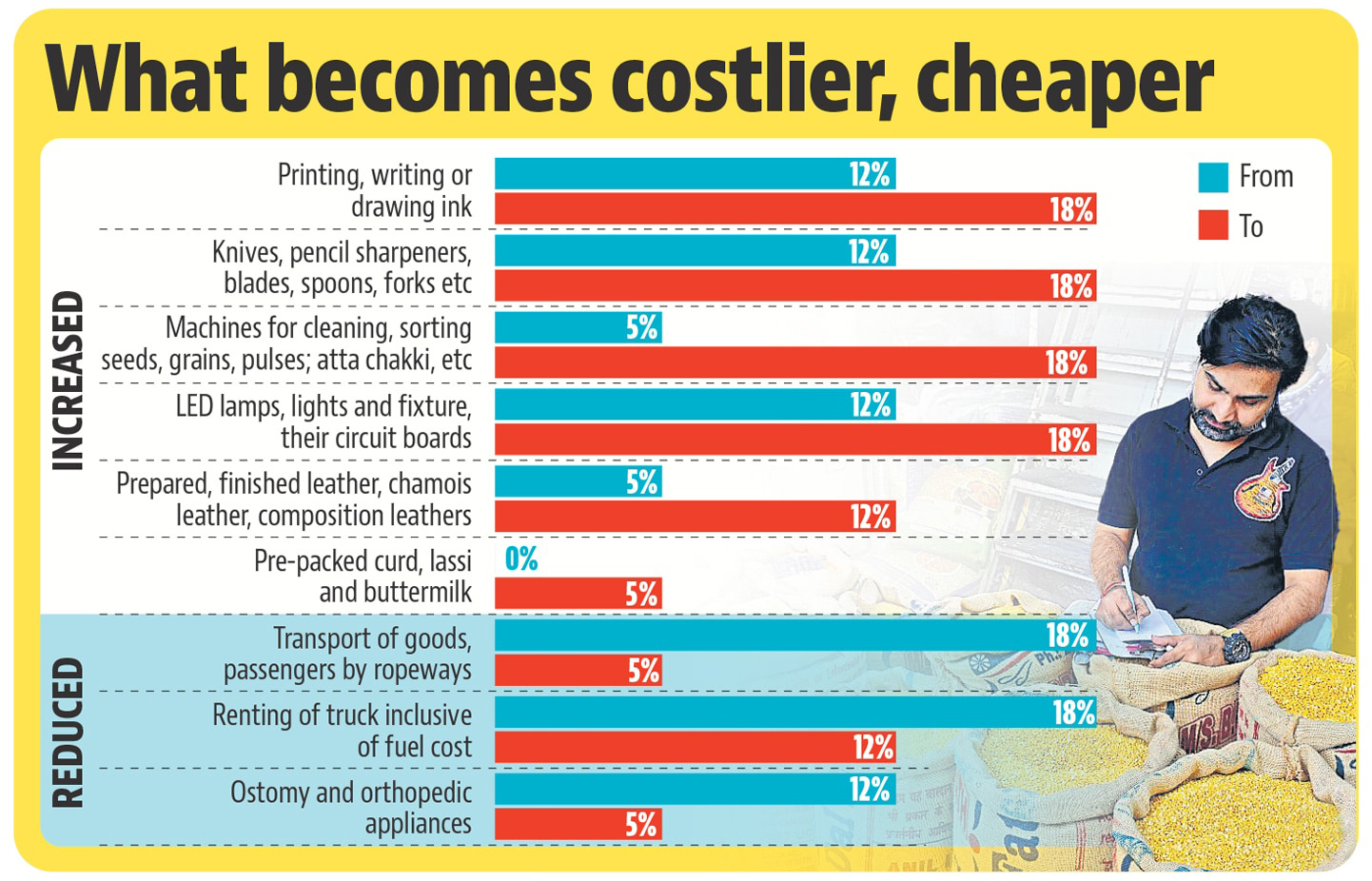

Recently, at the 47th meeting of the Goods and Services Tax (GST) Council, chaired by Union Finance Minister, officials approved hiking the rates for some goods and services while removing exemptions for several mass consumption items to simplify the rate structure.

What is the GST Council?

- Background:

- The Goods and Services Tax regime came into force after the Constitutional (122nd Amendment) Bill was passed by both Houses of Parliament in 2016.

- More than 15 Indian states then ratified it in their state Assemblies, after which the President gave his assent.

- About:

- The GST Council is a joint forum of the Centre and the states.

- It was set up by the President as per Article 279A (1) of the amended Constitution.

- Members:

- The members of the Council include the Union Finance Minister (chairperson), the Union Minister of State (Finance) from the Centre.

- Each state can nominate a minister in-charge of finance or taxation or any other minister as a member.

- Functions:

- The Council, according to Article 279, is meant to “make recommendations to the Union and the states on important issues related to GST, like the goods and services that may be subjected or exempted from GST, model GST Laws”.

- It also decides on various rate slabs of GST.

- For instance, an interim report by a panel of ministers has suggested imposing 28 % GST on casinos, online gaming and horse racing.

- Recent Developments:

- This is the first meeting since a decision of the Supreme Court in May 2022, Supreme Court stated that the recommendations of the GST Council are not binding.

- The court said Article 246A of the Constitution gives both Parliament and state legislatures “simultaneous” power to legislate on GST and recommendations of the Council “are the product of a collaborative dialogue involving the Union and States”.

- This was hailed by some states, such as Kerala and Tamil Nadu, who believe states can be more flexible in accepting the recommendations as suited to them.

What is Goods and Services Tax?

- About:

- GST was introduced through the 101st Constitution Amendment Act, 2016.

- It is one of the biggest indirect tax reforms in the country.

- It was introduced with the slogan of ‘One Nation One Tax’.

- The GST has subsumed indirect taxes like excise duty, Value Added Tax (VAT), service tax, luxury tax etc.

- It is essentially a consumption tax and is levied at the final consumption point.

- Tax Structure under GST:

- Central GST to cover Excise duty, Service tax etc,

- State GST to cover VAT, luxury tax etc.

- Integrated GST (IGST) to cover inter-state trade.

- IGST per se is not a tax but a system to coordinate state and union taxes.

- It has a 4-tier tax structure for all goods and services under the slabs- 5%, 12%, 18% and 28%.

- Reasons for introducing GST:

- To mitigate the double taxation, cascading effect of taxes, multiplicity of taxes, classification issues etc., and has led to a common national market.

- The GST that a merchant pays to procure goods or services (i.e. on inputs) can be set off later against the tax applicable on supply of final goods and services.

- The set off tax is called input tax credit.

- The GST avoids the cascading effect or tax on tax which increases the tax burden on the end consumer.

What is the Significance of GST?

- Create a Unified Common Market: Help to create a unified common national market for India. It will also give a boost to foreign investment and “Make in India” campaign.

- Streamline Taxation: Through harmonization of laws, procedures and rates of tax between Centre and States and across States.

- Increase Tax Compliance: Improved environment for compliance as all returns are to be filed online, input credits to be verified online, encouraging more paper trail of transactions at each level of supply chain;

- Discourage Tax evasion: Uniform SGST and IGST rates will reduce the incentive for evasion by eliminating rate arbitrage between neighbouring States and that between intra and inter-state sales

- Bring about Certainty: Common procedures for registration of taxpayers, refund of taxes, uniform formats of tax return, common tax base, common system of classification of goods and services will lend greater certainty to taxation system;

- Reduce Corruption: Greater use of IT will reduce human interface between the taxpayer and the tax administration, which will go a long way in reducing corruption;

- Boost Secondary Sector: It will boost export and manufacturing activity, generate more employment and thus increase GDP (Gross Domestic Product) with gainful employment leading to substantive economic growth.

What are the Issues Associated with GST?

- Multiple Tax Rates: Unlike many other economies which have implemented this tax regime, India has multiple tax rates. This hampers the progress of a single indirect tax rate for all the goods and services in the country.

- New Cesses crop up: While GST scrapped multiplicity of taxes and cesses, a new levy in the form of compensation cess was introduced for luxury and sin goods. This was later expanded to include automobiles.

- Trust Deficit: The Union government’s proclivity to levy and appropriate cess revenues for itself without sharing them with the states has lent credence to the wisdom of guaranteed compensation for states.

- It turned out to be prescient as GST failed to live up to its economic promises and states’ revenues were protected through this guarantee.

- Economy Outside GST purview: Nearly half the economy remains outside GST. E.g. petroleum, real estate, electricity duties remain outside GST purview.

- The complexity of tax filings: The GST legislation requires the filing of the GST annual returns by specified categories of taxpayers along with a GST audit. But, filing annual returns is a complex and confusing one for the taxpayers. Apart from that, the annual filing also includes many details that are waived in the monthly and quarterly filings.

- Higher Tax Rates: Though rates are rationalised, there is still 50 % of items are under the 18 % bracket. Apart from that, there are certain essential items to tackle the pandemic that was also taxed higher. For example, the 12% tax on oxygen concentrators, 5% on vaccines, and on relief supplies from abroad.

Way Forward

- The consultative and consensual nature of decision-making that has helped guide the Council’s decisions so far must be adhered to.

- Addressing the contentious issues will, first and foremost, require bridging the trust deficit between the Centre and states. The spirit of cooperative federalism, often advocated by the ruling dispensation, must be upheld.

- The trust deficit can be bridged only through acts of good faith. The Union government should commit to the states that it will not resort to cesses and surcharges that are outside the shareable pool of revenues. It must resolve to honour the revenue guarantee commitment to the states. It must respect and uphold the true spirit of not just fiscal federalism but political and constitutional federalism too.

- Democratically elected state governments in India do not have sole powers for both direct and indirect taxation, which is unheard of in any other federal democracy. GST centralised India’s indirect taxation. It is time to start a national discussion on reversing the course, moving towards decentralisation by giving states powers for direct taxation. A commitment to initiate such discussions by the Union government will be a healthy signal for states’ confidence and fiscal freedom.