Challenges Faced by Street Vendors

For Prelims: Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014, 74th Constitutional Amendment, Smart Cities Mission, National Urban Livelihood Mission, World Bank and UN-Habitat

For Mains: Urban Planning Issues, Issue of Street Vendor, Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act

Why in News?

Recently, the Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014 celebrated its tenth anniversary, signifying a culmination of four decades of legal evolution and advocacy by street vendor movements in India.

What is the Street Vendors Act and Associated Aspects?

- Street Vendors Act:

- Scope and Purpose: The Act was designed to protect and regulate street vending across Indian cities, involving local authorities in establishing designated vending zones.

- Vendors are crucial to urban life, contributing to food distribution and cultural identity, and the law aims to secure their livelihoods and integrate their activities into formal urban planning.

- Governance Structure: The Act establishes Town Vending Committees (TVCs), which include street vendor representatives, with women vendors constituting 33% of this group.

- These committees are responsible for the inclusion of vendors in designated zones and handling grievances through mechanisms like the Grievance Redressal Committee (chaired by a civil judge or judicial magistrate).

- Other Provisions:

- The Act clearly defines the roles and responsibilities of vendors and government at different levels.

- The provision requires States/ULBs to conduct a survey to identify SVs at least once every five years.

- Scope and Purpose: The Act was designed to protect and regulate street vending across Indian cities, involving local authorities in establishing designated vending zones.

- Implementation Challenges

- Administrative Challenges:

- Despite the protections outlined in the Act, street vendors frequently face harassment and eviction.

- This is partly due to persistent bureaucratic views of vending as an illegal activity.

- Additionally, TVCs often remain under the control of city authorities rather than representing the vendors themselves, with women’s representation often being only tokenistic.

- Governance Integration Issues:

- The Act struggles to integrate with broader urban governance frameworks, such as those established by the 74th Constitutional Amendment.

- Urban Local Bodies (ULBs) often lack the power and resources to effectively implement the Act, especially in the context of overarching policies like the Smart Cities Mission, which tend to prioritise infrastructure over inclusive urban planning.

- Societal Perception Problems:

- The prevailing vision of a ‘world-class city’ frequently excludes street vendors, who are seen as nuisances rather than as contributors to the urban economy.

- This societal stigma affects urban planning and policy, leading to designs and regulations that marginalise vendors.

- Administrative Challenges:

- Ways to strengthen the Law:

- Need for Supportive Implementation:

- While the Act is progressive, effective implementation is crucial and may require initial top-down guidance from higher government levels, such as the Ministry of Housing and Urban Affairs.

- Over time, a shift towards more decentralised governance is essential to tailor strategies to the diverse local contexts of vendors across the nation.

- Integration with Urban Schemes:

- Policies and urban planning guidelines must be revised to better incorporate street vending.

- This involves enhancing the capacities of ULBs to include vendors in city planning and moving from bureaucratic control to more inclusive, deliberative processes at the TVC level.

- Addressing New Challenges:

- Emerging issues such as climate change impacts, increased competition from e-commerce, and the proliferation of vendors call for creative use of the Act’s provisions.

- This includes leveraging components of national missions like the National Urban Livelihood Mission to innovate and adapt to these changing realities.

- Need for Supportive Implementation:

Evolution of Street Vendor Policy in India

- In 1995, India signed the Bellagio International Declaration of Street Vendors

- In 2001, GOI announced declaration Of drafting National Street Vending Policy

- In 2009, the policy was revised and accompanied by a model law which could be adopted by State Government.

- In 2012, the Union Government approved the Street Vendors (Protection of Livelihood and Reguation of Street Vending) Bill

- In 2014, parliament passed Street Vendors Act

What are the Challenges Faced by Street Vendors in India?

- Legal Limbo and Harassment:

- Uncertain Legal Status: Despite the Street Vendors Act, enforcement remains uneven. Many vendors operate without licences, making them vulnerable to eviction and harassment by authorities and local intermediaries.

- Bribes and Extortion: Reports by UN-Habitat highlight the issue of vendors being forced to pay bribes to police and local authorities, impacting their already meagre earnings.

- Precarious Livelihood and Infrastructure Woes:

- Competition and Fluctuating Income: Saturation in certain areas and competition from established businesses lead to unpredictable income and economic insecurity.

- Unrealistic License Caps: License caps is unrealistic in most cities like in Mumbai which has a ceiling of around 15,000 licences as against an estimated 2.5 lakh vendors.

- Lack of Basic Amenities: Limited access to clean water, sanitation facilities, and waste disposal creates health hazards for vendors and customers alike.

- Vulnerability to Eviction: Urban development projects and road widening initiatives often displace vendors, causing livelihood disruption.

- Occupational Hazards: Street vendors work in environments that are often hazardous to their health.

- Navigating the Formal System:

- Difficult Licensing Process: The licensing process under the Street Vendors Act can be complex and bureaucratic, discouraging vendors from formalisation.

- Limited Access to Credit: Informal income makes it difficult for vendors to secure loans for upgrades or business expansion.

- The PM SVANidhi Scheme, while well-intentioned, has not reached a significant portion of its target demographic.

- Issues such as lack of awareness, cumbersome documentation, and bureaucratic hurdles prevent many vendors from availing the benefits of the scheme.

- Gender-Based Discrimination: Women vendors often face gender-based discrimination, which affects their business opportunities and earnings.

- They are also more susceptible to harassment and violence, which can deter them from continuing their trade.

- Impact of Covid-19: The pandemic led to severe economic hardship for street vendors.

- With lockdowns and social distancing norms in place, many lost their sole source of income and were pushed further into poverty.

What are the Steps Needed to Deal With the Problem of Street Vendors?

- The World Bank and UN-Habitat recommend a shift from viewing street vendors as a problem to recognising them as a vital part of the urban economy.

- Formalization and Regulation: The Street Vendors Act is a positive step towards formalisation. Cities like Hanoi (Vietnam) and Ahmedabad (India) have established vendor registration systems, providing identity cards and training on hygiene and safety.

- Designated Zones: Cities like Rio de Janeiro (Brazil) and Kigali (Rwanda) have created designated vending zones, ensuring order and improved pedestrian flow.

- This can be implemented in India by identifying suitable areas in consultation with vendors and resident associations.

- Infrastructure and Support: Providing access to clean water, sanitation facilities, and waste disposal is crucial. Cities like Lima (Peru) offer training on waste management and micro-loans for equipment upgrades.

- Indian cities can replicate these models by collaborating with NGOs and self-help groups.

- Vendor Associations: Empowering vendors through associations like those in Kumasi (Ghana) facilitates dialogue with authorities and fosters collective bargaining.

- India can encourage vendor associations and integrate them into policy discussions.

- Fostering a Collaborative Approach: Effective street vendor management requires a multi-stakeholder approach:

- Local Authorities: Cities must play a leading role in creating a conducive environment. This includes issuing vending permits, establishing designated zones, and providing infrastructure support.

- Street Vendors: Vendors must comply with regulations, maintain hygiene standards, and pay designated fees. They should actively participate in vendor associations and engage in constructive dialogue with authorities.

- Resident Associations: Residents' concerns about congestion and waste management need to be addressed. Open communication and co-creation of solutions with vendor associations can bridge this gap.

International Efforts and Indian Initiatives for Street Vendors

| Category | Details |

| Global Initiatives |

ILO Recommendation 204 (Economic Inclusion of workers), UN SDGs 8 (decent work for all) Street Vendors Initiative for Global Advocacy (SVIGA) Women in Informal Employment: Globalizing and Organizing (WIEGO) |

| Indian Schemes | PM SVANidhi, Street Vendors Act 2014, State-specific schemes |

Conclusion

- India’s path forward lies in tailoring policies to the unique characteristics of each city, taking into account aspects such as population density and the diversity of merchandise. Ensuring the economic stability of vendors through skill development and microfinance programs is crucial.

|

Drishti Mains Question: Q. Discuss the challenges faced by street vendors in India post the implementation of the Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014. Critically analyse the effectiveness of the Act in addressing these challenges and suggest measures for improving the situation of street vendors in urban areas. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Mains:

Q. How has globalisation led to the reduction of employment in the formal sector of the Indian economy? Is increased informalization detrimental to the development of the country? (2016)

4th Session of Intergovernmental Negotiating Committee

For Prelims: Intergovernmental Negotiating Committee (INC-4), United Nations Environment Agency, Plastic, Carbon Emissions, Organisation for Economic Co-operation and Development, Extended Producer Responsibility

For Mains: Intergovernmental Negotiating Committee, Single-use plastics and related concerns, Environment Pollution and Degradation, Conservation.

Why in News?

Recently, the fourth session of the Intergovernmental Negotiating Committee (INC-4) of the United Nations Environment Agency (UNEA) was held in Ottawa, Canada attracting participation from over 170 member states.

- This session is part of the ongoing negotiations to build a legally binding treaty on plastics pollution by the end of 2024 under UNEA.

- The INC-4 for a global plastics treaty failed to reach an agreement. Negotiators aim to reach a consensus by the end of 2024 at INC-5 which is scheduled for November 2024 in South Korea.

Intergovernmental Negotiating Committee (INC)

- The INC is a committee established by the United Nations Environment Programme (UNEP) in March 2022 to develop an international legally binding agreement on plastic pollution.

- The INC's mandate is to develop an instrument that addresses the entire life cycle of plastic, including in the marine environment, and could include both voluntary and binding approaches.

- The INC-1 started in November 2022 in Punta del Este, Uruguay. The INC-2 occurred in May-June 2023 in Paris, France. The INC-3 convened in Nairobi in December 2023.

Why is a Global Plastics Treaty Needed?

- Rapid Expansion of Plastic Production:

- Since the 1950s, plastic production worldwide has skyrocketed. It increased from just 2 million tonnes in 1950 to more than 450 million tonnes in 2019.

- If left unchecked, the production is slated to double by 2050, and triple by 2060.

- Since the 1950s, plastic production worldwide has skyrocketed. It increased from just 2 million tonnes in 1950 to more than 450 million tonnes in 2019.

- Plastic Waste and Burden:

- Although plastic is a cheap and versatile material, with a wide variety of applications, its widespread use has led to a crisis.

- As plastic takes anywhere from 20 to 500 years to decompose, and less than 10% has been recycled till now, nearly 6 billion tonnes now pollute the planet, according to a 2023 study published by The Lancet.

- About 400 million tonnes of plastic waste is generated annually, a figure expected to jump by 62% between 2024 and 2050.

- Much of this plastic waste leaks into the environment, especially into rivers and oceans, where it breaks down into smaller particles (microplastic or nanoplastic).

- These contain more than 16,000 chemicals that can harm ecosystems and living organisms, including humans, the chemicals are known to disturb the body’s hormone systems, cause cancer, diabetes, reproductive disorders, etc.

- Although plastic is a cheap and versatile material, with a wide variety of applications, its widespread use has led to a crisis.

- Climate Change:

- Plastic production and disposal are also contributing to climate change. According to a report by the Organisation for Economic Co-operation and Development (OECD), in 2019, plastics generated 1.8 billion tonnes of GHG emissions (3.4% of global emissions).

- Roughly 90% of these emissions come from plastic production, which uses fossil fuels as raw material. If current trends continue, emissions from production could grow 20% by 2050.

- Plastic production and disposal are also contributing to climate change. According to a report by the Organisation for Economic Co-operation and Development (OECD), in 2019, plastics generated 1.8 billion tonnes of GHG emissions (3.4% of global emissions).

What Can the Global Plastic Treaty Entail?

- Global Objectives: The treaty aims to address marine and other types of environmental pollution caused by plastics.

- It focuses on establishing global objectives to combat plastic pollution and assess its impact on ecosystems.

- Guidelines for International Cooperation: The treaty may outline how wealthier nations can support poorer ones in achieving their plastic reduction goals.

- Prohibitions and Targets: It could include bans on specific plastics, products, and chemical additives, along with legally binding targets for recycling and recycled content in consumer goods.

- Chemical Testing Mandates: The treaty might require the testing of certain chemicals present in plastics to ensure safety and environmental protection.

- Consideration for Vulnerable Workers: Details may be included regarding a just transition for waste pickers and workers in developing countries reliant on the plastic industry for livelihoods.

- Progress Assessment: The treaty will include provisions for assessing member states' progress in implementing plastic pollution reduction measures.

- Regular evaluations will ensure accountability and drive continuous improvement in global efforts to combat plastic pollution.

What are the Challenges in Advancing the Treaty?

- Resistance from Oil and Gas Giants:

- Some major oil and gas-producing nations, along with fossil fuel and chemical industry groups, aim to narrow the treaty's focus solely on plastic waste and recycling.

- Polarising Negotiations:

- Since the inaugural talks in Uruguay in November 2022, oil-producing countries like Saudi Arabia, Russia, and Iran have strongly opposed plastic production caps, resorting to various delay tactics, such as procedural disputes, to obstruct productive discussions.

- The decision-making process for the treaty remains contentious, with countries yet to agree on whether consensus or majority voting should determine its adoption.

- High-Ambition Coalition vs. US Stance:

- The "High Ambition Coalition (HAC) to End Plastic Pollution," comprising approximately 65 nations including African nations and most of the European Union, advocates for ambitious goals such as ending plastic pollution by 2040 and phasing out problematic single-use plastics and harmful chemical additives.

- The US, although expressing a desire to end plastic pollution by 2040, diverges from the coalition's approach by promoting voluntary measures instead of binding commitments.

- The "High Ambition Coalition (HAC) to End Plastic Pollution," comprising approximately 65 nations including African nations and most of the European Union, advocates for ambitious goals such as ending plastic pollution by 2040 and phasing out problematic single-use plastics and harmful chemical additives.

- Influence of Industry Interests:

- Fossil fuel and chemical corporations are actively working to dilute the treaty's effectiveness, as evidenced by the record number of lobbyists.

- These industries, which profit heavily from plastics derived from fossil fuels, oppose production cuts and falsely assert that the plastics crisis is solely a waste management issue, rather than acknowledging the fundamental problem of plastic production itself.

- Fossil fuel and chemical corporations are actively working to dilute the treaty's effectiveness, as evidenced by the record number of lobbyists.

What is India's Stance at INC-4?

- Preamble and Objective:

- India advocated for the preamble to reaffirm "the sovereign rights of states to sustainable development".

- The proposed objective is "to safeguard human health and the environment from plastic pollution, including in marine environments, while ensuring sustainable development".

- India emphasised the incorporation of principles such as equity, sustainable development, and common but differentiated responsibilities.

- However, the list does not include fundamental human rights principles, such as the right to a healthy environment and the right to access information.

- India advocated for the preamble to reaffirm "the sovereign rights of states to sustainable development".

- Restrictions on Plastic Production:

- India opposes any limitations on primary plastic polymers or virgin plastics, arguing that production reductions exceed the scope of UNEA resolution 5/14.

- India highlights that some chemicals used in plastic manufacturing are already subject to prohibition or regulation under different conventions.

- India opposes any limitations on primary plastic polymers or virgin plastics, arguing that production reductions exceed the scope of UNEA resolution 5/14.

- Chemicals and Polymers of Concern:

- India advocates for a transparent and inclusive process informed by scientific evidence to make decisions regarding chemicals.

- India disagrees with the inclusion of language about polymers of concern.

- India advocates for a transparent and inclusive process informed by scientific evidence to make decisions regarding chemicals.

- Midstream Measures:

- Stresses the role of sustainable and efficient plastic usage, advocating for improved design to enhance product longevity.

- Asserts the need for nationally determined approaches for downstream measures like Extended Producer Responsibility (EPR), excluding international supply chains.

- Emissions and Releases:

- India emphasises the need to prioritise the elimination of plastic waste leakage into the environment, excluding considerations of emissions and effluents during manufacturing and/or recycling.

- Prioritising Waste Management:

- Advocates for prioritising plastic waste management as the primary area of intervention, excluding considerations of emissions during manufacturing and recycling stages.

- Expresses concerns regarding cross-cutting issues such as trade and financing, insisting on comprehensive financial and technical assistance alongside technology transfer.

What are the Initiatives Related to Plastic?

- Global:

- UNEP Plastics Initiative:

- It aims to end global plastic pollution by reducing the flow of virgin plastics and promoting the transition to a circular economy.

- It focuses on innovation, reduction, and reuse of plastics. The strategic goals include reducing the size of the problem, designing for circularity, ensuring circularity in practice, and managing plastic waste.

- By 2027, the initiative aims to improve plastics policies in 45 countries, engage 500 private sector actors in circular solutions, and involve 50 financial institutions in supporting the transition.

- Global Tourism Plastics Initiative:

- It aims to unite tourism stakeholders to fight plastic pollution. Led by the UN Environment and United Nations World Tourism Organization (UNWTO), the initiative supports organisations in reducing plastic waste and improving plastic use in their operations.

- It is developing commitments for the private sector, destinations, and associations to implement by 2025.

- Circular Plastic Economy:

- In 2015, the EU created a Circular Economy Action Plan which later consisted of the European Strategy for Plastics in a Circular Economy.

- This approach helps limit the amount of plastic waste by creating more of a “circular” method of reusing products and straying from single-use plastics.

- In 2015, the EU created a Circular Economy Action Plan which later consisted of the European Strategy for Plastics in a Circular Economy.

- Ban Plastic:

- Several countries have implemented bans on plastic products.

- In 2002, Bangladesh was the first country to ban thin plastic bags.

- China implemented a ban on plastic bags in 2020 with phased implementation.

- In the US, 12 states have banned single-use plastic bags.

- The European Union implemented the Directive on Single-Use Plastics in July 2021, which bans certain single-use plastics for which alternatives are available, including plates, cutlery, straws, balloon sticks, cotton buds, expanded polystyrene containers, and oxo-degradable plastic products.

- Several countries have implemented bans on plastic products.

- UNEP Plastics Initiative:

- India:

- Plastic Waste Management (Amendment) Rules, 2024

- The Plastics Manufacture and Usage (Amendment) Rules (2003).

- UNDP India’s Plastic Waste Management Program (2018-2024).

- Prakrit initiative.

- EPR Portal by Central Pollution Control Board (CPCB).

- India Plastics Pact

- Project REPLAN

- Swachh Bharat Mission

|

Drishti Mains Question: Q. Assess the effectiveness of existing global initiatives such as the UNEP Plastics Initiative and the Circular Plastic Economy in combating plastic pollution, highlighting their strengths and limitations. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q. Why is there a great concern about the ‘microbeads’ that are released into the environment? (2019)

(a) They are considered harmful to marine ecosystems.

(b) They are considered to cause skin cancer in children.

(c) They are small enough to be absorbed by crop plants in irrigated fields.

(d) They are often found to be used as food adulterants.

Ans: (a)

Q. In India, ‘extend producer responsibility’ was introduced as an important feature in which of the following? (2019)

(a) The Bio-medical Waste (Management and Handling) Rules, 1998

(b) The Recycled Plastic (Manufacturing and Usage) Rules, 1999

(c) The e-Waste (Management and Handling) Rules, 2011

(d) The Food Safety and Standard Regulations, 2011

Ans: (c)

Mains:

Q: What are the impediments in disposing the huge quantities of discarded solid waste which are continuously being generated? How do we remove safely the toxic wastes that have been accumulating in our habitable environment? (2018)

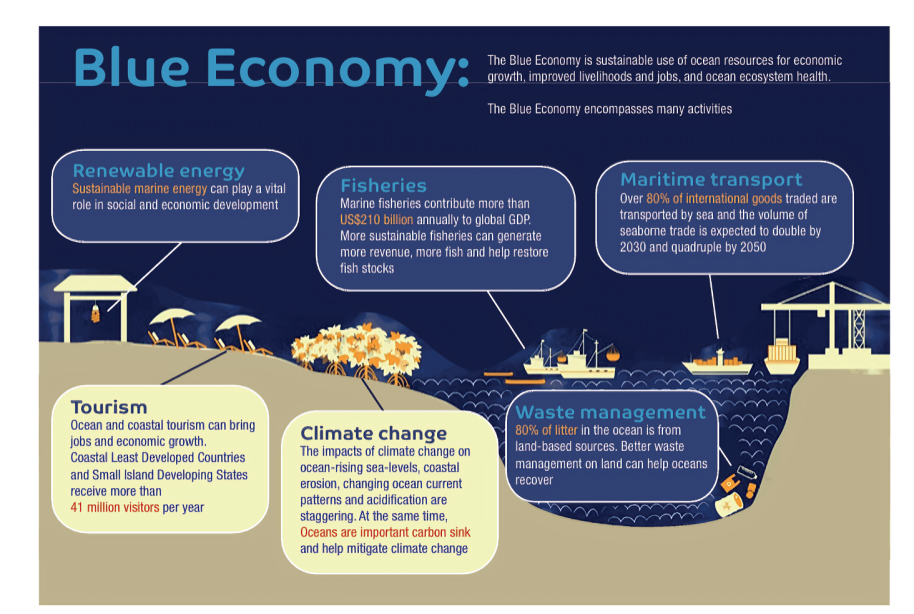

Regenerative Blue Economy

For Prelims: International Union for Conservation of Nature, Regenerative Blue Economy, Blue Economy, Circular economy, Blue Carbon, Great Blue Wall Initiative, Maritime India Vision 2030

For Mains: Significance of the Blue Economy, Challenges Related to Regenerative Blue Economy, Steps taken by the Government to Promote the Blue Economy.

Why in News?

The International Union for Conservation of Nature (IUCN) has released a report outlining a roadmap for a Regenerative Blue Economy (RBE).

- This approach goes beyond mere sustainability, aiming to actively restore and revitalize our oceans.

What are the Key Highlights of the Report?

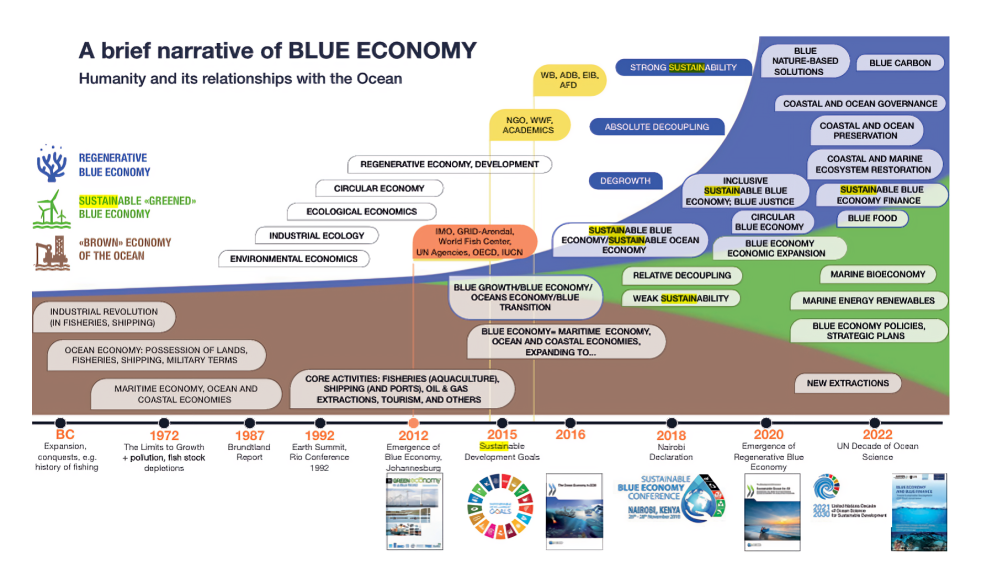

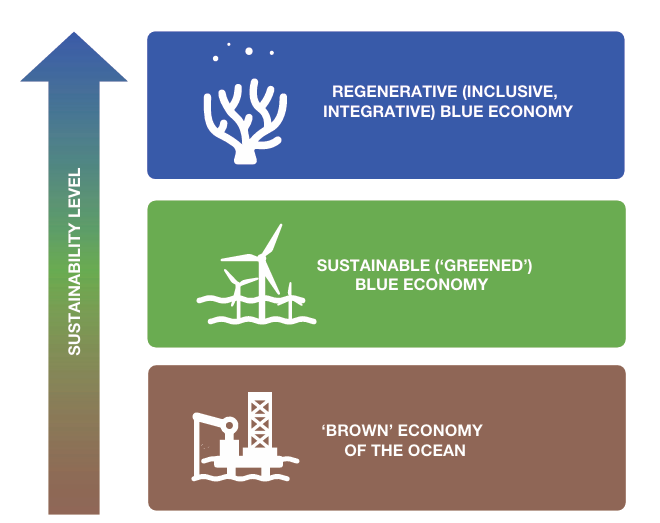

- Proposes a Hierarchy: The report proposes a hierarchical structure to categorize different interpretations and levels of sustainability within the Blue Economy concept, they are:

- Ocean/Brown Economy: Refers to all economic activities directly or indirectly related to the ocean.

- Synonymous with the traditional "marine economy" or "maritime sectors".

- Includes sectors like shipping, ports, fisheries, offshore oil/gas, etc.

- Follows a business-as-usual approach focused on economic contribution.

- Sustainable Blue Economy: Incorporates principles of environmental sustainability and ecosystem protection. Extends scope beyond just economic activities to include:

- Conservation and restoration of marine/coastal ecosystems.

- Valuation of ecosystem services like carbon sequestration.

- It includes major ocean industries, but with sustainability qualifications.

- Aligns with UN Sustainable Development Goals, especially SDG 14 on oceans about conserving and sustainably using the oceans, seas and marine resources.

- Regenerative Blue Economy: RBE goes beyond simply maintaining ocean health. It aims to actively restore and revitalize marine ecosystems.

- It is an economic model that combines rigorous and effective regeneration and protection of the Ocean and marine and coastal ecosystems with sustainable, low, or no carbon economic activities, and fair prosperity for people and the planet, now and in the future.

- Founding Principles of RBE:

- Protection and Restoration: Regenerate and protect marine and coastal ecosystems, resources, and natural capital. Combat climate change and biodiversity loss.

- Inclusive Economic System: Ensure inclusion, fairness, and solidarity within the economic system. Guarantee well-being, resilience, and reduced vulnerability to climate change, supported by sustainable funding.

- Inclusive and Participatory Governance: Establish an inclusive and participatory governance system with transparency. Integrate flexible legal and regulatory mechanisms into international agreements on climate and biodiversity.

- Low or No Carbon Activities: Prioritize low or no carbon activities that positively impact the regeneration of marine and coastal ecosystems and enhance the well-being of local populations.

- Priority Implementation in Island States: Implement RBE as a priority in island states with specific requirements. Consider the needs of coastal populations, particularly Indigenous peoples, and recognise their traditions in the implementation process.

- Ocean/Brown Economy: Refers to all economic activities directly or indirectly related to the ocean.

- Spectrum of Sustainability:

- The IUCN acknowledges various sustainability levels within the blue economy concept.

- RBE represents the most ambitious and restorative approach, moving beyond "business as usual" and "sustainable use" to actively restore ocean health.

- Principles of Blue Economy:

- The report states that various sets of principles proposed by different organizations (World Wildlife Fund, United Nations Global Compact, etc.)

- Common themes include: ecosystem health, sustainability, inclusivity, good governance.

- Blue Carbon and Nature-based Solutions:

- The report emphasizes the importance of valuing coastal/marine ecosystem services like carbon sequestration.

- Blue Carbon is highlighted as an emerging market opportunity and component of sustainable economies.

- Blue Carbon aligns with the broader push for Nature-based Solutions for climate change/biodiversity.

- Key Sectors and Considerations:

- Fishing and aquaculture must adopt sustainable methods, avoid overfishing and habitat destruction

- Preference for small-scale fisheries, eco-friendly aquaculture like shellfish/algae

- Maritime transport needs transition to low/zero-carbon fuels and technologies

- Establishment of Marine Protected Areas (MPAs) to compensate for extractive activities.

- Fishing and aquaculture must adopt sustainable methods, avoid overfishing and habitat destruction

- Connections to Other Approaches:

- The report strongly emphasizes the need to combine the Blue Economy principles with those of the circular economy, Bioeconomy , and Social and Solidarity Economy (SSE).

- The bioeconomy is a model for the economy and industry that uses biological resources to produce goods, services, and energy. It's a sustainable and circular model that uses biological resources, processes, and methods across all economic sectors.

- SSE refers to economic activities and relationships that prioritise social and environmental objectives over profit.

- The report strongly emphasizes the need to combine the Blue Economy principles with those of the circular economy, Bioeconomy , and Social and Solidarity Economy (SSE).

What is Blue Carbon?

- Definition: Blue Carbon refers to carbon stored in coastal and marine ecosystems.

- Significance: Coastal ecosystems like mangroves, tidal marshes, and seagrass meadows are crucial carbon sinks, storing more carbon per unit area than terrestrial forests.

- They play a significant role in mitigating climate change and contribute to countries' emissions reduction targets under the Paris Agreement.

- IUCN Involvement: IUCN engages in Blue Carbon initiatives through the Blue Natural Capital Financing Facility (BNCFF) and the Blue Carbon Accelerator Fund (BCAF).

- These initiatives support the development of sound investment-based projects with clear ecosystem service benefits, paving the way for private sector funding.

- Example: The study case of extensive shrimp farming and mangrove protection in Indonesia showcases the potential revenue generated through Blue Carbon initiatives.

What are the Initiatives Promoting Regenerative Blue Economy?

- Global Initiatives:

- IUCN Nature 2030: It is a comprehensive plan for conservation efforts aligning with the United Nations 2030 Agenda for Sustainable Development and the post-2020 global biodiversity framework

- Great Blue Wall Initiative: This African-led initiative aims to help countries reach the following targets:

- protect 30% of the ocean by 2030; achieve net gain of critical blue ecosystems such as mangroves, corals, seagrasses by 2030; develop a regenerative blue economy and create millions of jobs by supporting local communities through funding, training and technical assistance.

- Clean Seas Campaign: Led by the UN Environment Programme (UNEP), this campaign tackles plastic pollution in the ocean by encouraging governments and businesses to reduce single-use plastics.

- Moroni Declaration and Cape Town Manifesto: These recent declarations from African nations highlight the importance of a RBE for the continent's development and call for international support.

- India:

|

Drishti Mains Question: Q. Discuss the principles of Regenerative Blue Economy and its role in marine conservation. Differentiate RBE from conventional Blue Economy models. Assess its socio-economic benefits. |

UPSC Civil Services Examination, Previous Year’s Question (PYQs)

Prelims:

Q. What is blue carbon?

(a) Carbon captured by oceans and coastal ecosystems

(b) Carbon sequestered in forest biomass and agricultural soils

(c) Carbon contained in petroleum and natural gas

(d) Carbon present in atmosphere

Ans: (a)

Q. ‘Invasive Species Specialist Group’ (that develops Global Invasive Species Database) belongs to which one of the following organizations?(2023)

(a) The International Union for Conservation of Nature

(b) The United Nations Environment Programme

(c) The United Nations World Commission for Environment and Development

(d) The World Wide Fund for Nature

Ans: (a)

Mains:

Q. Defining blue revolution, explain the problems and strategies for pisciculture development in India. (2018)

Inheritance Tax

For Prelims: Economic and Social Development, Sustainable Development, Poverty, Inclusion, Demographics, Social Sector Initiatives, etc.

For Mains: Indian Economy and issues relating to planning, mobilisation, of resources, growth, development and employment.

Why in News?

Recently, a prominent political leader of India’s opposition party has expressed interest in the proposed legislation on Inheritance Tax.

- There has been a lot of discussion about using inheritance tax as a tool for redistribution of wealth to address Income Inequality in India.

What is Inheritance Tax?

- About:

- Inheritance tax is a tax paid for inheriting a property or asset from a deceased person.

- It is levied on the value of the inheritance received by the beneficiary, and it is paid by the beneficiary.

- Depending on the country, it can be as high as 55%.

- A person can receive inheritance either under a Will or under the personal law of the deceased.

- In India, the concept of levying tax on inheritance does not exist now.

- Calculation of Inheritance Tax:

- The first step is to determine the total value of assets.

- This involves assessing the value of all assets owned by the deceased, including real estate, investments, bank accounts, vehicles, and personal belongings, while also considering any outstanding debts or liabilities.

- Whether or not inheritance tax applies depends on several factors, including the total value of the estate and the laws of the jurisdiction.

- In some places, certain beneficiaries, such as spouses or children, may be exempt from paying inheritance tax or may receive a reduced tax rate.

- The first step is to determine the total value of assets.

- Reason to Abolish it:

- Procedural Harassment: Taxpayers were being unduly harassed with the existence of two separate taxes on property ie. wealth tax (before death) and estate duty (after death).

- Unmet Objectives: There was no reduction in the unequal distribution of wealth whereas, the tax did not assist states in financing their development schemes significantly either.

- Economically Not Feasible: While the yield from estate duty is only about Rs 20 crore in 1985, whereas its cost of administration and collection was relatively high.

- Tax Evasion: High rates of taxation often result in flight of capital and investment to tax havens or tax jurisdictions with favourable tax rates.

Examples of Inheritance Tax Around the World

- Most European, American and even African nations levy inheritance tax.

- In Europe, the top nations levying tax on inherited properties are France (60%), Germany (50%), United Kingdom (40%), Spain (33%) and Hungary (18%).

- Other countries with high inheritance taxes are Japan (55%), South Korea (50%), Ecuador (37%), Chile (25%), South Africa (25%) and Taiwan (20%).

What Factors Influence the Demand for Implementing Inheritance Tax in India?

- Rise in Wealth and Income Inequality in India:

- According to the World Inequality Report 2022, India ranks among the most unequal countries globally, with the top 10% and top 1% holding 57% and 22% of the national income, respectively.

- Meanwhile, the share of the bottom 50% has decreased to 13%.

- India exhibits staggering wealth inequality, with the top 10% of the population holding 77% of the total national wealth.

- The richest 1% owns 53% of the country’s wealth, leaving the poorer half with a mere 4.1%.

- According to the World Inequality Report 2022, India ranks among the most unequal countries globally, with the top 10% and top 1% holding 57% and 22% of the national income, respectively.

- Tax Burden on Poor:

- Approximately 64% of the total goods and services tax (GST) in the country came from the bottom 50% of the population, while only 4% came from the top 10%.

- Lack of Inclusive Growth:

- Skewed Distribution of Economic Gains: Economic growth may disproportionately benefit certain sectors or income groups, leading to an uneven distribution of wealth.

- Lack of Social Safety Nets: Inadequate social safety nets and welfare programs may leave vulnerable populations without sufficient support, widening the wealth gap.

- According to NITI Aayog’s National Multidimensional Poverty Index (MPI), India's population living in multidimensional poverty was 14.96% in 2019-21.

- The rural areas of India experienced multidimensional poverty of 19.28%.

- In urban areas, the poverty rate was 5.27%.

- According to NITI Aayog’s National Multidimensional Poverty Index (MPI), India's population living in multidimensional poverty was 14.96% in 2019-21.

- The Gini wealth coefficient in India has gone up from 81.3% in 2013 to 85.4% in 2017 (100% represents maximal inequality). The growth in India has not been inclusive.

- Endowments to Social Sector Institutions: Endowments and funds from inheritance tax are essential for Indian hospitals, universities, and other institutions. For example, Harvard University, receiving funds from estates, is exempt from inheritance tax.

- Need for more Direct Taxes: The government’s fiscal deficit has increased in recent years. Hence, additional sources of direct taxes like inheritance tax need to be explored to contain the fiscal deficit as mandated by the FRBM Act.

- International Practices: Developed countries such as England, France, Germany, the USA and India’s Southeast Asian counterparts like Philippines, Taiwan and Thailand have been charging inheritance tax.

World Bank Study 2000 (India's poverty Reduction During 1970s-1990s)

- When GDP growth picked up from a mere 3.5% in the initial years, India could achieve a sustained decline in poverty.

- The study found that a staggering 87% of the cumulative decline in poverty was attributed to the rise in the growth of mean consumption, while redistribution contributed to only 13%.

What are Advantages and Challenges in Implementation of Inheritance Tax in India?

- Advantages:

- More Efficient Dispersion of Wealth: In India, the richest and wealthy families inherited a large amount of wealth.

- This is not only unhealthy from an economic perspective, but also restricts social mobility.

- Thus, a proper implementation of inheritance taxes can remedy this malaise to a considerable extent.

- Based on Egalitarian Ideals: The redistribution of initial endowments is an important step in that direction to ensure equality as enshrined on the Principle of the Right to Equality in the Constitution of India.

- Additional Source of Revenue for Public Welfare: Inheritance tax provides additional sources of revenue to the government for expansion of social sector programmes, and its push towards public welfare schemes.

- Progressive in Nature: Inheritance tax is a progressive tax as it places a higher tax burden on wealthy individuals only.

- By this additional tax revenue collected in the form of Inheritance Tax, the Government would have the liberty of reducing the basic income tax liability on the economically weaker sections of the country.

- This could help combat the high barrier to entry to starting more entrepreneurial ventures.

- More Efficient Dispersion of Wealth: In India, the richest and wealthy families inherited a large amount of wealth.

- Challenges:

- Complexity of the Tax Structure: India already has a complex tax system with multiple taxes at the central and state levels.

- Introducing an additional tax like inheritance tax would add to this complexity, making compliance and enforcement challenging.

- Enforcing and administering an inheritance tax requires a robust administrative infrastructure.

- Resistance from Wealthy Families: Wealthy families in India may resist the imposition of an inheritance tax, as it would reduce the amount of wealth they can pass on to their heirs.

- This resistance could manifest politically and socially, making it difficult for the government to introduce and sustain such a tax.

- Inheritance taxes can have implications for family-owned businesses, particularly in sectors where succession planning is crucial.

- Lack of Comprehensive Data: Implementing an effective inheritance tax requires accurate data on individuals' wealth and assets.

- In India, there may be challenges in collecting comprehensive data on inheritance and wealth distribution, especially in rural areas where informal economies are prevalent.

- Avoidance and Evasion: High net worth individuals may attempt to avoid or evade inheritance tax through various means such as trusts, offshore accounts, or gifting assets during their lifetime.

- Impact on Agricultural Land: In India, agricultural land holds significant cultural and economic value, and it often passes down through generations.

- Imposing an inheritance tax on agricultural land could face resistance from agricultural communities and lead to concerns about the fragmentation of landholdings.

- Complexity of the Tax Structure: India already has a complex tax system with multiple taxes at the central and state levels.

What other Similar Taxes Does India Have?

- Death Tax: In 1953, India’s Parliament had passed the Estate Duty ‘Death Tax’ Act, which was later abolished in 1985.

- As per the Act, tax/duty was imposed on the principal value of movable and immovable property, including agricultural land, passed on to any person after the death of the owner of such property.

- The Act was applicable only if the property-owning person died as an adult (i.e. completed 18 years of age).

- Also, Estate duty was applicable only on inherited properties with a value above the exclusion limit set by the Act, and the tax rate was calculated as per the market value at the time of death.

- It included immovable and movable property owned by the deceased in India and outside, which were passed on to a successor– if the person died when domiciled in India.

- Gift Tax:

- The Gift Tax Act was passed by Parliament in 1958. It imposed a duty on any ‘gift’ made by one person to another in that financial year.

- It was imposed with a duty at the rate of 30%.

- A gift was defined as any existing movable or immovable property transferred by one person to another voluntarily, without considering its value in terms of money, after 01st April 1957.

- The purpose was that the government sought to recover some of the tax revenue lost when a high income tax donor transferred property to a donee falling in the lower income tax bracket.

- Due to similar constraints to those faced while implementing estate duty, this tax was abolished in 1998.

- It was reintroduced in 2004 in the Finance Act as part of additions to the Income Tax Act.

- Any cash gifts above Rs. 50,000 and any gifts in kind (i.e. immovable property) above the value of Rs. 50,000 are taxable.

- Exceptions include donations, inheritance, and gift money received during weddings.

- Wealth Tax:

- It was introduced in 1957 to impose a duty on a person’s net worth.

- A 1% duty was imposed on earnings of over Rs 30 lakh earned by a citizen in that financial year.

- The tax was imposed on all assets of Indian citizens and only Indian assets of non-residential Indians (NRIs).

- Assets under the purview of this regime were gold, silver, and platinum ornaments, transport vehicles like private aircrafts, ships, and cars, property apart from one’s residential home, and any cash above Rs. 50,000.

- Exemptions under the law included rental properties, business property, smaller properties below the prescribed limit, and investments in schemes.

- This tax was also abolished in 2015 due to heavy costs in execution.

Way Forward

- Introduction of Higher Threshold: If the government intends to introduce an inheritance tax, it should introduce it with a higher threshold, so that only the super-rich are taxed.

- Provisions of Exemption for Donations: The endowments by the super-rich to hospitals and universities should be exempted from the inheritance tax calculations.

- Improving the Government’s Tax Administrative Capacity: The tax agencies should take advantage of advanced technologies to reduce the cost of administering and monitoring compliance with inheritance tax.

|

Drishti Main Question: What is inheritance tax and why it was abolished in India? Discuss its desirability and impact on reducing economic inequality in India. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims

Q. The term ‘Base Erosion and Profit Shifting’ is sometimes seen in the news in the context of (2016)

(a) mining operation by multinational companies in resource-rich but backward areas

(b) curbing of the tax evasion by multinational companies

(c) exploitation of genetic resources of a country by multinational companies

(d) lack of consideration of environmental costs in the planning and implementation of developmental projects

Ans: (b)

Q. There has been a persistent deficit budget year after year. Which of the following actions can be taken by the government to reduce the deficit? (2015)

- Reducing revenue expenditure

- Introducing new welfare schemes

- Rationalizing subsidies

- Expanding industries

Select the correct answer using the code given below:

(a) 1 and 3 only

(b) 2 and 3 only

(c) 1 only

(d) 1, 2, 3 and 4

Ans: (a)

Mains

Q. Enumerate the indirect taxes which have been subsumed in the Goods and Services Tax (GST) in India. Also, comment on the revenue implications of the GST introduced in India since July 2017. (2019)

Significance of Carrier Aviation

For Prelims: INS Vikrant, INS Vikramaditya, Indian Ocean region, Indo-Pak War 1971, Defence Public Sector Units, SRIJAN Portal, Project 75I, Defence Procurement Policy

For Mains: Key features of INS Vikrant, Significance of aircraft carriers in India’s Maritime Security

Why in News?

Recently, the Indian Navy's two aircraft carriers, INS Vikramaditya and INS Vikrant, demonstrated "twin carrier operations," featuring simultaneous take-offs of MiG-29K fighter jets from both carriers, followed by cross-deck landings, underscoring a capability possessed by only a select few nations.

What are the Key Features of Indian Aircraft Carriers?

- India boasts two operational aircraft carriers, each with a rich history and unique capabilities.

- Origin:

- INS Vikrant is the first domestically built aircraft carrier boasting 76% indigenous content. It was constructed at Cochin Shipyard Limited, it's a symbol of India's growing shipbuilding prowess.

- On the other hand,INS Vikramaditya is a modified Kiev-class carrier, originally built for the Soviet Navy. After extensive refitting and modernisation, it was inducted into the Indian Navy in 2013.

- Size and Speed:

- INS Vikrant weighs around 43,000 tonnes and 262 meters long. Its design prioritises manoeuvrability with a top speed of 28 knots.

- Whereas, INS Vikramaditya is slightly larger,weighs around 44,500 tonnes and a length of 284 meters. It can reach speeds of up to 30 knots.

- Firepower and Flexibility:

- Both carry a similar arsenal of aircraft, including MiG-29K fighter jets for air defense and ground attack, Kamov-31 helicopters for airborne early warning, MH-60R helicopters for multi-role operations, and indigenously built Advanced Light Helicopters (ALH) for utility tasks.

- Modernity and Innovation:

- INS Vikrant incorporates the latest advancements in design, sensors, and electronics. It boasts a new combat management system, potentially offering superior situational awareness and operational efficiency.

- INS Vikrant ensures precision operations even in adverse conditions by utilising the STOBAR (Short Take-Off but Arrested Recovery) method.

- Whereas modernised, INS Vikramaditya still uses older technology.

- India’s Future Plans:

- India is planning to have four aircraft carrier battle groups (CBGs) instead of three to strengthen its naval presence.

- The Indian Navy's 15-year plan includes four fleet carriers and two light fleet carriers.

- The new indigenous aircraft carrier INS Vishal, also known as Indigenous Aircraft Carrier 3 (IAC-3), will be built at the Cochin Shipyard, similar to INS Vikrant.

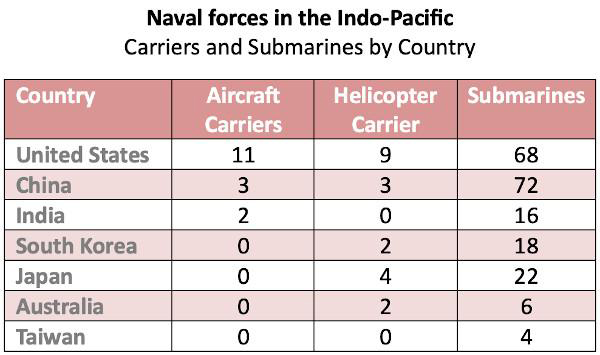

Debate on Aircraft Carriers vs Submarines

- A debate has emerged among navies on whether to focus on submarines or aircraft carriers due to technological developments.

- Technological developments such as anti-ship missiles, hypersonic missiles, and new anti-aircraft systems have raised concerns about the vulnerability of aircraft carriers.

- The economic costs of aircraft carriers are huge, limiting the ability of many countries to operate both submarines and carriers.

- Submarines are seen as a better alternative due to their stealth advantage and relatively cheaper cost compared to aircraft carriers.

What are the Challenges Associated with Indigenisation of Aircraft Carriers?

- Technological Complexity:

- Building an aircraft carrier involves integrating numerous advanced technologies from propulsion systems to combat management and aviation facilities.

- India initially planned for a catapult launch system (CATOBAR) but later switched to a ski-jump launch with arrested recovery (STOBAR) due to technological limitations. While STOBAR is a proven system, it limits the operational capabilities of heavier, more advanced aircraft.

- Building an aircraft carrier involves integrating numerous advanced technologies from propulsion systems to combat management and aviation facilities.

- Time-Consuming Process and High Cost Burden:

- Designing, procuring materials, and constructing a complex warship like an aircraft carrier is a time-consuming process. Delays can impact overall costs and strategic planning.

- The design work for INS Vikrant began in 1999, but the carrier wasn't commissioned until 2023 – a delay of over two decades.

- This extended timeline can also lead to technological advancements rendering some aspects of the carrier obsolete even before its completion.

- Building an aircraft carrier is an expensive undertaking, requiring significant investment in materials, labour, and specialised technologies.

- Designing, procuring materials, and constructing a complex warship like an aircraft carrier is a time-consuming process. Delays can impact overall costs and strategic planning.

- Skilled Manpower and Industrial Base:

- Constructing an aircraft carrier necessitates a large pool of skilled workers with expertise in various disciplines.

- India had to rely on foreign expertise and technology transfer for certain aspects of INS Vikrant's construction, highlighting the need for further development of its domestic shipbuilding industry.

- Constructing an aircraft carrier necessitates a large pool of skilled workers with expertise in various disciplines.

- Material Dependence:

- Even with an indigenous design, some critical materials and components might still need to be imported, creating a reliance on foreign suppliers.

- Although INS Vikrant boasts a high percentage of indigenous content, some key elements like high-tensile steel and specialised electronics might have been sourced internationally. This can create vulnerabilities in times of geopolitical tensions.

- Even with an indigenous design, some critical materials and components might still need to be imported, creating a reliance on foreign suppliers.

What is the Significance of Carrier Aviation for India in Modern Strategic Terms?

- Supporting Land and Air Operations:

- In the context of the ongoing disputes along India's land boundaries, the potential for border conflicts persists, emphasising the strategic advantage robust aircraft carriers would provide in future conflicts.

- During the 1971 operations for the liberation of Bangladesh, INS Vikrant's aircraft played a crucial role in striking deep into East Pakistan, highlighting its strategic significance in supporting land battles.

- In the context of the ongoing disputes along India's land boundaries, the potential for border conflicts persists, emphasising the strategic advantage robust aircraft carriers would provide in future conflicts.

- Maintaining Security of Sea-Lines of Communication:

- In times of military conflict, an aircraft carrier serves as the primary naval asset capable of comprehensively protecting merchant shipping routes vital for carrying strategic commodities to India.

- Concerns have been raised regarding the vulnerability of energy imports through the Strait of Hormuz due to China's strategic presence in Pakistan's Gwadar port, underscoring the importance of carriers in safeguarding sea-lines of communication.

- In times of military conflict, an aircraft carrier serves as the primary naval asset capable of comprehensively protecting merchant shipping routes vital for carrying strategic commodities to India.

- Ensuring Presence in the Indian Ocean Region (IOR):

- India's security interests are intricately linked to the Indian Ocean and its surrounding littoral region, where the presence of Chinese strategic assets poses challenges to India's influence.

- An aircraft carrier enables India to assert its influence in these waters and deter potential threats from extra-regional powers, thereby safeguarding its interests in the IOR.

- India's security interests are intricately linked to the Indian Ocean and its surrounding littoral region, where the presence of Chinese strategic assets poses challenges to India's influence.

- Protection of Important Overseas Interests:

- Carrier aviation provides India with the capability to safeguard its strategic interests overseas, particularly in Afro-Asian states facing political, socio-economic, and ethnic instabilities.

- India's economic and strategic stakes are increasing in these regions, necessitating the ability to respond effectively to emerging threats and protect its citizens and assets abroad.

- Carrier aviation provides India with the capability to safeguard its strategic interests overseas, particularly in Afro-Asian states facing political, socio-economic, and ethnic instabilities.

- Securing Island Territories:

- Integral naval aviation is essential for defending India's remote island territories, such as the Andaman and Nicobar Islands, which are vulnerable due to their geographical spread and limited infrastructure.

- The presence of an aircraft carrier serves as a deterrent against potential foreign military occupation or claims, ensuring the security of these strategically important territories.

- Integral naval aviation is essential for defending India's remote island territories, such as the Andaman and Nicobar Islands, which are vulnerable due to their geographical spread and limited infrastructure.

- Other Non-Military Missions:

- Beyond its military role, an aircraft carrier significantly expands India's operational capabilities to respond to natural disasters in regional seas or littoral areas.

- With its capacity akin to a floating city, a carrier can provide essential services and logistical support, complementing existing sealift platforms and enhancing India's disaster response capabilities.

- Efforts to incorporate modular concepts further enhance the carrier's versatility for non-military missions, enabling rapid deployment of specialised resources for specific humanitarian missions.

What are the Related Initiatives Towards Expanding India’s Defence Infrastructure?

- Development cum Production Partner Initiative

- Defence India Startup Challenge

- SRIJAN Portal

- Increased the Foreign Direct Investment (FDI) limit in defence sector from 49% to 74%

- Innovations for Defence Excellence (iDEX)

- Positive Indigenisation List (Defence Procurement Policy)

- Project 75I

Conclusion

India's focus on indigenous production and ambitious plans for additional carriers demonstrate its commitment to building a future-proof and powerful navy. While the debate between aircraft carriers and submarines continues, India's twin carrier operations showcase its strategic intent to leverage both for a comprehensive maritime defence strategy.

|

Drishti Mains Question: Q. Discuss about the key features of Indian aircraft carriers. Also, mention the significance of carrier aviation for India in modern strategic terms. |

UPSC Civil Services Examination, Previous Year Question (PYQ)

Q.1 Which one of the following is the best description of ‘INS Astradharini’, that was in the news recently? (2016)

(a) Amphibious warfare ship

(b) Nuclear-powered submarine

(c) Torpedo launch and recovery vessel

(d) Nuclear-powered aircraft carrier

Ans: (c)

Q.2 Consider the following in respect of Indian Ocean Naval Symposium (IONS): (2017)

- Inaugural IONS was held in India in 2015 under the chairmanship of the Indian Navy.

- IONS is a voluntary initiative that seeks to increase maritime co-operation among navies of the littoral states of the Indian Ocean Region.

Which of the above statements is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

Ans: (b)

Women in Global Capability Centers

Why in News?

A recent report highlighted that nearly 5 lakh women currently work in Indian Global Capability Centers (GCCs), across GCCs in India.

- Global Capability Centers are offshore units established by multinational corporations to perform a range of strategic functions.

What are the Key Highlights of the Report?

- GCCs Growth:

- India hosts nearly 1,600 GCCs, with a substantial addition of 2.8 lakh employees in 2022-23, expanding its talent base to over 1.6 million.

- Nearly five lakh women currently work in Indian global capability centres (GCCs), comprising 28% of the total 16 lakh employees across GCCs in India. Gender diversity in the deep tech ecosystem stands at 23%.

- Executive and Senior Level Roles:

- Only 6.7% of women hold executive roles in GCCs, and 5.1% in deep tech organisations.

- At the senior level (9-12 years of experience) in GCCs, the representation of women stands at 15.7%.

- Graduate Representation:

- The median representation of women graduates from top engineering universities stands at 25% between 2020-23.

- Challenges and Systemic Barriers:

- Women's attrition is influenced by factors such as family and caregiving responsibilities, limited access to career advancement and leadership opportunities, and poor work-life balance.

What are Global Capability Centers (GCCs)?

- About:

- Global capability centres (GCCs) represent offshore establishments set up by companies to deliver a range of services to their parent entities.

- Operating as internal entities within the global corporate framework, these centres offer specialised capabilities including IT services, research and development, customer support, and various other business functions.

- GCCs play a crucial role in capitalising on cost efficiencies, tapping into talent reservoirs, and fostering collaboration between parent enterprises and their offshore counterparts.

- Special Economic Zones (SEZs) can provide a fertile ground for GCCs to flourish by offering several advantages like tax breaks, simplified regulations and streamlined bureaucracy.

- Present Status:

- In 2022–23, around 1,600 GCCs made up a market of USD 46 billion, employing 1.7 million people.

- Within GCCs, professional and consulting services are the fastest-growing segment despite only accounting for 25% of India's services exports.

- Their compounded annual growth rate (CAGR) of 31% over the last four years significantly outpaces computer services (16% CAGR) and R&D services (13% CAGR).

What are Special Economic Zones (SEZ) ?

- An SEZ is a territory within a country that is typically duty-free (Fiscal Concession) and has different business and commercial laws chiefly to encourage investment and create employment.

- SEZs are created also to better administer these areas, thereby increasing the ease of doing business.

- Asia’s first EPZ (Export Processing Zones) was established in 1965 at Kandla, Gujarat.

- The Special Economic Zones Act was passed in 2005. The Act came into force along with the SEZ Rules in 2006.

- Presently, 379 SEZs are notified, out of which 265 are operational. About 64% of the SEZs are located in five states – Tamil Nadu, Telangana, Karnataka, Andhra Pradesh and Maharashtra.

- The Baba Kalyani-led committee was constituted by the Ministry of Commerce and Industry to study the existing SEZ policy of India and had submitted its recommendations in November 2018.

- It was set up with a broad objective to evaluate the SEZ policy towards making it WTO (World Trade Organisation) compatible and to bring in global best practices to maximise capacity utilisation and to maximise potential output of the SEZs.

UPSC Civil Services Examination Previous Year Question

Q. With reference to Foreign Direct Investment in India, which one of the following is considered its major characteristic? (2020)

(a) It is the investment through capital instruments essentially in a listed company.

(b) It is a largely non-debt-creating capital flow.

(c) It is the investment that involves debt-servicing.

(d) It is the investment made by foreign institutional investors in Government securities.

Ans: (b)

Q. Consider the following: (2021)

- Foreign currency convertible bonds

- Foreign institutional investment with certain conditions

- Global depository receipts

- Non-resident external deposits

Which of the above can be included in Foreign Direct Investments?

(a) 1, 2 and 3

(b) 3 only

(c) 2 and 4

(d) 1 and 4

Ans: (a)

Mains

Q1. “The broader aims and objectives of WTO are to manage and promote international trade in the era of globalization. But the Doha round of negotiations seems doomed due to differences between the developed and the developing countries.” Discuss from the Indian perspective. (2016)

Q2. What are the key areas of reform if the WTO has to survive in the present context of the ‘Trade War’, especially keeping in mind the interest of India? (2018)

Simultaneous Eruption of Solar Flares

Recently, the National Aeronautics and Space Administration (NASA) solar dynamics observatory captured a rare celestial event that occurred with four solar flares erupting simultaneously.

- It originated from three sunspots and a large magnetic filament, demonstrating complex magnetic interactions.

- When the sun reaches the peak of its 11-year solar cycle known as solar maximum, it exhibits heightened activity.

- It is known as a sympathetic solar flare, where multiple eruptions occur across the Sun's magnetic field, linked by massive magnetic field loops.

- Sympathetic flares are caused by one eruption triggering others, leading to Coronal Mass Ejections (CMEs) and massive bursts of plasma.

- It is considered rare because most reported sympathetic flares involve only two linked flares, while this one involved four flares erupting in unison making it a super-sympathetic event.

- These types of events have the potential to disrupt power grids, telecommunication networks on Earth, and orbiting satellites, and expose astronauts to dangerous radiation levels.

- This event offers scientists an opportunity to understand the Sun's complex life cycle and magnetic interactions better.

- The sun's magnetic field goes through a cycle, called the solar cycle, every 11 years the Sun's magnetic field completely flips which means the sun's north and south poles switch places.

Read more: Solar Radiation Management

Bhimtal Lake

- Bhimtal Lake is the largest lake in the Nainital district, in the state of Uttarakhand. It is the largest lake in the Kumaon region, known as the "lake district of India".

- It is named after the second Pandava called Bhima of the famous epic Mahabharata.

- It is a natural lake and its origin is attributed to several faults that occurred due to the shifting of the Earth's crust.

- The lake was built during British time in 1883 and has a masonry dam built on it.

- The lake has rich flora and fauna around it and thick forests of pine and oak cover the hill slopes around the lake.

- It is home to a number of migratory birds in the winter months.

- Famous species found in the area include bulbul, wall creeper, Emerald Dove, Black Eagle, and Tawny fish owl.

- The lake has an island at its centre developed as a tourist attraction with an aquarium.

Read more: sun-stream lake

Shompen Cast their First Vote

For the first time 7 members of the Shompen tribe, one of the Particularly Vulnerable Tribal Groups (PVTGs) residing in the Great Nicobar Island cast their votes in the Andaman and Nicobar Lok Sabha constituency.

- They are highly isolated, semi-nomadic hunter-gatherers. The estimated population of the Shompen tribe was 229 as per the 2011 Census data.

- They are known for their distinctive unique language, consisting of various dialects understood only within specific bands.

- The tribe's social structure is patriarchal, with the eldest male member overseeing family affairs. While monogamy is common, polygamy is also permissible.

- Five PVTGs are residing in Andamans archipelago are Great Andamanese, Jarwas, Onges, Shompens and North Sentinelese.

- PVTGs were originally labelled as Primitive Tribal Groups (PTGs) by the Dhebar Commission in 1973, later renamed PVTGs by the Government of India in 2006.

Options Writing

Retail investors and affluent individuals are increasingly diving into options writing, a riskier segment once dominated by institutional players and experts.

- This surge is amidst regulatory concerns over retail participation in derivatives trading, with a Securities and Exchange Board of India study estimating losses for 90% of individual traders in the Futures and Options (F&O) segment.

- Options writing refers to the strategy of selling options contracts, which grants the seller (writer) an obligation to buy or sell the underlying asset at a predetermined price (strike price) within a specified period (expiration date).

- This strategy is often employed by investors seeking to generate income through collecting premiums, but it comes with the risk of potentially unlimited losses if the market moves unfavourably against the writer.

- The introduction of daily and weekly expiry options has further fueled options writing, allowing traders to capitalise on short-term market movements and premium decay.

- Options writers benefit from theta decay (daily decline in an option's value), while buyers face challenges due to faster premium decay.

- Derivatives, financial instruments derived from underlying securities, include forwards, futures, and options.

- Forwards and futures mandate buyers to purchase an asset at a pre-agreed price on a future date.

- Options give buyers the right, but not obligation, to buy or sell the underlying asset at a predetermined price, exercisable on or before the maturity date.

Read more: Nifty Next 50 index

GST Revenue Collection for April 2024

The Gross Goods and Services Tax (GST) collections hit a record high in April 2024 at Rs 2.10 lakh crore. This represents a significant 12.4% year-on-year growth, driven by a strong increase in domestic transactions (up 13.4%) and imports (up 8.3%).

- After accounting for refunds, the net GST revenue for April 2024 stands at Rs 1.92 lakh crore, reflecting an impressive 15.5% growth compared to the same period of 2023.

- Finance Minister attributed this surge to the strong momentum in the economy and efficient tax collections, with no dues pending on account of IGST (Integrated GST) settlement to the States.

- GST compensation cess collections also hit an all-time high of Rs 13,260 crore,

- Introduced for five years to compensate States for revenue losses due to the 2017 switch to the GST regime, the cess is now being used to repay loans taken during the pandemic to compensate States amid a lockdown-triggered collapse in revenues.

- Mizoram reported the highest growth at 52%, followed by Assam at 25%, and Delhi, Bihar, and Goa at 23% rise in revenues.

Read more: Goods and Services Tax (GST)