Budgetary Dependence of CPSEs

For Prelims: Central Public Sector Enterprises, Capital expenditure, National Highways Authority of India, Foreign exchange reserves

For Mains: Role of CPSEs in Economic Development, Public Sector Enterprises: Issues and Challenges

Why in News?

Concerns arise as Central Public Sector Enterprises (CPSEs), shift their capital expenditure (capex) strategy, relying more on budgetary support than self-financing or private investment.

- This shift has sparked debate on the long-term financial sustainability and autonomy of CPSEs.

What are the Concerns Regarding CPSEs?

- Overdependence on Budgetary Support: CPSEs are increasingly relying on budgetary support (equity and loans from the government) rather than their own Internal and Extra Budgetary Resources (IEBR).

- Budgetary support for CPSEs has risen by over 150% in five years, from Rs 2.1 lakh crore in FY20 to Rs 5.48 lakh crore in FY25 (Revised Estimate).

- IEBR, which CPSEs use to finance their own capex, has declined significantly from Rs 6.42 lakh crore in FY20 to Rs 3.63 lakh crore in FY23 and estimated at Rs 3.82 lakh crore in FY25.

- The decline in IEBR restricts CPSEs’ financial flexibility and forces greater dependence on government funding.

- Reduced Private Sector Participation: CPSEs' reliance on budgetary support has deterred private investment.

- National Highways Authority of India (NHAI) was expected to raise 38% of its funding from private capital, but its IEBR fell to nil in FY23-FY24 due to rising debt (Rs 3.48 lakh crore in 2022) and policy instability, discouraging private investment.

- High debt limits CPSEs' ability to raise capital independently and weakens their financial health.

- Policy Concerns: The Standing Committee on Transport (FY22) noted that high budgetary support alone may not meet CPSE investment needs, urging private sector engagement.

- If CPSEs continue relying on government support, it could strain fiscal resources, reducing funds available for social and developmental programs.

- Pay High Dividends: The government's pressure on CPSEs to prioritize dividend payments over reinvestment limits their ability to expand, modernize, and make independent long-term growth decisions.

- Limited Financial Autonomy: CPSEs, unlike private firms, lack the flexibility to respond to market changes, leading to slow decision-making.

- Past mergers and acquisitions (e.g., acquisition of Hindustan Petroleum Corporation Limited (HPCL) by Oil and Natural Gas Corporation (ONGC)) reduced CPSE cash reserves, further restricting capex capabilities.

What are the Key Facts About CPSEs?

- About: CPSEs are companies where the Central Government or other CPSEs hold at least 51% stake.

- The Department of Public Enterprises (DPE) oversees CPSEs' performance, finance, and policies under various ministries.

- Post-independence, India's socialist model led to CPSEs in heavy industries, banking, oil & gas, steel, and power. The 1991 economic reforms ushered in corporatization, heightened competition, and a sharper focus on profitability and efficiency in CPSEs.

- Significance: CPSEs play a crucial role in India’s economic development, infrastructure creation, employment generation, and industrial growth.

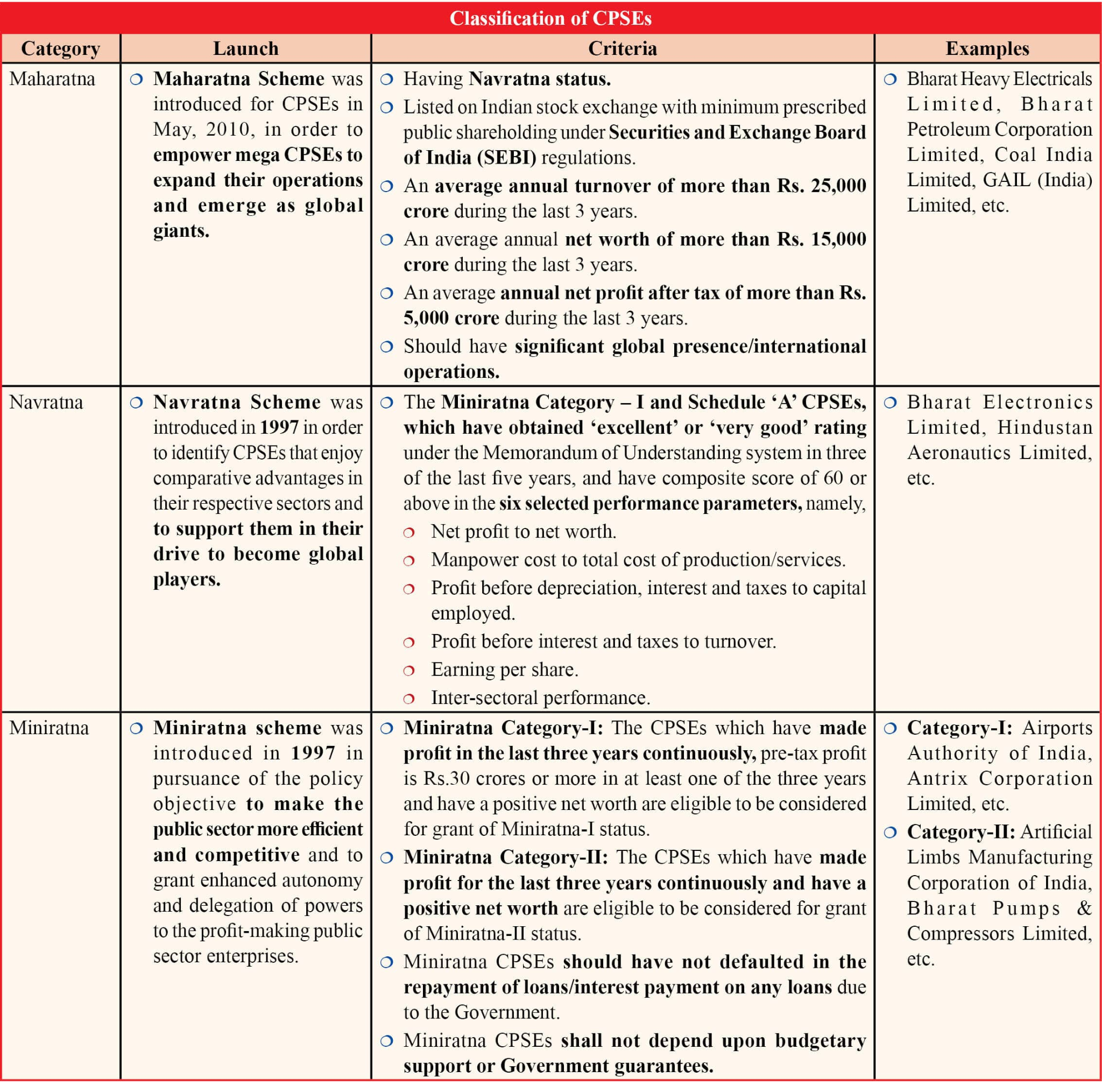

- Classification: CPSEs are categorized into Miniratna, Navratna, and Maharatna based on size, financial performance, and strategic importance.

- In February 2025, Indian Railway Catering and Tourism Corporation (IRCTC) and Indian Railway Finance Corporation (IRFC) as the country’s 25th and 26th Navratna companies respectively.

- Current Status of CPSEs: According to the Public Enterprises Survey 2023-24, as of March 2024, India has 448 CPSEs (only 272 operating in FY24).

- Financial Performance of CPSEs: Gross revenue of the operating CPSEs declined by 4.7% to Rs 36.08 lakh crore in FY24.

- Contributions to the Economy: CPSEs contributed Rs 4.85 lakh crore in FY 2023-24 to the Contribution to Central Exchequer (via taxes, duties, and dividends), marking a 5.96% increase from Rs 4.58 lakh crore in FY 2022-23.

- In FY 2023-24, all CSR eligible CPSEs spent around 4,900 crore on CSR activities, reflecting a 19.08% increase from FY 2022-23.

- CPSEs earned Rs 1.43 lakh crore in foreign exchange reserves in FY 2023-24, contributing to India’s trade balance and global business engagement.

Note: Other types of public enterprises include Public Sector Banks (PSBs), where the Central/State Government or other PSBs hold at least 51%, and State Level Public Enterprises (SLPEs), where the State Government or other SLPEs hold at least 51%.

What Measures Can Address CPSEs’ Concerns?

- Disinvestment: Under Department of Investment and Public Asset Management (DIPAM) and New Public Sector Enterprise Policy, 2021 non-strategic CPSEs can be prioritized for privatization to attract private investment and reduce the fiscal burden, while strategic ones are retained.

- Implement policy reforms to reduce regulatory bottlenecks and financial risks for private investors.

- Raise Capital Independently: Encourage CPSEs to revive IEBR financing through bonds, external commercial borrowings (ECBs), and partnerships with private players and reduce their dependence on budgetary support.

- Digital Transformation: CPSEs lag behind private companies in digital adoption, impacting operational efficiency. Integrating advanced digital infrastructure and automation in sectors like railways, power, and telecom can reduce operational costs.

- Limiting High Dividend Payout: As recommended by the 15th Finance Commission (2020-21), CPSEs should balance their dividend payments with reinvestment in infrastructure expansion.

- CPSE Performance Reviews: The 2005 Sengupta Committee recommended limiting CPSE performance reviews to twice a year for better efficiency.

|

Drishti Mains Question: Critically evaluate the financial health of CPSEs with a focus on their rising debt burden. What steps should be taken to ensure fiscal sustainability? |

Need for Balanced Cryptocurrency Regulation

For Prelims: Cryptocurrency, Blockchain, Bitcoin, Money Laundering, Digital Rupee, Taxation

For Mains: Issues in Regulating Cryptocurrency

Why in News?

The US administration has embraced crypto assets, solidifying their place in global finance. While countries like Vietnam push for clear regulations and the EU sets global standards with MiCA, India still waits for a discussion paper.

What is Cryptocurrency?

About

- A cryptocurrency is a digital or virtual currency that uses cryptography to secure transactions. It is a decentralized currency (not controlled by any government or institution).

- Transactions with cryptocurrency are recorded on a public digital ledger called blockchain.

- This ledger is maintained by a network of computers around the world, and each new transaction is verified and added to the blockchain by these computers.

- The decentralization and use of cryptography make it difficult for anyone to manipulate the currency or the transactions recorded on the blockchain.

- Some examples of cryptocurrencies include Bitcoin, Ethereum, and Litecoin.

Difference Between Cryptocurrency, e-Money, Physical Currency

|

Category |

Cryptocurrency |

e-Money |

Physical Currency (Rs) |

|

Accessibility |

Largely limited to Internet connection |

Access to e-devices such as mobile phones and an agent network |

Physical access to cash, ATMs, and bank branches |

|

Value |

Determined by supply, demand and trust in the system |

Equal to amount of fiat currency exchanged into electronic form |

Backed by the government, determined by monetary policy |

|

Customer ID |

Anonymous |

Required adequate customer identification |

Not required for transactions, but required for bank accounts |

|

Production/ Issuer |

Mathematically generated ("mined") by community of developers, called "miners" |

Digitally issued against receipt of equal value of fiat currency of central authority by RBI |

Central bank (RBI) |

|

Regulator or Oversight |

Mostly Unregulated |

Central Bank/Board |

Central Bank (RBI) |

Regulations

- Global: Most cryptocurrencies operate outside national government regulations, serving as alternative currencies beyond state monetary policies.

- Switzerland has embraced crypto with a well-defined regulatory framework, ensuring investor protection while fostering blockchain innovation.

In September 2021, El Salvador became the first country to adopt Bitcoin as legal tender.

- Switzerland has embraced crypto with a well-defined regulatory framework, ensuring investor protection while fostering blockchain innovation.

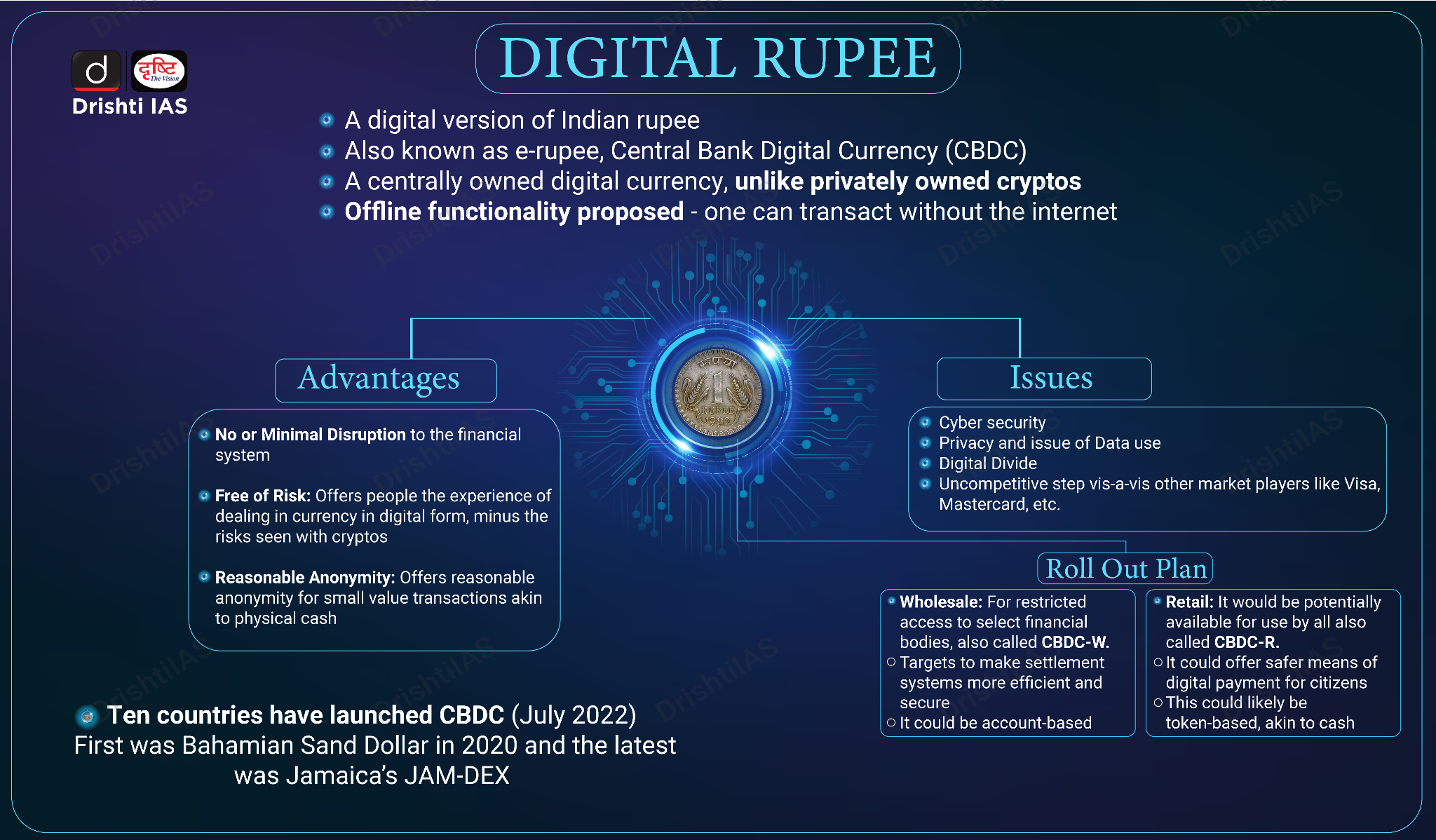

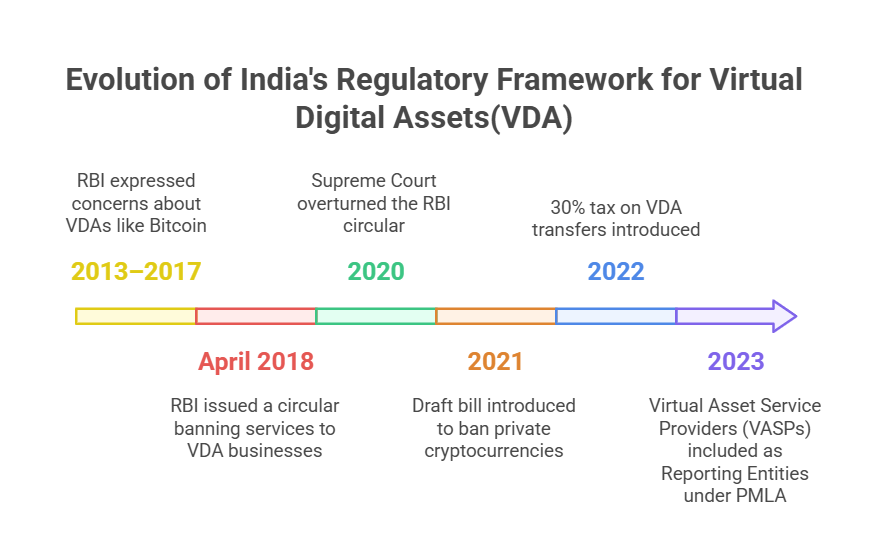

- India: Cryptocurrency in India is unregulated but not specifically banned.

- Timeline:

Why Does India Need a Policy for Cryptocurrency?

- Preventing Talent Exodus: A blanket ban on cryptocurrencies could lead to a significant brain drain, along with the flight of capital as seen after the RBI's 2018 ban, with blockchain experts moving to crypto-friendly countries and halting blockchain innovation in India.

- Integrating into the Global Financial Ecosystem: By embracing cryptocurrency, India can position itself as a key player in the global financial ecosystem, attracting investments and fostering growth in crypto startups through initiatives like 'crypto export zones.'

- Leveraging New Technology and Services: The growing demand for blockchain applications in scalability, security, and analytics presents an opportunity for India to develop a large talent pool with expertise in crypto technologies, driving technological advancement.

- Encouraging Financial Innovation: The dynamic nature of blockchain technology offers vast potential for innovative business models and applications, with long-term impacts that could revolutionize various sectors, necessitating a balanced regulatory approach.

- Enhancing Investor Protections: To safeguard investors, India needs to implement robust education and guidelines against mis-selling, regulate crypto assets as commodities, which can also boost government tax revenues by increasing tax base.

- Stricter oversight is also needed to prevent their use in sophisticated fraud schemes, including ransomware attacks and investment scams.

What are the Challenges Cryptocurrency Poses?

- Market Volatility: Cryptocurrency is highly speculative, leading to significant price fluctuations and potential for substantial losses when investing large amounts.

- Risk of Misuse: The ease of transferring cryptocurrency across borders without accountability increases the risk of it being used for money laundering and terror financing.

- Scalability Issues: Blockchain's growing data size limits capacity, making rapid large-scale transactions challenging, especially during national emergencies.

- Economic Imbalance: The rise of the cryptocurrency market can disrupt the circular flow of money in the Indian economy, differing significantly from traditional cash creation processes.

- Lack of Regulatory Oversight: The absence of a dedicated forum or grievance redressal mechanism for crypto assets leaves consumers vulnerable to transactional and informational risks.

Way Forward

- Regulatory Clarity: A comprehensive crypto regulation bill must differentiate between crypto assets on use cases.

- Investor Protection: Establishing mechanisms for dispute resolution, fraud prevention, and risk disclosures will ensure that retail investors are protected from bad actors.

- Stablecoin and CBDC Integration: India’s digital rupee initiative (CBDC) can coexist with crypto assets, provided there are clear regulatory distinctions and interoperability guidelines.

- Additionally, the government can adopt a stage-based approach to the use of crypto assets, allowing for phased integration based on risk assessment, regulatory readiness, and technological advancements.

- Taxation Reform: The current high tax regime in crypto is pushing businesses offshore. A more balanced tax structure can encourage domestic innovation while ensuring government revenue

- Public-private Collaboration: Engaging with industry leaders, blockchain startups, and international regulatory bodies will help India craft policies that foster innovation while mitigating risks.

|

Drishti Mains Question: Discuss the current regulatory framework for cryptocurrencies in India. Evaluate the challenges and suggest measures to ensure a balanced approach that fosters innovation while protecting investors. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. With reference to “Blockchain Technology”, consider the following statements: (2020)

- It is a public ledger that everyone can inspect, but which no single user controls.

- The structure and design of blockchain is such that all the data in it are about cryptocurrency only.

- Applications that depend on basic features of blockchain can be developed without anybody’s permission.

Which of the statements given above is/are correct?

(a) 1 only

(b) 1 and 2 only

(c) 2 only

(d) 1 and 3 only

Ans: (d)

Q. Consider the following pairs: (2018)

Terms sometimes seen in news Context/Topic

- Belle II experiment — Artificial Intelligence

- Blockchain technology — Digital/ Cryptocurrency

- CRISPR – Cas9 — Particle Physics

Which of the pairs given above is/are correctly matched?

(a) 1 and 3 only

(b) 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (b)

Mains:

Q. Discuss how emerging technologies and globalisation contribute to money laundering. Elaborate measures to tackle the problem of money laundering both at national and international levels. (2020)

Q. What is Cryptocurrency? How does it affect global society? Has it been affecting Indian society also? (2019)

Reasonable Classification Test

For Prelims: Reasonable Classification, Article 14, Special Courts, Sessions Court, High Court, Supreme Court.

For Mains: Evolution of reasonable classification doctrine and its importance in delivering social justice.

Why in News?

The Anwar Ali Sarkar Case, 1952 is a landmark Supreme Court ruling that laid the foundation for the reasonable classification test under Article 14 of the Indian Constitution.

- This test has now become a standard for evaluating the constitutionality of laws.

What is a Reasonable Classification Test?

- About: It is a legal principle under Article 14 of the Indian Constitution that ensures fair treatment by permitting the grouping of individuals or entities based on clear differences that are logically linked to the law's objective.

- It prevents arbitrary discrimination while acknowledging that not all cases are identical.

- Essential Features:

- Classification must be based on a clear and reasonable distinction.

- The distinction must logically connect to the law’s purpose.

- The classification should address social or policy needs without violating rights.

- Large groups cannot be arbitrarily selected for different treatment (no class legislation). It must ensure justified, not random, differences in treatment.

- Significance:

- Support Specific Regulations: It allows tailored laws for distinct societal conditions, ensuring equal treatment doesn’t lead to unfairness.

- It guides lawmakers and judges in interpreting statutes to prevent irrational outcomes.

- Legitimacy Testing: It assesses the legitimacy of laws, ensuring rationality and reducing legal challenges.

- Standard for Judicial Review: It offers a standard for courts to review and nullify irrational or arbitrary administrative actions, ensuring legislative accountability.

- Support Specific Regulations: It allows tailored laws for distinct societal conditions, ensuring equal treatment doesn’t lead to unfairness.

- Limitations:

- Risk of Unjustified Differentiation: If not applied properly, it can lead to unjust differentiation and potentially violate fundamental rights.

- Subjectivity: Classification factors (e.g., age, gender, physical strength) can be subjective, leading to inconsistent judicial interpretations of the doctrine.

What is the Anwar Ali Sarkar Case, 1952?

- Background: In 1950, Anwar Ali Sarkar was convicted under the West Bengal Special Courts Act, 1950 by the Alipore Sessions Court that sentenced him to transportation for life.

- SC Judgement (1952): The SC invalidated a law permitting the arbitrary referral of cases to special courts, stating that the classification lacked a logical connection to a legitimate objective.

- The ruling established the “reasonable classification” test, which allows for exceptions to equality under Article 14 under certain conditions.

Article 14 (Equality Before the Law)

- About: No person, whether a citizen or foreigner, can be denied equality before the law or the equal protection of the laws in India.

- Equality Before the Law ensures no special privileges, applying the same laws to all. Equal Protection of the Laws guarantees equal treatment under similar circumstances.

- Reasonable Classification: Article 14 forbids class legislation but allows reasonable classification based on intelligible differentia (distinguishable differences).

Judicial Stand on Doctrine of Reasonable Classification

- Saurabh Chaudri Case, 2004: Two key principles were laid down by the SC:

- Intelligible differentia: The classification must be based on clear and distinct reasons for distinguishing a group.

- Rational nexus: The classification must have a logical connection to the objective of the law.

- Shri Ram Krishna Dalmia, 1958: A law can be constitutional if it applies to a specific individual due to special circumstances, treating them as a class.

- There is a presumption of constitutionality, and the burden of proof is on challengers to show it violates constitutional standards.

Conclusion

The Anwar Ali Sarkar Case, 1952 laid the foundation for the "reasonable classification" test under Article 14, ensuring fairness and equality. It enables laws that treat different groups distinctly but requires logical justification, preventing arbitrary discrimination while promoting social justice.

|

Drishti Mains Question: Explain the doctrine of reasonable classification with judicial Stand. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Mains

Q. Analyse the distinguishing features of the notion of Right to Equality in the Constitutions of the USA and India. (2021)

Q. Starting from inventing the ‘basic structure’ doctrine, the judiciary has played a highly proactive role in ensuring that India develops into a thriving democracy. In light of the statement, evaluate the role played by judicial activism in achieving the ideals of democracy. (2014)

Space Debris Crisis

Why in News?

A 500-kg metal object crashed in Kenya, sparking concerns over space debris and highlighting the increasing global issues of accountability and safety measures for debris reentries.

What is Space Debris?

- About: According to the UN Committee on the Peaceful Uses of Outer Space (COPUOS) ‘Space debris is all man-made objects, including fragments and elements thereof, in Earth orbit or re-entering the atmosphere, that are non-functional’.

- It includes defunct satellites, rocket stages, and fragments from explosions or collisions.

- Origin: Most space debris comes from on-orbit breakups i.e., satellites or rocket stages explode, collide, or fragment in space.

- NASA estimates 23,000 debris pieces larger than a baseball, 500,000 marble-sized scraps, and 100 million fragments over one millimeter orbiting Earth.

- Space Debris Destruction: Debris loses altitude and burns up on re-entry due to atmospheric drag. It is intensified by the 11-year solar activity cycle that expands the atmosphere, accelerating the decay of low-orbit debris.

- Associated Risks:

- On-Orbit Risks: Large debris can destroy satellites, while even 1 cm fragments can disable spacecraft. Millimeter-sized particles erode surfaces and damage solar panels.

- Re-entry Risks: Most debris burns up, but some large fragments may reach Earth, though the risk of injury is very low.

- Kessler Syndrome: Kessler Syndrome is a chain reaction of debris collisions creating even more debris, potentially making orbits unusable for future space missions.

- International Regulations:

- Outer Space Treaty (1967): Article VI of the treaty makes states responsible for all national space activities, including private ones, but lacks enforcement mechanisms.

- Convention on International Liability for Damage Caused by Space Objects (1972): It imposes absolute liability for space object damage on Earth, requiring no proof of negligence, but enforcement is weak.

- Voluntary UN Guidelines on Deorbiting: The UN recommends deorbiting satellites within 25 years, but compliance rate is only around 30%.

- Initiatives to Remove Space Debris:

- Global: ClearSpace-1 and Remove DEBRIS (by ESA), OSAM-1 (NASA).

- India: Debris Free Space Mission (DFSM), Network for Space object TRacking and Analysis (NETRA).

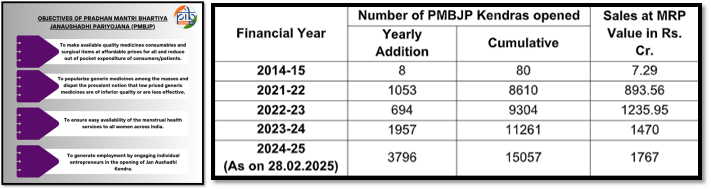

Jan Aushadhi Diwas

Every year, March 7th is celebrated as Jan Aushadhi Diwas to raise awareness about affordable generic medicines under the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP).

- Jan Aushadhi Diwas: Initiated on 7th March 2019, under the PMBJP. The initiative includes a week-long celebration, 'Janaushadhi Week,' from 1st-7th March across the nation.

- 2025 Theme: “Daam Kam - Dawai Uttam,” emphasizing affordable and high-quality medicines for all.

- PMBJP: The PMBJP was originally launched in 2008 as the Jan Aushadhi Scheme under the Ministry of Chemicals & Fertilizers to provide affordable medicines through outlets called Pradhan Mantri Bhartiya Janaushadhi Kendras (PMBJKs).

- In 2015, the scheme was revamped as the Pradhan Mantri Jan Aushadhi Yojana, and in 2016, it was renamed as the PMBJP.

- Features of PMBJP: Jan Aushadhi Kendras offer medicines at 50-80% lower prices than branded alternatives.

- A one-time Rs 2.00 lakh incentive is given to PMBJKs in targeted regions or opened by women, ex-servicemen divyang, a person from SC and ST.

- Suvidha Sanitary Napkins launched in 2019 at Rs 1 per pad, reached 72 crore in sales by January 2025.

- The Jan Aushadhi SUGAM App locates nearby Kendras, compares prices, and suggests affordable alternatives.

| Read more: Credit Assistance Program for Jan Aushadhi Kendra |

Gut Bacteria and Vitiligo

Research suggests that gut-friendly bacteria could play a crucial role in treating vitiligo.

- The treatment suppresses harmful T cells that attack pigment and boosts protective regulatory T cells.

- About Vitiligo: Vitiligo is a skin condition where the skin loses its pigment (melanin), leading to white patches. It is an autoimmune disorder.

- Causes: It results from melanocytes (pigment-producing cells) destruction due to autoimmune responses, genetic mutations, stress, or environmental triggers.

- Affected Population: Vitiligo affects 0.5%–2% of the global population, with India’s prevalence ranging from 0.25% to 4%.

- About Gut-Friendly Bacteria (Probiotics): They are beneficial microorganisms that help maintain a healthy gut microbiome. E.g.,

- Lactobacillus: Aids lactose digestion, prevents diarrhea.

- Bifidobacterium: Enhances gut health, reduces inflammation, boosts immunity.

- Saccharomyces Boulardii: Probiotic yeast that prevents diarrhea, supports gut balance.

| Read More: Microbiome Link to Autism |

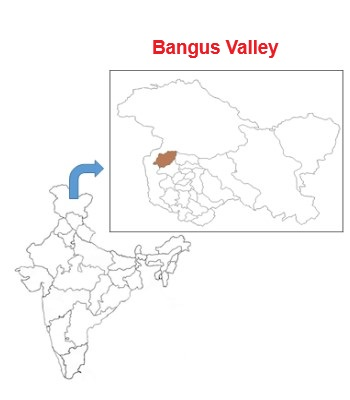

Bangus Valley

The Jammu and Kashmir government aims to promote Bangus valley as an ecotourism destination.

- Bangus Valley is located near the Line of Control (LoC) in north Kashmir’s Kupwara district.

- It consists of two bowl-shaped valleys, known as Bodh Bangus (Big Bangus) and Lokut Bangus (Small Bangus).

- It is surrounded by Rajwar and Mawar Mountains in the east, Shamasbury and Dajlungun in the west, and Chowkibal and Karnah Guli in the north.

- The landscape includes grasslands at lower altitudes and dense coniferous forests (Taiga biome).

- It offers lush green meadows, low-lying mountains covered with dense forests, and a serene environment.

| Read More: Agritourism in India |