Indian Economy

Financial Stability Report, June 2024

For Prelims: Reserve Bank of India, Non-Performing Assets, Bad Loan, Digital Personal Loan, SARFAESI ACT, 2002, Capital Adequacy Ratio, Inflation, Disinflation

For Mains: Issues Related to Banking Sector, Difference in NBFC and Banks.

Why in News?

The Reserve Bank of India (RBI) bi-annual Financial Stability Report (FSR) for June 2024 underscores India's robust financial resilience amid global uncertainties while highlighting concerns over the proliferation of digital personal loans and their impact on financial stability measures.

What are the Key Highlights of the FSR for June 2024?

- Global Macrofinancial Risks: The report states that the global economy and financial system are exhibiting resilience amidst heightened risks and uncertainties.

- The International Monetary Fund (IMF) projects global growth to remain steady at 3.2% in 2024, while the World Bank forecasts a lower rate of 2.6%.

- Near-term prospects are improving, but risks remain from the last mile of disinflation, high public debt, stretched asset valuations, economic fragmentation, geopolitical tensions, climate disasters, and cyber threats.

- Emerging market economies (EMEs) remain vulnerable to external shocks and spillovers.

- Domestic Macrofinancial Risks: Strong macroeconomic fundamentals and a sound and stable financial system have supported the sustained expansion of the Indian economy.

- Moderating inflation, a strong external position, and ongoing fiscal consolidation are anchoring business and consumer confidence.

- Domestic financial conditions are strengthened by healthy balance sheets across financial institutions, marked by strong capital buffers, improving asset quality, adequate provisioning, and robust earnings.

- Improved Asset Quality: The GNPA ratio of scheduled commercial banks (SCBs) has moderated to 2.8% in March 2024, the lowest in 12 years. The net non-performing assets (NNPA) ratio has also improved to a record low of 0.6%.

- Under the baseline stress scenario, the GNPA ratio is expected to improve further to 2.5% by March 2025.

- If the macroeconomic environment worsens significantly, the GNPA ratio could rise to 3.4%.

- The GNPA ratio for Public Sector Banks (PSBs) may increase from 3.7% in March 2024 to 4.1% in March 2025 under a severe stress scenario.

- Agriculture continued to have the highest GNPA ratio at 6.2%, while personal loans at 1.2%. Yet RBI remains concerned about potential financial issues arising from individual borrowers, particularly those accessing personal loans through digital apps.

- Deposits and Credit Growth: Deposit growth picked up in the second half of FY24, reaching 13.5% in the quarter ending March 2024.

- Private sector banks saw the highest deposit growth at 20.1%, followed by foreign banks at 15.1% and PSU banks at 9.6%.

- Overall credit growth remained healthy at 19.2%, though slightly lower than the previous half-year.

- Consumer loans moderated due to RBI regulations, but still remained the largest component of the lending portfolio at 32.9%.

- Capital Adequacy and Profitability:

- SCBs maintain strong capital buffers, with capital to risk-weighted assets ratio (CRAR) remaining stable at 16.8%, with PSBs seeing an improvement and private/foreign banks witnessing a slight decline.

- CRAR is a measure of a bank's available capital as a percentage of its risk-weighted credit exposures. It is used to ensure that banks have enough capital to handle potential losses and avoid insolvency.

- Return on assets (RoA) and Return on Equity (RoE) are close to decadal highs at 1.3% and 13.8%, respectively.

- ROA is a profitability ratio that measures how well a company uses its assets to generate profit. It's calculated by dividing a company's net income by its total assets and is expressed as a percentage.

- ROE is a key metric for assessing a company's financial health calculated as the company's net income divided by equity financing. It helps in understanding how efficiently shareholder equity has been used to generate profits.

- SCBs maintain strong capital buffers, with capital to risk-weighted assets ratio (CRAR) remaining stable at 16.8%, with PSBs seeing an improvement and private/foreign banks witnessing a slight decline.

- Stress Test Results: Banks have shown substantial resilience to stress, with SCBs well-capitalised to handle macroeconomic shocks in both medium and extreme stress scenarios.

- A stress test is an analytical tool used by RBI to assess how a bank or financial system can withstand adverse economic scenarios.

Note

The FSR is a biannual publication by the RBI. It reflects the collective assessment of the Sub-Committee of the Financial Stability and Development Council (FSDC), which is headed by the Governor of the RBI. The report evaluates the resilience of the Indian financial system and identifies risks to financial stability

What are Non-Performing Assets?

| Category | Description |

| Definition |

|

| Types of NPAs |

|

| Gross NPA (GNPA) |

|

| Net NPA |

|

| NPA Ratios |

|

Why are Digital Personal Loans a Concern?

- Rise of Digital Personal Loans: Personal loans disbursed via digital apps have the highest share of overdue accounts, raising alarms for financial stability.

- Up until the mid-2010s, banks frequently lent massive loans to big industries. However, many of these loans turned sour, with bad loans peaking at 10% in 2017.

- Following 2017, banks reduced lending to industries and increased focus on the retail sector, including personal loans, credit card receivables, and housing loans.

- The implementation of the Insolvency and Bankruptcy Code, 2016, helped banks recover bad loans, contributing to their improved health.

- The mid-2010s saw a proliferation of instant loan apps, targeting younger, digitally savvy consumers and leading to a potential debt trap.

- In the past 11 years, the digital lending market has grown significantly, reaching an estimated USD 350 billion by 2023.

- Impact on Banking Sector: The share of retail loans has grown significantly, surpassing both industrial and service loans in outstanding amounts.

- The alarming growth of retail loans prompted the RBI to implement regulatory measures, although the overall GNPA ratio for personal loans has been consistently reducing, reaching 1.2% in March 2024.

- The proliferation of instant loan apps has led to a debt trap for many consumers. These apps often tempt users to take more loans than they can manage, leading to financial distress.

- RBI's Concerns: Slippages, or fresh additions of bad loans, from retail loans (excluding home loans) have been increasing rapidly, forming 40% of fresh NPAs in FY24.

- Delinquency levels, especially for personal loans below Rs 50,000, remain high. Many of these loans were sanctioned by NBFC-Fintech lenders through digital apps.

- The delinquency rate is highest among borrowers under 25 years at 5%. For the 26-35 age segment, it is 3%, 36-45 years at 2%, and over 45 years at 1%. Urban and rural areas both report a 3% delinquency rate, while metro and semi-urban areas have a 2% rate.

Digital Personal Loans

- These are loans offered through mobile applications or online platforms. Unlike traditional banks, these lenders leverage technology for a streamlined application process, often with minimal paperwork and near-instantaneous approvals.

- This ease of access caters to a wider population, including those who might not have easy access to traditional banking services.

- Digital lending platforms reach unbanked or underbanked populations, promoting financial inclusion, a key government objective in India.

What can be Done to Recover Digital Personal Loans?

- Financial Technology: Encourage Fintech companies to develop recovery tools such as automated repayment plans and debt consolidation options.

- Continuously monitor loan performance and identify potential delinquencies early.

- Creditworthiness Assessment: Explore alternative credit scoring models that consider factors beyond traditional credit history, like income stability and financial behaviour patterns.

- Improved Efficiency: Digital NPA recovery processes can be streamlined compared to traditional methods. Automating tasks like communication and data analysis frees up resources for other areas.

- Legal Recourse: Utilise Debt Recovery Tribunals (DRT) to facilitate the recovery of dues. And leverage legal frameworks like Lok Adalat and SARFAESI ACT, 2002 for efficient recovery

|

Drishti Mains Question: Q. Examine the trends in non-performing assets (NPAs) in India and the implications for the banking sector's health. Q, Evaluate the rise of digital personal loans in India. What are the key factors driving their popularity, and what risks do they pose to financial stability? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Which of the following statements best describes the term ‘Scheme for Sustainable Structuring of Stressed Assets (S4A)’, recently seen in the news? (2017)

(a) It is a procedure for considering ecological costs of developmental schemes formulated by the Government.

(b) It is a scheme of RBI for reworking the financial structure of big corporate entities facing genuine difficulties.

(c) It is a disinvestment plan of the Government regarding Central Public Sector Undertakings.

(d) It is an important provision in ‘The Insolvency and Bankruptcy Code’ recently implemented by the Government.

Ans: (b)

Infographics

Governance

Cooperatives and Their Evolution in India

For Prelims: Cooperative sector, Primary Agricultural Credit Societies, Multi-State Co-operative Societies Act, 2002, 97th Constitutional Amendment Act of 2011, Multi-State Co-operative Societies (Amendment) Act, 2022, IFFCO.

For Mains: Status of the Cooperatives in India, Major Challenges Faced by Cooperatives in India.

Why in News?

Recently, the Union Home Minister and Minister of Cooperation addressed the 'Sahkar se Samriddhi' (Prosperity through Cooperation) program organised on the occasion of the 102nd International Day of Cooperatives in Gujarat.

Note

- International Day of Cooperatives is celebrated on 6th July every year.

- The Theme for the year 2024 is "Cooperatives Building a Better Future for All".

- The theme aligns well with the objectives of the upcoming UN Summit of the Future whose theme is "Multilateral solutions for a better tomorrow".

- The 2023 UN Secretary-General Report on Cooperatives in Social Development acknowledged that cooperatives have a track record of promoting the economic and social development of all people including marginalised groups.

- This day will build the momentum towards the 2025 International Year of Cooperatives.

How did Cooperatives Evolve in India?

- About Cooperatives:

-

These are people-centred enterprises owned, controlled, and run by and for their members to realise their common economic, social, and cultural needs and aspirations.

-

India has one of the world's largest cooperative networks, with over 800,000 cooperatives spread across various sectors like agriculture, credit, dairy, housing, and fisheries.

- The cooperative sector's significant contributions include 20% in agricultural loans, 35% in fertilizer distribution, 31% in sugar production, 13% in wheat purchase, and 20% in paddy purchase.

-

- Cooperatives in Pre-Independence Era:

-

First Cooperative Act in India: Indian Famine Commission (1901) led to the enactment of the first Cooperative Credit Societies Act in 1904 followed by the (amended) Cooperative Societies Act, 1912.

- Maclagan Committee: In 1915, a committee headed by Sir Edward Maclagan, was appointed to study and report whether the cooperative movement was proceeding on economically and financially sound lines.

- Montague-Chelmsford Reforms: Through the Montague-Chelmsford Reforms of 1919, co-operation became a provincial subject which gave further impetus to the movement.

- Post Economic Depression, 1929: Various committees were appointed in Madras, Bombay, Travancore, Mysore, Gwalior, and Punjab to examine the possibilities of restructuring the Cooperative societies.

- Gandhian Socialist Philosophy: Cooperation according to Gandhiji was necessary for the creation of a socialistic society and complete decentralisation of power.

-

He was of the opinion that cooperation was one of the important means to empower people.

- In South Africa, Mahatma Gandhi instituted the 'Phoenix Settlement' as a cooperative in a socialistic pattern.

- He established the Tolstoy Farm as a rehabilitation cooperative settlement for the families affected by the South African freedom struggle during the period.

-

-

- Cooperatives in Post- Independence India:

- First Five-Year Plan (1951-56): Highlighted the promotion of cooperatives for comprehensive community development.

- Multi-State Co-operative Societies Act, 2002: Provides for the formation and functioning of multi-state co-operatives.

- Multi-State Co-operative Societies (Amendment) Act, 2022 introduced the Co-operative Election Authority to oversee board elections in multi-state co-operative societies.

- 97th Constitutional Amendment Act of 2011: Established the right to form cooperative societies as a fundamental right (Article 19).

- Introduced a new Directive Principle of State Policy on Cooperative Societies (Article 43-B).

- Added a new Part IX-B to the Constitution titled "The Co-operative Societies" (Articles 243-ZH to 243-ZT).

- Empowered Parliament to enact laws governing multi-state cooperative societies (MSCS) and delegated authority to state legislatures for other cooperative societies.

- Establishment of Union Ministry of Cooperation (2021): Assumed responsibility for cooperative affairs, previously overseen by the Ministry of Agriculture.

- Impact of Cooperatives:

-

Empowering Marginalised Communities: The Amul Dairy Cooperative in Gujarat, with over 3.6 million milk producers (many from small & marginal farms), empowers rural communities by providing fair prices for milk and fostering economic independence, particularly for women.

-

Boosting Agricultural Productivity and Marketing: Indian Farmers Fertiliser Cooperative Limited (IFFCO) is the world's largest fertiliser producer. Cooperatives like IFFCO provide farmers with essential agricultural inputs like fertilisers, seeds, and credit at competitive prices, leading to increased productivity and farm incomes.

-

Facilitating Access to Essential Services: Kerala State Milk Marketing Federation (Milma), a dairy cooperative, procures milk from farmers and supplies it to consumers in Kerala at affordable prices. This ensures market access for producers and provides essential dairy products to the population.

-

Promoting Inclusive Growth and Job Creation: A NITI Aayog report highlights that sugar cooperatives in Maharashtra provide employment to over 5 lakh people (direct and indirect), contributing significantly to rural job creation and income generation.

-

Government Initiatives to Strengthen Cooperatives

- Umbrella Organization for UCBs: RBI has accorded approval to the National Federation of Urban Co-operative Banks and Credit Societies Ltd. (NAFCUB) for the formation of an Umbrella Organization (UO) for the UCB sector, which will provide necessary IT infrastructure and operation support to around 1,500 UCBs.

-

Ensuring Transparency and Sustainability:

- Model Bye-Laws for PACS making them multipurpose, multidimensional and transparent entities.

- World’s Largest Decentralised Grain Storage Plan (2023) in the Cooperative sector.

- The government aims to ensure every panchayat has a PACS by 2029, fulfilling Prime Minister Modi's vision of 'Sahkar se Samriddhi' (Prosperity through Cooperation).

- Other Initiatives:

- National Cooperative Database for authentic and updated data repository.

- Issuance of Rs 2000 crore bonds by National Cooperative Development Corporation (NCDC) for cooperative welfare.

- Inclusion of Cooperatives as ‘buyers’ on the GeM portal.

- Expansion of NCDC to increase its range and depth.

- National Cooperative Organic Limited (NCOL) was established to promote organic farming and ensure fair pricing.

- Launch of Bharat Organic Atta.

What are the Challenges Faced by the Cooperatives?

- Governance Challenges: Cooperatives struggle from the challenges of lack of transparency, accountability, and democratic decision-making processes.

- Limited member participation, inadequate representation of marginalised communities, and concentration of power within a few individuals can undermine the inclusive nature of cooperative enterprises.

- Limited Access to Financial Resources: Many cooperatives, particularly those serving marginalised communities, face challenges in accessing financial resources. They often lack collateral or formal documentation required by traditional financial institutions, making it difficult to obtain loans.

- Socio-economic Disparities and Exclusion: Cooperatives often face issues related to lack of inclusivity, existence of structural inequalities etc.

- Infrastructural Constraints: Infrastructural constraints and lack of connectivity affects their efficiency and effectiveness leading to limited outreach.

- Lack of Technical and Managerial Capacities: Lack of training and skill development initiatives is another challenge that leads to outdated human resources.

- Social and Cultural Factors: Lack of awareness about the cooperative model and its benefits among potential members limits their participation.

- In some cases, social hierarchies and caste-based divisions create barriers for equitable participation and representation within cooperatives.

Way Forward

- Implement digital platforms for financial reporting, conduct regular audits, and encourage member participation in decision-making processes.

-

Establish cooperative development funds with flexible collateral requirements to cater to the needs of marginalised communities. Encourage cooperatives to explore crowdfunding, social impact bonds, and other innovative financing solutions.

-

Design outreach programs to educate and attract members from marginalised communities, addressing specific needs and challenges.

-

Advocate for government investment in rural infrastructure development, improving connectivity and access to markets for cooperatives.

-

Partner with government agencies and training institutions to offer skill-building workshops for cooperative members and managers.

-

Launch targeted awareness campaigns in local languages to educate potential members about the benefits and principles of cooperatives.

|

Drishti Mains Question: Q. Discuss the major challenges faced by the cooperative sector in India. How can these challenges be addressed to strengthen the cooperative movement in India? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. In India, which of the following have the highest share in the disbursement of credit to agriculture and allied activities? (2011)

(a) Commercial Banks

(b) Cooperative Banks

(c) Regional Rural Banks

(d) Microfinance Institutions

Ans: (a)

Q. With reference to India, consider the following: (2010)

- Nationalisation of Banks

- Formation of Regional Rural Banks

- Adoption of village by Bank Branches

Which of the above can be considered as steps taken to achieve the “financial inclusion” in India?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)

Mains:

Q. “In the Indian governance system, the role of non-state actors has been only marginal.” Critically examine this statement. (2016)

Q. “In the villages itself no form of credit organisation will be suitable except the cooperative society.” – All India Rural Credit Survey. Discuss this statement in the background of agricultural finance in India. What constraints and challenges do financial institutions supplying agricultural finance face? How can technology be used to better reach and serve rural clients? (2014)

Social Issues

Issue of Menstrual Leave for Women

For Prelims: Menstrual Health, Right of Women to Menstrual Leave and Free Access to Menstrual Health Products Bill, 2022, Right of Children to Free and Compulsory Education Act (RTE), 2009, The National Guidelines on Menstrual Hygiene Management.

For Mains: Menstrual health – Challenges, Consequences and Way Forward

Why in News?

Recently, the Supreme Court has asked the Central Government to frame a model policy on menstrual leave for female employees.

- The court emphasised that this matter falls under the realm of policy-making and not within the court's jurisdiction.

What is the State of Menstrual Leaves in India?

- Menstrual (Period) Leave: It is a kind of leave where the working women have the option to avail either paid or unpaid leave from the institution of her employment during her period of menstruation as such a condition adversely affects her ability to to work .

-

Implemented the Policy: Bihar and Kerala are the only Indian states that have introduced menstrual leave policies for women.

- Bihar's policy was introduced in 1992, allowing women employees two days of paid menstrual leave every month.

- Kerala in 2023 has also allowed menstrual leave to female students of all universities and institutions and up to 60 days maternity leave to female students above the age of 18.

- Some companies in India have introduced menstrual leave policies, including Zomato, which announced a 10-day paid period leave per year in 2020.

- Other companies, such as Swiggy and Byjus, have also followed suit.

- Legislative Measures Taken:

- There is no law governing menstrual leave in India and also there is no centralised direction for ‘paid menstruation leave’ in India.

- Attempts Made in the Past: Parliament has seen attempts to introduce menstrual leave and menstrual health products related bills, but they have not been successful so far.

- Example: The Menstruation Benefits Bill, 2017’ and Women’s Sexual, Reproductive and Menstrual Rights Bill in 2018.

- Right of Women to Menstrual Leave and Free Access to Menstrual Health Products Bill, 2022:

- The proposed Bill provides for 3 days of paid leave for women and transwomen during the period of menstruation.

- The Bill cites research that 40% of girls miss school during their periods, and nearly 65% said it had an impact on their daily activities at school.

Countries Having Implemented Menstrual Leaves:

- Spain, Japan, Indonesia, Philippines, Taiwan, South Korea, Zambia and Vietnam.

- Spain is the first European country to grant paid menstrual leave to workers, with the right to three days of menstrual leave per month, which can be expanded to 5 days.

Why is there a Need for Paid Menstrual Leave for Women?

- Health and Well-being: Menstruation can cause physical discomfort (cramps, bloating) and emotional distress. Paid leave allows women to prioritise their health and manage these symptoms without financial penalty.

- Workplace Inclusivity and Gender Gap: This leave will normalise menstruation, reducing stigma and encouraging open discussion about menstrual health. Its impact on work performance helps address the gender pay gap by enabling women to fully participate in the workforce without sacrificing income.

- Productivity and Retention: Studies suggest that menstrual leave can improve productivity by allowing women to manage their periods effectively and avoid working while experiencing discomfort. It can also contribute to higher employee retention.

- Legal Perspectives:

- Article 15(3): Permits special provisions for women, countering claims of discrimination against men who can't avail menstrual leave.

- Article 42: Mandates the state to ensure "just and humane conditions of work" and "maternity relief." Menstrual leave is seen as an extension of this responsibility, promoting a humane work environment for women during menstruation.

Case Study on Maternal Healthcare Access for Tribal Population in Gujarat

- About Study:

-

The study focuses on the tribal population in Gujarat, which constitutes 14.8% of the state's total population. It examines the accessibility of healthcare facilities for maternal care across 14 tribal-concentrated districts.

-

-

Mapping Healthcare Disparities:

-

The average coverage of pregnancy care in Gujarat's tribal districts is 88%, with 80% receiving antenatal care (ANC), 90% giving birth at healthcare facilities, and 92% receiving postnatal care (PNC).

-

However, ANC coverage is notably lower in districts like Banaskantha, Mahisagar, Sabarkantha, Dahod, and Bharuch, falling below WHO-prescribed thresholds.

-

-

Transportation Constraints:

-

Over 50% of households reside more than 25 km away from tertiary care facilities, and about 30% live away from community healthcare centres and primary healthcare centres. Further, limited resources and social stigma often prevent women, especially in rural areas, from using public transportation available.

-

UN Report on Maternal Deaths

- As per the UN report, India had more than 17% of global maternal deaths in 2020, the highest share among ten countries responsible for a majority of maternal, stillbirth, and newborn deaths.

- It stressed the importance of focusing on maternal healthcare to reach Sustainable Development Goals (SDG) for better maternal and child health outcomes and healthcare access.

What are the Arguments Against the Menstrual Leaves?

- Discouragement of Hiring Female Employees: Paid menstrual leave might disincentivize companies from hiring women due to perceived absenteeism.

- Employers may perceive female employees as a liability due to the additional burden of paid leave every month.

- Discrimination at Workplace: Accommodating menstrual leaves may disrupt workflow, increase workload for other team members, or create resentment among employees who do not receive similar benefits.

- Enforcement Issues: Implementing paid leave for menstruation raises challenges such as determining legitimate use, preventing misuse, and defining acceptable enforcement methods for employers.

- This has been highlighted by incidents like those in Bhuj 2020 where 66 girls were forced to strip to verify menstruation status and similar incidents in Muzaffarnagar.

- Sensitivity and respect are crucial in developing policies around menstruation.

- Reinforcing Stigma: Special leave policies could highlight menstruation as a negative aspect, potentially leading to period shaming and discrimination.

Govt Schemes to Promote Menstrual Hygiene Management:

- Menstrual hygiene scheme launched by the Ministry of Health and Family Welfare

-

SABLA programme of the Ministry of Women and Child Development

-

Swachh Bharat Mission and Swachh Bharat: Swachh Vidyalaya (SB:SV)

- Scheme for Promotion of Menstrual Hygiene among adolescent girls in the age group of 10-19 years (supported by the National Health Mission)

Way Forward

- Promoting Menstrual Health Literacy: Ensure that employers, employees, and medical professionals have access to high-quality information about menstrual health and effective treatment options.

- Incorporating Adequate Rest Breaks: Provide workers, especially those who menstruate, with the ability to take breaks and access clean toilet facilities. This benefits all workers and reduces the risk of workplace injuries and illnesses.

- Incentivising Menstrual Leave Policies: The government could incentivise menstrual leave by providing tax exemptions to companies offering it and by introducing gender-neutral leave policies for all employees.

- Consideration could also be given to government aid covering leave costs through Direct Benefit Transfer (DBT).

- Access to Effective Treatment: Workplaces should provide free emergency period products, pain medication, and support for employees to access quality medical advice and treatment for severe menstrual symptoms.

- Flexible Working Conditions: Allow for flexible work arrangements, such as the ability to work from home or take shorter breaks, rather than requiring full-day leave.

- Adequate Standards for Working Conditions and Labour Rights: Improve global minimum labour standards regarding work hours, wages, health and safety, and equal opportunities, which would eliminate the need for separate menstrual leave policies.

|

Drishti Mains Question: Discuss the need for a policy measure on menstrual leave for women. What are its implications on gender equality and workforce dynamics? What measures can ensure its effective implementation? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Mains

Q. What are the continued challenges for women in India against time and space? (2019)

Q. Male membership needs to be encouraged in order to make women’s organisations free from gender bias. Comment. (2013)

Facts for UPSC Mains

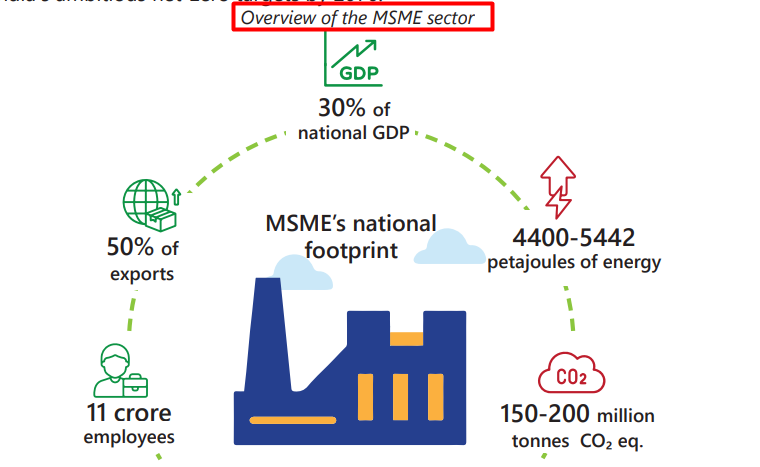

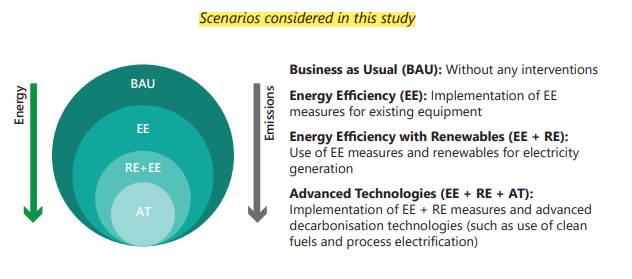

Decarbonizing MSME and Energy Sector

Why in News?

Recently, a study on decarbonisation of 7 MSME clusters (Alathur, Asansol-Chirkunda, Bengaluru, Delhi-NCR, Coimbatore, Ludhiana and Tiruppur) has revealed that adopting renewable energy solutions and energy efficient measures could lead to significant annual savings and reduction in emissions of CO2.

- It covered sectors such as pharmaceuticals, refractories, aluminium die-casting, bakeries and textiles units across these clusters.

Note

- 'Decarbonisation' refers to the process of reducing 'carbon intensity', lowering the amount of greenhouse gas emissions produced by the burning of fossil fuels.

What are the Key Findings of the Study on MSMEs?

- Key Findings:

-

MSME Energy Consumption: Approximately 31% of MSMEs are in the manufacturing sector, contributing 20%-25% of the country's industrial energy use.

-

Over 80% of this energy is needed for thermal processes, such as heating in boilers and furnaces.

-

-

Initial Investment & Cost Saving: Adopting energy efficient measures, renewable energy solutions in 7 key MSME clusters would require investment of Rs 90 crore and this could annually lead to cost savings of Rs 37 crore.

-

Emission Reduction: Decarbonising these sectors would also lead to reduction of 1,36,581 tonnes of CO2 emissions.]

-

-

Recommendations:

- Improve Access to Finance: Offer affordable, collateral-free financing for MSMEs by reviewing loan eligibility, building capacity for financial institutions, and exploring carbon financing options.

- Tailor MSME Policies: Set emission reduction targets, support energy audits, R&D, pilots, and financing for energy efficiency and renewable energy.

- Develop Biofuel Ecosystem: Expand biomass policies, include biodiesel in government schemes, and facilitate bio-CNG sales.

- Increase Renewable Energy Use: Promote rooftop solar and open-access systems by rationalising charges, aggregating demand, and utilising cluster development schemes.

- Regulatory Incentives: Provide incentives for MSMEs to switch to cleaner fuels, simplify clean fuel adoption, and monitor Scope 3 emissions.

- Scope 3 Emission: Indirect emissions that are a consequence of the company’s activities (upstream and downstream of the manufacturing site).

Challenges in Decarbonising the Energy Sector in India

- Target and Current State: India aims to decarbonise its energy sector and increase the share of natural gas to over 20% by 2030.

- Natural gas currently comprises less than 6% of India’s energy mix, in contrast to over 35% in the US and 20% in China.

- Key Challenges in Expanding Natural Gas Infrastructure:

-

Regulatory Uncertainty and interventions: Government interventions in the natural gas sector, including price caps, limitations on LNG terminal expansion, and restrictions on city gas distribution networks, are creating uncertainty for investors and hindering the country's goal of expanding natural gas use.

-

Underutilisation of Existing LNG Import Capacity: Despite a 17% increase in LNG imports, the utilisation of India's 6 LNG import facilities was below 30% in FY 2023-24.

- Understaffing and Lack of Expertise at the Regulator (PNGRB): The Petroleum & Natural Gas Regulatory Board (PNGRB) has functioned with low staff and diminishing board strength in recent years which has led to delays in approvals and introduction of new gas market mechanisms.

- Transition from Coal to Gas: India's energy mix is still dominated by coal (over 50%) compared to natural gas (less than 6%) making the transitioning of a large energy system a challenging task.

-

Read more: Towards Decarbonising Transport 2023, Decarbonising Steel Sector

|

Drishti Mains Question: Discuss how decarbonization and energy transition can support the growth and development of the MSME sector in India. Analyse the challenges for MSMEs in adopting clean energy technologies and transitioning towards a low-carbon economy. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q. Which one of the following statements best describes the term ‘Social Cost of Carbon’? It is a measure, in monetary value, of the (2020)

(a) long-term damage done by a tonne of CO2 emissions in a given year.

(b) requirement of fossil fuels for a country to provide goods and services to its citizens, based on the burning of those fuels.

(c) efforts put in by a climate refugee to adapt to live in a new place.

(d) contribution of an individual person to the carbon footprint on the planet Earth.

Ans: (a)

Q. Consider the following statements with reference to India : (2023)

- According to the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, the ‘medium enterprises’ are those with investments in plant and machinery between `15 crore and `25 crore.

- All bank loans to the Micro, Small and Medium Enterprises qualify under the priority sector.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Q. Which of the following are some important pollutants released by steel industry in India? (2014)

- Oxides of sulphur

- Oxides of nitrogen

- Carbon monoxide

- Carbon dioxide

Select the correct answer using the code given below:

(a) 1, 3 and 4 only

(b) 2 and 3 only

(c) 1 and 4 only

(d) 1, 2, 3 and 4

Ans: (d)

Q. Steel slag can be the material for which of the following? (2020)

- Construction of base road

- Improvement of agricultural soil

- Production of cement

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Mains:

Q. Account for the present location of iron and steel industries away from the source of raw material, by giving examples. (2020)

Q. Account for the change in the spatial pattern of the Iron and Steel industry in the world. (2014)

Important Facts For Prelims

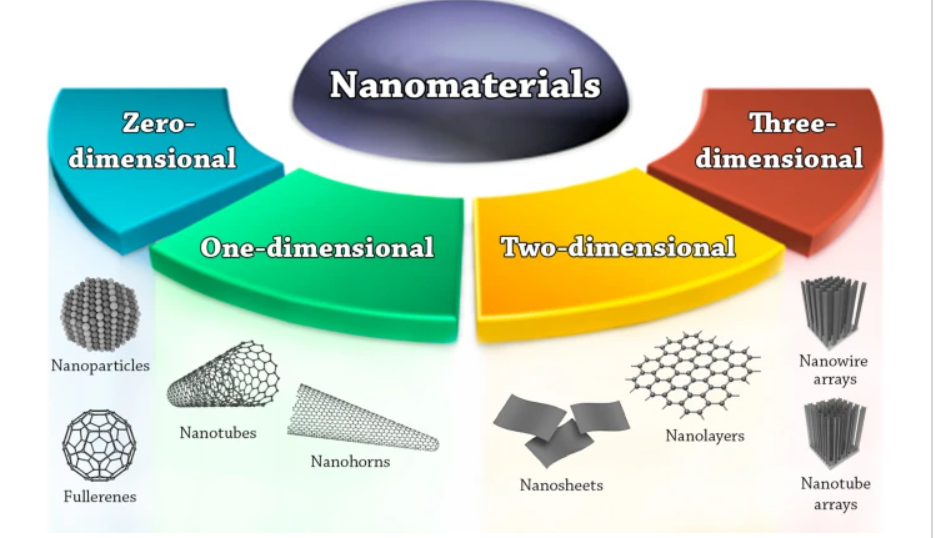

IIT-M Team Makes Mineral Nanoparticles with Water Droplets

Why in News?

Recently a study published in the journal Science has revealed that microdroplets of water possess the ability to break down minerals into nanoparticles.

Note: Properties of Microdroplets:

- Water microdroplets are significantly smaller than typical raindrops, being just a thousandth the size of a raindrop.

- These microdroplets exhibit more eagerness to participate in chemical reactions compared to bulk water due to their densely packed nature.

- Microdroplets can engage in chemical reactions much faster, up to a million times quicker than in bulk water.

- They act as excellent carriers of electric charge.

What are the Key Highlights of the Study?

- Experimental Findings:

- The study demonstrated that microdroplets could break down minerals such as silica (SiO2) and alumina (Al2O3) into nanoparticles.

- This was achieved by applying a high voltage to mineral microparticles suspended in water, causing them to break into nanoparticles within 10 milliseconds.

- The breakup of mineral microparticles into nanoparticles may be due to the protons squeezing into crystal layers, the electric fields produced by charged surfaces, and the surface tension of the microdroplets.

- Potential Applications:

- This process of nanoparticle formation has significant implications for agriculture, such as converting unproductive soil into productive land by supplying silica nanoparticles.

- Plants absorb silica in the form of nanoparticles to help them become taller.

- It also has relevance to the origins of life, as microdroplets might mimic proto-cells, potentially playing a role in early biochemical reactions.

- Future investigation may look into whether water microdroplets naturally react with minerals in atmospheric processes, potentially forming nanoparticles through 'microdroplet showers'.

- This process of nanoparticle formation has significant implications for agriculture, such as converting unproductive soil into productive land by supplying silica nanoparticles.

What are Nanoparticles?

- The International Organization for Standardization (ISO) defines nanoparticles(NPs) as nano-objects with all external dimensions in the nanoscale, where the lengths of the longest and the shortest axes of the nano-object do not differ significantly.

- If the dimensions differ significantly (typically by more than three times), terms such as nanofibers or nanoplates may be preferred to the term NPs.

- NPs can be of different shapes, sizes, and structures. They can be spherical, cylindrical, conical, tubular, hollow core, spiral, etc., or irregular.

- The size of NPs can be anywhere from 1 to 100 nm. If the size of NPs gets lower than 1 nm, the term atom clusters is usually preferred. NPs can be crystalline with single or multi-crystal solids, or amorphous. NPs can be either loose or agglomerated.

- NPs can be uniform, or can be composed of several layers.

- Classification: Based on their composition, NPs are generally placed into three classes namely organic, carbon-based, and inorganic.

- Applications: In medicine, pharma, electronics, agriculture, food industry, etc.

| Water Droplets vs Water Vapour | ||

| Feature | Water Droplets | Water Vapour |

| Physical State | Liquid | Gas |

| Visibility | Visible | Invisible |

| Formation | Condensation of water vapour | Evaporation of water |

| Examples | Rain, fog, mist, dew, clouds | Air on a humid day, steam |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. With reference to "water vapour", which of the following statements is/are correct? (2024)

- It is a gas, the amount of which decreases with altitude.

- Its percentage is maximum at the poles.

Select the answer using the code given below :

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (a)

Q. Consider the following statements: (2022)

- Other than those made by humans, nanoparticles do not exist in nature.

- Nanoparticles of some metallic oxides are used in the manufacture of some cosmetics.

- Nanoparticles of some commercial products which enter the environment are unsafe for humans.

Which of the statements given above is/are correct?

(a) 1 only

(b) 3 only

(c) 1 and 2

(d) 2 and 3

Ans: (d)

Q. There is some concern regarding the nanoparticles of some chemical elements that are used by the industry in the manufacture of various products. Why? (2014)

- They can accumulate in the environment, and contaminate water and soil.

- They can enter the food chains.

- They can trigger the production of free radicals.

Select the correct answer using the code given below:

(a) 1 and 2 only

(b) 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Rapid Fire

Groynes

Groynes are low-lying wood or concrete structures which are situated out to sea from the shore.

- They are designed to trap sediment, dissipate wave energy, and restrict the transfer of sediment away from the beach through longshore drift.

- Longshore drift is caused when prevailing winds blow waves across the shore at an angle that carries sediment along the beach.

- Groynes slow the process of erosion at the shore.

- They can also be permeable or impermeable, permeable groynes allow some sediment to pass through and some longshore drift to take place.

- However, impermeable groynes are solid and prevent the transfer of any sediment.

- They are very effective at protecting the coastline in the short-term as they are immediately effective as opposed to some longer-term soft engineering methods.

- However, they are often intrusive and can cause issues elsewhere in other areas along the coastline.

Read More: Coastal Erosion

Rapid Fire

Global Energy Independence Day

Global Energy Independence Day, celebrated globally on 10th July every year, marks a pivotal moment for countries striving to achieve energy self-sufficiency and sustainability.

- It is a call to action for individuals, businesses, and governments to recognize the importance of reducing dependence on non-renewable energy sources and transitioning to cleaner, more sustainable energy solutions.

- It has since become widely recognized worldwide and highlights the significance of energy autonomy and a variety of sustainable energy sources.

- The theme for the year 2024, “Energy Transition Now: Embrace the Future,” encapsulates the urgency and importance of adopting sustainable energy practices.

- With climate change accelerating and the demand for energy increasing, this day serves as a reminder of the critical need for innovation and commitment to sustainable energy.

Read more: Global Energy Equity

Rapid Fire

12th India-UAE Joint Defence Cooperation Committee Meeting

Recently, the 12th edition of the Joint Defence Cooperation Committee (JDCC) meeting between India and the United Arab Emirates (UAE) was held in Abu Dhabi focusing on enhancing bilateral defence and security cooperation.

- The meeting covered a wide range of areas, including training, joint exercises, defence industrial cooperation, and R&D, demonstrating a comprehensive approach to strengthening the partnership.

- The India-UAE JDCC was established in 2006. Since then, 11 rounds have been held. India and UAE have seen steady growth in bilateral defence interaction.

- India-UAE Defence Collaboration:

- Air Force: Trilateral Air Exercise on Humanitarian Assistance & Disaster Relief (HADR) in 2018.

- Navy: Exercise "Gulf Star 1", Zayed Talwar, and IDEX/NAVDEX.

- The UAE is located on the Arabian Peninsula, bordering the Gulf of Oman and the Persian Gulf. It is bordered by Saudi Arabia to the south and west, and the Sultanate of Oman (southeast), while Qatar lies to the northwest

- The UAE, along with Iran and Oman, shares a coastline with the Strait of Hormuz, making it one of the three countries bordering this strategic waterway.

- The UAE is governed by a Federal Supreme Council and is made up of seven Emirates of: Abu Dhabi (largest emirate), Dubai, Ajman, Fujairah, Sharjah, Ras al-Khaimah, and Umm al-Qaiwain.

Read More: India-UAE Relations