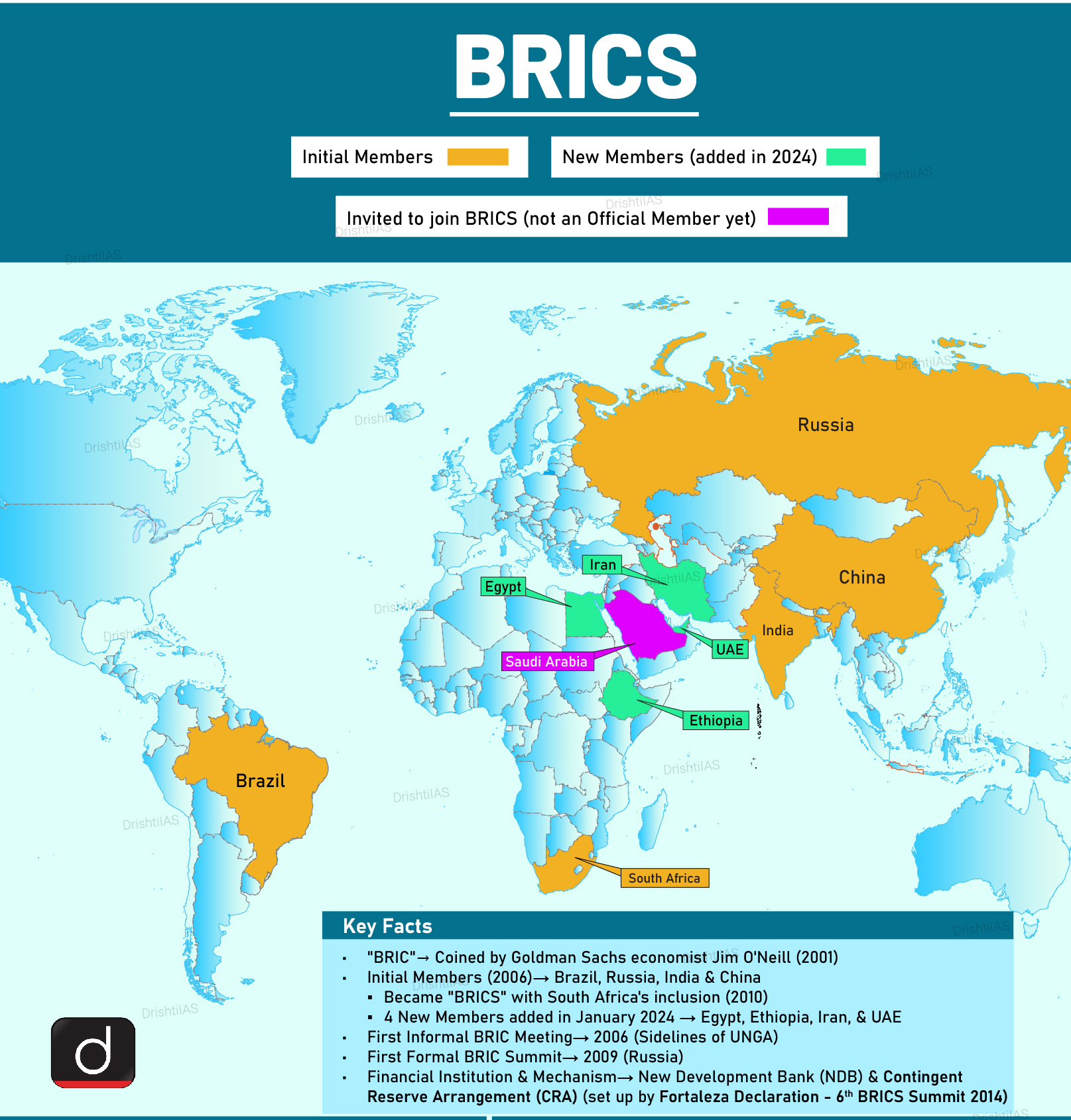

BRICS Nations Explore Alternative Currencies

For Prelims: 16th BRICS summit, Global South, SWIFT Network, Central Bank Digital Currency, Unified Payments Interface, Reserve Bank of India, India-UAE Local Currency Settlement System

For Mains: Impact of de-dollarization on global trade and finance, Internationalization of Indian Currency, Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests.

Why in News?

At the 16th BRICS summit in October 2024, BRICS countries discussed increasing the use of local currencies in trade or to create a new BRICS currency, to reduce reliance on the US dollar.

- In response, US President-elect Donald Trump stated that BRICS nations could face 100% import tariffs if they support a currency to replace the US dollar as the global reserve currency.

- India reaffirmed its commitment to strong economic ties with the US, emphasizing no intention to weaken the US dollar.

Why are BRICS Nations Exploring Alternative Currencies?

- Reducing Transaction Costs: Trading in local currencies eliminates the need for intermediary foreign currencies, which can lower transaction costs and make trade more efficient between BRICS countries.

- Dominance of the Dollar: The US dollar currently dominates over 90% of global trade and is central to international reserves. Relying heavily on the US dollar means that countries are significantly affected by US monetary policies.

- This can lead to economic instability in their own economies, prompting them to seek more control by using their own or other currencies.

- Many BRICS countries, particularly from the Global South, struggle to access major currencies like the dollar, hindering their ability to import goods, repay debts, and trade internationally.

- Using local currencies can bypass these challenges, fostering growth in local markets and boosting trade within the bloc.

- Political Motivations: One of the primary reasons for exploring local currencies is to escape the influence of financial sanctions by the US.

- For example, the US blocked Russia and Iran from the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network, a vital system for international financial transactions, which left these countries searching for alternatives to maintain trade.

- Avoiding the reliance on the US dollar also grants these countries more sovereignty in global trade and reduces vulnerability to external economic pressures.

- Geopolitical Reasons: Nations like Brazil, Russia are seeking greater autonomy from US influence by promoting currencies like the yuan and ruble, or even considering a unified BRICS currency, to reduce vulnerabilities tied to dollar dependency.

- As emerging economies like China grow, they are becoming major trading partners for many countries. This shift encourages the use of alternative currencies for trade settlements.

Trade in Local Currencies

- China’s Approach: China has promoted the use of its currency through bilateral currency swap agreements as seen in China’s trade with Ethiopia.

- A bilateral currency swap agreement is a financial contract between two central banks to exchange a specific amount of one currency for the same amount of another currency.

- China's barter trade model bypasses traditional currencies by exchanging goods with African countries for local currencies.

- These currencies are then used to buy goods from those countries, which are exported back to China and converted into renminbi, supporting its currency internationalization efforts.

- Southern Africa: The currency of South Africa (South African Rand) is essential for cross-border trade in the Southern African Customs Union, where Namibia, Botswana, Lesotho, and Eswatini use it alongside their own currencies, promoting economic integration and reducing reliance on the US dollar or euro.

- India-Russia: In response to US sanctions, India and Russia have been trading in their local currencies (rupee and rouble), with 90% of bilateral trade now conducted in these currencies or alternate currencies.

What are the Potential Risks of Moving Away from the US Dollar?

- Chinese Domination: Reducing reliance on the US dollar raises concerns about increasing Chinese economic dominance. China is pushing for greater use of the yuan in international trade, especially with Russia and other BRICS nations.

- Within BRICS, China's dominant economy could lead to disproportionate influence, potentially overshadowing the interests of other members like India, Brazil, and South Africa, who seek a multipolar financial system.

- Implementation Challenges: The adoption of a BRICS currency or local currencies faces challenges, as seen in India-Russia trade, where banking concerns over US sanctions hinder large-scale implementation.

- Many of the BRICS currencies are not widely used internationally, limiting the effectiveness of trading with local currencies.

- Countries that primarily export more than they import face the challenge of accumulating foreign currencies for trade, making the use of local currencies difficult.

- Liquidity Issues: The US dollar is highly liquid and widely accepted. Alternatives may not offer the same level of liquidity, complicating international transactions.

- Volatility and Exchange Rate Risks: During the transition away from the dollar, countries may experience increased exchange rate volatility.

- This is especially true for nations with less established financial markets. Such volatility can disrupt commerce, investment, and capital movements, creating further economic uncertainty.

What are the Potential Impacts of a 100% US Tariff on BRICS Imports?

- Impact on Global Trade: Such tariffs could force BRICS countries to deepen intra-bloc trade, accelerating de-dollarization.

- Import diversification to non-US markets could reduce US influence over global trade systems.

- This can lead to a rise in non-traditional reserve currencies like the Australian dollar, Chinese renminbi, and others reflecting a gradual move towards a multipolar global financial system.

- This transition reduces US financial leverage but increases competition among emerging currencies.

- Impact on US: A blanket 100% tariff on imports from BRICS countries would likely hurt the US economy by driving up the cost of imports.

- The US may see shifts in trade routes, with imports potentially moving to third-party countries. This could lead to higher costs for American consumers without significantly boosting domestic manufacturing.

- BRICS countries might retaliate with their own tariffs on US goods, further escalating trade tensions and impacting global trade dynamics.

- US economic dominance stems from the dollar's central role in trade. Growing adoption of alternatives could dilute its financial influence, pushing the US to adapt to a diversified global system.

What are India's Initiatives to Improve Trade in Local Currencies?

- Internationalizing the Rupee: In 2022, the Reserve Bank of India (RBI) allowed invoicing and payments for international trade in Indian rupees, especially with countries like Russia.

- This move was in response to US sanctions and aimed at reducing the dependence on the dollar.

- Initiatives like digital payment systems like UPI aim to internationalize the rupee.

- Bilateral Trade Agreements: India has been actively negotiating bilateral trade agreements that include provisions for using local currencies, such as with the India-UAE Local Currency Settlement System.

- This strategic move is part of broader efforts to enhance economic autonomy and reduce dependence on the US dollar.

- Foreign Exchange Reserves: The RBI has been diversifying its foreign exchange reserves by including other major currencies like the euro and yen, reducing the proportion held in US dollars.

Way Forward

- India’s Balanced Diplomacy: India has decided not to weaken the US dollar. However, at the same time, India should continue promoting initiatives like the adoption of Central Bank Digital Currency (CBDC) and the internationalization of the Unified Payments Interface (UPI).

- Additionally, India should collaborate with BRICS nations to ensure that financial reforms align with its long-term economic interests and work towards addressing trade imbalances by encouraging Indian exports to BRICS countries.

- Digital Payment Solutions: A reliable, digital payment system is essential to efficiently balance currency demand, reduce costs, and ensure the success of local currency trade.

- Incremental Progress: Given the complexities, a gradual approach seems most feasible. Countries should start by conducting some trade in local currencies, gradually building the infrastructure and confidence needed to expand the system.

|

Drishti Mains Question: Discuss the implications of de-dollarization, focusing on BRICS' role in reshaping global finance. Evaluate the challenges and opportunities for India. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Convertibility of rupee implies (2015)

(a) being able to convert rupee notes into gold

(b) allowing the value of rupee to be fixed by market forces

(c) freely permitting the conversion of rupee to other currencies and vice versa

(d) developing an international market for currencies in India

Ans: (c)

Q. With reference to a grouping of countries known as BRICS, consider the following statements: (2014)

- The First Summit of BRICS was held in Rio de Janeiro in 2009.

- South Africa was the last to join the BRICS grouping.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

International Debt Report 2024

For Prelims: International Debt Report 2024, Global Debt Trends and Implications, Debt, Gross Domestic Product (GDP), International Monetary Fund (IMF), World Bank, International Development Association (IDA).

For Mains: Global Debt Trends and Implications.

Why in News?

Recently released, World Bank’s "International Debt Report 2024" highlights a worsening debt crisis for developing nations, with 2023 marking the highest debt servicing levels in two decades, driven by rising interest rates and economic challenges.

- Also, earlier in June 2024, a UNCTAD report, "A World of Debt 2024: A Growing Burden to Global Prosperity", highlighted a severe global debt crisis impacting the world.

What are the Key Findings of the International Debt Report, 2024?

- Rising Debt Levels:

- The total external debt of Low- and Middle-Income countries (Developing or LMICs) reached a record USD 8.8 trillion by the end of 2023, marking an 8% increase since 2020.

- External debt for the International Development Association (IDA)-eligible countries rose by nearly 18%, reaching USD 1.1 trillion.

- IDA, established in 1960,is a World Bank Group institution providing concessional loans and grants to the world’s poorest nations with low income and poor creditworthiness.

- Rising Debt Servicing Costs:

- LMICs incurred a record USD 1.4 trillion in debt servicing costs (principal plus interest payments) in 2023, with interest payments increasing by 33% to USD 406 billion, placing immense pressure on national budgets.

- The sharp rise in interest payments has curtailed investments in vital sectors like health, education, and environmental sustainability, exacerbating developmental challenges.

- Rising Borrowing Costs:

- In 2023, interest rates on loans from official creditors doubled to over 4%, while rates from private creditors rose to 6%, the highest level in 15 years.

- This surge in interest rates significantly increased the financial burden on developing countries, exacerbating their debt servicing challenges.

- In 2023, interest rates on loans from official creditors doubled to over 4%, while rates from private creditors rose to 6%, the highest level in 15 years.

- Role of Private and Official Creditors:

- As global credit conditions worsened, private creditors cut lending to IDA nations, leading to USD 13 billion more in debt servicing than new loans.

- In contrast, multilateral lenders, like the World Bank, supported these economies by providing USD 51 billion more than they collected in debt payments.

- Impact on IDA-Eligible Countries:

- IDA-eligible countries faced severe financial strain in 2023, paying USD 96.2 billion in debt servicing, including USD 34.6 billion in record-high interest costs- 4 times higher than in 2014.

- On average, nearly 6% of their export earnings go to interest payments, with some allocating up to 38%.

Global Debt

- It refers to the total amount of money owed by governments, businesses, and individuals worldwide, including both public and private debt.

- Public Debt: This is the money owed by governments to domestic and foreign creditors. It is usually financed through the issuance of bonds, treasury bills, or loans from international organizations.

- Private Debt: This pertains to the money owed by businesses and individuals to banks, lenders, and financial institutions. It includes mortgages, corporate bonds, student loans, and credit card debts.

What is the State of the Global Debt Crisis as per UNCTAD World of Debt Report, 2024?

- Rapid Increase in Global Public Debt: Global debt, encompassing borrowings by households, businesses, and governments, is projected to reach USD 315 trillion in 2024, 3 times the global GDP.

- Public debt is rising rapidly due to factors like the Covid-19 pandemic, rising food and energy prices, climate change, and a sluggish global economy marked by slowing growth and rising bank interest rates.

- Regional Disparities in Debt Growth: Developing nations' public debt, now USD 29 trillion (30% of global debt, up from 16% in 2010), is growing twice as fast as in developed countries.

- Impact on Debt Servicing and Climate Initiatives: Around 50% of developing countries now allocate at least 8% of their government revenues to debt servicing, a figure that has doubled in the past decade.

- Currently, developing nations spend a higher percentage of GDP on servicing debts (2.4%) than on climate initiatives (2.1%), restricting their ability to address climate change.

- To meet the Paris Agreement goals, climate investments need to rise to 6.9% of GDP by 2030.

- Shifts in Official Development Assistance (ODA): ODA, which supports economic development and welfare in developing countries, is facing a significant decline and loans now form 34% of aid, up from 28% in 2012, increasing debt burdens.

- Debt relief funding has dropped drastically from USD 4.1 billion in 2012 to USD 300 million in 2022, worsening debt management for developing nations.

Note:

- Official Development Assistance (ODA) refers to the financial aid provided by donor countries to support the development of poorer nations.

- The International Development Association (IDA), a part of the World Bank, is a key multilateral institution within the ODA framework. It offers concessional loans and grants with favorable terms to the world's poorest countries, thus playing a crucial role in supporting development efforts in these nations.

- The G20 Common Framework for Debt Treatment, launched in 2020 and endorsed by the G20 in collaboration with the Paris Club, aims to provide structural support to Low-Income Countries (LICs) grappling with unsustainable debt levels.

- The framework offers a coordinated and comprehensive approach to address the severe debt challenges faced by LICs, which have been exacerbated by the Covid-19 pandemic.

What Measures Have Been Taken to Reduce the Global Debt Crisis?

- Debt Management and Financial Analysis System (DMFAS) Programme: The DMFAS programme has been implemented by UNCTAD which assists developing countries in improving their debt management practices.

- It provides training and technical support to enhance debt recording, risk assessment, and negotiations, thereby promoting sustainable borrowing practices and preventing future debt crises.

- Heavily Indebted Poor Countries (HIPC) Initiative:

- HIPC was launched by the IMF and World Bank in 1996. It provides debt relief and low-interest loans to world's poorest nations which are facing unsustainable debt, with eligibility based on strict criteria such as a track record of reforms and development of a Poverty Reduction Strategy Paper (PRSP).

- Countries that complete the program receive debt-service relief and additional financial resources.

- The Multilateral Debt Relief Initiative (MDRI), introduced in 2005, supplements the HIPC Initiative, helping countries achieve the Sustainable Development Goals.

- For example, Somalia saved USD 4.5 billion in debt service after completing the program in December 2023.

- Global Sovereign Debt Roundtable (GSDR):

- The GSDR brings together debtor countries and official and private creditors with the objective to build common understanding among key stakeholders on debt sustainability and debt restructuring challenges, and ways to address them.

- It is co-chaired by the IMF, World Bank, and the G20.

Way Forward

- Inclusive Governance:

- Increased participation of low-income countries in decision-making processes is crucial to ensure their voices are heard. Financial transparency and accountability are essential for preventing debt crises, as emphasized by the UN Office for Sustainable Development.

- Contingency Financing:

- The IMF plays a key role in providing emergency financial support. Measures such as increased access to Special Drawing Rights (SDRs), as proposed in a 2019 IMF report, can help bolster the reserves of developing countries during crises.

- Managing Unsustainable Debt:

- Existing debt restructuring frameworks, like the G20 Common Framework for Debt Treatment, need to be strengthened. Incorporating automatic provisions for debt payment suspensions during crises can provide flexibility to stabilize economies.

- Scaling up Sustainable Financing:

- Multilateral Development Banks (MDBs) should be transformed to focus more on long-term financing for Sustainable Development Goals (SDGs). It is also essential to attract private investment for sustainable projects, such as clean energy, and fulfill commitments related to aid and climate finance, particularly for developing nations.

Conclusion

The World Bank International Debt Report 2024 paints a stark picture of the challenges faced by developing nations in managing their debt. The findings underscore the urgent need for multilateral support and improved transparency in debt data to ensure sustainable economic development. As these nations navigate their financial challenges, the role of multilateral institutions becomes increasingly critical in providing the necessary support to balance debt repayments with essential development priorities.

|

Drishti Mains Question: What are the factors driving the global debt crisis? Assess the potential measures that both developed and developing countries can adopt to effectively address and manage this |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. Consider the following statements: (2018)

- The Fiscal Responsibility and Budget Management (FRBM) Review Committee Report has recommended a debt to GDP ratio of 60% for the general (combined) government by 2023, comprising 40% for the Central Government and 20% for the State Governments.

- The Central Government has domestic liabilities of 21% of GDP as compared to that of 49% of GDP of the State Governments.

- As per the Constitution of India, it is mandatory for a State to take the Central Government’s consent for raising any loan if the former owes any outstanding liabilities to the latter.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: C

Mains:

Q. Public expenditure management is a challenge to the Government of India in the context of budget-making during the post-liberalization period. Clarify it. (2019)

PMAY-U 2.0

For Prelims: Housing finance companies (HFCs), Primary lending institutions (PLIs), Pradhan Mantri Awas Yojana–Urban 2.0 (PMAY-U 2.0), Interest Subsidy Scheme (ISS),

For Mains: Role of Financial Institutions in providing affordable housing, Socio-Economic Implications of PMAY, Strategies for Enhancing the Implementation of PMAY-U 2.0

Why in News?

Recently, on 14th November 2024, the Ministry of Housing and Urban Affairs (MoHUA) in partnership with National Housing Bank (NHB), organized a national workshop in New Delhi focusing on the Pradhan Mantri Awas Yojana – Urban 2.0 (PMAY-U 2.0) and its Interest Subsidy Scheme (ISS).

What are the Core Themes in PMAY-U 2.0?

- Objective of PMAY-U 2.0: PMAY-U 2.0 will provide financial aid to 1 crore urban poor and middle-class families through States/UTs/PLIs for affordable housing in urban areas over five years from 1st September 2024.

- Preference will be given to widows, single women, persons with disabilities, senior citizens, transgenders, Scheduled Castes/Scheduled Tribes, minorities, and other vulnerable sections.

- Special focus includes Safai Karmi, street vendors (PM SVANidhi Scheme), artisans (Pradhan Mantri-Vishwakarma Scheme), Anganwadi workers, construction workers, slum/chawl residents, and other identified groups.

- Preference will be given to widows, single women, persons with disabilities, senior citizens, transgenders, Scheduled Castes/Scheduled Tribes, minorities, and other vulnerable sections.

- Workshop Participation: The workshop was attended by over 250 participants from various banks, housing finance companies (HFCs), and primary lending institutions (PLIs), emphasizing the collaborative effort needed for successful implementation.

- Key Features of PMAY-U 2.0:

- The scheme includes four verticals, allowing beneficiaries to choose based on eligibility.

- The ISS vertical provides interest subsidies to economically weaker sections (EWS), low-income groups (LIG), and middle-income groups (MIG) on home loans.

- The Government assistance under PMAY-U 2.0 will be upto 2.50 lakh per unit.

- Role of Financial Institutions: The Government called upon banks and HFCs to actively participate in this reformative journey towards achieving the goal of "housing for all" by 2047, which aligns with India’s vision of becoming a developed nation.

What is Pradhan Mantri Awas Yojana?

- The scheme has following two components:

- Pradhan Mantri Awaas Yojana- Gramin (PMAY-G):

- Launch: To achieve the objective of “Housing for All” by 2022, the erstwhile rural housing scheme Indira Awaas Yojana (IAY) was restructured to Pradhan Mantri Awaas Yojana-Gramin (PMAY-G) from 1st April 2016, as a centrally sponsored scheme.

- Ministry Involved: Ministry of Rural Development.

- Status: States/UTs have sanctioned 2.85 crore houses to the beneficiaries and 2.22 crore houses have been completed till March 2023.

- Aim: To provide a pucca house with basic amenities to all rural families, who are homeless or living in kutcha or dilapidated houses by the end of March 2022.

- To help rural people Below the Poverty Line (BPL) in the construction of dwelling units and upgradation of existing unserviceable kutcha houses by assisting in the form of a full grant.

- Beneficiaries: People belonging to SCs/STs, freed bonded labourers and non-SC/ST categories, widows or next-of-kin of defence personnel killed in action, ex-servicemen and retired members of the paramilitary forces, disabled persons and minorities.

- Selection of Beneficiaries: Through a three-stage validation such as Socio-Economic Caste Census 2011, Gram Sabha, and geo-tagging.

- Cost Sharing: The Centre and states share expenses in 60:40 ratio in case of plain areas, and in 90:10 ratio for northeastern states, two Himalayan states and the UT of Jammu and Kashmir.

- The Centre bears 100% cost in case of other Union Territories, including the UT of Ladakh.

- Pradhan Mantri Awaas Yojana- Gramin (PMAY-G):

- Pradhan Mantri Awas Yojana – Urban (PMAY-U):

- Launch: Launched on 25th June 2015 it intends to provide housing for all in urban areas by the year 2022.

- Implemented by: Ministry of Housing and Urban Affairs

- Status: A total of 118.64 lakh houses have been sanctioned and more than 88.02 lakh are completed/delivered to the beneficiaries.

- Features:

- Addresses Urban housing shortage among the Urban Poor including the Slum Dwellers by ensuring a pucca house for eligible urban poor.

- The Mission covers the entire urban area consisting of Statutory Towns, Notified Planning Areas, Development Authorities, Special Area Development Authorities, Industrial Development Authorities or any such authority under State legislation which is entrusted with the functions of urban planning & regulations.

- The Mission promotes women's empowerment by providing the ownership of houses in the name of female members or in a joint name.

- Scheme Implemented in Four Verticals:

- In-situ Rehabilitation of existing slum dwellers using land as a resource through private participation.

- Credit Linked Subsidy: People from Economically Weaker Section (EWS), Low Income Group (LIG), and Middle Income Groups (MIG-I and MIG-II) can get interest subsidies of 6.5%, 4%, and 3% on housing loans up to Rs. 6 lakh, Rs. 9 lakh, and Rs. 12 lakh respectively for buying or building houses.

- Beneficiary-led Individual House Construction/Enhancement: Central Assistance upto Rs. 1.5 lakh per EWS house is provided to eligible families belonging to EWS categories for individual house construction/ enhancement.

What are the Socio-Economic Implications of PMAY-U 2.0?

- Affordable Housing Access: PMAY-U 2.0 is expected to significantly increase access to affordable housing for urban poor and middle-class families, enhancing their quality of life.

- Economic Boost: By facilitating home ownership, the scheme can stimulate economic growth through increased construction activities and related job creation in the housing sector.

- Social Inclusion: The initiative promotes social equity by providing housing solutions to marginalized communities, thus contributing to inclusive urban development.

- Impact on Urban Infrastructure: Improved housing can lead to better urban infrastructure as more families gain access to basic amenities, contributing to overall urban planning efforts.

What Strategies Can Enhance the Implementation of PMAY-U 2.0?

- Strengthening Monitoring Mechanisms: Establish robust monitoring systems to track the progress of housing projects and ensure timely disbursement of subsidies.

- Public Awareness Campaigns: Launch awareness programs to educate potential beneficiaries about the scheme's benefits and application processes, ensuring wider participation.

- Capacity Building for Financial Institutions: Provide training for staff at banks and HFCs on the specifics of PMAY-U 2.0, enabling them to assist applicants effectively.

- Leveraging Technology: Utilize technology through a unified web portal that simplifies application processes, tracks status updates, and facilitates communication between stakeholders.

- Collaboration with State Governments: Foster partnerships between central and state governments to align efforts towards achieving housing targets effectively.

|

Drishti Mains Question Discuss how the Pradhan Mantri Awas Yojana – Urban 2.0 contributes to achieving sustainable urban development in India. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. Among other things, which one of the following was the purpose for which the Deepak Parekh Committee was constituted? (2009)

(a) To study the current socio-economic conditions of certain minority communities

(b) To suggest measures for financing the development of infrastructure

(c) To frame a policy on the production of genetically modified organisms

(d) To suggest measures to reduce the fiscal deficit in the Union Budget

Ans: (b)

Q. In the context of the Indian economy, non-financial debt includes which of the following? (2020)

- Housing loans owed by households

- Amounts outstanding on credit cards

- Treasury bills

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)

Mains:

Q. With a brief background of quality of urban life in India, introduce the objectives and strategy of the ‘Smart City Programme.” (2016)

Q. Discuss the various social problems which originated out of the speedy process of urbanization in India. (2013)

Profit-Oriented Research and R&D Challenges in India

For Prelims: Global Innovation Index 2024, Large language models, Chat GPT, World Intellectual Property Indicators 2024, Green hydrogen, National Quantum Mission, 5G Technology, Vigyan Dhara Scheme, Rashtriya Vigyan Puraskar (RVP)

For Mains: Challenges in India’s R&D Ecosystem, Commercialization of Scientific Research,Status of Research and Development in India

Why in News?

In May 2024, Google DeepMind released AlphaFold 3, an Artificial Intelligence (AI) tool for predicting protein structures. Unlike its previous open-source versions, AlphaFold 3’s full code was withheld, preventing scientists from fully understanding its workings or replicating its results.

- This decision has sparked discussions about the growing influence of for-profit funding(investors seeking profit) in scientific research, creating tensions between transparency and intellectual property protection, and highlighting challenges in India’s research and development ecosystem.

How Does Commercialisation Influence Scientific Research?

- Positive Impacts:

- Funding and Resources: For-Profit Companies fund research, providing access to advanced facilities and driving innovation, as seen in pharmaceutical trials like Bharat Biotech’s intranasal vaccine.

- Faster Development: Commercial incentives speed up technology development, with academia-industry collaboration driving breakthroughs in gene editing technologies like CRISPR advancing medicine and agriculture.

- Practical Applications: Research with commercial backing often focuses on real-world applications, leading to tangible benefits such as medical breakthroughs or developments of new large language models (LLM) like Chat GPT.

- Negative Impacts:

- Global Inequality in Research Access: Wealthier institutions have a competitive edge, while underfunded researchers face innovation barriers.

- Limited open-source tools hinder access in low-resource settings.

- Blurred Lines Between Academia and Industry: Increasing collaborations between corporations and universities challenge traditional academic norms of openness and independence.

- Companies often use academic platforms to legitimize restricted discoveries, raising concerns about fairness and ethical practices.

- Trust and Scientific Integrity: Open sharing of methodologies ensures robust testing and trust in scientific outputs, while withholding details creates a "black box," which may compromise the reliability and adoption of scientific advances.

- Ethical Concerns: Commercial pressures can sometimes lead to unethical practices, such as exploiting Intellectual property (IP) patents, prioritizing profit over public good, or compromising research integrity.

- Global Inequality in Research Access: Wealthier institutions have a competitive edge, while underfunded researchers face innovation barriers.

What Can be Done to Balance Transparency with Commercial Interests?

- Open-Source Models with Enterprise Versions: Researchers can share foundational discoveries openly while commercializing advanced applications for industry use (e.g., algorithms shared openly but bundled with proprietary tools).

- Encouraging public-private partnerships enables researchers to maintain transparency while leveraging industry resources, with companies providing unrestricted funding for broader research and reserving IP protections for specific commercial projects.

- Public Funding as a Catalyst: Increased government funding reduces reliance on private sponsors, allowing more open research.

- IP Laws and Secrecy: Reform IP laws to balance commercial protection with scientific openness, enabling both innovation and public access.

- Subsidies for essential commercial products (e.g., Covid-19 vaccines) can also ensure affordability while maintaining IP protection.

- Policymakers should establish guidelines to balance openness with IP rights, promoting fair citation and transparency in funded research.

- Rewards for Open Science: Scientists prioritizing transparency should receive institutional support, funding, and recognition.

What is the Current Scenario of Research & Development(R&D) in India?

- Global Innovation Index (GII): India’s secured rank of 39th in the GII 2024 among 133 economies underscores the country's increasing focus on R&D across sectors like biotechnology, space exploration, quantum technology, and renewable energy.

- World Intellectual Property Indicators (WIPI): According to the WIPI 2024, India holds the 6th position in patents filed, demonstrating progress in innovation.

- Scientific Publications: As of 2022, India ranks 3rd globally in scientific publications and scholarly output (India's research output surged by 54% from 2017 to 2022), highlighting its growing presence in global research.

- Biotechnology: India demonstrated its R&D prowess during the Covid-19 pandemic with the development of indigenous vaccines like Covaxin.

- Renewable Energy: India has made remarkable progress in renewable energy, especially solar and green hydrogen technologies, with record-low solar power costs and pioneering projects like the Kayamkulam Floating Solar Power Plant.

- Quantum and Supercomputing Technologies: India is also making strides in quantum technologies and supercomputing, with initiatives like the National Quantum Mission and the development of the PARAM Siddhi-AI supercomputer.

- Telecommunications: India's Own 5G Technology(5Gi) and Bharat 6G Project, are positioning India as a leader in telecommunications research.

What are the Challenges in India’s R&D Ecosystem?

- Low Budget Allocation: India spends less than 1% of its Gross Domestic Product (GDP) on R&D, far below global averages like the US (2.8%), and China (2.1%). This hampers research infrastructure development and restricts high-impact research capacity.

- Inclusivity Issues: Socio-cultural barriers and gender disparities have led to a lack of inclusivity in India's R&D activities.

- Women, for example, are underrepresented in Science, Technology, Engineering and Mathematics (STEM) fields and face hurdles in accessing research opportunities.

- This not only limits the talent pool but also hinders diversity in research perspectives, which is crucial for fostering innovation.

- Women, for example, are underrepresented in Science, Technology, Engineering and Mathematics (STEM) fields and face hurdles in accessing research opportunities.

- Education System: India’s educational system faces challenges for R&D growth, with low Ph.D. enrollment, and insufficient monitoring of research projects.

- The focus on rote learning and a disconnect between academics and industry needs hinder the development of research skills.

- Quality vs. Quantity: India publishes many research papers, but their quality is a concern due to low citation rates.

- Brain Drain: India faces a significant "brain drain," with top researchers migrating abroad for better opportunities.

- India has 216.2 researchers per million people, far behind China (1200) and the US (4300), due to low salaries, limited funding, and inadequate infrastructure, hindering R&D competitiveness.

- Translating Research into Technology: India struggles to convert basic research into successful technologies due to a focus on fundamental research, weak industry-academia ties, and inefficient technology transfer systems.

India’s Initiatives Related to Research and Development

- Vigyan Dhara Scheme

- Rashtriya Vigyan Puraskar (RVP)

- Science, Technology, and Innovation Policy 2020

- VAIBHAV Fellowship

- National Research Foundation

- AICTE - Research Promotion Scheme (RPS): Introduced by All India Council for Technical Education (AICTE) in order to promote research in identified thrust areas of technical education.

Way Forward

- Financial Support: Encourage sustainable funding for research in educational institutions through private sector investments, public-private partnerships (PPPs), tax incentives, and the establishment of innovation clusters.

- Address Brain Drain: Implement "Reverse Brain Drain" initiatives and offer competitive salaries to retain top talent.

- Education: Reallocating government funds to increase investment in basic and applied research, along with proper implementation of the National Education Policy, 2020, will foster a conducive ecosystem for research and innovation in higher education.

- Improve IPR and Innovation Culture: India’s patents are underutilized due to weak industry-academia links.

- Enhancing IPR, fostering research in universities, and strengthening collaboration can bridge the gap between research and practical applications.

- Promote Gender Inclusivity: Launch programs and policies like Vigyan Jyoti Scheme, and Knowledge Involvement Research Advancement through Nurturing (KIRAN) to encourage women’s participation in STEM.

|

Drishti Mains Question: In the context of India’s progress in R&D, discuss the challenges and opportunities in aligning commercial interests with the public good in scientific research. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims:

Q.1 Which of the following statements is/are correct regarding National Innovation Foundation-India (NIF)? (2015)

- NIF is an autonomous body of the Department of Science and Technology under the Central Government.

- NIF is an initiative to strengthen the highly advanced scientific research in India’s premier scientific institutions in collaboration with highly advanced foreign scientific institutions.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Q.2 For outstanding contribution to which one of the following fields is Shanti Swarup Bhatnagar Prize given? (2009)

(a) Literature

(b) Performing Arts

(c) Science

(d) Social Service

Ans: (c)

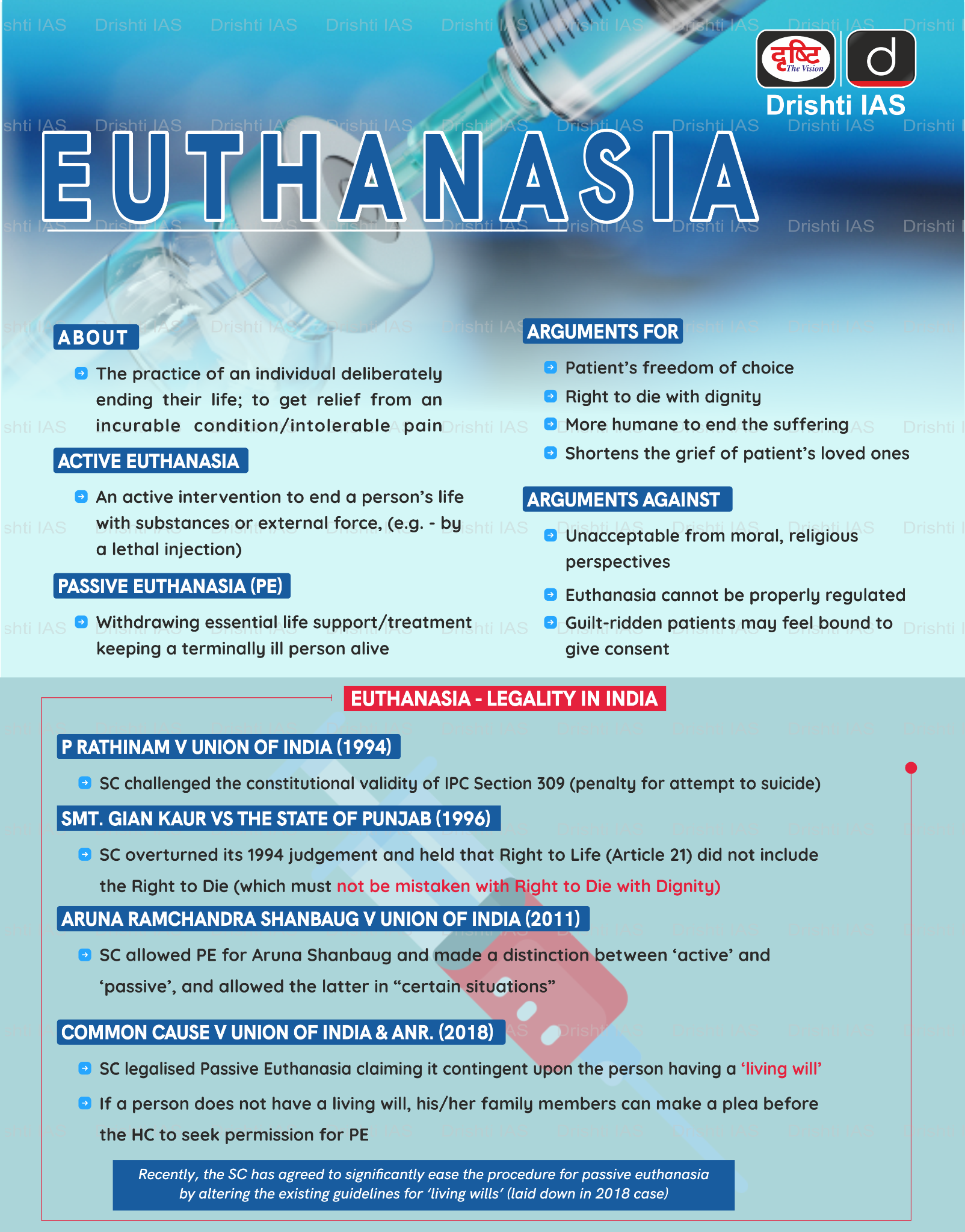

UK’s Assisted Dying Bill on Terminally ill Adults

Why in News?

Recently, the UK House of Commons voted in favour of the Terminally Ill Adults (End of Life) Bill, allowing terminally ill patients to request assistance to end their own lives.

- This landmark decision reflects ongoing debates about end-of-life rights and raises questions about ethical considerations and legal frameworks.

Assisted dying refers to both voluntary active euthanasia and physician-assisted death.

Euthanasia involves a doctor actively ending the life of a terminally ill patient.

What are the Key Highlights of the UK’s Assisted Dying Bill?

- Current Position of UK on Assisted Dying:

- The Suicide Act 1961 makes it illegal to encourage or assist a suicide in England, Wales and Northern Ireland.

- Assisted suicide is considered an offence and can be punished with up to 14 years in prison.

- Since 2013, at least three bills have been introduced to allow assisted dying in the UK.

- The Suicide Act 1961 makes it illegal to encourage or assist a suicide in England, Wales and Northern Ireland.

- Terminally Ill Adults (End of Life) Bill:

- Definition of Terminal Illness: A terminally ill person is defined as someone with a worsening condition that cannot be reversed by treatment and is expected to die within 6 months.

- The bill explicitly excludes individuals with disabilities or mental disorders.

- Eligibility Criteria: Only terminally ill individuals aged 18 and above with mental capacity can request assisted dying.

- Patients must be registered and residing in England or Wales for at least 12 months prior to the request.

- In the United Kingdom, each nation and crown dependency is responsible for its own health care, so Scotland and Northern Ireland would have to pass their own assisted-dying rules.

- Patients must be registered and residing in England or Wales for at least 12 months prior to the request.

- Request Process:

- Patients must sign a "first declaration" in the presence of a coordinating doctor and a witness.

- First Declaration: A person who wishes to be provided with assistance to end their own life in accordance with this Act must make a declaration to that effect.

- The coordinating doctor conducts an initial assessment to confirm eligibility and voluntary consent.

- If approved, the request is referred to an independent doctor after a minimum seven-day reflection period.

- Patients must sign a "first declaration" in the presence of a coordinating doctor and a witness.

- Judicial Oversight:

- If both doctors (coordinating and independent) agree, the request is sent to the High Court of Justice, which verifies compliance with legal requirements.

- The court can question both the patient and the doctors involved.

- If both doctors (coordinating and independent) agree, the request is sent to the High Court of Justice, which verifies compliance with legal requirements.

- Final Confirmation:

- A second reflection period of 14 days follows judicial approval, after which the patient signs a second declaration witnessed by both doctors and another person.

- Self-Administration of Substance:

- The coordinating doctor provides an “approved substance” for self-administration by the patient, doctors are not authorized to administer it themselves.

- Definition of Terminal Illness: A terminally ill person is defined as someone with a worsening condition that cannot be reversed by treatment and is expected to die within 6 months.

Euthanasia Policies in Different Countries

- Netherlands, Luxembourg, Belgium: Allow both euthanasia and assisted suicide for those with "unbearable suffering" with no chance of improvement.

- Switzerland: Prohibits euthanasia but permits assisted dying with a doctor's presence.

- United States: Euthanasia laws vary by state, with allowances in states like Washington, Oregon, and Montana.

- France: Adults with French citizenship or residency, suffering from a severe illness and unbearable pain, can request lethal medication if they can express their wishes. Assistance is permitted if they cannot self-administer.

What are the Provisions of Living Will and Passive Euthanasia in India?

- Passive Euthanasia: Passive euthanasia involves withholding or withdrawing medical treatment to allow a person to die.

- In contrast, active euthanasia involves actively ending a person's life through substances or external force, like a lethal injection.

- BJudicial Stand: The Supreme Court of India, in its 2018 judgment in Common Cause vs. Union of India, recognized the "right to die with dignity" as part of Article 21 of the Constitution.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Right to Privacy is protected as an intrinsic part of Right to Life and Personal Liberty. Which of the following in the Constitution of India correctly and appropriately imply the above statement? (2018)

(a) Article 14 and the provisions under the 42nd Amendment to the Constitution.

(b) Article 17 and the Directive Principles of State Policy in Part IV.

(c) Article 21 and the freedoms guaranteed in Part III.

(d) Article 24 and the provisions under the 44th Amendment to the Constitution.

Ans: (c)

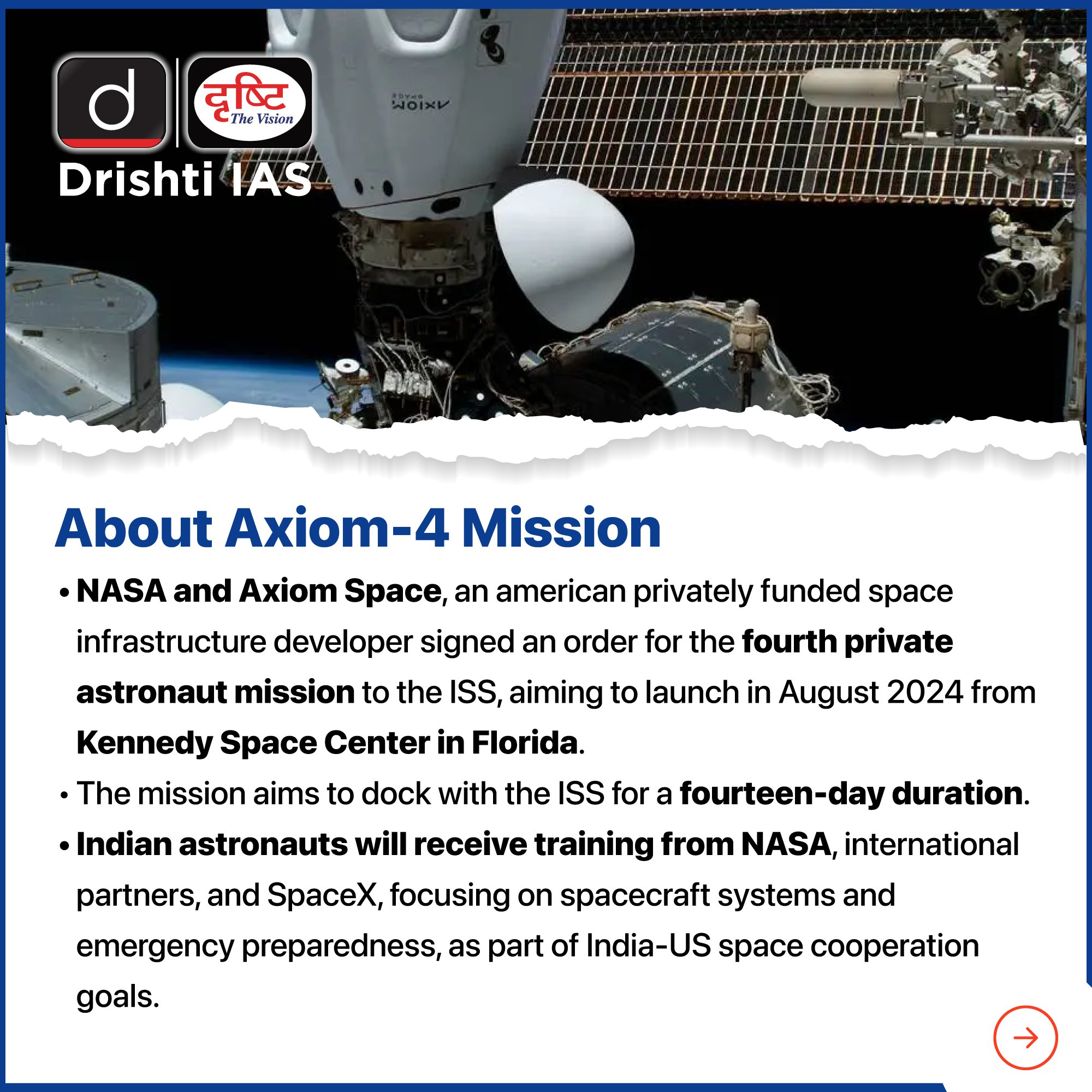

Axiom-4 Mission

Why in News?

Recently, the Indian Space Research Organisation (ISRO) announced that two Indian astronauts selected for the Axiom-4 mission (scheduled to launch in 2024) to the International Space Station (ISS) have completed the initial phase of training.

- These two Indian astronauts are Prime-Group Captain Shubhanshu Shukla and Backup-Group Captain Prasanth Balakrishnan Nair.

What is the Axiom-4 Mission?

- About:

- Axiom Mission 4 (Ax-4) is a private spaceflight to the ISS operated by Axiom Space (US-based space-infrastructure development company), using the SpaceX Crew Dragon spacecraft.

- The SpaceX Crew Dragon is a reusable spacecraft that carries astronauts to and from the ISS.

- It is the fourth flight in collaboration with the National Aeronautics and Space Administration (NASA), following Axiom Missions 1, 2, and 3.

- Mission Objectives:

- Commercial Space Initiatives: Axiom-4 focuses on enabling commercial activities like space tourism in Low Earth Orbit (LEO).

- It aims to demonstrate the feasibility of commercial space stations as platforms for business and research.

- International Collaboration: The mission features a diverse multinational crew, emphasising global cooperation in space exploration.

- It aims to strengthen international partnerships and promote joint efforts in advancing space science.

- Research and Development: The mission supports scientific experiments and technological advancements in microgravity.

- Research areas include materials science, biology, and Earth observation, offering potential breakthroughs.

- Commercial Space Initiatives: Axiom-4 focuses on enabling commercial activities like space tourism in Low Earth Orbit (LEO).

- Key Features:

- Spacecraft and Crew: The mission will deploy a SpaceX Dragon spacecraft launched by a Falcon 9 rocket, carrying professional astronauts, researchers, and private individuals.

- Mission Duration and Activities: With an expected duration of 14 days, the crew will conduct experiments, technology demonstrations, and educational outreach aboard the ISS.

- Commercial Space Station Development: Axiom-4 is part of Axiom Space’s vision to establish the first commercial space station, transitioning from ISS operations to an independent orbital platform.

- Significance for India:

- The Ax-4 marks a pivotal collaboration between the ISRO and NASA, highlighting India's growing presence in space exploration.

- This mission will facilitate Indian astronauts' participation in activities aboard the ISS, enhancing India's capabilities in human spaceflight and international cooperation in space science.

Note:

- During the Prime Minister's 2023 visit to the US, a joint statement confirmed that NASA would provide advanced astronaut training to India under the Artemis Accords.

- India’s Gaganyaan human spaceflight mission is planned for post-2025, following two successful unmanned missions.

What is the ISS?

- About: The International Space Station (ISS) is a large, permanently crewed laboratory orbiting Earth at an altitude of approximately 400 kilometres.

- Countries Involved: The ISS is a collaborative effort involving 15 countries and 5 space agencies: NASA, Roscosmos, European Space Agency, JAXA, and Canadian Space Agency.

- Operation at ISS: An international crew of seven astronauts and cosmonauts live and work aboard the station, travelling at a speed of 7.66 km/sec, completing an orbit around Earth every 90 minutes. The ISS orbits Earth 16 times within 24 hours.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. What is the purpose of the US Space Agency’s Themis Mission, which was recently in the news? (2008)

(a) To study the possibility of life on Mars

(b) To study the satellites of Saturn

(c) To study the colourful display of high-latitude skies

(d) To build a space laboratory to study the stellar explosions

Ans: (c)

Q. Consider the following statements: (2016)

The Mangalyaan launched by ISRO

- is also called the Mars Orbiter Mission

- made India the second country to have a spacecraft orbit the Mars after USA

- made India the only country to be successful in making its spacecraft orbit the Mars in its very first attempt

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

World Wildlife Conservation Day

World Wildlife Conservation Day (4th December) serves as a reminder of India’s rich biodiversity and the urgent need for action to protect its critically endangered species.

- History: Originating from a 2012 pledge by the US State Department, the day encourages global action for wildlife preservation and sustainability.

- India's Biodiversity: India, a megadiverse country with only 2.4% of the world's land area, accounts for 7-8% of all recorded species, including 91,000 species of animals.

- India hosts four out of 34 globally recognized biodiversity hotspots, namely the Himalayas, Indo-Burma, Western Ghats-Sri Lanka, and Sundaland.

- Threats to Wildlife: Rapid economic development and population growth in India increase demand for natural resources, conflicting with wildlife habitats.

- Poaching, trafficking, and land cultivation lead to significant man-animal conflicts. Despite the importance of wildlife sanctuaries and Biosphere Reserves, they lack fencing and face ongoing challenges.

- While big cats like tigers and lions receive attention, birds like the Great Indian Bustard are often overlooked despite threats.

- As of 2022, India has 73 critically endangered species, up from 47 in 2011, including 9 endemic mammal species.

PM-ABHIM

Recently, the Union Minister of State for Health and Family Welfare provided updates on the Pradhan Mantri Ayushman Bharat Health Infrastructure Mission (PM-ABHIM) in a written reply in the Lok Sabha.

- About: The PM Atmanirbhar Swasth Bharat Yojana (PMASBY), which has now been renamed as PM-ABHIM is one of the largest pan-India Centrally Sponsored Scheme (CSS) with certain Central Sector Components.

- It was launched in 2021 by the Union Ministry of Health and Family Welfare with the outlay of Rs. 64,180 Crores for the scheme period (2021-22 to 2025-26).

- Objective: It aims to strengthen India's healthcare infrastructure systems at all levels- primary, secondary, and tertiary- and enhance pandemic preparedness.

- It supplements the National Health Mission (NHM) by addressing infrastructure gaps in public health facilities.

- The initiative includes constructing 17,788 Ayushman Arogya Mandirs in rural areas, 11,024 urban Health & Wellness Centres, 3,382 Block Public Health Units, 730 District Integrated Public Health Labs, and 602 Critical Care Hospital Blocks in districts with over 5 lakh population.

- Other Related Government Initiatives:

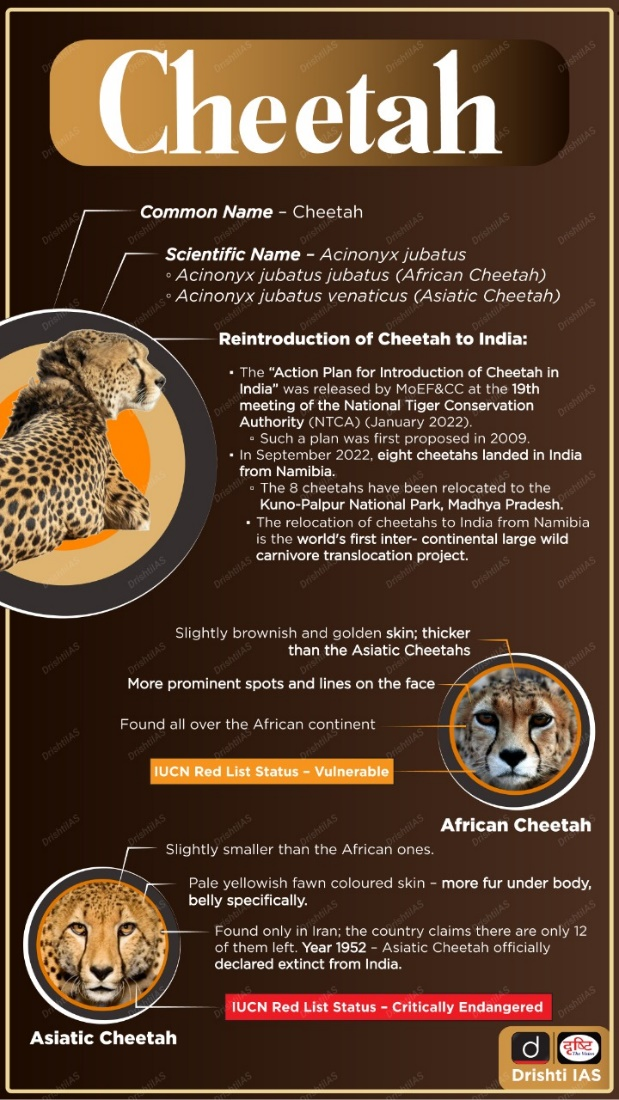

International Cheetah Day

Source: ICD

Every year 4th December is marked as International Cheetah Day since 2010. The day is dedicated to emphasizing global efforts to prevent the cheetah's extinction and promote its conservation.

- American zoologist, Dr. Laurie Marker, founder of the Cheetah Conservation Fund in 1991, designated this day in honor of Khayam, a cheetah she raised.

- About Cheetah:

- Cheetahs (Acinonyx jubatus) are part of the felidae family and are among the oldest big cat species, with their ancestry dating back over 5 million years to the Miocene era (geological period from 23.03 to 5.333 million years ago).

- They are the world’s fastest land mammals, found in parts of Africa and Asia.

- They have vanished from over 75% of their historic range in Africa, with their population declining by more than 30% in the past two decades.

- Namibia has the world's largest population of cheetahs.

- Under the Cheetah Reintroduction Project, cheetahs were translocated to India from Namibia and South Africa in 2022 and 2023.

Read More: One Year of Project Cheetah

Addressing Pollution in Ashtamudi Lake

The State Level Monitoring Committee (SLMC) in Kerala, appointed by the National Green Tribunal, has recommended urgent projects to prevent the illegal discharge of biowaste, including faecal sludge, into Ashtamudi Lake.

- A preliminary examination indicates the presence of an excessive algae bloom is attributed to the discharge of biowaste and septage into the waterbody.

- Ashtamudi Lake:

- A designated Ramsar site, located in Kollam district, Kerala, is a vital part of the backwater ecosystem and is often referred to as the gateway to Kerala’s backwaters.

- Covering 170 square kilometers, it has a unique eight-armed shape and is fed by the Kallada River, eventually draining into the Arabian Sea.

- Historically, it has been an important trade center and is known for its traditional coir industry.

- Government Initiatives to Protect Wetlands:

Read More: Wetlands

.png)

_Features.png)