Governance

Primary Agricultural Credit Societies

- 10 Feb 2023

- 10 min read

Prelims: Digitization of PACS, DBT, ISS, PMFBY, Atmanirbhar Bharat.

Mains: Significance of PACS and the Issues.

Why in News?

Recently, the Union Budget 2023 has announced Rs 2,516 crore for digitization of 63,000 Primary Agricultural Credit Societies (PACS) over the next five years.

What is the Aim of Digitizing PACS?

- It aims at bringing greater transparency and accountability in their operations and enabling them to diversify their business and undertake more activities.

- It aims to help PACS become a nodal centre for providing various services such as Direct Benefit Transfer (DBT), Interest Subvention Scheme (ISS), Crop Insurance Scheme (PMFBY), and inputs like fertilizers and seeds.

What is Primary Agricultural Credit Societies?

- About:

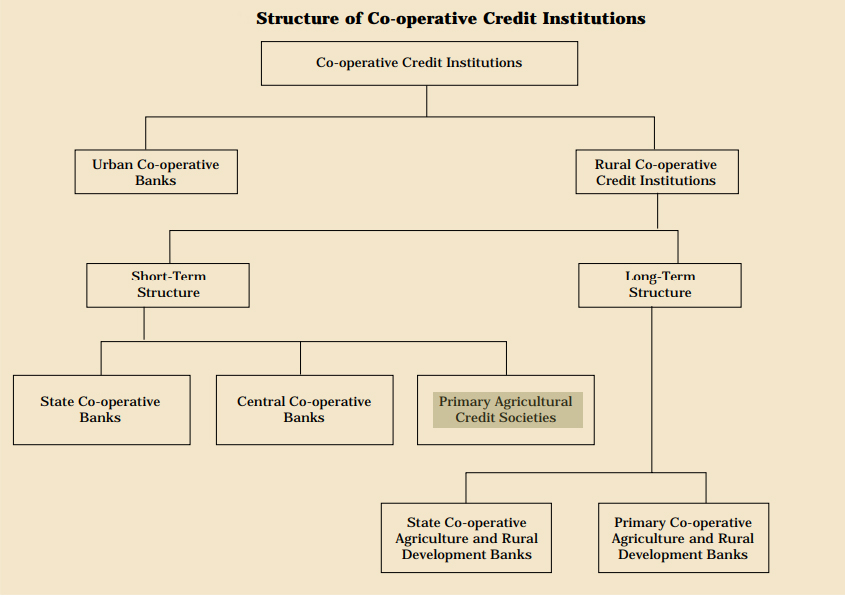

- PACS are village level cooperative credit societies that serve as the last link in a three-tier cooperative credit structure headed by the State Cooperative Banks (SCB) at the state level.

- Credit from the SCBs is transferred to the District Central Cooperative Banks (DCCBs), that operate at the district level. The DCCBs work with PACS, which deal directly with farmers.

- PACSs provide short-term, and medium-term agricultural loans to the farmers for the various agricultural and farming activities.

- The first PACS was formed in 1904.

- PACS are village level cooperative credit societies that serve as the last link in a three-tier cooperative credit structure headed by the State Cooperative Banks (SCB) at the state level.

- Status:

- A report published by the Reserve Bank of India on December 27, 2022 put the number of PACS at 1.02 lakh. At the end of March 2021, only 47,297 of them were in profit.

What is the Significance of PACS?

- Access to Credit:

- PACS provide small farmers with access to credit, which they can use to purchase seeds, fertilizers, and other inputs for their farms. This helps them to improve their production and increase their income.

- Financial Inclusion:

- PACS help to increase financial inclusion in rural areas, where access to formal financial services is limited. They provide basic banking services, such as savings and loan accounts, to farmers who may not have access to formal banking services.

- Convenient Services:

- PACS are often located in rural areas, which makes it convenient for farmers to access their services. This is important because many farmers are unable to travel to banks in urban areas to access financial services.

- PACS have the capacity to extend credit with minimal paperwork within a short time.

- Promoting Savings Culture:

- PACS encourage farmers to save money, which can be used to improve their livelihoods and invest in their farms.

- Enhancing Credit Discipline:

- PACS promote credit discipline among farmers by requiring them to repay their loans on time. This helps to reduce the risk of default, which can be a major challenge in the rural financial sector.

What are the Issues with the PACS?

- Inadequate Coverage:

- Though geographically active PACS cover about 90% of 5.8 villages, there are parts of the country, especially in the north-east, where this coverage is very low.

- Further, the rural population covered as members is only 50% of all the rural households.

- Inadequate Resources:

- The resources of the PACS are much too inadequate in relation to the short-and medium-term credit needs of the rural economy.

- The bulk of even these inadequate funds come from higher financing agencies and not through owned funds of societies or deposit mobilization by them.

- Overdues and NPAs:

- Large over-dues have become a big problem for the PACS.

- As per the RBI report, PACS had reported lending worth Rs 1,43,044 crore and NPAs of Rs 72,550 crore. Maharashtra has 20,897 PACS of which 11,326 are in losses

- They curb the circulation of loanable funds, reduce the borrowing as well as lending power of societies, and give them the bad image of the societies of defaulting debtors are willful.

- Large over-dues have become a big problem for the PACS.

Way Forward

- These more than a century-old institutions deserve another policy push and can occupy a prominent space in the vision of Atmanirbhar Bharat as well as Vocal for Local of the Government of India, as they have the potential to be the building blocks of an Atmanirbhar village economy.

- PACS have played a crucial role in the rural financial sector and have the potential to play an even greater role in the future.

- To achieve this, PACS must be made more efficient, financially sustainable, and accessible to farmers.

- At the same time, the regulatory framework must be strengthened to ensure that PACS are effectively governed and able to serve the needs of farmers.

UPSC Civil Services Examination Previous Year Questions (PYQs)

Prelims

Q1. Consider the following statements: (2020)

- In terms of short-term credit delivery to the agriculture sector, District Central Cooperative Banks (DCCBs) deliver more credit in comparison to Scheduled Commercial Banks and Regional Rural Banks.

- One of the most important functions of DCCBs is to provide funds to the Primary Agricultural Credit Societies.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Q2. With reference to ‘Urban Cooperative Banks’ in India, consider the following statements: (2021)

- They are supervised and regulated by local boards set up by the State Governments.

- They can issue equity shares and preference shares.

- They were brought under the purview of the Banking Regulation Act, 1949 through an Amendment in 1966.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

- Co-operative banks are financial entities which belong to its members, who are at the same time the owners and the customers of their bank. They are established by State laws.

- Co-operative banks in India are registered under the Cooperative Societies Act. They are also regulated by the RBI and governed by Banking Regulations Act, 1949 and Banking Laws (Co-operative Societies) Act,1955.

- Cooperative banks lend as well as accept deposits. They are established with the aim of funding agriculture and allied activities and financing village and cottage industries.

- National Bank for Agriculture and Rural Development (NABARD) is the apex body of cooperative banks in India.

- Urban Co-operative Banks (UCB) are regulated and supervised by State Registrars of Co-operative Societies (RCS) in case of single-state co-operative banks and Central Registrar of Co-operative Societies (CRCS) in case of multi-state co-operative banks and by the RBI. Hence, statement 1 is not correct.

- The banking related functions such as issue of license to start new banks/branches, matters relating to interest rates, loan policies, investments and prudential exposure norms are regulated and supervised by the Reserve Bank under the provisions of the Banking Regulation Act, 1949 after an amendment in 1966. Hence, statement 3 is correct.

- The Reserve Bank of India came out with draft guidelines allowing primary UCBs to augment capital through issuance of equity shares, preference shares and debt instruments.

- The UCBs could raise share capital by issue of equity to persons within their area of operation enrolled as members and also through additional equity shares to the existing members. Hence, statement 2 is correct.

- Therefore, option (b) is the correct answer.

Mains

Q.“In the villages itself no form of credit organization will be suitable except the cooperative society.” – All India Rural Credit Survey. Discuss this statement in the background of agricultural fi nance in India. What constraints and challenges do financial institutions supplying agricultural fi nance face? How can technology be used to better reach and serve rural clients? (2014)