Indian Economy

Central Bank Digital Currency

- 08 May 2024

- 7 min read

For Prelims: Central Bank Digital Currency, Reserve Bank of India (RBI), Cryptocurrencies, Fiat currency, Informal economy, Cyber Security.

For Mains: Central Bank Digital Currency, its Significance and Challenges.

Why in News?

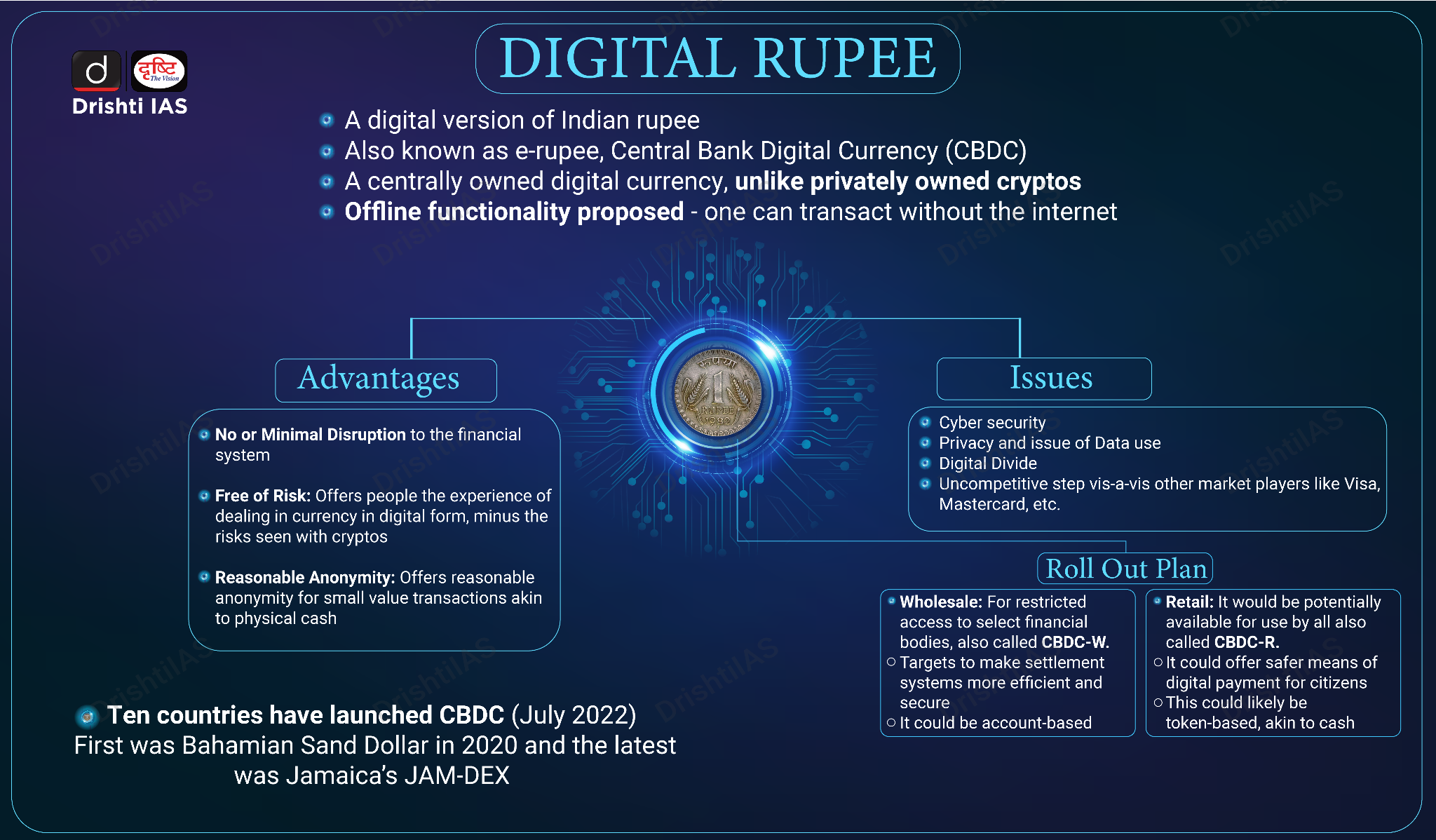

Recently, the Governor of the Reserve Bank of India emphasised the innovative features being developed for India's Central Bank Digital Currency (CBDC), also known as the e-rupee.

- He emphasised the potential of features like permanent transaction deletion to boost user anonymity.

What is Central Bank Digital Currency (CBDC)?

- About:

- A CBDC is a legal tender issued by a central bank in digital form.

- Unlike private cryptocurrencies, CBDCs are backed by the central bank, ensuring stability and trust.

- It is the same as a fiat currency and is exchangeable one-to-one with the fiat currency.

- A fiat currency is a national currency that is not pegged to the price of a commodity such as gold or silver.

- The digital fiat currency or CBDC can be transacted using wallets backed by blockchain.

- Though the concept of CBDCs was directly inspired by Bitcoin, it is different from decentralised virtual currencies and crypto assets, which are not issued by the state and lack the ‘legal tender’ status.

- A CBDC is a legal tender issued by a central bank in digital form.

- Objectives:

- The main objective is to mitigate the risks and trim costs in handling physical currency, costs of phasing out soiled notes, transportation, insurance and logistics.

- It will also wean people away from cryptocurrencies as a means for money transfer.

- Global Trends:

What are the Major Advantages of CBDC?

- Enhanced Security: CBDCs leverage digital security measures, potentially reducing the risk of counterfeiting and theft compared to physical cash.

- Improved Efficiency: Digital transactions can be settled instantly and efficiently, facilitating faster and more cost-effective payments.

- Financial Inclusion: CBDCs can potentially reach unbanked and underbanked populations by offering a secure and accessible digital payment option.

- The increased use of CBDC could be explored for many other financial activities to push the informal economy into the formal zone to ensure better tax and regulatory compliance.

- Enhanced Anonymity: The possibility of permanent transaction deletion is being explored to provide users with a level of anonymity comparable to cash transactions.

- Offline Functionality: The e-rupee is envisioned to be transferable offline, potentially overcoming limitations of internet connectivity in rural areas.

- Programmability: Programmable features could be introduced to enable targeted disbursement of government benefits or encourage specific financial behaviours, promoting financial inclusion.

- Cross-Border Transactions: CBDCs possess unique attributes that can revolutionise cross-border transactions.

- The instant settlement features of CBDCs are a significant advantage, making cross-border payments cheaper, faster, and more secure.

- Traditional and Innovative: CBDC can gradually bring a cultural shift towards virtual currency by reducing currency handling costs.

- Improved Monetary Policy: Central banks might have greater control over the money supply and interest rates with CBDCs. This could allow for more targeted and effective monetary policy interventions.

What are the Challenges Associated with the CBDC?

- Cybersecurity Concerns: Robust security measures are crucial to protect the e-rupee system from cyberattacks.

- Privacy Issues: Balancing user privacy with the need for anti-money laundering and countering financing of terrorism measures is a critical aspect.

- Concerns have arisen about the CBDC's privacy, with its electronic nature potentially leaving a traceable trail, unlike cash.

- UPI Preference and Interoperability: Despite efforts to promote the CBDC, there is a continued preference for UPI among retail users.

- However, the RBI expressed hope for a change in this trend and highlighted the RBI's efforts to enable the interoperability of CBDC with UPI.

- Non-Remunerative CBDC: The RBI made CBDC non-remunerative and non-interest-bearing to mitigate potential risks of bank disintermediation.

- However, non-banks are included in the CBDC pilot to leverage their reach for distribution and value-added services.

- Competition with Private Banks: CBDCs could potentially compete with private banks for deposits, impacting their ability to lend and invest.

- Finding a way for CBDCs to coexist with the existing financial system is necessary.

- Monetary Policy: The impact of CBDCs on monetary policy tools like interest rates remains unclear.

- Central banks will need to adapt their policies to accommodate CBDCs effectively.

Conclusion

The RBI's commitment to addressing privacy concerns surrounding the CBDC through technological and legislative means reflects its dedication to ensuring the successful implementation of digital currency.

- This emphasis on maintaining anonymity, alongside efforts to enhance accessibility and functionality, indicates India's progressive stance in adapting to the evolving digital currency landscape.

|

Drishti Mains Question: Q. What are the key features of the central bank digital currency (CBDC) in India, and how does it differ from traditional currency systems? Discuss the potential impact of CBDC on the Indian economy and its role in promoting financial inclusion. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q. With reference to Central Bank digital currencies, consider the following statements : (2023)

- It is possible to make payments in a digital currency without using US dollar or SWIFT system.

- A digital currency can be distributed with condition programmed into it such as a time-frame for spending it.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)