Indian Economy

Supreme Court’s Verdict on Demonetisation

- 04 Jan 2023

- 7 min read

Prelims: Supreme court, Constitution Bench, RBI, Section 26(2) of RBI Act.

Mains: Supreme Court’s Verdict on Demonetization.

Why in News?

Recently, the Supreme Court has passed a verdict on the Demonetisation of currency notes of Rs 500 and Rs 1,000 in a majority 4-1 by a five-judge Constitution Bench.

What are the Rulings of the Verdict?

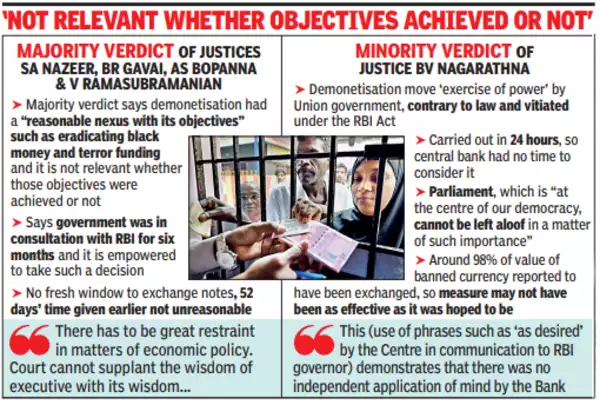

- Majority Ruling:

- The majority held that Centre’s notification dated November 8, 2016 is valid and satisfies the test of proportionality.

- The RBI and the Centre had been in consultation with each other for six months prior to the November 8 notification issued under Section 26(2) of the RBI (Reserve Bank Of India) Act, 1934.

- The statutory procedure under Section 26(2) of the RBI Act was not violated merely because the Centre had taken the initiative to “advice” the Central Board to consider recommending demonetisation.

- The government was empowered under the provision to demonetise “all series” of banknotes.

- On hasty decision, the court said such measures undisputedly are required to be taken with utmost confidentiality and speed. If the news of such a measure is leaked out, it is difficult to imagine how disastrous the consequences would be.

- Demonetisation was done for the “proper purposes” of eliminating fake currency, black money and terror financing.

- Minority Ruling:

- The government could have issued a notification under Section 26(2) of the RBI Act only if the RBI had initiated the proposal to demonetise by way of a recommendation.

- Therefore, the government's notification issued under Section 26(2) of the RBI Act was unlawful.

- In cases in which the government initiates demonetisation, it should take the opinion of the RBI. The opinion of the Board should be “independent and frank”.

- If the Board’s opinion was in the negative, the Centre could still go forward with the demonetisation exercise, but only by promulgating an ordinance or by enacting a parliamentary legislation.

- Describing the Parliament as the “nation in miniature”, “without the Parliament, democracy will not thrive”.

What is the Test of Proportionality?

- The test of proportionality is a commonly employed legal method used by courts around the world, typically constitutional courts, to decide cases where two or more legitimate rights clash.

- When such cases are decided, one right typically prevails at the expense of the other and the court thus has to balance the satisfaction of some rights and the damage to other rights resulting from a judgment.

- The principle of proportionality ordains that the administrative measure must not be more drastic than is necessary for attaining the desired result.

What was Demonetisation?

- About:

- On 8th November 2016, the government announced that the largest denomination of Rs 500 and Rs 1000 were demonetised with immediate effect ceasing to be a legal tender.

- It is the act of stripping a currency unit of its status as legal tender or fiat money.

- It occurs whenever there is a change of national currency and the current form or forms of money is pulled from circulation and retired, often to be replaced with new notes or coins.

- Objectives of Demonetisation:

- To discourage the use of high-denomination notes for illegal transactions and thus curb the widespread use of black money.

- To encourage digitisation of commercial transactions, formalise the economy and so, boost government tax revenues.

- The formalisation of the economy means bringing companies under the regulatory regime of government and subject to laws related to manufacturing and income tax.

- Operation Clean Money:

- It was launched by the Income Tax Department (CBDT) for e-verification of large cash deposits made during the period from 9th November to 30th December 2016.

- The programme was launched on 31st January 2017 and entered into the second phase in May 2017.

- It aimed to verify cash transaction status (exchange/savings of banned notes) of taxpayers during the demonetisation period and to take tax enforcement action if transactions do not match the tax status.

- Impact of the Move:

- Currency with the public stood at Rs. 17.97 lakh crore on 4th November 2016 and declined to Rs 7.8 lakh crore in January 2017 after demonetisation.

- Demands fell, businesses faced a crisis and gross domestic product (GDP) growth declined nearly 1.5%, with many small units and shops being shut down and it also created a liquidity shortage.

- Liquidity shortages or crises arise when financial institutions and industrial companies scramble for, and cannot find the cash they require to meet their most urgent needs or undertake their most valuable projects.

Way Forward

- Demonetization was an expeditious move to boldly counter the black money and parallel economy (illegal economy, such as money laundering, smuggling, etc.) threat with visible impact on how the government's policies are perceived in international circles of economic power.

- This move by the government achieved greater significance for a globally connected India as it showed boldness in tackling an issue which has remained a thorn in the growth success story of this generation.