International Relations

India-US Defence Pact to Deepen Cooperation

For Prelims: Logistics Exchange Memorandum of Agreement (LEMOA), Security of Supply Arrangement (SOSA), Memorandum of Agreement regarding Assignment of Liaison Officers, Defense Priorities and Allocations System (DPAS), Joint Declaration on Defence Cooperation, Communications Compatibility and Security Agreement (COMCASA), MH-60R Seahawk helicopters, Sig Sauer rifles, M777 howitzers.

For Mains: India-US Relations, India-US Defence Relations, Challenges, Opportunities and Way Forward

Why in News?

Recently, India and the US have signed two key pacts- a non-binding Security of Supply Arrangement (SOSA) and a Memorandum of Agreement regarding Assignment of Liaison Officers.

- Both countries also agreed to enhance priority co-production projects as part of the 2023 US-India Roadmap for Defence Industrial Cooperation.

What are the Key Defence Agreements Signed Between India and the US?

- Security of Supplies Arrangement (SOSA):

- The Security of Supplies Arrangement (SOSA) is an agreement between the US and India.

- India is the 18th SOSA partner of the US after Australia, Canada, Denmark, Estonia, Finland, Israel, Italy, Japan, Latvia, Lithuania, the Netherlands, Norway, Republic of Korea, Singapore, Spain, Sweden, and the UK.

- It allows both nations to prioritise each other's goods and services for national defense, ensuring supply chain resilience during emergencies.

- Under SOSA, US defense contractors can request expedited deliveries from India and vice versa.

- Although not legally binding, SOSA operates on mutual goodwill, with Indian companies prioritising US orders and the US offering assurances through its Defense Priorities and Allocations System (DPAS), managed by the Department of Defence (DoD) and the Department of Commerce (DOC).

- The Security of Supplies Arrangement (SOSA) is an agreement between the US and India.

- MoU on Liaison Officers:

- The Memorandum of Understanding (MoU) aims to enhance information-sharing between India and the US by establishing a system of Liaison Officers.

- It will start with India's deployment of an officer to the US Special Operations Command in Florida.

- This initiative builds on previous agreements, including the September 2013 Joint Declaration on Defence Cooperation and the 2015 Framework for US-India Defence Relations, reflecting a commitment to strengthen bilateral defense ties.

- Reciprocal Defence Procurement (RDP) Agreement:

- India and the US are discussing a Reciprocal Defence Procurement (RDP) Agreement which is yet to be finalised.

- These are designed to enhance the rationalisation, standardisation, interchangeability, and interoperability of defense equipment between the US and its allies.

- The US has signed RDP Agreements with 28 countries so far.

- This agreement would enable US companies to bypass certain procurement restrictions, such as India's "Make in India" initiative, facilitating the establishment of manufacturing bases in India and closer collaboration with local firms.

- SOSA Vs. RDP:

- SOSA and RDP both aim to enhance defense relations between two nations, but they have distinct objectives.

- SOSA focuses on maintaining the defense supply chain during crises, while RDP establishes a legally binding framework that requires prioritisation of defense orders, facilitating greater joint production and technological collaboration.

What are the Developments in India-US Defence Cooperation?

- GSOMIA: The foundation of India-US defense cooperation was laid with the 2002 General Security of Military Information Agreement (GSOMIA), facilitating the sharing of sensitive military information.

- LEMOA: This was followed by the Logistics Exchange Memorandum of Agreement (LEMOA) in 2016, which established the framework for reciprocal logistical support between the two militaries.

- COMCASA and BECA: The Communications Compatibility and Security Agreement (COMCASA) in 2018 enhanced secure military communications and access to advanced defense technologies, while the Basic Exchange and Cooperation Agreement (BECA) in 2020 enabled the sharing of geospatial data critical for military operations.

- 2+2 Dialogue: These foundational agreements supported by joint exercises and the 2+2 Ministerial Dialogue collectively facilitated interoperability and trust, setting the stage for deeper collaboration.

- Strategic Trade Authorization Tier-1 Status: India-US defense ties have grown significantly since the early 2000s. India was designated a Major Defense Partner in 2016 and granted Strategic Trade Authorization tier 1 status in 2018, allowing access to advanced technologies.

- DTTI: The Defence Trade and Technology Initiative (DTTI), established in 2012, aimed to streamline defense trade and promote co-production and co-development of defense technologies, reflecting a shift from a buyer-seller relationship to a partnership model.

- Military Procurement: India's military procured from the US MH-60R Seahawk helicopters, Sig Sauer rifles, and M777 howitzers.

- Ongoing negotiations to manufacture GE F-414 jet engines in India and procure MQ-9B High-Altitude Long-Endurance (HALE) UAVs signify a growing emphasis on indigenous production and technology transfer, in line with India's 'Make in India' initiative.

- INDUS-X: The launch of the India-US Defense Acceleration Ecosystem (INDUS-X) in June 2023, fostered defense innovation and industrial cooperation.

- In 2023, the defense cooperation roadmap highlighted priority areas such as Intelligence, Surveillance, and Reconnaissance (ISR), Undersea Domain Awareness, and Air Combat Systems.

- I2U2 Grouping: I2U2 comprises India, Israel, the US, and the United Arab Emirates, dedicated to joint investments and new initiatives in various sectors, including water, energy, transportation, space, health, and food security.

How India and US Relations Have Evolved Over the Time?

- Cold War Period:

- During the Cold War, India and the US were on opposite sides, with India pursuing non-alignment and Pakistan aligning with the US.

- Relations improved in the 1990s after India's economic liberalisation and the end of the Cold War.

- President Clinton's visit to India in 2000 marked a turning point, leading to strategic dialogues and increased economic cooperation, further strengthened by the Next Steps in Strategic Partnership (NSSP) in 2004.

- Nuclear Agreement:

- The 2008 Civil Nuclear Agreement ended India's nuclear isolation and recognized it as a responsible nuclear power, enhancing cooperation in defense and high-tech sectors and solidifying the US commitment to elevating India's global status.

- Economic Synergy: Bilateral trade reached USD 118.28 billion in 2023-24, making the US India's largest trading partner.

- Cooperation has expanded to clean energy, the digital economy, and healthcare, with initiatives like the US-India Strategic Clean Energy Partnership and collaboration on Covid-19 vaccines.

- Technology Cooperation: It has become a cornerstone of bilateral ties, with collaboration in Artificial Intelligence (AI), Quantum Computing, and 5G.

- The US-India Science and Technology Endowment Fund and recent initiatives like the US-India AI Initiative and iCET highlight the strategic importance of tech cooperation.

- The Artemis Accords signed by India and the United States establish a common vision for the future of space exploration with the two countries cooperating through the bilateral Civil Space Joint Working Group.

- Geopolitical Alignment: The rise of China has brought India and the US closer strategically.

- The revival of the Quad and India's inclusion in the US Indo-Pacific strategy reflect this alignment, emphasising a "free and open Indo-Pacific" and deepening geopolitical cooperation.

What are the Challenges to India-US Relations?

- Human Rights and Democratic Values: Relations between the US and India have been affected by concerns over the treatment of minorities, especially Muslims. The Citizenship Amendment Act (CAA) and the revocation of Jammu and Kashmir's special status have prompted discussions about India's commitment to secularism and tolerance.

- Strategic Competition with China: While both nations see China as a strategic challenge, their approaches sometimes diverge. India's economic ties with China occasionally conflict with US interests, creating friction.

- Trade and Economic Disputes: Trade disputes, protectionist measures, and concerns over market access and intellectual property rights complicate efforts to reach a comprehensive trade deal.

- Geopolitical Alignment: The legacy of India’s non-alignment during the Cold War, which saw it lean towards the Soviet Union, still influences perceptions and expectations in the bilateral relationship.

- India seeks to balance its relations with both the US and Russia. This balancing act can create tensions, especially when the US expects stronger condemnation of Russia from India over Russia-Ukraine War.

Way Forward

- Address Diplomatic Concerns: India and the US should resolve tensions by addressing issues related to democracy and strategic cooperation, with a focus on initiatives like the iCET.

- India’s Role as a Global Bridge: India can leverage its leadership in forums like the G20 and SCO to bridge gaps between the West and developing nations.

- Enhance Counterterrorism Cooperation: Strengthen efforts on counterterrorism, particularly in managing a Taliban-led Afghanistan and pressuring Pakistan to curb support for terrorist groups.

- Focus on Emerging Technologies and AI: Increase collaboration on emerging technologies and AI, emphasising data regulation, information sharing, and privacy for national security.

- Advance Multilateral Coordination: Prioritise coordination in forums like the Quad and I2U2 to address international strategic issues.

- Boost Economic Engagement: Enhance trade, investment, and technological cooperation, with initiatives like iCET driving economic growth and market access.

|

Drishti Mains Question: Discuss the evolution of India-US relations. How do India-US defence relations affect India's ties with other major powers? |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. From which one of the following did India buy the Barak anti-missile defence systems? (2008)

(a) Israel

(b) France

(c) Russia

(d) USA

Ans: (a)

Q. Recently, the USA decided to support India’s membership in multi-lateral export control regimes called the “Australia Group” and the “Wassenaar Arrangement”. What is the difference between them? (2011)

- The Australia Group is an informal arrangement which aims to allow exporting countries to minimize the risk of assisting chemical and biological weapons proliferation, whereas the Wassenaar Arrangement is a formal group under the OECD holding identical objectives.

- The Australia Group comprises predominantly of Asian, African and North American countries whereas the member countries of Wassenaar Arrangement are predominantly from the European Union and American Continents.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)

Mains:

Q. What is the significance of Indo-US defence deals over Indo-Russian defence deals? Discuss with reference to stability in the Indo-Pacific region. (2020)

Q. ‘What introduces friction into the ties between India and the United States is that Washington is still unable to find for India a position in its global strategy, which would satisfy India’s National self-esteem and ambitions’. Explain with suitable examples. (2019)

Indian Economy

High Attrition Rates in Regional Rural Banks

For Prelims: Regional Rural Banks, National Bank for Agriculture and Rural Development , Reserve Bank of India, Non-Performing Assets, Digital banking, Pradhan Mantri MUDRA Yojana, One District One Product

For Mains: Challenges in Regional Rural Banks, Rural Development, Banking Sector and Reforms

Why in News?

Recently the Union Finance Minister addressed the high attrition rates in Regional Rural Banks (RRBs), urging these institutions to adopt more employee-friendly policies.

- This highlighted the need for reforms to enhance employee satisfaction, improve customer service, and ultimately boost the performance of RRBs.

Note: Attrition rate is a metric that quantifies the rate at which employees depart an organisation, whether voluntarily or involuntarily.

Why are RRBs Facing High Attrition Rates?

- Lack of Employee Benefits: RRB employees often leave due to better opportunities in Scheduled Commercial Banks (SCBs), which offer superior facilities despite similar pay scales.

- According to National Bank for Agriculture and Rural Development (NABARD) the total number of employees in 43 RRBs decreased from 95,833 in FY 2022 to 91,664 in FY23, while the number of branches saw a minor increase from 21,892 in FY22 to 21,995 in FY23.

- Challenging Work Environment: Employees who relocate from other states to work in RRBs struggle to adapt to rural life, prompting them to seek other opportunities.

- Slower Career Growth: Compared to SCBs, RRBs offer slower promotions and fewer incentives, leading to dissatisfaction among employees.

How Can RRBs Improve Employee Retention?

- Prioritising Local Postings: Assigning employees to work in their home regions can help them balance their personal and professional lives better, reducing the desire to leave for other opportunities.

- Enhancing Employee Benefits: RRBs should strive to offer benefits and facilities that are competitive with those provided by SCBs, such as improved housing, healthcare, and retirement plans.

- Accelerating Career Growth: Implementing faster promotion tracks and more frequent career advancement opportunities can motivate employees to stay and grow within the organisation.

- Supportive Work Environment: RRBs should foster a more employee-friendly culture by offering flexible working conditions, regular training, and professional development programs to enhance job satisfaction.

- Providing additional support for employees posted in rural areas, such as better housing options and community engagement activities, can help them adapt and thrive in their roles.

- Expanding Digital Capabilities: Enhancing digital banking services, such as mobile banking, can help RRBs improve their performance and attract tech-savvy employees who value innovation and convenience.

What are the Regional Rural Banks?

- About: The Narasimham committee on rural credit (1975) recommended the establishment of RRBs.

-

RRBs were established in 1975 under the RRB Act, 1976, to develop the rural economy by providing credit and other facilities to small and marginal farmers, agricultural laborers, artisans, and small entrepreneurs, thereby supporting agriculture, trade, commerce, and industry in rural and semi-urban areas.

- RRBs operate in areas notified by the Government, covering one or more districts in a State.

- They aimed to merge the local touch of cooperatives with the professionalism of commercial banks.

- RRBs operate in areas notified by the Government, covering one or more districts in a State.

- By March 2023, there were 43 RRBs sponsored by 12 scheduled commercial banks, operating across 26 states and 3 Union Territories.

- The first RRB was Prathama Bank, with its head office in Moradabad, Uttar Pradesh.

- RRBs are owned by the Central government, concerned State government and the sponsor bank in proportion of 50:15:35 (each RRB is sponsored by a particular bank).

- In India, the Reserve Bank of India (RBI) oversees the entire banking system, while NABARD supervises rural financial institutions, including RRBs under the Banking Regulation Act, 1949.

-

- Financial Performance: RRBs have shown significant improvement over the last three years. The total business of RRBs crossed Rs 10 lakh crore during FY23, growing at a rate of 10.1% year-on-year.

- As of March 2023, Gross Non-Performing Assets (NPAs) were at 7.28%, the lowest in seven years, while Net NPAs stood at approximately 3.2%.

- RRBs recorded a highest-ever consolidated net profit of Rs 4,974 crore in FY22-23. In FY23-24, the net profit up to the third quarter was Rs 5,236 crore.

- Challenges:

- Asset Quality Maintenance: Maintaining asset quality is a critical issue for RRBs, particularly as they work to expand credit and grow their portfolios in rural and semi-urban areas.

- Limited Digital Infrastructure: RRBs often struggle with upgrading and maintaining digital banking services, especially in regions with poor connectivity, which can hinder their ability to compete with larger banks.

- Corporate Governance Issues: Ensuring robust corporate governance is an ongoing challenge, with RRBs needing to improve their internal processes and compliance to maintain credibility and efficiency.

- Pressure to Increase Credit Penetration: RRBs are under pressure to increase their share in agriculture credit disbursement and other priority sector lending, which requires careful balancing of resources and risks.

- Increased Competition: The growing presence of private sector banks has intensified competition, as these banks offer superior technology, more comprehensive services, and a more streamlined customer experience.

- RRBs struggle to compete with the advanced resources and infrastructure of private banks.

- Small finance banks have also increased competition by offering specialised services and advanced technology, further challenging the RRBs' ability to attract and retain customers.

- Non-Performing Assets: The significant burden of NPAs has affected RRBs' financial health, leading them to focus on reducing these problematic loans rather than expanding their services.

-

Opportunities to Boost RRBs Performance:

- Review Operational Models: Consider the potential benefits and challenges of merging RRBs with their sponsor banks to enhance efficiency.

- Assess the impact of consolidation on service delivery and rural focus before making any decisions.

- Map RRBs with MSME Clusters: Align RRB operations with Micro, Small, and Medium Enterprises (MSMEs) to enhance credit delivery and support local businesses.

- Use MSME clusters to identify areas for expansion and tailored financial products.

- Provide targeted financial products and services to MSMEs in rural areas, fostering entrepreneurship and economic growth.

- Expand Financial Inclusion Efforts: Increase outreach and support for government schemes like Pradhan Mantri MUDRA Yojana and PM Vishwakarma, and improve the uptake of these programs in underdeveloped regions.

- Actively promote and implement schemes like PM Surya Ghar Muft Bijli Yojana and One District One Product (ODOP) to support local development and increase credit penetration.

- Leverage CASA Ratio for Credit Growth: Utilise the healthy Current Account Savings Account (CASA) ratio to extend more credit, particularly to underserved sectors like MSMEs and agriculture.

- Enhance Customer Engagement: Improve customer relations through better local connections and personalised services to boost performance and customer satisfaction.

- Collaboration with Sponsor Banks: Work closely with sponsor banks to gain technical assistance, share best practices, and access resources needed for growth and stability.

- Focus on Asset Quality: Maintain and improve asset quality by implementing effective risk management practices and regular review of credit portfolios.

- Review Operational Models: Consider the potential benefits and challenges of merging RRBs with their sponsor banks to enhance efficiency.

National Bank for Agriculture and Rural Development

- The RBI formed the Committee to Review the Arrangements For Institutional Credit for Agriculture and Rural Development (CRAFICARD) in 1979 to address the need for institutional credit in rural areas.

- The committee's recommendations led to the creation of NABARD, which was established in 1982 under National Bank for Agriculture and Rural Development Act, 1981, by transferring agricultural credit functions from RBI and refinance functions from the Agricultural Refinance and Development Corporation (ARDC).

- NABARD envisions itself as the "Development Bank of the Nation for Fostering Rural Prosperity," focusing on enhancing rural livelihoods and boosting the rural economy.

- Milestone Achievements:

- Self Help Group (SHG) Bank linkage (BL) Project: Launched in 1992, this initiative has evolved into the world’s largest microfinance project, significantly enhancing financial inclusion.

- Kisan Credit Card: Designed by NABARD, it has become an essential financial tool for millions of farmers.

- Rural Infrastructure: NABARD has financed approximately one-fifth of India’s total rural infrastructure.

|

Drishti Mains Question: Q. Examine the challenges faced by Regional Rural Banks in promoting financial inclusion in rural India. What steps can be taken to enhance their effectiveness? |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. Which of the following grants/grant direct credit assistance to rural households? (2013)

- Regional Rural Banks

- National Bank for Agriculture and Rural Development

- Land Development Banks

Select the correct answer using the codes given below:

(a) 1 and 2 only

(b) 2 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Indian Economy

Ten Years of Pradhan Mantri Jan-Dhan Yojana

For Prelims: Pradhan Mantri Jan-Dhan Yojana, Direct Benefit Transfer, Overdraft Facility, Financial Literacy, Jan Dhan Darshak App, Micro Insurance, National Strategy for Financial Inclusion, Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Micro Units Development & Refinance Agency Bank (MUDRA), Digital Public Infrastructure (DPI).

For Mains: Pradhan Mantri Jan-Dhan Yojana (PMJDY) and its Impact on Indian Banking, Government Policies & Interventions.

Why in News?

The year 2024 marks the tenth year of the Pradhan Mantri Jan-Dhan Yojana (PMJDY). PMJDY was launched ten years ago on 28th August, 2014.

- The government aims to open more than 3 crore accounts under the PMJDY during the current financial year 2024-25.

What are the Achievements of Pradhan Mantri Jan-Dhan Yojana?

- Account Expansion: PMJDY has moved from the modest beginning with 147 million accounts opened in March 2015 to a mammoth 520 million accounts in March 2024.

- Deposit Mobilisation: The deposit mobilisation was Rs 15,600 crore in March 2015 which increased to Rs 2.32 trillion in March 2024.

- The deposit mobilisation grew at a compound average growth rate of 30% over the last 10 years.

- Average balance increased from Rs 1,065 in March 2015 to Rs 4,476 in March 2024, nearly quadrupling in the last decade.

- Expansion of Banking Infrastructure: Over 1.3 million banking touch points have been mapped on the Jan Dhan Darshak (JDD) App.

- A total of 601,000 villages are mapped on the JDD app as of July 2023. Out of these, 599,468 (99.7%) of total mapped villages are covered with banking outlets (bank branch, banking corner, or Indian Post Payment Banks within 5 km radius).

- The Jan Dhan Darshak App is a mobile application that helps citizens locate banking touchpoints like branches, ATMs, Banking Correspondents (BCs), IPPBs etc.

- Rural-Urban Parity: As per Ministry of Finance, PMJDY achieved a milestone of a total of 53.13 crores PMJDY accounts out of which 55.6% (29.56 crores) Jan-Dhan account holders are women and 66.6% (35.37 crores) Jan Dhan accounts are in rural and semi-urban areas.

- Boost in Digital Payments: The total number of UPI financial transactions have increased from 920 million in Financial Year (FY) 2018 to 131.2 billion in FY 2024.

- Similarly, total number of RuPay card transactions at point of sale (PoS) and e-commerce have increased from 670 million in FY 2018 to 1.26 billion in FY 2023.

- Direct Benefit Transfer (DBT): PMJDY transferred about USD 361 billion directly to beneficiaries from 53 central government ministries through 312 key schemes.

- During Covid-19, the PMJDY accounts were instrumental in one-time ex gratia payment of Rs 500 per month for three months (April, May and June 2020) under Pradhan Mantri Garib Kalyan Yojana (PMGKY), benefiting 206.4 million women account holders..

- Overdraft (OD) Accounts: As of March 2024, a total of 1,17,701 overdraft facility have been opened with a sanctioned amount of Rs 190 crore to such PMJDY account holders. The limit utilisation stands at 80.5%.

- It has ensured access to credit from the formal financial system for the poorest of the poor.

- Low Zero Balance Accounts: Although zero balance accounts are permitted under PMJDY and maintenance of minimum balance is not mandatory, only 8.4% accounts have zero balance.

- Praised by the World Bank: As per the World Bank, India has achieved as much in just six years what would have taken about five decades.

- The Jan Dhan-Aadhaar-Mobile (JAM) trinity has propelled the financial inclusion rate to 80% of adults from 25% in 2008, a journey shortened by up to 47 years and made possible due to Digital Public Infrastructure (DPI).

What is PMJDY?

- PMJDY is a financial inclusion program that aims to ensure access to financial services, namely, basic savings & deposit accounts, remittance, credit, insurance, pension in an affordable manner.

- Under the scheme, a basic savings bank deposit (BSBD) account can be opened in any bank branch or Business Correspondent (Bank Mitra) outlet, by persons not having any other account.

- Features:

- No Minimum Balance: There is no requirement to maintain any minimum balance in PMJDY accounts.

- Free Debit Card: Free Rupay Debit card is provided to PMJDY account holders.

- Accident Insurance: Accident Insurance Cover of Rs.1 lakh (enhanced to Rs. 2 lakh to new PMJDY accounts opened since 2018 is available with RuPay card issued to the PMJDY account holders.

- OD Facility: An overdraft (OD) facility up to Rs. 10,000 to eligible account holders is available.

- DBT Benefits: PMJDY accounts are eligible for DBT, Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY), Micro Units Development & Refinance Agency Bank (MUDRA) scheme.

- However, there is no mandatory free cheque book facility with a PMJDY account. Banks can issue cheque books on PMJDY accounts which may/may not be priced.

What are the Challenges Associated with PMJDY?

- Multiple Accounts: The lure of getting a large insurance cover, accidental death benefit cover and overdraft facility prompt people to open multiple accounts in different banks using different identification documents like Aadhaar card, PAN card etc.

- Economic Burden on Banks: Too many accounts with persistent low balance creates financial problems for banks in managing them.

- Money Laundering: There are concerns that Jan Dhan accounts owned by the poor are used in money laundering by black money operators.

-

Jan Dhan accounts were used to launder money after demonetisation.

-

- Declining Overdraft facility: Providing OD facility is the discretion of the concerned banks. Many banks decline to extend the OD facility therefore defeating the purpose.

- Misusing Authority: Sometimes Business correspondents (BCs) misuse the authority and make the life of people below poverty line miserable.

- BCs may charge extra fees for services that are supposed to be free or have minimal costs, such as opening bank accounts, processing transactions, or providing loans.

- Bad Loans: It is a possibility that the overdraft facility could end up as bad loans for banks as the scheme does not spell out how the banks can collect debts.

- With many debt waivers in the past, people may end up treating the loans as freebies.

- Financial and Technology Illiteracy: There is a lack of awareness, knowledge and skills among rural people to make informed decisions about savings, borrowings, investments and expenditure.

- A survey conducted by financial services giant Visa revealed that 65% of Indians lack financial literacy.

Way Forward

- Centralised Verification System: Implement a centralised system to prevent duplication of accounts using biometric and digital identity verification.

- Develop incentives for individuals to maintain a single account rather than multiple ones, such as enhanced benefits or reduced fees.

- National Strategy for Financial Inclusion (NSFI): The upcoming NFSI for 2025-30 should emphasise PMJDY to expand social security scheme penetration and their awareness among the targeted population.

- Insurance for All: India needs to move away from sole focus on accounts and balances.

- Endeavour is needed to ensure coverage of PMJDY account holders under Micro Insurance schemes.

- Improving access of PMJDY account holders to micro-credit and micro investment such as flexi-recurring deposit is needed.

- Increased Penetration of OD accounts: The penetration of OD accounts must be improved so that PMJDY becomes a catalyst for a virtuous cycle of growth and contribution towards Viksit Bharat.

- New Focus Areas: The Centre believes that PMJDY has covered the majority of the adult population. Now, our focus is to cover the entire adult population and continue to cover those acquiring adulthood.

|

Drishti Mains Question: Q.Critically discuss how Pradhan Mantri Jan-Dhan Yojana has helped in financial inclusion in India in the last 10 years. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Priority Sector Lending by banks in India constitutes the lending to (2013)

(a) agriculture

(b) micro and small enterprises

(c) weaker sections

(d) All of the above

Ans: (d)

Q.‘Pradhan Mantri Jan-Dhan Yojana’ has been launched for (2015)

(a) providing housing loan to poor people at cheaper interest rates

(b) promoting women’s Self-Help Groups in backward areas

(c) promoting financial inclusion in the country

(d) providing financial help to the marginalised communities

Ans: (c)

Mains

Q. Pradhan Mantri Jan Dhan Yojana (PMJDY) is necessary for bringing unbanked to the institutional finance fold.Do you agree with this for financial inclusion of the poor section of the Indian society?Give arguments to justify your opinion. (2016)

Q. Among several factors for India’s potential growth, the savings rate is the most effective one. Do you agree? What are the other factors available for growth potential? (2017)

Geography

Transboundary Rivers of India

For Prelims: Dambur Dam, Gumti River, Transboundary rivers between India and Bangladesh, National Perspective Plan for Interlinking Rivers, Kosi River.

For Mains: Transboundary Rivers in India and Related Issues, Water Sharing Issues between India and Neighbouring Countries, Water Management.

Why in News?

Bangladesh has recently faced severe floods, leading to concerns that the water might be coming from the Dumbur dam in Tripura, India.

- However, the Indian government has clarified that the flooding is caused by heavy rainfall in the larger catchment areas of the Gumti River, which flows through both nations, rather than the dam’s water release.

Gumti River and Dambur Dam and Dumboor Lake:

- Gumti River:

- It is also known as Gomti, Gumati, or Gomati, which originates in Tripura and flows through the district of Comilla in Bangladesh.

- The right bank tributaries of Gumti river include Kanchi Gang, Pitra Gang, San Gang, Mailak Chhara, and Surma Chhara, while the left bank tributaries are Ek Chhari, Maharani Chhara, and Ganga.

- Dumbur Dam:

- It is built upon the Gumti river in Tripura.

- It is 30 metres in height and generates power that feeds into a grid. Bangladesh draws 40 megawatts (MW) of power from Tripura.

- Dumboor Lake:

- It is situated in Gandacherra, near Agartala and is near the Tirthamukh Hydel Project, the source of the Gomati River.

- Formed by the confluence of the Raima and Sarma rivers, it is known for its diverse fish species.

- The lake hosts the annual 'Poush Sankranti Mela' on 14th January every year.

What are the Transboundary Rivers of India with Neighboring Countries?

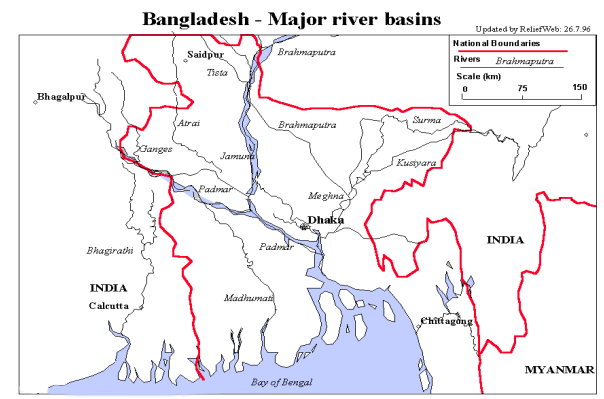

- India-Bangladesh: India and Bangladesh share 54 rivers, with India having the most rivers flowing into the Bay of Bengal via Bangladesh. Major rivers are:

-

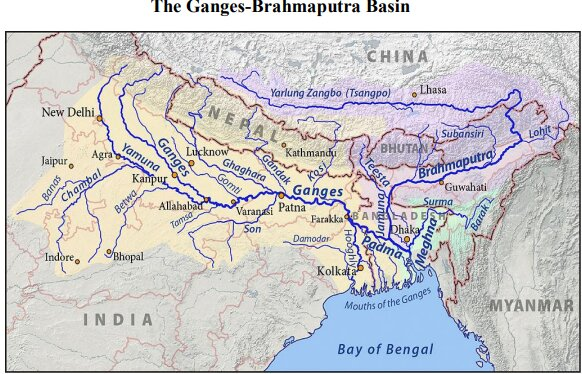

The Ganges (Padma in Bangladesh): This major river flows from India into Bangladesh, traversing the Gangetic plain of North India.

- Major left-bank tributaries include the Gomti, Ghaghara, Gandak and Kosi.

- Major right-bank tributaries include the Yamuna, Son, Punpun and Damodar.

- Ghaghara: Originating in the Tibetan Plateau, it joins the Ganges near Patna and is notable for its high discharge, especially during the monsoon.

- Son River: Flowing through the Kaimur Range, it covers 487 miles before joining the Ganges above Patna, Bihar.

- In Bangladesh, the Ganges has only one tributary, the Mahananda, while it has distributaries such as the Ichamati, Nabaganga, Bhairab, Kumar, Goari Madhumati, and Arial Khan.

- Teesta: It originates in the Himalayas and flows through Sikkim and West Bengal before merging with the Brahmaputra in Assam and the Jamuna (called Brahamputra in India) in Bangladesh.

- Bangladesh is advocating for a fair allocation of Teesta River waters from India, similar to the Ganga Water Treaty of 1996. However, this request has not been successful.

- The 1996 Ganges Water Treaty between Indian and Bangladesh aimed to resolve disputes between India and Bangladesh over water flow entitlements, which emerged after the Farakka Barrage was built in 1975 to divert Ganges water to the Hooghly River for maintaining Calcutta port.

- Feni: This river flows 135 km south of Agartala, the capital of Tripura. Out of its 1,147 square km catchment area, 535 square km is in India, with the remainder in Bangladesh.

- It forms part of the India-Bangladesh border.

- Maitri Setu, a 1.9 km Long Bridge over Feni River, is constructed in Tripura to link India and Bangladesh.

- Some notable tributaries of the Feni River include the Muhuri River, Raidak River, Chandkhira River, Ryang River, and Kushiyara River.

- Kushiyara River: It is a distributary of the Barak River, originates at the Amlshid bifurcation point on the India-Bangladesh border, where the Barak divides into the Kushiyara and Surma rivers.

- It begins in Assam and gathers tributaries from Nagaland and Manipur.

- Brahmaputra River: It originates from Chemayungdung glacier as the Yarlung Tsangpo in Tibet near Mount Kailash, flows through India and Bangladesh forming a natural border between the two countries.

- It passes through Arunachal Pradesh, Assam, and Meghalaya before entering Bangladesh (called as the Jamuna).

- Major tributaries include the Subansiri, Kameng, Manas, and Dhansiri rivers in India, and the Teesta River in Bangladesh.

- The Brahmaputra River joins the Ganga River in Bangladesh, forming the Padma River, which then merges with the Meghna River and flows into the Bay of Bengal through the Meghna Estuary.

- Meghna: Barak river in India divides into 2 streams Surma and Kushiyara in Karimganj district in Assam. Surma and Kushiyara rejoin at Kishoreganj district in Bangladesh to be known as Meghna.

- Upto Chandpur in Bangladesh, it is known as Upper Meghna and after meeting Padma in Chandpur, it is known as Lower Meghna.

- Jamuna (called Brahmaputra in India): Jamuna is a distributary of Brahmaputra, separating from the mainstream at the point where Brahmaputra meets Teesta in Bangladesh, and flows with the name Jamuna till Goalundo ghat in Bangladesh where it meets Padma river (called Ganga in India).

-

- India-China: The Trans-border rivers flowing from China to India fall into two main groups.

- Brahmaputra River System: The Brahmaputra river system on the eastern side, which consists of river Siang (main stream of river Brahmaputra) and its tributaries, namely Subansiri and Lohit, with the river Brahmaputra called Yaluzangbu or Tsangpo in China; and

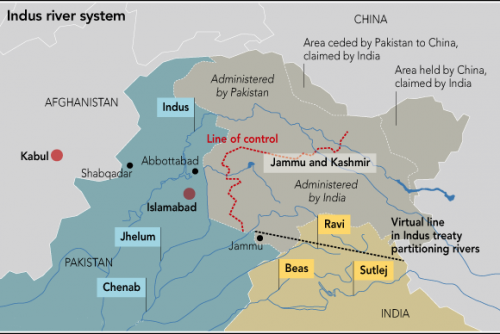

- Indus River System: The Indus River system on the western side, consisting of river Indus and the river Sutlej.

- There are two MoUs signed between India and China for provision of hydrological information on these two rivers by China to India.

- India-Pakistan:

- Indus River: The Indus is a trans-boundary river in Asia that originates in Western Tibet, flows northwest through the Kashmir, and then continues south-by-southwest through Pakistan, eventually emptying into the Arabian Sea near Karachi.

- The water of the Indus River and other west-flowing rivers from India has been a contentious issue between India and Pakistan since independence.

- Sutlej: It is a major tributary of the Indus River, originating at Rakas Lake in Pakistan.

- It flows parallel to the Indus for about 400 kilometres, enters India through Himachal Pradesh's Shipki La Pass, and continues through Punjab.

- There, it meets the Beas River, forming part of the India-Pakistan border before joining the Chenab River.

- The combined flow creates the Panjnad River, which empties into the Indus.

- Chenab: It is a major tributary of the Indus River, originating from the confluence of the Chandra and Bhaga streams at Tandi in Himachal Pradesh.

- Known as Chandrabhaga in its upper reaches, it flows west through Jammu and Kashmir and then southwest into Pakistan.

- It descends into the Punjab province's alluvial lowlands and meets the Jhelum River near Trimmu before emptying into the Sutlej River.

- Jhelum:

- Originating from Verinag Spring in the Kashmir Valley, it travels through Jammu and Kashmir and Punjab.

- It passes through Srinagar and Wular Lake, entering Pakistan through a gorge near Gilgit and merging with the Chenab River near Jhang.

- Beas:

- The Beas River originates at Beas Kund near Rohtang Pass in Himachal Pradesh.

- It flows through the Kullu valley and joins the Sutlej River at Harike in Punjab.

- Ravi:

- Ravi River originates at Bara Bangal of Kangra district, Himachal Pradesh, and flows through Bara Bansu, Tretha, Chanota and Ulhansa, covering 158 km before entering Punjab state.

- Its famous tributaries are Budhil, Siul, Baljeri, Chatrari and Baira.

- The 1960 Indus Waters Treaty has allocated control of the Beas, Ravi, and Sutlej rivers to India and the Indus, Chenab, and Jhelum rivers to Pakistan.

- Indus River: The Indus is a trans-boundary river in Asia that originates in Western Tibet, flows northwest through the Kashmir, and then continues south-by-southwest through Pakistan, eventually emptying into the Arabian Sea near Karachi.

- India-Nepal:

- The Kosi and Gandak are major rivers from Nepal that flow into India. Other significant rivers include the Rapti, Narayani, and Kali.

- These rivers, which enter India from Nepal, primarily originate in the Tibetan Plateau and the Himalayan ranges.

- Kosi:

- The Kosi River, a transboundary river flowing through China, Nepal, and India, is a major tributary of the Ganges.

- Originating from the confluence of the Sun Kosi, Arun Kosi, and Tamur Kosi in the Himalayas, it flows through Nepal and Bihar before joining the Ganges in Bihar.

- Kosi is known for its frequent course changes and flooding, earning it the nickname "sorrow of Bihar."

- Gandak:

- It is also known as the Gandaki or Narayani River, flows through northern India and Nepal.

- Originating in Tibet near the Nepal border at an altitude of 7,620 metres.

- It passes through Bihar and Uttar Pradesh before merging with the Ganges near Patna.

- Major tributaries include the Mayangadi, Bari, Trisuli, Panchand, Sarhad, and Budhi Gandak.

- Sharda/Kali/Mahakali River:

- It originates at Kalapani in Uttarakhand. It flows along the western border of Nepal and India.

- After merging with the Ghaghra River and passing through the hills as the Kali River, it enters the Terai plains and is known as the Sharda River.

- The Pancheshwar Dam, a joint India-Nepal project for irrigation and hydroelectric power, has been proposed for this river.

- India and Nepal have traditionally disagreed over the interpretation of the Sugauli Treaty 1816, which delimited the boundary along the Maha Kali River in Nepal, with the two countries differing as to which stream constitutes the source of the river.

|

Drishti Mains Question: What are the major transboundary rivers of India? Examine the challenges and opportunities in managing transboundary rivers in India. |

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. With reference to river Teesta, consider the following statements: (2017)

- The source of river Teesta is the same as that of Brahmaputra but it flows through Sikkim.

- River Rangeet originates in Sikkim and it is a tributary of river Teesta.

- River Teesta flows into Bay of Bengal on the border of India and Bangladesh.

Which of the statements given above is/are correct?

(a) 1 and 3 only

(b) 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (b)

Q. With reference to the Indus river system, of the following four rivers, three of them pour into one of them which joins the Indus directly. Among the following, which one is such a river that joins the Indus direct? (2021)

(a) Chenab

(b) Jhelum

(c) Ravi

(d) Sutlej

Ans: (d)

Q. Consider the following pairs (2019)

| Glacier | River | |

| 1. | Bandarpunch | Yamuna |

| 2. | Bara Shigri | Chenab |

| 3. | Milam | Mandakini |

| 4. | Siachen | Nubra |

| 5. | Zemu | Manas |

Which of the pairs given above are correctly matched?

(a) 1, 2 and 4

(b) 1, 3 and 4

(c) 2 and 5

(d) 3 and 5

Ans: (a)

Mains:

Q1. Present an account of the Indus Water Treaty and examine its ecological, economic and political implications in the context of changing bilateral relations. (2016)

Q2. Discuss the Namami Gange and National Mission for Clean Ganga (NMCG) programmes and causes of mixed results from the previous schemes. What quantum leaps can help preserve the river Ganga better than incremental inputs? (2015)

Important Facts For Prelims

165th Anniversary of Income Tax Day

Why in News?

Recently, the Union Finance Minister presided over the 165th Anniversary of Income Tax Day observed by the Central Board of Direct Taxes (CBDT) in New Delhi, highlighting the Income Tax Department's significant achievements.

What is Income Tax Day?

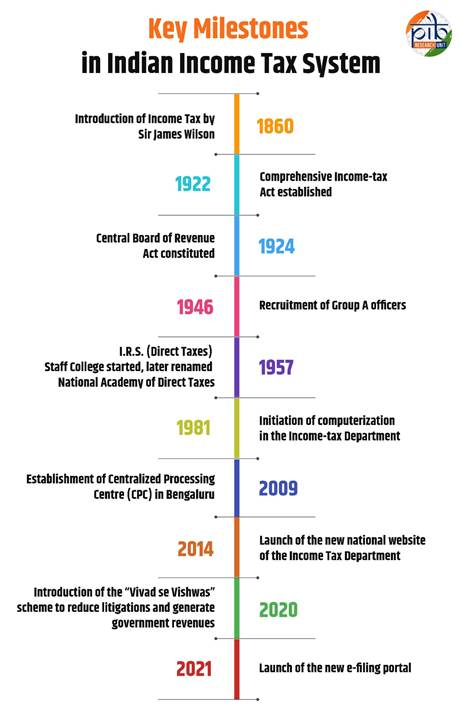

- About: Income Tax Day (or Aaykar Divas), celebrated on 24th July, marks a significant milestone in India's fiscal history. This day commemorates the introduction of income tax in India by Sir James Wilson, a British economist in 1860 to meet the losses from the 1857 Military Mutiny.

- Income Tax Day not only honours the historical development of tax administration in India but also highlights the continuous advancements and modernization efforts aimed at creating a more efficient and taxpayer-friendly system.

- Evolution of Income Tax in India:

- Income-tax Act of 1922: It established a structured tax system in India by formalising various income tax authorities and laying the foundation for a systematic administration framework.

- Central Board of Revenue Act (1924): Created the Central Board of Revenue, a statutory body responsible for administering income tax.

- Recruitment of Group A Officers (1946): Enhanced professional development with training in Bombay and Calcutta.

- Establishment of the National Academy of Direct Taxes (1957): Strengthened professional training and development.

- Income Tax Act of 1961: Several amendments were made over the years, leading to the Income Tax Act of 1961, which has been in force since April 1962 and applies to the whole of India.

- Bifurcation of Central Board of Revenue in 1964: Initially the Board was in charge of both direct and indirect taxes.

- However, when the administration of taxes became too burdensome for a single board, it was divided into two separate entities: the Central Board of Direct Taxes and the Central Board of Excise and Customs, under the Central Boards of Revenue Act, 1963.

- Technological Advancements: The introduction of computerisation in 1981 focused on processing challans electronically. In 2009, the Centralized Processing Centre (CPC) was set up in Bengaluru to handle the bulk processing of e-filed and paper returns, operating efficiently in a jurisdiction-free manner.

- The E-Verification Scheme enables authorities to collect information to accurately determine a taxpayer's income and reduce tax evasion, while providing taxpayers with relevant financial data from various sources.

- Vivad se Vishwas scheme: It is a settlement program in India that aims to end pending direct tax disputes between taxpayers and the government.

- The scheme helps litigants settle their disputes and allow the government to collect revenue that's tied up in litigation.

What is Income Tax?

- Definition: It is a government levy on the income earned by individuals and businesses during a financial year.

- "Income" encompasses various sources, defined broadly under Section 2(24) of the Income Tax Act, 196.

- Income Sources:

- Salary: Includes all payments from an employer to an employee, such as basic pay, allowances, commissions, and retirement benefits.

- House Property: Rental income from residential or commercial properties is taxable.

- Business/Profession: Profits from business or professional activities are taxable after deducting expenses.

- Capital Gains: Profits from selling capital assets like property or jewellery are taxable. These gains can be long-term or short-term.

- Other Sources: Includes income not covered by the other categories, such as savings interest, family pension, gifts, lottery winnings, and investment returns.

- Importance: It is crucial for nation-building, providing essential revenue for security, services, and economic development.

- It balances wealth redistribution and state power, shaping social structure and establishing a social contract.

- Tax reforms enhance governance, expand state capacity, and boost legitimacy, making income tax vital for a self-sustaining state and societal welfare.

- Current Landscape: The landscape of personal income tax (PIT) in India has seen significant growth, reflecting the country's expanding economy and improved tax compliance.

- Gross PIT, including the Securities Transaction Tax (STT), increased from Rs 5.75 lakh crore in 2020-21 to Rs 9.67 lakh crore in 2022-23. By 2023-24, the personal income tax collections, including STT, had surged to an impressive Rs 12.01 lakh crore (provisional, as of April 2024).

- For the assessment year (AY) 2024-25, there were 58.57 lakh first-time Income Tax Returns (ITRs) filers (Total ITRs filed for AY 2024-25 is 7.28 crore), showcasing India's economy becoming more formalised as more people voluntarily pay taxes.

- ITR is a form that individuals in India must submit to the Income Tax Department, containing information about their income and taxes for the financial year from 1st April to 31st March of the following year.

- The Income Tax Department has made significant progress since its inception, with revenue growing from Rs. 30 lakh to Rs. 20 lakh crore, doubling the tax base, and increasing the tax-to-GDP ratio, through initiatives like the rationalisation of corporate tax and the new tax regime.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. With reference to India’s decision to levy an equalization tax of 6% on online advertisement services offered by non-resident entities, which of the following statements is/are correct? (2018)

- It is introduced as a part of the Income Tax Act.

- Non-resident entities that offer advertisement services in India can claim a tax credit in their home country under the “Double Taxation Avoidance Agreements”.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (d)

Important Facts For Prelims

RBI to Launch Unified Lending Interface

Why in News?

The Reserve Bank of India (RBI) plans to launch the Unified Lending Interface (ULI) at national level to transform India’s lending sector. The ULI was launched as a pilot project by the RBI in 2023.

What is Unified Lending Interface (ULI)?

- About: ULI is a digital platform that is expected to make the lending process easy.

- It would enable friction-less credit while delivering banking services to farmers and MSME borrowers.

- Key Features of ULI:

- Consent-Based Digital Access: ULI will provide lenders with digital access to both financial and non-financial data of customers, including land records, through a consent-based system.

- Common and Standardised APIs: ULI will feature standardised Application Programming Interface (APIs) that allow for a ‘plug and play’ approach, simplifying data access and reducing technical integration complexity.

- The 'plug and play' concept refers to ready-made facilities with essential infrastructure like power, network etc allowing industries to start operations immediately.

- Potential Benefits:

- Frictionless Credit: ULI aims to facilitate a smoother lending experience by minimising paperwork, particularly for smaller and rural borrowers.

- Reduced Appraisal Time: By consolidating data from various sources, ULI will minimise the time required for credit evaluation.

- Centralised Data Access: The platform will consolidate financial and non-financial data from multiple sources, making it easily accessible to lenders.

- Focus on Agriculture and MSMEs: ULI is expected to address the large unmet demand for credit in sectors such as agriculture and Micro, Small, and Medium Enterprises (MSMEs).

- Relation to Other Digital Initiatives:

- JAM-UPI-ULI: ULI will be part of the 'new trinity' of JAM (Jan Dhan, Aadhaar, and Mobile), UPI, and ULI, representing a significant advancement in India’s digital infrastructure.

- Digital Infrastructure: The integration of these systems aims to cater to the large unmet demand for credit and enhance financial inclusion.

What are the Other Platforms that Facilitate Lending in india?

- Public Credit Registry (PCR): PCR is a central database that stores comprehensive credit information of borrowers to help lenders assess creditworthiness and reduce information asymmetry in the credit market.

- Account Aggregator (AA) Framework: AA Framework is a consent-based RBI-regulated platform that enables customers to share their financial information across institutions, streamlining access for lenders and facilitating quicker, informed lending decisions.

- Credit Information Companies (CICs): Companies like CIBIL, Equifax, Experian etc collect and maintain credit information of individuals and businesses.

- Trade Receivables Discounting System (TReDS): TReDS is an electronic platform that allows MSMEs to auction their trade receivables at competitive rates.

- Peer-to-Peer (P2P) Lending Platforms: Online platforms like Faircent and Lendbox allow individuals to lend and borrow money directly from each other.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. Which of the following phrases defines the nature of the ‘Hundi’ generally referred to in the sources of the post-Harsha period? (2020)

(a) An advisory issued by the king to his subordinates

(b) A diary to be maintained for daily accounts

(c) A bill of exchange

(d) An order from the feudal lord to his subordinates

Ans: (c)

Q. Consider the following statements: (2020)

- In terms of short-term credit delivery to the agriculture sector, District Central Cooperative

- Banks (DCCBs) deliver more credit in comparison to Scheduled Commercial Banks and Regional Rural Banks.

- One of the most important functions of DCCBs is to provide funds to the Primary Agricultural Credit Societies.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Rapid Fire

Civic Police Volunteers

The rape and murder of a doctor at Kolkata’s R.G. Kar Medical College has sparked widespread protests across India. The accused, a civic police volunteer (CPV) with access to sensitive areas of the hospital, has highlighted serious concerns about the oversight and roles of these volunteers.

- CPV, or village police volunteers as they are known in rural areas, are contractual workers engaged by the police for assistance, particularly in traffic management and other minor duties that do not require police personnel.

- They are not trained for formal law enforcement tasks, such as conducting investigations or making arrests.

- In West Bengal, to qualify as a CPV, individuals must be local residents, at least 20 years old, have passed Class VIII (initially Class X), and have no criminal record.

- Legal and Judicial Concerns: In Chandra Kanta Ganguli vs The State of West Bengal and Others, 2016, the Calcutta High Court has raised concerns about the recruitment and legal validity of CPVs, noting issues with the vetting process (background check).

- The High Court and police administration have stated that CPVs have been involved in law enforcement duties despite orders restricting them from such roles, leading to further legal concerns.

- Criticisms: There have been multiple reports of CPVs overstepping their roles and involvement in criminal activities.

- Critics argue that CPVs are sometimes appointed based on political loyalty rather than merit, leading to concerns about the politicization of the police force and potential conflicts of interest.

Rapid Fire

Japan’s SLIM Moon Mission

Recently, Japan's space agency, JAXA, has concluded operations of its Moon lander, the Smart Lander for Investigating Moon (SLIM), also known as the "Moon Sniper," after losing communication with it.

- This operation was halted after the failure of multiple attempts to establish connection with the SLIM spacecraft.

- About SLIM

- SLIM is a small-scale lunar lander designed for precise landings, reduced equipment size and weight, and investigating the Moon's origins.

- It was an uncrewed spacecraft that also aimed to test low-gravity exploration technology essential for future solar system exploration.

- It is nicknamed the "Moon Sniper" because of its ability to land very precisely on the Moon's surface.

- It made a soft landing on the Moon in January 2024, making Japan the 5th nation to achieve this feat.

- Other countries that have successfully achieved a soft lunar landing are India, Russia, the United States, and China.

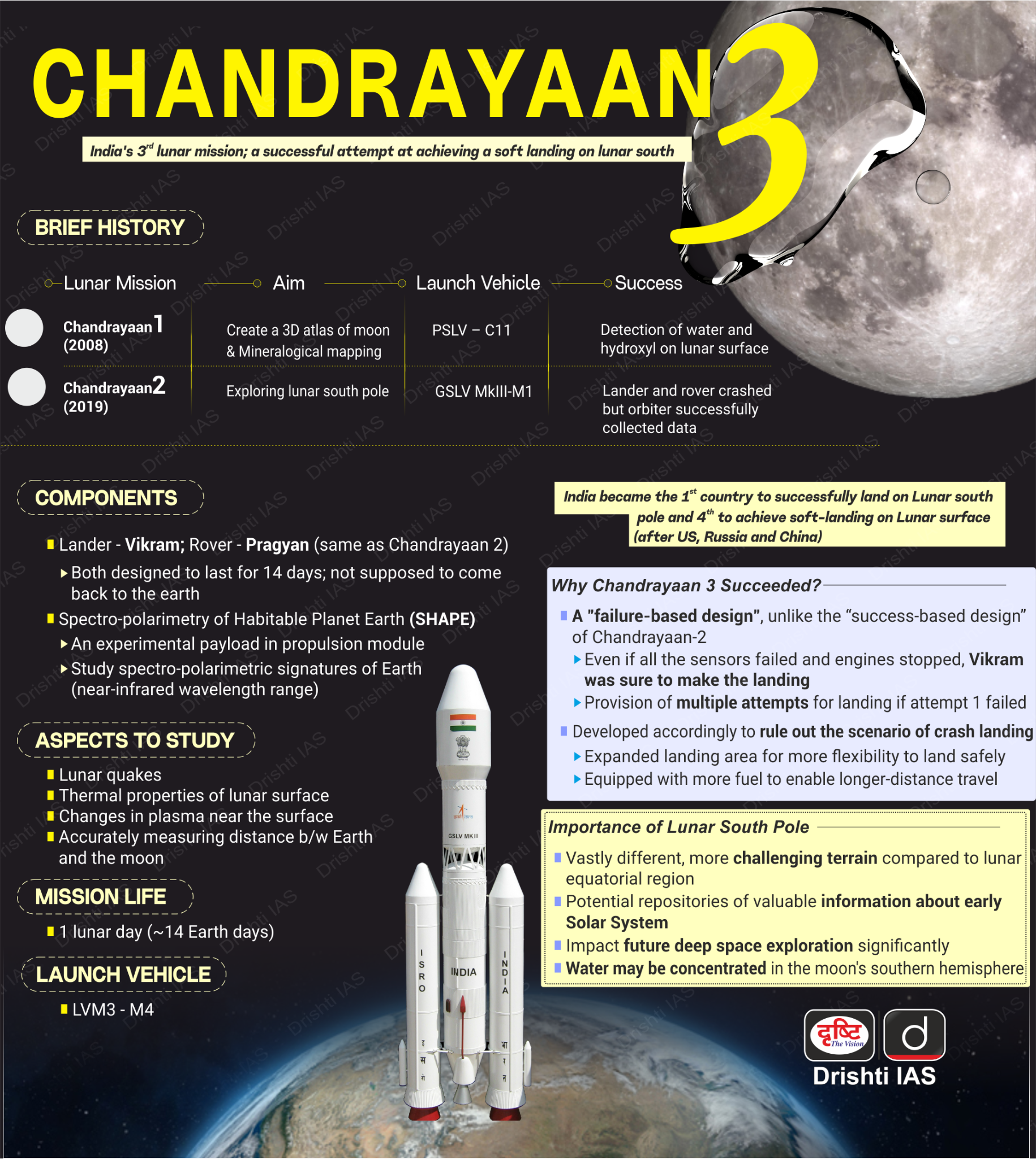

- ISRO’s Chandrayaan 3 Mission successfully soft-landed a lander on the moon, in the natural satellite’s south pole region.

Rapid Fire

Legal Right to Disconnect from Work

Recently, in a significant labour reform, Australia granted the legal right to "disconnect" from work outside of their designated hours.

- This reform allows Workers to refuse to monitor, read, or respond to work-related communications outside their official hours unless such refusal is deemed unreasonable.

- The determination of what constitutes an "unreasonable" refusal will be based on various factors, including the nature of the employee’s role and compensation for extra hours.

- Australia's legislation is in line with similar laws in European and Latin American countries, reflecting a global movement against the "always on" work culture.

- France introduced a similar right to disconnect in 2017, aiming to combat the constant connectivity facilitated by smartphones and other digital devices.

- Industry Concerns: Australian industry leaders have expressed concerns, labelling the law as rushed, confusing, and potentially disruptive to business operations.

- Employers are worried about the practical implications, such as the uncertainty of whether they can contact employees after hours for tasks like offering extra shifts.

- India has also explored similar protections with the Right to Disconnect Bill of 2018. However, this bill has yet to gain significant legislative traction.

Rapid Fire

Humanoid Skull for Gaganyaan Mission

Recently, the Indian Space Research Organisation’s (ISRO) Thiruvananthapuram unit has finalised the design of the skull for the humanoid on the Gaganyaan mission.

- It weighs 800 grams and measures 200 mm x 220 mm. It is made from a high-strength aluminium alloy that can endure pressure and vibration.

- Before launching astronauts for the Gaganyaan mission in 2025, ISRO will send a humanoid robot, Vyommitra, into space to test spacecraft safety.

- Vyommitra will resemble the upper human body, featuring movable arms, face, and neck equipped with sensors to perform human-like functions and assess the impacts of space travel.

Gaganyaan Mission: It will carry three Indian astronauts into space, about 400 km from the Earth’s surface, for three days.

- Indian Air Force pilots Prasanth Balakrishnan Nair, Ajit Krishnan, Angad Pratap and Shubhanshu Shukla have been selected for the Gaganyaan mission.

- Shubhanshu Shukla has been shortlisted for a joint ISRO-NASA space flight in 2025 which will take him to the International Space Station.