PRS Capsule - July 2024 | 14 Aug 2024

Key Highlights of PRS

- Polity and Governance

- Independent Body Constituted to Advise on the Implementation of NEP

- TRAI Amends Regulatory Framework For Broadcasting And Cable Services

-

- Supreme Court Upholds the State’s Power to Tax Mines And Minerals

- Guidelines For Implementing Incentive Scheme For Green Hydrogen Production

- Guidelines For Funding Testing Infrastructure Under The National Green Hydrogen Mission Released

- Fifth Positive Indigenisation List Notified

- Economy

- Union Budget 2024-25 Presented

- Economic Survey 2023-24 Tabled in Parliament

- RBI Issues Directions on Treatment of Wilful And Large Defaulters

- RBI Releases Master Directions on Fraud Risk Management

- Environment

- Comments Invited on The Amendments to The Environment (Protection) Rules, 1986

Polity and Governance

Independent Body Constituted to Advise on the Implementation of NEP

TRAI Amends Regulatory Framework for Broadcasting and Cable Services

- The Telecom Regulatory Authority of India(TRAI) has amended the tariff order, interconnection regulations, and quality of service regulations for broadcasters.

- Key Features:

- Tariff changes: Broadcasters charge Network Capacity Fees (NCF) from subscribers ceiling has been removed.

- Penalties: The amended regulatory framework also provides for financial penalties for contravention of provisions.

- Change in Carriage Fees: The method of calculating carriage fees has been simplified.

- Quality of Service (QoS) Amendments: The regulatory framework amends various QoS standards. Charges for services such as installation, activation, and relocation have been deregulated.

Supreme Court Upholds the State’s Power to Tax Mines and Minerals

- With an 8:1 majority, the Supreme Court upheld states’ power to tax mineral-bearing lands.

- In India, mines and minerals are primarily regulated by the Mines and Minerals (Development and Regulations) (MMDR) Act, 1957.

- The Court held that royalty is not a tax. It is a payment that arises out of the contractual obligation to enjoy mineral rights.

- The Court also held that the power of states to tax mineral rights cannot be superseded by the powers of Parliament to regulate the sector.

- It also stated that the Parliament cannot limit states’ powers to tax mineral-bearing lands.

Guidelines for Implementing Incentive Scheme for Green Hydrogen Production

- This scheme is a component of the Strategic Interventions for Green Hydrogen Transition Programme (SIGHT).

- The programme provides financial incentive mechanisms to boost the domestic manufacturing of electrolysers and green hydrogen in India.

- Key Features:

- Structure of Scheme: The second tranche allocates a production capacity of 4,50,000 MT (Metric tonnes) of Green Hydrogen.

- Incentive for Production: The minimum bid for production through agnostic pathways is 10,000 MT while the maximum bid allowed is 90,000 MT.

- Eligibility of Bidder: In order to participate in the bidding process, the bidder's net worth must exceed Rs 15 crore per thousand MT per annum of the quoted production capacity under the technology-agnostic pathway.

Guidelines for Funding Testing Infrastructure Under the National Green Hydrogen Mission Released

- The Green Hydrogen Mission aims to make India the Global Hub for production, usage, and export of Green Hydrogen and its derivatives.

- A total of Rs 200 crore has been allocated until 2025-26 for this scheme.

- The scheme for supporting testing infrastructure will:

- Identify gaps in existing testing facilities, fund their upgradation and create new facilities for testing

- Validate and certify technologies used in the production of Green Hydrogen

- Encourage private and government participation in establishing world-class testing facilities.

- The scheme will be implemented by the National Institute of Solar Energy.

Fifth Positive Indigenisation List Notified

- The Ministry of Defence has notified the fifth positive indigenisation list consisting of 346 items.

- These items include various systems, sub-systems, spares, and raw materials which will be indigenised in a staggered manner.

- Their total import substitution value is Rs 1,048 crore.

- These items will be produced domestically by defence public sector undertakings.

Economy

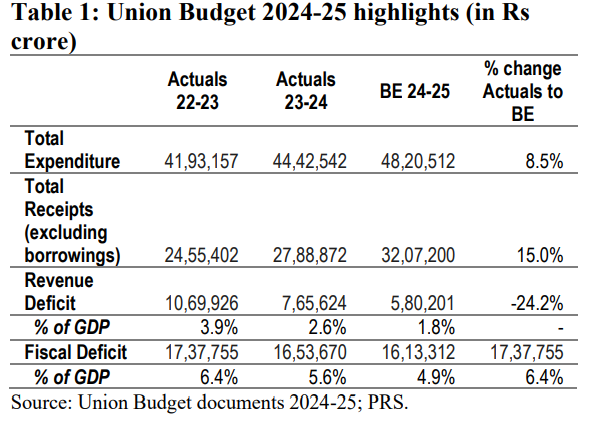

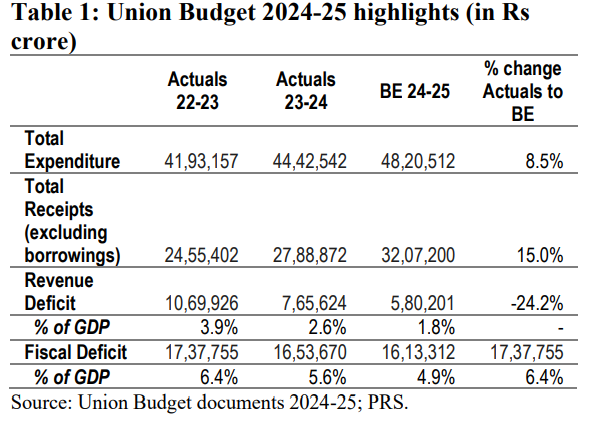

Union Budget 2024-25 Presented

- The Finance Minister presented the 2024-25 Union Budget on 23 July 2024.

- Key Highlights:

- Tax proposals: Short-term capital gains tax on listed equity shares, equity mutual funds, and REITs/INVITs is proposed to be increased from 15% to 20%.

- Long-term capital gains tax will be levied at 12.5% across asset categories.

- Indexation for calculating long-term capital gains for property, gold, and other unlisted assets will be removed.

- Income Tax Slabs: Income tax slabs under the new tax regime have been modified.

- The standard deduction for salaried individuals and pensioners is proposed to be increased from Rs 50,000 to Rs 75,000.

- Angel Tax: Angel tax on unlisted funds in excess of the face value of their shares has been removed.

- Policy Proposals:

- A scheme to upskill 20 lakh youth over the next five years will be launched.

- Three schemes to promote employment and increase workforce participation were announced.

- Financial support of Rs 15,000 crore will be given to Andhra Pradesh for a new capital this year.

Economic Survey 2023-24 Tabled in Parliament

- The Finance Minister tabled the Economic Survey 2023-24 on 22 July 2024.

- Key Highlights:

- Gross Domestic Product (GDP): The Survey has forecasted a real GDP growth of 6.5%-7% in 2024- 25.

- Growth in 2024-25 is expected to be supported by strong domestic investment demand, improved agricultural performance, and an increase in merchandise and services exports.

- Inflation: Retail inflation in 2023-24 was 5.4%, the lowest since the Covid-19 pandemic.

- Sectoral Growth: India’s agriculture sector has recorded an annual average growth rate of 4.2% over the last five years.

- Infrastructure: The central government’s capital expenditure witnessed a three-fold increase in 2023-24 as compared to 2019-20 with a focus on sectors such as roads and railways.

- Debt: The general government debt-to-GDP ratio increased slightly in 2023-24 due to increasing interest rates and lower-than-budgeted nominal GDP growth.

RBI Issues Directions on Treatment of Wilful and Large Defaulters

- The Reserve Bank of India (RBI) issued the RBI (Treatment of Wilful Defaulters and Large Defaulters) Directions, 2024.

- The Directions provide a procedure for the classification of a borrower as a wilful defaulter by lenders.

- Key Features:

- A wilful defaulter refers to a borrower or a guarantor who has committed wilful default of at least Rs 25 lakh or above as notified by RBI.

- Large defaulter refers to a defaulter with an outstanding amount of at least one crore rupees and whose account has been categorised as a doubtful or loss account.

- Wilful default by a borrower will be deemed to have occurred when he defaults in meeting repayment obligations to the lender.

- In addition, at least one of the specified conditions needs to be fulfilled. These include:

- Default despite having the capacity to honour the obligations

- Diversion or siphoning off of funds availed from the lender, or

- Disposal of assets given for securing the credit without the lender’s knowledge.

- Wilful default by a guarantor will be deemed to have occurred if he does not honour the guarantee despite having the ability to do so.

- The evidence of wilful default will be examined by an identification committee set up by the lender.

RBI Releases Master Directions on Fraud Risk Management

- The Reserve Bank of India (RBI) released three revised master directions on fraud risk management that apply to:

- Commercial banks and all India financial institutions

- Cooperative banks

- Non-banking finance companies

- Key Features:

- Fraud Risk Management Structure: Regulated entities must have a policy approved by their respective boards on fraud risk management which must be reviewed at least once in three years.

- Early Detection of Frauds: Commercial banks, certain cooperative banks, and NBFCs in the middle and upper layers must have a framework for early warning signals under their fraud risk management policy.

- Treatment of Fraud Accounts: In case of red-flagged accounts or suspicion of fraud, regulated entities must conduct an external or internal audit as per their policy.

Environment

Comments Invited on the Amendments to the Environment (Protection) Rules, 1986

- These Rules have been issued under the Environment (Protection) Act, 1986.

- The 2023 Act decriminalized certain offences under the 1986 Act.

- These include discharging pollutants above prescribed standards, not furnishing the required information, and contravention of directions issued under the Act.

- It provides for the appointment of an Adjudicating Officer for adjudicating offences and determining penalties.

- It also establishes the Environment Protection Fund.

- The draft Rules seek to give effect to these provisions.