Indian Economy

RBI Tightens Capital Norms for Unsecured Loans

- 22 Nov 2023

- 8 min read

For Prelims: RBI Tightens Capital Norms for Unsecured Loans, Reserve Bank of India (RBI), Risk weight on Bank Exposure, NBFCs (Non Banking Financial Companies).

For Mains: RBI Tightens Capital Norms for Unsecured Loans, Inclusive growth and issues arising from it.

Why in News?

Recently, the Reserve Bank of India (RBI) has increased Risk Weight on Bank Exposure to check on Unsecured Loans, like Personal Loans, Credit Card Receivables etc.

- The RBI’s move to increase the risk weight on unsecured loans is a way of increasing the Capital to Risk-Weighted Assets Ratio (CRAR) requirement for banks that lend to these categories.

- An Unsecured Loan is a loan that does not require one to provide any collateral to avail them. It is issued by the lender on one’s creditworthiness as a borrower. And hence, having an excellent credit score is a prerequisite for the approval of an Unsecured Loan.

What is Capital Adequacy Ratio (CAR)?

- The CAR is a measure of a bank's available capital expressed as a percentage of a bank's risk-weighted credit exposures.

- The Capital Adequacy Ratio, also known as Capital-to-Risk Weighted assets ratio (CRAR), is used to protect depositors and promote the stability and efficiency of financial systems around the world.

What is Risk Weight on Bank Exposure?

- About:

- Risk weight on bank exposure refers to a method used by regulators, such as central banks or financial supervisory authorities, to assess the risk associated with various types of assets held by banks.

- This method determines the amount of capital that banks need to hold against these assets as a buffer to cover potential losses.

- The risk weight assigned to different categories of assets is based on their perceived riskiness.

- Lower risk assets receive lower risk weights, requiring banks to allocate less capital against them, while higher risk assets have higher risk weights, necessitating a greater capital allocation.

- Examples:

- Low-risk assets like cash or government securities might have a risk weight of 0% or a very low percentage. This implies that banks need to allocate minimal capital against these assets

- Higher-risk assets like unsecured consumer loans, corporate loans, or derivatives may have risk weights ranging from 20% to 150% or higher, depending on their perceived risk. This means banks must allocate more capital as a buffer against potential losses from these assets.

What is the RBI’s Move Pertaining to Unsecured Loans and Need for it?

- Increased Risk Weights:

- The RBI has raised the risk weight on banks' exposure to certain categories like consumer credit, credit card receivables, and NBFCs.

- The risk-weights on banks’ unsecured personal loans and consumer durable loans have been increased to 125% from 100%, and that on credit cards have been increased to 150% from 125%.

- Further, the risk-weights on NBFCs’ unsecured personal and consumer durables loans, and credit cards have been increased to 125% from 100%.

- It means that banks and financial institutions need to set aside more capital as a buffer against potential losses arising from these specific loan categories.

- The RBI has, however, exempted microfinance loans by NBFCs from the risk-weight increase.

- The RBI has raised the risk weight on banks' exposure to certain categories like consumer credit, credit card receivables, and NBFCs.

- Need for Such a Move:

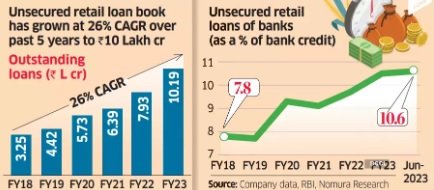

- Control Unbridled Growth: Unsecured Loans, especially consumer Loans, had been expanding rapidly, surpassing the growth rate of less risky lending assets. This unchecked growth could pose risks to the stability of the financial system.

- These loans are not backed by collateral, making them riskier for lenders. If borrowers default on these loans due to economic downturns or personal financial issues, it can lead to significant credit losses for banks and other lending institutions.

- Risk Mitigation: By increasing risk weights on consumer loans provided by banks, NBFCs (Non Banking Financial Companies), and credit card providers, the RBI aims to make these loans more capital-intensive for financial institutions.

- This helps in aligning the capital requirements with the associated risks, making it more expensive for lenders to extend such loans.

- Prevent Escalation of Risk: Establishing board-monitored processes for these advances helps ensure that banks have proper risk assessment mechanisms in place. This step intends to prevent the escalation of risk associated with unsecured retail lending.

- Maintain Financial Stability: The overarching goal is to maintain financial stability by addressing the imbalance in lending practices and ensuring that the rapid growth in unsecured retail loans doesn't pose a systemic risk to the banking and financial sectors.

- Control Unbridled Growth: Unsecured Loans, especially consumer Loans, had been expanding rapidly, surpassing the growth rate of less risky lending assets. This unchecked growth could pose risks to the stability of the financial system.

What is the Current Scenario of Unsecured Credit for Banks?

- Unsecured credit, excluding microfinance institutions, for large banks is only about 5-13% of their total loans. Further, loans extended to NBFCs constitute another 5-12% for banks.

- According to analysts’ estimates, the share of the total impacted book, which is NBFC and unsecured loans, is the lowest for IndusInd Bank at 10%, and ranges from 15 to 20% for other major banks.

- Among NBFCs, the most affected would be SBI Cards, as 100% of the loans are unsecured.

- The next would be Bajaj Finance as unsecured loans form 38% of the total loan, followed by Aditya Birla Capital with a 20% exposure in unsecured consumer loans.

What will the Implications of this Move on Banks and NBFCs?

- Impact on Borrowing Costs:

- It can cause a rise in lending rates for consumers due to these regulatory changes.

- This increase in lending rates by banks to non-banking financial institutions might also affect corporate bonds, leading to higher yields and widening credit spreads for these institutions.

- Can Address Systemic Risks Associated with Such Lending:

- The higher capital requirements are expected to moderate the growth of unsecured loans and potentially address systemic risks associated with such lending.

Way Forward

- Banks and NBFCs may need to reassess their risk models and lending practices for unsecured loans.

- They might focus more on creditworthiness assessments and consider alternative strategies to manage risk while continuing to lend.

- Financial institutions might diversify their loan portfolios by shifting focus to more secured lending or exploring other creditworthy segments to balance the impact of increased risk-weighting on unsecured loans.