Indian Economy

Analyzing State Finances Through Budgets

- 13 Apr 2024

- 20 min read

This editorial is based on “Decoding State Budgets” which was published in Indian Express on 12/04/2024. The article explains various aspects of state budgets and emphasizes that the actual grants from the Centre to the states have consistently shown significant differences from the revised/budget estimates made by the states, especially regarding Centrally Sponsored Schemes.

For Prelims: Reserve Bank of India’s (RBI), Annual Study on State Finances, Covid-19 Pandemic, Fiscal Deficits, GDP, GST(Goods and Services Tax), Finance Commissions, Human Capital, Centrally Sponsored Schemes

For Mains: Fiscal Challenges Faced by Indian States, Significance of States Reducing their Revenue Deficits.

The ongoing election season has drawn sharp attention to India’s fiscal health. While the Government of India’s fiscal metrics are keenly dissected and well understood, the fiscal situation of state governments tends to be less scrutinised. However, the rise in market borrowings of state governments and key policy changes in recent years have rekindled an interest among market participants on the fiscal health of states.

State budgets are a rich source of publicly available information on state government finances. A web of factors among states makes analysing their budgets both interesting and challenging. Additionally, the publication of monthly fiscal indicators by the Comptroller and Auditor General (CAG), albeit with modest lags, is useful in assessing emerging trends in state finances.

The 2024-25 budgets or votes on account (VoA) are available in the public domain for 26 states (except Arunachal Pradesh and Sikkim). An analysis of the data they contain reveals that the states expect a 9.2 % growth in their combined revenue receipts this year. While this growth appears moderate, it hinges on the correctness of the base revenues indicated in the revised estimates for 2023-24, among other factors.

What is the Fiscal Position of Indian State Governments?

- Over-Reliance on Their Own Revenues:

- Around half of the total revenues of states is from states’ own tax revenues (SOTR). Therefore, a material deviation between the actual and indicated growth of own taxes can impact the expansion in the total revenues of the states.

- In the FY2025 Budget estimates (BE), the combined SOTR of the 26 states is set to expand by 13.8 % on the back of an even higher 15.4 % growth estimated in the previous year’s revised estimates.

- Far Below Growth Levels of Own Taxes:

- Disappointingly however, the provisional data of many of the sample states for April-February 2023-24 indicates that the growth of key components of own taxes such as sales tax, state GST and excise duty was far below the levels included in the revised estimates.

- This implies that a much higher growth would be needed to meet the absolute level of targets in the FY2025 budgets if the actual revenues last year turn out to be lower than those assumed.

- Disappointingly however, the provisional data of many of the sample states for April-February 2023-24 indicates that the growth of key components of own taxes such as sales tax, state GST and excise duty was far below the levels included in the revised estimates.

- Devolution from the Centre to States:

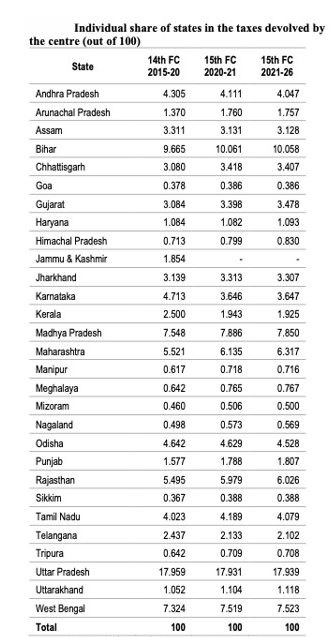

- Around 40-45 %of the revenues of the states is accounted for by transfers from the Centre, taxes and grants. Taxes devolved by the Centre to the states are projected to increase by 10.4 % in 2024, in line with the growth indicated by the Government in the interim Union budget. States received an upside in their revenues on account of higher-than-budgeted tax devolution for three consecutive years during FY2022-24.

- Improved Tax Buoyancy:

- Till 2016-17, sales tax/VAT was the largest component of own tax revenue. From 2017-18, however, State Goods and Services Tax (SGST) has emerged as the most important source, followed by sales tax/VAT, excise duty, stamp duty and registration fees and taxes on vehicles.

- States’ tax buoyancy has improved in the recent period. SGST collection has picked up since 2021-22 with a buoyancy above one, benefitting from the revival in economic activity and increased compliance due to improved tax administration, especially among the larger States.

- Reforms Undertaken by State Governments:

- States have undertaken taxation reforms to augment their own tax capacity. Several States have reset stamp duty rates, revised fair value of land parcels, and introduced e-stamping/ digital stamping of various non-registerable documents.

- Some States have revised the excise duty on liquor, increased license fees, introduced social security cess on liquor consumption and facilitated digital modes of payment at liquor outlets to boost collections.

- The most common reforms in motor vehicle taxation include revision of the life tax on vehicles, introduction of green tax/green cess, and implementation of strict enforcement practices by punishing vehicle tax defaulters with hefty penalties.

What are the Different Concerns in Management of the State Finances?

- Significant Variation in Grants as Per Revised/Budget Estimates:

- Actual grants from the Centre to the states have consistently displayed significant variation from the revised/budget estimates made by the latter, particularly in the case of the Centrally Sponsored Schemes (CSS). The actual amount received from the Centre depends on the state spending its share under the CSS, adherence to the other guidelines of the Centre including submission of utilisation certificates etc.

- Variance in Devolution of Grants Across States:

- During April-February 2023-24, the combined grants of a sizeable subset of the sample states declined by a considerable 22%, led by factors such as lower revenue deficit grants and the phasing out of GST compensation. Despite this, the 26 states have indicated a high 18% expansion in grants in their revised estimates, followed by a 7% contraction in their combined grants in 2024.

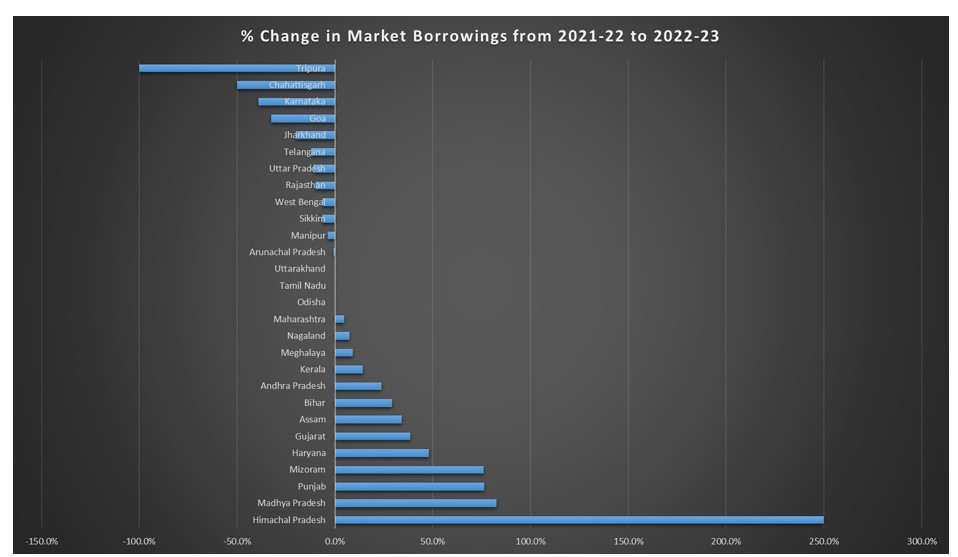

- High Debt Issuance:

- The actual debt issuance during March 2024 amounted to a surprisingly large Rs 1.9 trillion, 51% higher than the indicated amount of Rs 1.3 trillion. Several factors, such as a preference to hold larger cash going into the period of the Model Code of Conduct (MCC), may have driven some states to expand their borrowings.

- It is also possible that some states have chosen to use up a larger part of their borrowing limit for 2023-24 before the year ended. Gross borrowing is projected to increase to Rs 10.5-11 trillion in the current year.

- The actual debt issuance during March 2024 amounted to a surprisingly large Rs 1.9 trillion, 51% higher than the indicated amount of Rs 1.3 trillion. Several factors, such as a preference to hold larger cash going into the period of the Model Code of Conduct (MCC), may have driven some states to expand their borrowings.

- Low Capital Spending by States:

- Capital spending is anticipated to start on a slow note in the first few weeks of the 2024 with parliamentary elections underway and the lull to sustain until the final Union Budget is presented. The tepidness may unfortunately extend further during the monsoon months.

- Overall, capital spending by states this year is likely to end up being heavily back-ended, which may influence the timing of the states’ market borrowings over the course of the year.

- Capital spending is anticipated to start on a slow note in the first few weeks of the 2024 with parliamentary elections underway and the lull to sustain until the final Union Budget is presented. The tepidness may unfortunately extend further during the monsoon months.

- High Degree of Technical Inefficiency:

- In India, collection of different State taxes, viz., stamp duty and registration fees, sales tax/ VAT, excise duty on alcoholic beverages and motor vehicles tax suffer from a high degree of technical inefficiency.

- This is mostly related to the rate structure - stamp duty rates range between 5-8% across States as against the international average of less than 5%. High tax rates lead to high transaction costs, tax evasion and destabilisation of urban land markets.

- Lack of Uniformity in Motor Vehicle Tax Structure:

- The current rate structure of GST consisting of four tax slabs – 5%, 12%, 18%, and 28%, also adds to complexity. The motor vehicle tax structure in India lacks uniformity due to different bases for computation and different rates across, leading to varying incidence of taxes per vehicle in different States.

- Inter-state variations result from the application of ‘lifetime’ and annual tax rates to vehicle categories; use of specific and ad valorem rates; and multiplicity of rates. A substantial proportion of the arrears in revenue remains outstanding in courts and other appellate authorities depriving States of potential revenues.

- Resorting to Non Tax Revenue Measures:

- Growing demand for public expenditures, limitations in expanding tax capacity and limited scope to deviate from common harmonized indirect tax system under the GST regime have induced States to look for opportunities to expand revenue mobilisation from non-tax sources.

- To augment revenues from non-tax sources, measures undertaken by State governments include, inter alia, e-auction of mining leases, royalty revision across different segments of mining minerals, revision of the penal rates to curb secret mining etc.

- Divergence Between State and Central Governments:

- In India, the Union government has the power to levy major taxes such as income tax, corporation tax and excise duties while States can levy taxes such as stamp duty, registration fees, VAT/sales tax on petroleum products and excise duty on liquor. By contrast, States have major expenditure responsibilities, especially economic and social services such as health, education, law and order leading to vertical fiscal gap, a common feature in many federal countries.

- Vertical fiscal imbalance in India is higher than in countries like Brazil and Canada with Indian States collecting 37% of general government taxes while spending 64% of total expenditure.

- In India, the Union government has the power to levy major taxes such as income tax, corporation tax and excise duties while States can levy taxes such as stamp duty, registration fees, VAT/sales tax on petroleum products and excise duty on liquor. By contrast, States have major expenditure responsibilities, especially economic and social services such as health, education, law and order leading to vertical fiscal gap, a common feature in many federal countries.

- Concerns Related to Cess and Surcharge:

- While cess and surcharge are fundamentally distinct concepts, under Article 270 of the Indian Constitution, the revenue collected from both cess and surcharge are at the exclusive disposal of the Union government, i.e., these taxes are not required to be shared with the State governments. The revenue collected by the Union government from cesses increased from 6.4% of its gross tax revenue in 2011-12 to 17.7% in 2021-22.

What are the Different Suggestions to be Incorporated for Improving State Finances?

- Maintaining Balance Between Tax and Non-Tax Revenues:

- The Own Tax and Non-Tax Revenue Ratios of the GSDP should increase in a sustained manner, but to the extent that they do not impose undue burden on the people and do not kill their initiative and enterprise while pursuing the objective of restructuring.

- At the same time, It has to be ensured that financial resources so mobilized, flow into such channels which are consistent with priorities of the State. It has also to be ensured that outlays become the outcomes.

- Prioritizing Inflows of Private Investments to Less Developed States:

- Available statistics in respect of private investment since economic reforms indicate that most of the investment is flowing to those States which are more developed and have better infrastructure and efficient administration.

- The official aid flows from bilateral and multilateral agencies also show a similar trend of favouring developed States. These are clear indications for the less developed States like Chhattisgarh which are endowed with rich resources and have potential for growth but lack adequate resources to achieve high growth. These states should be provided adequate focus.

- Recommendations of 12th Finance Commission:

- The XIIth Finance Commission has recommended a Multi-Dimensional Restructuring of Government Finances aimed at both the qualitative and quantitative aspects of managing government finances.The proposed restructuring covers the following areas :-

- Taxation Reforms aimed at building up non-distortionary and revenue elastic system of taxation with tax rates that are low, limited in number of rate categories and are stable.

- Non-Tax Revenues where user charges as a short term objective, ensure recoveries of current costs and aiming at full recovery of full costs in the long run.

- Expenditure Restructuring relating to both its size and sectoral allocations, aimed at removing inefficiencies arising from mis-allocations, designing and implementation of schemes and delivery of services.

- Rationalizing Subsidies by reducing their overall volume, increasing their transparency by making them explicit and improving their targeting.

- Fiscal Transfer System where equalizing transfers are given much greater weight and extended to Local Bodies.

- Strengthening the role of Local Bodies to become a more effective instrument in the delivery of local public goods.

- Suggesting institutional frameworks including ceiling on Debt and Deficits and the mechanism for their monitoring through State level fiscal responsibility legislation.

- The XIIth Finance Commission has recommended a Multi-Dimensional Restructuring of Government Finances aimed at both the qualitative and quantitative aspects of managing government finances.The proposed restructuring covers the following areas :-

- Recommendations of the 15th Finance Commission:

- A threshold should be fixed for annual allocation to CSS below which the funding for a CSS should be stopped (to phase out CSS which outlived its utility or has insignificant outlay). Third-party evaluation of all CSS should be completed within a stipulated timeframe. Funding pattern should be fixed upfront in a transparent manner and be kept stable.

- States should amend their fiscal responsibility legislation to ensure consistency with the centre’s legislation, in particular, with the definition of debt. States should have more avenues for short-term borrowings other than the ways and means advances, and overdraft facility from the Reserve Bank of India. States may form an independent debt management cell to manage their borrowing programmes efficiently.

- Rationalizing Revenue Deficits:

- It is held that in no case the State should resort to borrowings for meeting the Revenue Expenditure. In no case the Capital Receipts are to be deployed for meeting the Revenue Expenditure of the State Government. This is a sound and time honoured principle of Public Finance. But fiscal deficit may increase for meeting the requirements of increasing investment in the State.

- Harnessing Royalty Rates on Minerals:

- The State Government does not have the power to raise rates of Royalty on Minerals because such a power vests with the Central Government but it has not been revising the rates as required. It is recommended that since Royalty from Minerals can be an important source of Revenue of the State which is minerally rich, the rates of royalty should be revised at regular intervals and levied on ad valorem basis.

Conclusion

Improving the finances of state governments requires a multi-faceted approach encompassing enhanced revenue mobilization, prudent fiscal management, and efficient utilization of resources. State governments must focus on boosting economic growth, reducing non-essential expenditures, and exploring innovative financing mechanisms. Additionally, greater coordination between the central and state governments, along with regular monitoring and evaluation of fiscal policies, is crucial. By adopting these strategies, state governments can strengthen their financial position and better serve the needs of their citizens.

|

Drishti Mains Question: Discuss the challenges faced by Indian states in managing their finances and suggest measures to enhance revenue and fiscal discipline. |

UPSC Civil Services Examination, Previous Year Questions (PYQs)

Prelims:

Q. Consider the following statements: (2018)

- The Fiscal Responsibility and Budget Management (FRBM) Review Committee Report has recommended a debt to GDP ratio of 60% for the general (combined) government by 2023, comprising 40% for the Central Government and 20% for the State Governments.

- The Central Government has domestic liabilities of 21% of GDP as compared to that of 49% of GDP of the State Governments.

- As per the Constitution of India, it is mandatory for a State to take the Central Government’s consent for raising any loan if the former owes any outstanding liabilities to the latter.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: C

Mains:

Q.1 Public expenditure management is a challenge to the Government of India in the context of budget-making during the post-liberalization period. Clarify it. (2019)

Q.2 Normally countries shift from agriculture to industry and then later to services, but India shifted directly from agriculture to services. What are the reasons for the huge growth of services vis-a-vis the industry in the country? Can India become a developed country without a strong industrial base? (2014)