Centre-State Revenue Dynamics | 18 Jan 2025

For Prelims: Capital expenditure, Goods and Services Tax, Gross State Domestic Product, Income tax, Excise Duty , Gati Shakti, Finance Commissions, Tax devolution.

For Mains: Fiscal Federalism in India, Revenue Mobilization, Impact of Central Transfers on State Finances, Inter-State Fiscal Inequality

Why in News?

In the past decade (Fiscal Year 2016 (FY16) to FY25), the share of States' revenue derived from Central transfers and grants has significantly increased, highlighting a growing dependence on the Centre.

- A significant rise in the Centre’s share of state revenue, coupled with declining efficiency in states' tax collection efforts, has deepened this reliance.

What are the Key Trends in States’ Revenue Composition?

- Pandemic Aftermath: States’ revenue expenditures increased by 14% during the Covid pandemic due to welfare measures.

- Capital expenditure for infrastructure slowed, affecting long-term economic growth.

- Debt-to-GDP Ratio Trends: While states' debt-to-GDP ratio (relative measure of debt compared to economic output) is at 28.5% in March 2024. This indicates that states' fiscal health is still under strain.

- State debt levels exceed the Fiscal Responsibility and Budget Management committee's recommended debt-to-GDP ratio of 20% for states, highlighting the unsustainable debt burden faced by states.

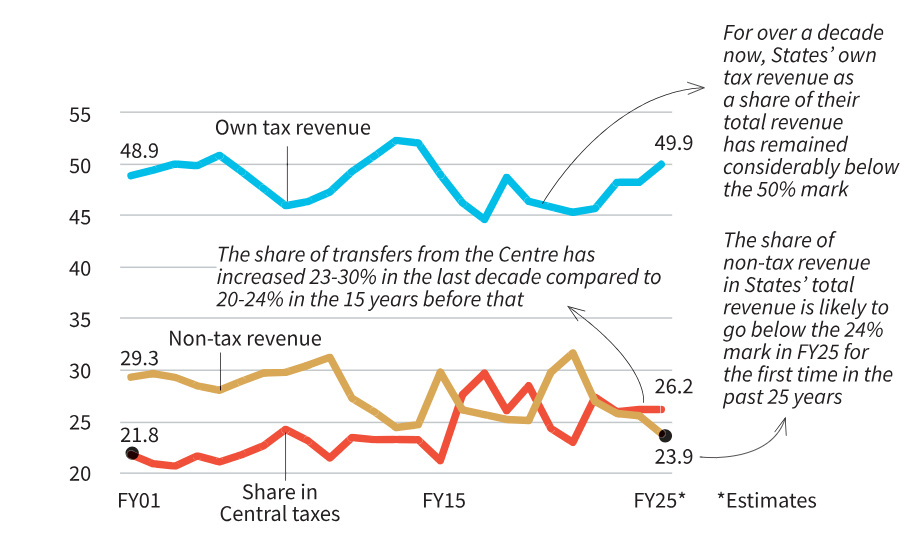

- Increased Central Transfers: States' revenue from Central transfers has increased to 23-30% of their total revenue in the last decade, compared to 20-24% in the 2000s and early 2010s.

- Grants from the Centre now account for 65-70% of States' non-tax revenue, up from 55-60% earlier.

- States' Own Tax Revenue: It has consistently remained below the 50% mark as a share of total revenue over the last decade, whereas it often exceeded 50% in the 2000s.

- Despite State Goods and Services Tax (SGST) contribution increasing from 15% to 22% of States' total revenue between FY18 and FY25, the share of own tax revenue (excluding SGST) has fallen from 34% to 28%.

- Reduced Non-Tax Revenue: The share of non-tax revenue in total revenue is projected to fall below 24% in FY25, the lowest in 25 years.

- Key components like interest receipts and dividends from State public sector enterprises remain negligible (under 1%).

- Earnings from services rendered, such as public health (social service) and power (economic service), did not cross the 30% mark in the last decade.

- Inefficiency in Tax Collection: Revenue from avenues like stamp duty, registration fees, and motor vehicle taxes has been insufficient due to sporadic and inefficient collection efforts.

- The own tax revenue to Gross State Domestic Product (GSDP) ratio has declined in major States like Tamil Nadu, Kerala, and Karnataka, indicating a systemic issue in tax mobilisation.

What are the Implications of Increasing Dependency of States on Centre?

- Fiscal Autonomy at Risk: States often depend heavily on the Centre for funding due to the uneven distribution of revenue-raising powers.

- The Centre controls dynamic taxes like income tax and GST, while states manage slower-growing taxes such as sales tax and land revenue.

- This imbalance restricts states' fiscal independence, limiting their capacity to tailor policies to local needs.

- Additionally, tax decisions like SGST rates are influenced by the GST Council, where states have limited bargaining power, further constraining their autonomy.

- Constraints on Developmental Expenditure: Weaker fiscal states often face inadequate resources as central allocations may prioritize performance over need, deepening inter-state inequalities and widening regional disparities.

- Inefficient tax mobilization hampers states' ability to meet rising developmental demands.

- Heavy dependence on the Centre also limits states' capacity for counter-cyclical fiscal measures, crucial for stimulating aggregate demand.

- Political Tensions: Centralised decision-making in tax policies led to disagreements between the Centre and Opposition-ruled States.

- Overburdened Central Government: States' increasing dependence on the Centre could strain the nation's overall fiscal health, limiting the Centre's ability to support states during economic downturns or crises.

Sources of Revenue for States

- States’ Own Tax Revenue (OTR): Includes taxes levied by state governments such as State GST (SGST) (a part of the GST collected by the Union Government), State Excise Duty on alcohol, Sales Tax or Value Added Tax (VAT) on items not covered by GST, Stamps and Registration Duty on property transactions, Vehicle Registration Tax, and Entertainment Tax on movie tickets.

- States’ Non-Tax Revenue: Includes earnings from the lease or sale of natural resources, economic services like irrigation, health, and education, sale of lotteries, and interest receipts from loans provided to public sector undertakings or local bodies.

- Grants from the Central Government: These grants support states in areas like welfare, infrastructure, and disaster relief, providing critical financial assistance.

- States' Share of Central Taxes: Refers to the portion of tax revenue collected by the Union Government and shared with the states as mandated by the Article 270 of Indian Constitution.

How Can States Improve Revenue Mobilisation?

- Strengthen Fiscal Federalism: Increase states’ share in revenue through progressive recommendations by the Finance Commissions, as seen in the 14th and 15th Finance Commissions, which raised the tax devolution share to 42% and 41% respectively.

- Enhancing Tax Collection Efficiency: Implement technology-driven solutions to improve collection from property taxes, motor vehicle taxes, and registration fees.

- Modernising tax administration systems to reduce evasion and enhance compliance.

- Incentivize states to improve their tax collection mechanisms and fiscal discipline through performance-based grants.

- Broadening the Tax Base: Explore new revenue sources, such as environmental taxes or congestion charges, tailored to State-specific contexts. Rationalise tax exemptions and subsidies to maximise revenue.

- Strengthening Non-Tax Revenue Sources: Boost earnings from State public sector enterprises by improving operational efficiency. Monetise underutilised State assets and services.

- Collaborative Policy Making: Increase engagement with the GST Council to advocate for region-specific needs. Work towards harmonising tax policies across States to reduce disparities.

- Foster inter-State knowledge sharing to replicate best practices.

- Leverage Central Schemes: Utilize programs like Gati Shakti and capital assistance schemes to spur economic activity and support infrastructure development.

- Reduce Public Debt: Tighten fiscal discipline with data-driven decision-making and prioritize reliance on own-source revenues (SOR).

Key Revenue Mobilization Initiatives by States

- Property Tax Reforms: Tamil Nadu, Telangana, and Kerala revised property taxes to enhance revenue.

- According to the World Bank, India’s property tax collection is just 0.2% of GDP, far below the Organisation for Economic Co-operation and Development (OECD) nations average of 1.1%, emphasizing the critical need for reform.

- Power Tariff Adjustments: States like Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, and others revised power tariffs in FY23 to boost revenues.

- New Liquor Policies: Uttar Pradesh introduced a new liquor policy, increasing license fees, renewal charges, and processing fees.

- Privatization and Asset Monetization: Several states privatized SPSEs and monetized assets during FY21 and FY22 to unlock funds tied in unproductive assets.

Conclusion

The growing dependence of states on the Centre has led to challenges in fiscal autonomy and development. Strengthening revenue mobilization through improved tax collection and fiscal discipline is essential. Collaborative efforts between states and the Centre can ensure sustainable growth and reduce regional disparities.

|

Drishti Mains Question: Analyze the implications of increasing dependency of states on central transfers for India's fiscal federalism. How can states improve their revenue mobilization? |

UPSC Civil Services Examination Previous Year Question

Prelims

Q1. Which one of the following is likely to be the most inflationary in its effect? (2021)

(a) Repayment of public debt

(b) Borrowing from the public to finance a budget deficit

(c) Borrowing from the banks to finance a budget deficit

(d) Creation of new money to finance a budget deficit

Ans: (d)

Q2. Consider the following statements: (2018)

- The Fiscal Responsibility and Budget Management (FRBM) Review Committee Report has recommended a debt to GDP ratio of 60% for the general (combined) government by 2023, comprising 40% for the Central Government and 20% for the State Governments.

- The Central Government has domestic liabilities of 21% of GDP as compared to that of 49% of GDP of the State Governments.

- As per the Constitution of India, it is mandatory for a State to take the Central Government’s consent for raising any loan if the former owes any outstanding liabilities to the latter.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (c)

Q3. Which of the following is/are included in the capital budget of the Government of India? (2016)

- Expenditure on acquisition of assets like roads, buildings, machinery, etc.

- Loans received from foreign governments

- Loans and advances granted to the States and Union Territories

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)