Biodiversity & Environment

EU's Carbon Border Tax Impact

- 09 Jan 2024

- 12 min read

This editorial is based on “Understanding the EU’s carbon border tax” which was published in The Hindu on 09/01/2024. It talks about the Carbon Border Adjustment Mechanism (CBAM) and its implications for India.

For Prelims: EU, Carbon Trade, Carbon Emission, EU Emissions Trading System (ETS), Green Energy, Decarbonization, FTA (Free Trade Agreement), Common but Differentiated Responsibility (CBDR).

For Mains: Carbon Border Adjustment Mechanism and its Implications on India.

The European Union's (EU) intention to implement a Carbon Border Adjustment Mechanism (CABM) tax starting January 1, 2026, has raised concerns about increased costs for India's exports, as noted by experts closely monitoring the situation. Since October 2023, Indian exporters have been required to submit documentation on their processes approximately every two months.

- The EU intends to implement verifiers to examine submissions from Indian exporters. Initially, this scrutiny will target specific sectors, but there are anticipations that the verification process will eventually encompass all imports into the EU.

What is the EU's CBAM?

- About:

- The CBAM is a key element of the EU's "Fit for 55 in 2030 package”, designed to slash greenhouse gas emissions by 55% by 2030 compared to 1990 levels.

- This policy is set to impose a fair price on carbon emissions associated with the production of specific goods imported into the EU.

- CBAM's Environmental Objectives:

- The CBAM seeks to drive cleaner industrial production outside the EU, discouraging carbon leakage where carbon-intensive activities relocate to regions with lax environmental standards.

- By extending the carbon pricing to imports, the EU aims to promote global adherence to stringent climate policies and mitigate the environmental impact of production processes beyond its borders.

- CBAM and European Green Deal:

- The CBAM is a component of the European Green Deal, designed to prevent carbon leakage and maintain competitiveness by imposing import duties on carbon-intensive industries from non-EU countries.

- Coverage and Target Sectors:

- The CBAM will specifically target imports of cement, iron and steel, aluminium, fertilisers, electricity, and hydrogen.

- These goods will face carbon pricing measures if their countries of origin have less rigorous climate policies than the EU.

- Importers will be required to purchase carbon certificates corresponding to the embedded carbon emissions in their products.

- Market Mechanism and Carbon Certificates:

- The pricing of carbon certificates under the CBAM will align with the rates in the EU Emissions Trading System (ETS).

- This market-based system regulates industrial emissions within the EU.

- Importers will need to acquire these certificates at prices reflecting the carbon cost, incentivizing cleaner production practices globally.

What are the Challenges in Implementation of CBAM?

- Opposition from BASIC Countries to EU's Proposal:

- The BASIC countries, comprising Brazil, South Africa, India, and China, jointly opposed the EU’s proposal, denouncing it as "discriminatory" and contrary to the principles of equity and 'Common but Differentiated Responsibilities and Respective Capabilities' (CBDR-RC).

- Lack of Global Consensus:

- The EU's pursuit of a uniform global environmental standard faces criticism in light of the global consensus outlined in Article 12 of the Rio Declaration.

- This article asserts that standards applicable to developed countries should not be imposed on developing nations.

- Issues in Greenhouse Gas Inventories:

- Additionally, the policy's requirement to adjust the greenhouse content of imports in the inventories of importing countries challenges the conventional approach to greenhouse gas accounting.

- Perceived as a Disguised Form of Protectionism:

- The EU's carbon border tax policy raises concerns about potential protectionism.

- Protectionism involves government policies that restrict international trade to boost domestic industries.

- The tax could be perceived as a disguised form of protectionism, creating risks of 'green protectionism,' where local industries are unduly shielded from foreign competition under the guise of environmental considerations.

- The EU's carbon border tax policy raises concerns about potential protectionism.

What are the Implications for India Due to CBAM?

- Issues in India-EU Trade Relations:

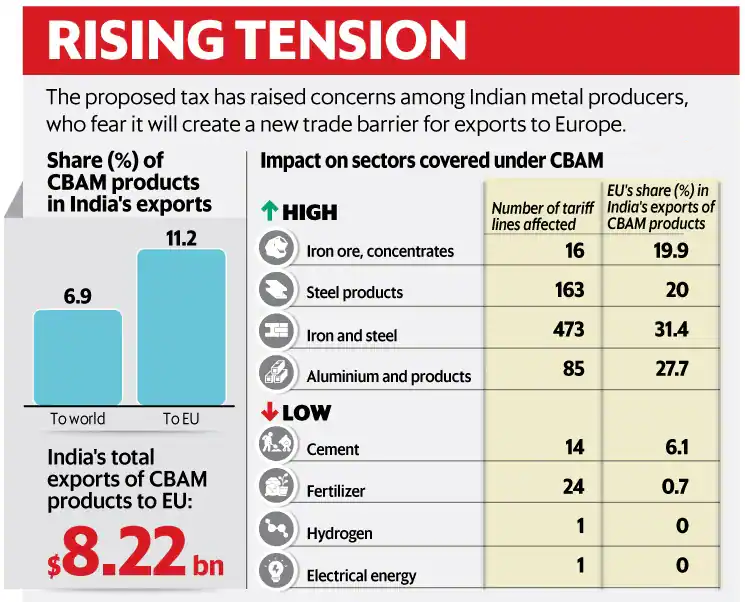

- India, being among the top eight countries adversely affected by CBAM, faces potential challenges as it exports 27% of its iron, steel, and aluminium products worth $8.2 billion to the EU, and key sectors like steel may be significantly impacted.

- By elevating the prices of Indian-made goods in the EU, the tax threatens to diminish their appeal to buyers, potentially leading to a decline in demand.

- This development could pose significant near-term challenges for companies with larger greenhouse gas footprints.

- CBAM’s Impact on Manufacturing:

- India's Commerce and Industry Ministry has criticised the CBAM as "ill-conceived," foreseeing detrimental effects on India's manufacturing sector, potentially acting as the "death knell."

- India's Carbon Credit Trading System (CCTS):

- India has introduced its own carbon trading mechanism, the Carbon Credit Trading System (CCTS), amending the Energy Conservation Act in 2022.

- The Ministry of Power is working on the specifics to operationalize the CCTS in India, which is complemented by the Green Credit Programme Rules, encouraging environmentally proactive actions beyond carbon reduction.

- The CCTS aims to incentivize emission reductions and boost clean energy investments.

- India's Limited Options to Navigate CBAM:

- India's strategies to deal with CBAM are limited, which includes challenging it as violative of the Paris Agreement's common but differentiated responsibilities principle.

- Otherwise, it can negotiate from the EU to return collected funds to invest in green technologies.

- India's strategies to deal with CBAM are limited, which includes challenging it as violative of the Paris Agreement's common but differentiated responsibilities principle.

- Obligatory for India to Formulate Carbon Taxation Measures:

- With the UK enforcing its own CBAM by 2027, there is a pressing need for India to formulate its own carbon taxation measures aligning with Paris Agreement principles.

- Against FTA Norms:

- CBAM is criticised as a non-tariff barrier that undermines zero duty Free Trade Agreements (FTAs). India pays the levy while allowing duty-free entry for supposedly 'green' products from EU member countries, which is seen as contradictory.

What Steps Can be Taken By India To Counter CBAM?

- Opposition to CBAM:

- India should vehemently oppose the CBAM in international forums, asserting that it undermines the crucial principle of 'common but differentiated responsibility.'

- By imposing restrictions on the developing world's ability to industrialise, CBAM challenges the equity envisioned in international climate agreements.

- India should vehemently oppose the CBAM in international forums, asserting that it undermines the crucial principle of 'common but differentiated responsibility.'

- Consideration of Export Tax:

- As a strategic response, India contemplates imposing a similar tax on its exports to the EU. While this could subject producers to a comparable tax burden, the funds generated offer a unique opportunity to reinvest in environmentally friendly production processes.

- This not only mitigates the impact of current taxes but also positions India favourably for potential future reductions.

- However, despite the potential benefits of an export tax, uncertainties loom over its acceptance by the EU and the feasibility of its implementation without triggering legal questions both domestically and internationally.

- The success of this countermeasure hinges on navigating these uncertainties and securing international cooperation.

- As a strategic response, India contemplates imposing a similar tax on its exports to the EU. While this could subject producers to a comparable tax burden, the funds generated offer a unique opportunity to reinvest in environmentally friendly production processes.

- Market Diversification Strategy:

- To strategically respond to the challenges posed by CBAM, India should proactively reduce its dependence on the EU market.

- Exploring new opportunities in regions like Asia, Africa, and Latin America is a key step toward market diversification.

- This approach aims to shield India from the vulnerabilities associated with CBAM and other dynamic economic changes, contributing to a more resilient and adaptable economic stance.

- To strategically respond to the challenges posed by CBAM, India should proactively reduce its dependence on the EU market.

- Seizing the Green Opportunity:

- Amidst the challenges posed by CBAM, India can turn adversity into opportunity by initiating preparations to make production processes greener and more sustainable.

- Incentivising cleaner production not only aligns with global environmental goals but also positions India to remain competitive in a future where carbon consciousness plays a pivotal role.

- This proactive approach contributes to India's long-term economic and environmental sustainability goals, harmonising with its 2070 Net Zero Targets.

Conclusion

The EU's rationale for CBAM, aimed at reducing greenhouse gas emissions and preventing carbon leakage, has prompted India to explore its own carbon trading mechanism, the CCTS. With the CBAM's transitional phase ending in December 2025, India must swiftly formulate and implement its carbon taxation measures aligned with the principles of the Paris Agreement to safeguard its industries from potential adverse effects. Ongoing negotiations with the EU, including the challenge before the World Trade Organization, will play a crucial role in determining India's response to this global environmental policy landscape.

|

Drishti Mains Question: How does the European Union's Carbon Border Adjustment Mechanism (CBAM) impact India's manufacturing sector? What strategic measures can India adopt to align with global environmental policies while safeguarding its industries? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q1. Which of the following adopted a law on data protection and privacy for its citizens known as ‘General Data Protection Regulation’ in April, 2016 and started implementation of it from 25th May, 2018? (2019)

(a) Australia

(b) Canada

(c) The European Union

(d) The United States of America

Ans: (c)

Q2. ‘Broad-based Trade and Investment Agreement (BTIA)’ is sometimes seen in the news in the context of negotiations held between India and : (2017)

(a) European Union

(b) Gulf Cooperation Council

(c) Organization for Economic Cooperation and Development

(d) Shanghai Cooperation Organization

Ans: (a)