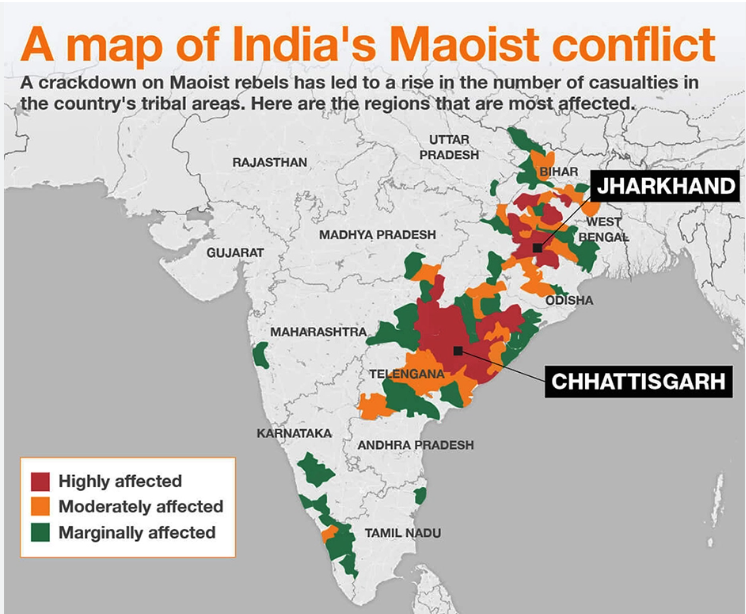

Eliminating Maoist Insurgency

For Prelims: Central Reserve Police Force, Commando Battalion for Resolute Action, Operation SAMADHAN, Pradhan Mantri Gram Sadak Yojana, Aspirational Districts Programme, Civic Action Program, Forest Rights Act, 2006, Unlawful Activities (Prevention) Act, 1967, Forest Conservation Act, 1980, Fifth and Ninth Schedules, Tribal Advisory Councils.

For Mains: Issues and Challenges Associated with Left Wing Extremism in India.

Why in News?

Recently, the Union Home Minister paid tributes to the martyrs who have laid down their lives fighting Maoist Insurgency (Naxalism) at Amar Shaheed Smarak, Jagdalpur, Chhattisgarh.

- He also said that by March 2026, India will be completely free from maoist insurgency (Naxalism) using the three-pronged strategy.

- The three-pronged carrot-and-stick strategy involves Security measures, development, and empowerment to deal with Maoist Insurgency.

What is the Three-Pronged Strategy to Eliminate Maoist Insurgency?

- Security Measures (Force):

- Deployment of Security Forces: Strengthening the presence of Central and State police forces in Left Wing Extremism (LWE)-affected areas.

- Joint Operations: Coordinated actions between state police and central armed forces like the CRPF (Central Reserve Police Force) and COBRA (Commando Battalion for Resolute Action).

- Capacity Building: Upgrading weapons, communication systems, and infrastructure for forces. E.g., use of Mini UAV for CAPF battalions, solar lights, mobile towers etc.

- Operation SAMADHAN: A focused approach addressing intelligence gathering, operational strategy, and development.

- Development Initiatives:

- Focused Development Schemes: Implementation of flagship programs such as:

- PMGSY (Pradhan Mantri Gram Sadak Yojana): For rural road connectivity.

- Aspirational Districts Programme: The government has approved the construction of 15,000 houses in Naxal-affected regions.

- Efforts are underway to achieve 100% saturation of government welfare schemes in every village

- Skill Development in 47 LWE Affected Districts Scheme: Specifically tailored for LWE-affected areas.

- Civic Action Program (CAP): Providing financial grants for CAPFs to undertake various welfare activities in the LWE affected areas

- Special Infrastructure Scheme: Creation of basic infrastructure like roads, bridges, and schools in remote areas.

- Better Governance: Enhancing administrative efficiency in these regions through recruitment of local personnel.

- Focused Development Schemes: Implementation of flagship programs such as:

- Empowerment (Winning Hearts and Minds Approach):

- Public Engagement: Fostering trust and communication between the government and tribal communities, reducing alienation.

- Rehabilitation Policies: Surrender and rehabilitation schemes for Maoist cadres, offering incentives like education, vocational training, and financial aid.

- Addressing Grievances: Ensuring fair land acquisition policies, implementation of Forest Rights Act, 2006, and protection of tribal rights to reduce the socio-economic gap.

Note: SAMADHAN stands for S – Smart Leadership, A – Aggressive Strategy, M – Motivation and Training, A – Actionable Intelligence, D -Dashboard Based KPIs (Key Performance Indicators), and KRAs (Key Result Areas), H- Harnessing Technology, A – Action plan for each theatre and N- No access to Financing.

What is Maoism?

- About: Maoism is a form of communism developed by Mao Tse Tung. It is a doctrine to capture State power through a combination of armed insurgency, mass mobilization and strategic alliances.

- Mao called this process, the ‘Protracted People's War’, where the emphasis is on ‘military line’ to capture power.

- Maoist Ideology: The central theme of Maoist ideology is the use of violence and armed insurrection as a means to capture State power.

- ‘Bearing of arms is non-negotiable’ as per the Maoist insurgency doctrine.

- Indian Maoists: The largest and the most violent Maoist formation in India is the Communist Party of India (Maoist) formed in 2004.

- The CPI (Maoist) and its front organizations were banned under the Unlawful Activities (Prevention) Act, 1967.

- Front Organizations are the off-shoots of the parent Maoist party, which professes a separate existence to escape legal liability.

- The CPI (Maoist) and its front organizations were banned under the Unlawful Activities (Prevention) Act, 1967.

What are the Recent Achievements in Eliminating Maoist Insurgency?

- ‘Maoist-Free’ Villages: In 2023, 287 Naxalites were neutralized, approximately 1,000 were arrested, and 837 surrendered in Chhattisgarh.

- Villages in Dantewada have been progressively declared ‘Maoist-free’, with over 15 villages achieving this status by 2021.

- Never before has such a vast area been freed from Naxal influence in a year, with record numbers of Naxalites neutralized, arrested, or surrendered.

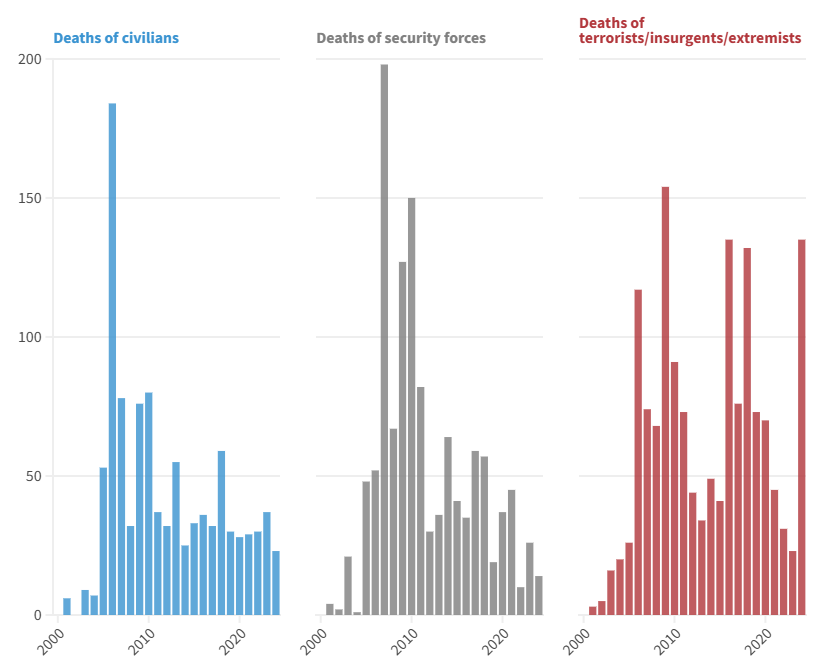

- Low Security Forces’ Casualties: In 2024, 14 security personnel deaths were reported, a dramatic decline compared to 198 deaths in 2007 (the highest recorded).

- Winning Hearts and Minds: The Maoists' setbacks are due to waning support from tribal communities, who, after years of harm, now show fatigue and alienation.

- Enhanced Security Measures: Deployment of 12 helicopters, up from just 2 earlier, for troop support and operational efficiency has drastically reduced the number of casualties among government troops.

- Infrastructure and Logistics: Between 2014 and 2024, 544 fortified police stations were built, compared to only 66 between 2004 and 2014.

- Filling of 45 police stations to eliminate security vacuums.

- Special Central Assistance: A total of Rs 14,367 crore has been approved so far, out of which Rs 12,000 crore has been spent on improving basic infrastructure in affected regions.

What are the Challenges in Eliminating Maoist Insurgency?

- Exploitation and Oppression: Maoists’ core base tribals and dalits faced historic marginalization, with Adivasis further alienated by the feudal system, caste hierarchy, and laws like the Forest Conservation Act, 1980.

- Lack of Development: Interior areas lack basic infrastructure, with development stalled by governance and implementation failures despite significant allocations.

- Centralized Maoist Command: The CPI (Maoists) have centralized command, while the government's fragmented response allows areas like Abhujmadh to serve as logistical bases.

- Access to Rich Resources: 80% of coal reserves and nearly 19% of other rich mineral resources are located in naxal affected tribal areas which has given them an additional weapon and impetus to extract maximum benefits.

- Trust Deficit: Local alienation is worsened by ineffective governance, non-implementation of constitutional provisions (e.g., Fifth and Ninth Schedules), and displacement without proper rehabilitation.

Way Forward

- Governance Reforms: Constitute Tribal Advisory Councils as mandated by the Fifth Schedule to empower tribals in managing their resources.

- Enforce Land Ceiling Acts under the Ninth Schedule to redistribute land to the landless.

- Economic Development: Focus on aggressive and inclusive developmental initiatives to address basic human needs.

- Provide alternative livelihoods to replace dependency on illegal activities like opium cultivation.

- Security Measures: Deploy specialised unit of paramilitary forces to secure tribal areas while empowering local governance structures.

- Resource Management: Ensure sustainable and equitable exploitation of natural resources with tribals as stakeholders in the process.

|

Drishti Mains Question: Q. Analyze the three-pronged strategy used by the government of India to eliminate Maoist insurgency. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Mains

Q. What are the determinants of left-wing extremism in the Eastern part of India? What Strategy should the Government of India, civil administration and security forces adopt to counter the threat in the affected areas? (2020)

Q. The persisting drives of the government for development of large industries in backward areas have resulted in isolating the tribal population and the farmers who face multiple displacements. With Malkangiri and Naxalbari foci, discuss the corrective strategies needed to win the Left Wing Extremism (LWE) doctrine that affected citizens back into the mainstream of social and economic growth. (2015)

Applying POSH Act in Political Parties

For Prelims: Supreme Court, Public Interest Litigation, Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013, Vishakha guidelines

For Mains: Application of POSH Act in Political Parties, Need, Implications and Challenges in applying POSH in political parties, Initiatives Related to Women’s Safety in India.

Why in News?

Recently, a Public Interest Litigation (PIL) has been heard by the Supreme Court regarding applicability of Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 (POSH Act) in political parties.

- This issue has remained an area of ambiguity, especially considering the peculiar structure of political organisations in India.

Why is there a Need to Bring Political Parties under the POSH Act?

- Harassment of Women Parliamentarians: A 2016 Inter-Parliamentary Union (IPU) survey found that 82% of women parliamentarians globally face psychological violence, including sexist remarks and threats.

- In regions like Africa, 40% of parliamentarians experiencing sexual harassment.

- Ensuring Safe Work Environment: Despite growing participation, women hold only 14.4% of Lok Sabha seats and less than 10% in state legislatures, reflecting systemic barriers.

- Ensuring safety in political parties can encourage greater representation and leadership roles for women.

- Legal and Constitutional Mandate: Articles 14 and 15 of the Constitution guarantee equality and non-discrimination and POSH Act’s broad definition of “workplace” and “employee” can cover party workers, volunteers, and field operatives, ensuring their rights are protected.

- Lack of Internal Mechanisms: Political parties often lack proper grievance redressal systems.

- Internal committees are not mandated to include external members or meet impartiality standards as required under the POSH Act, leading to underreporting of harassment cases.

- Electoral and Institutional Reforms: Including political parties under the POSH Act aligns with the Election Commission’s emphasis on transparency and accountability in party operations, ensuring internal democracy and gender justice in influential institutions.

- Global Best Practices: Countries like Sweden and Norway have institutionalized gender-sensitive practices in political organizations, serving as models for India.

- The UK Parliament's Independent Complaints and Grievance Policy (ICGP), established in 2017, aims to tackle bullying and sexual harassment in UK Parliament.

What is the POSH Act?

- About:

- It was enacted by the Government of India to address the issue of sexual harassment in workplaces and ensure a safe and conducive environment for women.

- Background:

- The genesis of the PoSH Act lies in the landmark 1997 Supreme Court judgment in Vishakha and Others v. State of Rajasthan, which formulated the Vishakha Guidelines to safeguard women from sexual harassment.

- These guidelines, based on constitutional principles (such as Article 15, which prohibits discrimination on grounds of sex) and international conventions (like the Convention on the Elimination of All Forms of Discrimination Against Women (CEDAW), which India ratified in 1993, served as the foundation for the Act.

- Sexual Harassment:

- The Act defines sexual harassment in broad terms, including unwelcome physical contact, sexual advances, requests for sexual favors, sexually colored remarks, showing pornography, and any other unwelcome conduct of a sexual nature, whether physical, verbal, or non-verbal.

- Definition of Workplace:

- Section 3(1) of the POSH Act states that “No woman shall be subjected to sexual harassment at any workplace.” The definition of “workplace” is broad and includes:

- Public sector organizations established or financed by the government.

- Private sector organizations.

- Locations visited by employees during the course of employment.

- Section 3(1) of the POSH Act states that “No woman shall be subjected to sexual harassment at any workplace.” The definition of “workplace” is broad and includes:

- Key Provisions:

- Prevention and Prohibition: The Act places a legal obligation on employers to prevent and prohibit sexual harassment in the workplace.

- Internal Complaints Committee (ICC): Employers are required to constitute an ICC at each workplace with 10 or more employees to receive and address complaints of sexual harassment.

- The Complaints Committees have the powers of civil courts for gathering evidence.

- An appeal from the ICC can be filed in the industrial tribunal or the labor court.

- In organizations with less than 10 employees or specific circumstances lacking an Internal Committee (IC), a Local Committee (LC) is constituted by the District Officer to receive and address complaints.

- The Complaints Committees have the powers of civil courts for gathering evidence.

- Duties of Employers: Employers must undertake awareness programs, provide a safe working environment, and display information about the POSH Act at the workplace.

- Complaint Mechanism: The Act lays down a procedure for filing complaints, conducting inquiries, and providing a fair opportunity to the parties involved.

- Penalties: Non-compliance with the Act's provisions can result in penalties, including fines and cancellation of business licenses.

Recommendations of the Justice Verma Committee on Sexual Harassment at Workplace:

The Justice Verma Committee, which was constituted in response to the 2012 Delhi gang rape case to review laws relating to sexual violence against women. It made several key recommendations regarding sexual harassment at the workplace such as:

- Inclusion of Domestic Workers: The Committee recommended that domestic workers should be covered under the PoSH Act to ensure their protection from sexual harassment.

- Employer Compensation: The Committee recommended that the employer should be liable to pay compensation to women who have suffered sexual harassment at the workplace, alongside other legal remedies.

- Employment Tribunal: Instead of relying solely on an Internal Complaints Committee (ICC), the Committee proposed setting up an Employment Tribunal to address complaints of sexual harassment, ensuring more impartial and comprehensive adjudication.

What are the Challenges in Application of POSH Act in Political Parties?

- Lack of Traditional Structure:

- Political parties often employ temporary workers who may not have a defined workplace or a direct relationship with high-ranking officials.

- This makes it challenging to identify the workplace responsible for establishing ICCs.

- Political parties often employ temporary workers who may not have a defined workplace or a direct relationship with high-ranking officials.

- Absence of Explicit Guidelines:

- Political parties typically manage internal discipline (including sexual harassment cases) through their own committees as there is absence of explicit guidelines for application of POSH related to parties.

- Role of the Election Commission of India (ECI):

- ECI has explicit mandate in case of RPA Act under Article 324 of the Constitution but it lacks in other laws like POSH.

- ECI has enhanced transparency through measures like mandatory candidate disclosures and political funding accountability.

- However, its role in enforcing workplace safety laws, such as the POSH Act, remains unclear.

- Legal Precedents:

- The Kerala High Court, in the case of Centre for Constitutional Rights Research and Advocacy v. State of Kerala (2022) ruled that political parties do not have an employer-employee relationship with their members and thus are not obligated to establish ICCs.

- This ruling underscores the complexity of applying workplace laws to the political sphere.

Similar Issues Related to Political Parties

- Bringing Political Parties under RTI Act: Despite being declared public authorities by the CIC in 2013, most political parties have resisted coming under the ambit of the RTI Act.

- This lack of transparency in their functioning and financial dealings undermines public trust and democratic accountability.

- No Mandatory Income Tax Compliance: Under Section 13A of the Income Tax Act, 1961, political parties are exempt from taxes if they maintain proper accounts and submit audited reports.

- However, there are allegations of misuse, with many parties not fully disclosing their financial details. Reforms to mandate greater accountability and taxation compliance could help curb financial opacity.

Way Forward

- Legislative Amendments: Amend the POSH Act to explicitly include political parties, addressing ambiguities regarding “workplace” and “employer” in the context of party structures.

- Explicit guidelines from the ECI or the Supreme Court are essential to ensure political parties comply with workplace safety laws like the POSH Act.

- If smaller institutions with 10 or more members are mandated to constitute Internal Committees, there is no justification for exempting political parties.

- Institution of ICCs: Mandate the establishment of Internal Complaints Committees (ICCs) within political parties to ensure adherence to the POSH Act and provide a robust grievance redressal mechanism.

- Capacity Building and Awareness: Conduct regular sensitisation and training programs within political parties to educate members on issues related to sexual harassment and the functioning of ICCs.

- Dedicated Tribunal for Women: As recommended by the Verma Committee, a dedicated tribunal for addressing complaints of harassment within political parties can be established as an independent and specialized mechanism.

- This would foster accountability, ensure timely redressal, and create a safer, more inclusive political environment for women politicians.

- Strengthening ECI Oversight: Empower the Election Commission of India (ECI) to monitor and enforce compliance with workplace safety norms, ensuring accountability and transparency within political parties.

Conclusion

The Supreme Court's deliberations on the applicability of the POSH Act to political parties underscore the pressing need for robust legal frameworks to ensure workplace safety. Given their pivotal role in shaping governance and societal norms, political parties must prioritize safeguarding women against harassment. The verdict in this matter holds the potential to set a transformative precedent, impacting not only the functioning of political parties but also workplace safety standards across diverse sectors in India.

|

Drishti Mains Question: Analyze the role of the POSH Act in ensuring workplace safety for women. Should political parties be brought under its ambit? Justify your answer with arguments and examples. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains

Q. We are witnessing increasing instances of sexual violence against women in the country. Despite existing legal provisions against it, the number of such incidences is on the rise. Suggest some innovative measures to tackle this menace. (2014)

Switzerland Suspends MFN Status to India

For Prelims: Most Favoured Nation Clause, Double Tax Avoidance Agreement, Withholding Tax, Organisation for Economic Cooperation and Development, Income Tax Act, 1961, Trade and Economic Partnership Agreement, European Free Trade Association, International Monetary Fund, Tax Evasion, World Trade Organization, Free Trade Agreements.

For Mains: Significance of Most Favoured Nation Clause and Double Taxation Avoidance Agreements in international taxation.

Why in News?

Switzerland has decided to rescind its unilateral application of the most-favoured-nation (MFN) clause in its Double Tax Avoidance Agreement (DTAA) with India.

- Switzerland will revert to the earlier withholding tax rate of 10% on Indian entities starting 1st January 2025.

What are Key Facts Regarding MFN Clause in DTAA?

- DTAA between India and Switzerland: DTC IN-CH (India-Switzerland Direct Tax Convention) was signed on 2nd November 1994, to avoid double taxation on income between India and Switzerland. It was revised in 2000 and 2010.

- Article 11 of the 2010 protocol contains the MFN clause, which forms the basis for withdrawal of the MFN status by Switzerland under DTAA.

- MFN Clause in Protocol: The MFN clause ensures that lower tax rates offered by India to any third-country Organisation for Economic Cooperation and Development (OECD) member automatically apply to Switzerland as agreed upon after the 2010 protocol.

- The MFN clause aimed to maintain parity in taxation rates.

- Reason for Switzerland’s MFN Withdrawal: After the 2010 protocol, India signed DTAA with two OECD members i.e., Lithuania (5% tax rate on dividends) and Colombia (5% general tax rate on dividends).

- However, the same concessional tax rate was not extended to Switzerland.

- Following the Indian Supreme Court's ruling in 2023, Switzerland acknowledged the lack of reciprocity in its MFN clause interpretation and decided to revert to the earlier 10% withholding tax rate starting 1st January 2025.

- India’s Response: India claimed that the MFN clause does not apply automatically unless officially notified under Section 90 of the Income Tax Act, 1961.

- It further argued that the clause applies only to countries that were OECD members at the time of signing the 2010 protocol.

- In October 2023, India’s Supreme Court ruled that Lithuania and Colombia joining the OECD after 2010 does not trigger the MFN clause, so India need not lower its dividend tax rates to 5%.

- Lithuania and Colombia joined the OECD in 2018 and 2020 respectively.

- Future Taxation under DTAA: From 1st January 2025, the withholding tax rate will be 10% as the MFN clause no longer applies. 5% tax rate valid for the period 2018-2024.

- Impact on Investments and Trade: Switzerland clarified that this decision will not affect the free trade agreement between India and Switzerland or Swiss investments in India.

- India and EFTA have signed the Trade and Economic Partnership Agreement (TEPA) in 2024 under which India will receive USD 100 billion as foreign direct investment (FDI) in 15 years.

- EFTA (European Free Trade Association) consists of Iceland, Switzerland, Norway, and Liechtenstein.

- India and EFTA have signed the Trade and Economic Partnership Agreement (TEPA) in 2024 under which India will receive USD 100 billion as foreign direct investment (FDI) in 15 years.

India-Switzerland Investment Scenario

- According to the Ministry of Commerce and Industry Switzerland’s investment flows in India amounted to USD 9.95 billion between 2000 and 2023 making it the 12th largest investor in India.

- According to the International Monetary Fund (IMF) Swiss investment stocks in India amounted to USD 35 billion in 2021.

- According to the IMF, Switzerland is the 8th largest recipient of Indian FDIs stocks, amounting to USD 3.7 billion.

- Over 330 Swiss companies, including Nestle, ABB, Novartis, Roche, UBS, and Credit Suisse, have invested in India across sectors like machinery, pharmaceuticals, finance, construction, sustainable technologies, and ICT services.

- Nearly 140 Indian companies, including TCS, Infosys, HCL Tech, and Wipro, have investments in about 180 entities in Switzerland, mainly in technology (32%) and life sciences (21%).

Switzerland

- Switzerland, officially the Swiss Confederation, is a small mountainous country in Central Europe, known for Alps mountains, lakes, and valleys.

- It is a landlocked country bordered by France, Italy, Austria, Germany, and Liechtenstein.

- It has been well-known for centuries for its neutrality.

- As a result, Switzerland, particularly Geneva, is a popular headquarters location for international organizations, such as the International Committee of the Red Cross and the United Nations.

- It is not a member of the European Union and NATO.

- It is also known for its secretive banking sector.

What can be the Impact of Suspension of MFN Status with India?

- Increased Tax Liabilities: Indian businesses operating in Switzerland may face higher tax liabilities as withholding tax on dividends from Switzerland will rise to 10% from 5%.

- Withholding Tax (retention tax) is an obligation on the individual (either resident or non-resident) to withhold or deduct tax when making payments e.g., in the form of dividends, interest, and royalties.

- Cross-Border Tax Disputes: The suspension could lead to disputes between India and Switzerland regarding the interpretation of the treaty provisions.

- Protectionism in Taxation: Switzerland's move reflects a broader trend of countries, including India, adopting stricter tax treaty interpretations to protect domestic revenues.

- This decision could be seen as part of a global shift where countries are adopting more protectionist policies to safeguard their tax bases.

- Evolving International Tax Norms: The decision may push other countries to follow uniformity in tax treaty negotiations, ensuring that all parties align on essential clauses like MFN.

What is a Double Tax Avoidance Agreement (DTAA)?

- About: DTAA is a bilateral or multilateral agreement between two or more countries aimed at avoiding double taxation of the same income.

- It ensures that income is not taxed by both the country of residence and the country of source.

- Objectives of DTAA:

- Double Taxation Avoidance: Prevents paying taxes twice on the same income.

- Fiscal Evasion Prevention: Enables information sharing to combat tax evasion.

- International Trade Encouragement: Promotes cross-border business with clear tax rules and reduced liabilities.

- Mechanisms of DTAA:

- Residency and Source-based Taxation: DTAA defines tax rights for both residence and source countries.

- Credit Method: Tax paid in the source country is credited in the residence country.

- Exemption Method: Income is taxed in one country and may be exempt in the other.

- India's DTAA: India has one of the largest networks of DTAAs consisting of over 94 comprehensive DTAAs and eight limited DTAAs.

What is MFN Status?

- About: MFN refers to a trade status granted by one country to another, ensuring non-discriminatory trade between them.

- It does not mean preferential treatment, but guarantees that the recipient country will not face disadvantages compared to other trade partners of the granting country.

- MFN and WTO: MFN is a key principle of World Trade Organization (WTO) rules.

- Under WTO rules, if a country grants special status to one trade partner, this status must be extended to all WTO members.

- Non-Discriminatory Trade: MFN ensures that countries treat each other equally by offering the same trade conditions including:

- Lowest possible trade tariffs and trade barriers.

- Highest import quotas

- Increased market access

- Improved conditions for the flow of goods

- Exceptions to MFN:

- Free Trade Agreements (FTAs): Countries in a FTA offer special concessions to each other, excluding non-members.

- Regional Trade Agreements (RTAs): Member countries negotiate better terms among themselves, often excluding non-members.

Conclusion

- Switzerland's decision to suspend the MFN clause in its DTAA with India marks a significant shift in international taxation, highlighting the evolving global norms in tax treaties. This change could increase tax liabilities for Indian entities operating in Switzerland and impact cross-border investment flows, while underscoring the need for clear treaty interpretations.

|

Drishti Mains Question: Q. Discuss the role of Double Tax Avoidance Agreements (DTAAs) in preventing double taxation and fiscal evasion. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. With reference to India’s decision to levy an equalization tax of 6% on online advertisement services offered by non-resident entities, which of the following statements is/are correct? (2018)

- It is introduced as a part of the Income Tax Act.

- Non-resident entities that offer advertisement services in India can claim a tax credit in their

- home country under the “Double Taxation Avoidance Agreements”.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)

Q. A great deal of Foreign Direct Investment (FDI) to India comes from Mauritius than from many major and mature economies like the UK and France. Why? (2010)

(a) India has preference for certain countries as regards receiving FDI

(b) India has double taxation avoidance agreement with Mauritius

(c) Most citizens of Mauritius have ethnic identity with India and so they feel secure to invest in India

(d) Impending dangers of global climatic change prompt Mauritius to make huge investments in India.

Ans: (b)

Mains

Q. Comment on the important changes introduced in respect of the Long-term Capital Gains Tax (LCGT) and Dividend Distribution Tax (DDT) in the Union Budget for 2018-2019. (2018)

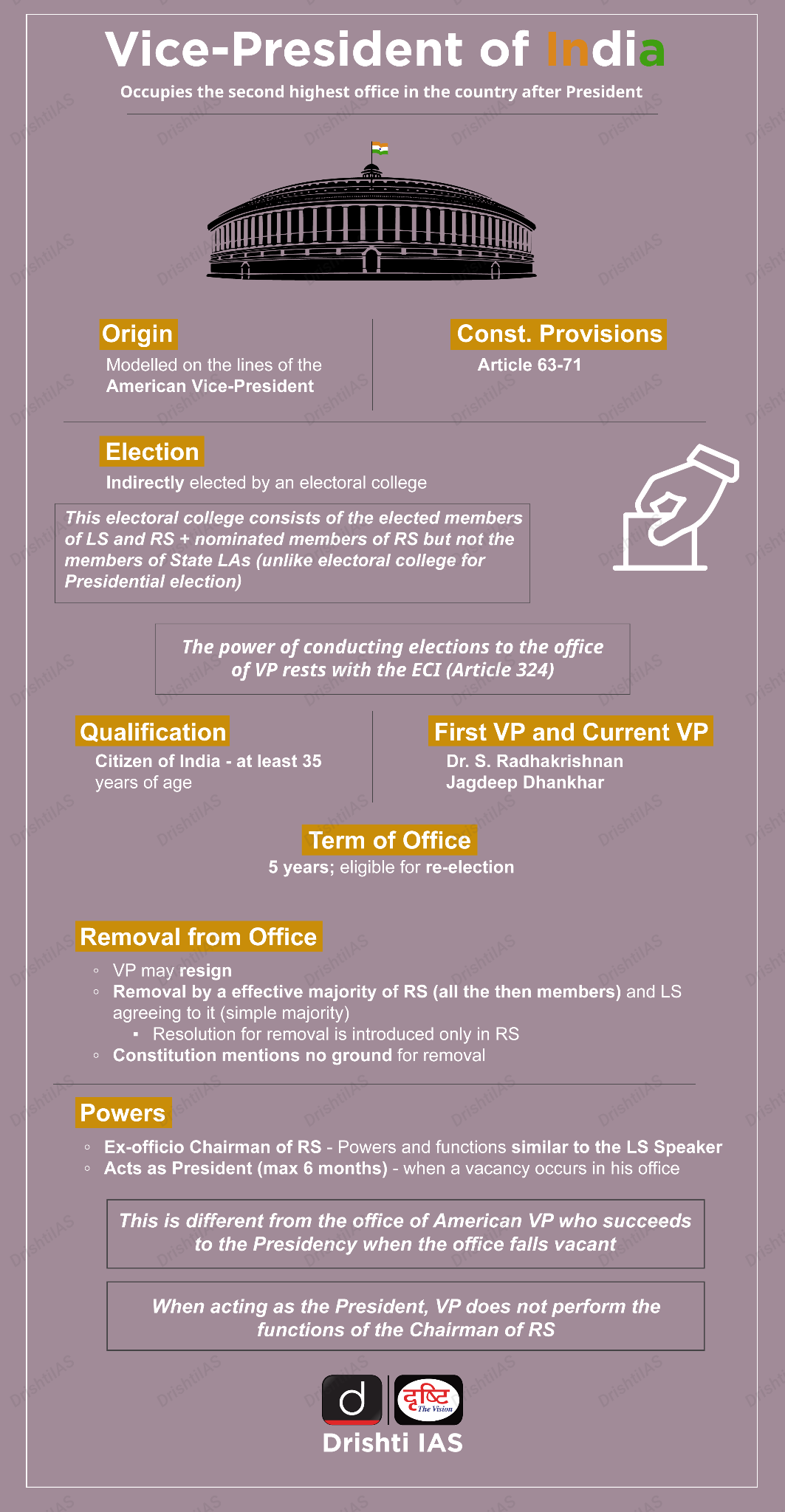

Removal of Vice-President

For Prelims: Vice-President of India, Related Constitutional Provisions

For Mains: Election Procedure of Vice-President of India, and Associated Issues.

Why in News?

Recently, the Opposition parties have decided to submit a notice (under Article 67(b)) to move a motion of no-confidence against the Vice-President, who also serves as the Chairman of the Rajya Sabha.

- The motion of no-confidence with respect to the Rajya Sabha is an informal term and is not mentioned in the Constitution.

No-Confidence Motion

- A No-Confidence Motion is introduced in the Lok Sabha (and not in the Rajya Sabha) to assess the government's support.

- It requires backing from 50 members to be considered and if passed, the government must resign.

- These motions are crucial political events, typically arising when the government is perceived to be losing majority support.

What are the Constitutional Provisions Regarding the Vice-President?

- Vice President:

- Article 63 of the Constitution of India states that there shall be a Vice-President of India.

- Article 64 states that the Vice President also serves as the ex-officio Chairperson of the Rajya Sabha and cannot hold any other office of profit.

- When the Vice President assumes the role or duties of the President under Article 65 of the Constitution of India, they will not perform the responsibilities of the Chairman of the Rajya Sabha and will not receive the salary or allowances designated for the Chairman under Article 97.

- Resignation from the office requires submitting a letter to the President of India, effective upon acceptance.

- Qualification for the Office: Article 66 specifies the qualifications required for a person to be eligible for the office of Vice President.

- Must be an Indian citizen.

- Must be at least 35 years old.

- Must be eligible for election as a member of the Rajya Sabha.

- Must not hold any office of profit under the Union or state governments, local authorities, or any other public authorities.

- Election:

- Vacancy: Article 68 of the Constitution mandates that the election to fill the Vice President's vacancy due to term expiration must be completed before the current term ends.

- Article 324 of the Constitution, grants the Election Commission of India the authority to oversee, direct, and control the election process for the Vice President.

- Participants: Article 66 states that the Vice President is elected by an Electoral College, which consists of elected and nominated members from both Houses of Parliament.

- The election follows a system of proportional representation using a single transferable vote, and the voting is conducted by secret ballot.

- Vacancy: Article 68 of the Constitution mandates that the election to fill the Vice President's vacancy due to term expiration must be completed before the current term ends.

- Oath:

- According to Article 69, the Vice President must take an oath or affirmation before the President, or an appointed representative, before assuming office.

- Term of the Office:

- Article 67 of the Constitution of India states that the Vice President serves a five-year term from the date they assume office.

- The Vice President holds the second highest constitutional position and will remain in office beyond this term until their successor takes over.

- Removal:

- Article 67(b) states that the Vice President may be removed if an effective majority “all the then members of Rajya Sabha” passes a resolution for his removal, which must then be “agreed to” by the Lok Sabha, with at least 14 days' notice given before moving the resolution.

- Upon the expiry of the 14-day period, Rajya Sabha will take up the resolution for discussion, following the procedure outlined in Article 67(b).

- There are no precedents to indicate if the resolution can be considered in the next session.

- Article 92 of the Constitution explicitly bars the Chairman or Deputy Chairman from presiding over proceedings while a resolution for their removal is under consideration.

- Article 67(b) states that the Vice President may be removed if an effective majority “all the then members of Rajya Sabha” passes a resolution for his removal, which must then be “agreed to” by the Lok Sabha, with at least 14 days' notice given before moving the resolution.

- Power and Functions:

- The Chairman of the Rajya Sabha can adjourn the House or suspend its sitting if there is no quorum.

- The 10th Schedule of the Constitution authorizes the Chairman to decide on the disqualification of a Rajya Sabha member due to defection.

- The Chairman's approval is required to raise a question of breach of privilege in the House.

- Parliamentary Committees, whether established by the Chairman or the House, operate under the Chairman's guidance.

- The Chairman appoints members to various Standing Committees and Department-related Parliamentary Committees. He also chairs the Business Advisory Committee, the Rules Committee, and the General Purposes Committee.

- The Chairman is responsible for interpreting the Constitution and rules related to the House, and no one can dispute the Chairman's interpretation.

Note: The original Constitution provided that the Vice-President would be elected by the two Houses of Parliament assembled at a joint meeting.

- This cumbersome procedure was done away by the 11th Constitutional Amendment Act of 1961.

Differences Between the Vice Presidents of India and the US

|

India |

US |

|

|

|

|

|

|

|

Drishti Mains Question Discuss the constitutional provisions related to the Vice-President in India and its role in parliamentary democracy. |

UPSC Civil Services Exam, Previous Year Questions (PYQ)

Prelims

Q. Consider the following statements: (2013)

- The Chairman and the Deputy Chairman of the Rajya Sabha are not the members of that House.

- While the nominated members of the two Houses of the Parliament have no voting right in the presidential election, they have the right to vote in the election of the Vice President.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Restructuring of NTA

Why in News?

A government-appointed panel, led by former ISRO chairman K. Radhakrishnan, has recommended extensive reforms in the National Testing Agency (NTA).

What are the Key Recommendations for Restructuring the NTA?

- Empowered Governance: Create an empowered governing body with three sub-committees on audit, ethics, and stakeholder relations.

- The Director-General (DG) should be at least of additional secretary rank and hold a dedicated leadership position.

- ‘Digi Exam’ System: It suggests launching a ‘Digi Exam’ system to prevent impersonation.

- The process uses Aadhaar, biometrics, and AI analytics to authenticate candidates' identities at various stages of the exam process.

- Mobile Test Centers (MTCs): Equip buses with workstations, internet connectivity, and power supply to reach remote locations like the Northeast, Himalayan states, and islands.

- Hybrid Testing Methods: Encrypted question papers are transmitted to the centralised servers of testing centers, printed securely, using high-speed printers for ensuring confidentiality.

- Printing of Question Papers: The printing press should undergo pre-approval verification and continuous monitoring throughout printing, packaging, and transportation.

- Question papers and OMR sheets should be uniquely coded and audited.

- Testing Innovations: The panel recommended three policy innovations.

- Multi-Session Testing: For large-scale exams, particularly when participant numbers exceed two lakh.

- Multi-Stage Testing: Test to be conducted in phases, with each stage focusing on a specific aspect of the candidate's knowledge or skills.

- Cluster Approach: Streamlining the wide range of subject streams for CUET admission into more focused clusters of related subjects.

- Test Centre Allocation: The panel proposed allocating testing centers near candidates' residences and establishing secure centers in each district.

- The National Testing Agency should aim to set up 1,000 secure centers, prioritizing government institutions.

- Permanent Staffing: It recommended NTA to hire permanent staff.

- Collaboration: The NTA should collaborate with Test Indenting Agencies, including the University Grants Commission (UGC) and Council of Scientific and Industrial Research (CSIR), throughout the testing process.

What is the National Testing Agency?

- About: NTA was established in 2017 as a Society registered under the Indian Societies Registration Act, of 1860.

- Objective: It is a premier, specialist, autonomous and self-sustained testing organization to conduct entrance examinations for admission/fellowship in higher educational institutions. E.g., JEE (Main), CMAT, UGC - NET etc.

- Governance: NTA is chaired by an eminent educationist appointed by the Ministry of Education.

- The Director General is assisted by 9 verticals headed by academicians/ experts.

- The CEO is the Director General appointed by the Government.

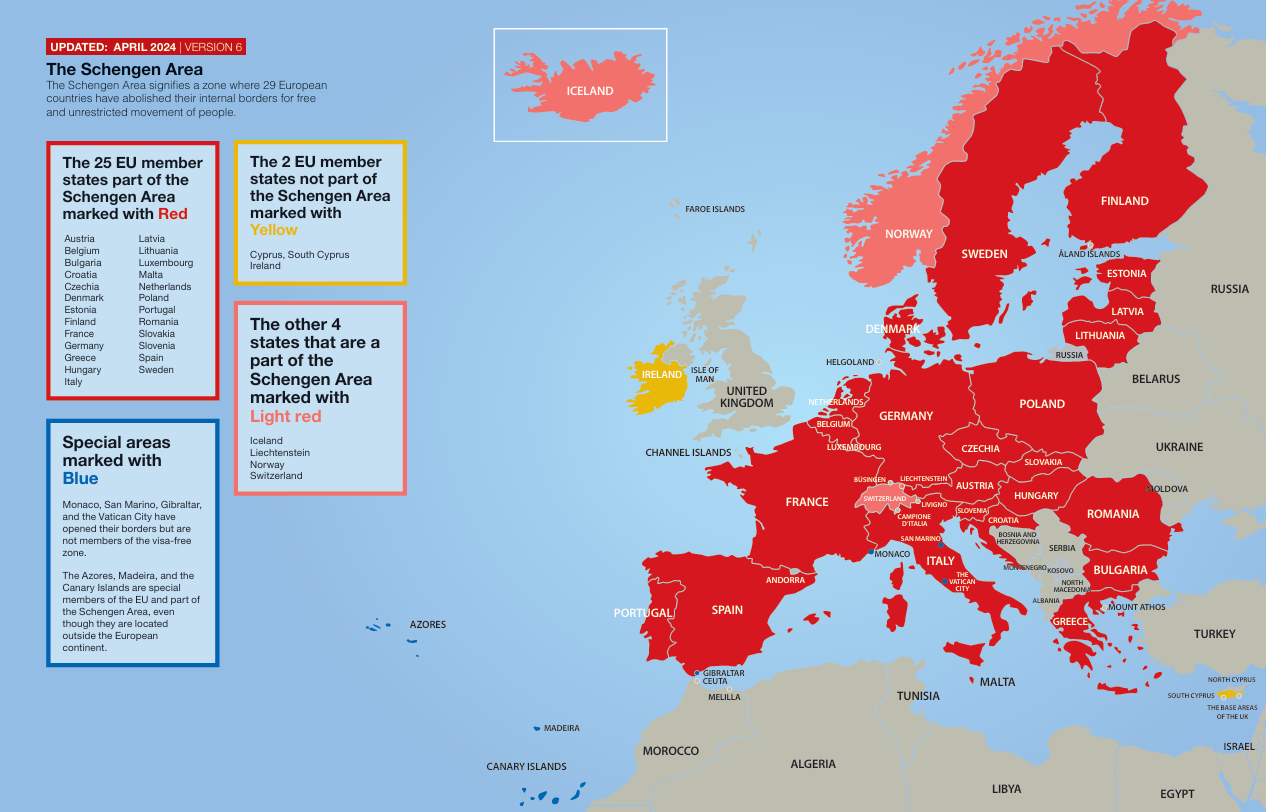

Romania and Bulgaria Join Schengen Zone

Why in News?

Bulgaria and Romania will join the European Union's Schengen zone on 1st January 2025. Both nations, which have been EU members since 2007, will finally be able to join the borderless area, allowing for seamless travel and movement across Europe.

What is the European Union's Schengen Zone?

- About: The Schengen Zone is named after a small village in Luxembourg, where the Schengen Agreement (1985) and Schengen Convention (1990) were signed.

- These agreements abolished internal border checks between participating countries, allowing for free movement of people across most EU states and some non-EU countries.

- The Schengen Area is the world's biggest area without internal border controls, and now covers 29 countries (25 of the 27 EU member states (excluding Cyprus and Ireland), as well as four non-EU countries (Iceland, Liechtenstein, Norway, and Switzerland).

- Key Features of the Schengen Zone:

- Free Movement: The Schengen Area guarantees free movement for over 425 million EU citizens and non-EU nationals legally residing in or visiting the EU.

- By abolishing internal border checks, it allows seamless travel, living, and working across participating countries.

- A uniform visa policy allows short-term stays of up to 90 days for tourists, business travelers, and other visitors.

- Cross-Border Cooperation: The Schengen Area includes provisions for police cooperation, judicial collaboration, and the Schengen Information System (SIS) to ensure security.

- SIS is the most widely used and largest information sharing system for security and border management in Europe.

- Temporary Border Controls: In exceptional circumstances, countries can temporarily reintroduce border controls for security reasons, but they must inform other member states and the European Commission.

- Schengen Evaluation: Countries wishing to join the Schengen Area must meet specific criteria, including effective border control, visa issuance, and law enforcement cooperation.

- Free Movement: The Schengen Area guarantees free movement for over 425 million EU citizens and non-EU nationals legally residing in or visiting the EU.

Key Facts About Bulgaria and Romania

- Bulgaria:

- Capital: Sofia.

- Geography: Bulgaria is located in the Balkans in Southeastern Europe. It borders the Black Sea and lies between Romania and Turkey.

- Bulgaria is bounded by Romania to the north, Turkey and Greece to the south, North Macedonia to the southwest, and Serbia to the west.

- Political System: Parliamentary Republic.

- Foreign Relations: Bulgaria is a member of the United Nations (UN), North Atlantic Treaty Organization (NATO), the European Union, and the Schengen Area.

- Romania:

- Capital: Bucharest.

- Geography: Romania is bounded by Ukraine to the north, Moldova to the northeast, the Black Sea to the southeast, Bulgaria to the south, Serbia to the southwest, and Hungary to the west.

- Political System: Semi-Presidential Republic.

- Foreign Relations: Romania is a member of the UN, NATO, EU, Euro-Atlantic Partnership Council, and Organization for Security and Cooperation in Europe (OSCE).

Jalvahak Scheme

Recently, the Union Minister for Ports, Shipping & Waterways launched the 'Jalvahak' scheme to promote inland waterways and cargo movement.

- Objective: It aims to unlock the trade potential of inland waterways, reduce logistics costs, and alleviate congestion in road and rail networks.

- It incentivises long-haul cargo movement on National Waterways (NW) 1 (Ganga), 2 (Brahmaputra), and 16 (Barak).

- Incentives:

- Provides reimbursements up to 35% of operating expenses for cargo movement on NW 1, 2 and 16 via the Indo-Bangladesh Protocol Route.

- It encourages hiring of vessels owned by private operators, promoting competition and efficiency.

- Economic and Environmental Impact:

- It aims to shift 800 million tonne-kilometres of cargo by 2027.

- The target is to increase cargo movement via waterways from 132.89 million tonnes (2023-24) to 200 million tonnes by 2030, and 500 million tonnes by 2047, supporting the Blue Economy and Atma Nirbhar Bharat initiatives.

- Inland Waterways Authority of India (IWAI):

- It was established in 1986 to regulate and develop inland waterways.

- India has 14,500 km of navigable waterways, including rivers, canals, and backwaters.

- Under the National Waterways Act, 2016, 111 waterways (5 existing and 106 new) have been declared as NWs.

Read More: India’s Inland Water Transport

Composite License for Insurer

Recently, the central government proposed introducing composite licenses through an amendment to the Insurance Act, 1938, aiming to increase insurance penetration in India and achieve ‘Insurance for All by 2047.

- Composite License: A composite license allows insurers to offer life and non-life insurance under a single registration, consolidating operations into one entity.

- Currently, insurers need to obtain separate licenses for each line of business.

- Benefits:

- A composite license reduces costs and compliance by allowing insurers to manage multiple lines under one entity, boosting innovation and efficiency.

- Life insurers can provide indemnity-based health insurance, improving underwriting and reducing costs with integrated IT systems.

- Agents can sell both life and non-life products, better meeting customers' financial needs.

- Regulatory Changes:

- Public Sector Undertaking (PSU) insurers need amendments to the Life Insurance Corporation (LIC) Act of 1956 and the General Insurance Business (Nationalisation) Act (GIBNA) of 1972 to be eligible for composite licenses.

Read more: GST on Health and Life Insurance in India

Opening of Moldova's Embassy in India

Recently, the Republic of Moldova, an east European country, inaugurated its embassy in New Delhi.

- India and Moldova established diplomatic relations in 1992 following Moldova's independence after the Soviet Union's collapse in 1991.

- Moldova:

- Moldova (Previous name: Bessarabia) is a landlocked country bordering Ukraine and Romania.

- It is in the northeastern corner of the Balkan Peninsula.

- The Balkan Peninsula is located in southeastern Europe and the name is derived from the Balkan mountain range.

- Most of Moldova lies between the great meandering Prut and Dniester rivers.

- It lies to the east of the great arc of the Carpathian Mountains.

- Transnistria is a tiny breakaway region of Moldova to the east of river Dniester.

- Transnistria is controlled by pro-Russian separatists and permanently hosts Russian troops as well as a large arms depot.

Read more: Transnistria in the Russia-Ukraine War

29th Delhi CII Summit

Recently, India's Union Commerce Minister emphasised on the need for equitable responsibilities in sustainable development during the 29th CII Partnership Summit held in Delhi.

Key Highlights of Summit

- Environmental Equity: India advocated for "common but differentiated responsibilities" (CBDR) and "polluter pays" principle, holding developed nations accountable for historical environmental damage.

- Opposition to Unilateral Measures: It criticized the EU's Carbon Border Adjustment Mechanism (CBAM) and EU Deforestation Regulation (EUDR) for harming developing nations' exports.

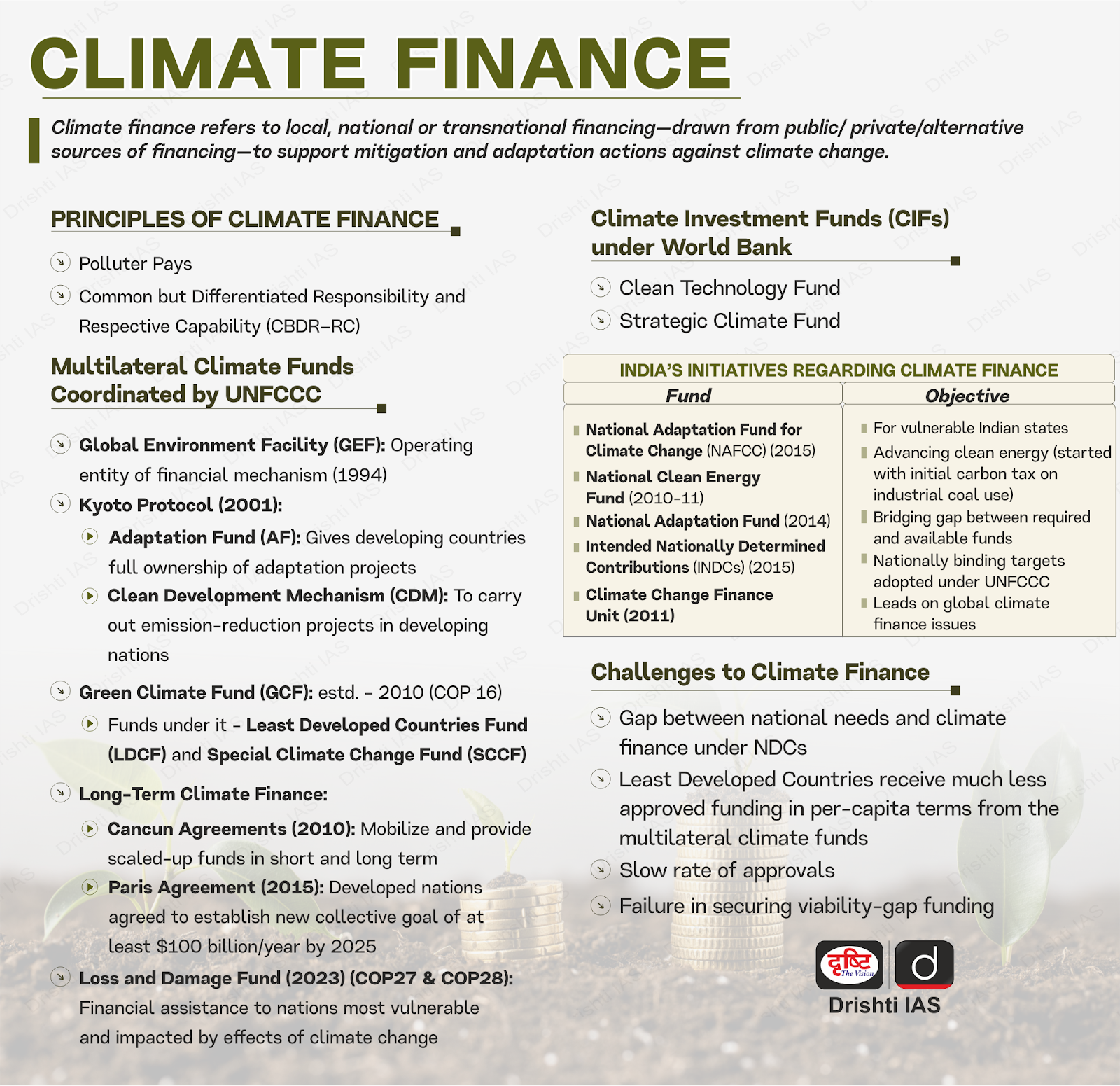

- Climate Finance: India expressed dissatisfaction with the USD 300 billion climate-finance package at CoP29 at Baku, emphasizing the need for focus on adaptation and finance for the Global South.

- Partnerships & Technology: India emphasized strengthening ties with nations like Israel, Italy, and Qatar, advocating technology exchange in climate resilience and wastewater management while promoting trade, sustainability, and regional security.

CII Partnership Summit 2024:

- Organizer: Confederation of Indian Industry (CII) in collaboration with DPIIT, Ministry of Commerce and Industry.

- Theme (2024): “Partnerships for Progress”.

- Participation: Delegates from 61 countries, focusing on sustainability, trade, green technologies, and regional security.

Read More: Climate Finance

Read More: Climate Finance