Economy

UN Report on Global Debt Crisis

- 11 Jun 2024

- 9 min read

For Prelims: Global Debt Trends and Implications, Debt, Recession, Gross Domestic Product (GDP), International Monetary Fund (IMF).

For Mains: Global Debt Trends and Implications.

Why in News?

Recently, a report released by the UN Trade and Development (UNCTAD) titled "A World of Debt 2024: A Growing Burden to Global Prosperity," has revealed an unprecedented global debt crisis in the world.

- Approximately 3.3 billion people currently live in countries where the payment of interest on debts surpasses the expenditure on either education or health.

What is Global Debt?

- About: Debt is an amount of money one borrows and has to pay back later.

- Global Debt refers to the total outstanding amount owed by governments, businesses, and individuals across the world.

- It encompasses both public and private debt.

- Global Debt refers to the total outstanding amount owed by governments, businesses, and individuals across the world.

- Composition of Global Debt:

- Public Debt: This is the money owed by governments to domestic and foreign creditors.

- It is typically financed through issuing bonds, treasury bills, or loans from international organisations.

- Private Debt: This is the money owed by businesses and individuals to banks, lenders, and other financial institutions.

- It includes mortgages, corporate bonds, student loans, and credit card debt.

- Public Debt: This is the money owed by governments to domestic and foreign creditors.

What are the Key Highlights of the Report?

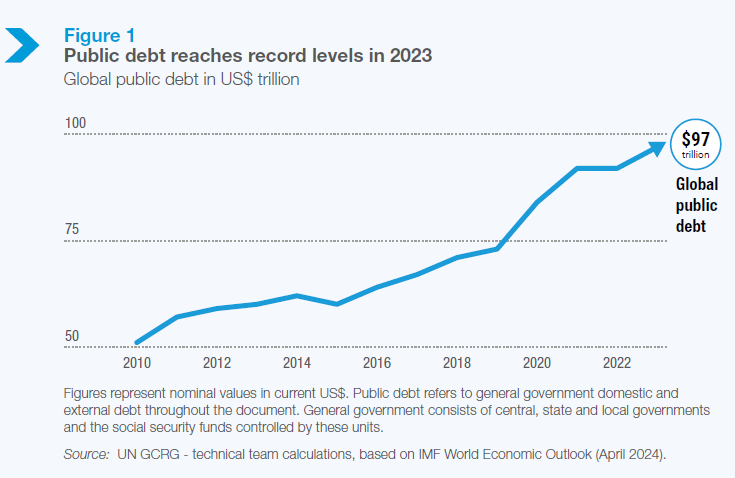

- Rapid Increase in Public Debt:

- Institute of International Finance (a global association of financial institutions) has estimated that global debt (including borrowings of households, businesses and governments) has reached USD 315 trillion in 2024, which is 3 times the global Gross Domestic Product (GDP).

- Global public debt is rising rapidly, due to a combination of recent crises (such as Covid-19, rising food and energy prices, climate change, etc.) and a sluggish global economy (slowing growth of economy, rising bank interest rates etc).

- Net interest payments on public debt reached USD 847 billion in 2023 in developing countries, a 26% increase compared to 2021.

- Institute of International Finance (a global association of financial institutions) has estimated that global debt (including borrowings of households, businesses and governments) has reached USD 315 trillion in 2024, which is 3 times the global Gross Domestic Product (GDP).

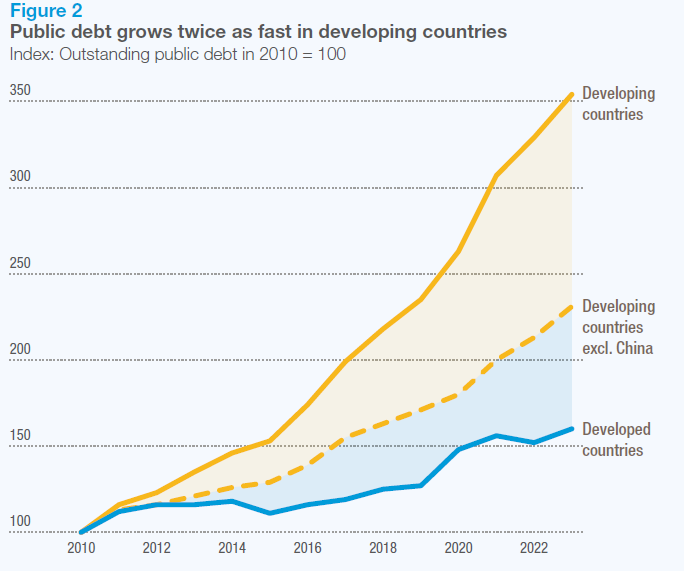

- Regional Disparity in Debt Growth:

- Public debt in developing countries is rising at twice the rate of that in developed countries.

- It reached USD 29 trillion (30% of the global total) in 2023, increasing from 16% in 2010.

- Africa's debt burden is growing faster than its economy leading to a rise in the debt-to-GDP ratio.

- The number of African countries with debt-to-GDP ratios above 60% has increased from 6 to 27 between 2013 and 2023.

- This is due to unforeseen global issues impacting their expansion and reduced domestic income as a result of a slow economy.

- Public debt in developing countries is rising at twice the rate of that in developed countries.

- Higher Debt Servicing Share of Income & Impact on Climate Initiatives:

- Roughly 50% of developing countries are now dedicating a minimum of 8% of their government revenues to servicing their debts, a number that has increased twofold in the last ten years.

- Currently, developing nations are spending a greater portion of their GDP on paying off interest (2.4%) than on climate efforts (2.1%).

- Their ability to address climate change is being constrained by debt. In order to meet the targets of the Paris Agreement, there is a requirement to raise climate investments to 6.9% by 2030.

- 3 Shifts in Official Development Assistance (ODA):

- ODA is government aid aimed at promoting economic development and welfare in developing countries.

- Repaying loans has become more difficult for developing countries, due to recent changes made in nature of foreign aid such as:

- Decreasing Overall Aid: ODA has been decreasing for two years in a row, dropping to USD 164 billion in 2022.

- More Loans and Less Grants: The proportion of aid given as loans is increasing, rising from 28% in 2012 to 34% in 2022. This creates debt burdens for developing countries.

- Less Help with Existing Debt: Funds for dealing with debt, like debt relief and restructuring, have dropped significantly from USD 4.1 billion in 2012 to just USD 300 million in 2022. This makes it harder for them to deal with their current borrowing and could limit their ability to access future loans.

What are the Initiatives Related to Solving Debt Crisis?

- Heavily Indebted Poor Countries (HIPC) Initiative:

- The IMF and World Bank's initiative tackles debt crises in the world's poorest countries. It recognises their struggle to repay debts without sacrificing crucial investments. By offering debt relief, the program frees up resources.

- This allows these nations to invest in healthcare, education, and poverty reduction, promoting long-term economic growth and social progress.

- The IMF and World Bank's initiative tackles debt crises in the world's poorest countries. It recognises their struggle to repay debts without sacrificing crucial investments. By offering debt relief, the program frees up resources.

- Debt Management and Financial Analysis System (DMFAS) Programme:

- UNCTAD's DMFAS program helps developing countries manage debt responsibly. It provides training and technical support to improve their borrowing practices, including tools for recording debt, assessing risks, and negotiating effectively.

- This program promotes sustainable debt management so these countries can borrow for development without creating future crises.

- UNCTAD's DMFAS program helps developing countries manage debt responsibly. It provides training and technical support to improve their borrowing practices, including tools for recording debt, assessing risks, and negotiating effectively.

- Global Sovereign Debt Roundtable (GSDR):

- The roundtable is co-chaired by the IMF, World Bank and G20 presidency, which aims to address debt challenges comprehensively. It brings together debtor countries and creditors with the objective of fostering a greater common understanding among key stakeholders on issues related to debt sustainability, debt restructuring challenges, and potential solutions.

What Measures should be taken to Address the Global Debt Crisis?

- Inclusive Governance, Transparency and Accountability:

- The World Bank's 2022 International Debt Statistics report highlights a concerning rise in public debt, particularly for low-income countries, thus increased participation for these nations in decision-making processes is essential.

- The UN Office for Sustainable Development emphasises that financial transparency and accountability are crucial for preventing debt crises.

- Contingency Financing:

- The IMF performs a vital role in providing emergency financial support.

- A 2019 IMF Report titled "Three Steps to Avert a Debt Crisis" proposed measures like increased access to Special Drawing Rights (SDRs) to bolster developing countries' reserves during emergencies.

- Managing Unsustainable Debt (Managing Debt Challenges):

- Existing frameworks for debt restructuring, such as the G20 Common Framework for Debt Treatment should be improved.

- In addition, including automatic provisions for suspending debt payments for countries facing crises would offer essential flexibility to help them stabilize their economies.

- Scaling up Sustainable Financing:

- Multilateral Development Banks (MDBs) need to be transformed to play a more prominent role in long-term financing for Sustainable Development Goals (SDGs).

- Attracting private investment towards sustainable projects like clean energy is also crucial. Fulfilling existing commitments for aid and climate finance, particularly for developing countries, is essential for facilitating this transition.

G20 Common Framework for Debt Treatment

- It is an initiative established in 2020, endorsed by the G20, in collaboration with the Paris Club to provide structural support to Low-Income Countries (LICs) facing unsustainable debt burdens.

- This framework aims to offer a coordinated and comprehensive approach to tackling the severe debt challenges faced by LICs, which have been worsened by the Covid-19 pandemic.

|

Drishti Mains Question: Q. Discuss the key factors contributing to the escalating global debt crisis and evaluate the possible measures that can be undertaken by both developed and developing economies to manage this crisis effectively. |