Indian Economy

Menace of Fraudulent Loan Apps in Digital Lending Landscape

- 21 Nov 2023

- 8 min read

For Prelims: Digital lending, Non-Banking Finance Companies (NBFCs), Reserve Bank of India (RBI)

For Mains: Concerns About the Emergence of Fraudulent Practices, Issues Related to Banking Sector

Why in News?

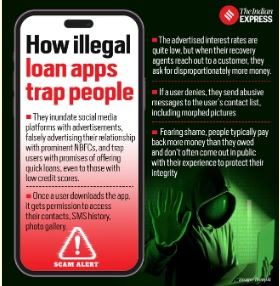

The proliferation of fraudulent loan apps on social media platforms poses a significant risk to borrowers, with instances of outrageous interest rates and mental harassment on the rise.

- Despite the rapid growth in digital lending, a regulatory vacuum allows scam apps to thrive, exploiting unsuspecting users.

Note:

Digital lending refers to the process of providing loans or credit to individuals or businesses through online platforms or digital channels without the need for traditional physical documentation or in-person interactions.

What are Fraudulent Loan Apps?

- About:

- Fake loan apps are unauthorized and illegal digital lending platforms that offer loans, from as little as Rs.1,000 to Rs.1 lakh targeting low-income and financially untrained individuals.

- They claim to provide instant and hassle-free loans without any credit checks, documentation, or collateral.

- Operating Procedure:

- Fraudulent loan apps often present themselves as legitimate financial tools, such as loan calculators or aggregators, exploiting the trust of users seeking financial assistance.

- These apps freely advertise on popular social media platforms like Instagram ,Facebook, and WhatsApp, leveraging the vast user base.

- Even though there are warning signs, the absence of careful investigation allows them to continue their deceptive advertising.

- Users, attracted by false claims and promises, fall victim to these deceptive apps, exposing them to exorbitant interest rates and harassment.

- If the borrower fails to repay the loan on time, the app starts sending abusive and threatening messages, calls, and emails to the borrower and their contacts.

- The app may also access the borrower’s photos and videos, and create morphed and obscene images to blackmail them.

- Some apps may even resort to physical violence and harassment by hiring recovery agents.

- In some cases, the borrowers are driven to suicide due to the extreme pressure and humiliation.

- Growth of Digital Lending and Emergence of Fraudsters:

- Over the last 11 years, the digital lending market has experienced significant growth, reaching an estimated USD 350 billion by 2023, having grown at a compounded annual growth rate of almost 40%, much of this is powered by genuine fintech companies backed by Non-Banking Finance Companies (NBFCs) and banks.

- However, this growth has also provided an opportunity for fraudsters, with the illegal lending market potentially reaching USD 700-800 million.

- Led by banks, NBFCs, and fintech companies, digital lending is expected to reach 80 billion in 2023. The collaboration between banks, NBFCs, and fintech firms contributes to the sector's expansion.

What are the Concerns Regarding the Fraud Loan Apps?

- Absence of Regulatory Norms:

- Stakeholders highlight the absence of government and regulatory norms, enabling online platforms to conduct minimal due diligence.

- Different regulators like the Reserve Bank of India (RBI), Ministry of Electronics and Information Technology (MeitY), Telecom Regulatory Authority of India (TRAI), and state governments lack coordination and supervision.

- There is a lack of enforcement and accountability, as many illegal loan apps evade detection and action by using fake or foreign identities, changing their names and logos frequently, and operating through multiple channels and intermediaries.

- Stakeholders highlight the absence of government and regulatory norms, enabling online platforms to conduct minimal due diligence.

- RBI's Limited Guidelines:

- While the RBI released guidelines for digital lending in September 2022, these guidelines only apply to regulated entities like banks and NBFCs. Fraudulent apps, without such associations, remain largely unchecked.

- Lack of Seriousness by Social Media Companies:

- Despite the growing menace, social media companies are criticized for not actively monitoring advertisements of fake loan apps.

- Some argue that corporate greed plays a role in the weak oversight.

- Despite the growing menace, social media companies are criticized for not actively monitoring advertisements of fake loan apps.

- Regulatory Uncertainty Impacting Legitimate Apps:

- Regulatory crackdowns sometimes affect legitimate lending apps, causing uncertainty.

- The ban on certain apps in 2021 impacted genuine lending companies, showcasing the challenges in regulatory actions.

- Regulatory crackdowns sometimes affect legitimate lending apps, causing uncertainty.

- Misrepresentation of Legitimate NBFCs:

- Legitimate NBFCs express concerns about their misrepresentation by illegal lending apps.

- A few fraudulent apps can tarnish the reputation of the entire sector.

- Legitimate NBFCs express concerns about their misrepresentation by illegal lending apps.

- Consumer Awareness:

- There is a lack of consumer awareness and protection, as many borrowers do not verify the credentials and terms of the loan apps, and fall prey to their deceptive and coercive practices

Way Forward

- Strengthening Regulatory Framework:

- Establish comprehensive legal guidelines for digital lending platforms, particularly those operating through mobile apps.

- Extend the scope of RBI guidelines to cover a broader spectrum of digital lending entities, including unregulated platforms.

- Enforce strict due diligence procedures for online platforms to prevent fraudulent loan apps from exploiting regulatory gaps.

- Establish comprehensive legal guidelines for digital lending platforms, particularly those operating through mobile apps.

- Enhanced Oversight on Social Media Platforms:

- Collaborate with social media companies to actively monitor and regulate advertisements related to loan apps.

- Encourage social media platforms to implement stricter screening processes to identify and remove fraudulent apps.

- Establish penalties for social media companies that fail to address the proliferation of fake loan apps on their platforms.

- Collaborate with social media companies to actively monitor and regulate advertisements related to loan apps.

- Consumer Education and Awareness:

- Launch awareness campaigns to educate consumers about the risks associated with fraudulent loan apps.

- Promote responsible borrowing habits and encourage individuals to verify the legitimacy of lending platforms before engaging with them.

- Launch awareness campaigns to educate consumers about the risks associated with fraudulent loan apps.

- International Collaboration:

- Foster partnerships with global organizations and regulators to track and penalize cross-border fraudulent loan app operations.

- Tap into global expertise to strengthen regulatory measures and ensure a unified approach to tackling digital lending challenges.

- Foster partnerships with global organizations and regulators to track and penalize cross-border fraudulent loan app operations.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. With reference to the Non-banking Financial Companies (NBFCs) in India, consider the following statements: (2010)

- They cannot engage in the acquisition of securities issued by the government.

- They cannot accept demand deposits like Savings Account.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)