Indian Economy

Account Aggregator System

- 06 Sep 2021

- 3 min read

Why in News

Recently, eight major banks have joined the Account Aggregator (AA) network that will enable customers to easily access and share their financial data.

Key Points

- About:

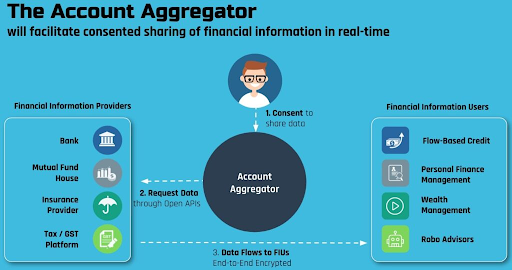

- An AA is a framework that simply facilitates sharing of financial information in a real-time and data-blind manner (Data flow through AA are encrypted) between regulated entities (Banks and NBFCs).

- The RBI (Reserve Bank of India) in 2016 approved AA as a new class of NBFC (Non Banking Financial Companies), whose primary responsibility is to facilitate the transfer of user’s financial data with their explicit consent.

- AAs enable flow of data between Financial Information Providers (FIPs) and Financial Information Users (FIUs).

- The architecture of AA is based on the Data Empowerment and Protection Architecture (DEPA) framework.

- DEPA is an architecture that lets users securely access their data and share the same with third parties.

- Significance:

- For Consumers:

- The AA framework allows customers to avail various financial services from a host of providers on a single portal based on a consent method, under which the consumers can choose what financial data to share and with which entity.

- It permits users to control who gets access to their data, track and log its movement and reduce the potential risk of leakage in transit.

- For Banks:

- As an addition to India’s digital infrastructure, it will allow banks to access consented data flows and verified data. This will help banks reduce transaction costs, which will enable them to offer lower ticket size loans and more tailored products and services to their customers.

- Reduce Frauds:

- AA reduces the fraud associated with physical data by introducing secure digital signatures and end-to-end encryption for data sharing.

- For Consumers:

Way Forward

- Going ahead, a large number of Small and Medium Enterprises (SMEs) can be reached without physical branches and it will transform credit penetration. As we go deeper into this, open banking works wonderfully as India is underserved when it comes to credit and other financial products. A large push will come from awareness and ecosystem-level adoption.

- AA framework can be extended to handle data from other domains also, such as data related to healthcare and telecom. However, if non-licensed entities have to be allowed it is important to have a data privacy framework in place as the RBI currently looks at safeguarding only financial data within its mandate.