Indian Economy

Money Laundering

- 28 Aug 2019

- 7 min read

Why in news?

The Asia-Pacific Group (APG) on Money Laundering, a regional affiliate of the Financial Action Task Force (FATF), has placed Pakistan in the "Enhanced Expedited Follow Up List (Blacklist)" for its failure to meet its standards.

What is Money Laundering?

- Money laundering is concealing or disguising the identity of illegally obtained proceeds so that they appear to have originated from legitimate sources. It is frequently a component of other, much more serious, crimes such as drug trafficking, robbery or extortion.

- According to the IMF, global Money Laundering is estimated between 2 to 5% of World GDP.

How Money Laundering works?

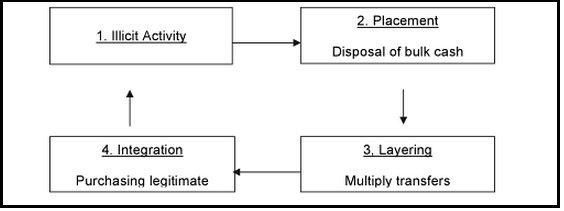

- It involves three steps: placement, layering and integration.

- Placement puts the "dirty money" into the legitimate financial system.

- Layering conceals the source of the money through a series of transactions and bookkeeping tricks.

- In the case of integration, the now-laundered money is withdrawn from the legitimate account to be used for criminal activities.

- Money Laundering can take several forms, some of them are:

- Structuring also called as Smurfing

- Bulk Cash Smuggling

- Cash intensive Businesses

- Trade based Laundering

- Shell companies

- Round tripping

- Gambling

- Black salaries

- Tax amnesties

- Transaction laundering

Impacts of Money Laundering

- Economic Impacts:

- Undermines legitimacy of private sector

- Undermines integrity of financial markets

- Loss of control of economic policy

- Economic distortion and instability

- Loss of revenue

- Security threats to privatisation efforts

- Volatility in exchange rates and interest rates due to unanticipated transfers of funds

- Rise of economic prices

- Affects trade and international capital flows

- Social Impacts:

- Increased criminality

- Decreases human development

- Misallocation of resources

- Affects trust of local citizens in their domestic financial institutions

- Declines the moral and social position of the society by exposing it to activities such as drug trafficking, smuggling, corruption and other criminal activities

- Political Impacts:

- Initiates political distrust and instability

- Criminalisation of politics

Steps Taken by Government of India to Prevent Money Laundering

- Criminal Law Amendment Ordinance (XXXVIII of 1944): It covers proceeds of only certain crimes such corruption, breach of trust and cheating and not all the crimes under the Indian Penal Code.

- The Smugglers and Foreign Exchange Manipulators (Forfeiture of Property) Act, 1976: It covers penalty of illegally acquired properties of smugglers and foreign exchange manipulators and for matters connected therewith and incidental thereto.

- Narcotic Drugs and Psychotropic Substances Act, 1985: It provides for the penalty of property derived from, or used in illegal traffic in narcotic drugs.

- Prevention of Money-Laundering Act, 2002 (PMLA)

- It forms the core of the legal framework put in place by India to combat Money Laundering.

- The provisions of this act are applicable to all financial institutions, banks(Including RBI), mutual funds, insurance companies, and their financial intermediaries.

- PMLA (Amendment) Act, 2012

- Adds the concept of ‘reporting entity’ which would include a banking company, financial institution, intermediary etc.

- PMLA, 2002 levied a fine up to Rs 5 lakh, but the amendment act has removed this upper limit.

- It has provided for provisional attachment and confiscation of property of any person involved in such activities.

- Financial Intelligence Unit-IND: It is an independent body reporting directly to the Economic Intelligence Council (EIC) headed by the Finance Minister.

- Enforcement Directorate (ED):

- It is a law enforcement agency and economic intelligence agency responsible for enforcing economic laws and fighting economic crime in India.

- One of the main functions of ED is to Investigate offences of money laundering under the provisions of Prevention of Money Laundering Act, 2002(PMLA).

- It can take actions like confiscation of property if the same is determined to be proceeds of crime derived from a Scheduled Offence under PMLA, and to prosecute the persons involved in the offence of money laundering.

- India is a full-fledged member of the FATF and follows the guidelines of the same.

Global efforts to combat Money Laundering

- The Vienna Convention: It creates an obligation for signatory states to criminalize the laundering of money from drug trafficking.

- The 1990 Council of Europe Convention: It establishes a common criminal policy on Money Laundering.

- G-10’s Basel Committee statement of principles: It issued a “statement of principles” with which the international banks of member states are expected to comply.

- The International Organization of Securities Commissions (IOSCO): It encourages its members to take necessary steps to combat Money Laundering in securities and futures markets.

- The Financial Action Task Force:

- It has been set up by the governments of the G-7 countries at their 1989 Economic Summit, has representatives from

- 24 OECD countries

- Hong Kong

- Singapore

- The Gulf Cooperation Council

- The European Commission

- It monitores members’ progress in applying measures to counter Money Laundering.

- The famous Forty Recommendations are given by FATF.

- It has been set up by the governments of the G-7 countries at their 1989 Economic Summit, has representatives from

- IMF: It has pressed its 189 member countries to comply with international standards to thwart terrorist financing.

- The United Nations office on Drugs and Crime: It proactively tries to identify and stop Money Laundering.

Way Forward

The evolving threats of money laundering supported by the emerging technologies need to be addressed with the equally advanced Anti-Money Laundering mechanisms like big data and artificial intelligence. Both international and domestic stakeholders need to come together by strengthening data sharing mechanisms amongst them to effectively eliminate the problem of money laundering.