Indian Economy

India's Fiscal Deficit Targets

- 07 Feb 2023

- 9 min read

For Prelims: Union Budget for 2023-24, Fiscal Deficit, Subsidies, Capital spending, Gross Domestic Product (GDP), Balance of payments, India's external debt.

For Mains: Economic Survey 2022-23, Positive Aspects of Fiscal Deficit, Negative Aspects of Fiscal Deficit.

Why in News?

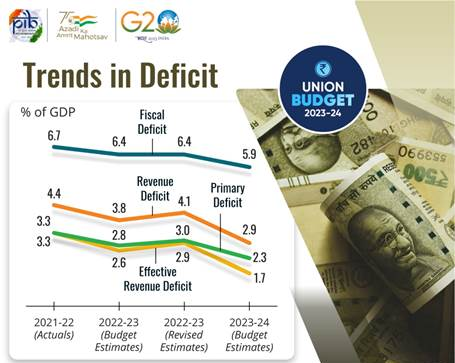

In the Union Budget for 2023-24, the government announced the adoption of relative fiscal prudence and projected a decline in fiscal deficit to 5.9% of gross domestic product (GDP) in FY24, compared with 6.4% in FY23.

- The government planned to continue on the path of fiscal consolidation and reach a fiscal deficit below 4.5% by 2025-26.

What is the Direction on Deficit Given in the Budget?

- In the revenue budget, the deficit was 4.1% of GDP in 2022-23 (revised estimate). In Union Budget 2023-24, revenue deficit is 2.9% of GDP.

- If interest payments are deducted from fiscal deficit, which is referred to as primary deficit, it stood at 3% of GDP in 2022-23 (RE).

- The primary deficit, which reflects the current fiscal stance devoid of past interest payment liabilities, is pegged at 2.3% of GDP in Union Budget 2023-24.

What are the Major Steps of Government Towards Fiscal Consolidation?

- Reduced Subsidies:

- The government has reduced the amount of money allocated for food, fertiliser and petroleum subsidies.

- The food subsidy in 2022-23 (RE) was ₹2,87,194 crore. In 2023-24, it has been reduced to ₹1,97,350 crore.

- Similarly, the fertilizer subsidy in 2022-23 was ₹2,25,220 crore (RE); it has been reduced to ₹1,75,100 crore for FY24.

- The petroleum subsidy in 2022-23 was ₹9,171 crore (RE); it has declined to ₹2,257 crore in 2023-24 (Budget estimate/BE).

- The decrease in subsidies compared to the previous year is not as sharp, but it is still a positive step towards reaching a fiscal deficit target of 4.5% by 2025-26.

- The government has reduced the amount of money allocated for food, fertiliser and petroleum subsidies.

- Capital Expenditure:

- In the Budget for 2023-24, capital spending is planned to rise to 3.3% of GDP, and the government has provided an interest-free loan of ₹1.3 lakh crore for 50 years to states to boost growth.

- Debt Management:

- The majority of the fiscal deficit is financed through internal market borrowings, with a small portion coming from securities against savings, provident funds, and external debt.

- In the 2023 Union Budget, India's external debt is only 1% of the total fiscal deficit, which is estimated at ₹22,118 crore.

- The states are free to maintain a fiscal deficit of 3.5% of their Gross State Domestic Product (GSDP) with 0.5% tied to power sector reforms.

- The majority of the fiscal deficit is financed through internal market borrowings, with a small portion coming from securities against savings, provident funds, and external debt.

Why is Fiscal Consolidation Important for an Emerging Economy?

- Fiscal consolidation refers to the ways and means of narrowing the fiscal deficit. A government typically borrows to bridge the deficit. It will then have to allocate a part of its earnings to service the debt.

- The interest burden will increase as the debt increases. In the Budget for FY22, of the total government expenditure of over ₹34.83 lakh crore, more than 8.09 lakh crore (around 20%) went towards interest payment.

What is Fiscal Deficit?

- About:

- Fiscal deficit is the difference between the government's total expenditure and its total revenue (excluding borrowings).

- It is an indicator of the extent to which the government must borrow in order to finance its operations and is expressed as a percentage of the country's Gross Domestic Product (GDP).

- A high fiscal deficit can lead to inflation, devaluation of the currency and an increase in the debt burden.

- While a lower fiscal deficit is seen as a positive sign of fiscal discipline and a healthy economy.

- Fiscal deficit is the difference between the government's total expenditure and its total revenue (excluding borrowings).

- Positive Aspects of Fiscal Deficit:

- Increased Government Spending: Fiscal deficit enables the government to increase spending on public services, infrastructure, and other important areas that can stimulate economic growth.

- Finances Public Investments: The government can finance long-term investments, such as infrastructure projects, through fiscal deficit.

- Job Creation: Increased government spending can lead to job creation, which can help reduce unemployment and increase the standard of living.

- Negative Aspects of Fiscal Deficit:

- Increased Debt Burden: A persistent high fiscal deficit leads to an increase in government debt, which puts pressure on future generations to repay the debt.

- Inflationary Pressure: Large fiscal deficits can lead to an increase in money supply and higher inflation, which reduces the purchasing power of the general public.

- Crowding out of Private Investment: The government may have to borrow heavily to finance the fiscal deficit, which can lead to a rise in interest rates, and make it difficult for the private sector to access credit, thus crowding out private investment.

- Balance of Payments Problems: If a country is running large fiscal deficits, it may have to borrow from foreign sources, which can lead to a decrease in foreign exchange reserves and put pressure on the balance of payments.

What are the Other Types of Deficits in India?

- Revenue Deficit: It refers to the excess of government’s revenue expenditure over revenue receipts.

- Revenue Deficit = Revenue expenditure – Revenue receipts

- Primary Deficit: Primary deficit equals fiscal deficit minus interest payments. This indicates the gap between the government’s expenditure requirements and its receipts, not taking into account the expenditure incurred on interest payments on loans taken during the previous years.

- Primary deficit = Fiscal deficit – Interest payments

- Effective Revenue Deficit: It is the difference between revenue deficit and grants for creation of capital assets.

- The concept of effective revenue deficit has been suggested by the Rangarajan Committee on Public Expenditure.

Conclusion

India’s priority is to recover the economy through capital expenditure (capex). With increased government investment in infrastructure, private investment will also increase, boosting the economic (GDP) growth, and as a result the ratio of fiscal deficit to GDP will decrease.

UPSC Civil Services, Previous Year Questions (PYQ)

Prelims

Q1. In the context of governance, consider the following: (2010)

- Encouraging Foreign Direct Investment inflows

- Privatization of higher educational Institutions

- Down-sizing of bureaucracy

- Selling/offloading the shares of Public Sector Undertakings

Which of the above can be used as measures to control the fiscal deficit in India?

(a) 1, 2 and 3

(b) 2, 3 and 4

(c) 1, 2 and 4

(d) 3 and 4 only

Ans: D

Q2. Which one of the following is likely to be the most inflationary in its effect? (2021)

(a) Repayment of public debt

(b) Borrowing from the public to finance a budget deficit

(c) Borrowing from the banks to finance a budget deficit

(d) Creation of new money to finance a budget deficit

Ans: (d)

Q3. Which of the following is/are included in the capital budget of the Government of India? (2016)

- Expenditure on acquisition of assets like roads, buildings, machinery, etc.

- Loans received from foreign governments

- Loans and advances granted to the States and Union Territories

Select the correct answer using the code given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (d)

Mains

Q1. One of the intended objectives of the Union Budget 2017-18 is to ‘transform, energise and clean India’. Analyse the measures proposed in the Budget 2017-18 to achieve the objective. (2017)

Q2. Distinguish between Capital Budget and Revenue Budget. Explain the components of both these Budgets. (2021)