Economy

Cryptocurrency and Blockchain

- 30 Aug 2024

- 11 min read

For Prelims: Cryptocurrency, Blockchain Technology, Central Bank Digital Currency (CBDC), Bitcoin, inflation, digital wallet, tokenisation, money laundering, tax evasion.

For Mains: Impact of cryptocurrency on economy.

Why in News?

Recently, former US President Donald Trump expressed support for Bitcoin at a crypto gathering.

- Amidst widespread discontent with government handling of inflation and economic crises, there emerges a measured scepticism towards conventional financial systems.

- This movement, fueled by a pursuit of financial autonomy and a conviction in the transformative promise of blockchain technology, continues to evolve, though its enduring financial viability and existential sustainability remain uncertain.

What is Cryptocurrency and How Does it Work?

- Cryptocurrency is a decentralised digital or virtual currency that uses cryptography for security. Examples include Bitcoin, Ethereum, Ripple and Litecoin.

- Cryptocurrency transactions are documented on a public digital ledger known as the blockchain. This ledger is maintained by a decentralised network of computers distributed globally, which verify and add each new transaction to the blockchain.

- The decentralisation of the system, coupled with the application of cryptographic techniques, renders it challenging for any entity to manipulate the currency or alter the transactions recorded on the blockchain.

- To engage in cryptocurrency transactions, individuals or businesses must first obtain a digital wallet, a software application that securely stores the user's public and private keys.

- These keys are essential for sending and receiving cryptocurrency, as well as for verifying transactions on the blockchain.

- Cryptocurrency can be acquired through a process known as "mining," which involves utilising computational power to solve intricate mathematical problems.

- This process validates and records transactions on the blockchain, rewarding the miner with a certain amount of cryptocurrency in return.

What is Blockchain Technology?

- It is a decentralised, digital ledger that records transactions across a network of computers.

- Each block in the chain contains a number of transactions, and every time a new transaction occurs on the blockchain, a record of that transaction is added to every participant's ledger.

- The decentralised nature of technology ensures that no single entity can alter or delete previous transactions, providing a high degree of security and transparency.

- Blockchain is the foundation of cryptocurrencies such as Bitcoin, but it has many potential uses beyond cryptocurrencies:

- Financial institutions have been using blockchain for secure and transparent transaction processing, reducing fraud and operational costs.

- A blockchain-based ecosystem could also be used to design a scholarship system incentivising students to maintain consistency and achieve academic excellence.

- Blockchain can provide an excellent framework to manage student records ranging from day-to-day information such as assignments, attendance and extracurricular activities, to information about degrees and colleges they have attended.

What is the Legal Status of Cryptocurrency in India?

- Cryptocurrency in India is unregulated but not specifically banned. The government does not recognize cryptocurrencies as legal tender, and it intends to limit their use in financing illegal activities or as a payment method.

- In 2022, the Government of India mentioned in the Union budget 2022-23 that the transfer of any virtual currency/cryptocurrency asset will be subject to 30% tax deduction.

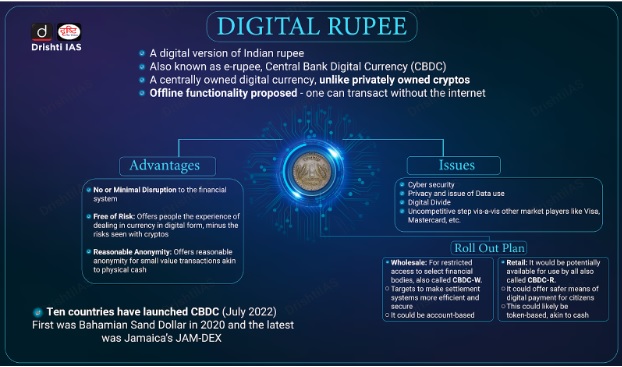

- The National Payments Corporation of India (NPCI), in association with the Department of Financial Services (DFS), National Health Authority (NHA), Ministry of Health and Family Welfare (MoHFW), and partner banks, has launched India’s own Central Bank Digital Currency (CBDC) – Digital Rupee or ‘e-RUPI’.

- CBDCs are a digital form of a paper currency and unlike cryptocurrencies that operate in a regulatory vacuum, these are legal tenders issued and backed by a central bank.

- The digital fiat currency or CBDC can be transacted using wallets backed by blockchain.

- Though the concept of CBDCs was directly inspired by Bitcoin, it is different from decentralised virtual currencies and crypto assets, which are not issued by the state and lack the ‘legal tender’ status.

What are the Pros and Cons of Cryptocurrency?

Pros of Cryptocurrency:

- Blockchain-Driven Security and Transparency: Cryptocurrencies leverage blockchain technology, which offers enhanced security, transparency, and efficiency in financial transactions.

- This decentralised ledger system reduces fraud and operational costs for financial institutions, ensuring a more secure and transparent transaction processing environment.

- Potential for Innovation and Tokenization: The underlying blockchain technology enables tokenization, which can be applied across various sectors, allowing for the conversion of assets into digital tokens.

- This innovation can be harnessed independently of cryptocurrencies, facilitating new financial instruments and asset management models.

- Reshaping Global Finance: Cryptocurrencies represent the latest evolution in the history of assets, testing the boundaries of trust, redefining ownership, and potentially reshaping global financial systems.

- As digital assets gain acceptance, they could transform how value is stored and transferred across borders, offering a new paradigm for financial inclusion and global trade.

- Potential for Financial Autonomy: Cryptocurrencies provide a means for financial autonomy, especially in regions with unstable economies or limited access to traditional banking systems.

- They offer individuals and businesses an alternative to centralised financial institutions, potentially reducing reliance on traditional banking infrastructure.

Cons of Cryptocurrecy:

- Speculative Nature and Volatility: The highly speculative nature of cryptocurrencies often overshadows their functional potential. Their value is largely driven by market sentiment and speculation, leading to extreme price volatility.

- This volatility undermines their utility as a stable medium of exchange and a reliable store of value.

- Regulatory Challenges and Uncertainty: The regulatory environment surrounding cryptocurrencies is fraught with uncertainty, with governments oscillating between acceptance and outright bans.

- Concerns over money laundering, tax evasion, and the financing of illegal activities necessitate stringent regulatory measures, which may stifle innovation and hinder the integration of cryptocurrencies into the mainstream financial system.

- Limited Practical Utility and Acceptance: The limited acceptance of cryptocurrencies by financial institutions and merchants restricts their practical utility.

- The volatility of crypto assets makes it challenging for businesses to consistently price goods and services, discouraging their use in everyday transactions.

- Additionally, the lack of integration with traditional financial systems complicates the conversion of crypto to fiat currency, making it cumbersome and costly for businesses.

- High Transaction Costs and Inefficiency: Cryptocurrencies often suffer from high transaction fees and slower processing times compared to conventional payment methods.

Conclusion

In conclusion, the burgeoning growth of cryptocurrency in India signifies the nation’s swift progress towards digitalisation. However, this rapid expansion is accompanied by significant challenges due to the absence of a regulatory framework governing the crypto-assets market. This regulatory vacuum not only generates uncertainty for businesses aspiring to venture into this domain but also exposes investors to potential fraud and financial crimes. Moreover, an unregulated ecosystem could inadvertently serve as a conduit for money laundering, fraud, and terror financing, necessitating the urgent establishment of robust regulatory oversight.

|

Drishti Mains Question: Q. Evaluate the role of cryptocurrencies in promoting financial inclusion while examining the risks related to economic stability, regulatory challenges, and market volatility. Discuss the implications for India's regulatory framework. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. With reference to “Blockchain Technology”, consider the following statements: (2020)

- It is a public ledger that everyone can inspect, but which no single user controls.

- The structure and design of blockchain is such that all the data in it are about cryptocurrency only.

- Applications that depend on basic features of blockchain can be developed without anybody’s permission.

Which of the statements given above is/are correct?

(a) 1 only

(b) 1 and 2 only

(c) 2 only

(d) 1 and 3 only

Ans: (d)

Q. Consider the following pairs: (2018)

Terms sometimes Context/Topic

seen in news

1. Belle II experiment — Artificial Intelligence

2. Blockchain technology — Digital/ Cryptocurrency

3. CRISPR – Cas9 — Particle Physics

Which of the pairs given above is/are correctly matched?

(a) 1 and 3 only

(b) 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

Ans: (b)

Mains:

Q. Discuss how emerging technologies and globalisation contribute to money laundering. Elaborate measures to tackle the problem of money laundering both at national and international levels? (2020)

Q. What is Cryptocurrency? How does it affect global society? Has it been affecting Indian society also? (2019)