Indian Economy

Digital Currency

- 12 Aug 2022

- 10 min read

For Prelims: United Nations Trade and Development Body (UNCTAD), Digital Currency,Bitcoin, Ethereum, Blockchain, Central Bank Digital Currencies, Virtual Currencies.

For Mains: Significance & Challenges of Digital Currencies.

Why in News?

According to a recent study by the United Nations Trade and Development Body (UNCTAD), over 7% of India's population owned Digital Currency in 2021.

- Also, India was ranked seventh in the list of top 20 global economies for digital currency ownership as share of population.

What are the Other Highlights of the Study?

- Developing countries accounted for 15 of the top 20 economies when it comes to the share of the population that owns cryptocurrencies.

- Ukraine topped the list which is followed by Russia, Venezuela, Singapore, Kenya, and the US.

- Global use of cryptocurrencies has increased exponentially during the Covid-19 pandemic, including in developing countries.

What are the Issues Highlighted by the Study?

- Unstable Financial Asset:

- Private digital currencies have rewarded some and facilitated remittances, but they are an unstable financial asset that can also bring social risks and costs.

- Unregulated:

- As these Digital currencies are not regulated, there has been a rapid rise in their demand in developing countries as it also helps in facilitating remittances and act as a hedge against inflation.

- Volatile System:

- The recent digital currency shocks in the market suggest that there are private risks to holding crypto, but if the central bank steps in to protect financial stability, then the problem becomes a public one.

- Jeopardies the Monetary Sovereignty:

- If cryptocurrencies become a widespread means of payment and even replace domestic currencies unofficially (a process called cryptoisation), this could jeopardies the monetary sovereignty of countries.

- Undermine Domestic Policies:

- Cryptocurrencies can undermine domestic resource mobilisation in developing countries.

What are the Suggestions Highlighted by the Study?

- The Government can facilitate remittances, they may also enable tax evasion and avoidance through illicit flows.

- The study urged authorities to take steps to curb the expansion of cryptocurrencies in developing countries, including ensuring comprehensive financial regulation of cryptocurrencies by regulating crypto exchanges, digital wallets and decentralized finance, and by prohibiting regulated financial institutions from holding cryptocurrencies (including stablecoins) or offering related products to customers.

- It also called for restrictions on advertising related to digital currencies, as with other high-risk financial assets.

- Further, providing a secure, reliable and cost-effective public payment system that is fit for the digital age; Implement global tax harmonization on digital currency tax practices, regulations and information sharing, and redesign capital controls to accommodate the decentralized, borderless and pseudonymous characteristics of digital currencies.

What is Digital Currency?

- About:

- Digital currency is a form of currency that is available only in digital or electronic form.

- It is also called digital money, electronic money, electronic currency, or cybercash.

- It does not have physical attributes and is available only in digital form.

- The transactions involving digital currencies are made using computers or electronic wallets connected to the internet or designated networks.

- Whereas, physical currencies, such as banknotes and minted coins, are tangible, meaning they have definite physical attributes and characteristics.

- Features:

- Digital currencies can be centralized or decentralized.

- Fiat currency, which exists in physical form, is a centralized system of production and distribution by a central bank and government agencies.

- Prominent cryptocurrencies, such as Bitcoin and Ethereum, are examples of decentralized digital currency systems.

- Fiat currency, which exists in physical form, is a centralized system of production and distribution by a central bank and government agencies.

- Digital currencies can be centralized or decentralized.

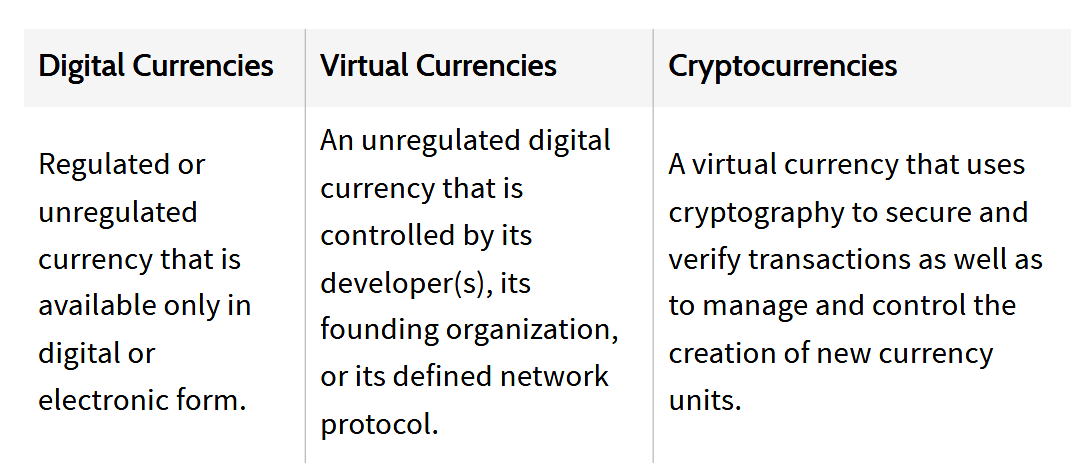

- Types: Different types of currencies exist in the electronic realm. Broadly, there are three different types of currencies:

- Cryptocurrencies:

- Cryptocurrencies are digital currencies that use cryptography to secure and verify transactions in a network.

- Cryptography is also used to manage and control the creation of such currencies.

- Bitcoin and Ethereum are examples of cryptocurrencies.

- Cryptography is also used to manage and control the creation of such currencies.

- Cryptocurrencies are digital currencies that use cryptography to secure and verify transactions in a network.

- Virtual Currencies:

- Virtual currencies are unregulated digital currencies controlled by developers or a founding organization consisting of various stakeholders involved in the process.

- Virtual currencies can also be algorithmically controlled by a defined network protocol.

- An example of a virtual currency is a gaming network token whose economics is defined and controlled by developers.

- Central Bank Digital Currencies:

- Central bank digital currencies (CBDCs) are regulated digital currencies issued by the central bank of a country.

- A CBDC can be a supplement or a replacement to traditional fiat currency.

- Unlike fiat currency, which exists in both physical and digital form, a CBDC exists purely in digital form.

- England, Sweden, and Uruguay are a few of the nations that are considering plans to launch a digital version of their native fiat currencies.

- Central bank digital currencies (CBDCs) are regulated digital currencies issued by the central bank of a country.

- Cryptocurrencies:

- Advantages:

- Fast Transaction time:

- Because digital currencies generally exist within the same network and accomplish transfers without intermediaries, the amount of time required for transfers involving digital currencies is extremely fast.

- Do not require Physical Manufacturing & Saves Cost:

- Many requirements for physical currencies, such as the establishment of physical manufacturing facilities, are absent for digital currencies. Such currencies are also immune to physical defects or soiling that are present in physical currency.

- Ease Implementation of Monetary and Fiscal Policy:

- Under the current currency regime, the Central bank works through a series of intermediaries—banks and financial institutions—to circulate money into an economy. CBDCs can help circumvent this mechanism and enable a government agency to disburse payments directly to citizens.

- Make Transaction Costs Cheaper:

- Digital currencies enable direct interactions within a network. For example, a customer can pay a shopkeeper directly as long as they are situated in the same network.

- Fast Transaction time:

- Disadvantages:

- Susceptible to Hacking:

- Their digital provenance makes digital currencies susceptible to hacking. Hackers can steal digital currencies from online wallets or change the protocol for digital currencies, making them unusable.

- Volatile Value:

- Digital currencies used for trading can have wild price swings.

- For example, the decentralized nature of cryptocurrencies has resulted in a profusion of thinly capitalized digital currencies whose prices are prone to sudden changes based on investor whims.

- Susceptible to Hacking:

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. With reference to “Blockchain Technology”, consider the following statements: (2020)

- It is a public ledger that everyone can inspect, but which no single user controls.

- The structure and design of blockchain is such that all the data in it are about cryptocurrency only.

- Applications that depend on basic features of blockchain can be developed without anybody’s permission.

Which of the statements given above is/are correct?

(a) 1 only

(b) 1 and 2 only

(c) 2 only

(d) 1 and 3 only

Ans: (d)

Exp:

- A blockchain is a form of public ledger, which is a series (or chain) of blocks on which transaction details are recorded and stored on a public database after suitable authentication and verification by the designated network participants. A public ledger can be viewed but cannot be controlled by any single user. Hence, statement 1 is correct.

- The blockchain is not only about the cryptocurrency but it turns out that blockchain is actually a pretty reliable way of storing data about other types of transactions, as well.

- In fact, blockchain technology can be used in property exchanges, bank transactions, healthcare, smart contracts, supply chain, and even in voting for a candidate. Hence, statement 2 is not correct.

- Although cryptocurrency is regulated and needs approval of the central authorities, blockchain technology is not only about cryptocurrency. It can have various uses, and applications based on basic features of the technology can be developed without anybody’ approval. Hence, statement 3 is correct. Therefore, option (d) is the correct answer.