Indian Economy

Bond Yield

- 23 Mar 2024

- 12 min read

For Prelims: Bond Yield, State Development Loan (SDL), Reserve Bank of India (RBI), Government Securities (G-Sec).

For Mains: Bond Yield, Indian Economy and issues relating to planning.

Why in News?

Recently, the State governments have mobilised a record Rs 50,206 crore through the auction of State Development Loan (SDL) Bonds, marking the largest such weekly borrowing ever.

- The funds raised far exceeded the indicative borrowing target of Rs 27,810 crore set for the period, as per Reserve Bank of India (RBI) data. This indicates robust demand for state government securities in the financial markets.

- SDLs are the part of Government Securities (G-Sec), where State Governments raise loans from the market. SDLs are dated securities issued through normal auctions similar to the auctions conducted for dated securities issued by the Central Government.

What are Bonds?

- About:

- A bond is an instrument to borrow money. It is like an IOU (I owe you).

- An IOU is a written acknowledgement of debt that one party owes another. IOUs are less formal and legally binding than promissory notes.

- A bond could be floated/issued by a country’s government or by a company to raise funds.

- Since Government Bonds (referred to as G-secs in India, Treasury in the US, and Gilts in the UK) come with the sovereign’s guarantee, they are considered one of the safest investments.

- A bond is an instrument to borrow money. It is like an IOU (I owe you).

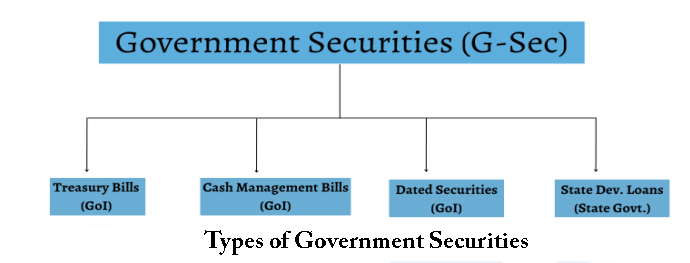

- Types of G-Secs:

- Treasury Bills (T-bills): Treasury bills are zero coupon securities and pay no interest. Instead, they are issued at a discount and redeemed at the face value at maturity.

- Cash Management Bills (CMBs): In 2010, the Government of India, in consultation with RBI introduced a new short-term instrument, known as CMBs, to meet the temporary mismatches in the cash flow of the Government of India.

- The CMBs have the generic character of T-bills but are issued for maturities of less than 91 days.

- Dated G-Secs: Dated G-Secs are securities that carry a fixed or floating coupon rate (interest rate) which is paid on the face value, on a half-yearly basis. Generally, the tenor of dated securities ranges from 5 years to 40 years.

- State Development Loans (SDLs): State Governments also raise loans from the market which are called SDLs. SDLs are dated securities issued through normal auctions similar to the auctions conducted for dated securities issued by the Central Government.

- Bond Yields:

- The yield of a bond is the effective rate of return that it earns. But the rate of return is not fixed — it changes with the price of the bond.

- But to understand that, one must first understand how bonds are structured.

- Every bond has a face value and a coupon payment. There is also the price of the bond, which may or may not be equal to the face value of the bond.

- In addition to the face value and coupon payment, bonds also have a coupon rate.

- The coupon rate is the fixed annual interest rate expressed as a percentage of the bond's face value.

- For Instance, the face value of a 10-year G-sec is Rs 100, and its coupon payment is Rs 5, and coupon rate is 5%.

- Buyers of this bond will give the government Rs 100 (the face value); in return, the government will pay them Rs 5 (the coupon payment) every year for the next 10 years, and will pay back their Rs 100 at the end of the tenure.

- In this case, the bond’s yield, or effective rate of interest, is 5%. The yield is the investor’s reward for parting with Rs 100 today, but for staying without it for 10 years.

- Yield Curve:

- The Yield Curve is a graphical representation of the interest rates on debt for a range of maturities.

- It shows the yield an investor is expecting to earn if he lends his money for a given period of time.

- A fixed income Analyst may use the yield curve as a leading economic indicator, especially when it shifts to an inverted shape, which signals an economic downturn, as long-term returns are lower than short-term returns.

How Does RBI Manage Bond Yield?

- The Reserve Bank of India (RBI) employs Open Market Operations (OMOs) as a pivotal tool to manage bond yields and regulate monetary conditions within the economy. Through OMOs, the RBI strategically sells or purchases Government Securities (G-secs) in the open market.

- When the RBI aims to curb excess liquidity and temper inflationary pressures, it sells G-secs, effectively absorbing liquidity from the market. Conversely, to stimulate economic activity and bolster liquidity, the RBI buys back G-secs, injecting funds into the system.

- When the RBI sells G-secs, it puts upward pressure on bond yields, making borrowing costlier and thereby curbing excessive borrowing and spending. Conversely, purchasing G-secs tends to drive bond prices higher, pushing yields lower, which can encourage borrowing and investment.

- In conjunction with OMOs, the RBI employs a suite of monetary policy tools including the repo rate, cash reserve ratio, and statutory liquidity ratio.

- By strategically deploying these tools, the RBI orchestrates a comprehensive approach to managing bond yields and fostering stable economic conditions conducive to growth and stability.

What are the Factors Influencing the Yield Curve?

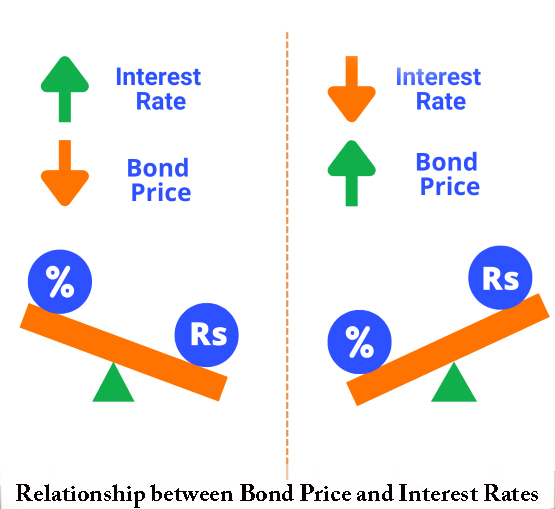

- Market Demand and Bond Prices:

- Imagine there's only one bond available, and two buyers want to buy it. They might bid against each other, driving the bond's price up.

- Even though the bond's face value remains the same, say Rs 100, if it's sold for Rs 110, the yield decreases because the coupon payment remains constant at, say, Rs 5. So, the yield is effectively calculated based on the price paid for the bond.

- Alignment with Economy's Interest Rate:

- If the interest rate in the economy is different from the bond's initial coupon payment, market forces adjust the bond's yield to align with the prevailing interest rate.

- For example, if the economy's interest rate is 4% and a bond offers a 5% yield, many investors will rush to buy it for a higher return.

- This demand drives up the bond's price until its yield matches the economy's interest rate.

- Conversely, if the economy's interest rate is higher than the bond's yield, the bond's price decreases until its yield matches the prevailing rate.

- Analogy: If the economy's interest rate is higher than the bond's yield, it's like having a heavier weight on the side of the economy's interest rate. This causes the seesaw to tilt towards the economy's interest rate side, indicating that the bond's yield is lower relative to the interest rate.

- Conversely, if the bond's yield is higher than the economy's interest rate, it's like having a heavier weight on the side of the bond's yield. This tilts the seesaw towards the bond's yield side, indicating that the bond's yield is higher relative to the interest rate.

What will be the Impact of the Hardening of Bond Yield?

- Losses to Banks and Mutual Funds:

- Both banks and mutual funds holding government securities (g-secs) will suffer losses due to the inverse relationship between bond prices and yields. As bond yields rise, bond prices fall, leading to mark-to-market losses for these institutions.

- Increased Cost of Borrowings:

- Higher yields on government securities imply that the government will have to offer higher interest rates on fresh borrowings. This increase in government borrowing costs can have a ripple effect on the entire economy, leading to higher interest rates for corporates and potentially higher lending rates for banks, affecting the cost of borrowing for businesses and individuals.

- Impact on Corporate Bonds:

- Corporates may need to increase interest rates on their bonds to attract investors amid rising bond yields in the market. This could lead to higher borrowing costs for companies, potentially impacting their profitability and investment decisions.

- Impact on Equity Markets:

- As bond yields rise, the opportunity cost of investing in equities increases since fixed-income securities become relatively more attractive compared to stocks. Investors may shift their allocations away from equities towards bonds, leading to a decrease in demand for stocks and potentially resulting in a decline in equity prices.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q.1 In the context of the Indian economy, non-financial debt includes which of the following? (2020)

- Housing loans owed by households

- Amounts outstanding on credit cards

- Treasury bills

Select the correct answer using the code given below:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) 1, 2 and 3

Ans: (d)

Q.2 Consider the following statements: (2018)

- The Reserve Bank of India manages and services Government of India Securities but not any State Government Securities.

- Treasury bills are issued by the Government of India and there are no treasury bills issued by the State Governments.

- Treasury bills offer are issued at a discount from the par value.

Which of the statements given above is/are correct?

(a) 1 and 2 only

(b) 3 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (c)

Q.3 In the context of Indian economy, ‘Open Market Operations’ refers to (2013)

(a) borrowing by scheduled banks from the RBI

(b) lending by commercial banks to industry and trade

(c) purchase and sale of government securities by the RBI

(d) None of the above

Ans: (c)

-min.jpg)