Biodiversity & Environment

18th India State of Forest Report 2023

For Prelims: India State of Forest Report, Forest Survey of India, Carbon Stock, Western Ghats Eco-Sensitive Areas, Mangrove, Nationally Determined Contribution, Carbon Sink, Degraded Land, Bonn Challenge, Global Forest Resource Assessment, FAO, Forest Cover, National Commission on Agriculture, UNDP, Soil Health, Biodiversity, Paris Agreement.

For Mains: Status of forest and tree cover in India.

Why in News?

Recently, the Ministry for Environment, Forest and Climate Change released the 18th India State of Forest Report 2023 (ISFR 2023).

- ISFR is brought out by the Forest Survey of India (FSI) on a biennial basis since 1987.

What are the Key findings of ISFR 2023?

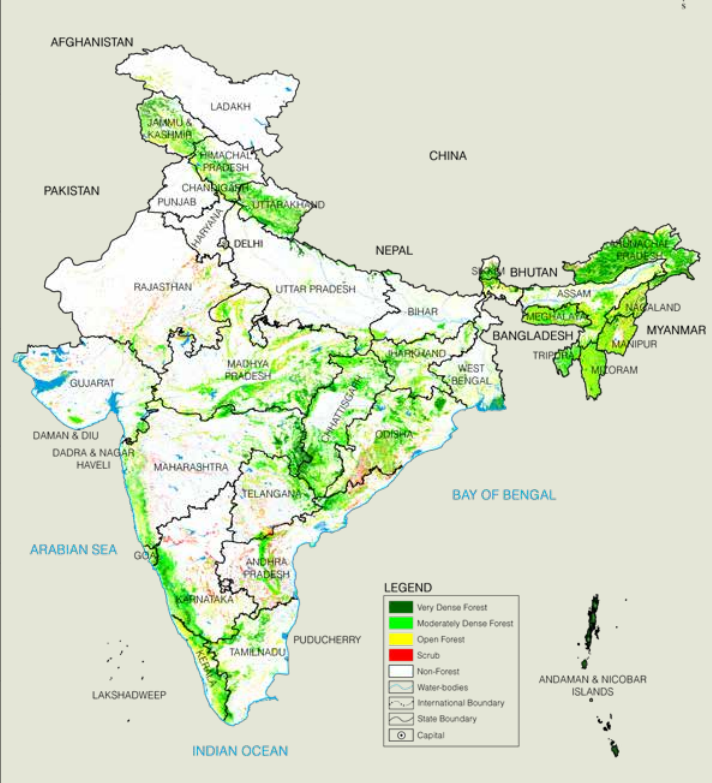

- Forest and Tree Cover: The total forest and tree cover of the country is 8,27,356.95 km2 which is 25.17% of the geographical area (GA) of the country.

- The total Forest Cover has an area of 7,15,342.61 km2 (21.76%) whereas the Tree Cover has an area of 1,12,014.34 km2 (3.41%).

|

Class |

Area (km²) |

Percentage of GA |

|

Forest Cover |

7,15,342.61 |

21.76% |

|

Tree Cover |

1,12,014.34 |

3.41% |

|

Total Forest and Tree Cover |

8,27,356.95 |

25.17% |

|

Scrub |

43,622.64 |

1.33% |

|

Non Forest |

24,16,489.29 |

73.50% |

|

Geographical Area of the Country |

32,87,468.88 |

100.00% |

- Increase in Forest and Tree Cover: The country's forest and tree cover has increased by 1,445.81 km², with a 156.41 km² rise in forest cover compared to 2021.

- Maximum increase (Forest and Tree Cover): Chhattisgarh (684 sq km) followed by Uttar Pradesh (559 sq km), Odisha (559 sq km) and Rajasthan (394 sq km).

- Maximum Increase (Forest Cover): Mizoram (242 sq km) followed by Gujarat (180 sq km) and Odisha (152 sq km).

- Largest Decrease: Madhya Pradesh (612.41 km²) followed by Karnataka (459.36 km²), Ladakh (159.26 km²), and Nagaland (125.22 km²).

- Top Three States: Area wise top three states having largest forest cover are Madhya Pradesh (77,073 sq km) followed by Arunachal Pradesh (65,882 sq km) and Chhattisgarh (55,812 sq km).

- In terms of percentage of forest cover with respect to total geographical area, Lakshadweep (91.33%) has the highest forest cover followed by Mizoram (85.34%) and Andaman & Nicobar Island (81.62%).

- High Forest Cover: 19 states/UTs have above 33% of the geographical area under forest cover.

- Out of these, eight states/UTs namely Mizoram, Lakshadweep, A & N Island, Arunachal Pradesh, Nagaland, Meghalaya, Tripura, and Manipur have forest cover above 75%.

- Carbon Stock: The country's forest carbon stock is estimated at 7,285.5 million tonnes, with an increase of 81.5 million tonnes compared to 2021.

- Top 3: Arunachal Pradesh (1,021 Mt) followed by Madhya Pradesh (608 Mt), Chhattisgarh (505 Mt) and Maharashtra (465 Mt).

- India's carbon stock has reached 30.43 billion tonnes of CO2 equivalent, exceeding the 2005 base year by 2.29 billion tonnes, nearing the 2030 target of 2.5–3.0 billion tonnes.

- Regional Performance: The Western Ghats Eco-Sensitive Areas (WGESA) covers 60,285.61 km², with 44,043.99 km² (73%) under forest cover.

- The total forest and tree cover in the Northeastern region is 1,74,394.70 km2 , which is 67% of the geographical area of these states.

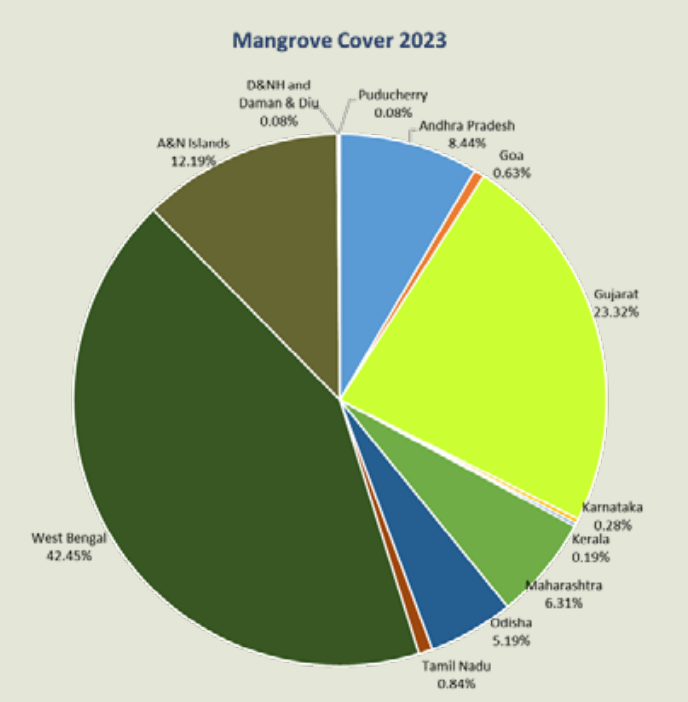

- Mangrove Cover: India's mangrove cover is 4,991.68 km², representing 0.15% of the total geographical area, with a net decrease of 7.43 km² since 2021.

- Gujarat saw a decrease of 36.39 km² in mangrove cover, while Andhra Pradesh and Maharashtra experienced increases of 13.01 km² and 12.39 km², respectively.

- Forest Fire: The top three states with the most fire incidents in the 2023-24 season are Uttarakhand, Odisha, and Chhattisgarh.

Note

- Paris Agreement: In the Nationally Determined Contribution (NDC) commitments made at the Paris Climate Change Agreement, India has resolved to create an additional carbon sink of 2.5 to 3 billion tonnes of CO2 equivalent through additional forest and tree cover by 2030.

- Bonn Challenge: India has also pledged to bring in 26 million hectares of degraded land under restoration by 2030, as part of Bonn Challenge.

- Livelihood: India’s forests support the livelihoods of about 17% of the global human population and 18% of the world’s total livestock.

- Global Standing: As per Global Forest Resource Assessment (GFRA, 2020) published by FAO, India is ranked amongst the top 10 countries of the world, in terms of forest area and holds 3rd position for highest annual net gain in forest cover between 2010-2020.

Forest Survey of India

- Established: Established on 1st June 1981, succeeding the Pre Investment Survey of Forest Resources (PISFR) initiated in 1965.

- In 1976, the National Commission on Agriculture (NCA) recommended establishing a National Forest Survey Organization, leading to the creation of FSI.

- PISFR was initiated in 1965 by the Government of India with the sponsorship of FAO and UNDP.

- Parent Organization: Ministry of Environment and Forests, Government of India.

- Primary Objective: To assess and monitor the forest resources of India regularly.

- In addition, it is also engaged in providing the services of training, research and extension.

- Functioning: FSI has headquarters at Dehradun and has pan India presence with four regional offices at Shimla, Kolkata, Nagpur and Bangalore.

- The Eastern zone has a sub centre at Burnihat (Meghalaya).

What are the Trend in Forestry Parameters Between 2013-2023?

- Increase in Greenery: The forest cover of the country has shown an increase of 16,630.25 km2.

- The tree cover has shown an increase of 20,747.34 km2.

- Mangrove cover of the country has increased by 296.33 km2.

- Soil Health: There is a general improvement in soil health (87.16% of shallow to deep soil as against 83.53% in 2013) reflected by improvement in humus.

- The soil organic carbon has increased from 55.85 tonnes per hectare to 56.08 tonnes per hectare.

- Soil organic carbon is carbon contained in soil organic matter which contributes to soil aggregation, enhancing soil structure and stability.

- The soil organic carbon has increased from 55.85 tonnes per hectare to 56.08 tonnes per hectare.

- Biotic influences: Biotic influences on forests have also come down to 26.66% from 31.28% in 2013 which indicates improved floral biodiversity, and improved surroundings for faunal biodiversity.

- Biotic influences are any influence of living organisms. In forests, the biotic influences could include grazing, browsing, man-made fire, pollarding, illicit felling, and lopping.

Conclusion

The 18th India State of Forest Report 2023 highlights positive trends in forest and tree cover, carbon stock, and soil health, while addressing challenges like forest fires and mangrove loss. India's commitment to global climate goals, such as the Paris Agreement and Bonn Challenge, reinforces its ongoing conservation efforts.

|

Drishti Mains Question: Analyze the key findings of the 18th India State of Forest Report 2023 (ISFR 2023) and assess its implications for India’s environmental sustainability and climate change goals. |

UPSC Civil Services Examination Previous Year’s Question (PYQs)

Prelims

Q. Consider the following States: (2019)

- Chhattisgarh

- Madhya Pradesh

- Maharashtra

- Odisha

With reference to the States mentioned above, in terms of percentage of forest cover to the total area of State, which one of the following is the correct ascending order?

(a) 2-3-1-4

(b) 2-3-4-1

(c) 3-2-4-1

(d) 3-2-1-4

Ans: (c)

Q. A particular State in India has the following characteristics: (2012)

- It is located on the same latitude which passes through northern Rajasthan.

- It has over 80% of its area under forest cover.

- Over 12% of forest cover constitutes Protected Area Network in this State.

Which one among the following States has all the above characteristics?

(a) Arunachal Pradesh

b) Assam

(c) Himachal Pradesh

(d) Uttarakhand

Ans: (a)

Mains

Q. Examine the status of forest resources of India and its resultant impact on climate change (2020).

Q. Discuss the causes of depletion of mangroves and explain their importance in maintaining coastal ecology (2019)

Governance

SAFE Accommodation: Worker Housing for Manufacturing Growth Report

For Prelims: NITI Aayog, Labor Mobility, Economic Survey, Nominal GVA, Semiconductor, Special Economic Zone, Floor Area Ratios, Minimum Wage, Viability Gap Funding, Labourforce.

For Mains: Need of accommodation facilities for workers to promote growth in the manufacturing sector.

Why in News?

Recently, NITI Aayog released a report on SAFE Accommodation: Worker Housing for Manufacturing Growth that explores the crucial role of secure, affordable, flexible, and efficient (SAFE) accommodations for industrial workers.

- It identifies key challenges, offers actionable solutions, and highlights the pivotal interventions required to scale up such housing facilities across the country.

Note: SAFE accommodation originally stands for Site Adjacent Factory Employee Accommodation.

What is SAFE Accommodation?

- About: SAFE Accommodation is a concept aimed at providing housing facilities for employees close to their workplace, typically near industrial or factory sites.

- Facilities: It includes long term dormitory-style accommodation which is rented directly to workers or their employers.

- It includes essential amenities such as water, electricity, sanitation facilities, and other basic services like food, laundry, and dispensary facilities.

- It excludes family housing.

- Objectives:

- Facilitate labor mobility and productivity through SAFE accommodations to enhance manufacturing competitiveness.

- Designate workers' accommodations as critical infrastructure with tailored regulations for construction and operation.

- Develop a market-driven ecosystem for private developers to provide affordable accommodations with attractive returns.

Note: Dormitory-style accommodation is a large space with many rooms where people sleep. It can also refer to a room with multiple beds for people to stay in.

What SAFE Accommodation Helps in Manufacturing Growth?

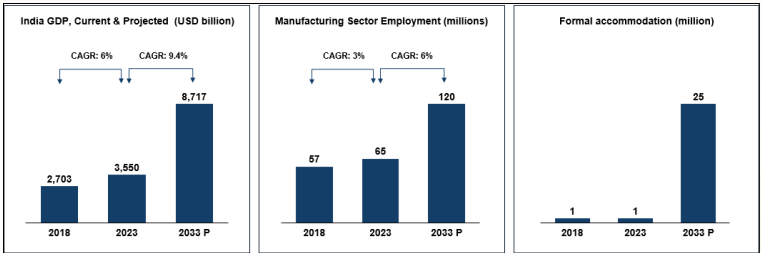

- Manufacturing Growth: According to the Economic Survey 2023-24, India needs to add 7.85 million jobs every year until 2030 to sustain economic growth.

- Formal accommodations near work sites can attract and retain the workforce necessary to support this expansion.

- Women Empowerment: In China, women contribute 41% to the GDP with a 61% labor participation rate, nearly double India's 18% GDP contribution and lower participation.

- SAFE Accommodation can ensure secure housing for women while generating employment and opportunities for them.

- Sectoral Transition: Manufacturing employs 11% of the workforce but contributes 14% to nominal GVA, while agriculture employs 46% but contributes only 18% to GVA.

- SAFE Accommodation can help transfer surplus labourforce from agriculture to industry.

- India aims to increase the share of manufacturing in its GDP to 25%. However, it has been hovering around 14-16% since FY12.

- Supporting Make in India: Specific industrial hubs are emerging, such as the assembly and packaging industry in Sriperumbudur, Tamil Nadu, the Electric Vehicle (EV) hub in Hosur, Tamil Nadu, and the semiconductor hub in Dholera, Gujarat.

- SAFE Accommodation can help secure adequate workforce in a single concentrated location which will typically include migrant workers.

- Rising Accommodation Demand: India needs to grow economically at a Compound Annual Growth Rate (CAGR) of 9.4% per annum to reach its Viksit Bharat goals and create more jobs.

- By 2033, ~20% of the workforce may prefer affordable formal housing, requiring 25 million housing units for manufacturing workers.

- Enhances Productivity and Retention: Proximate and well-designed housing improves workers’ quality of life, reduces commute times, and enhances overall productivity.

- This leads to lower attrition rates and recruitment costs, ensuring a stable and skilled workforce for factories.

- Attracting Global Investments: Multinational corporations prioritise worker welfare and efficiency, with quality accommodations making India a preferred manufacturing hub.

- It aligns with global labour standards that prioritise adequate and safe worker housing.

Global Examples of SAFE Accommodation

- China: A majority of migrant factory workers were accommodated in workers’ dormitories built by employers, often on land provided for free by local governments.

- About 80% of the thirty million assembly-line workers in China’s Special Economic Zones are female recruited from rural areas of interior provinces.

- Accommodation is often part of the employment agreement.

- Japan: Early Japanese industrialisation housed female labour force from faraway villages in dormitory accommodation.

- Singapore: Singapore has a separate act for migrant housing called the Foreign Employee Dormitories Act, 2015 and differential building regulations for workers’ dormitories.

- Vietnam: Vietnam had approved a plan to build 1 million social housing units for low- and middle-income households in urban areas and for workers in industrial parks to facilitate recruitment of female labour from rural areas.

What Challenges are Involved in Scaling Up Worker Accommodation?

- Restrictive Zoning Laws: Residential developments are often prohibited in industrial zones unless explicitly permitted, forcing workers to live far from their workplaces.

- This increases commute times and costs, impacting productivity and retention.

- Conservative Building Bye-Laws: Low Floor Area Ratios (FAR) and other inefficient land-use regulations limit the potential for high-capacity housing on available land.

- High Operating Costs: Hostel accommodations in industrial zones are often classified as commercial establishments, leading to higher property taxes and utility rates.

- These increased costs discourage private sector participation.

- Financial Viability: High capital costs and low returns make large-scale worker accommodation projects unattractive to private developers.

- Infrastructure investors require a lease rental of Rs. 4,000 per worker for 80 square feet which is about 30% of a minimum-wage worker's salary, making it unaffordable for many.

- Coordination: Coordination challenges also arise, as industrial hubs require synchronized investments in housing, infrastructure, and industries to succeed.

What is the Proposed Way Forward?

- Regulatory Recommendations:

- Reclassify Worker Accommodations: Designate SAFE accommodations as a distinct residential category, ensuring residential property tax, electricity, and water tariffs apply, along with GST exemptions for accommodations.

- E.g., Rs 20,000 per person for a continuous 90-day stay.

- Environmental Clearances: Include SAFE accommodations under the exemptions provided for industrial sheds, schools, colleges, and hostels in the draft notification issued by the Ministry of Environment, Forest, and Climate Change (MoEFCC).

- Gender-Inclusive Policies: Encourage the development of accommodations suitable for workers, addressing their specific safety and welfare needs.

- Flexible Zoning Laws: Amend zoning regulations to allow mixed-use developments near industrial hubs, facilitating worker housing close to workplaces.

- Reclassify Worker Accommodations: Designate SAFE accommodations as a distinct residential category, ensuring residential property tax, electricity, and water tariffs apply, along with GST exemptions for accommodations.

- Financial Recommendations:

- Viability Gap Funding (VGF): Provide up to 30%-40% of project costs (excluding land) through VGF support.

- This includes 20% from the Department of Economic Affairs (DEA) and 10% from the sponsoring nodal ministry, with additional contributions from state governments.

- Competitive Bidding: Implement transparent bidding processes to determine VGF support, ensuring efficiency and cost-effectiveness.

- Retrofitting Existing Facilities: Leverage VGF to upgrade brownfield worker accommodations, enhancing their safety, capacity, and utility.

- Viability Gap Funding (VGF): Provide up to 30%-40% of project costs (excluding land) through VGF support.

|

Drishti Mains Question: Q.How can SAFE accommodations contribute to improving women’s workforce participation in India? Illustrate with global examples |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. In the context of the Indian economy, non-financial debt includes which of the following? (2020)

- Housing loans owed by households

- Amounts outstanding on credit cards

- Treasury bills

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)

Q. With reference to the role of UN-Habitat in the United Nations programme working towards a better urban future, which of the statements is/are correct?(2017)

- UN-Habitat has been mandated by the United Nations General Assembly to promote socially and environmentally sustainable towns and cities to provide adequate shelter for all.

- Its partners are either governments or local urban authorities only.

- UN-Habitat contributes to the overall objective of the United Nations system to reduce poverty and to promote access to safe drinking water and basic sanitation.

Select the correct answer using the code given below:

(a) 1, 2 and 3

(b) 1 and 3 only

(c) 2 and 3 only

(d) 1 only

Ans: (b)

Mains

Q. With a brief background of quality of urban life in India, introduce the objectives and strategy of the ‘Smart City Programme.” (2016)

Q. Discuss the various social problems which originated out of the speedy process of urbanization in India. (2013)

Agriculture

Making India’s FPOs Global

For Prelims: Farmer Producer Organisations, Indian Council for Research on International Economic Relations, Small Farmers’ Agribusiness Consortium, Cooperative Society, Small and Marginal Farmers, FSSAI, BIS, APEDA, Spices Board, ONDC, eNAM, Kandhamal Turmeric, Sanitary and Phytosanitary Measures.

For Mains: Challenges and Opportunities in farmer producer organisations (FPOs).

Why in News?

Recently, Indian Council for Research on International Economic Relations (ICRIER) analyzed issues plaguing India’s farmer producer organisations (FPOs) and suggested reforms.

- ICRIER (1981) is a prominent Indian policy research think tank specialising in Agriculture, Climate Change, Digital Economy, Economic Growth among others.

What is a Farmers Producer Organisation?

- About: FPO is a type of producer organisation (PO) where the members are farmers.

- Small Farmers’ Agribusiness Consortium (SFAC) supports promotion of FPOs.

- PO is a generic name for an organisation of producers of any produce, e.g., agricultural, non-farm products, artisan products, etc.

- A PO can be a producer company, a cooperative society or any other legal form which provides for sharing of profits/benefits among the members.

- Need for FPO: To help small and marginal farmers achieve economies of scale, increase their bargaining power by negotiating collectively, double their income, and reach the global markets.

- In India, small and marginal farmers represent 86% of farmers.

- Ownership: The ownership of the FPO is with its members. It is an organization of the producers, by the producers and for the producers.

- Legal Forms of FPO: FPOs can be registered under:

- Companies Act, 1956 and Companies Act, 2013.

- Societies registered under Society Registration Act, 1860

- Public Trusts registered under Indian Trusts Act, 1882

- Differences between PO and Cooperative Societies:

|

Parameter |

Cooperative Society |

Producer Organisation |

|

Objectives |

Single object |

Multi-object |

|

Membership |

Individuals and cooperatives |

Any individual, group, association, producer of goods or services |

|

Government control |

Highly patronized to the extent of interference |

Minimal, limited to statutory requirements |

|

Reserves |

Created if there are profits |

Mandatory to create every year |

What Problems are Plaguing India’s FPOs?

- Limited Market Linkages: Around 80% FPOs are unable to identify and reach buyers, manufacturers, processors, and exporters.

- Lack of Product Information: Although over 8,000 FPOs are registered on the website of the ministry of agriculture and farmers welfare, there is no information on which products they cater to.

- Companies and foreign agents prefer sourcing through traders and traditional mandis due to the lack of information.

- Complex Regulations:

- Multiplicity of Standards: Different agencies like FSSAI, BIS, APEDA, and Spices Board provide varying standards that confuse FPOs about compliance and market access.

- Information Deficit: About 72% of FPOs find the domestic standard-setting process too complex and lack adequate knowledge of export standards and requirements.

- Non-Acceptance by Importing Countries: Very few countries have mutual recognition agreements for standards with India.

- Although our standards are good, they are rarely accepted by importing countries.

- Traceability Issues: Global buyers want product traceability, and many FPOs do not know how to implement it.

- Product traceability tracks products through the supply chain by logging and monitoring manufacturing data at each step.

- Limited E-commerce Adoption: Despite government initiatives like ONDC and eNAM, FPOs have limited awareness and capability to leverage e-commerce platforms effectively.

- E.g., as of November, 2024, no turmeric FPOs are listed on ONDC.

Success Story of FPOs in India

- Kandhamal Apex Spices Association for Marketing (KASAM) in Odisha has been set up for promoting Kandhamal turmeric. It is a collaboration of 61 Spice Development Societies under the government of Odisha.

- It signed a memorandum of understanding with Kisan Saathi, under which the former has been working with two KASAM FPOs—Gumapadar FPC Ltd. and Sastri FPC Ltd.—to help them to reach global markets.

- Gumapadar FPC Ltd. is exporting Kandhamal turmeric to NedSpice Group from the Netherlands.

- It signed a memorandum of understanding with Kisan Saathi, under which the former has been working with two KASAM FPOs—Gumapadar FPC Ltd. and Sastri FPC Ltd.—to help them to reach global markets.

- This demonstrates that with strategic partnerships and coordinated efforts, FPOs can overcome market barriers and go global.

Global Success Stories

- Mexico (Ejido System): Ejidos are communal farming systems where land is collectively owned and managed by communities.

- It helped farmers access international markets, particularly in crops like avocados and berries.

- Thailand: Thailand has a strong network of agricultural cooperatives, especially in rice production.

- Programs like "One Tambon (Village) One Product" promote unique local agricultural products.

- China: Farmer Professional Cooperatives (FPCs) in sectors like tea, fruits, and aquaculture have successfully penetrated global markets.

- Platforms like Alibaba have enabled cooperatives to sell directly to consumers.

Way Forward

- Database of FPOs: Develop a detailed, product-specific database of FPOs to enable global companies to locate and engage with relevant FPOs.

- Enhance visibility and foster partnerships for better price realization and address barriers like lack of product traceability.

- E-commerce Platforms: There is a need for increased support to onboard the FPOs on e-commerce platforms, along with educating farmers on using government platforms like the eNAM to help them expand market reach.

- Global Compliance Standards: Knowledge transfer on global compliance standards like sanitary and phytosanitary measures, maximum residue levels, and technical barriers to trade is crucial to avoid rejection of India’s agricultural products.

- Product-Specific Training: There is a need for product-specific training and guidelines related to compliance standards and regulations for key markets.

- Scaling Up Best Practices: Identify successful case studies like Kandhamal turmeric FPOs and replicate these models through structured knowledge-sharing mechanisms.

|

Drishti Mains Question: Examine the key challenges faced by FPOs in India and suggest reforms to make them more effective in enhancing farmers' market access. |

UPSC Civil Services Examination Previous Year’s Question (PYQs)

Prelims

Q. With reference to ‘Urban Cooperative Banks’ in India, consider the following statements:

- They are supervised and regulated by local boards set up by the State Governments.

- They can issue equity shares and preference shares.

- They were brought under the purview of the Banking Regulation Act, 1949 through an Amendment in 1966.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b)

Q. Consider the following statements: (2020)

- In terms of short-term credit delivery to the agriculture sector, District Central Cooperative

- Banks (DCCBs) deliver more credit in comparison to Scheduled Commercial Banks and Regional Rural Banks.

- One of the most important functions of DCCBs is to provide funds to the Primary Agricultural Credit Societies.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Mains

Q. In the villages itself no form of credit organisation will be suitable except the cooperative society.” – All India Rural Credit Survey. Discuss this statement in the background of agricultural finance in India. What constraints and challenges do financial institutions supplying agricultural finance face? How can technology be used to better reach and serve rural clients? (2014)

Indian Economy

RBI Report on State Finances 2024-25

For Prelims: Reserve Bank of India, Tax buoyancy, Gross Domestic Product, Pradhan Mantri Ujjwala Yojana, Production Linked Incentives, Centrally-Sponsored Schemes, State Goods and Services Tax

For Mains: Impact of Subsidies on Fiscal Health of States, Fiscal Discipline for Sustainable Growth, State budgets.

Why in News?

The Reserve Bank of India's (RBI) report, State Finances – A Study of Budgets of 2024-25, highlighted the progress made by state governments in fiscal consolidation, alongside significant challenges such as high debt levels and rising subsidies.

What are the Key Highlights of the Report?

- States Performance Post-Pandemic:

- Improved Tax Revenue: The average tax buoyancy (responsiveness of tax revenue to changes in the economic growth rate) increased to 1.4 (during 2021-25) from 0.86 (during 2013 to 2020), reflecting improved efficiency in tax collection.

- Higher tax revenues have enabled states to allocate greater funds for asset creation, including highways and bridges.

- Capital Expenditure: States have consistently improved the quality of expenditure, with capital expenditure rising from 2.4% of Gross Domestic Product (GDP) in 2021-22 to 2.8% in 2023-24, and it is budgeted at 3.1% of GDP in 2024-25.

- This indicates a sustained focus on improving the quality of expenditure with growth-enhancing investments.

- Fiscal Discipline: States’ gross fiscal deficit is budgeted at 3.2% of GDP for 2024-25, a marginal increase from 2023-24 (2.9%).

- States’ revenue expenditure is projected to increase to Rs 47.5 trillion in FY25, which accounts for 14.6% of GDP as against Rs 39.9 trillion or 13.5% of GDP FY24.

- Dependence on Borrowing: States’ dependence on market borrowings has surged, accounting for 79% of the gross fiscal deficit (GFD) in FY25.

- Gross market borrowings of states and Union Territories increased by 32.8% to Rs 10.07 trillion in FY 2023-24.

- Elevated Debt Levels: States' debt-to-GDP ratio (relative measure of debt compared to economic output) decreased from 31.0% of GDP in March 2021 to 28.5% in March 2024, but remained higher than the pre-pandemic level of 25.3% in March 2019.

- State debt levels exceed the Fiscal Responsibility and Budget Management committee's recommended debt-to-GDP ratio of 60% by 2023 (with 40% for the Central Government and 20% for State Governments).

- States like Arunachal Pradesh, Himachal Pradesh, Sikkim, and Tripura have forecast high fiscal deficits, while larger economies like Gujarat and Maharashtra have lower deficits as a share of GDP.

- Electricity distribution companies (DISCOMs) continue to strain State finances, with accumulated losses reaching Rs 6.5 lakh crore by 2022-23 (2.4% of India's GDP).

- Improved Tax Revenue: The average tax buoyancy (responsiveness of tax revenue to changes in the economic growth rate) increased to 1.4 (during 2021-25) from 0.86 (during 2013 to 2020), reflecting improved efficiency in tax collection.

- Concerns Regarding States Budgets:

- Rising Subsidy Burden: Several states have announced “farm loan waivers, free/subsidised services (like electricity to agriculture and households, transport, gas cylinder and cash transfers to farmers, youth and women)”.

- These measures risk crowding out funds meant for critical social and economic infrastructure.

- Subsidy schemes like income transfers for women (around Rs 2 lakh crore, ~0.6% of GDP) strain state finances.

- Revenue Generation: Revenue from non-tax sources and central grants has contracted in FY25.

- The pace of growth in State Goods and Services Tax (SGST), the primary driver of state tax revenues, has slowed.

- Lack of Fiscal Transparency: Inadequate reporting of off-budget liabilities obscures the true fiscal position.

- Rising Subsidy Burden: Several states have announced “farm loan waivers, free/subsidised services (like electricity to agriculture and households, transport, gas cylinder and cash transfers to farmers, youth and women)”.

What are the Recommendations by RBI on State Finances?

- Debt Consolidation: Establish clear, transparent, and time-bound glide paths for debt reduction. Ensure uniform reporting of liabilities to improve fiscal accountability.

- The report calls for "next generation" fiscal rules that offer states flexibility to handle shocks while ensuring medium-term fiscal sustainability.

- Expenditure Efficiency: Focus on outcome-based and climate-sensitive budgeting.

- Rationalise centrally-sponsored schemes (CSS) effectively to free up resources for state-specific needs and reduce fiscal stress.

- Subsidy Rationalization: Contain and optimize subsidies to prevent them from overshadowing more productive expenditures.

- Efficient Market Borrowings: Reduce over-reliance on market borrowings to manage fiscal deficits and minimize financial vulnerabilities.

- Revenue Generation: Strengthen collection mechanisms for SGST, stamp duty, and other key revenue sources. Increase non-tax revenues and grants to reduce dependency on market borrowings.

Note: A subsidy is a government benefit provided to individuals, or institutions, either directly (cash payments) or indirectly (tax breaks), aimed at easing burdens and promoting social or economic goals.

What is the Need for Balancing Subsidies and Fiscal Discipline?

- Importance of Subsidies:

- Human Development: Welfare programs like subsidies, healthcare, and income transfers support vulnerable populations.

- For example, Pradhan Mantri Ujjwala Yojana (PMUY) provides subsidized LPG connections to poor households, reducing health risks from traditional cooking.

- The Public Distribution System (PDS) offers subsidized food grains to low-income families, ensuring food security.

- For example, Pradhan Mantri Ujjwala Yojana (PMUY) provides subsidized LPG connections to poor households, reducing health risks from traditional cooking.

- Economic Equality: Subsidies help reduce income inequality by redistributing wealth, which can contribute to more inclusive growth.

- Subsidies help mitigate the negative impacts of market forces on the poor, providing a safety net during times of economic distress.

- Human Development: Welfare programs like subsidies, healthcare, and income transfers support vulnerable populations.

- Importance of Fiscal Discipline:

- Sustainable Public Finances: Excessive welfare spending without proper funding can lead to high deficits and rising public debt, jeopardizing long-term financial stability.

- Maintaining fiscal discipline ensures sustainable government spending, prevents excessive deficits.

- Investor Confidence: Maintaining fiscal discipline is key to ensuring that markets and foreign investors continue to view the country as a reliable economic partner.

- The government's focus on fiscal consolidation through schemes like Goods and Services Tax (GST) and Fiscal Responsibility and Budget Management (FRBM) Act, 2013 ensures stable fiscal management.

- Economic Growth: Focusing too much on welfare spending at the cost of productive investments can hinder economic growth, reducing the resources available for sustainable development.

- Sustainable Public Finances: Excessive welfare spending without proper funding can lead to high deficits and rising public debt, jeopardizing long-term financial stability.

- Balancing Subsidies and Fiscal Discipline:

- Targeted Welfare Programs: Targeted welfare spending, like Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) for farmers and Direct Benefit Transfer Scheme for efficient subsidy delivery, ensures resources reach those in need, maximizing impact and minimizing wastage.

- Streamlining welfare programs through Digital India and Aadhaar-linked benefits improves subsidy efficiency, reduces leakages, and frees up resources for infrastructure, health, and education investments.

- Revenue Growth: Strengthening the tax base through GST enhances revenue collection. Developing initiatives like Production Linked Incentives (PLI), which can provide long-term income rather than additional subsidies, creates fiscal space for both welfare and investment.

- Economic Stability: Maintaining fiscal discipline helps in controlling inflation, reducing public debt, and ensuring economic stability.

- Targeted Welfare Programs: Targeted welfare spending, like Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) for farmers and Direct Benefit Transfer Scheme for efficient subsidy delivery, ensures resources reach those in need, maximizing impact and minimizing wastage.

Conclusion

Balancing subsidies with fiscal discipline is crucial for sustaining India's growth trajectory. Efficient allocation of resources, along with strategic reforms in welfare spending and revenue generation, can pave the way for a stable and prosperous economy.

|

Drishti Mains Question: Discuss the challenges faced by Indian states in balancing welfare spending and fiscal discipline, and suggest measures to address them. |

UPSC Civil Services Examination Previous Year Question

Prelims

Q1. Which one of the following is likely to be the most inflationary in its effect? (2021)

(a) Repayment of public debt

(b) Borrowing from the public to finance a budget deficit

(c) Borrowing from the banks to finance a budget deficit

(d) Creation of new money to finance a budget deficit

Ans: (d)

Q2. Consider the following statements: (2018)

- The Fiscal Responsibility and Budget Management (FRBM) Review Committee Report has recommended a debt to GDP ratio of 60% for the general (combined) government by 2023, comprising 40% for the Central Government and 20% for the State Governments.

- The Central Government has domestic liabilities of 21% of GDP as compared to that of 49% of GDP of the State Governments.

- As per the Constitution of India, it is mandatory for a State to take the Central Government’s consent for raising any loan if the former owes any outstanding liabilities to the latter.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Q3. Which of the following is/are included in the capital budget of the Government of India? (2016)

- Expenditure on acquisition of assets like roads, buildings, machinery, etc.

- Loans received from foreign governments

- Loans and advances granted to the States and Union Territories

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Important Facts For Prelims

Birth Anniversary of Chaudhary Charan Singh and National Farmers' Day 2024

Why in News?

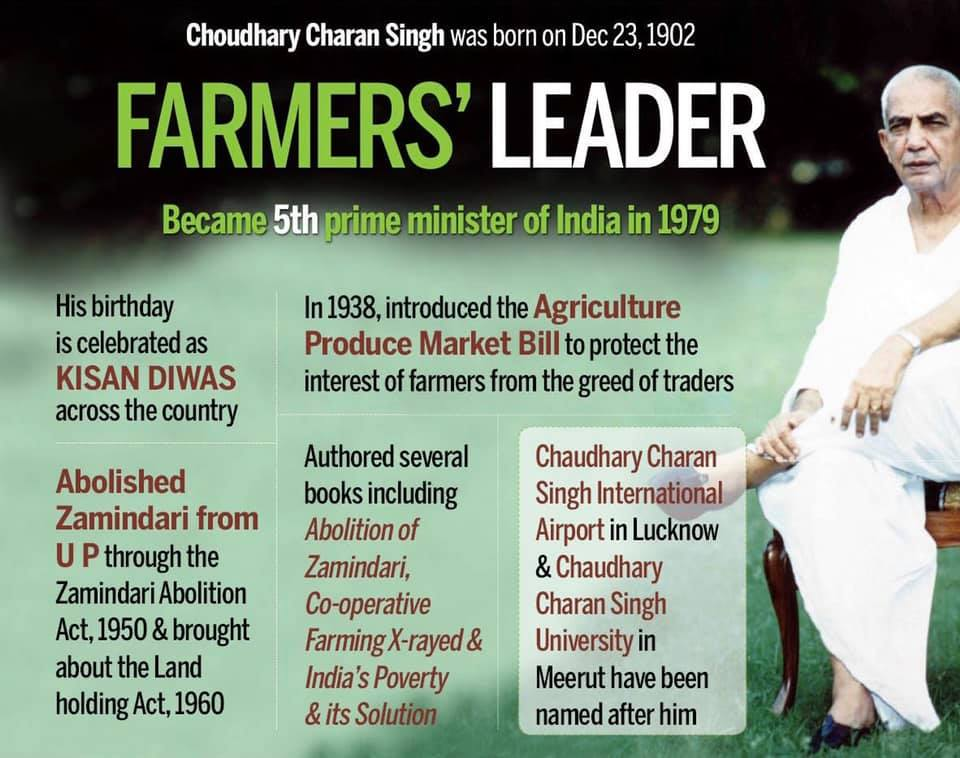

Recently, National Farmers' Day (Kisan Diwas) was celebrated on 23rd December 2024 to honor farmers and commemorate the birth anniversary of Sri Chaudhary Charan Singh.

- Known as the ‘Kisan Leader,’ his birth anniversary is celebrated as ‘Kisan Diwas’ since 2001 for his contributions to Indian agriculture and rural development.

What are the Key Facts Related to Chaudhary Charan Singh?

- About:

- Born in 1902 at Noorpur, Meerut, Uttar Pradesh, he was an Indian politician and a freedom fighter who served as the 5th Prime Minister of India (1979-80).

- He also served as Deputy Prime Minister (January-July 1979) and Chief Minister of Uttar Pradesh twice.

- He represented Chhaprauli in the U.P. Legislative Assembly (1937, 1946, 1952, 1962, 1967) and later as MP for Baghpat.

- Key Contributions:

- He drafted the Debt Redemption Bill, 1939, relieving peasants from moneylenders and was instrumental in the Land Holding Act, 1960, lowering land ceiling limits.

- He advocated for Minimum Support Price (MSP), introduced the Consolidation of Holdings Act (1953) and UP Zamindari and Land Reforms Act (1952) to benefit the landless.

- He proposed the Agricultural Produce Marketing Bill (1938), creating an agri-market infrastructure.

- He elevated the Rural Development Department to a Ministry and played a crucial role in establishing NABARD.

- He promoted decentralisation, grassroots governance, and local economic autonomy.

- Social Contribution:

- He followed Mahatma Gandhi in a non-violent struggle for independence from the British Government and was imprisoned several times.

- He advocated for social justice by opposing caste divisions, promoting inter-caste marriages, and supporting quotas for agriculturists’ dependents, aligning with BR Ambedkar’s vision of integrated social and economic reforms.

- He authored influential books like ‘Abolition of Zamindari’, ‘Co-operative Farming X-rayed’, ‘India’s Poverty and its Solution’, ‘Peasant Proprietorship or Land to the Workers’ and ‘Prevention of Division of Holdings Below a Certain Minimum’.

- Relevance:

- Today’s Initiatives like Doubling Farmers’ Income, MSME promotion, Panchayati Raj, and ethical administration are inspired by his visionary thoughts.

- Recently, in 2024 the government has honored him with the prestigious Bharat Ratna, along with 4 other awardees- Karpoori Thakur, Mankombu Sambasivan (MS) Swaminathan, Pamulaparthi Venkata (P. V.) Narasimha Rao, Lal Krishna Advani.

- The government renamed the Lucknow Airport in 2008 as Chaudhary Charan Singh International Airport in his honour.

- He passed away on 29th May 1987. His memorial in New Delhi is called Kisan Ghat.

What are the Related Initiatives for Farmers?

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Q1. Under the Kisan Credit Card scheme, short-term credit support is given to farmers for which of the following purposes? (2020)

- Working capital for maintenance of farm assets

- Purchase of combine harvesters, tractors and mini trucks

- Consumption requirements of farm households

- Post-harvest expenses

- Construction of family house and setting up of village cold storage facility

Select the correct answer using the code given below:

(a) 1, 2 and 5 only

(b) 1, 3 and 4 only

(c) 2, 3, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)

Important Facts For Prelims

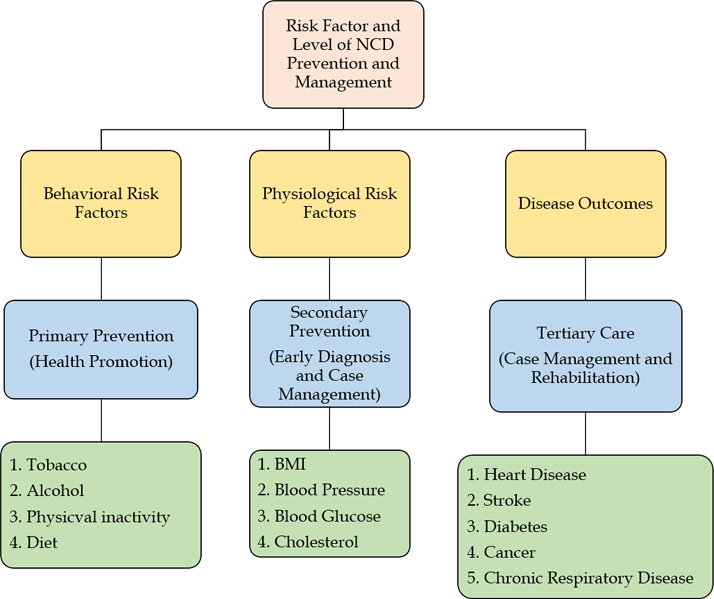

National Programme for Prevention and Control of NCD

Why in News?

Recently, the Ministry of Health and Family Welfare highlighted the progress of the National Programme for Prevention and Control of Non-Communicable Diseases (NP-NCD) across India.

What is the NP-NCD?

- About: The NP-NCD is aimed at addressing the growing burden of non-communicable diseases (NCDs) such as cardiovascular diseases (CVDs), cancer, and diabetes.

- These diseases have emerged as major public health concerns, contributing to approximately 63% of all deaths in India.

- Objectives: The primary goal of NP-NCD is to prevent and control major NCDs through infrastructure strengthening, human resource development, health promotion, and early diagnosis and management of diseases.

- Implementation: The program is implemented at national, state, and district, with financial support provided under the NCD Flexi-Pool through the National Health Mission (NHM).

- States receive financial aid to implement NCD-related activities at the district level and below, with a 60:40 Centre-State share (90:10 for North Eastern and hilly states).

- Key Components of NP-NCD:

- NCD Screening: Targeting individuals aged 30 years and above for screening of diabetes, hypertension, and common cancers such as oral, breast, and cervical cancer.

- NCD Clinics: Establishment of District NCD Clinics and Cardiac Care Units (CCUs), and Community Health Centre (CHC) NCD Clinics for early diagnosis, treatment, and emergency care.

- Cancer Care: Setting up Day Care Centres for cancer patients and supporting tertiary cancer care infrastructure.

- Training: Health workers like ASHAs (Accredited Social Health Activists), ANMs (Auxiliary Nurse Midwives), and Medical Officers are trained in early detection, management, and prevention of NCDs.

- Digital Integration: Use of the National NCD Portal and mobile applications to track and manage NCD data and screenings.

- Impact: Established 770 District NCD Clinics, 372 Day Care Centres, 233 CCUs, and around 6,410 CHC NCD Clinics for accessible NCD diagnosis and management.

- Implemented population-based screening for common NCDs as part of primary healthcare under NHM.

- ASHAs educate communities on NCD prevention, promote healthy habits, and stress early detection through screenings and check-ups.

Non-Communicable Diseases

- About: NCDs, also known as chronic diseases, are long-lasting conditions that are not transmitted from person to person.

- These diseases develop over a long period and are influenced by genetic, environmental, and behavioral factors.

- Risk Factors for NCDs: Tobacco use, excess salt, alcohol abuse, inactivity, raised blood pressure, obesity, high blood lipids, and air pollution.

- Impact: NCDs account for 74% of global deaths, with over 15 million premature deaths annually (ages 30-69), 85% of which occur in low- and middle-income countries.

- Prevention and Control Strategies: Reduce tobacco, alcohol use, promote exercise, healthy diets, and better air quality. Early screening, primary care, and universal health coverage can improve outcomes and reduce costs.

- WHO Response: The World Health Organization (WHO) Global Action Plan for NCDs to 2030 includes an Implementation Roadmap to accelerate progress toward Sustainable Development Goals (SDG) target 3.4, aiming to reduce premature NCD deaths by one-third.

UPSC Civil Services Examination Previous Year Question (PYQ)

Prelims

Q. Brominated flame retardants are used in many household products like mattresses and upholstery. Why is there some concern about their use? (2014)

- They are highly resistant to degradation in the environment.

- They are able to accumulate in humans and animals.

Select the correct answer using the code given below:

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (c)

Exp:

- Brominated Flame Retardants (BFRs) are mixtures of man-made chemicals that are added to a wide variety of products, to make them less flammable. They are commonly used in plastics, textiles and electrical/ electronic equipments.

- The BFRs are highly resistant to degradation in natural environment. Hence, 1 is correct.

- BFRs can be accumulated in humans and animals and can cause diabetes, neurobehavioral and developmental disorders, cancer, reproductive health effects and alteration in thyroid function. Hence, 2 is correct. Therefore, option (c) is the correct answer

Rapid Fire

Flowers Pollination by Large Carnivore

The Ethiopian wolf, a rare and endangered species, acts as an unexpected pollinator, challenging traditional views on plant-pollinator relationships.

- The Ethiopian wolf feeds on the nectar of Ethiopian red hot poker flowers, potentially aiding in pollination by transferring pollen on its muzzle.

- The Ethiopian red hot poker is a red and yellow colored flower that produces a sweet nectar attracting a host of pollinators.

- Ethiopian Wolf:

- It is a specialised rodent hunter in the Afroalpine ecosystem.

- Afroalpine ecosystems are unique high-altitude regions of Africa, particularly in the Ethiopian Highlands (3200 meters above sea level, cold and harsh climate).

- It is about the size of a large dog, with a reddish coat, white markings on its throat and chest, and a black bushy tail.

- With fewer than 500 alive today, it is Africa’s most endangered carnivore.

- It lives only in Ethiopia, in high-altitude "sky islands" above the tropical forests.

- Sky Islands are isolated mountains surrounded by radically different lowland environments.

- It is a specialised rodent hunter in the Afroalpine ecosystem.

- Other Carnivore Pollinators: Bats are nectar-eating pollinator mammals.

- Small carnivore species such as civets or mongooses do pollination.

- Omnivorous bears, such as sun bears, may eat nectar too.

Read More: Field Pansy's Evolution

Rapid Fire

72nd plenary of the North Eastern Council

At the 72nd plenary of the North Eastern Council (NEC) in Agartala, Tripura. The Union Home Minister stressed the need for police forces in the Northeastern (NE) States to shift focus from insurgency control to ensuring citizens' constitutional rights, reflecting a new phase of governance in the region.

- NEC: The NEC, established in 1971 (by an Act of Parliament), is the nodal agency for the economic and social development of the NE Region, comprising Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, and Tripura.

- It aims to address developmental challenges and unlock the region's potential.

- Achievements of the NEC: Constructed over 11,500 kilometers of roads, improving connectivity across the NE Region.

- Boosted power generation capacity through projects led by the North Eastern Electric Power Corporation (NEEPCO).

- Set up foundational institutions like the Regional Institute of Medical Sciences (RIMS) and various educational and technical hubs.

- Transitioned from an advisory body to a Regional Planning Agency, playing a critical role in strategic decision-making.

Read more: Reviving Eastern India for a Developed Nation

Rapid Fire

Green Deposits

Green deposits in India face sluggish adoption due to pricing issues, low public engagement, and limited interest from private banks.

- Green Deposits: These are interest-bearing deposits earmarked for funding green projects, such as solar energy, clean transportation, and sustainable water management.

- In June 2023, the Reserve Bank of India’s (RBI) introduced a framework for green deposits to promote sustainable investments.

- However, banks like SBI have seen limited uptake, as the interest rates are not competitive with regular deposits.

- In June 2023, the Reserve Bank of India’s (RBI) introduced a framework for green deposits to promote sustainable investments.

- Challenges in Green Deposits: Low interest rates for green deposits compared to regular deposits discourage potential customers.

- Banks struggle with defining which activities qualify as “green” and the overall lack of a clear framework for green investments.

- The CRR (Cash Reserve Ratio) requirement for green deposits is higher, which could be a barrier to attracting more customers.

- India’s Commitment to Green Deposits: India aims for carbon neutrality by 2070, with green finance pivotal in this transition.

Read more: RBI’s Green Deposits Framework

Rapid Fire

Elephant Parade in Thrissur Pooram

Recently, the Supreme Court stayed a series of restrictions imposed by the Kerala high court on the use of elephants in Thrissur Pooram.

- Earlier the Kerala High Court mandated a 3-meter gap between elephants, 8 meters from the public or percussion displays, and a 100-meter buffer from areas using fireworks.

- Thrissur Pooram:

- It is an annual Hindu temple festival held in Thrissur, Kerala which is a symbolic meeting of deities of 10 temples.

- Celebrated in Medam (April-May) in Kerala, it is known as the Mother of all Poorams (temple festival).

- It was started by Raja Rama Varma, famously known as Sakthan Thampuran, the Maharaja of Cochin (1790–1805), with the participation of 10 different temples.

- Vibrantly decked elephants are a major highlight of Thrissur Pooram.

- The festival starts with the flag hoisting ceremony, known as Kodiyettam. The final day is marked by a spectacular fireworks display.

Read More: Thrissur Pooram