Indian Economy

Gist of Economic Survey 2023-24

- 30 Jul 2024

- 234 min read

01: State Of The Economy: Steady As She Goes

What is the Current State of the Indian Economy?

- Economic Growth and Trends:

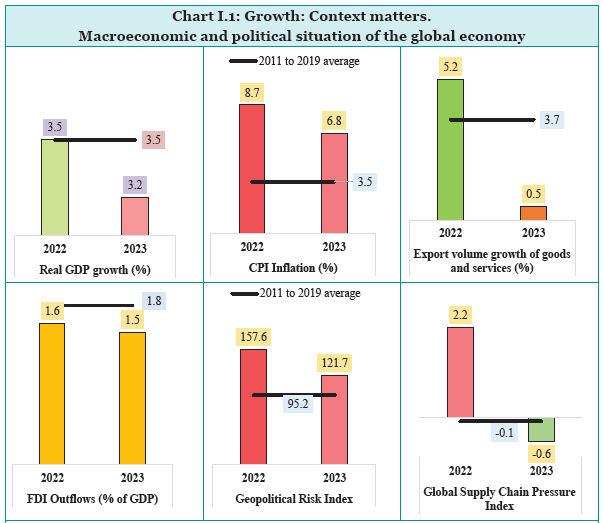

- Global Growth Rate: The global economy grew by 3.2% in 2023, slightly lower than previous years but higher than earlier projections of 2.8%.

- Regional Performance:

- Emerging Markets: Many emerging economies outperformed expectations, buoyed by resilient domestic demand and strategic policy responses.

- Advanced Economies: While the US continued its growth momentum, the Euro area faced subdued economic activity despite signs of recovery.

- Asia: China and India showed significant recovery post-pandemic, with robust growth rates surpassing pre-crisis levels.

- Inflation and Monetary Policy:

- Inflationary Pressures: Persistent core inflation remained a challenge, influenced by strong labour markets and service sector dynamics, particularly in advanced economies.

- Monetary Policy: Central banks globally responded by maintaining or raising interest rates to combat inflation, although China pursued stimulus measures to support its economic recovery.

- Geopolitical Impacts:

- Supply Chain Disruptions: The escalation of conflicts, such as the Russia-Ukraine crisis and geopolitical tensions in the Middle East, intermittently disrupted global supply chains, affecting trade and economic operations.

- Trade and Investment: Despite easing supply chain pressures, global trade growth was modest, with rising cross-border restrictions and cautious investor sentiment leading to a decline in foreign direct investment flows.

- Sectoral Resilience:

- Services sectors, including finance and technology, demonstrated resilience post-pandemic while manufacturing sectors faced challenges due to high input costs and fluctuating demand.

- India's Economic Resilience:

- India's economy continued its upward trajectory in FY24, maintaining momentum despite global challenges.

- GDP Growth: India's real GDP grew by 8.2% in FY24, exceeding the 8% mark in three out of four quarters of FY24.

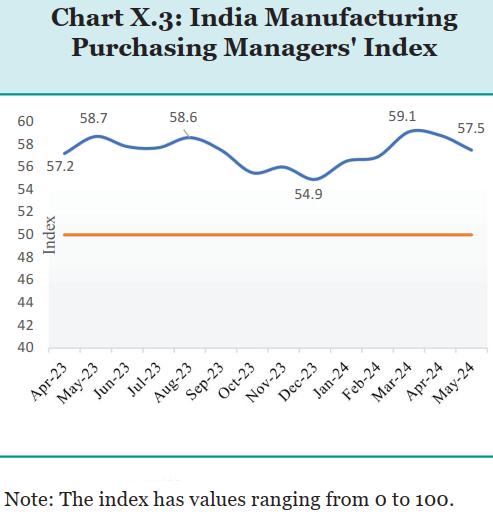

- Sectoral Growth: The services sector, bolstered by financial and professional services, led growth, while the manufacturing and construction sectors also showed significant expansion.

- Economic Indicators:

- Private Consumption: Private final consumption expenditure remained strong, supported by urban and rural demand growth across various sectors.

- Private final consumption expenditure (PFCE) grew by 4.0% in real terms in FY24.

- Investment Dynamics: Gross Fixed Capital Formation (GFCF) increased, reflecting sustained private and government investment activities.

- Between FY19 and FY23, the cumulative growth in private sector non-financial Gross Fixed Capital Formation (GFCF) is 52% at current prices while for general government (which includes states) is 64%.

- Financial Sector: The banking sector maintained stability, supporting credit growth to key sectors such as MSMEs and housing.

- Private Consumption: Private final consumption expenditure remained strong, supported by urban and rural demand growth across various sectors.

- Trade and External Factors:

- Export Performance: India's merchandise exports saw growth, supported by resilient services trade despite global trade slowdowns.

- Union Government Finances:

- Fiscal Deficit: Reduced from 6.4% to 5.6% of GDP in FY24, aided by robust tax revenues and restrained expenditure.

- Tax Reforms: Direct tax revenues grew by 15.8% and indirect taxes by 10.6%, reflecting improved tax compliance and structural reforms.

- Capital Expenditure and Economic Stimulus:

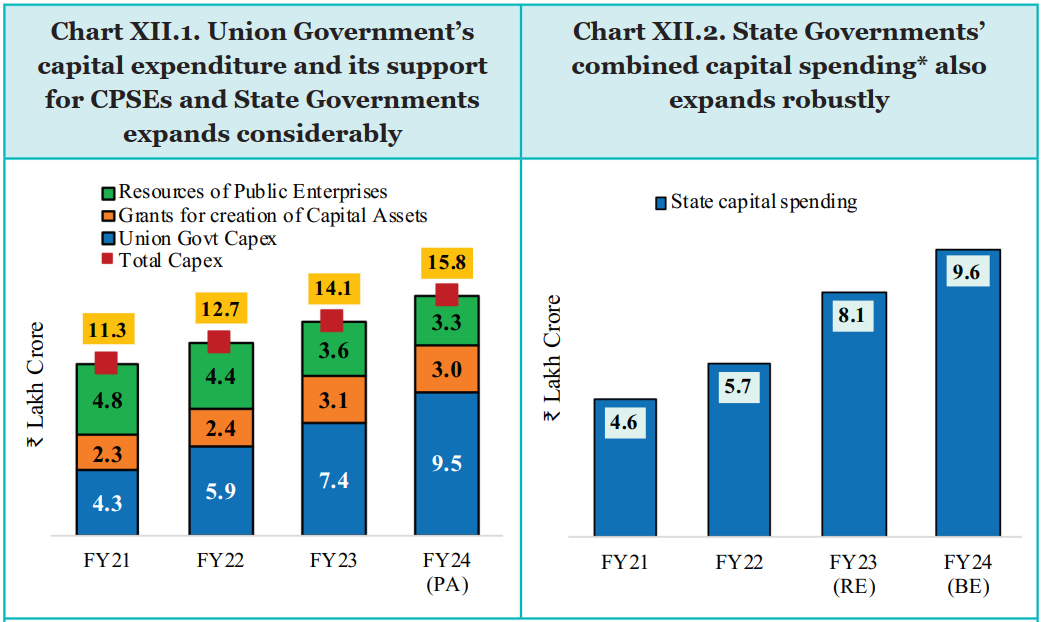

- Government Investments: Increased capital expenditure by 28.2% YoY in FY24, focusing on infrastructure development and boosting private sector participation.

- National Monetisation Pipeline (NMP): Raised Rs 3.9 lakh crore from asset monetisation, supporting fiscal objectives and enhancing capital allocation efficiency.

- Domestic Inflation Control:

- Retail inflation decreased from 6.7% in FY23 to 5.4% in FY24 despite global disruptions.

- Government interventions in LPG, petrol, and diesel prices aided inflation management.

- Financial System Resilience:

- RBI’s regulatory measures maintained stability with Gross Non-Performing Assets (GNPA) ratio at a 12-year low of 2.8%.

- Scheduled Commercial Banks’ (SCB) profitability indicators remained robust, ensuring systemic strength.

- Trade and Foreign Inflows:

- Merchandise exports moderated due to global demand, balanced by lower import growth.

- Service exports reached USD 341.1 billion.

- The current Account Deficit (CAD) stood at 0.7% of the GDP during FY24, an improvement from the deficit of 2.0% of GDP in FY23.

- Foreign portfolio investment (FPI) inflows surged to USD 44.1 billion, bolstering forex reserves and stabilising the rupee.

- External Debt and Exchange Rate:

- External debt remained manageable at 18.7% of GDP.

- Forex reserves covered over 11 months of imports, securing against external shocks.

- Inclusive Growth Initiatives:

- Welfare Reforms:

- Shift from input-based to outcome-based welfare under flagship schemes like PM Ujjwala Yojana and PM-AWAS Yojana.

- Direct Benefit Transfer (DBT) and Jan Dhan Yojana enhanced fiscal efficiency and reduced leakages.

- Social Sector Impact:

- The decline in poverty and rise in consumption expenditure showcased tangible benefits.

- Empowerment initiatives like the Aspirational Districts Programme and the Vibrant Villages Programme targeted rural development.

- Welfare Reforms:

- Economic Growth Forecast:

- Projected real GDP growth is 6.5–7% for FY25, supported by structural reforms and improving global economic conditions.

- Risks balanced amidst global uncertainties and monetary policy adjustments.

02: Monetary Management and Financial Intermediation: Stability is the Watchword

What is the Status of India’s Monetary Management and Financial Intermediation?

- Monetary Policy and Inflation Control:

- The Reserve Bank of India (RBI) maintained a steady policy repo rate at 6.5% throughout FY24.

- Inflation remained under control, despite global economic pressures post-Russia-Ukraine conflict.

- Food inflation stood at 6.6% in FY23 and increased to 7.5% in FY24.

- Significant policy repo rate hikes (250 basis points) from from 4% in May 2022 to 6.5 % in February 2023, this influenced lending and deposit rates.

- Liquidity Management:

- RBI's liquidity interventions included Variable Rate Reverse Repo (VRRR) and Variable Repo (VRR) auctions, totaling 49 fine-tuning operations in FY24.

- Temporary measures like Incremental Cash Reserve Ratio (I-CRR) managed surplus liquidity.

- Banking Sector Performance:

- India's banking sector improved with a lower Gross Non-Performing Assets (GNPA) ratio of 2.8% in FY24.

- Agriculture, Micro, Small and Medium Enterprises (MSME), and personal loans showed robust credit growth.

- Initiatives like Kisan Credit Card (KCC) and Emergency Credit Linked Guarantee Scheme (ECLGS) enhanced credit availability.

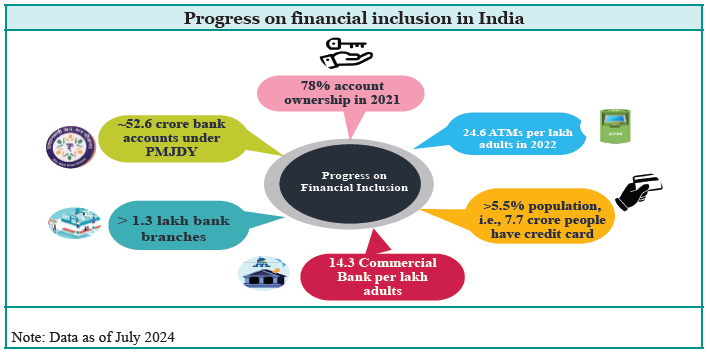

- Digital Financial Inclusion:

- Digital infrastructure and credit bureaus played pivotal roles in enhancing financial inclusion.

- Introduction of Open Credit Enablement Network (OCEN) is expected to further streamline credit flows.

- The number of adults with an account in a formal financial institution increased from 35% in 2011 to 77% in 2021.

- India has more than 116.5 crore smartphone subscribers as of 31st March 2024 enhancing the success of UPI.

- Securities Markets and Financial Services:

- India's stock market capitalization to GDP ratio ranked fifth globally, supported by robust regulatory frameworks and digital infrastructure.

- India’s market capitalisation to GDP ratio has improved significantly over the last five years to 124% in FY24, compared to 77% in FY19, far higher than that of other emerging market economies like China and Brazil.

- Gujarat International Finance Tec-City (GIFT City) emerged as a global financial hub, facilitating international financial services.

- Developments in the Insurance Sector:

- Total global insurance premiums contracted by 1.1% in real terms in 2022.

- Non-life insurance sector saw a 0.5% increase, driven by rate hardening in developed markets.

- Life insurance premiums contracted by 3.1% in 2022.

- Overall insurance penetration (a percentage of total premiums collected to the country's GDP) in India moderated slightly to 4% in FY23, from 4.2% in FY22.

- Insurance penetration in the life-insurance segment declined from 3.2 % in FY22 to 3% in FY23, while it remained flat at 1 % for the non-life insurance segment.

- Overall insurance density (a ratio of total insurance premium collected to total population of the country) increased from USD 91 in FY22 to USD 92 in FY23.

- Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) achieved a milestone by issuing 34.2 crore Ayushman cards across India, with 49.3% of them held by females.

- Government and Regulatory Responses:

- Regulatory Framework: Strengthening of banking regulations, amendments in recovery laws, and enactment of the Insolvency and Bankruptcy Code (IBC) aimed at resolving stress in banks and corporations.

- Asset Reconstruction Companies (ARCs) have emerged as key players in acquiring distressed assets and facilitating their resolution.

- During FY23, 28 ARCs were operating in the market and 9.7% of the previous year’s stock of Scheduled Commercial Banks (SCB)’s GNPAs was sold to ARCs, compared to only 3.2 %in FY22.

- Enhancing Investor Participation:

- SEBI facilitated Foreign Portfolio Investors (FPIs) investment in debt instruments issued by companies undergoing resolution.

- In 2022, SEBI introduced the Special Situation Fund, a sub-component of the Alternative Investment Funds, to allow investors to invest in security receipts (SRs) issued by ARCs.

- These measures have led to an increase in FPI investment in security receipts (SRs) issued by ARCs from around Rs 10,000 crore to Rs 14,482 crore during FY22.

- National Asset Reconstruction Company (NARCL) established to acquire distressed assets from banks with government-backed guarantees, thereby clearing bank balance sheets for further lending.

- Microfinance Institutions (MFI):

- RBI's regulatory framework ensures uniformity and consumer protection across all microfinance entities.

- Self-regulatory organisations (SROs) like Sa-Dhan and MFIN contribute to maintaining ethical practices and standards within the sector.

- About 74% of MFI clients reside in rural areas, emphasising their role in rural development.

- Women constitute 98% of MFI clients, highlighting the sector's emphasis on women empowerment.

- SC/ST borrowers represent 23% of MFI clients, showcasing inclusive growth initiatives.

- MFIs have shown robust performance with Return on Assets (RoA) and Return on Equity (RoE) improving consistently.

- RBI's regulatory framework ensures uniformity and consumer protection across all microfinance entities.

- Developments in the Pension Sector:

- In India, the share of insurance and pension fund assets in GDP stands at 19% and 5%, respectively, compared to a high of 52% and 122% in the USA and 112% and 80% in the UK.

- As of March 2024, India's pension sector had 735.6 lakh subscribers, marking an 18% year-on-year increase from 623.6 lakh in March 2023.

- The total number of Atal Pension Yojana (APY) subscribers, including its earlier version, National Pension Scheme (NPS) Lite, grew from 501.2 lakh in March 2023 to 588.4 lakh in March 2024.

- APY subscribers constitute approximately 80% of the total pension subscriber base.

- Female subscribers in APY have increased from 37.2% in FY17 to 48.5% in FY23.

- Pension coverage under NPS and APY as a percentage of the total population has increased from 1.2% in FY17 to 5.3% in FY24.

- The Financial Sector Assessment Program (FSAP) for India:

- FSAP is a periodic assessment jointly conducted by the IMF and World Bank in countries with significant financial sectors, which aims to comprehensively analyse financial stability and sector development.

- India underwent its first FSAP in 2011-12 and the second in 2017 and India's third FSAP is scheduled for 2023-24, with reports expected to be published by February 2025.

03: Prices and Inflation: Under Control

What are the Prices and Inflation Trends in India?

- India's Recent Inflation Trends

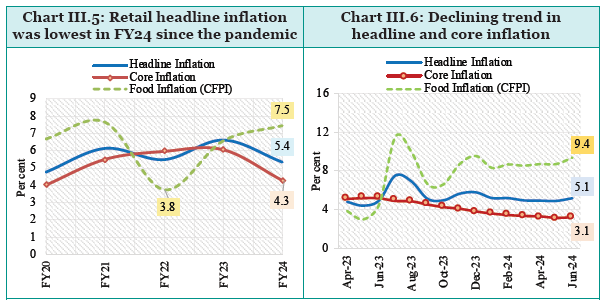

- India successfully managed to maintain retail inflation at 5.4% in FY24, marking the lowest level since the onset of the Covid-19 pandemic.

- As per the recent data released by the Ministry of Statistics and Programme Implementation (MoSPI), the retail inflation rate was 5.1% in June 2024.

- Following the pandemic and subsequent supply chain disruptions due to events like the Russia-Ukraine war, global inflation trends were characterized by a decline, primarily driven by reduced energy prices and coordinated monetary tightening in advanced economies.

- According to International Monetary Fund (IMF) data, India's inflation rate consistently remained lower than the global average and that of Emerging Markets and Developing Economies (EMDEs) in 2022 and 2023.

- Factors Influencing India's Inflation Management:

- Established monetary policies, economic stability, efficient market mechanisms, and stable currency conditions.

- Domestic Retail Inflation Trends

- Gradual decline in core inflation to 3.1% by June 2024.

- Government interventions, including price cuts in LPG, petrol, and diesel, significantly contributed to lowering fuel inflation.

- The Pradhan Mantri Garib Kalyan Anna Yojana ensured food security for vulnerable populations.

- Core Inflation Dynamics

- Due to effective monetary policy transmission and subdued inflationary pressures in both goods and services sectors the core inflation saw a decline to a four-year low in FY24.

- The RBI has increased the repo rate gradually by 250 basis points from May 2022 to February 2023.

- Consequently, core inflation declined by around four percentage points between April 2022 and June 2024.

- Consumer durables inflation moderated due to improved raw material supply, while core services inflation, although stable, remained a focus area for policy adjustments.

- Food Inflation Challenges and Mitigation Strategies

- Adverse weather conditions severely impacted food production, leading to increased prices of essential commodities like vegetables, pulses, and milk.

- Food inflation stood at 6.6% in FY23 and increased to 7.5% in FY24.

- Timely actions such as open market sales, imports, and policy restrictions on exports (e.g., sugar) helped stabilise food prices amidst global volatility.

- Rural areas, with higher reliance on food items in the consumption basket, experienced higher inflation rates compared to urban areas, reflecting interstate variations and differential impacts of price movements.

- Outlook and Future Strategies

- The RBI and IMF project a gradual alignment of India's inflation towards the target range.

- The RBI projects inflation to fall to 4.5% in FY25 and 4.1% in FY26, while IMF has projected an inflation rate of 4.6% in 2024 and 4.2% in 2025 for India.

- Anticipated declines in global commodity prices, particularly in energy and food sectors, are expected to further support India's inflation outlook.

- To sustain long-term price stability, enhancing domestic production of key commodities like edible oils and pulses, improving storage facilities for perishable items, and refining high-frequency price monitoring mechanisms are crucial.

04: External Sector: Stability Amid Plenty

How is India's External Sector Performing Amidst Global Uncertainties?

- Global Foreign Direct Investment (FDI):

- Global FDI declined marginally by 2% to USD 1.3 trillion in 2023 (UNCTAD).

- Global trade in merchandise fell by 5% in 2023 amid these geopolitical challenges.

- External debt as a percentage of GDP in Emerging Market and Developing Economies (EMDEs) increased to 29.8% in 2023 from 26.2% in 2012.

- Trade practices such as ‘decoupling’, ‘derisking’, and ‘reshoring’ are reshaping international trade relationships.

- Global FDI declined marginally by 2% to USD 1.3 trillion in 2023 (UNCTAD).

- India’s International Trade Sector:

- Overall Trade Performance:

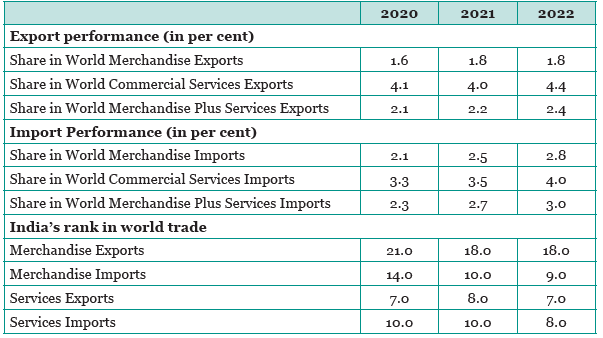

- India’s trade openness indicator rose from 37.5% in FY05 to 45.9% in FY24, significantly contributing to economic growth through efficient resource allocation.

- The share of trade in GDP (excluding petroleum products exports and crude oil imports) rose from 32.3% in FY05 to 40.8% in FY23.

- Merchandise Trade Trends:

- India’s merchandise exports and imports showed resilience amidst global challenges, with exports crossing USD 776 billion and imports at USD 898 billion in FY23.

- In FY24, merchandise exports grew slightly by 0.23%, while imports declined by 4.9%, widening the trade deficit.

- Engineering goods maintained dominance with a 25% of total export share, followed by agriculture and allied products (11%).

- Electronics exports saw significant growth from 0.63 % in 2018 to 0.88% in 2022, ranking 24th globally in 2022, up from 28th in 2018.

- Services Sector:

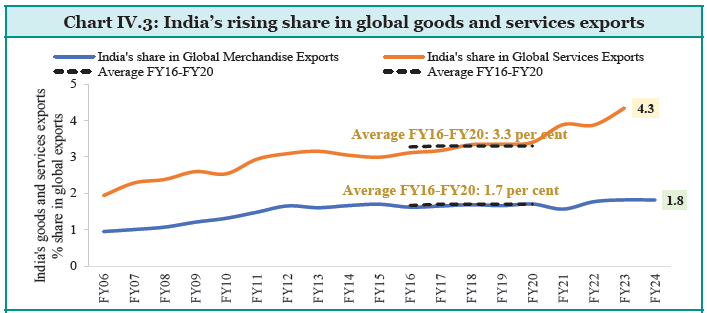

- India’s services exports grew at a CAGR of over 14% from 1993 to 2022, contributing significantly to India’s export basket.

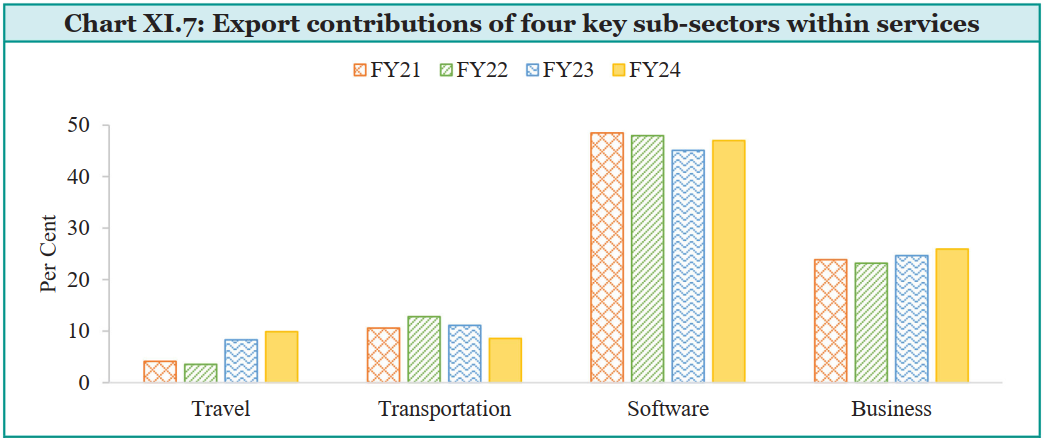

- India’s services exports grew by 4.9% to USD 341.1 billion in FY24, with growth largely driven by IT/software services and ‘other’ business services.

- IT services remained the largest contributor (48%), followed by other business services (26%).

- India’s External Debt Trends:

- India’s management of external debt has been adept, navigating challenges while maintaining fiscal discipline.

- The external debt to GDP ratio declined to 18.7% at the end of March 2024 from 19.0% at the end of March 2023.

- The share of short-term debt in total external debt declined to 18.5% at the end of March 2024 from 20.6% at the end of March 2023.

- Remittance:

- The net private transfer receipts, mainly representing remittances by Indians employed overseas, was USD 106.6 billion in FY24, against their level of USD 101.8 billion during the previous year.

- The increase in remittances was driven mainly by declining inflation and strong labour markets in the US and Europe, the largest destination for India’s skilled migrants, and other OECD destinations, as well as positive demand for skilled and less-skilled workers in the GCC countries

- Balance of Payments:

- The current account balance has shown resilience, supported by robust services exports, buffering the economy against external shocks.

- Foreign Exchange Reserves (FER) and International Investment Position (IIP):

- India’s FER and IIP remain robust, providing stability amidst global uncertainties.

- Overall Trade Performance:

India’s Rising Participation in Global Value Chains (GVCs)

|

- Changing Landscape of India’s Trade Arrangements

- India’s approach to global trade involves a mix of multilateral engagements and bilateral FTAs, aimed at expanding market access and optimising trade relations.

- India’s recent FTAs with Mauritius, UAE, Australia, and CEPA and India-Australia ECTA, offers specific advantages, including preferential access to key markets and sectors like pharmaceuticals and digital trade.

- Ongoing negotiations with partners like the UK, EU, and ASEAN reflect India’s commitment to broadening its trade footprint globally.

- Economic Impacts and Outlook

- India’s participation in GVCs and proactive trade policies have contributed positively to economic indicators like the Current Account Balance (CAB) and capital inflows.

- Improved Current Account Deficit (CAD) in FY24, bolstered by rising services exports and remittances, underscores India’s stable external sector.

- India’s CAD narrowed to USD 23.2 billion (0.7 per cent of GDP) in FY24 from USD 67 billion (2% of GDP) during the previous year.

- A narrowing merchandise trade deficit and rising service exports have improved the CAD, ending with a surplus of 0.6% of GDP in Q4 of FY24.

- Robust Foreign portfolio investment (FPI) inflows and ongoing FDI interest in key sectors highlight investor confidence and economic stability.

- Over the last two decades, India’s FDI and equity portfolio inflows have totalled about 2.5% of GDP annually (IMF, 2023).

- FDI in the Industry and Services Sector

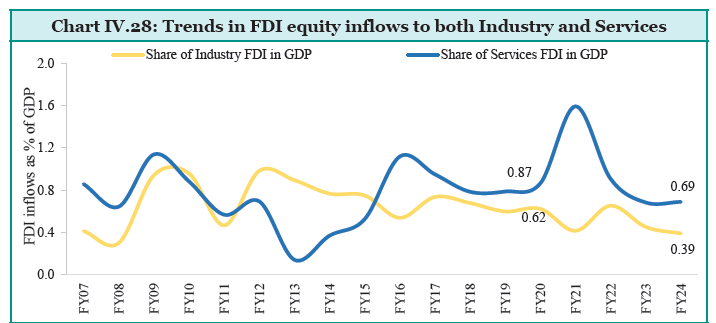

- Recent years have seen a decline in FDI inflows relative to GDP, particularly in the industry and services sectors.

- Net FDI inflows to India declined from USD 42.0 billion during FY23 to USD 26.5 billion in FY24.

- However, gross FDI inflows moderated by only 0.6% in FY24.

- The share of industry sector FDI in GDP dropped from 0.62% in FY20 to 0.39% in FY24.

- Similarly, the services sector's FDI share decreased from 0.87% to 0.69% over the same period.

- Investment intentions have shifted notably towards new and futuristic sectors such as renewables, artificial intelligence, EVs, and semiconductors. This shift indicates a growing attractiveness of high-tech and sustainable sectors for FDI.

- Physical FDI vs Digital FDI

- Historically dominant, physical FDI (includes sectors such as automobiles, pharmaceuticals, and construction) has faced challenges due to geopolitical factors and the rise of non-equity modes of international production like contract manufacturing.

- Rising protectionism and geopolitical tensions have constrained physical FDI, affecting sectors reliant on traditional manufacturing and infrastructure investments

- While, digital FDI (computer services, telecommunications, consultancy services, and information and broadcasting) witnessed significant growth, driven by sectors like software, hardware, and digital services.

- The share of digital FDI in total FDI rose from 46.6% in FY17 to 69.2% in FY21.

- Enhanced by global trends towards digital transformation, including AI, cybersecurity, and data analytics, India has become a preferred destination for digital investments.

- The pandemic accelerated this trend as digital infrastructure became essential for business continuity.

- Historically dominant, physical FDI (includes sectors such as automobiles, pharmaceuticals, and construction) has faced challenges due to geopolitical factors and the rise of non-equity modes of international production like contract manufacturing.

- Exchange Rates and Economic Stability:

- Despite global economic volatility, the Indian Rupee exhibited relative stability against major currencies in FY24, reflecting strong macroeconomic fundamentals and policy interventions by the RBI.

- India’s foreign exchange reserves reached USD 653.7 billion in June 2024, bolstering economic resilience and ensuring liquidity to meet external obligations.

- India’s foreign exchange reserves is enough to cover more than 10 months of imports projected for FY25 and more than 98% of total external debt outstanding at the end of March 2024.

- Government Initiatives on Trade Facilitation

- India has implemented various measures to bolster trade efficiency, reduce logistics costs, and streamline export processes.

- To boost efficiency and lower logistics costs, the Government launched the PM GatiShakti and the National Logistics Policy.

- Digital reforms, such as the Unified Logistics Interface Platform (ULIP) and the Logistics Data Bank, are additional measures taken towards improving logistics.

- The Government has also streamlined trade processes, enhancing transparency and promoting cooperation among stakeholders through initiatives such as Turant, Customs, Single Window Interface for Facilitation of Trade (SWIFT), pre-arrival data processing, e-Sanchit, and Coordinated Border Management.

- Upgrades in port infrastructure under schemes like Sagarmala have augmented India’s maritime trade capabilities, supporting increased cargo throughput and reduced turnaround times.

- Initiatives, such as railway track electrification, reduced release times by the Land Ports Authority of India (LPAI), and the launch of NLP Marine for port-related logistics were also undertaken.

- Challenges and Outlook:

- Ongoing geopolitical tensions and protectionist policies pose risks to India’s trade and investment environment, influencing FDI inflows.

- To sustain FDI growth, India must enhance ease of doing business, strengthen regulatory frameworks, and invest in critical sectors like digital infrastructure and sustainable technologies.

05: Medium-Term Outlook: A Growth Vision for New India

What is India’s Medium-Term Growth Outlook?

- India’s economy has demonstrated resilience over the past decade setting it on a path to become the world's third-largest economy.

- With sustained efforts, India can maintain a 7% growth rate in the medium term.

- Despite global challenges such as geopolitical conflicts, economic nationalism, and climate change, India aims to balance growth with sustainability and security, primarily relying on domestic resources for investment and development.

Key Areas of Policy Focus for Short to Medium-Term Growth:

- Generating Productive Employment

- Current Workforce Distribution:

- Agriculture: 45%

- Manufacturing: 11.4%

- Services: 28.9%

- Construction: 13%

- Job Creation Needs: India needs to generate 78.51 lakh jobs annually in the non-farm sector. Focus on increasing productive jobs outside agriculture, especially in organised manufacturing and services.

- Current Workforce Distribution:

- Skill Gap Challenge

- Employability of Youth: 51.25% (improved from 34% in the last decade)

- Challenges in Skill Development:

- Public perception, lack of coordination, inconsistent assessment, paucity of trainers, and demand-supply mismatch.

- Issues like low female labour participation (37.0%), non-inclusion of entrepreneurship in formal education, and inadequate innovation-driven entrepreneurship support.

- Tapping the Full Potential of the Agriculture Sector

- Structural Issues:

- Sustaining growth without causing food price inflation.

- Improving price discovery, efficiency, reducing disguised unemployment, and increasing crop diversification.

- Required Improvements: Upgradation of technology, modern farming skills, better marketing avenues, price stabilisation, and reducing input wastages.

- Structural Issues:

- Easing Compliance and Financing for MSMEs

- Challenges:

- Extensive regulation and compliance requirements.

- Significant bottlenecks in access to affordable and timely funding; credit gap of Rs 20-25 lakh crore (Lok Sabha Standing Committee report, April 2022)

- Threshold-based concessions and exemptions causing unintended effects.

- Government Initiatives: Schemes like Pradhan Mantri Mudra Yojana and Credit Guarantee Fund Trust for MSMEs aimed at providing affordable credit.

- Challenges:

- Managing India’s Green Transition

- Commitments: Reducing GHG emissions by 33-35% (from 2005 levels), increasing non-fossil fuel-based electricity to 40%.

- Enhance forest cover to absorb 2.5 to 3 billion tonnes of CO2 by 2030

- Challenges:

- Ensuring consistency of E-Mobility policy, grid stability, affordable storage technology, and dealing with dependence on China for critical minerals.

- Addressing financing gaps, with the need for 2.5% of GDP to be allocated to green finance (RBI).

- Green Finance Sources:

- Domestic sources: 87% (FY 2019), 83% (FY 2020)

- International sources: 13% (FY 2019), 17% (FY 2020)

- Commitments: Reducing GHG emissions by 33-35% (from 2005 levels), increasing non-fossil fuel-based electricity to 40%.

- The Chinese Conundrum

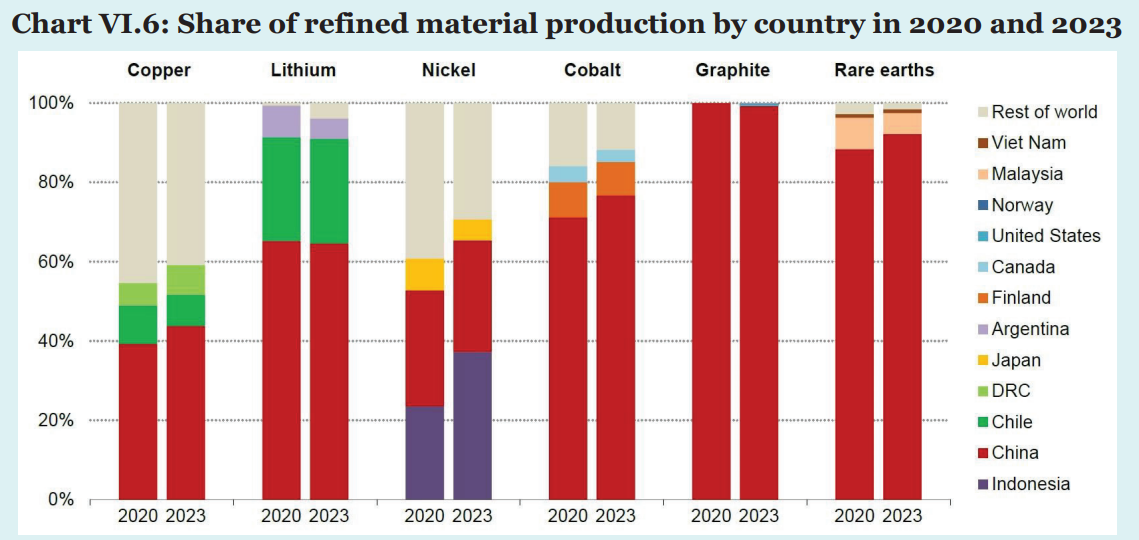

- Complex dynamics with China dominating global supply chains.

- Concerns over India’s dependence on China for critical and rare earth minerals essential for renewable energy.

- Balancing integration into the global supply chain without heavy reliance on China.

- Complex dynamics with China dominating global supply chains.

China's Manufacturing Dominance: A Challenge for Emerging EconomiesEmerging economies (EMEs) are imposing import restrictions on Chinese goods to protect their domestic manufacturers due to China's manufacturing overcapacity, which has led to a global price collapse in various sectors.

|

- Deepening the Corporate Bond Market

- Current State:

- Small size of the corporate bond market compared to other Asian emerging markets (Malaysia, Korea, and China).

- Dominated by highly-rated issuers and a limited investor base.

- Need for Development: Efficient corporate bond market with lower costs and quicker issuing time for longer-term funds.

- Current State:

- Tackling Inequality

- Income Distribution: Top 1% accounts for 6-7% of total incomes, top 10% for one-third of total incomes.

- Policy Focus:

- Creating jobs, integrating the informal sector, expanding the female labour force.

- Tax policies on capital and labour incomes, considering the impact of technology like AI.

- Improving Health of India’s Young Population

- Current Health Issues:

- 56.4% of disease burden due to unhealthy diets (ICMR, April 2024)

- 65% of India's population is under 35.

- 56.4% of disease burden due to unhealthy diets (ICMR, April 2024)

- Rise in consumption of highly processed foods, obesity (Adult obesity rate tripled), and micronutrient deficiencies.

- India's annual rise in children's obesity is among the steepest globally.

- Health Parameters: Need for balanced and diverse diet to leverage demographic divide

- Current Health Issues:

Growth Strategy for Amrit Kaal: Strong, Sustainable, and Inclusive

- Boosting Private Sector Investment

- Focus Areas: Machinery & Equipment, Intellectual Property products.

- Government Initiatives: Aatmanirbhar packages, Production Linked Incentive (PLI), National Infrastructure Pipeline (NIP), National Monetisation Pipeline (NMP), India Industrial Land Bank (IILB), Industrial Park Rating System (IPRS), National Single Window System (NSWS).

- Goal: Increase private sector non-residential investment to sustain efforts towards boosting investment to 35% of GDP.

- Growth and Expansion of India’s Mittelstand (MSMEs)

- Current Contributions: 30% of GDP, 45% of manufacturing output, employment for 11 crore people.

- Government Support: Rs 5 lakh crore Emergency Credit Line Guarantee Scheme (ECLGS), Rs 50,000 crore equity infusion through MSME Self-Reliant India Fund, revised MSME classification criteria, RAMP programme with Rs 6,000 crore outlay, Udyam Assist Platform (UAP).

- Key Challenges: Access to timely and affordable credit.

- Future Directions: Deregulation, physical and digital connectivity, infrastructure upgrades, and targeted training in enterprise management.

- Export Strategy for Mittelstand

- Initiative: Make in India Mittelstand (MIIM) collaboration with Germany.

- Achievements: Supported over 151 German Mittelstand companies, resulting in €1.4 Bn declared investment.

- Focus Areas: Automotive, renewables, construction, consumer goods, electronics, chemicals, waste/water management.

- Strategic Considerations: Balancing trade and investment with China against India’s territorial and non-territorial security.

- Removing Growth Impediments in Agriculture

- Significance: Agriculture's role in food and nutrition security, climate change adaptation and mitigation, sustainable resource use.

- Potential: Employment in horticulture, livestock, fisheries, dairy, and food processing.

- Strategic Shift: Re-imagine agriculture to leverage its importance in physical, food, and economic security amid geopolitical and climatic challenges.

- Financing Green Transition

- Climate Financing Needs: Exploit global green capital from sovereign wealth funds, pensions, private equity, and infrastructure funds.

- Innovative Approaches: Blended finance integrating public and private capital, sector-specific financial institutions to mobilise green funds.

- Potential Role: International Financial Services Centres Authority (IFSCA) to attract international capital for climate finance.

- Bridging the Education-Employment Gap

- Global Megatrends: Automation, climate action, digitalisation changing work and skill demands.

- Policy Frameworks: National Policy on Skill Development & Entrepreneurship (NPSDE), National Education Policy (NEP) 2020 and 2023.

- Focus Areas: Foundational literacy, numeracy, grade-appropriate learning outcomes, employable skills, industry engagement.

- Role of Industry: Collaborate with academic institutions for skilling initiatives.

- Enhancing State Capacity and Capability

- Achievements Since 2014: Delivery of crucial infrastructure, implementation of direct benefit schemes.

- Future Directions: Expand lateral entry into senior ranks, re-imagine training for civil servants, establish accountability mechanisms, annual goal and measurement conversations.

Medium-Term Outlook

- Resilience: India’s growth sustained through multiple global crises with strategic government interventions.

- Growth Path: IMF forecasts 6.8% growth for 2024-25, making India the fastest-growing G20 economy.

- Strategic Goals: Viksit Bharat @2047, building on structural reforms since 2014.

- Citizen Participation: ‘Sabka Prayas’ (everyone’s effort) as a driving mantra for achieving a developed India.

06: Climate Change and Energy Transition: Dealing with Trade-offs

What is the Current Status of India’s Climate Action and Energy Transition Strategy?

- Despite being a rapidly growing economy, India’s per capita carbon emissions are one-third of the global average.

- India aims to achieve a 'Viksit Bharat' or 'Developed India' by 2047 and targets Net Zero carbon emissions by 2070.

- This vision drives the country’s efforts to foster high, inclusive, and environmentally sustainable economic growth.

- Ensuring stable and affordable energy to meet these ambitious goals while maintaining a low-carbon pathway is crucial.

- However, this is challenging due to the need for viable battery storage technologies and access to critical minerals for reliable green energy sources, all while relying heavily on domestic financing.

Present Status of India’s Climate Action - India's Overall Climate Change Strategy

- National Action Plan on Climate Change (NAPCC):

- Principles: High economic growth + Ecological sustainability

- Missions: Nine national missions targeting various sectors:

- National Solar Mission

- National Water Mission

- National Mission for Enhanced Energy Efficiency

- National Mission for a Green India

- National Mission on Sustainable Habitat

- National Mission for Sustainable Agriculture

- National Mission for Sustaining the Himalayan Ecosystem

- National Mission on Strategic Knowledge for Climate Change

- National Mission on Human Health (recently added)

- State Action Plans on Climate Change (SAPCC):

- Current Status: 34 state action plans on climate change operational, outlining sector-specific and cross-sectoral, time-bound priority actions.

Progress on Climate Action

- Solar Power:

- 2023-24 Addition: 15.03 GW

- Cumulative (as of April 30, 2024): 82.64 GW

- Energy Efficiency (Perform Achieve and Trade (PAT) Scheme):

- Eighth Cycle (2023-26):

- Target Sectors: Aluminium, Cement, Chlor-Alkali, Iron & Steel, Pulp & Paper, Textile

- Energy Saving Target: 0.3370 MTOE (million tonnes of oil equivalent)

- Impact: Significant energy savings and GHG emissions reduction

- Eighth Cycle (2023-26):

- Nationally Determined Contributions (NDC):

- Achievements:

- 40% cumulative electrical power installed capacity from non-fossil fuels by 2021

- Reduced emission intensity of GDP by 33% from 2005 levels by 2019

- Updated Targets (August 2022):

- Reduce emissions intensity of GDP by 45% by 2030 (from 2005 levels)

- 50% cumulative electric power installed capacity from non-fossil fuels by 2030

- Current Status (as of May 31, 2024):

- Share of non-fossil sources in installed electricity generation capacity: 45.4%

- Carbon sink: 1.97 billion tonnes of CO2 equivalent (2005-2019)

- Achievements:

- National Communication (NC) to UNFCCC:

- Third National Communication (TNC):

- Energy sector: 75.81% of anthropogenic emissions.

- Agriculture sector: 13.44%.

- Industrial Process & Product Use (IPPU): 8.41%.

- Waste: 2.34%.

- Land Use, Land-Use Change & Forestry (LULUCF): Net sink of 485,472 GgCO2e in 2019.

- Net national emissions in 2019: 26,46,556 GgCO2e.

- Emission Growth (2016-2019):

- Total national emissions increased by 4.56%.

- GDP grew at a CAGR of about 7%, emissions grew at a CAGR of about 4%.

- International Recognition:

- India is the only G20 nation in line with 2℃ warming (International Finance Corporation report).

- Third National Communication (TNC):

Adaptation Actions

- Government Initiatives:

- National Innovations on Climate Resilient Agriculture (NICRA)

- Swachh Bharat Mission

- Mahatma Gandhi National Rural Employment Guarantee Act

- Pradhan Mantri Awas Yojana

- Saubhagya Scheme

- Adaptation Expenditure:

- 2021-22: 5.60% of GDP

- 2015-16: 3.7% of GDP

- Need for Increased Finance: To ease resource constraints

- Coastal Adaptation:

- Ramsar Sites (since 2014):

- 56 new wetlands designated

- Total: 82 sites, 1.33 million ha

- Amrit Dharohar Initiative (2023):

- Promotes nature tourism in Ramsar sites

- Mission Sahbhagita: Participatory conservation (Wetland Mitras), preparation of wetland health cards, engaging communities and private sector

- Ramsar Sites (since 2014):

Community-led Water Governance - Case of NavanagarWater Governance24, a village in Sabarkantha District, Gujarat, faced severe water scarcity with water tables at 500-600 feet and high TDS levels (900-1100 mg/litre), making agriculture unviable.

|

Low Carbon Development and Energy Composition

- Future Energy Demands:

- India’s energy requirements are projected to increase by 2 to 2.5 times by 2047 to support its growing economy and developmental goals.

- The transition to meet these demands must balance resource constraints, climate change resilience, and sustainable development.

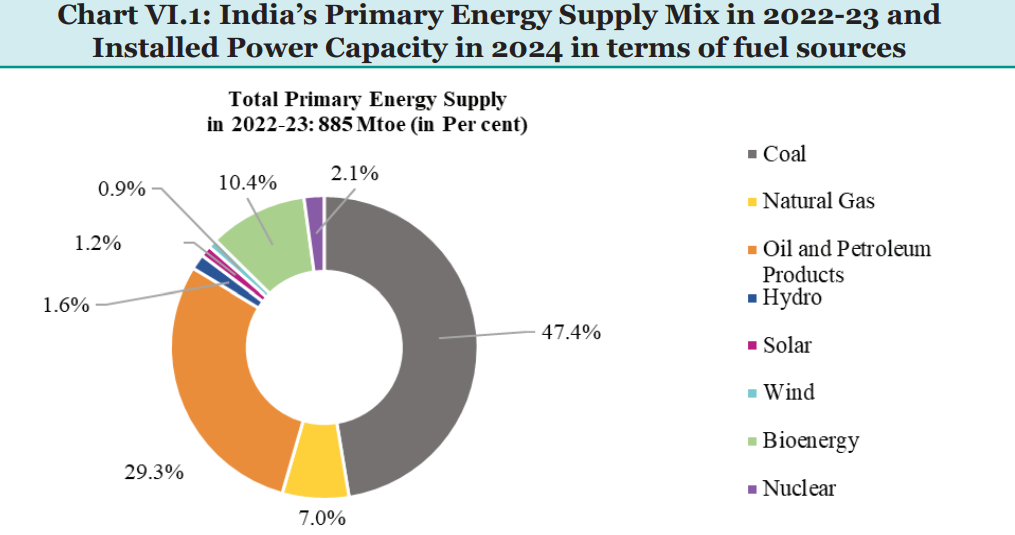

- Current Energy Composition (2022-23):

- Primary Energy Mix: Fossil fuels (coal, oil, and natural gas) constituted approximately 84% of India’s primary energy mix in 2022-23.

- Electricity Sector Composition: The share of non-fossil power capacity increased from around 32% in April 2014 to 45.4% as of May 2024.

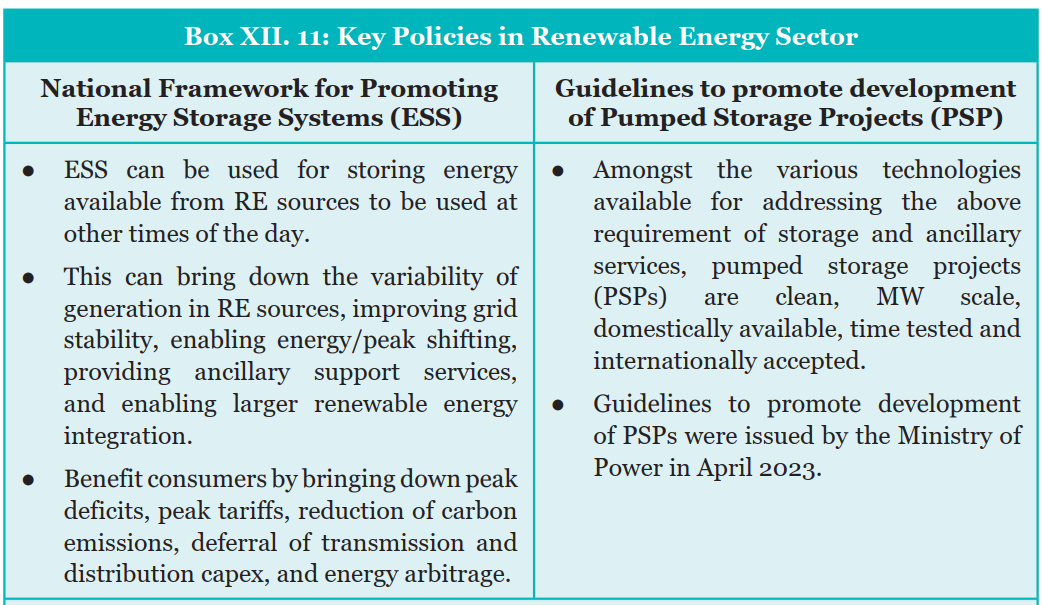

- Recent Initiatives in Renewable Energy:

- PM-Surya Ghar Yojana (February 2024):

- Capacity Addition: 30 GW of solar capacity.

- CO2 Reduction: 720 million tonnes.

- Job Creation: Approximately 1.7 million direct jobs.

- Offshore Wind Energy:

- Policy and Rules (2023): National offshore wind energy policy and offshore wind energy lease rules notified.

- Initial Capacity Funding: Viability gap funding for 1GW capacity.

- Green Hydrogen Mission:

- Target: 5 MMT of green hydrogen by 2030.

- Financial Incentives: Boosts electrolyser manufacturing and production.

- Tender Awarded: Strategic Interventions for Green Hydrogen Transition (SIGHT) scheme awarded for 4,12,000 tons capacity.

- PM-Surya Ghar Yojana (February 2024):

- Challenge of Environmental and Resource Management:

- Land and Water Demand: Expanding renewable energy increases demand for land and water, with India having the lowest land availability per capita among G20 countries.

- Renewable Waste Recycling: Solar PV Waste is estimated to be 78 million tonnes by 2050; needs comprehensive policy for managing disposal and recycling.

- Critical Minerals: Concentration of critical minerals like Graphite, Cobalt, rare earth elements, and Lithium is geographically skewed.

- Financial Aspects of Energy Transition:

- Investment Requirements: Approximately USD 250 billion per year needed until 2047 for Net Zero pathways.

- Financing Mechanisms:

- Sovereign Green Bonds: Rs 16,000 Crore issued in January-February 2023 and Rs 20,000 Crore in October-December 2023 for green projects.

- SEBI’s Sustainability Reporting: Enhanced ESG disclosures for top listed entities.

- RBI Initiatives: Framework for Green Deposits and concessional credit for renewable energy through Priority Sector Lending (PSL).

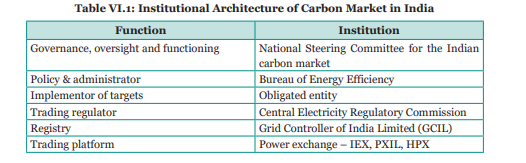

Indian Carbon Market Framework

- Carbon Credit Trading Scheme (CCTS):

- Objective:

- Determine a price for one tonne of carbon dioxide equivalent emissions.

- Encourage entities to account for previously unpriced emission costs.

- Incentivize investment in low-emission technologies.

- Transition:

- CCTS will replace the existing Perform, Achieve, and Trade (PAT) scheme.

- Designated Consumers (DCs) under PAT will gradually shift to CCTS by 2028-2030.

- Mechanism:

- Emission Targets: Government will set entity-wise Greenhouse Gas (GHG) emission intensity targets.

- Compliance: Obligated Entities (OEs) must meet these targets and report compliance within nine months post-compliance cycle.

- Carbon Credit Certificates (CCC):

- Objective:

- Voluntary Carbon Market (VCM):

- Overview:

- Global Market Size: Over USD 1.2 billion.

- India’s Position: Second-largest supplier of carbon offsets.

- Function:

- Allows entities to offset emissions by funding emission reduction/removal projects elsewhere.

- Offsets can be used to meet personal emission reduction goals.

- Challenges:

- Double Counting: Risk of both sellers and buyers claiming the same carbon reductions.

- Credit Claims: Uncertainty over whether credits used by foreign entities can be simultaneously claimed by the credit-originating country.

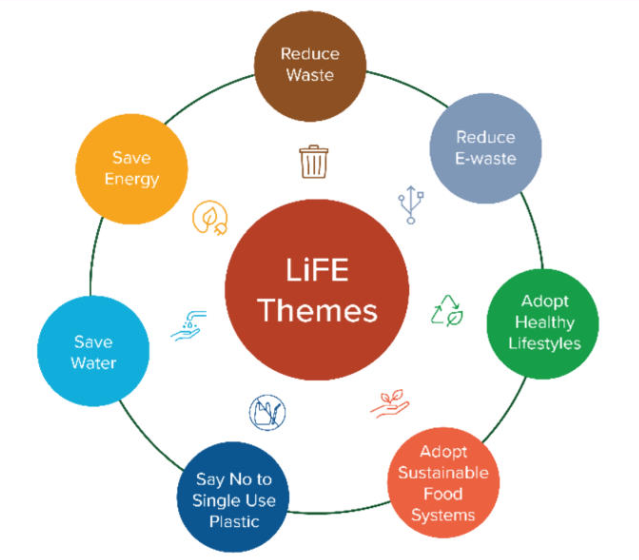

- Mission LiFE and Voluntary Actions:

- Aims to address climate change through sustainable living based on conservation and moderation.

- Green Credit Programme (GCP):

- Objective: Encourage environmental actions by offering green credits as rewards.

- Participants: Individuals, communities, private sector industries, and companies.

International Commitments on Climate Finance: Recent Developments

- Current Financial Constraints:

- Estimated Resource Needs: USD 5.8 trillion to USD 11.5 trillion needed by 2030 to meet NDC targets.

- Adaptation Costs: Estimated to be 10 to 18 times greater than the current international adaptation finance flow of USD 21.3 billion.

- Existing Frameworks:

- UNFCCC and Paris Agreement: Mandate developed countries to provide grant or concessional financial resources and technology access to developing nations.

- Currently, most international finance for developing countries is in the form of loans rather than grants.

- India’s Financial Requirements:

- Overall Resource Requirement:

- Nationally Determined Contribution Estimates: USD 2.5 trillion required for 2015-2030.

- Long-Term Low Emission Development Strategy Estimates: Tens of trillions of dollars needed by 2050 for a low-carbon transition.

- Adaptation Communication: Rs 56.68 trillion needed by 2030 for adaptation.

- Domestic vs. International Finance:

- Much of the climate action is funded by domestic resources.

- Developed countries’ emphasis on private finance is debated due to limitations in private capital and its macroeconomic implications.

- Overall Resource Requirement:

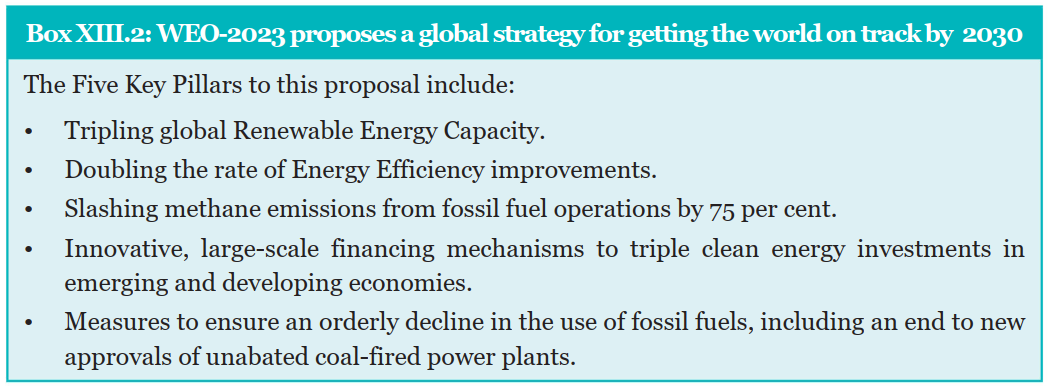

- COP 28 and Global Stocktake:

- Outcomes of COP 28:

- Global Stocktake (GST): Aims to increase global climate ambition by 2030. Developed a framework for the Global Goal for Adaptation (GGA), requiring all countries to have adaptation plans by 2030.

- Loss and Damage Fund: Agreement on operationalising the fund and its funding arrangements.

- Adaptation and Mitigation Targets: Calls to scale up adaptation finance and achieve global renewable energy capacity, phase-down coal power, and phase out inefficient fossil fuel subsidies.

- Implementation:

- Actions to be implemented nationally, considering diverse national circumstances.

- Outcomes of COP 28:

- New Collective Quantified Goal (NCQG):

- It is being negotiated under the UNFCCC to set an annual climate finance goal from developed countries to developing countries starting in 2025.

- Baseline: Minimum of USD 100 billion per year.

India’s International Initiatives to Address Climate Change Issues

- International Solar Alliance (ISA)

- Founded: 2015 by India and France.

- Goal: Deploy solar energy solutions and unlock USD 1 trillion in investments by 2030.

- Members: 119 Member and Signatory countries.

- One World, One Sun, One Grid (OSOWOG)

- Objective: Create a massive interconnection of solar energy systems globally.

- Phase 1: Connect Indian grid to Middle East, South Asia, and South-East Asia.

- Phase 2: Extend connections to renewable resources in Africa.

- Phase 3: Achieve global interconnection with a target of 2,600 GW by 2050.

- Coalition for Disaster Resilient Infrastructure (CDRI)

- Launched: September 23rd, 2019, at the UN Climate Action Summit.

- Goal: Enhance resilience of infrastructure to climate and disaster risks.

- Leadership Group for Industry Transition (LeadIT)

- Founded: September 2019 by India and Sweden.

- Objective: Promote industry transition to achieve Paris Agreement goals.

- LeadIT 2.0 (2024-26): Focus Areas:

- Inclusive Industry Transition: Shaping policy frameworks and fostering international cooperation.

- Technology Development: Co-development and transfer of low-carbon technology.

- Financial Support: Supporting industry transition in emerging economies.

07- Social Sector: Benefits That Empower

What is the Current Status of India’s Social Sector?

Context

- With the goal of becoming a developed nation by 2047, India is seeing enhanced quality of life, greater women’s empowerment, and better rural governance.

- This progress highlights India’s commitment to sustainable, equitable development while addressing ongoing and emerging challenges.

Dovetailing Growth with Empowering Welfare: A Paradigm Shift

- Key Developments in Welfare

- Major Welfare Schemes:

- PM Ujjwala Yojana: Over 10.3 crore free gas connections provided.

- Swachh Bharat Mission: 11.7 crore toilets built.

- Jan Dhan Accounts: 52.6 crore accounts opened.

- PM-AWAS Yojana: 3.47 crore pucca houses built for the poor.

- Jal Jeevan Mission: 11.7 crore households provided tap water connections.

- Ayushman Bharat Scheme: 6.9 crore hospital admissions made.

- Pillars of the New Approach to Welfare:

- Cost-Effectiveness: Transforming implementation and effectiveness of Government programs.

- Technology Utilisation: Enhanced fiscal efficiency through DBT and JAM trinity. Over Rs.38 lakh crore transferred via DBT since 2013.

- Outcome Budget: Goal-oriented approach for budgetary allocation.

- Targeted Implementation Reforms:

- Aspirational Districts Programme (ADP): Convergence, collaboration, and competition approach leading to substantial improvements in health, nutrition, education, and infrastructure.

- Other Programs: Aspirational Blocks Programme, Vibrant Villages Programme, Viksit Bharat Sankalp Yatra.

- Corporate Social Responsibility (CSR):

- Mandatory CSR Spending: Section 135 of the Companies Act 2013 requires companies to spend on social purpose programs.

- Major Welfare Schemes:

- Overall Progress and Outcomes

- Improvements in Multidimensional Poverty:

- National Multidimensional Poverty Index (MPI): Estimated by NITI Aayog, measuring health, education, and standard of living.

- Reduction in Poverty: MPI nearly halved from 0.117 (2015-16) to 0.066 (2019-21). 13.5 crore Indians escaped multidimensional poverty.

- Regional Progress: Significant improvements in states like Bihar, MP, UP, Odisha, and Rajasthan.

- Household Consumption Expenditure Survey (HCES) 2022-23:

- Increase in Monthly Per Capita Consumption Expenditure: 40% rise in rural areas and 33.5% in urban areas over 2011-12.

- Gini Coefficient: Decline from 0.283 to 0.266 (rural) and from 0.363 to 0.314 (urban).

- Rural-Urban Divide: Decreased from 83.9% to 71.2%.

- Economic Inequality: Consumption of the lowest 5% grew faster than the top 5%.

- Improvements in Multidimensional Poverty:

- Minding the Mind: Mental Health Scenario

- Rising Prevalence of Mental Health Issues:

- Global Statistics: 970 million people with mental disorders; increase in depressive and anxiety disorders due to Covid-19.

- Indian Context: National Mental Health Survey (NMHS) 2015-16 showed 10.6% prevalence of mental disorders. Higher morbidity in urban areas.

- Mental Health of Children and Youth:

- Global: One in seven 10-19-year-olds with mental disorders.

- India: Increased prevalence among adolescents due to academic pressures, social media, and socio-economic factors.

- Economic Impact of Mental Health: Associated with absenteeism, decreased productivity, and increased healthcare costs.

- Economic Benefits of Mental Health Investment: Investment in mental health has high economic returns.

- In India, studies estimate a return on investment of 6.5 times for the implementation of the Mental Health Care Act 2017

- Related National and State Initiatives: India has made significant strides in mental health policy with the National Mental Health Policy (2014), National Youth Policy (2014), and National Education Policy (2020).

- State-Level Initiatives:

- Meghalaya: State Mental Health Policy aims to train Community Health Centre and school staff to support children and adolescents.

- Delhi: Introduced a Happiness Curriculum for younger students integrating mindfulness, meditation, and values-based education.

- Kozhikode, Kerala: The ‘Our Responsibility to Children’ initiative focuses on teacher, peer, and social mentoring, life skills education, and support for children with special needs.

- State-Level Initiatives:

- Policy Recommendations:

- Increase Psychiatrist Numbers: Raise the number of psychiatrists from 0.75 per lakh population to the WHO norm of 3 per lakh.

- Nurture Peer Support: Strengthen peer support networks and self-help groups to reduce stigma.

- Sensitisation: Initiate mental health sensitisation at the preschool and Anganwadi levels.

- Standardise Private Sector Services: Ensure standardisation in mental health start-ups.

- Rising Prevalence of Mental Health Issues:

Warning Labels on Social Media PlatformsIn India, a 2021 study by the National Commission for Protection of Child Rights found that 23.8% of children use smartphones in bed, and 37.2% have reduced concentration due to smartphone use.

|

- Education Sector Developments

- National Education Policy (NEP) 2020: NEP 2020 aims to provide quality education and prepare youth for the knowledge-driven economy.

- It emphasises foundational literacy, numeracy, multilingual education, and experiential learning.

- School Education Progress:

- Improved Facilities: Enhanced basic facilities in government schools, including toilets, drinking water, and smart classrooms.

- National Curriculum Framework (NCF-SE) 2023: Focuses on competency-based education, vocational education from grade 3, and integrating Indigenous knowledge.

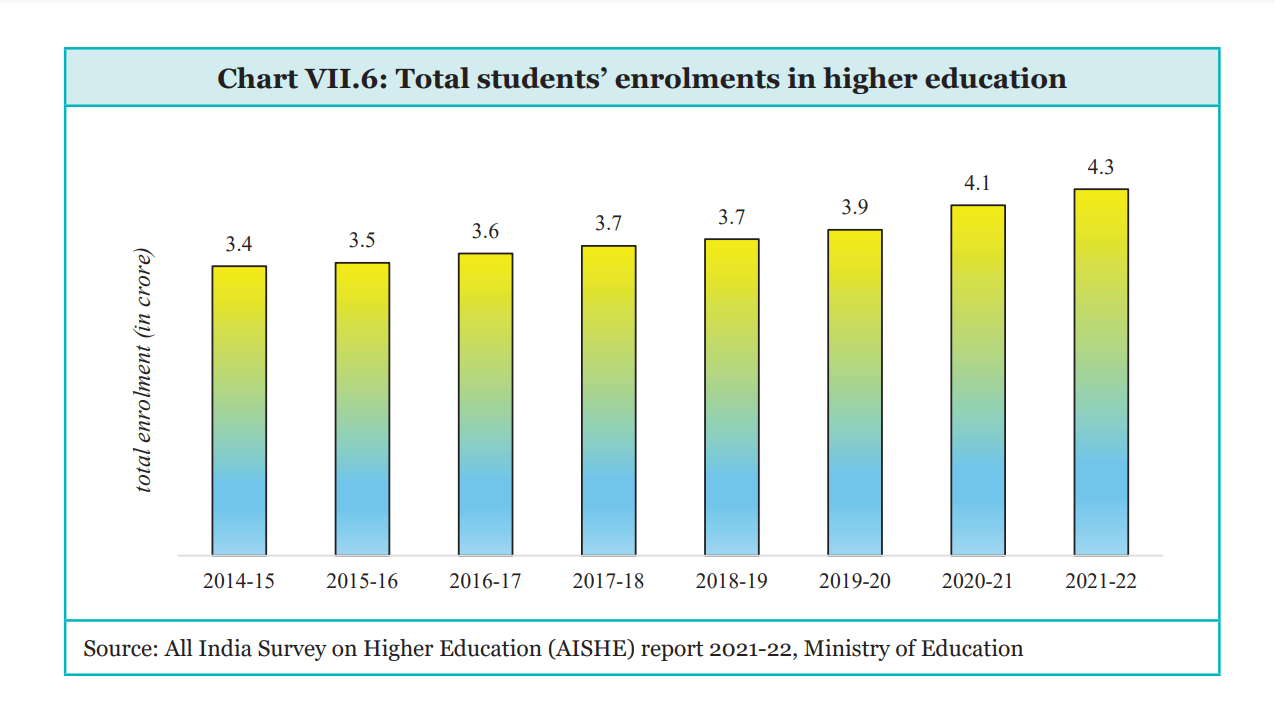

- Higher Education:

- Digital Transformation in Education:

- National Credit Framework (NCrF): Under NEP 2020, the NCrF supports lifelong learning and includes digital solutions like APAAR and the Academic Bank of Credits (ABC).

- Online Learning: University Grants Commission (UGC) Regulations allow earning up to 40% of credits from online courses.

- National Education Policy (NEP) 2020: NEP 2020 aims to provide quality education and prepare youth for the knowledge-driven economy.

Vidyanjali ProgrammeLaunched on 7th September 2021, the Vidyanjali programme aims to enhance school infrastructure and education quality through community involvement and Corporate social responsibility.

|

- Research and Development (R&D)

- Growth and Investment:

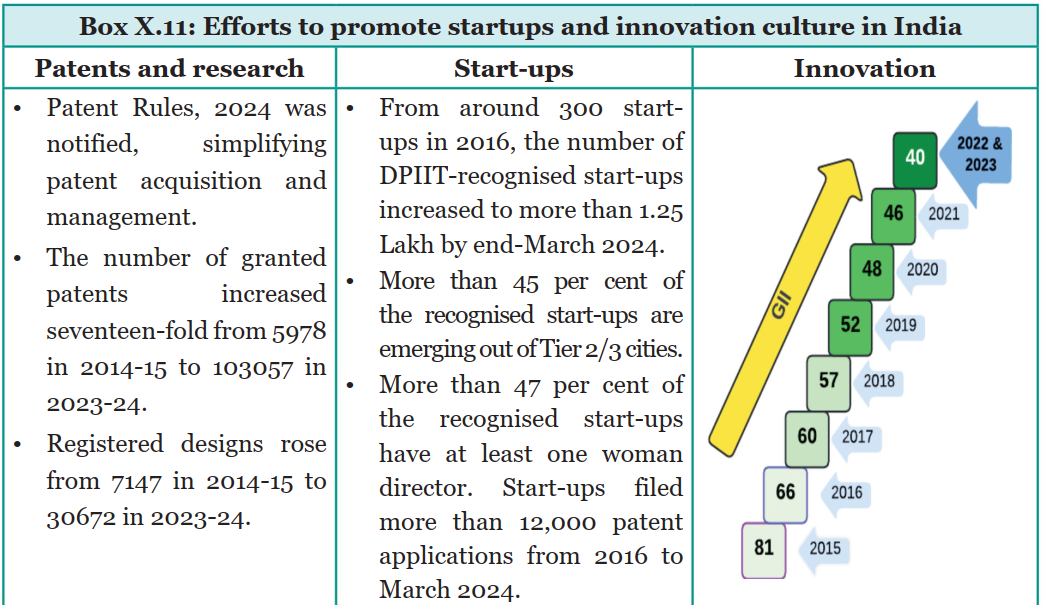

- Patent Grants: Nearly 1 lakh patents were granted in FY24, with a significant increase in patent filings (31.6% growth in 2022).

- Global Innovation Index: India’s rank improved to 40th in 2023.

- Gross Expenditure on R&D (GERD): More than doubled from Rs. 60,196.8 crore in FY11 to Rs. 127,381 crore in FY21.

- Challenges:

- R&D Investment: India’s R&D investment as a percentage of GDP stands at 0.64%, lower compared to China (2.41%) and the US (3.47%).

- Future Directions:

- Strengthen Research-Industry Links: Improve collaboration between higher education, industry, and research institutions.

- Anusandhan Foundation: Launched to enhance the R&D ecosystem with a proposed corpus of Rs.1 lakh crore for research and innovation.

- Growth and Investment:

Empowerment of Women

- Social Empowerment of Women

- Transition to Women-Led Development: India is shifting focus from mere women's development to women-led development.

- India's G20 Presidency in 2023 prioritised 'women-led development,' reflecting global recognition of gender issues.

- Government Initiatives and Budget:

- Gender Budget: Increased from Rs.97,134 crore in FY14 to Rs.3.10 lakh crore in FY25, marking a significant rise.

- Health and Education: Emphasis on improving health and education for the girl child through initiatives like "Beti Bachao, Beti Padhao" and Sukanya Samriddhi Yojana.

- Maternal Health: Programs like Janani Shishu Suraksha Karyakram and PM Matru Vandana Yojana have improved institutional delivery rates and maternal health.

- Nutritional Security:

- Mission Saksham Anganwadi & Poshan 2.0: Focuses on addressing malnutrition through a lifecycle approach and improving Anganwadi services with upgraded facilities and technology.

- Safety and Support:

- Sambal: Includes one-stop centres for women affected by violence and the 24-hour women’s helpline ‘181’ for emergency assistance.

- Education and Skilling:

- Gender parity in school enrolment and a higher female GER in higher education.

- Skilling schemes like PMKVY and Jan Shikshan Sansthan focus on increasing women's participation and training in various sectors.

- Women in Science and Non-Conventional Roles:

- WISE KIRAN: Encourages women’s participation in STEM fields.

- Political Empowerment:

- Nari Shakti Vandan Abhiniyam, 2023 (NSVA): Aims to enhance women’s political participation and improve public goods investment linked to women’s concerns.

- Transition to Women-Led Development: India is shifting focus from mere women's development to women-led development.

- Economic Empowerment of Women

- Labour Force Participation:

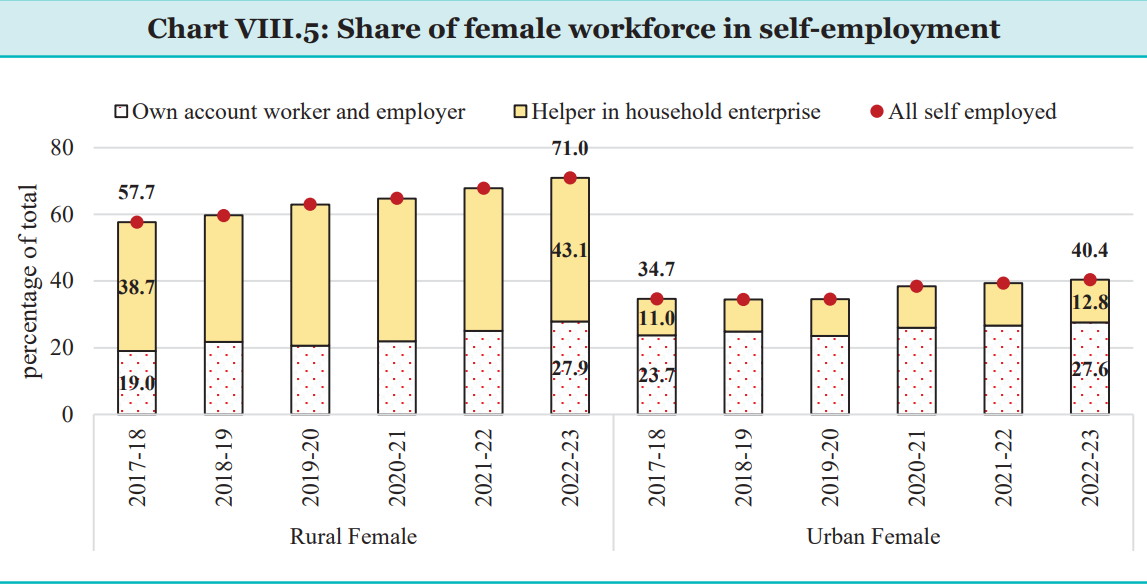

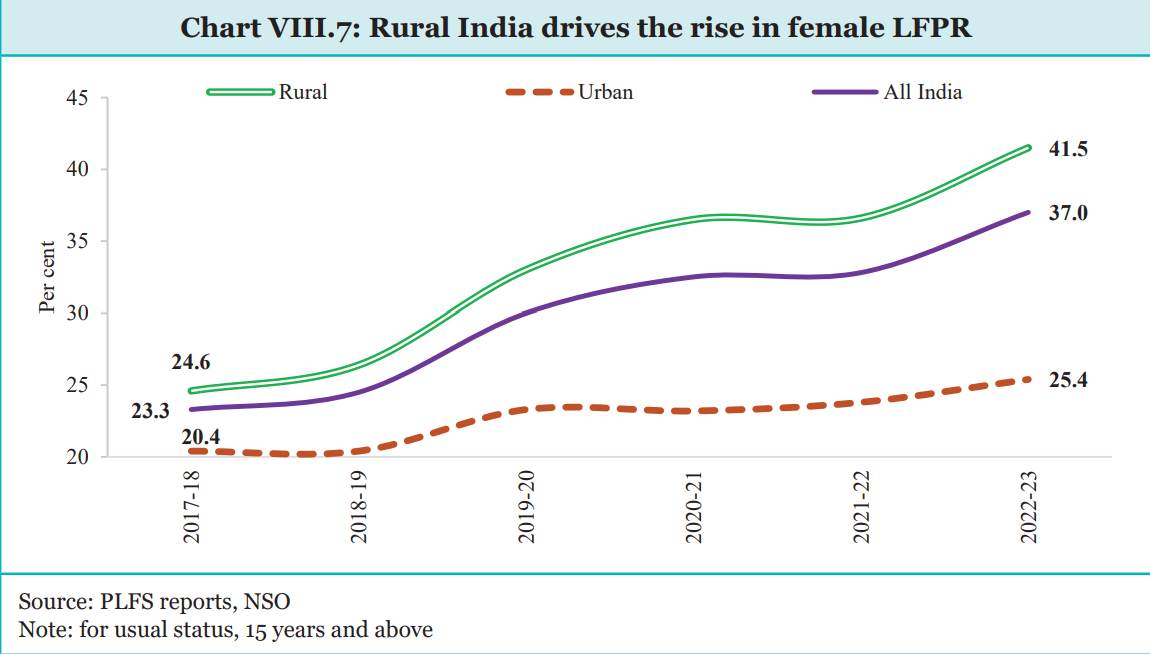

- Increase in female Labour Force Participation Rate (LFPR) from 23.3% in 2017-18 to 37% in 2022-23, with a notable rise in rural areas.

- Encouraging trends in sectors like agro-processing for rural women.

- Financial Inclusion:

- PM Jan Dhan Yojana: Facilitated the opening of 52.3 crore bank accounts, with significant female participation and increased deposits.

- Rural Microfinance:

- Deendayal Antyodaya Yojana-NRLM: Empowers women through SHGs, enhancing self-esteem and access to government schemes.

- Successful models include Kudumbashree, Jeevika, and others.

- Deendayal Antyodaya Yojana-NRLM: Empowers women through SHGs, enhancing self-esteem and access to government schemes.

- Entrepreneurship:

- Female entrepreneurs have benefitted from schemes like PM Mudra Yojana and Stand-Up India, with substantial female participation.

- Labour Force Participation:

Rural Economy: Driving the Growth Engine

- Key Areas of Focus:

- Welfare services (school infrastructure, primary healthcare centers)

- Technology solutions for governance issues

- Improved transport and communication

- Strengthening Mahatma Gandhi National Rural Employment Guarantee Scheme

- Objective:

- MGNREGA: Provides at least 100 days of guaranteed wage employment annually to rural households

- Efficiency Reforms:

- Geotagging: Before, during, and after work

- Payments: 99.9% through National Electronic Fund Management System

- DBT and Aadhaar-Based Payments: Enabled for 98.6% of active workers

- Social Audit Units: Established in 28 states/UTs

- Evolution:

- From Wage Employment to Asset Creation: Individual beneficiary works on land rose from 9.6% in FY14 to 73.3% in FY24

- Capacity Development: Initiatives like BareFoot Technicians (BFT) and UNNATI skilling project.

- Objective:

- Nurturing Rural Entrepreneurship

- Government Schemes for Rural Entrepreneurship:

- Deendayal Antyodaya Yojana-National Rural Livelihood Mission (DAY-NRLM):

- Objective: Empower poor households for self-employment and skilled wage employment

- Enterprises Supported: Solar panels, sanitary pads, soaps, detergents, etc.

- Lakhpati Didis Initiative (2023):

- Target: Uplift three crore SHG households to minimum annual income of Rs.1 lakh within three years

- Saras Aajeevika Portal and eSARAS Mobile App (2023):

- Purpose: Showcase and sell handcrafted products by SHGs

- Start-Up Village Entrepreneurship Programme (SVEP) and Aajeevika Grameen Express Yojana (AGEY):

- SVEP: Supports local enterprises, provides start-up loans

- AGEY: Provides community-monitored transport services to rural areas

- Rural Self Employment Training Institute (RSETI) Scheme:

- Purpose: Provide skill training, credit assistance, and mentorship

- Coverage: 50.72 lakh trained candidates, 36.23 lakh settled entrepreneurs/apprentices

- Financing Rural Entrepreneurship:

- NABARD: Supports Micro Entrepreneurship Development Programmes (MEDPs) and Livelihood & Enterprise Development Programmes (LEDPs)

- Funding: Rs.52.39 crore for MEDPs, Rs.106.10 crore for LEDPs

- Deendayal Antyodaya Yojana-National Rural Livelihood Mission (DAY-NRLM):

- Government Schemes for Rural Entrepreneurship:

Towards Sustainable Development

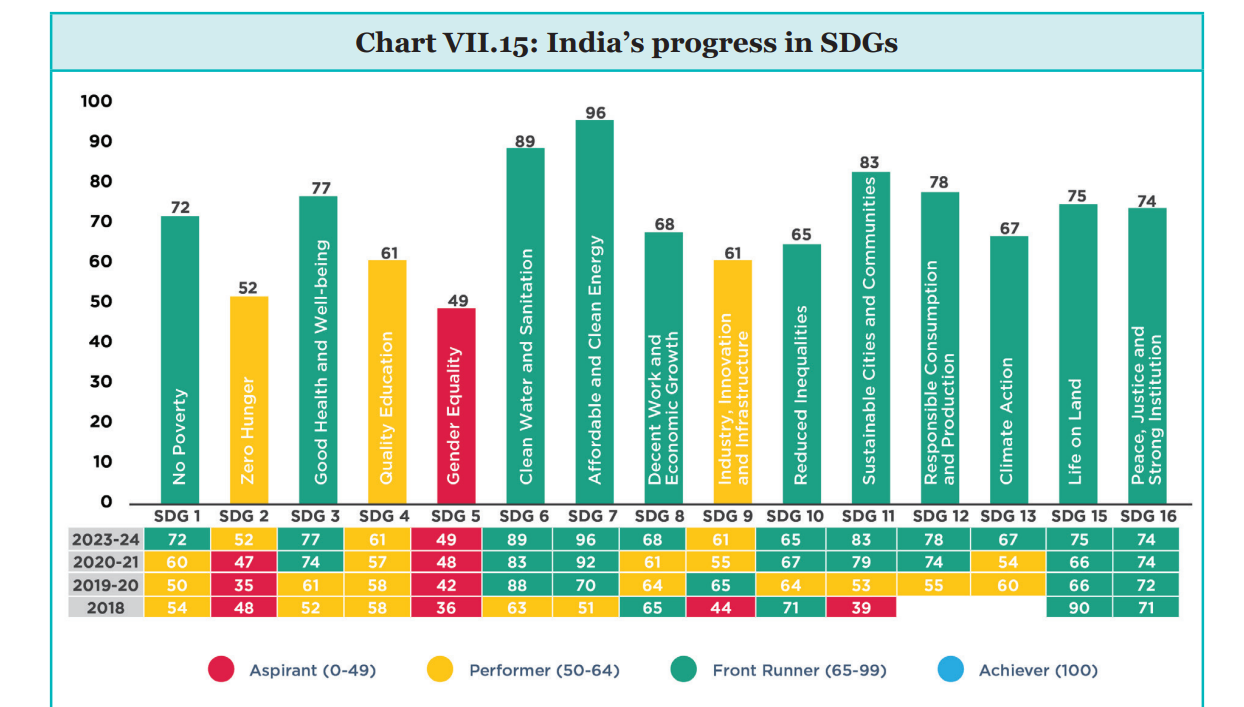

- Embracing SDGs:

- India is actively adopting and championing the Sustainable Development Goals (SDGs) to enhance welfare and quality of life for its citizens.

- Despite global economic challenges, India has demonstrated resilience and commitment towards achieving the 2030 Agenda.

- SDG India Index Scores:

- 2020-21: 66

- 2023-24: 71

08: Employment and Skill Development: Towards Quality

What is the Current Status of Employment and Skill Development in India?

Context

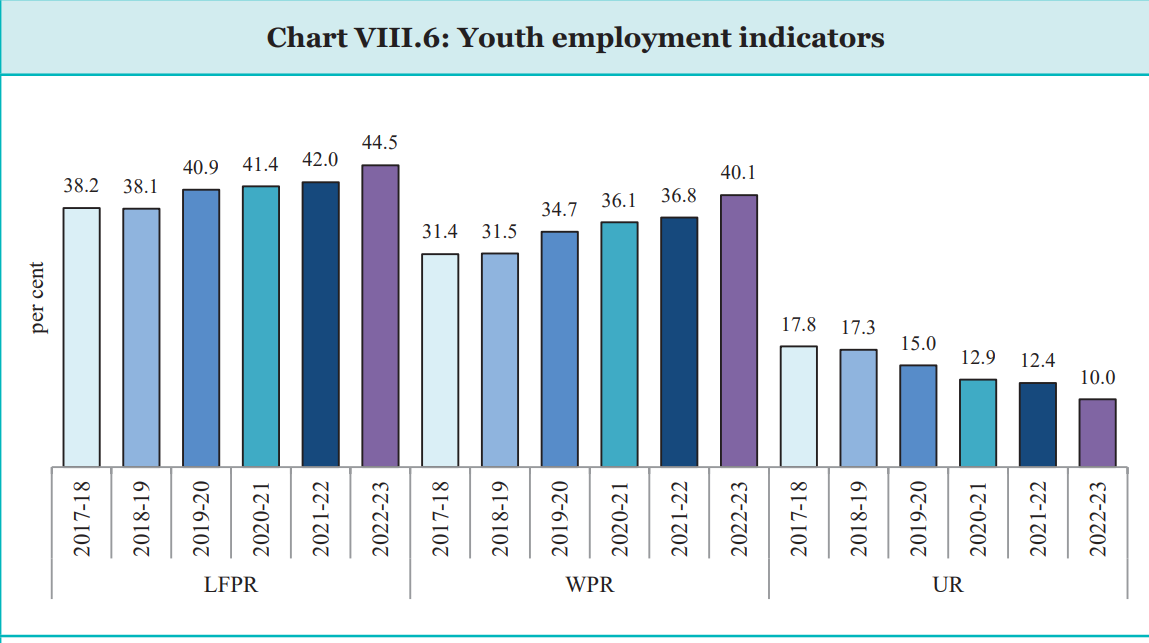

- The Indian labour market has shown significant improvement over the past 6 years, with the unemployment rate dropping to 3.2% in 2022-23.

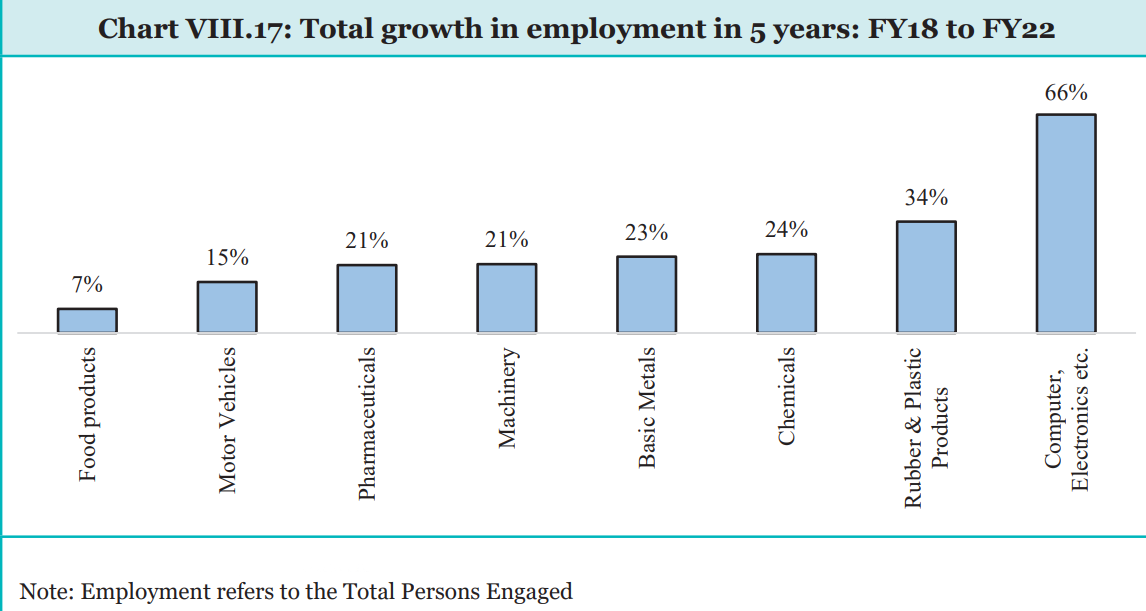

- The manufacturing sector has rebounded, with rising factory employment and upscaling of operations.

- Formal employment growth is robust, evidenced by a doubling of EPFO payroll additions.

- However, the job market must adapt to technological advancements, particularly artificial intelligence, while ensuring collective welfare.

- Also, despite progress in skilling, only 4.4% of the young workforce is formally skilled, indicating scope for further improvement.

Current Employment Scenario

- Unemployment and Employment Metrics

- Unemployment Rate (UR):

- Trend: The all-India annual unemployment rate (UR), for individuals aged 15 years and above based on the usual status, has been declining since the Covid-19 pandemic.

- Labour Force Participation Rate (LFPR) and Worker-to-Population Ratio (WPR)

- Quarterly Data: The quarterly PLFS reports for urban areas reveal that:

- The unemployment rate for people aged 15 years and above is 6.7% in the quarter ending March 2024.

- This is a slight decrease from 6.8% in the same quarter of 2023.

- There has been an increase in both the WPR and LFPR, reflecting a recovery in employment post-pandemic.

- The unemployment rate for people aged 15 years and above is 6.7% in the quarter ending March 2024.

- Quarterly Data: The quarterly PLFS reports for urban areas reveal that:

- Unemployment Rate (UR):

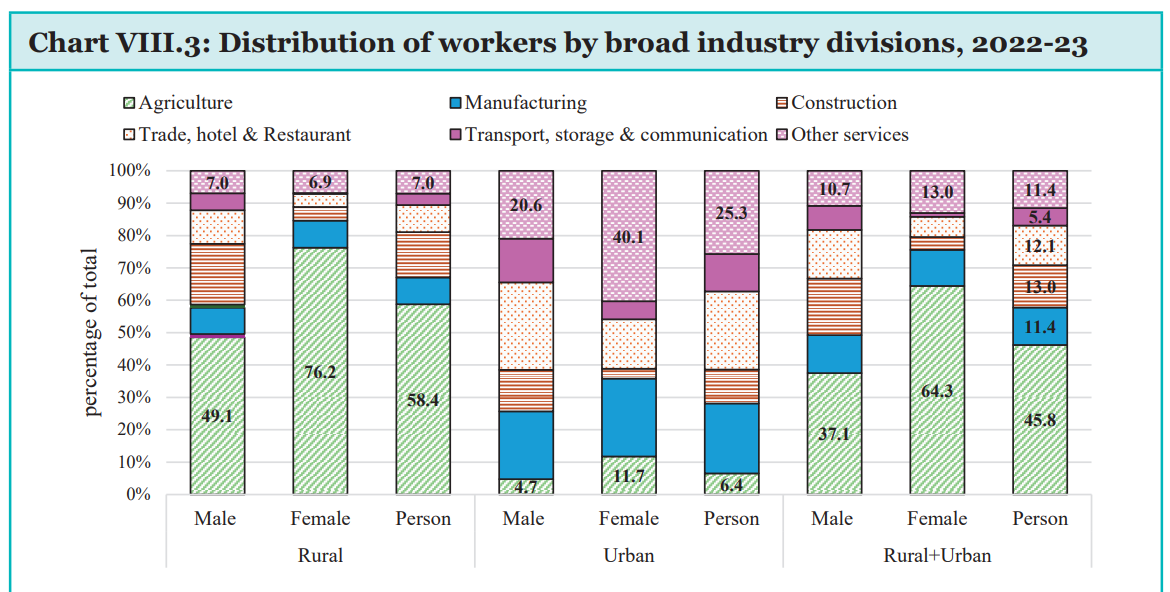

- Workforce Composition

- Estimated Workforce Size

- 2022-23 Estimate: India’s workforce was approximately 56.5 crore.

- Employment Distribution by Sector

- Agriculture: 45% of the workforce.

- Manufacturing: 11.4% of the workforce.

- Services: 28.9% of the workforce.

- Construction: 13% of the workforce.

- Estimated Workforce Size

- Employment Status

- Breakdown of Employment Status

- Self-Employed: 57.3% of the total workforce.

- Unpaid Workers in Household Enterprises: 18.3%.

- Casual Labour: 21.8%.

- Regular Wage/ Salaried Workers: 20.9%.

- Gender Differences

- Breakdown of Employment Status

Youth and Female Employment in India

- Youth Employment

- Youth Unemployment Rate

- Formal Employment Growth

- EPFO Data: Reflects the rise in youth employment.

- Trend: The annual new EPF subscribers aged 18-28 years have been increasing post-Covid-19 pandemic.

- Current Status: Nearly two-thirds of new EPFO payroll subscribers are in the 18-28 years age band.

- EPFO Data: Reflects the rise in youth employment.

- Female Labour Force Participation Rate (FLFPR)

- FLFPR Trends: The FLFPR has been rising for the past six years.

- Rural FLFPR: Increased by 16.9% points from 2017-18 to 2022-23, highlighting the growing contribution of women to rural production.

- FLFPR Trends: The FLFPR has been rising for the past six years.

- Employment in Factories

- Manufacturing Sector Resilience

- Annual Survey of Industries (ASI): Shows recovery in employment post-pandemic.

- 2020-21: Slight fall in employment.

- 2021-22: Employment in the organized manufacturing sector surpassed pre-pandemic levels.

- Employment Per Factory: Continued to rise, with wages per worker increasing.

- Annual Survey of Industries (ASI): Shows recovery in employment post-pandemic.

- Wage Growth

- Rural Areas (FY15-FY22): Wages per worker grew at a 6.9% CAGR.

- Urban Areas (FY15-FY22): Wages per worker grew at a 6.1% CAGR.

- Top States by Factory Employment: Tamil Nadu, Gujarat, and Maharashtra account for over 40% of factory employment.

- Highest Employment Growth (FY18-FY22): States with a higher share of young population, including Chhattisgarh, Haryana, and Uttar Pradesh.

- Factory Size Trends

- Small Factories (2021-22): Factories employing less than 100 people constituted 79.2% of all factories but only contributed 22.1% of total employment.

- Growth in Larger Factories: Factories employing more than 100 workers grew by 11.8% from FY18 to FY22.

- Sectoral Employment Share

- Largest Employers: Food products (11.1%), textiles, primary metals, wearing apparel, and motor vehicles.

- Emerging Sectors: Computers and electronics, rubber and plastic products, and chemicals.

- Manufacturing Sector Resilience

- Government Initiatives to Boost Employment

- Production Linked Incentive (PLI) Scheme

- Self-Employment Promotion

- National Career Service (NCS) Portal

- Includes 407 Model Career Centres and over 46,000 job fairs.

- e-Shram Portal

- National database of unorganised workers with over 29 crore registered workers.

- Integrated with NCS portal to facilitate job search and access to Central Government schemes.

- Aatmanirbhar Bharat Rojgar Yojana (ABRY)

- Benefited 60.5 lakh individuals across 1.5 lakh establishments by March 2024.

- Contributory Pension Schemes

- Atal Pension Yojana (APY): Over 6.5 crore subscribers.

- Pradhan Mantri Shram Yogi Maan-Dhan (PM-SYM): Over 50 lakh workers enrolled.

- Affordable Insurance Programs

- Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY): Rs. 2 lakh life cover at an annual premium of Rs. 436.

- Pradhan Mantri Suraksha Bima Yojana (PMSBY): Rs.2 lakh disability cover at an annual premium of Rs.20.

- PM Street Vendor’s Atma Nirbhar Nidhi (PM SVANidhi) Scheme

- Provides collateral-free working capital loans to street vendors, benefiting over 64 lakh individuals.

- One Nation One Ration Card Programme

- Enhances migrant workers' welfare by allowing portable food security across India with over 124 crore portability transactions till December 2023.

- Deendayal Antyodaya Yojana – National Urban Livelihoods Mission (DAY-NULM)

- Aims to reduce urban poverty by providing self-employment and skilled wage employment opportunities, benefiting 5.48 lakh individuals from 2018-19 to January 2024.

- Trend in Rural Wages

- FY24 Rural Wages

- Growth Rate: Nominal wage rates in agriculture grew by 7.4% for men and 7.7% for women.

- Non-Agricultural Wages: Grew by 6.0% for men and 7.4% for women.

- Inflation Impact: Expected to lead to a sustained rise in real wages as inflation eases.

- FY24 Rural Wages

The Evolving Landscape of Jobs in India

The landscape of jobs in India is undergoing a significant transformation influenced by various factors such as technological advancements, the transition towards a greener economy, and the rise of the gig economy.

- Fourth Industrial Revolution and Technological Advancements

- Disruption and Reskilling: The global labour market is experiencing a significant disruption driven by the fourth industrial revolution.

- Technological advancements, including AI, machine learning, IoT, big data, and automation, are reshaping how work is done.

- Impact of AI: AI, recognized as a general-purpose technology, has the potential to both boost productivity and disrupt employment in certain sectors.

- The exposure to AI in India is estimated at 26%, divided into high and low complementarity roles.

- Disruption and Reskilling: The global labour market is experiencing a significant disruption driven by the fourth industrial revolution.

- Rise of the Gig Economy

- Growth and Characteristics: The gig economy, comprising freelancers, platform workers, and self-employed individuals, is expanding rapidly in India, driven by technological platforms, increased internet access, and the demand for flexible work arrangements.

- In 2020-21, around 7.7 million workers were part of the gig economy, constituting 2.6% of the non-agricultural workforce.

- Future Projections: The gig workforce is expected to grow to 23.5 million by 2029-30, forming 6.7% of the non-agricultural workforce.

- Growth and Characteristics: The gig economy, comprising freelancers, platform workers, and self-employed individuals, is expanding rapidly in India, driven by technological platforms, increased internet access, and the demand for flexible work arrangements.

- Climate Change and Green Energy Transition

- Job Losses and Productivity Impact: Climate change poses a significant risk to job security and productivity, especially in agriculture and construction.

- High temperatures are expected to result in substantial working hour losses and economic impacts.

- Green Job Creation: Efforts to mitigate climate change through green technologies are creating job opportunities in the renewable energy sector.

- By 2030, clean energy initiatives could create around 3.4 million jobs in solar and wind energy sectors in India.

- Health and Safety Concerns: Climate change also affects worker well-being, particularly for manual labourers exposed to extreme weather conditions. Innovative solutions, like SEWA’s heat-linked parametric insurance, are being implemented to protect workers' health and incomes.

- Job Losses and Productivity Impact: Climate change poses a significant risk to job security and productivity, especially in agriculture and construction.

- Policy Recommendations and Future Directions

- AI Research and Development: India needs to enhance its research and development in this sector.

- The US, for instance, has a strategic plan for strengthening its AI sector, which India could emulate.

- Skill Development and Education: To leverage the opportunities presented by AI and technological advancements, India needs to focus on skill development.

- This includes analytical thinking, innovation, complex problem-solving, and adaptability.

- Social Security for Gig Workers: The rise of the gig economy necessitates the expansion of social security benefits to gig and platform workers. The Code on Social Security (2020) is a step in this direction.

- Encouraging Green Jobs: Policies that support the transition to green jobs and protect workers from the impacts of climate change are crucial.

- This includes investments in renewable energy and insurance products for climate-related risks.

- AI Research and Development: India needs to enhance its research and development in this sector.

Job Creation Requirements Until 2036

- Current Workforce and Future Projections

- Workforce Participation Rate (WPR):

- Men: Constant at 54.4% (2023).

- Women: Rising from 27.0% (2023) to 40.0% (2036), increasing by 1% point annually.

- Agriculture Sector: Expected to decline from 45.8% (2023) to 25% (2047).

- Annual Job Creation Needed: Approximately 78.5 lakh jobs in the non-farm sector until 2030.

- Workforce Participation Rate (WPR):

- Key Focus Areas- Agro Processing and Care Economy

- Agro-Processing Sector for Rural Employment

- Opportunities and Benefits

- Current Processing Levels: Low in India compared to global standards (e.g., 4.5% for fruits).

- Rising Demand: Increased affluence and diet-consciousness are driving demand for processed food.

- Success Stories: Examples include Sahyadri Farmer Producer Company, Araku Coffee plantations, and SEWA's spice-processing group.

- Potential Benefits

- Rural Growth: Can accelerate crop diversification and provide productive employment.

- Avenues: Can supply local units like Aanganwadis, mid-day meal programs, and export markets.

- Program Synergies: Benefits from integrating Mega Food Park, Skill India, Mudra, and other existing schemes.

- Opportunities and Benefits

- Care Economy:

- Categories:

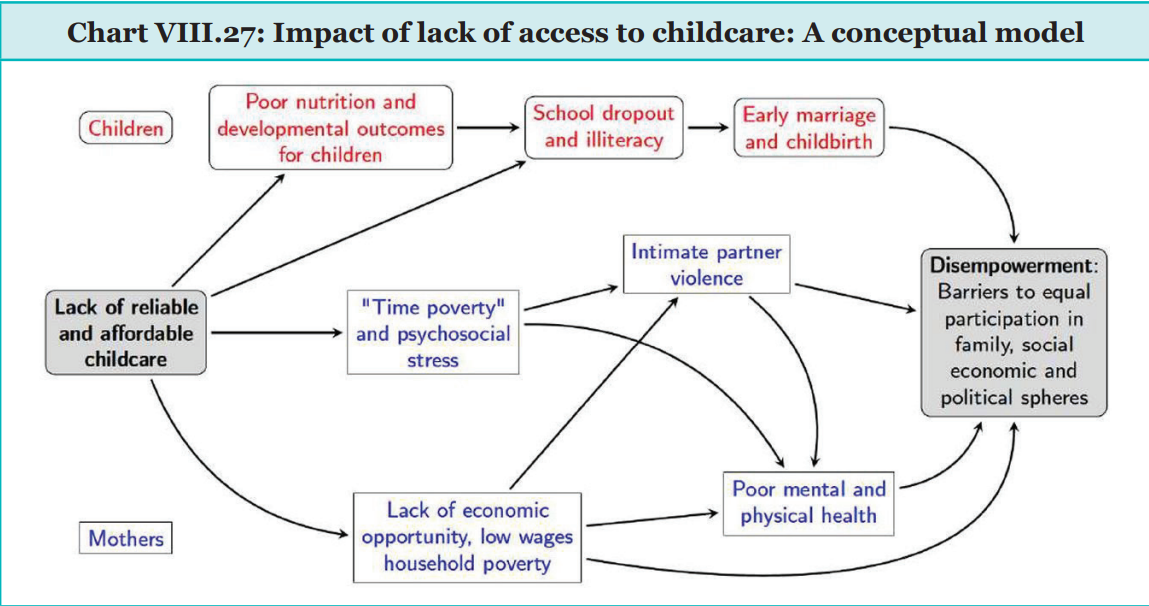

- Need for a Developed Care Economy

- Demographic Transition: Increasing elderly population and need for care.

- Gender Equity: Reducing the burden of unpaid care work to increase female labor force participation.

- Economic Potential: Investing in care services could generate substantial employment and economic benefits.

- Empirical Evidence

- International Examples: Successful care programs in Mexico and Brazil.

- Government Initiatives

- Palna Scheme: Revisions under Mission Shakti aim to establish 17,000 Anganwadi-cum-Crèches.

- Senior Care Reforms: Need for a structured policy to address elderly care, including infrastructure, research, and know-how.

- Agro-Processing Sector for Rural Employment

Developments and Progress in Skilling

- Skills Improvement (2017-18 to 2022-23):

- Increased Skilled Workforce: There has been significant progress in skill acquisition across various socio-economic groups, including rural and urban areas and different genders.

- Training Data: As per the Periodic Labour Force Survey (PLFS) 2022-23:

- 4.4% of youth aged 15-29 years received formal vocational/technical training.

- 16.6% received informal training.

- Schemes and Their Progress:

- PM Vishwakarma Scheme:

- Purpose: To support artisans and craftspeople, enhancing their enterprises and modernising traditional vocations.

- Pradhan Mantri Kaushal Vikas Yojana (PMKVY):

- Training: 14.27 million persons trained since 2015.

- Certification: 11.37 million certified.

- Reforms: Emphasis on industry relevance, on-the-job training, and increased participation of women (52.3% in FY24).

- Craftsmen Training Scheme at ITIs:

- Enrollment: 124,000 persons enrolled (2014-2023).

- Gender Participation: Increased from 9.8% in FY16 to 13.3% in FY24.

- New Grading: Data-driven grading methodology implemented from 2023-24.

- Jan Shikshan Sansthan (JSS):

- Training: 26.37 million trained, 24.95 million certified (FY19-FY24).

- Women Beneficiaries: 82% of total beneficiaries.

- Capacity Building: Setting up Model JSS, upgrading labs, and training staff.

- National Apprenticeship Promotion Scheme (NAPS):

- Apprentices: 32.38 million engaged (FY17-FY24).

- Women Participation: Increased from 7.74% (2016-17) to 20.77% (2023-24).

- Stipend Support: Rs.320.88 crore released through 22.46 million transactions.

- Skill India Digital Hub Platform:

- Features: Integrates various skilling schemes, online courses, and digital services.

- Engagement: 6 million learners registered, 8.4 million app downloads.

- PM Vishwakarma Scheme:

09: Agriculture and Food Management: Plenty of Upside Left If We Get It Right

What is the Current Status of India’s Agriculture and Allied Sector?

Context

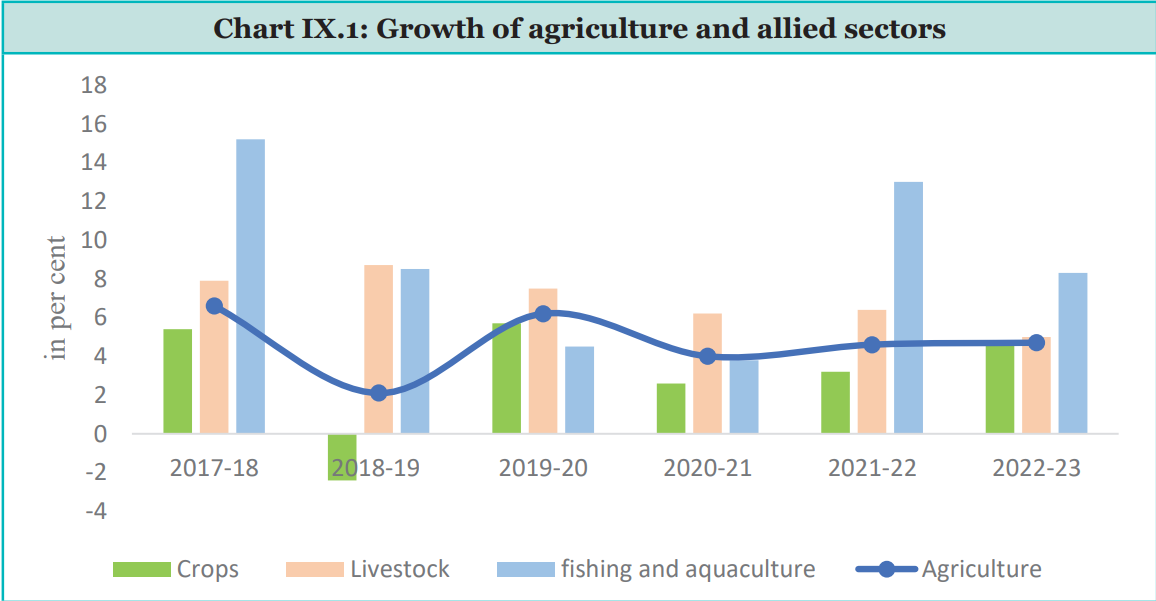

- India’s agriculture sector has grown at 4.18% annually over the past five years, supporting 42.3% of the population and contributing 18.2% to GDP.

- Despite this growth, challenges such as low productivity, fragmented land holdings, and inadequate infrastructure persist.

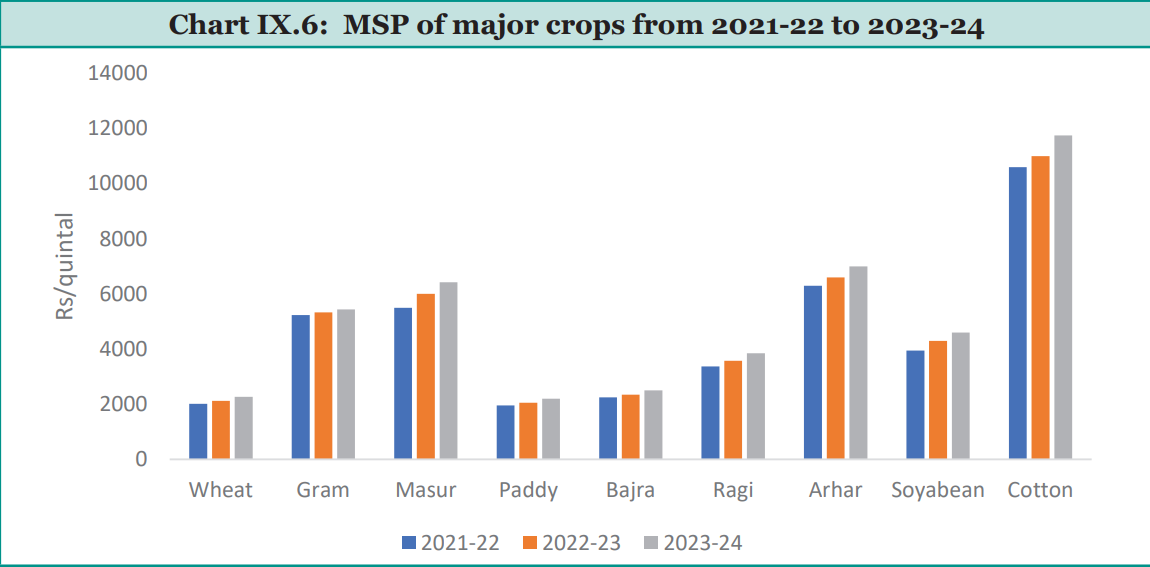

- Government interventions aim to address these issues through measures like the Minimum Support Price (MSP), improved access to credit, and support for sustainable practices.

- The Pradhan Mantri Kisan Samman Nidhi (PM KISAN) provides financial aid to farmers, while schemes like Per Drop More Crop (PDMC) and the National Mission on Sustainable Agriculture (NMSA) focus on efficiency and sustainability.

- In addition to crops, allied sectors like livestock and fisheries are crucial. Programs such as the Rashtriya Gokul Mission and Pradhan Mantri Matsya Sampada Yojana (PMMSY) aim to enhance productivity and infrastructure, with the fisheries sector showing a notable growth rate of 7.4% annually from 2020-21.

Agriculture Production: Performance and Promoting Crop Diversification

- Performance Overview

- Foodgrain Production: In 2022-23, foodgrain production reached a record 329.7 million tonnes, but slightly decreased to 328.8 million tonnes in 2023-24 due to adverse monsoon conditions.

- Oilseeds Production: Rose to 41.4 million tonnes in 2022-23, with a slight increase in 2023-24.

- Nutri-Cereals: Increased by 1% from 2023.

- Tur Production: Estimated at 33.85 lakh tonnes, up from 33.12 lakh tonnes.

- Lentil Production: Estimated at 17.54 lakh tonnes, higher by 1.95 lakh tonnes compared to 2023.

- Crop Diversification Initiatives

- Government Programs:

- Crop Diversification Programme (CDP): Under Rashtriya Krishi Vikas Yojna (RKVY), this program promotes alternative crops like pulses and legumes to replace water-intensive paddy cultivation.

- National Food Security Mission (NFSM): Enhances production and productivity of foodgrains and commercial crops through technology demonstration and capacity building.

- Minimum Support Prices (MSP): Increased MSPs for oilseeds and pulses to encourage diversification. For example:

- Lentils (Masur): MSP is 89% over production cost.

- Tur: MSP is 58% over production cost.

- Coarse cereals (e.g., Bajra): MSP is 82% over production cost.

- Safflower and Soybean: MSPs are 52% over production cost.

- Government Programs:

- Oilseeds and Oil Palm

- National Food Security Mission- Oilseeds & Oil Palm (NFSM-OS&OP): Implemented from 2018-19 to improve vegetable oil availability.

- Area Coverage: Increased from 25.60 million hectares in 2014-15 to 30.08 million hectares in 2023-24 (17.5% growth).

- Domestic Availability: Rose from 86.30 lakh tonnes in 2015-16 to 121.33 lakh tonnes in 2023-24.

- Imported Oil Share: Reduced from 63.2% in 2015-16 to 57.3% in 2022-23.

- National Food Security Mission- Oilseeds & Oil Palm (NFSM-OS&OP): Implemented from 2018-19 to improve vegetable oil availability.

- Investment and Credit

- Gross Capital Formation (GCF):

- Growth: Increased by 19.04% in 2022-23. GCF as a percentage of GVA rose from 17.7% in 2021-22 to 19.9% in 2022-23.

- Annual Growth Rate: Average of 9.70% from 2016-17 to 2022-23.

- Challenges:

- Need for a 12.5% annual growth in agriculture investment to double farmers' income.