Economy

Reassessing India’s Free Trade Agreements

- 22 Oct 2024

- 18 min read

This editorial is based on “Welcome rethink on FTAs” which was published in The Hindu Business Line on 21/10/2024. The article highlights India's strategic pause in FTA negotiations to safeguard its government procurement policies, which have successfully supported domestic manufacturing and MSEs. It underscores limited opportunities in EU and UK markets despite their perceived attractiveness.

For Prelims: Free Trade Agreement, European Union , Comprehensive Economic Partnership Agreement , European Free Trade Association, Australia-India Economic Cooperation and Trade Agreement, SPS (Sanitary and Phytosanitary), South Asian Free Trade Agreement , EU's Carbon Border Adjustment Mechanism, Regional Comprehensive Economic Partnership , India Stack.

For Mains: Benefits of Free Trade Agreements for India, Key Issues Related to India's FTAs.

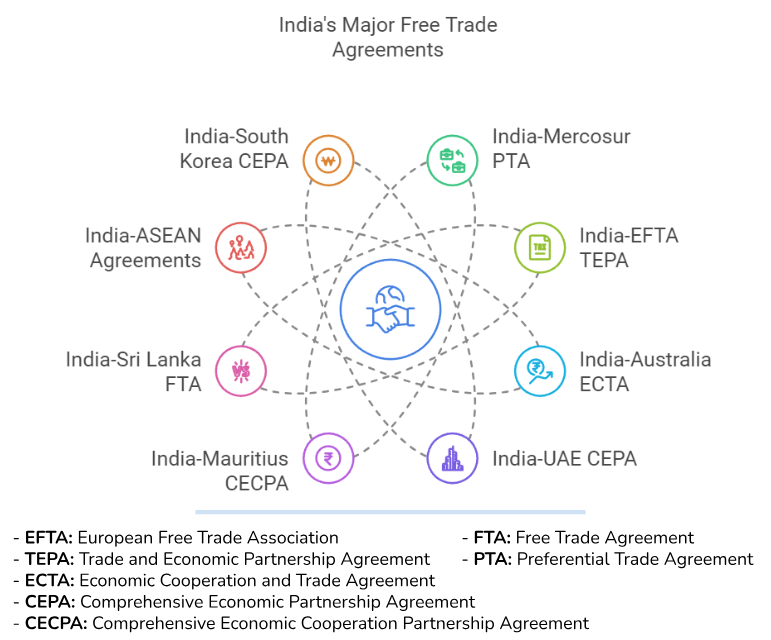

India's Department of Commerce is pausing Free Trade Agreement (FTA) negotiations to reassess its stance, particularly on government procurement policies. While developed nations push for open procurement access in FTAs, India has effectively used procurement to boost domestic manufacturing and support MSEs, achieving ₹82,630.38 crore in 2023-24. Despite the attractiveness of European Union and United Kingdom procurement markets, historical data suggests limited opportunities for Indian exporters. This pause allows India to carefully reconsider its position, ensuring domestic policies remain intact.

What are the Benefits of Free Trade Agreements for India?

- Enhanced Market Access and Export Growth: India's FTA with UAE demonstrates this benefit powerfully - exports to UAE grew by 11.8% to reach $31.3 billion in FY23 after Comprehensive Economic Partnership Agreement implementation.

- The agreement has opened up preferential access for Indian goods in over 97% of UAE's tariff lines, particularly benefiting textiles, gems and jewelry, and engineering goods sectors.

- These recent successes have created a template for India's ongoing negotiations with larger markets like the EU and UK, where similar preferential access could significantly boost India's export potential.

- Strategic Investment Inflows and Manufacturing Growth: The recent agreement with the European Free Trade Association exemplifies this benefit, with its unprecedented $100 billion investment commitment over 15 years.

- This investment focus represents a new approach in India's FTA strategy, linking trade access with concrete investment promises. The investment chapters in modern FTAs are particularly boosting India's manufacturing ambitions - for instance, the UAE-India CEPA has already facilitated several manufacturing investments, including a $2 billion food processing facility.

- These investments contribute directly to Make in India goals while creating employment opportunities and technology transfer.

- Supply Chain Resilience and Diversification: Post-pandemic, FTAs are helping India reduce dependency on single sources and build resilient supply chains.

- The Australia-India Economic Cooperation and Trade Agreement (ECTA) for instance, provides assured access to critical minerals needed for India's green technology and EV manufacturing.

- The ongoing negotiations with the EU and UK could further strengthen India's position in global supply chains, particularly in sectors like pharmaceuticals and automotive components.

- Technology Access and Innovation Ecosystem: Modern FTAs are facilitating technology transfer and innovation partnerships.

- The India-Japan CEPA has been instrumental in bringing advanced manufacturing technologies, particularly in the electronics and automotive sectors.

- The recent EFTA agreement, while protecting India's generic pharmaceutical interests by rejecting data exclusivity, includes provisions for technology cooperation in emerging areas like green technology and digital innovation.

- This aspect of FTAs is becoming increasingly important as India positions itself in global value chains.

- Services Sector Growth and Professional Mobility: Recent FTAs show significant gains for India's services sector.

- The UAE CEPA includes unprecedented provisions for mutual recognition of professional qualifications and easier visa access for skilled professionals.

- The Australia ECTA provides quota for Indian chefs and yoga teachers, while ongoing EU negotiations focus on IT/ITeS sector access.

- Sectoral Competitiveness and Quality Standards: FTAs are driving quality improvements and competitiveness in Indian industry.

- For example, the textiles sector saw a major growth in exports to Australia of an average of 11.84% over the last 5 years, driven by quality upgrades to meet Australian standards.

- Similar improvements are visible in pharmaceutical exports under various FTAs, with Indian companies increasingly meeting global quality benchmarks. This competitive pressure is actually helping Indian industries prepare for global competition.

What are the Key Issues Related to India's FTAs?

- Trade Deficit Concerns: India's trade deficits with FTA partners have consistently widened post-implementation.

- With ASEAN, the trade deficit increased from USD 5 billion in 2010 (when FTA was implemented) to over USD 43.57 billion in FY23.

- The India-Korea CEPA has seen a similar trend, with the deficit growing to USD 9.5 billion in 2021-22.

- Analysis shows that India’s FTA partners often utilize the agreements more effectively - for instance, India's FTA utilization remains very low at around 25%, while utilization for developed countries typically sits between 70-80%.

- Rules of Origin Issues: Misuse of Rules of Origin has become a critical concern, particularly with re-routing of Chinese goods through FTA partners.

- A 2020 report stated that Customs have detected fraudulent claims under FTA to the tune of Rs 1,200 crore.

- Indian manufacturers stated that imports are hurting domestic industry as the Chinese firms are resorting to dumping their products by misusing the FTA route.

- The issue is particularly acute in sectors like electronics and textiles.

- Non-Tariff Barriers: While FTAs reduce tariffs, non-tariff barriers often persist and limit market access. Indian pharmaceutical exports face significant regulatory hurdles in the EU despite proposed FTA negotiations.

- Recent data shows that Indian pharma companies spend 15-20% more on compliance for EU markets compared to other destinations.

- Similarly, Indian food exports face strict SPS (Sanitary and Phytosanitary).

- A total of 3,925 human food export shipments from India were refused entry at US customs in the last 4 years.

- Popular Indian spice brand MDH, under scrutiny for alleged contamination in some products, has since 2021 seen an average 14.5% of its US shipments rejected.

- Impact on Domestic Industries: FTAs have had a negative impact on many domestic industries, especially small and medium enterprises (SMEs) and traditional sectors like agriculture and dairy.

- Cheap imports of agricultural and dairy products from FTA partner countries have placed immense pressure on local farmers and producers, who find it difficult to compete.

- In 2022, the Indian government delayed negotiations for an FTA with Australia due to concerns raised by Indian dairy farmers, who feared losing out to competition from Australian dairy products.

- Recently, Indian Commerce and Industry Minister stated that India's dairy sector will not receive duty concessions under any Free Trade Agreements due to its sensitivity involving small farmers' livelihoods

- Similarly, India’s textile sector, which employs millions, has struggled with the influx of cheaper textile imports from countries like Bangladesh.

- In 2006, India permitted the duty-free import of readymade garments from Bangladesh under the South Asian Free Trade Agreement (SAFTA). This has led to a rise in apparel imports made from Chinese fabrics and yarns.

- Bangladesh imports these fabrics from China, manufactures garments using its low-cost labor, and then exports the finished products to India without incurring import duties.

- Lack of Improved Access for Indian Services: India’s FTAs have not sufficiently secured reciprocal market access for its competitive service sectors, such as IT, finance, and professional services.

- Many FTA partner countries impose stringent regulatory barriers, preventing Indian service providers from benefiting fully from the agreements.

- This issue became evident in the India-ASEAN FTA, where while goods trade increased, Indian service providers struggled to enter Southeast Asian markets due to several restrictions.

- A similar problem has emerged in India’s ongoing negotiations with the UK, where India is pushing for the liberalization of services and visa-related matters, particularly regarding the movement of professionals

- Intellectual Property Rights Tensions: IPR provisions in FTAs, particularly with developed partners, often create tensions with India's domestic policies.

- The ongoing India-EU FTA negotiations face challenges over pharmaceutical patent protection , EU demands could increase medicine costs if implemented.

- Similar issues exist in negotiations with the UK, where data exclusivity requirements could impact India's generic drug industry.

- Environmental and Labor Standards: New-age FTAs increasingly include environmental and labor standards that could impact competitiveness.

- The EU's Carbon Border Adjustment Mechanism could affect USD 8 billion worth of Indian exports despite FTA preferences.

- Labor standard requirements in proposed FTAs with developed nations could increase compliance costs for labor-intensive sectors like textiles and leather, affecting their export competitiveness.

- Geopolitical Concerns: India’s strategic and geopolitical concerns significantly influence its approach to FTAs, particularly in the context of rising tensions with China.

- India has been cautious about joining large regional agreements like the Regional Comprehensive Economic Partnership (RCEP). In 2019, India opted out of the RCEP negotiations, citing concerns about unequal market access and the potential negative impact on sectors such as agriculture, dairy, and small-scale industries.

- Additionally, India was apprehensive about China’s economic dominance within the agreement, which could lead to increased trade imbalances and dependency on Chinese goods, undermining India’s economic security.

What Strategies can India Pursue to Negotiate FTAs that Effectively Safeguard its National Interests?

- Strategic Negotiation Framework: Develop a data-driven negotiation framework using sector-specific impact assessment models.

- Establish clear thresholds for market access commitments based on domestic industry readiness scores (measured through productivity, quality standards, and competitiveness indices).

- Create an AI-powered trade analytics system to monitor real-time trade flows and predict impact scenarios. For example, implement a system similar to KOSIS KOrean Statistical Information Service that provides dynamic impact assessments.

- Set up a permanent multi-stakeholder negotiation team combining technical experts, industry representatives, and government officials.

- Rules of Origin Enforcement Mechanism: Strengthen the online Certificate of Origin management system with blockchain technology for real-time verification.

- Implement mandatory geo-tagging and digital tracking for sensitive import categories. Deploy AI-based risk assessment systems to flag suspicious trade patterns. For instance, establish a system similar to Singapore's Networked Trade Platform that tracks credentials across supply chains.

- Create dedicated RoO enforcement cells at major ports with advanced testing facilities for value addition verification.

- Domestic Industry Preparedness Program Launch sector-specific competitiveness enhancement programs before FTA implementation.

- Create a dedicated fund for technology upgradation and quality certification support. Establish industry-specific training centers in partnership with FTA partner countries.

- Like Setting up more Japan-India Manufacturing Institutes in key industrial clusters. Develop a rating system for export-ready firms and provide targeted support based on ratings.

- Services Trade Enhancement: Create a comprehensive database of non-tariff barriers in services sectors across FTA partners.

- Establish mutual recognition agreements for professional qualifications on priority basis.

- Develop a digital platform for service providers to report market access issues. For example, implement a system similar to the EU's Trade Barriers Reporting mechanism. Set up dedicated service export promotion councils with market-specific strategies.

- MSME Integration Strategy: Establish MSME export facilitation centers in all major industrial clusters with FTA-specific advisory services.

- Create a digital platform connecting MSMEs with potential buyers in FTA partner countries. Provide financial support for international certification and compliance.

- Launch an "MSME Global Connect" program with targeted interventions for each FTA market. Develop specialized credit schemes for MSME exporters with performance-based incentives.

- Digital Trade Infrastructure: Develop secure data exchange protocols with FTA partners for seamless digital trade. Create standardized digital documentation systems accepted across FTA networks promoting India Stack.

- Establish cross-border digital payment using UPI mechanisms with partner countries.

- Set up dedicated cyber security frameworks for cross-border digital trade.

- Value Chain Integration Program: Identify strategic value chains where India can play a larger role and develop targeted interventions.

- Create specialized industrial parks for deeper integration with FTA partner value chains. Establish supplier development programs with major companies from FTA partners.

- Launch sector-specific skill development initiatives aligned with value chain requirements.

- Review and Renegotiation Mechanism: Implement regular review mechanisms with clear performance metrics for each FTA.

- Establish trigger mechanisms for safeguard measures based on import surge indicators. Create a permanent joint working group with each FTA partner for continuous dialogue. Develop clear protocols for addressing emerging issues and concerns.

Conclusion

India's strategic pause in FTA negotiations highlights the need to reassess government procurement policies while safeguarding domestic manufacturing and MSEs. By prioritizing thorough evaluations and addressing existing challenges, India can ensure that future trade agreements not only promote economic growth but also align with national interests. A balanced approach will enable India to harness the benefits of FTAs while protecting its vital industries.

|

Drishti Mains Question: Discuss the impact of India's Free Trade Agreements (FTAs) on its economic growth and trade relations and suggest measures to enhance their effectiveness. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q1. Increase in absolute and per capita real GNP do not connote a higher level of economic development, if (2018)

(a) Industrial output fails to keep pace with agricultural output.

(b) Agricultural output fails to keep pace with industrial output.

(c) Poverty and unemployment increase.

(d) Imports grow faster than exports.

Ans: (c)

Q. Consider the following countries: (2018)

- Australia

- Canada

- China

- India

- Japan

- USA

Which of the above are among the ‘free-trade partners’ of ASEAN?

(a) 1, 2, 4 and 5

(b) 3, 4, 5 and 6

(c) 1, 3, 4 and 5

(d) 2, 3, 4 and 6

Ans: (c)