Indian Economy

GST Compensation Extension

- 01 Jan 2022

- 6 min read

For Prelims: GST compensation cess regime, centrally-sponsored schemes,

For Mains: Revenue Shortfall and Economic Slowdown owing to Covid-19 pandemic, Cooperative federalism, fiscal federalism.

Why in News

Many states have demanded that the GST compensation cess regime be extended for another five years. Also, states have demanded that the share of the Union government in the centrally-sponsored schemes should be raised.

- These demands are made as Covid-19 pandemic has impacted their revenues.

- The provision for GST compensation is going to end in June 2022.

Key Points

- About:

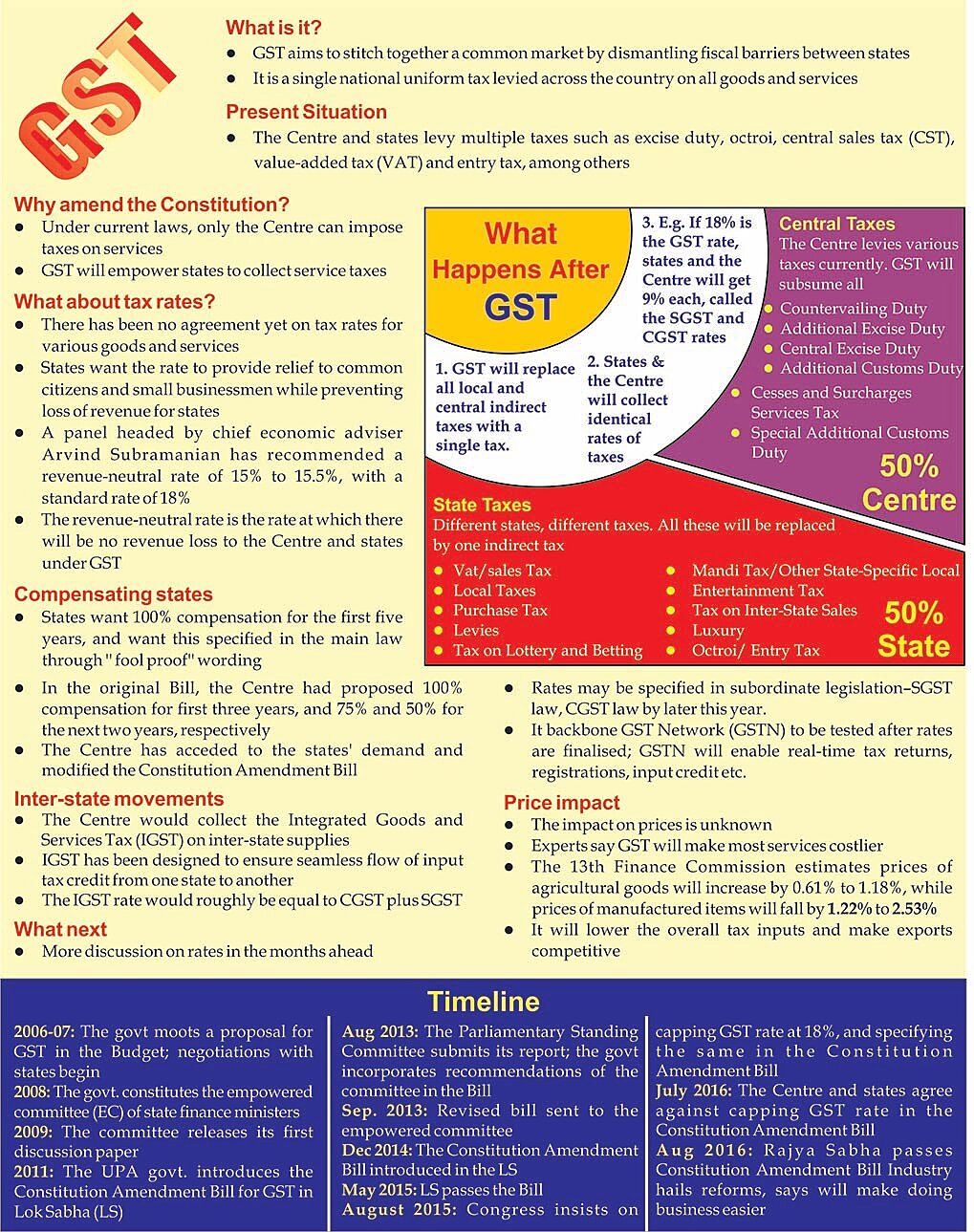

- GST Taxation: The GST became applicable from 1st July 2017 after the enactment of the 101st Constitution Amendment Act, 2016.

- With GST, a large number of central and state indirect taxes merged into a single tax.

- GST Compensation: In theory the GST should generate as much revenue as the previous tax regime. However, the new tax regime is taxed on consumption and not manufacturing.

- This means that tax won’t be levied at the place of production which also means manufacturing states would lose out and hence several states strongly opposed the idea of GST.

- It was to assuage these states that the idea of compensation was mooted.

- The Centre promised compensation to the States for any shortfall in tax revenue due to GST implementation for a period of five years.

- This promise convinced a large number of reluctant States to sign on to the new indirect tax regime.

- GST Taxation: The GST became applicable from 1st July 2017 after the enactment of the 101st Constitution Amendment Act, 2016.

- Compensation Cess:

- States are guaranteed compensation for any revenue shortfall below 14% growth (base year 2015-16) for the first five years ending 2022.

- GST compensation is paid out of Compensation Cess every two months by the Centre to states.

- The compensation cess was specified by the GST (Compensation to States) Act, 2017.

- All the taxpayers, except those who export specific notified goods and those who have opted for GST composition scheme, are liable to collect and remit the GST compensation cess to the central government.

- Compensation Cess Fund: The GST Act states that the cess collected and the amount as may be recommended by the GST Council would be credited to the fund.

- States are guaranteed compensation for any revenue shortfall below 14% growth (base year 2015-16) for the first five years ending 2022.

- Concerns of States:

- Revenue Shortfall: The state’s GST revenue gap in 2020-21 is expected to be about Rs. 3 lakh crore, while cess collections are only projected to reach Rs. 65,000 crore, leaving a shortfall of Rs. 2.35 lakh crore.

- Economic Slowdown: At a time when growth is faltering, the delays in paying compensation to states as guaranteed by the GST Act will make it more difficult for them to meet their own finances.

- Decreasing Centre Devolution: Most states are of the view that the Centre’s share in centrally-sponsored schemes has gradually reduced and states' share has increased.

- Due to this, their most significant demand is increasing share in centrally-sponsored schemes.

Goods and Services Tax

- GST was introduced through the 101st Constitution Amendment Act, 2016.

- It is one of the biggest indirect tax reforms in the country.

- It was introduced with the slogan of ‘One Nation One Tax’.

- The GST has subsumed indirect taxes like excise duty, Value Added Tax (VAT), service tax, luxury tax etc.

- It is essentially a consumption tax and is levied at the final consumption point.

- This has helped mitigate the double taxation, cascading effect of taxes, multiplicity of taxes, classification issues etc., and has led to a common national market.

- The GST that a merchant pays to procure goods or services (i.e. on inputs) can be set off later against the tax applicable on supply of final goods and services.

- The set off tax is called input tax credit.

- The GST avoids the cascading effect or tax on tax which increases the tax burden on the end consumer.

- Tax Structure under GST:

- Central GST to cover Excise duty, Service tax etc,

- State GST to cover VAT, luxury tax etc.

- Integrated GST (IGST) to cover inter-state trade.

- IGST per se is not a tax but a system to coordinate state and union taxes.

- It has a 4-tier tax structure for all goods and services under the slabs- 5%, 12%, 18% and 28%.