Biodiversity & Environment

Carbon Markets

- 20 Dec 2022

- 11 min read

For Prelims: Carbon Credit Market, NDCs, GHG, Kyoto Protocol, Net Zero, PLI Scheme, Energy Conservation.

For Mains: India’s Evolving Carbon Market and its Significance.

Why in news?

The Parliament has passed the Energy Conservation (Amendment) Bill, 2022 in order to establish Carbon Markets in India and specify a Carbon Trading Scheme.

- The Bill amends the Energy Conservation Act, 2001.

What is the Energy Conservation (Amendment) Bill, 2022?

- About:

- The Bill empowers the Centre to specify a carbon credits trading scheme.

- Under the Bill, the central government or an authorised agency will issue carbon credit certificates to companies or even individuals registered and compliant with the scheme.

- These carbon credit certificates will be tradeable in nature. Other persons would be able to buy carbon credit certificates on a voluntary basis.

- Concerns:

- Bill does not provide clarity on the mechanism to be used for the trading of carbon credit certificates— whether it will be like the cap-and-trade schemes or use another method— and who will regulate such trading.

- It is not specified, which is the right ministry to bring in a scheme of this nature,

- While carbon market schemes in other jurisdictions like the U.S., United Kingdom, and Switzerland are framed by their environment ministries, the Indian Bill was tabled by the power ministry instead of the Ministry of Environment, Forest, and Climate Change (MoEFCC).

- The Bill does not specify whether certificates under already existing schemes would also be interchangeable with carbon credit certificates and tradeable for reducing carbon emissions.

- Two types of tradeable certificates are already issued in India— Renewable Energy Certificates (RECs) and Energy Savings Certificates (ESCs).

- These are issued when companies use renewable energy or save energy, which are also activities which reduce carbon emissions.

What are Carbon Markets?

- About:

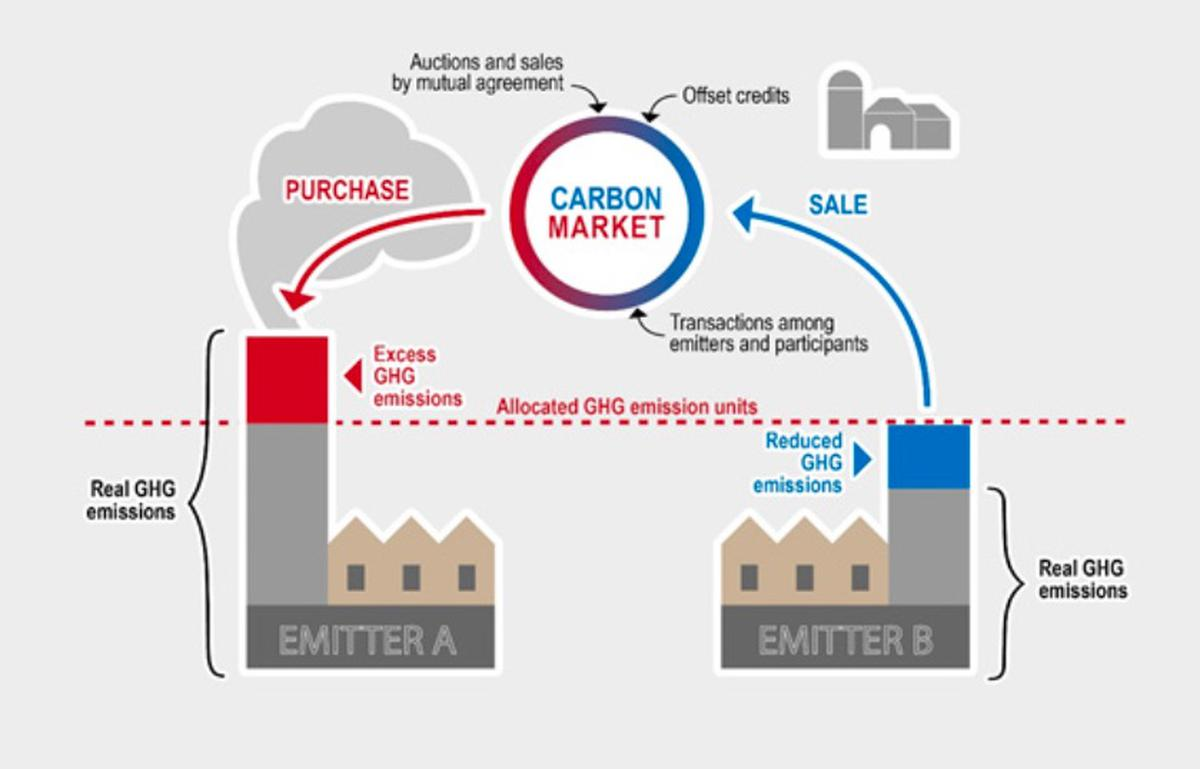

- Carbon markets are a tool for putting a price on carbon emissions. It allows the trade of carbon credits with the overall objective of bringing down emissions.

- These markets create incentives to reduce emissions or improve energy efficiency.

- For example, an industrial unit which outperforms the emission standards stands to gain credits.

- Another unit which is struggling to attain the prescribed standards can buy these credits and show compliance to these standards. The unit that did better on the standards earns money by selling credits, while the buying unit is able to fulfill its operating obligations.

- It establishes trading systems where carbon credits or allowances can be bought and sold.

- A carbon credit is a kind of tradable permit that, per United Nations standards, equals one tonne of carbon dioxide removed, reduced, or sequestered from the atmosphere.

- Carbon allowances or caps, meanwhile, are determined by countries or governments according to their emission reduction targets.

- Article 6 of the Paris Agreement provides for the use of international carbon markets by countries to fulfill their NDCs (Nationally Determined Contributions).

- NDCs are climate commitments by countries setting targets to achieve net-zero emissions.

- Types of Carbon Markets:

- Compliance Markets:

- Compliance markets are set up by policies at the national, regional, and/or international level and are officially regulated.

- Today, compliance markets mostly operate under a principle called ‘cap-and-trade”, most popular in the European Union (EU).

- Under the EU’s emissions trading system (ETS) launched in 2005, member countries set a cap or limit for emissions in different sectors, such as power, oil, manufacturing, agriculture, and waste management. This cap is determined as per the climate targets of countries and is lowered successively to reduce emissions.

- Entities in this sector are issued annual allowances or permits by governments equal to the emissions they can generate.

- If companies produce emissions beyond the capped amount, they have to purchase additional permits. This makes up the ‘trade’ part of cap-and-trade.

- The market price of carbon gets determined by market forces when purchasers and sellers trade in emissions allowances.

- Compliance markets are set up by policies at the national, regional, and/or international level and are officially regulated.

- Voluntary Markets:

- Voluntary markets are those in which emitters— corporations, private individuals, and others— buy carbon credits to offset the emission of one tonne of CO2 or equivalent greenhouse gases.

- Such carbon credits are created by activities which reduce CO2 from the air, such as afforestation.

- In this market, a corporation looking to compensate for its unavoidable GHG emissions purchases carbon credits from an entity engaged in projects that reduce, remove, capture, or avoid emissions.

- For Instance, in the aviation sector, airlines may purchase carbon credits to offset the carbon footprints of the flights they operate. In voluntary markets, credits are verified by private firms as per popular standards. There are also traders and online registries where climate projects are listed and certified credits can be bought.

- Compliance Markets:

- Status of Global Carbon Markets:

- In 2021, the value of global markets for tradeable carbon allowances or permits grew by 164% to a record 760 billion euros (USD 851 billion), according to an analysis by Refinitiv.

- The EU’s ETS contributed the most to this increase, accounting for 90% of the global value at 683 billion euros.

- As for voluntary carbon markets, their current global value is comparatively smaller at USD 2 billion.

- The World Bank estimates that trading in carbon credits could reduce the cost of implementing NDCs by more than half — by as much as USD 250 billion by 2030.

What are the Challenges to Carbon Markets?

- Poor Market Transparency:

- The UNDP (United Nations Development Programme) points out serious concerns pertaining to carbon markets- ranging from double counting of greenhouse gas reductions and quality and authenticity of climate projects that generate credits to poor market transparency.

- Greenwashing:

- Companies may buy credits, simply offsetting carbon footprints instead of reducing their overall emissions or investing in clean technologies.

- May Increase Net Emission through ETS:

- As for regulated or compliance markets, ETSs (Emissions Trading System) may not automatically reinforce climate mitigation instruments.

- The International Monetary Fund (IMF) points out that including high emission-generating sectors under trading schemes to offset their emissions by buying allowances may increase emissions on net and provide no automatic mechanism for prioritizing cost-effective projects in the offsetting sector.

What is the Related Indian Initiative?

- Clean Development Mechanism:

- In India, the clean development mechanism under the Kyoto Protocol provided a primary carbon market for the players.

- The secondary carbon market is covered by the perform-achieve-trade scheme (which falls under the energy efficiency category) and the renewable energy certificate.

Way Forward

- In order to keep global warming within 2°C, ideally no more than 1.5°C, global greenhouse gas (GHG) emissions need to be reduced by 25 to 50% over this decade. Nearly 170 countries have submitted their nationally determined contributions (NDCs) so far as part of the 2015 Paris Agreement, which they have agreed to update every five years.

- The UNDP emphasises that for carbon markets to be successful, “emission reductions and removals must be real and aligned with the country’s NDCs”.

- There must be “transparency in the institutional and financial infrastructure for carbon market transactions”.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q1. The concept of carbon credit originated from which one of the following? (2009)

(a) Earth Summit, Rio de Janeiro

(b) Kyoto Protocol

(c) Montreal Protocol

(d) G-8 Summit, Heiligendamm

Ans: (b)

Q2. Regarding “carbon credits”, which one of the following statements is not correct? (2011)

(a) The carbon credit system was ratified in conjunction with the Kyoto Protocol

(b) Carbon credits are awarded to countries or groups that have reduced greenhouse gases below their emission quota

(c) The goal of the carbon credit system is to limit the increase of carbon dioxide emission

(d) Carbon credits are traded at a price fixed from time to time by the United Nations Environment Programme.

Ans: (d)

Mains

Q1. Should the pursuit of carbon credits and clean development mechanisms set up under UNFCCC be maintained even though there has been a massive slide in the value of a carbon credit? Discuss with respect to India’s energy needs for economic growth. (2014)

Q2. Discuss global warming and mention its effects on the global climate. Explain the control measures to bring down the level of greenhouse gases which cause global warming, in the light of the Kyoto Protocol, 1997. (2022)