Economy

Reviewing Free Trade Agreements

For Prelims: Free Trade Agreement, MSMEs, Trade Deficit, Non-Tariff Barriers, Rules of Origin, ASEAN, FDI, Intellectual Property Rights, UPOV 1991, International Union for the Protection of New Varieties of Plants, TRIPS, EU, Economic Cooperation and Trade Agreement, Production-Linked Incentive (PLI) Scheme.

For Mains: Concerns related to India's FTAs and way forward.

Why in News?

Recently, India's External Affairs Minister stated that the government has adopted a cautious approach to free trade agreements (FTAs) to protect the interests of MSMEs or farmers.

- The decision has been taken weighing the unfavourable outcomes of past agreements and ensuring that FTAs do not adversely impact MSMEs or farmers.

How FTAs Proved Unfavorable for India?

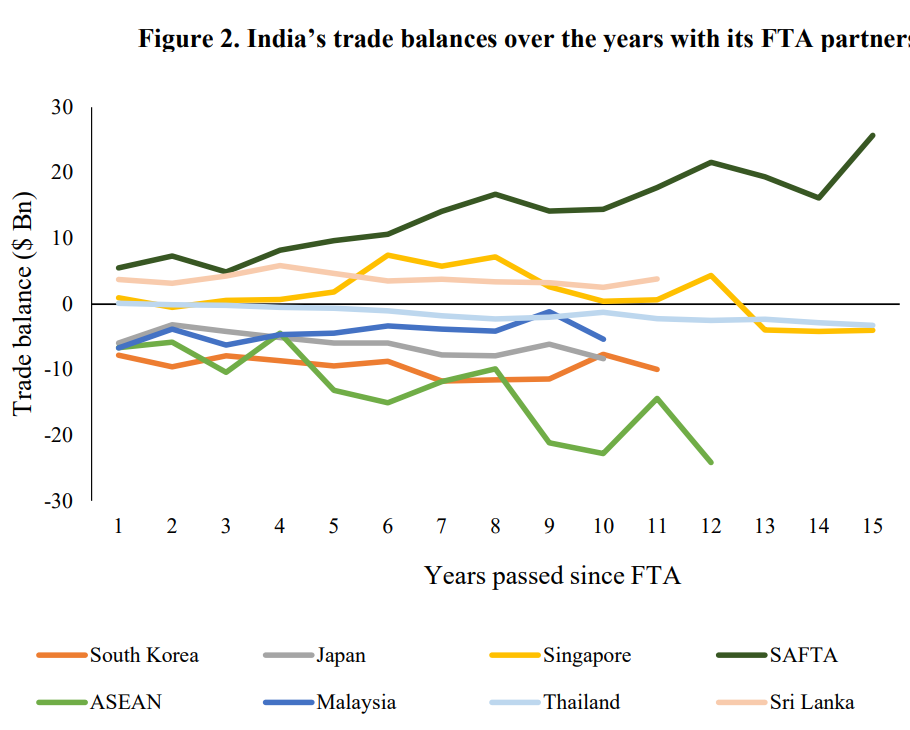

- Worsening Trade Deficits: Between 2017 and 2022, while India’s exports to FTA partners grew by 31%, its imports surged by 82% highlighting an unsustainable trade deficit.

- India has been opening its markets without gaining proportionate access to markets in return.

- Low FTA Utilisation: India's FTA utilisation remains alarmingly low at around 25%, far below the typical 70–80% utilisation rate seen in developed countries.

- It highlights India's failure to fully utilize the benefits of its bilateral and multilateral trade agreements.

- Poor Manufacturing Competitiveness: ASEAN's focus on research, innovation, government support, and value chain upgrades has boosted their global competitiveness by lowering production costs.

- South Korea and ASEAN outperformed India in sectors like electronics, automobiles, and textiles.

- It leads to a situation of inverted duty structure where import duties on raw materials goods are higher than on finished goods.

- E.g., higher GST rate paid on purchase of domestic raw materials compared to low import duty on imported goods.

- Lack of Stakeholder Consultation: Negotiators failed to involve representatives from relevant industries, businesses and associations, leading to a limited understanding of FTAs' impact and granting market access without considering domestic concerns.

- Non-Tariff Barriers: The FTAs led to a reduction in tariff rates, enabling partners to penetrate deeper into the Indian market.

- But non-tariff barriers by partner countries such as stringent standards, sanitary and phytosanitary measures and technical barriers to trade persisted, limiting Indian exporters' market access and export opportunities.

- Complex Certification: The complexity of certification requirements and rules of origin under the FTAs have made it difficult for exporters to meet prescribed standards and increased compliance costs.

- Lack of Awareness: Many exporters do not know about the incentives and potential advantages available to them under the FTAs, hindering the FTAs’ effective implementation.

- Limited Services Trade: Despite India having a competitive edge in services, services trade has not grown as expected.

- Technology Transfer and Investment Challenges: The FDI inflows have not translated into significant advancements in technology or value-added linkages that could enhance India's industrial capacity.

Free Trade Agreements

- About: FTAs are trade agreements between two countries (or blocs) which aim to give each other access to markets by lowering or removing border protection measures such as border taxes on exports and imports, and other barriers (such as standards, processes).

- Coverage: FTAs can cover trade in goods (such as agricultural or industrial products) or trade in services (such as banking, construction, trading etc).

- FTAs can also cover other areas such as intellectual property rights (IPRs), investment, government procurement and competition policy.

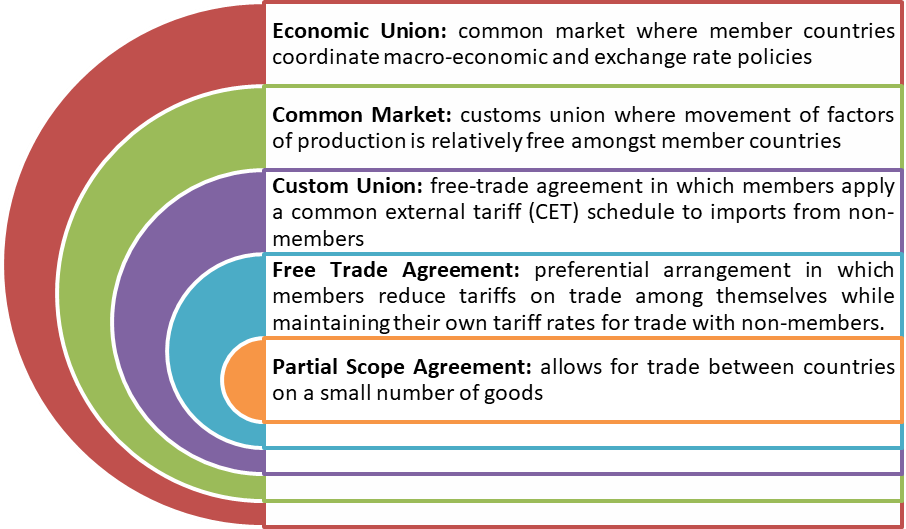

- Types of Trade Agreements:

- Major Trade Agreements of India:

Examples of the Use of Export Taxes to Maintain Competitiveness

- Kenya: Kenya got its leather industry back on its foot by imposing 40% export duty on raw hides and skins.

- This policy increased the number of tanneries in the country, created seven thousand new jobs, increased incomes for another 40,000 people and boosted earnings from the sector by almost Euros 8 million, with the potential for much more.

- Malaysia: Malaysia’s furniture sector is dependent on the export restrictions and taxes on raw timber which keep their inputs relatively cheap in order to remain competitive.

- Without these export restrictions and taxes, furniture SMEs are likely to be unable to compete.

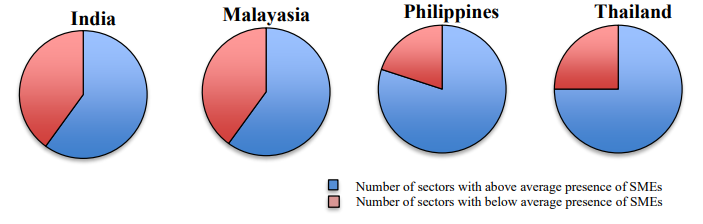

- Furniture SMEs are 6% of Malaysian SMEs in the manufacturing sector.

How FTAs Can Negatively Impact MSMEs?

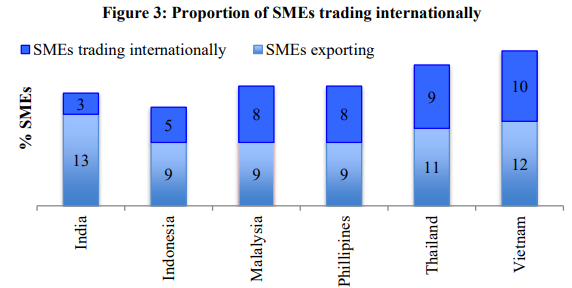

- Limited Global Reach: Only 16% of Indian SMEs engage in international trade, with 13% involved in exports. This is significantly lower than the international average of 19%.

- Vulnerability to External Shocks: Indian SMEs are vulnerable to global disruptions, as seen during the Covid-19 lockdown, which severely impacted supply chains.

- Technical Barriers: Indian MSMEs often struggle with compliance to international standards, including sanitary and phytosanitary (SPS) measures and technical barriers to trade (TBTs).

- Limited Networking Opportunities: MSMEs in India often lack connections with potential buyers abroad, which limits their market access and visibility.

- Loss of Domestic Market Share: As cheaper imported goods flood the market due to lower tariffs under FTAs, domestic MSMEs may lose market share to foreign competitors, leading to a decrease in sales and revenue.

- Scaling Challenges: The lack of capital, technology, and access to skilled labor can hinder their ability to compete on price, quality, and efficiency against foreign goods entering the Indian market.

How FTAs Can Negatively Impact Farmers?

- UPOV 1991 Convention: EU is pushing India to join the UPOV 1991 (International Union for the Protection of New Varieties of Plants) which grants exclusive rights over new plant varieties to large corporations.

- By joining UPOV 1991, India could face restrictions on seed sovereignty, where farmers may be forced to buy seeds every season due to use of Terminator seeds (genetically engineered to be sterile after first harvest).

- TRIPS-Plus Demands: The EU's TRIPS-plus demands aim to expand the intellectual property (IP) rights of multinational companies (MNCs) over agrochemicals, such as pesticides and fertilizers.

- It would lead to the monopolization of agrochemical markets by large companies and increase in prices of essential inputs for farmers.

- Non-Tariff Barriers (NTBs): Applying the EU’s pesticide maximum residue limit (MRL) of 0.01 parts per million (ppm) for several pesticides and food commodities could lead to the rejection of India’s agricultural export consignments.

- Increased Competition: Under Economic Cooperation and Trade Agreement (ECTA), Australia is looking to expand the export of pulses, wines, sheep meat, wool and horticultural produce to India which may prove detrimental for subsistence based Indian small landholder farmers.

- Food Insecurity: India currently applies a 30% tariff to all Canadian lentil exports which will be eliminated after India-Canada FTA.

- It could lead to a 147% increase in Canada's exports over five years, threatening India's goal to boost domestic pulse production and reduce import dependency.

Way Forward

- Investment in Infrastructure: Streamlining logistics through digital tools and integrating transportation modes (road, rail, and ports) would reduce logistics costs and improve efficiency.

- Relaxation of Rules of Origin (ROO): To improve FTA utilization, India should work on making ROO requirements more flexible and commodity-specific rather than uniform across all sectors to lower transaction costs for exporters.

- Emphasis on Services: India should focus on designing FTAs with greater emphasis on market access for its strong services sectors, particularly in IT, business process outsourcing (BPO), and other knowledge-based services.

- Re-negotiating Existing FTAs: For FTAs already signed, India should seek to renegotiate terms to focus on diversifying into high-tech and value-added products like chemicals, automotive components, and electrical apparatus.

- Boosting R&D: Boosting R&D in Export-Oriented Industries to create high-value products that align with global demand.

- Integrated Policy Approach: India’s Production-Linked Incentive (PLI) scheme, aimed at boosting manufacturing in select sectors, should be aligned with future FTAs to ensure that sectors benefiting from the PLI scheme are also given preferential treatment in trade agreements.

|

Drishti Mains Question: Q. Critically analyze the impact of Free Trade Agreements (FTAs) on India's agricultural sector and small-scale industries. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Consider the following countries: (2018)

- Australia

- Canada

- China

- India

- Japan

- USA

Which of the above are among the ‘free-trade partners’ of ASEAN?

(a) 1, 2, 4 and 5

(b) 3, 4, 5 and 6

(c) 1, 3, 4 and 5

(d) 2, 3, 4 and 6

Ans: (c)

Q. The term ‘Regional Comprehensive Economic Partnership’ often appears in the news in the context of the affairs of a group of countries known as(2016)

(a) G20

(b) ASEAN

(c) SCO

(d) SAARC

Ans: (b)

Mains

Q. How would the recent phenomena of protectionism and currency manipulations in world trade affect macroeconomic stability of India? (2018)

Q. Evaluate the economic and strategic dimensions of India’s Look East Policy in the context of the post Cold War international scenario. (2016)

Governance

PSC Suggests Reforms in MGNREGA Scheme

For Prelims: Parliamentary Standing Committee on Rural Development and Panchayati Raj, Mahatma Gandhi National Rural Employment Guarantee Scheme, Aadhaar-Based Payment Systems, Aadhaar, Gram Panchayat, Ombudsman, Inflation, National Mobile Monitoring System, Consumer Price Index for Agricultural Labour, National Minimum Wage, Consumer Price Index (CPI) Rural, Speaker.

For Mains: Challenges associated with MGNREGA Scheme and way forward.

Why in News?

Recently, the Parliamentary Standing Committee (PSC) on Rural Development and Panchayati Raj has highlighted the challenges that wages under MGNREGS have not kept pace with inflation and recommended certain reforms in the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS).

Note: Inflation refers to a decrease in the purchasing power of money, which is evident through a general rise in the prices of goods and services within an economy.

What are the Challenges in Implementation of MGNREGS?

- Wages Not aligned with Inflation: MGNREGA wage rates haven't kept up with inflation which reduces rural workers' purchasing power and discourages them from completing the full 100 workdays.

- Additionally, the 100-day wage guarantee often falls short, especially during natural calamities and post-pandemic recovery which restricts its potential to provide long-term livelihood security to rural households.

- Revision of permissible works: The MGNREGA work list often fails to address rural needs like flood protection and land erosion management.

- Delays in revising permissible works based on local needs limit the scheme’s effectiveness in addressing regional challenges.

- Delayed Payment of Wages: Delays in payment are often due to issues with Aadhaar-based payment systems (ABPS), inactive Aadhaar details, or frozen bank accounts undermining the scheme’s intended impact.

- Potential technical glitches and infrastructure issues leave vulnerable workers unpaid.

- Delay in Compensation: In case of delay in payment of wages, beneficiaries are entitled to compensation at the rate of 0.05% of unpaid wages per day for the duration of delay.

- However, payment of delay compensation is not adhered to in most places in the country.

- Unemployment Allowance: Under MGNREGA, persons who apply for work but are not provided within 15 days are entitled to a daily unemployment allowance.

- The unemployment allowance is rarely paid, and the amounts provided are minimal.

- Weak Social Audits: Under MGNREGA, the Gram Sabha must conduct regular social audits of all projects taken up within the Gram Panchayat.

- However, in 2020-21, only 29,611 Gram Panchayats were audited at least once showing weak social audits mechanisms.

- Lack of Ombudsman: Out of 715 possible appointments, so far only 263 ombudsmen have been appointed.

What are the Various Recommendations Suggested by the PSC for Reforming MGNREGS?

- Revision of Wage Rates: Wage rates should be linked to a suitable inflation index commensurate with the existing inflation to reflect the rising cost of living in rural areas.

- Update the base year 2009-2010 and rates to align with current inflation trends and rural economic conditions.

- Increase Days of Work: The committee also recommended an increase in the number of days of work sought under MGNREGS from 100 to 150 days.

- Payment Mechanisms: It recommended maintaining alternative payment systems alongside APBS to ensure uninterrupted wage disbursements.

- The panel recommended a streamlined payment process to ensure timely wage disbursement, aiming to reduce bureaucratic hurdles.

- National Mobile Monitoring System (NMMS): The committee stressed the need for awareness campaigns and training programs to help beneficiaries use NMMS effectively.

- It also recommended retaining alternative attendance methods to avoid excluding workers due to technological issues.

- NMMS tracks attendance and work progress under MGNREGS to enhance transparency and accountability.

- Sufficient Fund Allocation for MGNREGS: The committee emphasized the need for the government to ensure sufficient financial allocations for MGNREGS to ensure its effectiveness in providing livelihood security to rural households.

Note:

- In the financial year 2024-25, the average MGNREGA wage increased across India by Rs 28 per day only.

- The MGNREGA wage increase for the financial year 2023-24 ranged from 2%-10%.

- The Government of India notifies the wage rate under MGNREGA using Consumer Price Index for Agricultural Labour (CPI-AL).

- Dr. Anoop Satpathy committee (2019) to review and recommend methodology for fixation of National Minimum Wage (NMW) had recommended that wages under MGNREGA should be Rs 375 a day.

- Dr. Nagesh Singh Committee (2017) recommended indexing MGNREGA wages to Consumer Price Index (CPI) Rural as opposed to CPI-Agricultural Labour.

What is the Parliamentary Standing Committee on Rural Development & Panchayati Raj?

- About: It was created for the first time on 5th August, 2004 under Rule 331C of the Rules of Procedure and Conduct of Business in Lok Sabha to give focussed attention to the issues related to rural development.

- Jurisdiction: The following Ministries/Departments are under the jurisdiction of the Committee:

- Ministry of Rural Development

- Ministry of Panchayati Raj

- Composition: The Committee has 31 members: 21 from Lok Sabha, nominated by the Speaker, and 10 from Rajya Sabha, nominated by the Chairman.

- A Minister is not nominated as a member of the Committee.

- The Chairman of the Committee is appointed by the Speaker from amongst the members of the Committee from Lok Sabha.

- Tenure of Members: The term of office of the members of the Committee does not exceed one year.

- Functions:

- Considers Demands for Grants and reports to the Houses.

- Examines Bills referred by the Speaker or Chairman and reports on them.

- Reviews Annual Reports of Ministries/Departments and reports.

- Considers national policy documents referred by the Speaker or Chairman and reports.

MGNREGS

- About: Launched in 2005 by the Ministry of Rural Development, MGNREGS is one of the largest work guarantee programs, providing 100 days of unskilled manual work at minimum wage for rural households each year.

- Implementation: The Ministry of Rural Development oversees the scheme's implementation with state governments.

- Major Features:

- Legal Guarantee: MGNREGA's key feature is its legal guarantee, ensuring rural adults can request work and receive it within 15 days.

- Unemployment Allowance: If the work is not provided within 15 days, an unemployment allowance must be provided.

- Women Focussed: The scheme prioritizes women, ensuring that at least one-third of beneficiaries are women who have registered and requested work.

- Social Audit: Section 17 of the Mahatma Gandhi NREGA, 2005 mandates the Gram Sabha to conduct social audits of scheme works.

- Cost Sharing: Financial assistance shall be provided by Central and State Governments in the ratio of 90:10 respectively.

- Ban on Contractors: Engagement of contractors and use of labour displacing machines are banned.

Conclusion

The Parliamentary Standing Committee's recommendations for MGNREGS aim to address key challenges such as inadequate workdays, wage disparities, delayed payments, and weak monitoring systems. Effective implementation of these reforms is essential for improving rural livelihoods and ensuring the scheme’s sustainability in the long term.

|

Drishti Mains Question: Q. Critically evaluate the challenges in the implementation of the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) and suggest reforms to enhance its effectiveness. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. Among the following who are eligible to benefit from the “Mahatma Gandhi National Rural Employment Guarantee Act”? (2011)

(a) Adult members of only the scheduled caste and scheduled tribe households

(b) Adult members of below poverty line (BPL) households

(c) Adult members of households of all backward communities

(d) Adult members of any household

Ans: (d)

Mains

Q. Hunger and Poverty are the biggest challenges for good governance in India still today. Evaluate how far successive governments have progressed in dealing with these humongous problems. Suggest measures for improvement. (2017)

Q. Do government’s schemes for up-lifting vulnerable and backward communities by protecting required social resources for them, lead to their exclusion in establishing businesses in urban economies? (2014)

Indian Economy

Loan Write-Offs and NPA Reduction in PSBs

For Prelims: Debt Recovery Tribunals (DRTs), NPA, National Asset Reconstruction Ltd (NARC), Reserve Bank of India (RBI), India Debt Resolution Company Ltd, SARFAESI Act, Insolvency and Bankruptcy Code (IBC)

For Mains: Loan Write-Off: Implication, Challenges and Way Forward, Challenges of NPA, Provisions to NPA resolution

Why in News?

A large-scale loan write-off by banks over the past few years has contributed to a significant reduction in non-performing assets (NPAs).

- As a result, banks have achieved a 12-year low NPA ratio of 2.8% of advances by March 2024.

What is the Key Data Regarding Loan Write-Offs by Banks?

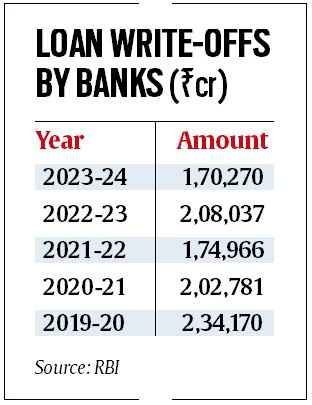

- Loan Write-Offs:

- Between FY2015 and FY2024, Indian commercial banks wrote off loans amounting to Rs 12.3 lakh crore, with Rs 9.9 lakh crore in the last 5 years alone (FY 2020-2024).

- The peak in loan write-offs occurred in FY2019 at Rs 2.4 lakh crore, following an asset quality review initiated in 2015.

- However, write-offs have decreased since then, with FY2024 recording the lowest at Rs 1.7 lakh crore, amounting to just 1% of the total bank credit.

- Public Sector Banks' Share:

- Public sector banks (PSBs) accounted for 53% (Rs 6.5 lakh crore) of the total loan write-offs in the last 5 years (FY 2020-2024).

- Recovery Rates:

- Despite loan write-offs, the recoveries from these write-offs have been relatively low, standing at only 18.7% (Rs 1.85 lakh crore) in the last 5 years (FY 2020-2024).

- Over 81% of the written-off amount (over Rs 8 lakh crore) remained unrecovered between FY 2020-2024, indicating challenges in recovering defaulted loans.

- These loan accounts were mostly wilful defaults with promoters and directors of some of the companies even fleeing the country.

- Despite loan write-offs, the recoveries from these write-offs have been relatively low, standing at only 18.7% (Rs 1.85 lakh crore) in the last 5 years (FY 2020-2024).

- Impact on NPA Ratios:

- As of September 2024, the gross NPAs of PSBs and private sector banks (PSBs) stood at Rs 3.16 lakh crore and Rs 1.34 lakh crore, respectively.

- The NPA ratio as a percentage of outstanding loans was 3.01% for PSBs and 1.86% for private sector banks.

Note:

- A wilful defaulter is a borrower or guarantor who has intentionally failed to repay a loan, with an outstanding amount of Rs 25 lakh or more.

- A large defaulter refers to a borrower with an outstanding loan balance of Rs 1 crore or more, whose account has been classified as doubtful or a loss.

- Write-offs refer to the removal of a non-performing loan or asset from a bank’s financial records, recognizing that the debt is unlikely to be recovered.

- This process does not relieve the borrower of the responsibility to repay the debt but acknowledges the improbability of recovery.

What is Non-Performing Asset (NPA)?

- About:

- It refers to loans or advances issued by banks or financial institutions that no longer bring in money for the lender since the borrower has failed to make payments on the principal and interest of the loan for at least 90 days.

- For agricultural loans, a loan granted for short duration crops will be treated as NPA, if the installment of principal or interest thereon remains overdue for two crop seasons.

- Types of NPAs:

- Gross NPA: This is the total amount of NPAs without deducting the provisional amount.

- Net NPA: This is the gross NPA minus the provision.

- Provision refers to funds left aside by banks to cover potential losses arising from bad loans or NPAs.

- Laws and Provisions Related to NPAs:

- Bad Bank:

- The National Asset Reconstruction Company Ltd (NARC) is India's designated "bad bank."

- To facilitate the sale of these assets, the government has also established the India Debt Resolution Company Ltd (IDRC), which works to sell the assets in the market.

- Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002:

- Insolvency and Bankruptcy Code (IBC), 2016:

- It also established the National Company Law Tribunal (NCLT) and the Insolvency and Bankruptcy Board of India (IBBI) to oversee the process.

- The Recovery of Debts Due to Banks and Financial Institutions Act (RDB Act), 1993.

- Bad Bank:

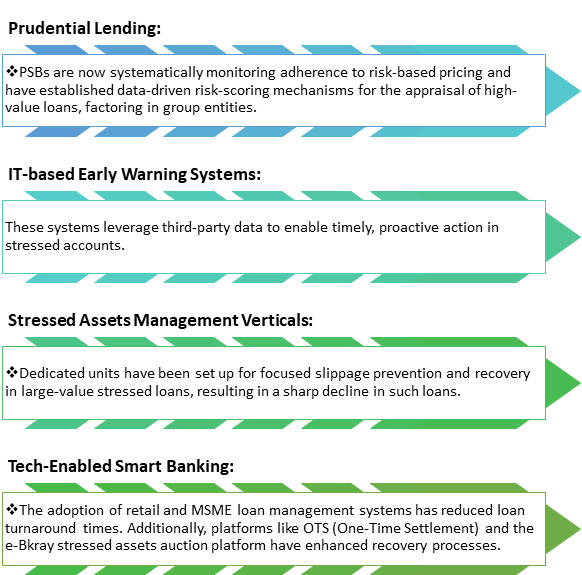

EASE Framework

- The government has introduced the Enhanced Access & Service Excellence (EASE) framework in 2018 to improve the financial health of PSB.

- It focuses on governance, prudent lending, risk management, technology adoption, and outcome-oriented human resource management by institutionalizing incremental reforms that align with the evolving banking landscape, enhancing PSBs' efficiency and stability.

What are Loan Write-Offs by Banks?

- About:

- Loan write-offs refer to the process of removing a loan from a bank's asset records, indicating that the bank no longer expects to recover the amount.

- It is primarily an accounting measure undertaken by banks to clean their balance sheets of NPAs and improve their financial health.

- This process allows banks to focus on recoverable assets and manage their tax liabilities efficiently.

- Loan write-offs refer to the process of removing a loan from a bank's asset records, indicating that the bank no longer expects to recover the amount.

- Accounting Mechanism:

- NPA Classification and Provisioning:

- As per Reserve Bank of India (RBI) prudential norms, banks must create provisions for NPAs, which increase with the aging of the asset and are influenced by the realizable value of the collateral.

- This ensures a cautious accounting approach to mitigate financial risks associated with non-performing loans.

- Technical Write-offs:

- Technical write-offs occur when provisions match the outstanding loan amount, allowing banks to remove the loan from their balance sheets while classifying it as an off-balance-sheet item under "Advances Under Collection."

- Despite the write-off, the borrower’s liability remains, and recovery efforts persist through legal and institutional mechanisms.

- Regulatory Guidelines:

- It requires that write-offs adhere to board-approved policies focused on balance sheet management and tax efficiency.

- Banks must continue tracking written-off accounts and actively pursue recoveries to optimize returns.

- Additionally, the Income Tax Act allows deductions for written-off amounts, helping to reduce the tax burden on banks.

- NPA Classification and Provisioning:

What are the Causes of Rising NPA in India?

- Defective Lending Process: Inadequate due diligence during borrower selection and periodic review of credit profiles result in improper assessment of repayment capabilities.

- Also, lack of end-use monitoring systems facilitates the diversion of funds for non-productive purposes, further exacerbating the problem of NPAs.

- Willful Defaults and Poor Credit Culture: A rise in the number of willful defaults, contributes higher NPAs. PSBs have seen a steady increase in the number of willful defaulters with outstanding loans of Rs 2.5 million and above, rising from 10,209 in June 2019 to 14,159 by March 2023.

- Frequent loan waivers, especially for agricultural loans, have adversely impacted the credit culture.

- Promises of loan waivers encourage borrowers to default in anticipation of future waivers.

- Frequent loan waivers, especially for agricultural loans, have adversely impacted the credit culture.

- Industrial Sickness: Industrial sickness arises from ineffective management, inadequate technological advancements, and frequent shifts in government policies render industries financially unstable, leading to poor loan recovery rates for banks.

- Frauds and Malpractices: Increasing fraud cases by both bankers and borrowers have exacerbated the NPA crisis.

- In the first half of FY 2023-24, Indian banks reported a 166% rise in fraud cases to over 36,000.

- High-profile scams like the Nirav Modi-PNB fraud and Vijay Mallya-Kingfisher default have severely impacted public trust and financial stability.

- Regulatory and Policy Risks: Non-compliance with RBI guidelines, such as deficiencies in statutory and regulatory adherence, has led to penalties on banks such as the recent Rs 2.91 crore fine on Axis Bank and HDFC Bank by RBI in September 2024.

- Furthermore, practices like evergreening of loans and window dressing of balance sheets (manipulating financial statements to present a healthier financial position) have been prevalent, especially among PSBs and cooperative banks.

- These practices distort true asset quality, masking underlying financial stress and hindering accurate risk assessment.

- Furthermore, practices like evergreening of loans and window dressing of balance sheets (manipulating financial statements to present a healthier financial position) have been prevalent, especially among PSBs and cooperative banks.

- Sector-Specific Challenges: Industry-specific factors such as high operating costs in the aviation sector lead to higher NPAs.

- Indian airlines are projected to incur net losses of Rs 2,000–3,000 crore in FY 2025, primarily due to high operating expenses and low ticket prices.

- Priority Sector Lending (PSL) to agriculture and MSMEs often face repayment challenges, leading to higher NPAs in the banking sector.

- Inefficiencies in Resolution Mechanisms: Delay in the resolution of cases before Debt Recovery Tribunals (DRTs) and the slow implementation of recovery laws like the Insolvency and Bankruptcy Code (IBC) and SARFAESI Act have hindered effective NPA management.

What are the Challenges Related to NPA Recovery?

- Legal and Regulatory Hurdles: NPA recovery in India is hindered by a slow and outdated legal framework. Despite laws like the IBC and SARFAESI Act, the resolution of corporate insolvency cases takes over 400 days, as reported by the Insolvency and Bankruptcy Board of India (IBBI).

- Borrowers often exploit legal tactics to delay recovery, exacerbating the situation.

- Proper Asset Valuation and Realization: Accurate asset valuation is critical in NPA recovery. Market conditions and economic factors can lead to overvaluation or undervaluation, resulting in financial losses.

- Converting collateral into cash, especially during economic downturns or in niche markets, can be slow and challenging, with assets often failing to meet their original valuation.

- Debtor Cooperation: It is crucial for NPA recovery. Many borrowers either lack the ability or willingness to repay, resorting to tactics such as hiding or undervaluing assets, or using legal delays, significantly hampering the recovery process.

- Operational Inefficiencies: Internal inefficiencies, such as poor documentation, inadequate tracking systems, and lack of coordination, hinder NPA recovery.

- The absence of a centralized management system leads to mismanaged information, delaying recovery and increasing costs.

- Economic and Market Conditions: Economic downturns lead to a decline in asset values, making it difficult to recover full loan amounts. Market volatility, especially in sectors like real estate and machinery, further complicates the recovery process.

Way Forward

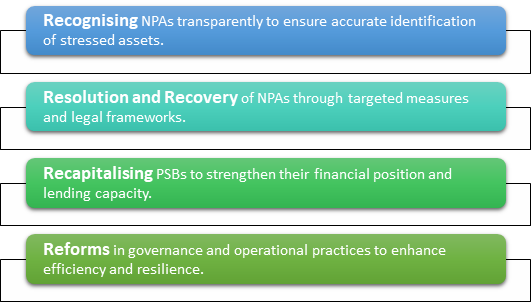

- Government Support: Implement a 4R strategy- Recognition, Resolution, Recapitalization, and Reforms to strengthen PSBs and reduce NPAs through transparent recognition, improved recovery, recapitalization, and financial ecosystem reforms.

- Enhanced Monitoring: Banks should invest in better monitoring systems to detect early signs of loan defaults and take preventive measures before loans become NPAs.

- Proactive engagement with borrowers and regular reassessment of loan performance can help mitigate the risk of defaults.

- Approval Process: Establish a structured credit approval process, including comprehensive assessments and periodic reviews of borrowers' financial health and repayment capacity.

- Institutional Mechanism: Create new Development Financial Institutions (DFIs) to support long-term industrial and infrastructure funding.

- Public-Private Collaboration: Collaborative efforts between public and private sector banks, along with specialized agencies, could improve the efficiency of recovery actions.

- Using technology and data analytics to track defaulters and locate absconding promoters could also enhance recovery efforts.

- Risk Management: Mitigate concentration risks by diversifying loan portfolios, reducing reliance on specific sectors or borrowers to minimize NPAs during downturns.

- Banks should adopt stricter lending norms and focus on financing projects with a higher probability of success.

Conclusion

While loan write-offs have provided temporary relief by reducing NPAs for Indian banks, the long-term sustainability of this approach depends on improving recovery mechanisms, strengthening legal frameworks, and enhancing the overall governance of financial institutions.

|

Drishti Mains Question: Analyze the causes of rising NPAs in Indian banks and evaluate the effectiveness of government and RBI measures to address them. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Which of the following statements best describes the term ‘Scheme for Sustainable Structuring of Stressed Assets (S4A)’, recently seen in the news? (2017)

(a) It is a procedure for considering ecological costs of developmental schemes formulated by the Government.

(b) It is a scheme of RBI for reworking the financial structure of big corporate entities facing genuine difficulties.

(c) It is a disinvestment plan of the Government regarding Central Public Sector Undertakings.

(d) It is an important provision in ‘The Insolvency and Bankruptcy Code’ recently implemented by the Government.

Ans: (b)

Governance

Oilfields Amendment Bill 2024

For Prelims: Rajya Sabha, Hydrocarbons, Helium, Crude oil and natural gas, Petroleum and Natural Gas Board Regulatory Board

For Mains: Oilfields (Regulation and Development) Amendment Bill 2024, Regulations in mineral oil extraction, India's Energy policies.

Why in News?

Recently, the Oilfields (Regulation and Development) Amendment Bill, 2024 was passed by the Rajya Sabha, aiming to encourage domestic production of petroleum and mineral oils while attracting private investment.

- This bill seeks to amend the existing Oilfields Act of 1948 by clearly delineating the governance of oil production from mining activities.

What are the Key Provisions of the Oilfields Amendment Bill?

- Definition of Mineral Oil: The Bill broadens the definition of mineral oils to include naturally occurring hydrocarbons (such as petroleum and natural gas), as well as coal bed methane and shale gas/oil.

- Petroleum Leases: The Bill replaces the term “mining leases” with “petroleum leases”, which will govern activities like exploration, production, and disposal of mineral oils.

- Existing mining leases granted under the Oilfields Act of 1948 remain valid and will not be altered.

- Penalties for Violations: Under the Oilfields Act of 1948, violations can result in up to six months of imprisonment, a fine of Rs 1,000, or both.

- The new Bill replaces criminal penalties for violations of the Oilfields Act with financial penalties, increasing the maximum fine to Rs 25 lakh, with additional daily fines of up to Rs 10 lakh for ongoing violations.

- Encouragement of Private Investment: The Bill includes measures to attract private investment in petroleum production, clarifying that existing mining leases will remain valid without disadvantage to lessees.

- Rule-Making Powers of the Central Government: The Bill retains the central government's power to make rules on various aspects, including the granting and regulating of leases, setting terms and conditions( such as area and duration of leases), conservation and development of mineral oils, and methods for producing oil along with the collection of royalties.

- Additionally, the Bill expands the central government's authority to include the merger of petroleum leases, sharing of facilities, lessees' obligations to protect the environment and reduce emissions, and alternative dispute resolution mechanisms for petroleum lease grants.

- Adjudication of penalties: The central government will appoint an officer of Joint Secretary rank or higher to adjudicate penalties.

- Appeals against the Adjudicating Authority's decisions will go to the Appellate Tribunal specified in the Petroleum and Natural Gas Board Regulatory Board(PNGRB) Act, 2006.

- According to the PNGRB Act, 2006, appeals against the decisions of the PNGRB are to be made before the Appellate Tribunal for Electricity, which is constituted under the Electricity Act, 2003.

Petroleum and Natural Gas Board Regulatory Board

- The PNGRB was established under the Petroleum and Natural Gas Regulatory Board Act of 2006.

- Nodal MInistry: Ministry of Petroleum and Natural Gas

- Its objective is to protect consumer interests, regulate petroleum-related activities, and promote competitive markets.

- The PNGRB authorizes City Gas Distribution (CGD) networks, natural gas and petroleum product pipelines, sets tariffs, and establishes technical and safety standards.

What are the Concerns Regarding the Oilfields Amendment Bill, 2024?

- Impact on State Rights: The Bill's shift from mining leases to petroleum leases raises concerns that states may lose their taxation rights under Entry 50 of the State List.

- A Supreme Court of India judgment in Mineral Area Development Authority & Anr v. M/S Steel Authority of India & Anr 2024 confirmed that states have exclusive power to tax mining activities under Entry 50 of the State List in the Indian Constitution.

- Critics argue that Entry 53 of the Union List, which grants the central government authority over oilfields and mineral oils, may increase central control, raising concerns about federalism and potential disputes over jurisdiction and revenue.

- Environmental Concerns: Increased involvement of private players may lead to weaker environmental safeguards.

- There is apprehension that private companies may prioritize profits over environmental protection, potentially increasing emissions and ecological damage.

- Penalties for Non-Compliance: Replacing criminal penalties with fines raises accountability concerns, potentially reducing deterrence and compliance with safety and environmental standards.

- Private Investment vs. Public Sector Priority: Opposition parties argue that public-sector enterprises like the Oil and Natural Gas Corporation (ONGC) should be prioritized over private entities for resource exploration.

- Critics fear private investment may weaken public-sector dominance and prioritize profit over community welfare and sustainability.

Way Forward

- Jurisdictional Boundaries: Establish clear boundaries between central and state authority to prevent jurisdictional disputes, ensuring a cooperative federal structure in resource governance.

- Transparent Revenue Sharing: Develop a transparent and equitable revenue-sharing mechanism between the Centre and states to ensure fair distribution of resources and reduce tensions over financial control.

- Sustainable Practices: Incorporate incentives for companies that prioritize sustainability, such as tax rebates or reduced royalties for reducing carbon emissions and investing in renewable energy technologies.

- Strengthening Environmental Regulations: Implementing robust environmental safeguards within the Bill can mitigate risks associated with increased private sector involvement in oil production. This includes mandatory environmental impact assessments for new projects.

- Public Awareness Campaigns: Raising awareness about the benefits of domestic oil production and its implications for energy security can foster public support for the Bill while addressing misconceptions.

|

Drishti Mains Question Critically analyze the implications of the Oilfields (Regulation and Development) Amendment Bill, 2024 on India's energy security and state rights. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. The term ‘West Texas Intermediate’, sometimes found in news, refers to a grade of (2020)

(a) Crude oil

(b) Bullion

(c) Rare earth elements

(d) Uranium

Ans: (a)

Q. According to India’s National Policy on Biofuels, which of the following can be used as raw materials for the production of biofuels? (2020)

- Cassava

- Damaged wheat grains

- Groundnut seeds

- Horse gram

- Rotten potatoes

- Sugar beet

Select the correct answer using the code given below:

(a) 1, 2, 5 and 6 only

(b) 1, 3, 4 and 6 only

(c) 2, 3, 4 and 5 only

(d) 1, 2, 3, 4, 5 and 6

Ans: (a)

Mains:

Q. Access to affordable, reliable, sustainable and modern energy is the sine qua non to achieve Sustainable Development Goals (SDGs). Comment on the progress made in India in this regard. (2018)

Important Facts For Prelims

Protecting Sacred Groves

Why in News?

Recently, the Supreme Court directed the Union government to create a comprehensive policy for the protection of sacred groves across the country.

- The judgment was inspired from the Piplantri Model created in a Piplantri village in Raasthan's Rajsamand district.

What are Sacred Groves?

- About: Sacred Groves are the tracts of virgin forests that are left untouched by the local inhabitants and are protected by the local people due to their culture and religious beliefs.

- Sacred groves are relic vegetation of once dominant flora.

- Sacred Groves in India: Over 1 million sacred forests and 100,000 to 150,000 sacred groves exist across India.

- It is prominent in Maharashtra, Karnataka, Kerala, Tamil Nadu, and Uttarakhand.

- Statutory Provision: Wild Life (Protection) Act, 1972 empowers State governments for declaration of any private or community land, as a community reserve, under which sacred groves can be declared as community reserves.

- National Forest Policy, 1988, backed by the Godavarman Case, 1996, encouraged communities with customary rights to protect and improve these forest patches on which they depend for their needs.

- Cultural Significance: It is integral to Hindu beliefs, promoting coexistence and reverence for nature.

- Role in Conservation: Practices like tree worship and strict prohibitions on logging and hunting align with biodiversity principles.

- Serve as refuges for diverse flora and fauna and maintain clean water ecosystems.

- They are examples of Other Effective Area-Based Conservation Measures (OECMs).

- Different Names:

| Region/State | Name of Sacred Groves |

| Himachal Pradesh | Devban |

| Karnataka | Devarakadu |

| Kerala | Kavu |

| Madhya Pradesh | Sarna |

| Rajasthan | Oran |

| Maharashtra | Devrai |

| Manipur | Umanglai |

| Meghalaya | Law Kyntang/Law Lyngdoh |

| Uttarakhand | Devan/Deobhumi |

| West Bengal | Gramthan |

| Andhra Pradesh | Pavithravana |

Note:

- The Supreme court (SC) cited Verse 20 from Chapter 13 of the Bhagavad Gita: “Nature is the source of all material things: the maker, the means of making, and the things made. Spirit is the source of all consciousness which feels pleasure and feels pain.”

- In the Godavarman Case 1996, the SC addressed multiple environmental issues, ranging from encroachments of forest lands to wildlife conservation, the regulation of mining activities within forest areas.

Piplantri Model

- It showed how environmental protection, gender equality, and economic growth can work together to change communities.

- The sarpanch of the Piplantri village started the initiative to plant 111 trees for every girl child born.

- It started after the tragic death of her girl child due to environmental damage caused due to excessive marble mining, leading to water shortages, deforestation, and economic decline.

- Environmentally, over 40 lakh trees have been planted, which has helped raise the water table by 800-900 feet and cooled the climate by 3-40C.

- It also led to drastic lowering of female foeticide, increased local income, avenues of education and saw women self-help groups flourish.

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q.The most important strategy for the conservation of biodiversity together with traditional human life is the establishment of (2014)

(a) biosphere reserves

(b) botanical gardens

(c) national parks

(d) wildlife sanctuaries

Ans: (a)

Rapid Fire

SEBI Introduced Specialised Investment Funds (SIFs)

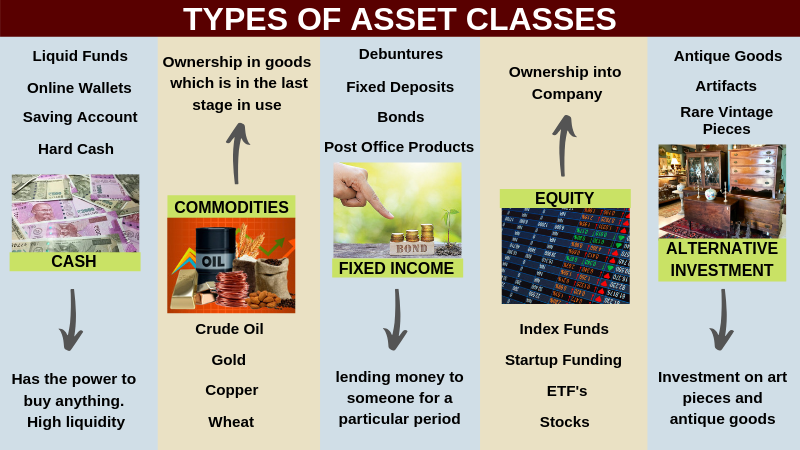

SEBI has introduced a new asset class called Specialised Investment Fund (SIF). It is designed for informed investors willing to take on riskier investments.

Specialised Investment Fund (SIF):

- SIF bridges the gap between mutual funds (MFs) and portfolio management services (PMS).

-

It requires a minimum investment of Rs 10 lakh, with lower thresholds for accredited investors. SIFs will offer open-ended, close-ended, and interval investment strategies.

- Asset Class:

- It is a group of investments that share similar characteristics and are governed by the same regulations.

- Example: Equities (stocks), fixed income (bonds), cash and cash equivalents, real estate, commodities, and currencies.

- MFs: These are investment vehicles that pool money from multiple investors to purchase securities such as bonds, stocks, or a combination of both.

- PMS: It provides personalized investment management, where a dedicated portfolio manager tailors strategies to an investor’s specific needs, risk tolerance, and financial goals.

- Unlike MFs, PMS offers customized portfolios, with professional management based on in-depth research.

- It typically targets high-net-worth individuals and involves higher fees.

- SEBI also introduced Mutual Fund Lite regulations (a simplified regulatory system) to facilitate the passively managed funds schemes such as exchange traded funds (ETFs) and index funds by encouraging more players to enter the mutual fund market by reducing compliance burdens and easing entry barriers.

Read More: Amendment to Mutual Fund Rules

Rapid Fire

RBI Enhances Collateral-Free Loan for Farmers

The Reserve Bank of India (RBI) has increased the collateral-free loan limit for farmers from Rs 1.6 lakh to Rs 2 lakh to support small and marginal farmers amidst rising input costs.

Key Highlights:

- Beneficiaries: Over 86% of farmers, primarily small and marginal landholders, are expected to benefit.

- Extended Coverage: Includes loans for allied agricultural activities, enabling income diversification.

- Banks have been directed to ensure prompt implementation and raise awareness about the provision.

- Complementary Schemes: The measure will ease access to Kisan Credit Card (KCC) loans and align with the Modified Interest Subvention Scheme, offering loans up to Rs 3 lakh at an effective interest rate of 4%.

- This initiative enhances financial inclusion in agriculture, enabling farmers to manage input costs effectively, invest in operations, and improve livelihoods.

Read More: Kisan Credit Card

Rapid Fire

Global Decline in Diarrhoeal Disease Deaths

A recent study published in The Lancet Infectious Diseases highlights a decline in global deaths caused by diarrheal diseases.

- There has been a nearly 60% drop in global deaths due to diarrhoeal diseases, with 1.2 million deaths reported in 2021, down from 2.9 million in 1990.

- Children under five and the elderly (above 70 years) remain highly vulnerable, especially in sub-Saharan Africa and South Asia, where mortality rates are highest.

- Notably, while mortality among children under five has decreased by 79%, this age group still experiences the highest mortality rate.

- Disability-adjusted life years (DALY) , representing years of life lost and lived with disability, dropped from 186 million in 1990 to 59 million in 2021, with 31 million in children under five.

- In high-income countries, there are less than one death per 100,000 population in children under five, while sub-Saharan Africa reports at least 150 deaths per 100,000 population in the same demographic.

- Diarrhoea: Diarrhoea is defined as the passage of three or more loose or liquid stools per day (or more frequent passage than is normal for the individual).

- The most severe threat posed by diarrhoea is dehydration.

Read More: Stop Diarrhoea Drive, Asian Conference on Diarrhoeal Disease and Nutrition

Rapid Fire

NIA can Probe Linked Non-Scheduled Offences: SC

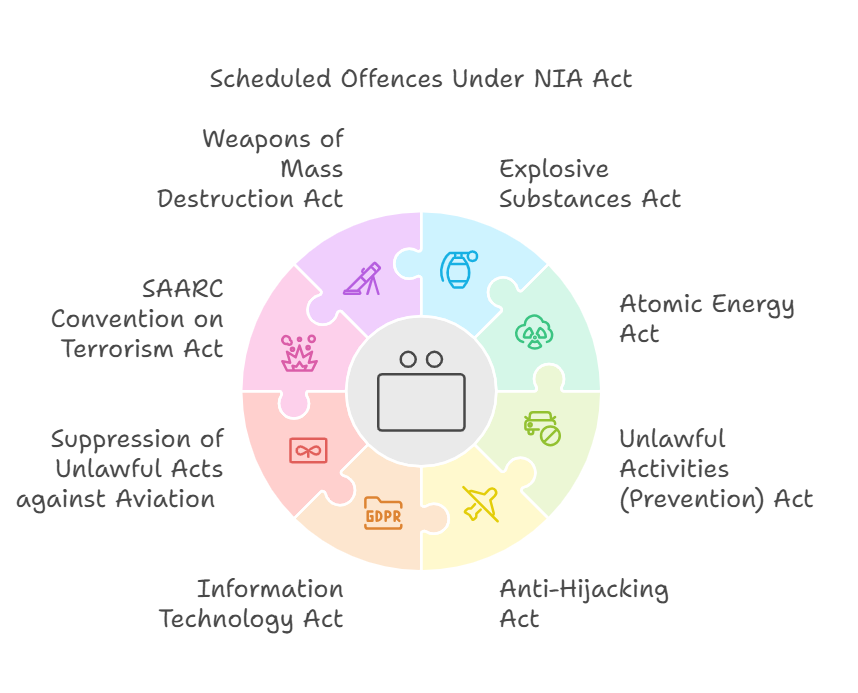

Recently, the Supreme Court (SC) has held that the National Investigation Agency (NIA) has the power to probe non-scheduled offences if they are linked to scheduled offences under the NIA Act.

- The SC clarified that the NIA can probe offences under the NDPS Act, 1985 (not scheduled under the NIA Act) if they are connected to offences under the UAPA, which is scheduled under the Act.

- Scheduled Offences Under NIA Act, 2008:

- The NDPS Act, 1985 regulates narcotics-related activities, penalizing offences like drug trafficking with imprisonment (10–20 years), fines (minimum Rs 1 lakh), and death for severe repeat offences.

- It also mandates property forfeiture linked to drug crimes and established the Narcotics Control Bureau in 1986 for enforcement.

- NIA is India’s central counter-terrorism law enforcement agency, established under the NIA Act, 2008.

- It investigates offences affecting India’s sovereignty, security, and integrity, including cross-border crimes like arms smuggling, drug trafficking, and fake currency circulation.

- It operates under the Ministry of Home Affairs.

Read More: National Investigation Agency

Rapid Fire

Marine Heat Wave Killed 4 Million Murre Seabirds

A marine heatwave (MHW) nicknamed “the Blob” killed 4 Million of Alaska’s Common Murre Seabirds between 2014 and 2016.

- This was the largest documented die-off of a single species of wild bird or mammal.

- Common Murres: They are black-and-white seabirds (often described as "flying penguins”) that somewhat resemble penguins in appearance, and are among the most plentiful seabirds in Alaska.

- They are the deepest diving bird in the northern hemisphere diving up to 600 feet deep.

- IUCN Status: Least Concern.

- MHW: It occurs when the surface temperature of a particular region of the sea rises to 3 or 4 degree Celsius above the average temperature for at least five days.

- MHWs can last for weeks, months or even years.

- MHWs destroy kelp forests as Kleps (underwater ecosystems in shallow water) usually grow in cooler waters.

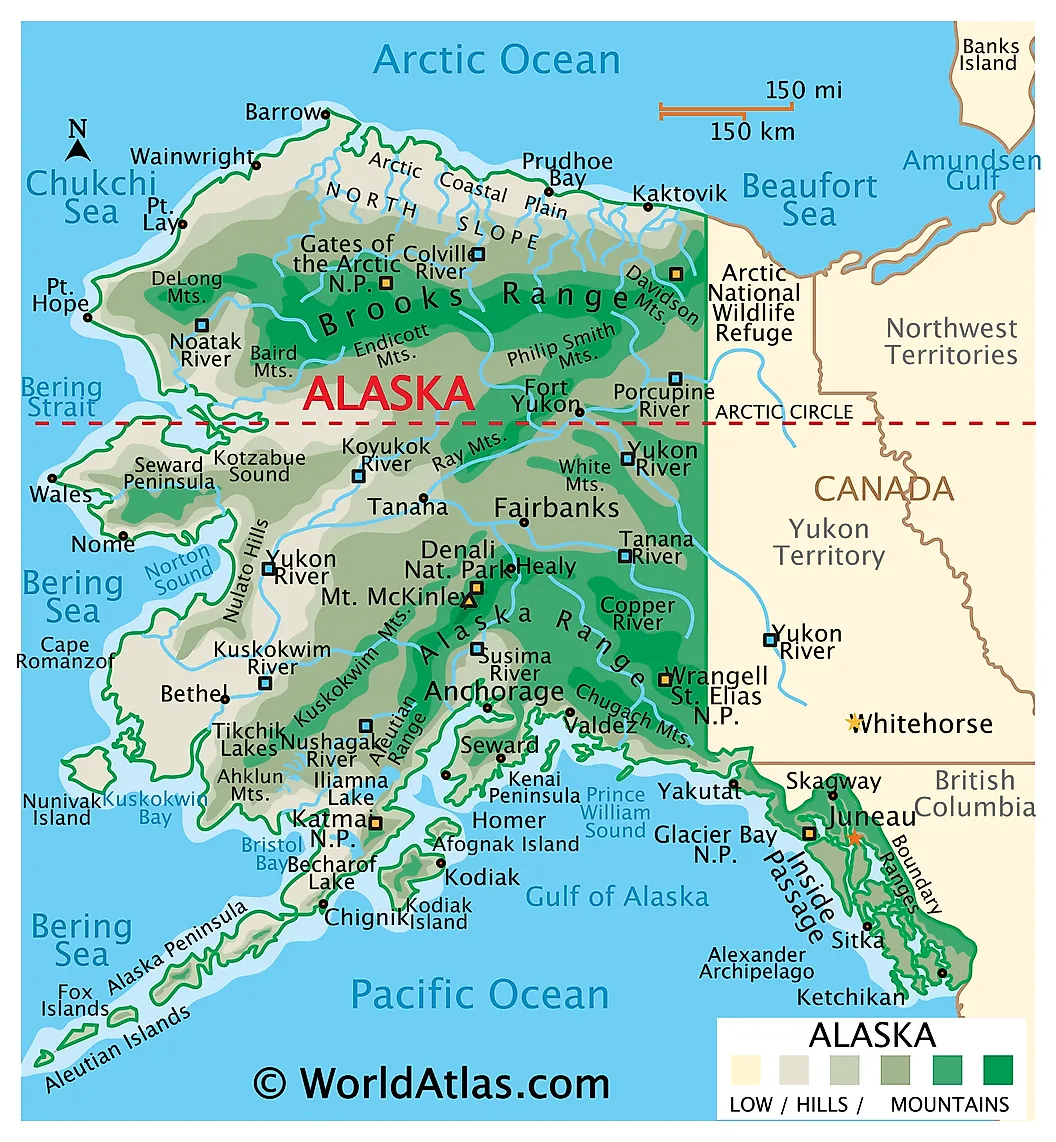

- Alaska:

- Alaska is the largest state in the US by area.

- It is bordered by the Arctic Ocean to the north, Canada to the east, the Pacific Ocean to the south, and Russia across the Bering Strait to the west.

- Originally a part of Russia, Alaska was purchased by the US in 1867.

- It is rich in oil, natural gas, and minerals.

Read More: Marine Heatwaves in Arctic Ocean

.png)